公司簡介

| 國信期貨 評論摘要 | |

| 成立年份 | 2008 |

| 註冊國家/地區 | 中國 |

| 監管機構 | CFFEX(受監管) |

| 市場工具 | 黃金、鋼鐵、農產品、基本金屬、能源產品 |

| 模擬帳戶 | ❌ |

| 交易平台 | 國信期貨CTP-博易雲交易版、EasyStar 9.5 macOS、國信期貨CTP-快期V3客戶端、文華溫順WH6等 |

| 最低存款 | / |

| 客戶支援 | 電話:400-86-95536 / 0755-22941888 |

國信期貨有限公司是國信證券股份有限公司的全資子公司。總部位於上海,提供在其各種交易平台上交易的可交易資產。國信期貨憑藉國信證券的100多個業務部門在主要城市建立的廣泛網絡,享有行業前十的地位。它受到CFFEX的嚴格監管。

優點和缺點

| 優點 | 缺點 |

| 受CFFEX監管 | 開戶程序耗時 |

| 多種交易平台適用於多種設備 | 聯繫渠道有限 |

| 無模擬帳戶 |

國信期貨 是否合法?

國信期貨 受中國金融期貨交易所有限公司(CFFEX)監管。它持有期貨牌照,牌照號碼為0113。

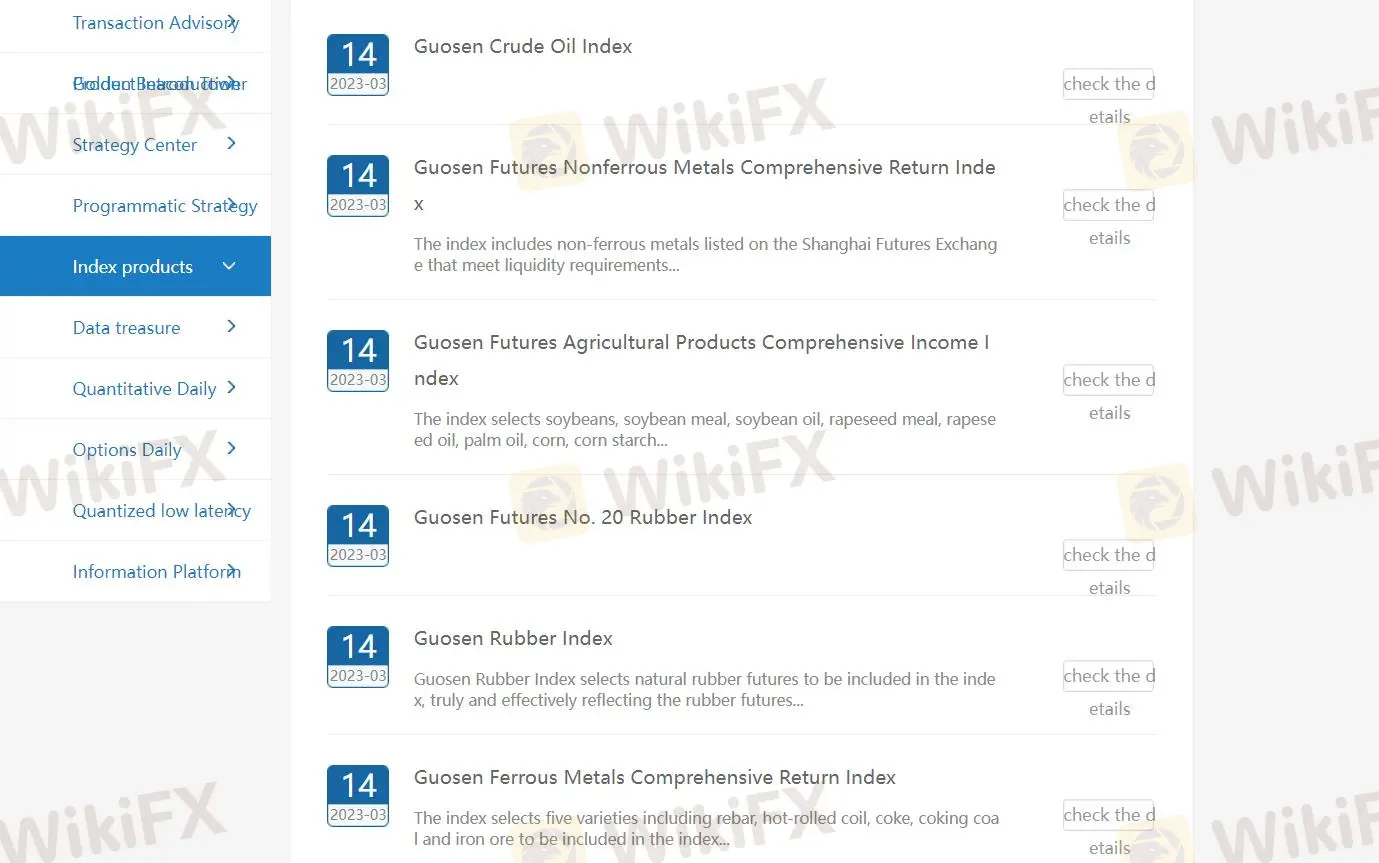

國信期貨 可以交易什麼?

國信期貨 提供期貨、黃金、鋼鐵、農產品、基本金屬和能源產品。

帳戶類型

要開設國信期貨的帳戶,您可以通過手機或電腦註冊並登錄期貨互聯網開戶雲系統,填寫個人信息,選擇要開設的帳戶類型。此外,您還需要進行評估,申請相應的交易所,簽署相關文件等。因此,程序復雜且耗時。

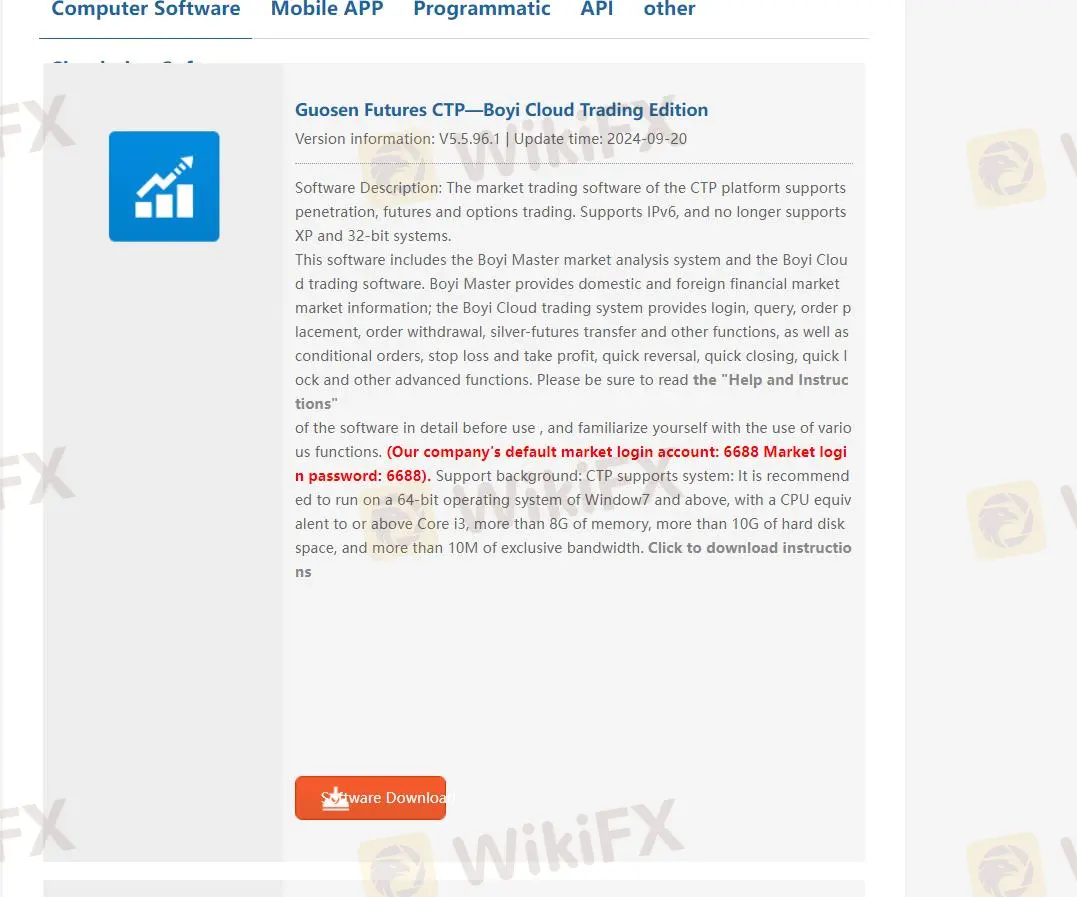

交易平台

國信期貨 提供多種交易平台,包括桌面軟件、移動應用程序、程序化、API等。計算機軟件包括國信期貨CTP-博易雲交易版、EasyStar 9.5 macOS、國信期貨CTP-快期V3客戶端、文華溫順WH6等。

此外,他們的App有國信期貨和國信期貨高級版。您可以根據自己的交易條件選擇不同的平台。有關交易平台的更多詳細信息,可以通過以下網址獲取:https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

存款和取款

國信期貨支持銀期轉帳、網上銀行轉帳和櫃檯轉帳。銀期轉帳開放給工商銀行、農業銀行、中國銀行、建設銀行、交通銀行、浦發銀行、民生銀行、招商銀行、中信銀行、光大銀行、平安銀行、興業銀行和郵儲銀行。

您每天可以提取的最高金額為人民幣1000萬元,單筆轉帳的最高限額也是人民幣1000萬元。人民幣100保證金不可提取(如果當天沒有交易或持倉,可以通過電話申請提取保證金)。