Présentation de l'entreprise

| GUOSEN FUTURES Résumé de l'examen | |

| Fondé | 2008 |

| Pays/Région enregistré | Chine |

| Réglementation | CFFEX (Réglementé) |

| Instruments de marché | Or, Acier, Produits agricoles, Métaux de base, Produits énergétiques |

| Compte de démonstration | ❌ |

| Plateforme de trading | Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 et autres |

| Dépôt minimum | / |

| Assistance client | Téléphone: 400-86-95536 / 0755-22941888 |

Guosen Futures Limited est une filiale à part entière de Guoxin Securities Company Limited. Basée à Shanghai, elle propose des actifs négociables sur ses différentes plateformes de trading. Occupant une position parmi les dix premières de l'industrie, Guosen Futures bénéficie de son vaste réseau couvrant les principales villes, facilité par plus de 100 départements commerciaux de Guoxin Securities. Elle est soumise à une réglementation stricte de la part de la CFFEX.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par la CFFEX | Procédures d'ouverture de compte longues |

| Diverses plateformes de trading sur de nombreux appareils | Canaux de contact limités |

| Pas de compte de démonstration |

Est-ce que GUOSEN FUTURES est légitime ?

GUOSEN FUTURES est réglementé par China Financial Futures Exchange Co. Ltd. (CFFEX). Il détient une licence de futures avec le numéro de licence 0113.

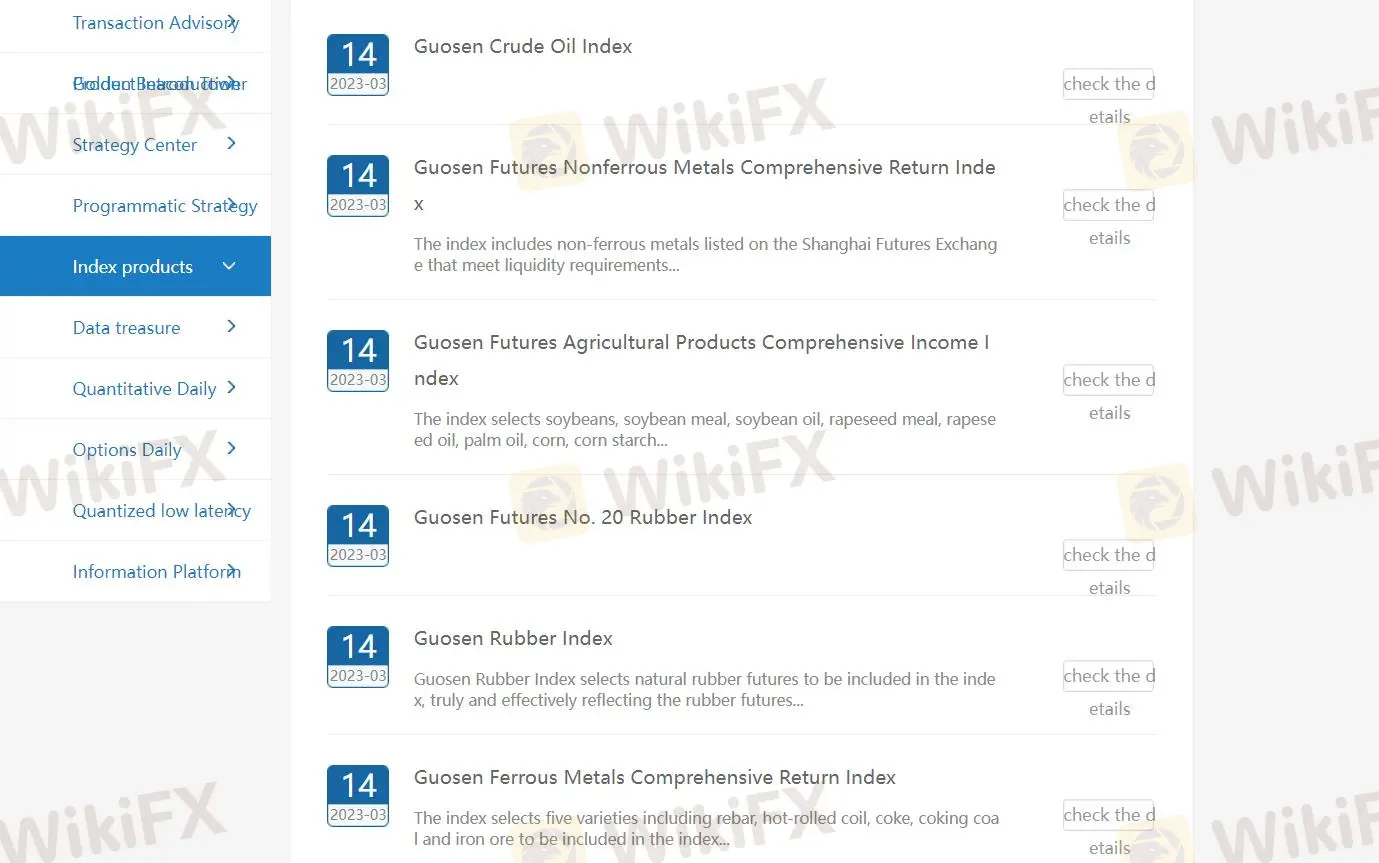

Que puis-je trader sur GUOSEN FUTURES ?

GUOSEN FUTURES propose des futures, de l'or, de l'acier, des produits agricoles, des métaux de base et des produits énergétiques.

Type de compte

Pour ouvrir un compte chez GUOSEN FUTURES, vous pouvez vous inscrire et vous connecter au système de compte d'ouverture de compte internet à terme via un téléphone mobile ou un ordinateur, remplir vos informations personnelles et sélectionner le type de compte que vous souhaitez ouvrir. De plus, vous devrez également passer une évaluation, demander l'échange correspondant et signer les documents pertinents, etc. Par conséquent, les procédures sont complexes et prennent du temps.

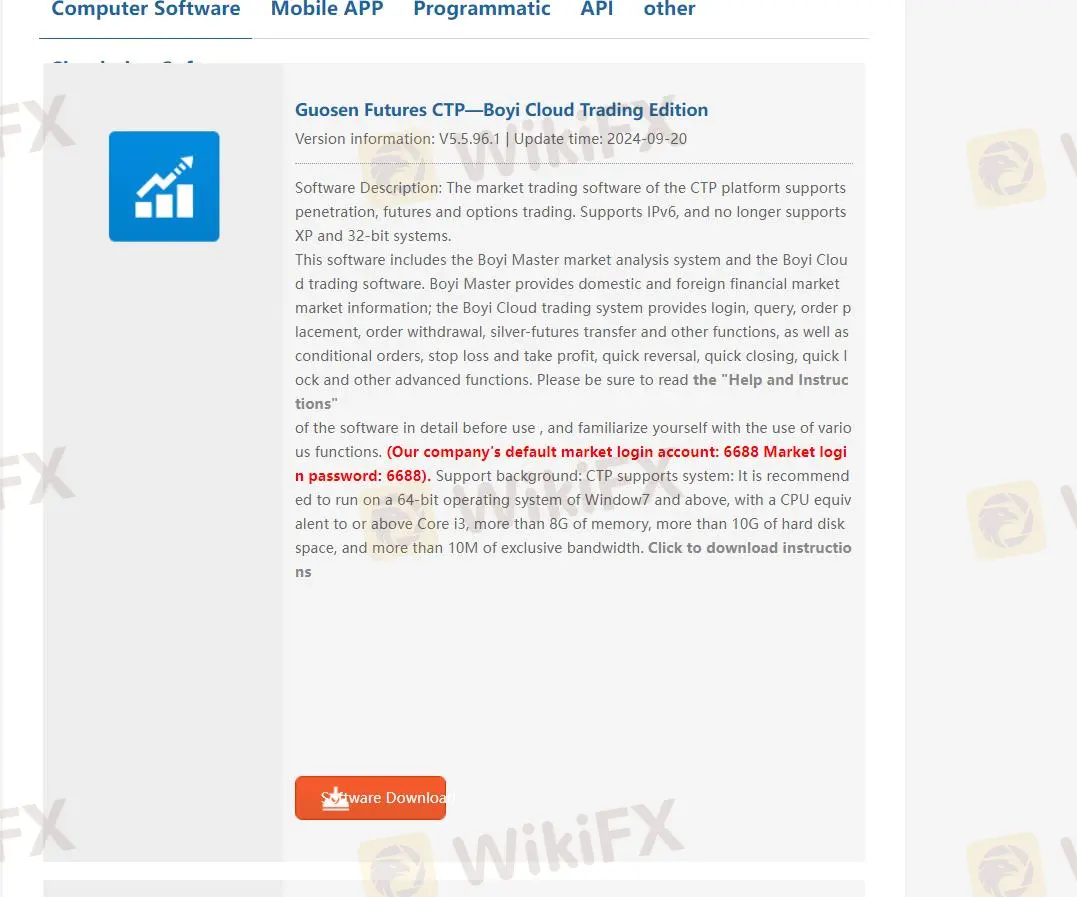

Plateforme de trading

GUOSEN FUTURES propose différentes plateformes de trading, notamment des logiciels de bureau, une application mobile, Programmatic, API et autres. Les logiciels pour ordinateur comprennent Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6, etc.

En outre, leurs applications sont Guosen Futures et Guosen Futures Premium Edition. Vous pouvez choisir différentes plateformes en fonction de vos conditions de trading. Plus de détails sur les plateformes de trading peuvent être appris via : https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

Dépôt et retrait

GUOSEN FUTURES prend en charge le transfert bancaire-futures, le transfert bancaire en ligne et le transfert de gré à gré. Les transferts bancaires-futures sont ouverts à ICBC, ABC, BOC, CCB, BOC, SPDB, Minsheng, CMB, CITIC, Everbright, Ping An, Industrial Bank et Postal Savings Bank.

Le montant maximum que vous pouvez retirer quotidiennement est de 10 millions de RMB, et la limite maximale pour un transfert unique est également de 10 millions de RMB. Le fonds de garantie de 100 RMB ne peut pas être retiré (si aucune transaction ou position n'est effectuée dans la journée, vous pouvez demander le retrait du fonds de garantie par téléphone).