公司简介

| 国信期货 评论摘要 | |

| 成立时间 | 2008 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX(受监管) |

| 市场工具 | 黄金、钢铁、农产品、基本金属、能源产品 |

| 模拟账户 | ❌ |

| 交易平台 | 国信期货CTP-博易云交易版、EasyStar 9.5 macOS、国信期货CTP-快期V3客户端、文华万顺WH6等 |

| 最低存款 | / |

| 客户支持 | 电话:400-86-95536 / 0755-22941888 |

国信期货有限公司是国信证券股份有限公司的全资子公司。总部位于上海,提供在其各种交易平台上交易的可交易资产。作为行业前十名之一,国信期货受益于其覆盖主要城市的广泛网络,由国信证券的100多个业务部门提供支持。它受到CFFEX的良好监管。

优点和缺点

| 优点 | 缺点 |

| 受CFFEX监管 | 开户流程耗时 |

| 多种交易平台适用于多种设备 | 联系渠道有限 |

| 无模拟账户账户 |

国信期货 是否合法?

国信期货 受到中国金融期货交易所有限责任公司(CFFEX)的监管。它持有期货许可证,许可证号码为0113。

国信期货 可以交易什么?

国信期货 提供期货、黄金、钢铁、农产品、基本金属和能源产品。

账户类型

要开设国信期货的账户,您可以通过手机或计算机注册并登录期货互联网开户云系统,填写个人信息,并选择要开设的账户类型。此外,您还需要进行评估,申请相应的交易所,并签署相关文件等。因此,流程复杂且耗时。

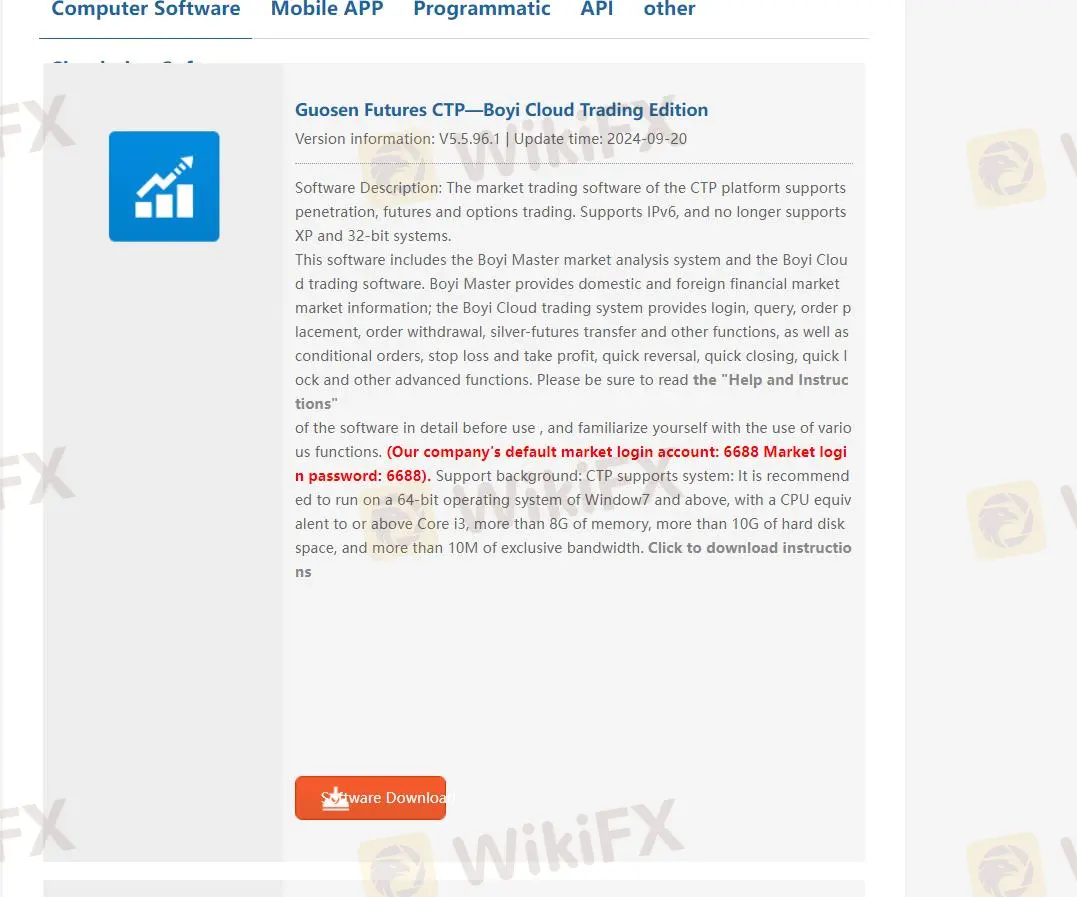

交易平台

国信期货 提供多种交易平台,包括桌面软件、移动应用、程序化、应用程序接口等。计算机软件包括国信期货CTP-博易云交易版、EasyStar 9.5 macOS、国信期货CTP-快期V3客户端、文华万顺WH6等。

此外,他们的App有国信期货和国信期货高级版。您可以根据您的交易条件选择不同的平台。有关交易平台的更多详细信息可以通过以下链接了解:https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

存取款

国信期货支持银期转账、网银转账和柜台转账。银期转账开通了工商银行、农业银行、中国银行、建设银行、交通银行、浦发银行、民生银行、招商银行、中信银行、光大银行、平安银行、兴业银行和邮储银行。

您每天最多可以提取人民币1000万元,单笔转账的最高限额也是人民币1000万元。人民币100保证金不能提取(如果当天没有交易或持仓,可以通过电话申请提取保证金)。