Abstract:Find the best forex spread calculators to help you accurately calculate spread costs and reduce trading fees. Maximize your forex profits today!

When you step into the world of forex trading, one of the first things youll quickly learn is that costs matter—a lot. A key cost that every trader faces, whether novice or seasoned, is the spread. Simply put, the spread is the difference between the buying price and selling price of a currency pair. It might sound small, but it has a big impact on your trading profits and how you manage your trades.

In this article, we‘ll break down what the forex spread is, how it’s calculated, and why it matters. We‘ll also take a look at some popular tools you can use to calculate spreads quickly and accurately. Plus, we’ll explore other common fees in forex trading, share tips on how to keep costs low, and even walk through real-world examples so you can see the spread in action. Whether youre just starting out or looking to sharpen your strategy, understanding the spread and how to manage it is essential to your success.

What Is the Forex Spread?

Think of forex trading like buying and selling at a market stall. Theres a price to buy something and a slightly different price to sell it back. In forex, the spread is the difference between the price you pay to buy a currency (called the ask price) and the price you get when you sell it (called the bid price).

This difference might be just a few points or “pips,” as traders call them, but its essentially the fee brokers charge to make the market work for you. The tighter (or smaller) the spread, the less you pay in trading costs, which is always better for your bottom line.

Understanding spread is especially important because it directly affects how soon you can start making a profit on a trade. When you open a position, youre effectively starting behind by the amount of the spread.

How to Calculate Forex Spread: The Simple Formula

To figure out the actual cost, you can use a straightforward formula:

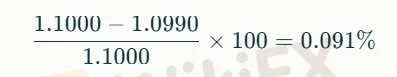

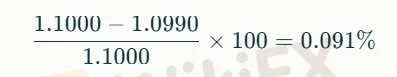

Imagine the EUR/USD pair is quoted with an ask price of 1.1000 and a bid price of 1.0990. Plugging these numbers in:

That means the spread is about 0.091% of the trade value. If you want to think in terms of pips (which means the fourth decimal in most pairs), the calculation is even simpler:

For example, if GBP/USD is at 1.3089/1.3091, the spread is 0.0002—or 2 pips.

Knowing how to calculate the spread helps you understand the actual cost hidden in each trade.

Handy Tools: Comparing Forex Spread Calculators

There are plenty of online tools designed to help you quickly calculate forex spreads and related trading costs. These calculators not only save time but also help you make smarter trading decisions by giving you clear numbers before you enter a trade.

Heres a quick rundown of some of the most popular tools:

Most forex spread calculators give you more than just the spread—they show your pip value, calculate profits, and help you manage leverage and margin. Some are free and great for beginners, while others cater to professionals looking for detailed options.

Forex Trading Fees: More Than Just the Spread

When trading forex, the spread isn‘t the only fee you’ll encounter. Heres a quick overview of the common fees that can add up:

- Spread Cost: The primary fee built into every trade, reflecting the difference between the buying and selling price.

- Commissions: Some brokers add explicit commission fees on top of the spread. These can be fixed per trade or a small percentage of your trade size.

- Overnight (Swap) Fees: If you hold positions overnight, you might pay—or sometimes earn—interest known as swap or rollover fees. This depends on the interest rate differences between currencies.

While commissions and overnight fees can vary based on your broker and trading style, the spread cost is unavoidable for every trader and usually the biggest cost in active trading.

How to Keep Your Spread Costs Down

Smart traders actively look for ways to minimize spread costs. Here are some practical strategies:

- Choose Brokers with Tight Spreads: ECN brokers or those catering to high-volume traders usually offer narrower spreads, especially on major pairs.

- Trade During Peak Market Hours: Spreads tighten during the busy London-New York session overlap when liquidity is highest.

- Use a Spread Calculator Regularly: Tools like a free spread calculator for currency trading help you spot the best times and pairs to trade.

- Avoid Exotic Currency Pairs: Exotic pairs usually have wider spreads because of lower liquidity.

- Consider Account Types: Some accounts offer fixed spreads, which might suit traders with large lot sizes better.

- Plan Your Strategy Around Spread: Scalpers and day traders who open and close many positions benefit most from minimizing spread.

- Stay Aware of News Events: Big economic announcements can cause spreads to widen sharply; sometimes its best to wait them out.

Real-World Example: A Spread Cost Breakdown

Let‘s say you want to buy 100,000 units of EUR/USD when the ask price is 1.1000 and the bid is 1.0998. That’s a 2-pip spread.

- You enter the market at 1.1000, spending $110,000 (100,000 × 1.1000).

- If you immediately sold, youd get 1.0998 × 100,000 = $109,980.

- Youve effectively lost $20 right away to the spread.

Using a spread calculator can help you see this upfront and compare brokers or trade times to find lower-cost spread options. Over many trades, saving just a few pips per trade can make a huge difference in profitability.

Wrapping It Up

Understanding forex spread and other fees is an important step for traders who want to keep more of their profits. Using a spread calculator forex tool is the simplest way to know exactly what youre paying on each trade and to find opportunities to reduce those costs.

Try out different calculators to find one that fits your trading style. Be mindful of the times you trade and choose brokers with competitive spreads. The more you manage your spread cost wisely, the better your trading results will be.

Dont overlook this crucial aspect—mastering your spread costs can make your forex trading experience much more rewarding.

Ready to take control of your trading fees? Explore the best and free spread calculators today and start trading smarter, not harder.