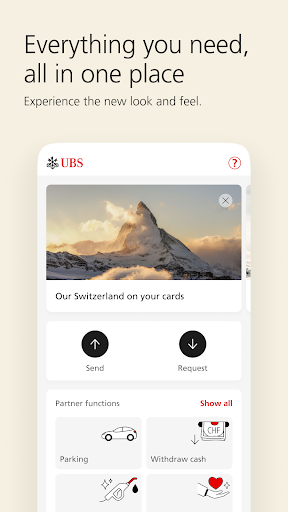

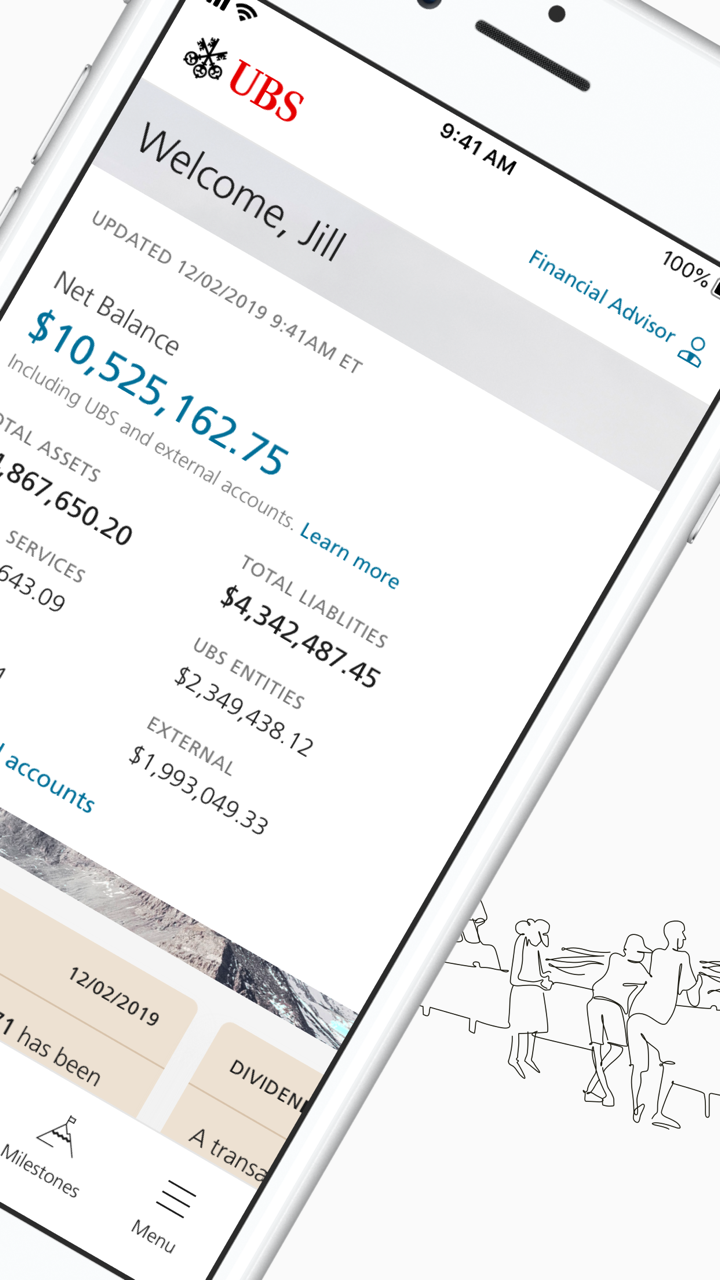

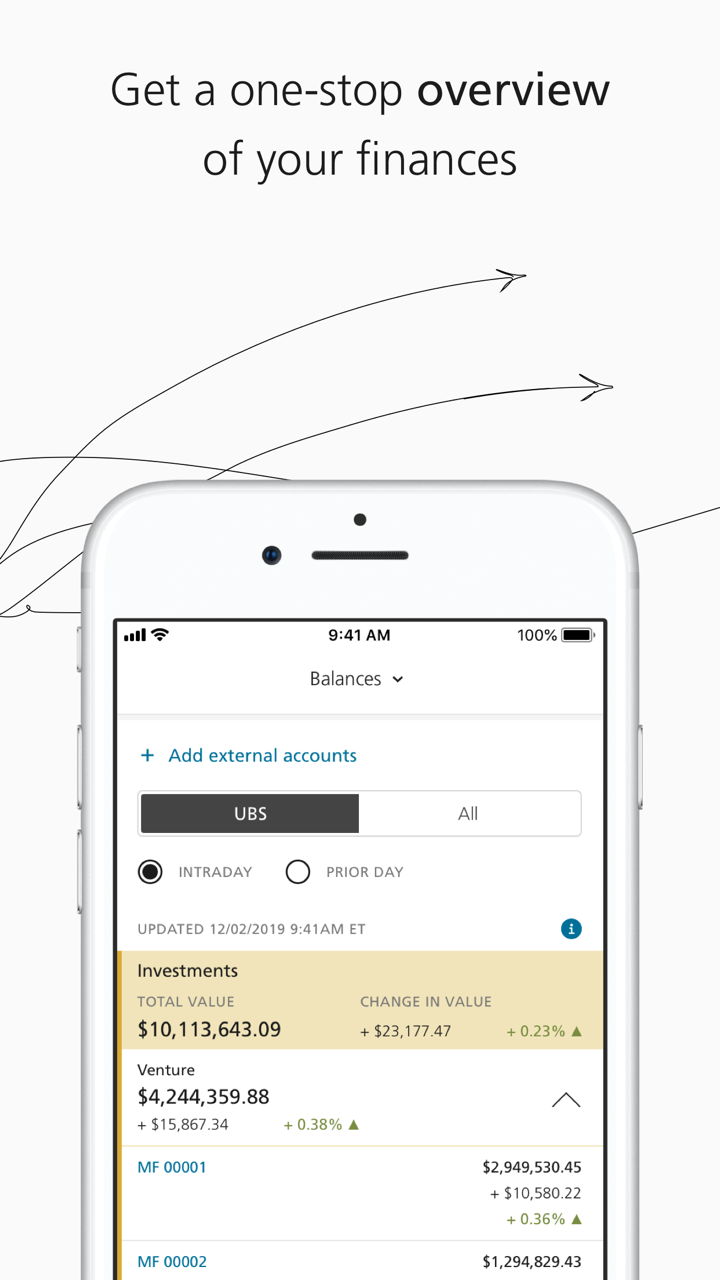

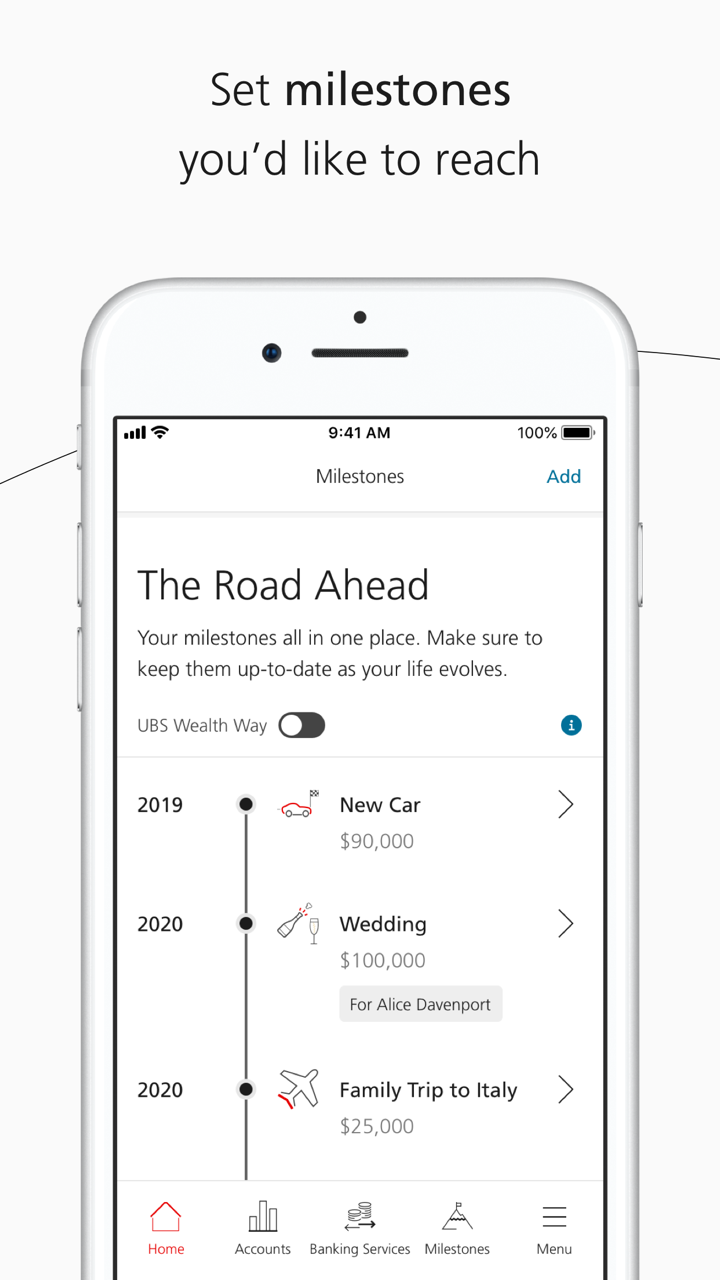

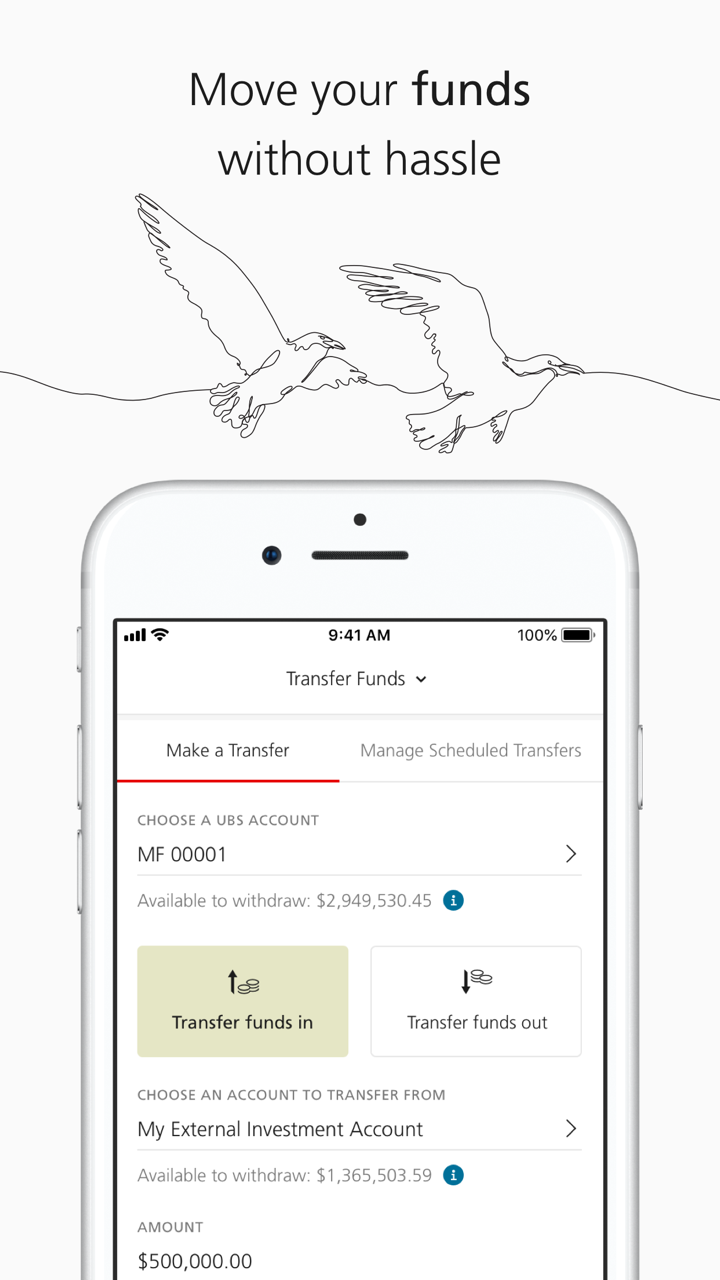

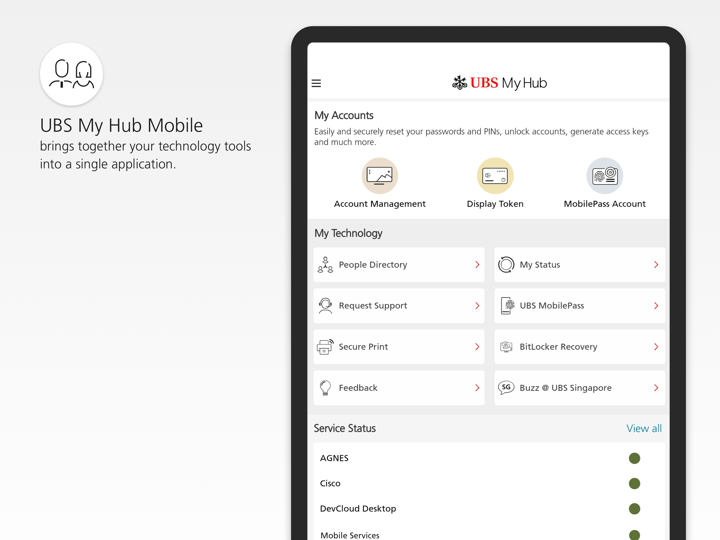

公司簡介

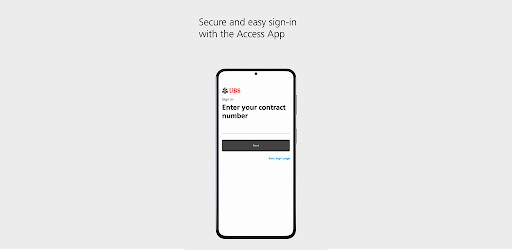

基本信息及監管 瑞銀

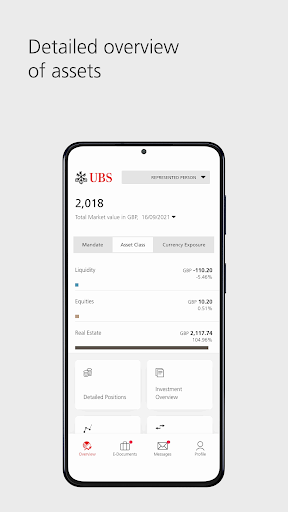

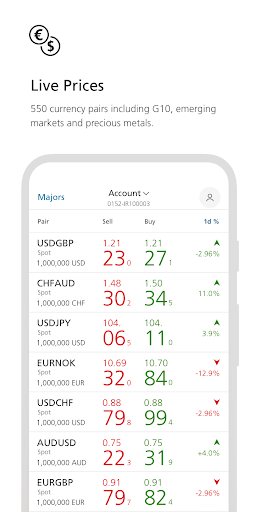

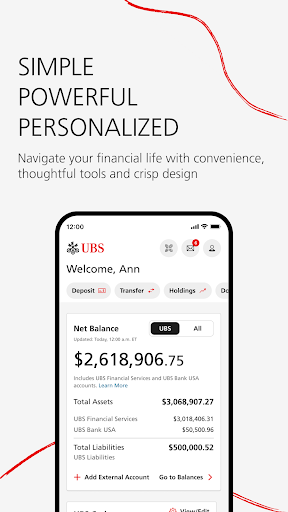

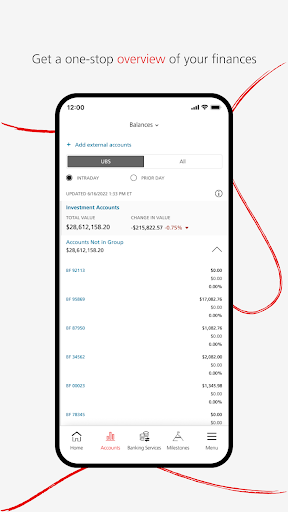

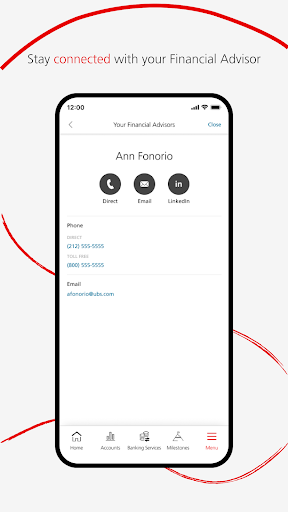

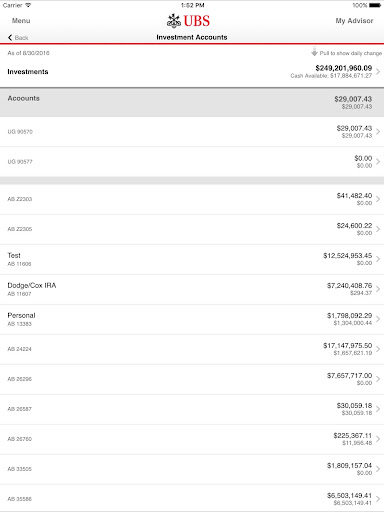

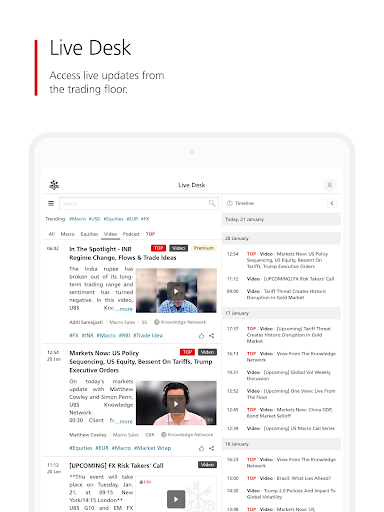

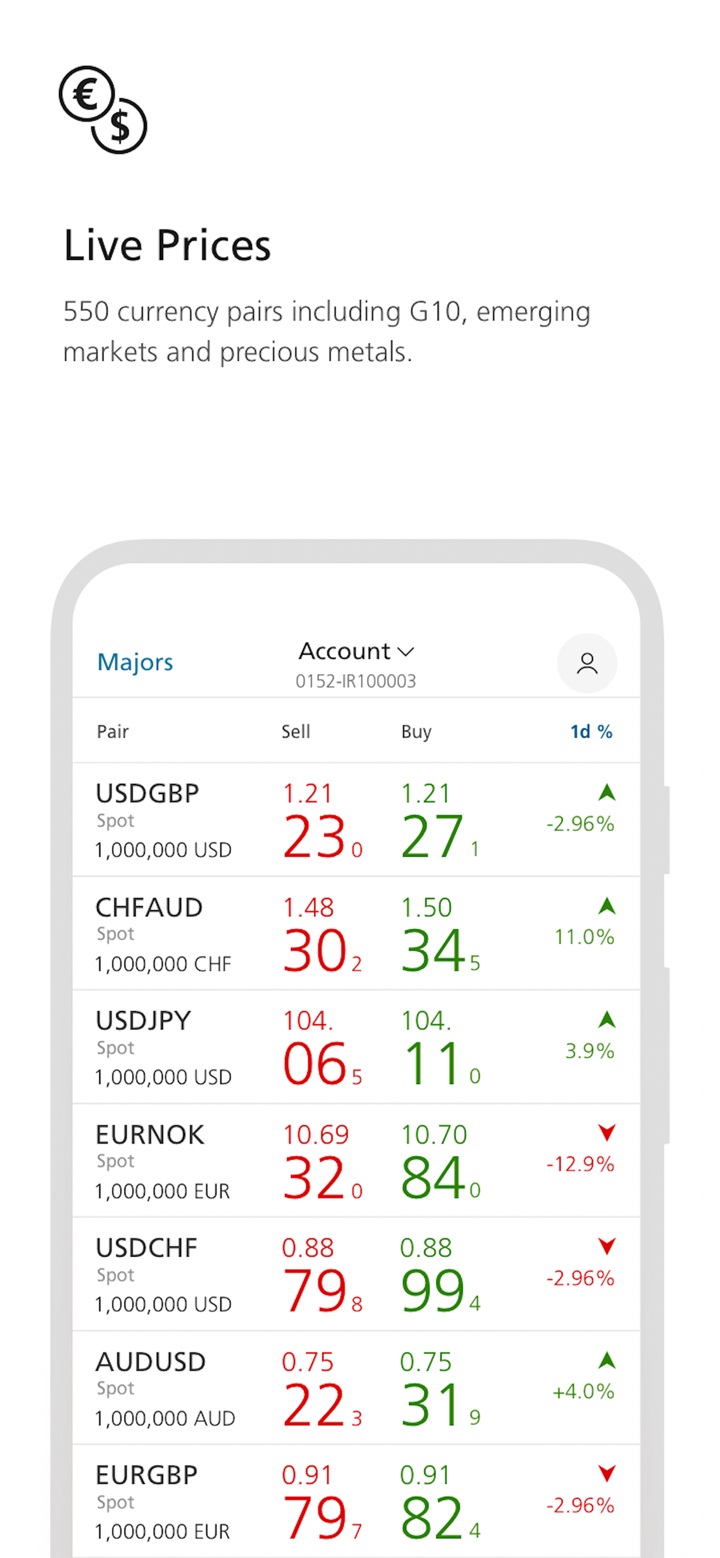

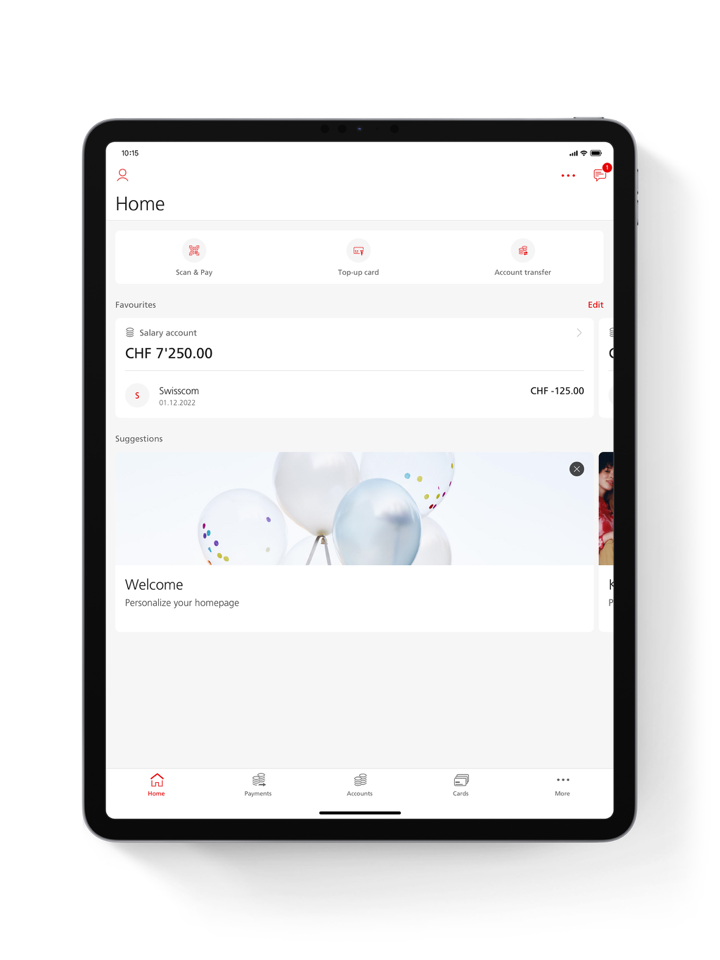

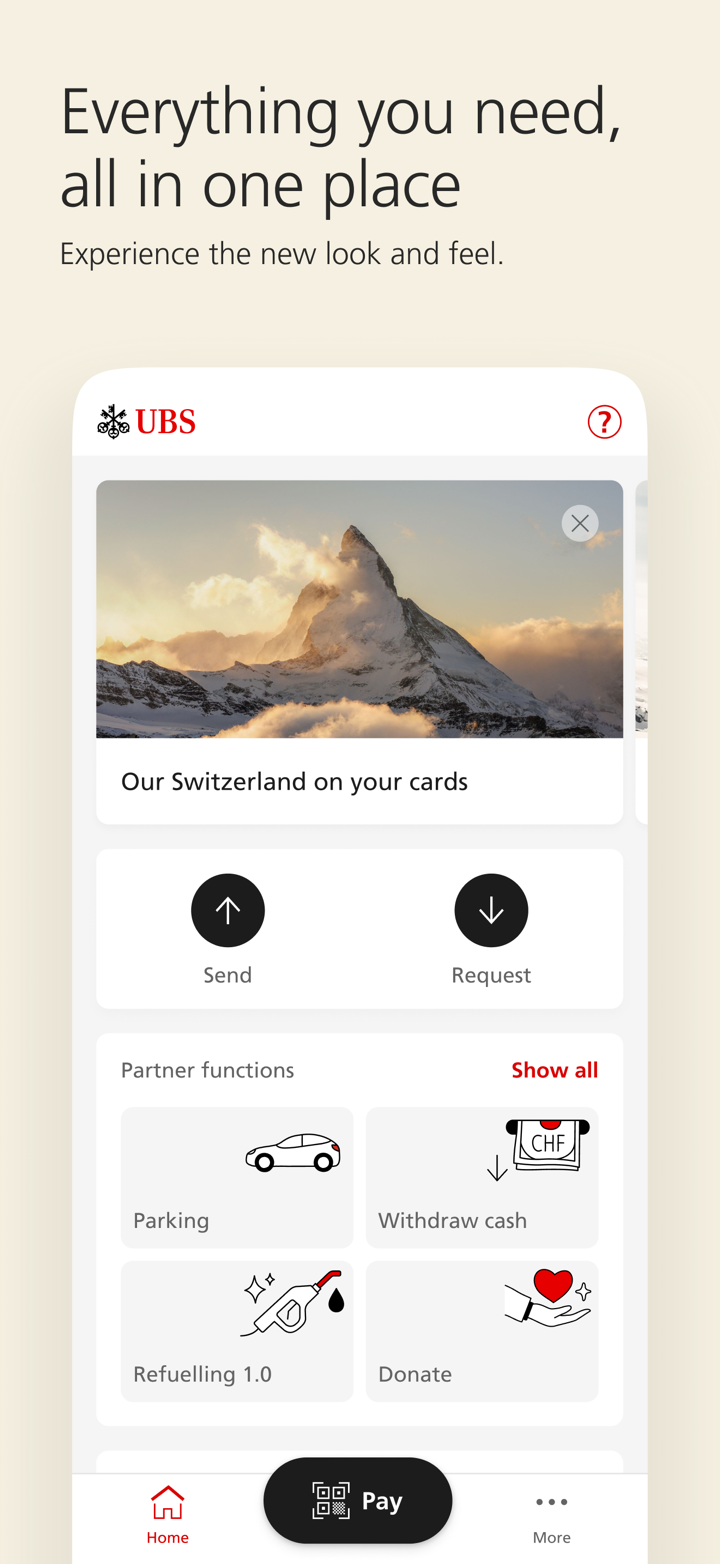

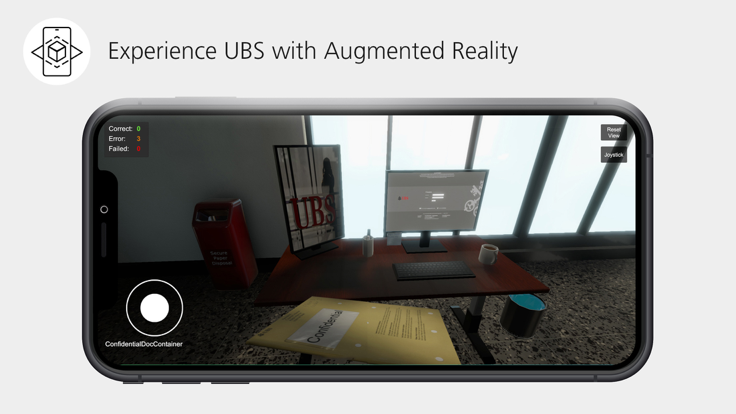

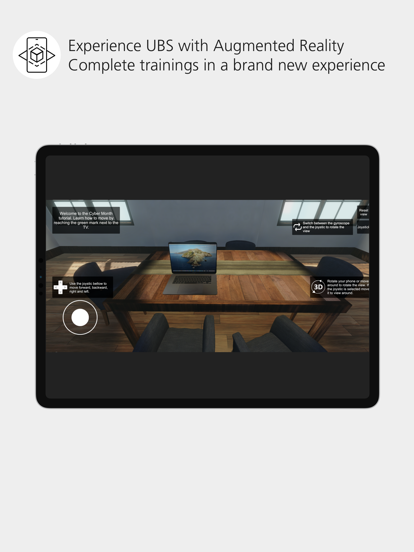

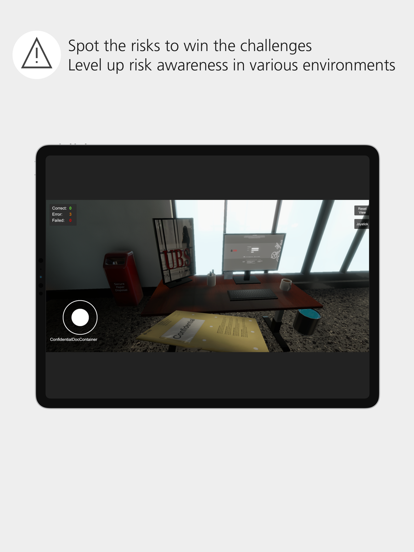

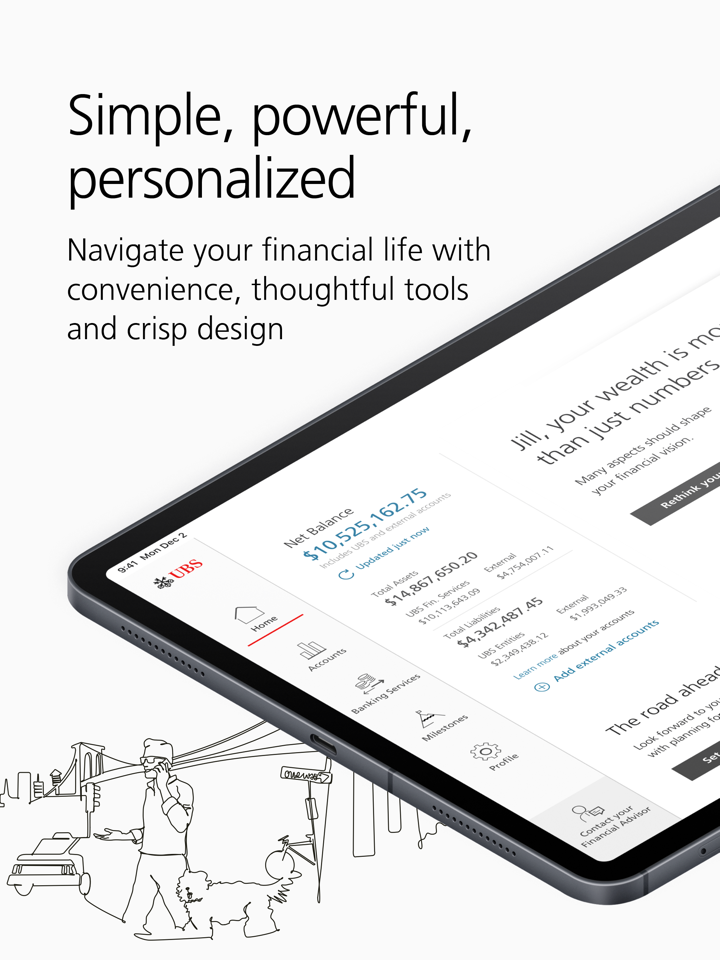

瑞銀最早成立於1862年,總部位於瑞士蘇黎世,與370多家金融機構共同組成了今天的 瑞銀團體。 瑞銀在全球開展業務,各業務部門之間密切合作。其業務涵蓋財富管理、資產管理和投資銀行三大板塊。 瑞銀證券亞洲有限公司持有中國金融期貨交易所(cffex)的期貨交易牌照(監管編號:0317)。

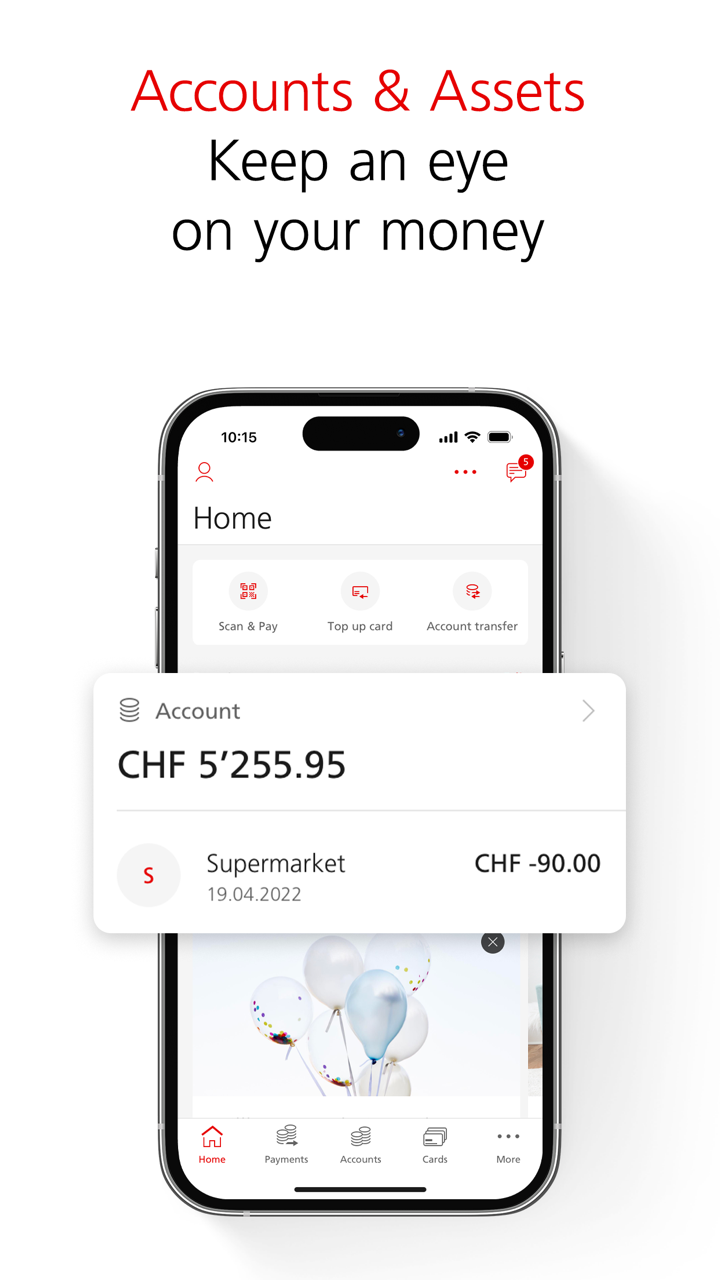

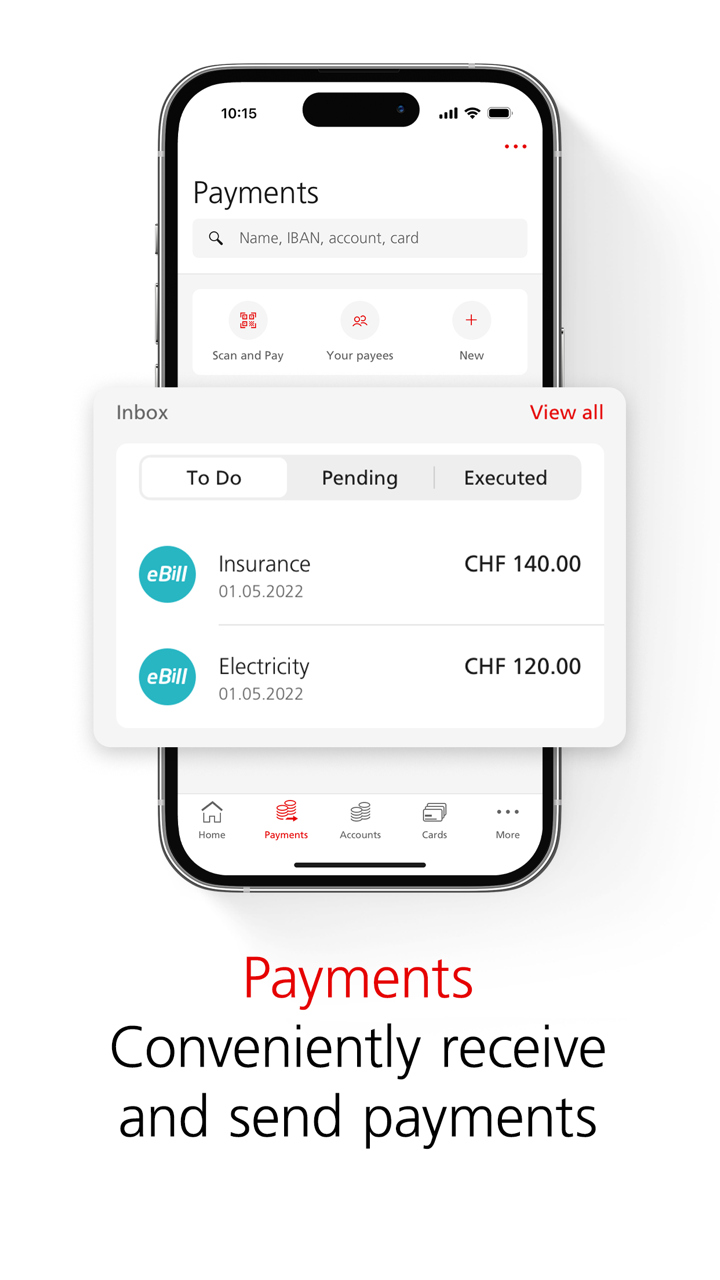

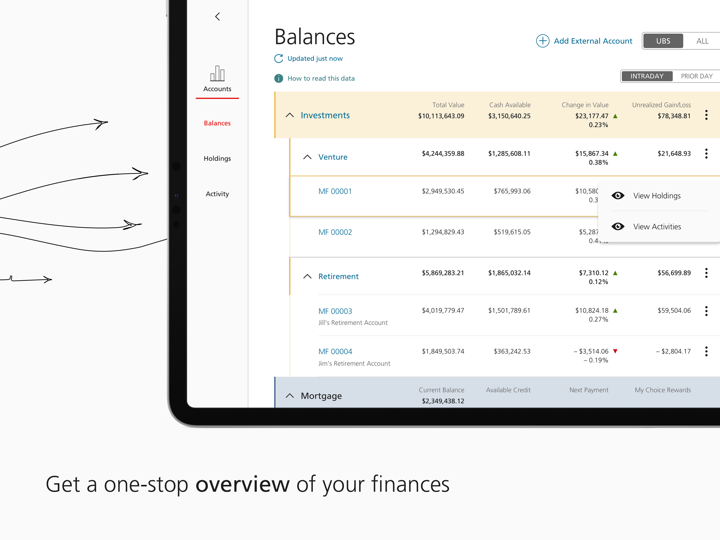

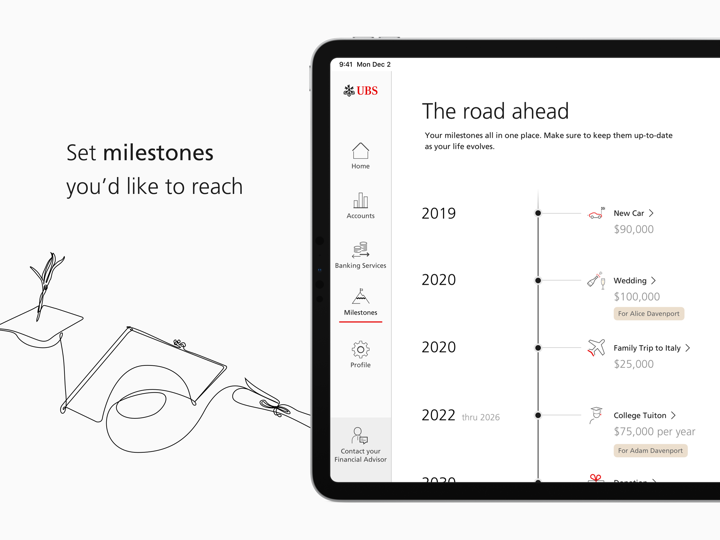

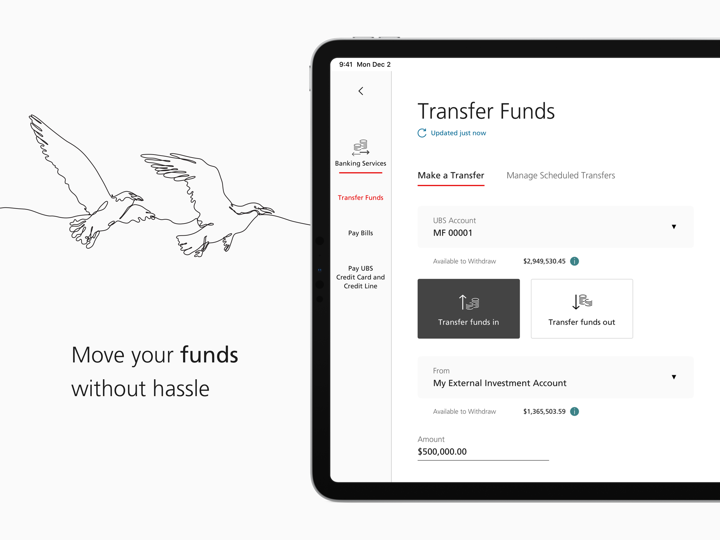

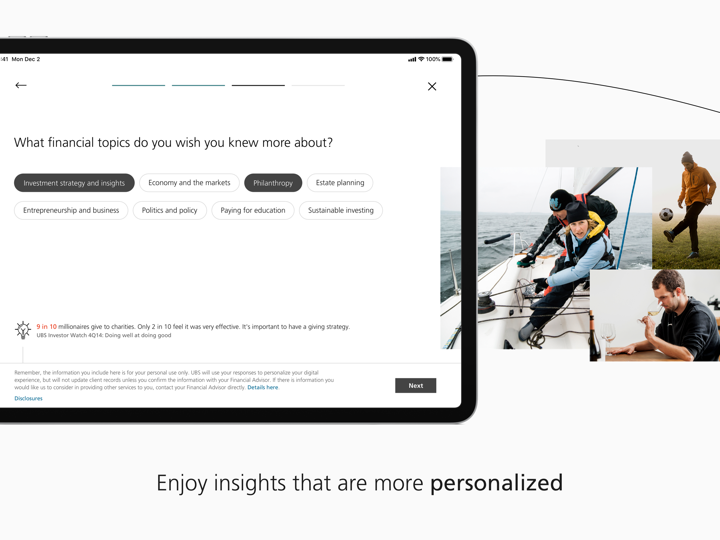

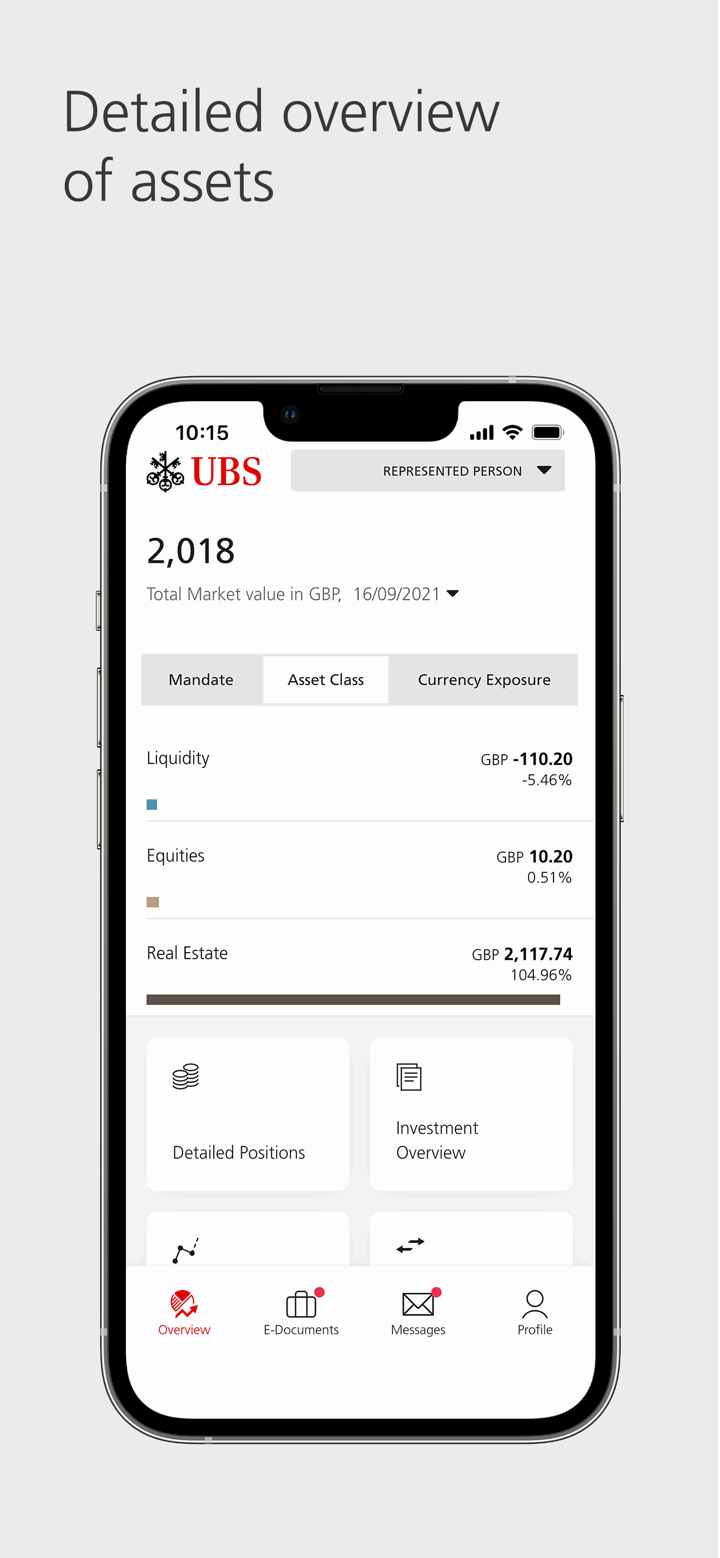

主營業務 瑞銀

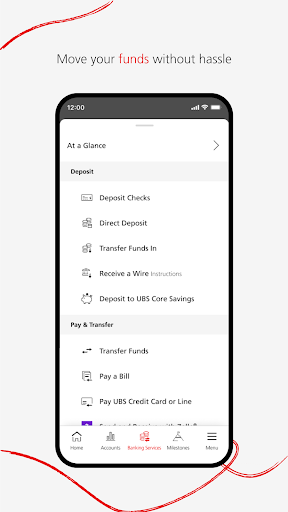

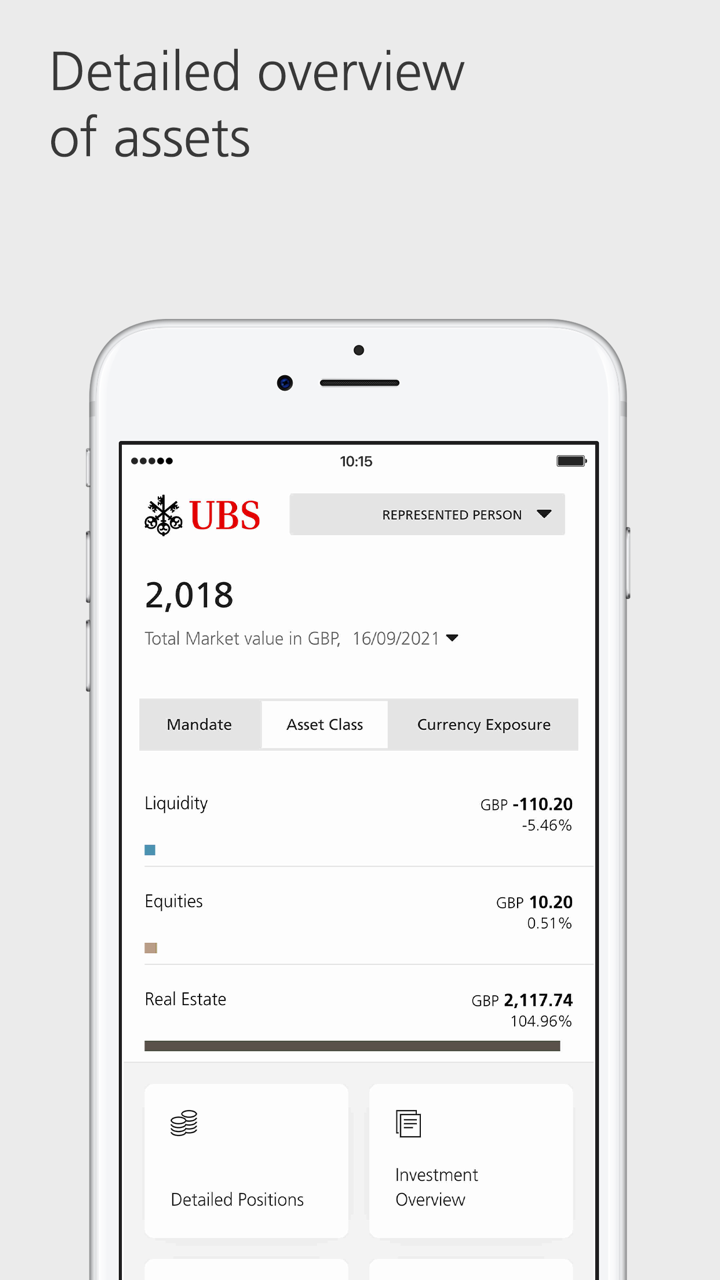

瑞銀為全球個人、機構和企業客戶以及瑞士的私人客戶提供財務諮詢解決方案,包括財富規劃、投資管理、資本市場和銀行服務、貸款以及機構和企業財務諮詢。此外 瑞銀除了自己的產品之外,投資者還可以從其他世界領先的第三方機構獲得廣泛的產品選擇。 瑞銀是集團在22個國家的資產管理業務,為包括個人、第三方中介機構和機構投資者在內的廣泛客戶提供跨主要傳統和另類資產類別的投資服務。此外, 瑞銀 瑞銀還為政府和中央銀行等主權客戶提供專有諮詢、投資和解決方案。

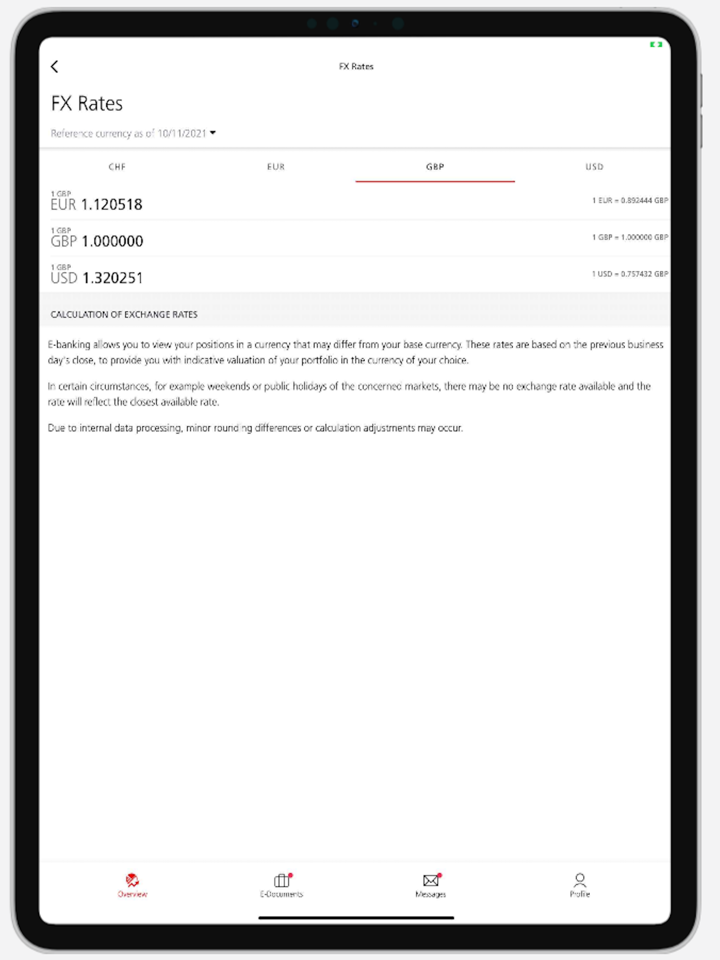

FX1739561792

埃及

關閉我的帳戶和整個社區帳戶 請 永久刪除它們

爆料

薇11六1四3零2七1

香港

9月6日被助理拉近一个白洋互利共赢交流群群,开始由该群有个白洋老师讲解大盘行情和推荐股票偶尔讲完后还会推荐几支牛股让大家购买,我觉得白洋老师讲的还不错,没事了就来听白洋老师讲课,之后白洋老师就几次三番的给我发信息说现在股市不好做,散户赚钱太难,让我眼着他做港股说做港股目前的行情闭着眼都能赚钱,说着便晒出了自己的赚钱截图。可我之前没有接触过这个,因为白洋老师带我炒股赚了一点,觉得也不会骗我,他对我说,建议用50万做港股,保正能赚钱甚至一周翻几倍。当时我还有点犹豫,白洋老师就催着快点开设个人账户,说下午就能带着赚钱,并且把瑞银环球客服的名片份享给我,给我开户。在白洋老师的催促下,9月10号,考虑了一晚上就开了户,并且把多年积蓄拿出一大半全部入了金,折合60万左右。 9月20日,白洋老师在直播间里叫单,我总共听指导做了几次单,账户出现巨额亏损,60万只剩余1万多,犹如晴天霹雳,整个人的状态差到了极点。但已经到了这一步了,白洋老师并未给我合理的解释,还是不断催促我加金,说带我做单,把前面亏的赚回来,这下让我彻底心凉了也醒悟了,在拒绝加金并且停止做单后,就被踢出了群,给白洋老师发消息也不回,后来直接拉黑并删除了。

爆料

yukiiii

香港

瑞银国际,出金要求提前支付百分之五印花税,是不是骗子平台??

爆料

AlfredoRomero

阿根廷

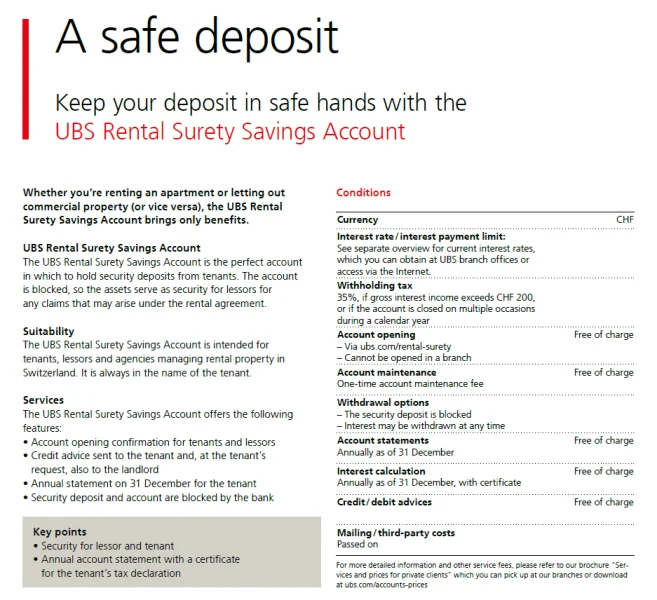

我認為這是一家適合我交易的好經紀商,我的帳戶取得了不錯的成果,而且有很多好處。此外,我覺得槓桿水平非常吸引人。這些是安全的存款。

好評

Scott Walker

法國

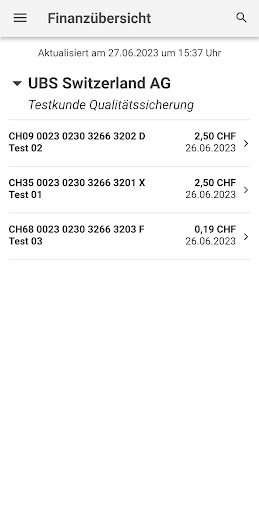

8年前,我在UBS建立了我的退休金,选择投资他们在瑞士管理的高风险增长基金之一。诚然,由于我经营一家大型企业并且已经最大化了我的养老金缴纳,我没有每年审查它。然而,这些年来,该基金的增长仅平均为3.5%,考虑通货膨胀后实际上导致净亏损。此外,每年咨询费为£5,000,基金费用约为1%,我最终决定将所有投资从UBS转移到更好的投资机构。

中評

Đặng Công Hà

越南

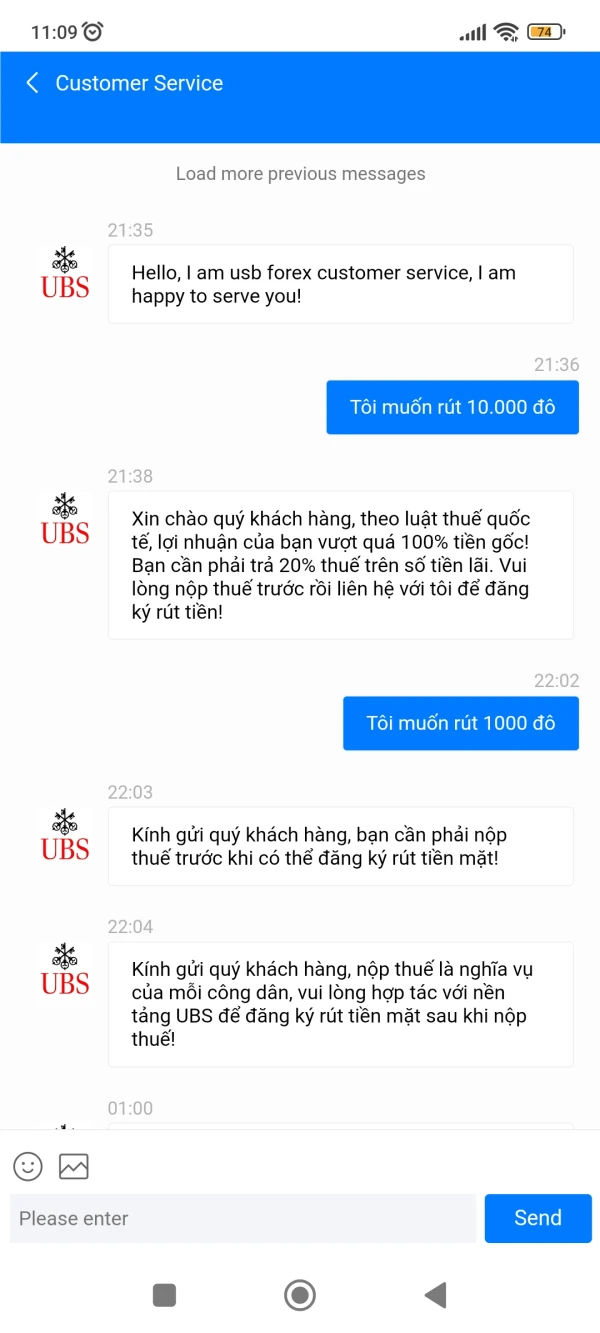

他們強迫你納稅,因為你的利潤帳戶超過了100%。

爆料

Ajs142

巴基斯坦

從UBs到幣安

爆料

salman khan468

印度

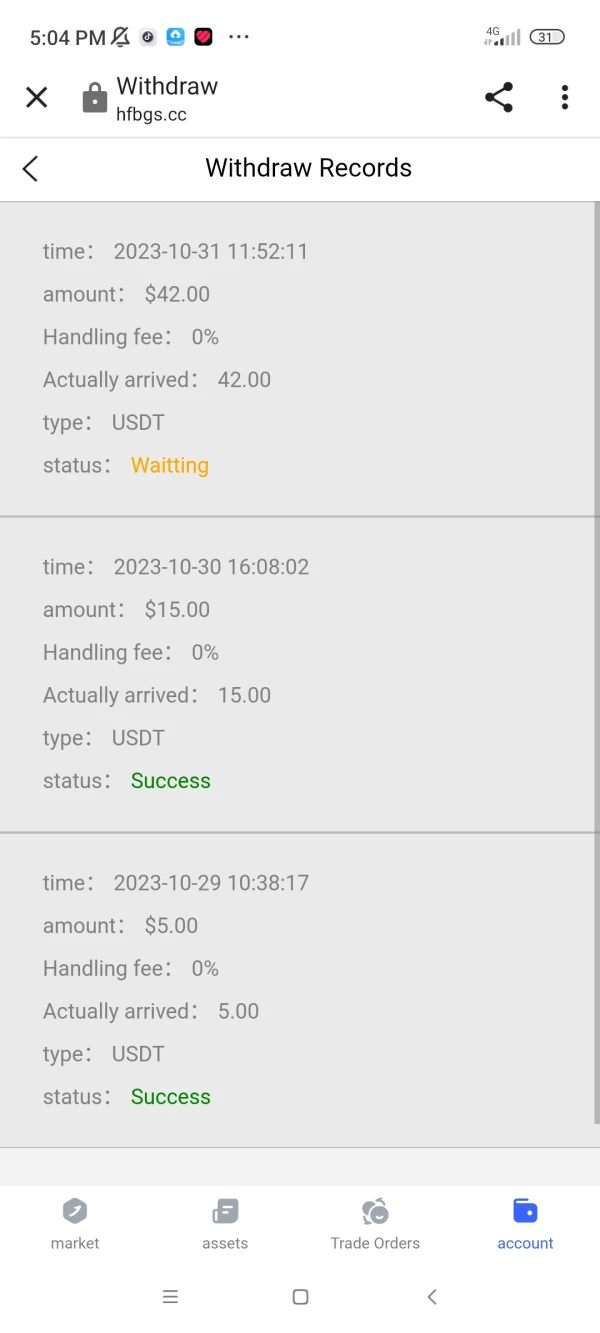

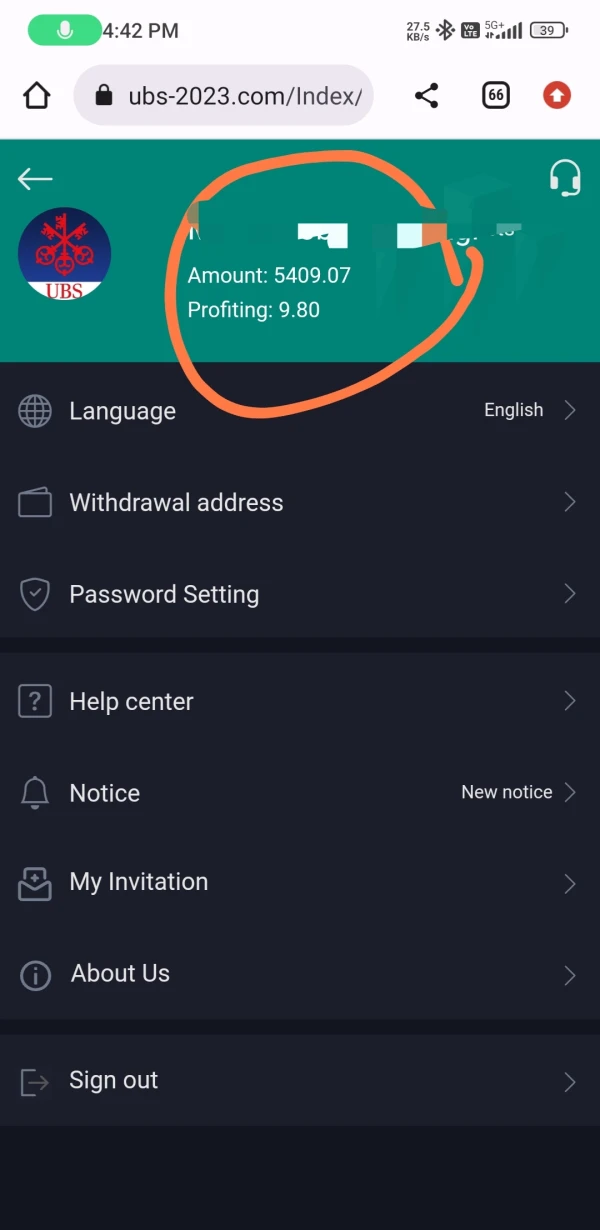

我存入 2400 USDT 並賺取 3000 USDT 現在我的帳戶中有 5400+ USDT 瑞銀市場帳戶,當我嘗試提款時,他們告訴你必須繳納20%的稅,這完全是欺詐,他們可以從我的帳戶中扣除

爆料

FX1352371297

印尼

他們調查了我的一筆交易,我抱怨圖表操縱,結果證明他們操縱了背後的賬戶。我真正想抱怨的是,他們的員工似乎沒有裝備精良,我的意思是,在知識方面。他們沒有了解客戶需求的基本技能,與他們交談真的很折磨我......

好評

FX4198274585

澳大利亞

在交易虧錢后,他們不允許我提現我的2138.73。 我已經給客戶服務發了無所次消息,但都沒有回應。我試圖進行交易但不被允許, 我需要幫助來提現。

爆料

筱飛【Graphic Design】

香港

欧福国际外汇平台 投资十几万提现失败 种种借口 无法出金

爆料

往后7407

香港

总有借口不肯出金,一天一个说法说不能出金,一直要入金说才能出金?

爆料

D S Y

香港

瑞银证券太坑人了,真的是一系列的坑啊,一个坑接一个

爆料

D S Y

香港

瑞银证券无法出金,要交68888升级为会员,才可以出金

爆料

起风了69241

香港

没有办法提现,客服要求必须存够五万成为会员才能提现

爆料

FX3892210959

美國

认识了一个人被忽悠去投资,下载了这个app-UBEX。这是个虚假的数字货币平台,充值了1000多美金交易了几次以后,赚了点钱,随后申请提现不成功,客服给出的理由是:我达不到两万的流水标准 (关键是我从未被告知过这个信息,我当时的交易额大概有有一千多)。随后我故意透露出我之后还会继续投几万块,希望尽快让我提现成功。客服一听立马说:系统会自动安排办理 (一点原则都没有)。过了一天,我问客服怎么样能够快速提现,客服:充值会员即可,5000块。我又问了些别的问题,最后问一句:我的流水还差多少 (这几天没有进行过交易)客服:还差5000。

爆料

Bottle

香港

跟随技术员操作完成后,提现显示银行信息错误,要求交30%的保证金才能修改信息提现,已提供身份证和银行卡信息,还是不能提现

爆料

FX3393443657

香港

不让出金 ,说要通过审核,审核后交税才能提现。

爆料