Información básica

China

ChinaCalificación

China

|

De 5 a 10 años

|

China

|

De 5 a 10 años

| http://www.guosenqh.com.cn/main/index/index.shtml

Sitio web

Índice de calificación

influencia

D

índice de influencia NO.1

Hong Kong 2.73

Hong Kong 2.73 Licencias

LicenciasInstitución autorizada:国信期货有限责任公司

Número de regulación:0113

China

China guosenqh.com.cn

guosenqh.com.cn China

China| GUOSEN FUTURES Resumen de la reseña | |

| Fundado | 2008 |

| País/Región Registrado | China |

| Regulación | CFFEX (Regulado) |

| Instrumentos de Mercado | Oro, Acero, Productos Agrícolas, Metales Básicos, Productos Energéticos |

| Cuenta Demo | ❌ |

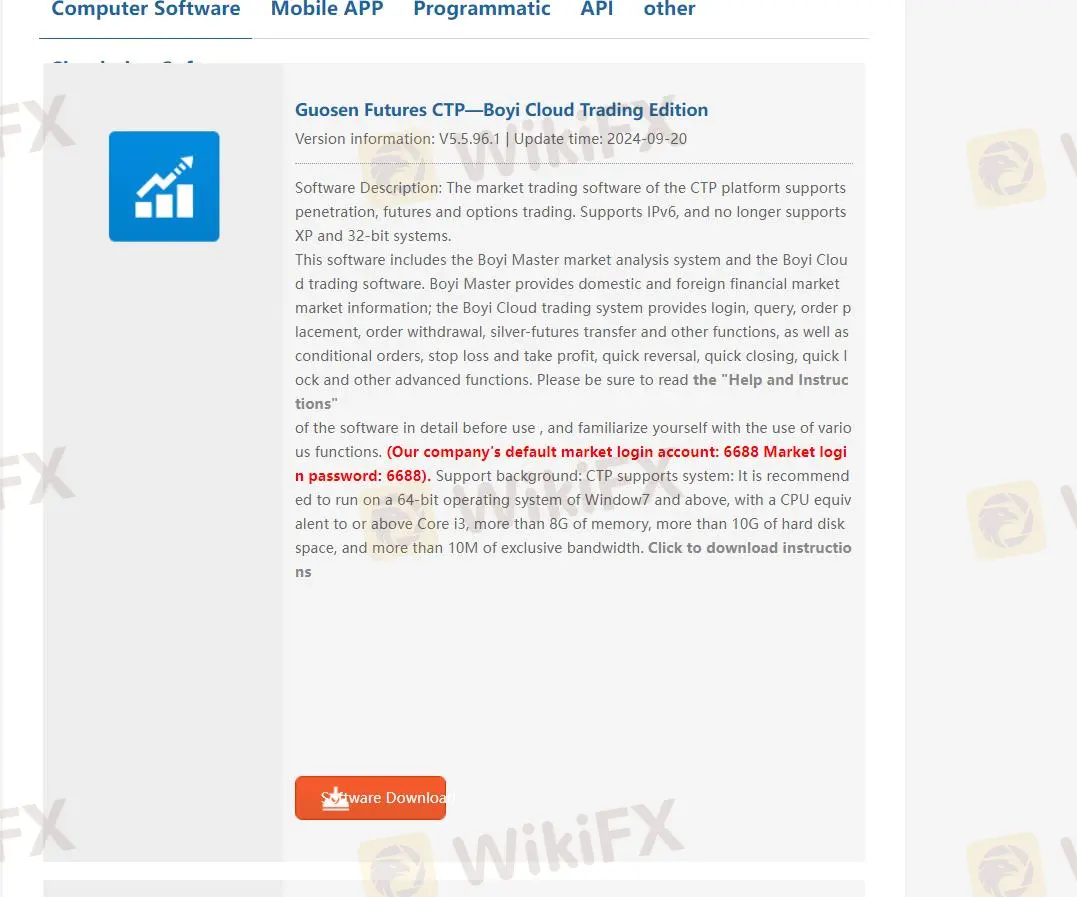

| Plataforma de Trading | Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 y otros |

| Depósito Mínimo | / |

| Soporte al Cliente | Teléfono: 400-86-95536 / 0755-22941888 |

Guosen Futures Limited es una subsidiaria de propiedad total de Guoxin Securities Company Limited. Con sede en Shanghai, ofrece activos negociables en sus diversas plataformas de trading. Disfrutando de una posición entre los diez primeros de la industria, Guosen Futures se beneficia de su extensa red que cubre las principales ciudades, facilitada por más de 100 departamentos comerciales de Guoxin Securities. Está bajo una regulación adecuada por parte de CFFEX.

| Ventajas | Desventajas |

| Regulado por CFFEX | Procedimientos de apertura de cuenta que consumen tiempo |

| Diversas plataformas de trading en varios dispositivos | Canales de contacto limitados |

| No hay cuentas demo |

GUOSEN FUTURES está regulado por China Financial Futures Exchange Co. Ltd. (CFFEX). Tiene una licencia de futuros con el número de licencia No.0113.

GUOSEN FUTURES ofrece futuros, oro, acero, productos agrícolas, metales básicos y productos energéticos.

Para abrir una cuenta en GUOSEN FUTURES, puedes registrarte e iniciar sesión en el sistema de apertura de cuenta de futuros en la nube a través de teléfono móvil o computadora, completar tu información personal y seleccionar el tipo de cuenta que deseas abrir. Además, también deberás realizar una evaluación, solicitar el intercambio correspondiente y firmar documentos relevantes, entre otros. Por lo tanto, los procedimientos son complejos y consumen tiempo.

GUOSEN FUTURES ofrece varias plataformas de trading, incluyendo software de escritorio, aplicación móvil, programático, API y otros. El software de computadora incluye Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 y otros.

Además, sus aplicaciones son Guosen Futures y Guosen Futures Premium Edition. Puede elegir diferentes plataformas según sus condiciones de negociación. Puede obtener más detalles sobre las plataformas de negociación a través de: https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

GUOSEN FUTURES admite transferencia bancaria-futuros, transferencia bancaria en línea y transferencia en mostrador. Las transferencias bancarias-futuros están abiertas a ICBC, ABC, BOC, CCB, BOC, SPDB, Minsheng, CMB, CITIC, Everbright, Ping An, Industrial Bank y Postal Savings Bank.

La cantidad máxima que puede retirar diariamente es de 10 millones de RMB, y el límite máximo para una transferencia única también es de 10 millones de RMB. El fondo de garantía de 100 RMB no se puede retirar (si no hay transacciones o posiciones en el día, puede solicitar la retirada del fondo de garantía por teléfono).

In my experience, GUOSEN FUTURES does make it possible to trade a range of underlying asset classes, including commodities such as gold and various energy products. Specifically, I noted that they offer futures contracts on gold and other related commodities, in line with what is standard on Chinese derivatives markets. However, as a trader who regularly evaluates access to global instruments, I need to emphasize that GUOSEN FUTURES is fundamentally a domestic Chinese futures broker. This means that trading “gold” here typically refers to gold futures traded on Chinese exchanges, not international gold spot trading such as XAU/USD pairs found on global forex platforms. The same goes for crude oil—what’s accessible is generally Chinese crude oil futures, not direct international contracts like WTI or Brent CFDs. Personally, I value the transparency and regulatory oversight, given their CFFEX license, but I also recognize the platform’s limitations for those seeking access to international spot asset pairs or a straightforward XAU/USD product. Additionally, the account opening process can be quite lengthy and documentation-intensive by international standards, which would likely matter to anyone seeking a quick start in commodities trading. So, while it is certainly possible to trade gold and energy products at GUOSEN FUTURES, it’s not the same as trading international spot assets like XAU/USD or global oil CFDs. This distinction is important for setting the right expectations if your focus is on broader market access or 24-hour forex-style products. Always verify whether the specific asset contracts offered align with your trading objectives and geographic considerations before committing funds.

From my detailed review of GUOSEN FUTURES, I could not find any indication that the broker currently provides a swap-free or Islamic account option. As someone who considers diverse account types essential—especially for traders who must comply with specific religious principles—this is an important omission for me to note. The available disclosures focus on futures and a range of commodities such as gold, steel, and agricultural products, with regulated status under the China Financial Futures Exchange, but there is no mention of Sharia-compliant or swap-free features. When assessing whether a broker addresses the needs of various traders, I always look for clear account type information and transparent disclosure on fee structures or special account accommodations. GUOSEN FUTURES does outline its platforms, deposits, and withdrawal procedures in detail, but based on all available information, a swap-free alternative does not seem to be on offer. For traders who require this account type for religious reasons, I would advise confirming directly with the broker’s customer support before considering registration, as my experience shows that lack of clarity in this area can lead to disappointment or unexpected costs down the line.

In my hands-on experience as a trader, I always approach new platforms with caution, especially when considering local brokerages such as GUOSEN FUTURES. Although GUOSEN FUTURES is officially regulated by the China Financial Futures Exchange (CFFEX), which certainly lends credibility and a layer of investor protection, I found several concerns that would give me pause. First, the account opening process with GUOSEN FUTURES is notably lengthy and complex. Unlike many international brokers where onboarding is relatively smooth, here you’re required to complete assessments, sign various documents, and navigate time-consuming steps. For me, such friction can lead to delays and frustration, which is particularly significant if you value quick market access or need to respond to fast market changes. Another key issue is the lack of a demo account. Demo environments are crucial for me to familiarize myself with a broker’s unique platform quirks, and without one, I would be risking live capital without a proper trial. This is a conservative red flag, especially considering their software is proprietary and reviews mention an outdated interface and slow trade execution. Both individually and together, these can impact trading effectiveness and add uncertainty. Support also feels weak. The available communication channels are limited and user feedback indicates that customer service can be unresponsive or generic, which is troubling during urgent situations. In my view, the combination of these operational drawbacks with the platform’s legitimate regulatory footing means GUOSEN FUTURES might not be the right fit for all traders—at least not without significant due diligence and measured expectations.

Based on my direct experience trading with domestic futures platforms like GUOSEN FUTURES, I have found that the typical approach in these regulated Chinese futures brokers does not mirror the fixed or variable “spread” structure familiar to forex or CFD brokers. Instead, futures trading is centralized on the exchange, and what traders actually pay is the exchange-determined bid-ask spread, which naturally varies according to market liquidity and volatility, rather than being set or manipulated by the broker itself. In my trading sessions, especially during major news releases or periods of heightened uncertainty, the spread between bid and ask can widen significantly due to reduced liquidity or spikes in trading activity. This is a typical market response on exchange-driven platforms, and it means that, unlike some international brokers who may advertise fixed spreads, I never expect stable costs during volatile conditions. GUOSEN FUTURES, being under the supervision of CFFEX, cannot independently offer fixed spreads—the spreads reflect the real-time market depth of the exchange. In practice, I always approach high-impact news events with great caution, fully aware that my transaction costs can increase, and order execution may experience slippage, particularly when trading thinner or more volatile contracts. This requires a risk-averse approach in moments of major market movement.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora