Company Summary

| Connext Review Summary | |

| Registered | 2022 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | FSA (Offshore Regulated) |

| Market Instruments | Forex, Precious Metals, Energies, and Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 1.2 pips (Standard account) |

| Trading Platform | MT5 |

| Minimum Deposit | $10 |

| Copy Trading | ✅ |

| Customer Support | Tel: +248 4377028 |

| Email: support@connextfx.com | |

| Facebook, YouTube, WhatsApp | |

Connext Information

Connext is a global CFD broker. It offers trading in forex, precious metals, energies and cryptocurrencies via the MT5 platform, with leverage of up to 1:1000. Account types include Micro Accounts, Ultra Accounts, No Swap Accounts for Islamic traders, and demo accounts. Features such as copy trading and multi-device MT5 access are also provided.

Pros and Cons

| Pros | Cons |

| Demo accounts available | Offshore regulation risks |

| Low minimum deposit of $10 | Commission fees charged |

| No deposit fees | Limited info on deposit and withdrawal |

| MT5 available | |

| Copy trading function |

Is Connext Legit?

The Seychelles Financial Services Authority (FSA) offshore regulates Connext with license number SD155. Although the platform claims to be regulated by the FCA, a top UK regulatory authority, it has not provided actual proof. It is recommended that traders prioritize brokers regulated by top-tier regulatory authorities for their transactions.

What Can I Trade on Connext?

Connext provides forex, precious metals, energy, and cryptocurrencies, specifically including over 60 major and minor currency pairs (such as EUR/USD, GBP/JPY), gold, silver, crude oil (such as UKOIL, USOIL), natural gas, Bitcoin, Ethereum, Monero, and more.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious Metals | ✔ |

| Energies | ✔ |

| Cryptocurrencies | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

Account Type

| Account Type | Micro | Ultra | Standard | No Swap | ULTRA GOLD |

| Minimum Deposit | $10 (1,000 cents) | $10 | |||

| Maximum Leverage | 1:1000 | ||||

| Spread from | 1.4 pips | 0.6 pips | 1.2 pips | 1.5 pips | 1.5 - 2.3 pips |

| Commission | ❌ | From $6 per lot | ❌ | ❌ | From $3 per lot |

| Swap | ✔ | ✔ | ✔ | ❌ | ✔ |

Connext Fees

Spread: The minimum spread for major currency pairs is 0.6 pips (Ultra account), and the spread for gold is 1.5-2.3 pips (ULTRA GOLD account).

Commission: $6 per lot for Ultra, $3 per lot for ULTRA GOLD.

Swap: Overnight holding will generate interest for all accounts except the No Swap account, with the interest being positive or negative depending on the long/short position.

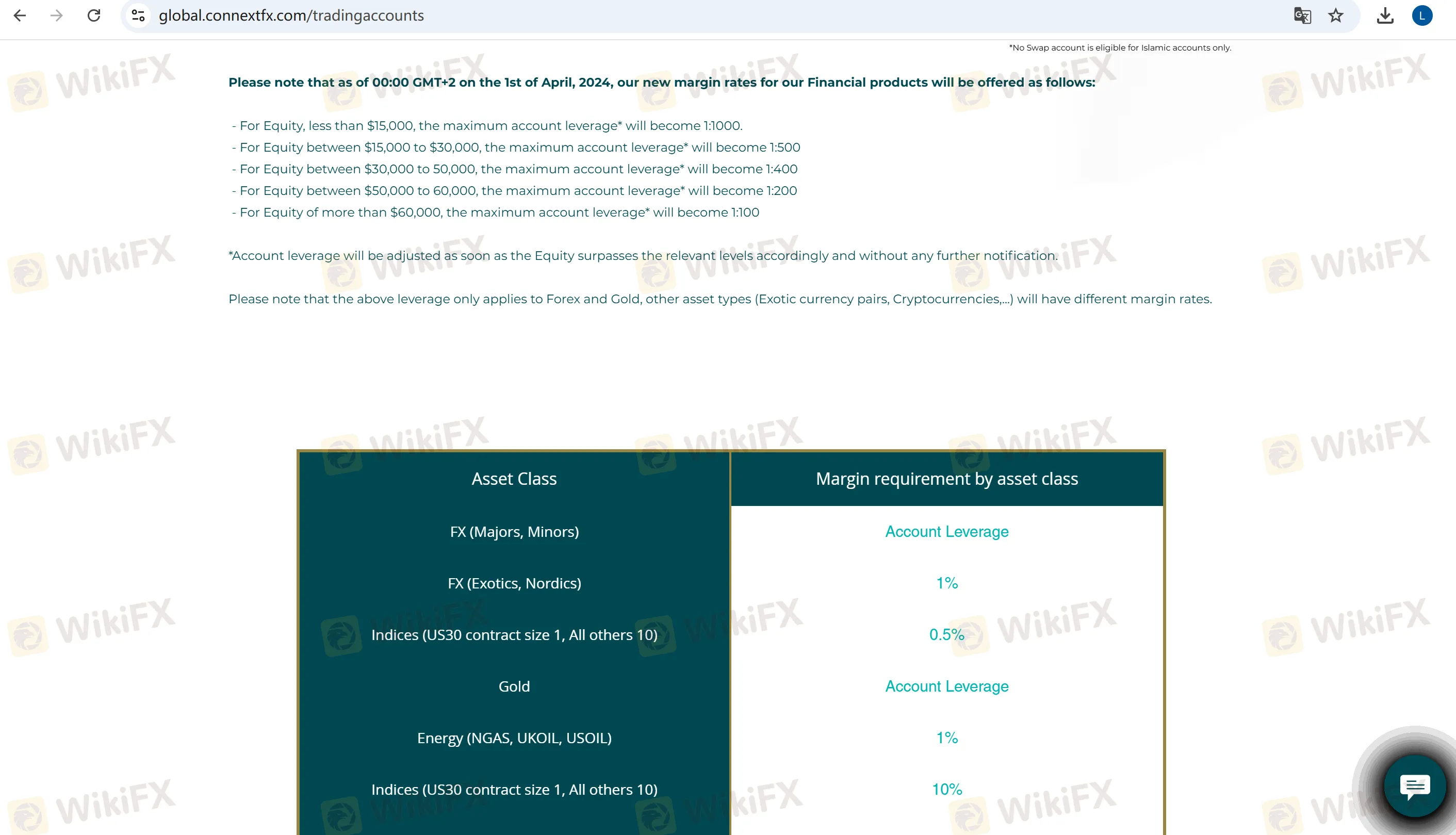

Leverage

The leverage can be as high as 1:1000. From 00:00 GMT+2 on April 1, 2024, the new margin rates for financial products will be as follows:

| Stock Amount Range (USD) | Maximum Leverage |

| <15,000 | 1:1000 |

| 15,000 - 30,000 | 1:500 |

| 30,000 - 50,000 | 1:400 |

| 50,000 - 60,000 | 1:200 |

| 60,000+ | 1:100 |

Margin

| Asset Class | Margin |

| FX (Majors, Minors) | Account Leverage |

| FX (Exotics, Nordics) | 1% |

| Indices (US30 contract size 1, All others 10) | 0.5% |

| Gold | Account Leverage |

| Energy (NGAS, UKOIL, USOIL) | 1% |

| Indices (US30 contract size 1, All others 10) | 10% |

| Crypto (Except Monero) | 20% |

| Crypto (Monero) | 50% |

| Stocks | 10% |

Trading Platform

Connext provides MetaTrader 5 (MT5), which supports multi-terminal synchronization, such as desktop, mobile, and web terminals. It also supports the EA intelligent trading system, making it suitable for Experienced traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced Traders |

| MT4 | ❌ | / | Beginners |

Copy Trading

Through the built-in Copy mechanism of the platform, users can replicate the strategies of over 6,000 professional traders worldwide, making it suitable for traders lacking time or experience.

Deposit and Withdrawal

Connext offers a minimum deposit of only $10 and it does not charge any deposit fees. However, other details such as payment options, processing time, and accepted currencies, are not clear.

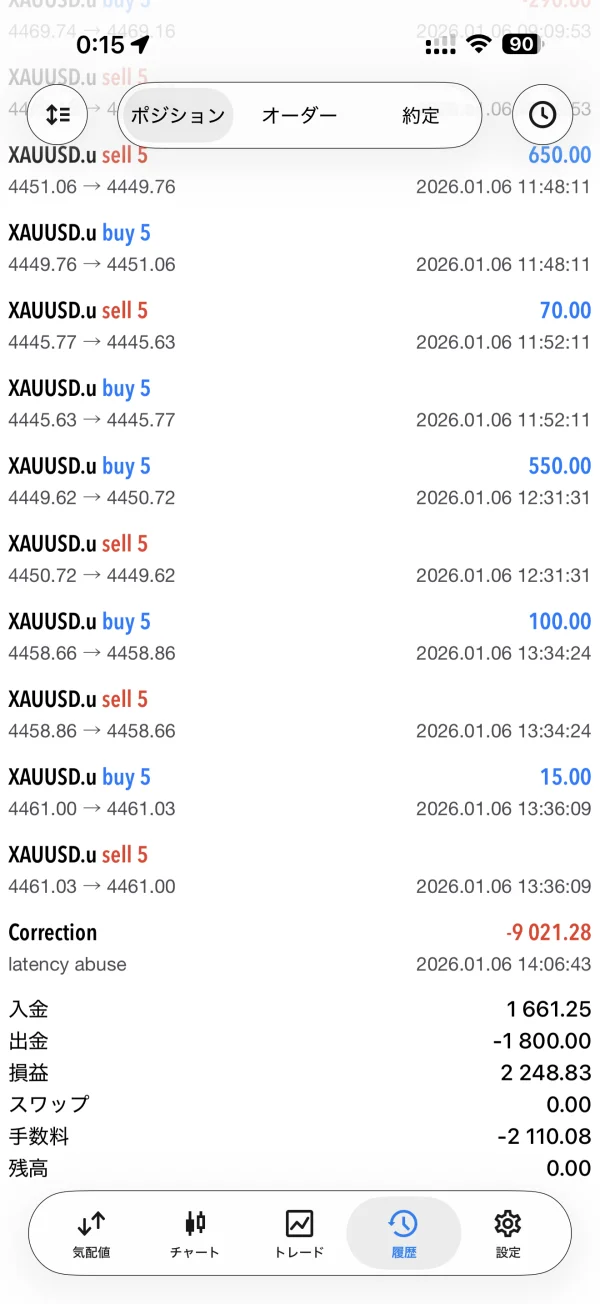

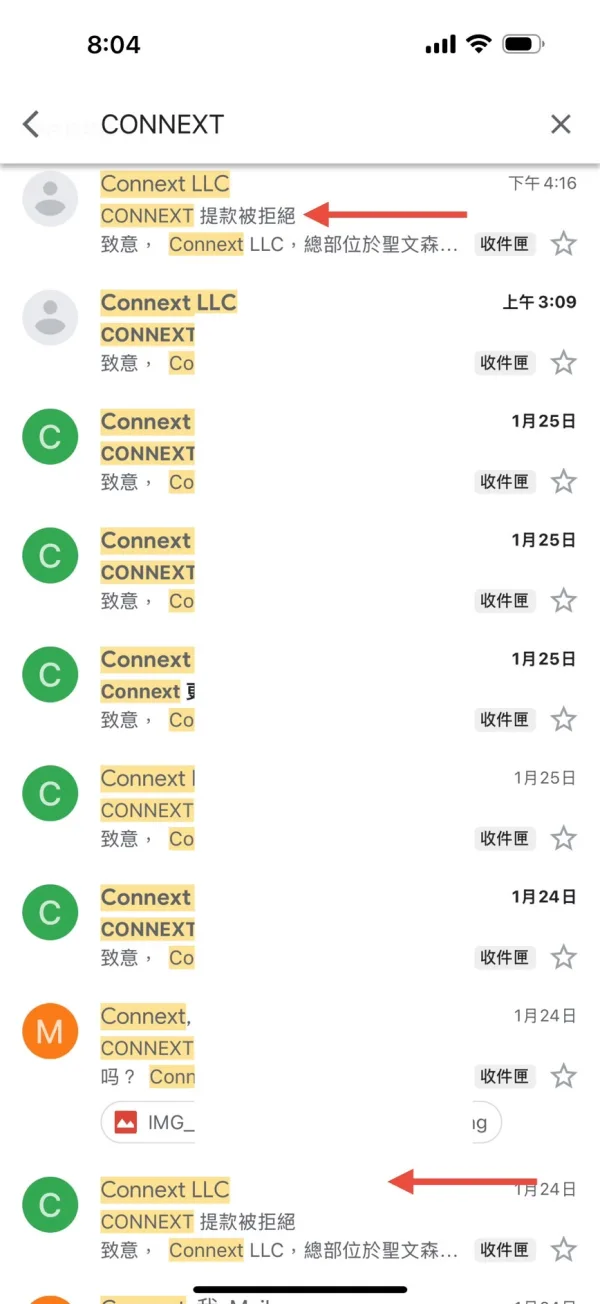

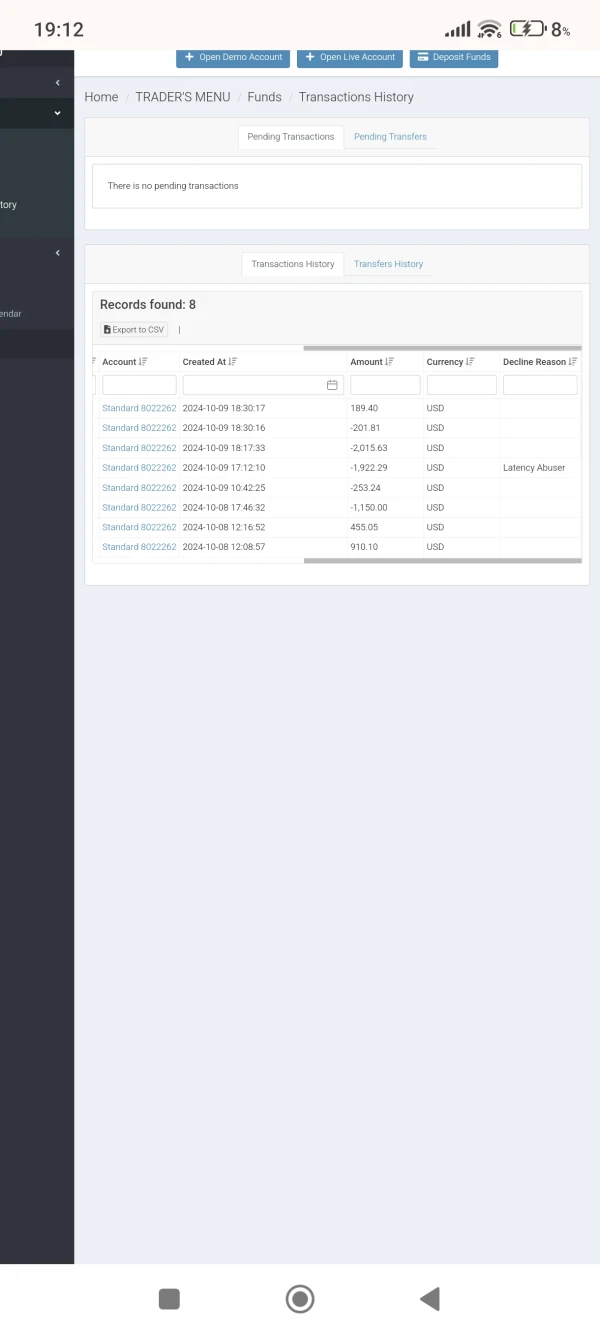

FX3191785814

Japan

They claim it was a terms of service violation, and despite my requests for proof of fraud, they only repeat the violation claim without providing any evidence. Am I just supposed to accept this and give up? This document, “Connext,” is proof that my entire account balance was wiped out.

Exposure

clover1453

Singapore

I deposited USD 450 into my Connextfx account in October 2025 and started trading with very small positions. After a few trades, my balance grew to about USD 549, reflecting only a modest profit of around USD 99. To my shock, the broker suddenly deducted all money from my account with the explanation of “violating rules.” This completely erased not only the profit but also my initial deposit. When I contacted support, they refused to provide any clear explanation or evidence, and simply responded that “no further adjustments will be made.” This is deeply unfair and feels like my money has been taken without justification. I am now demanding at least the return of my USD 450 deposit. Taking client deposits under vague claims of rule violations is unacceptable and destroys trust. ⚠️ Warning: Based on my experience, your money may not be safe with Connextfx. Please be very cautious before depositing.

Exposure

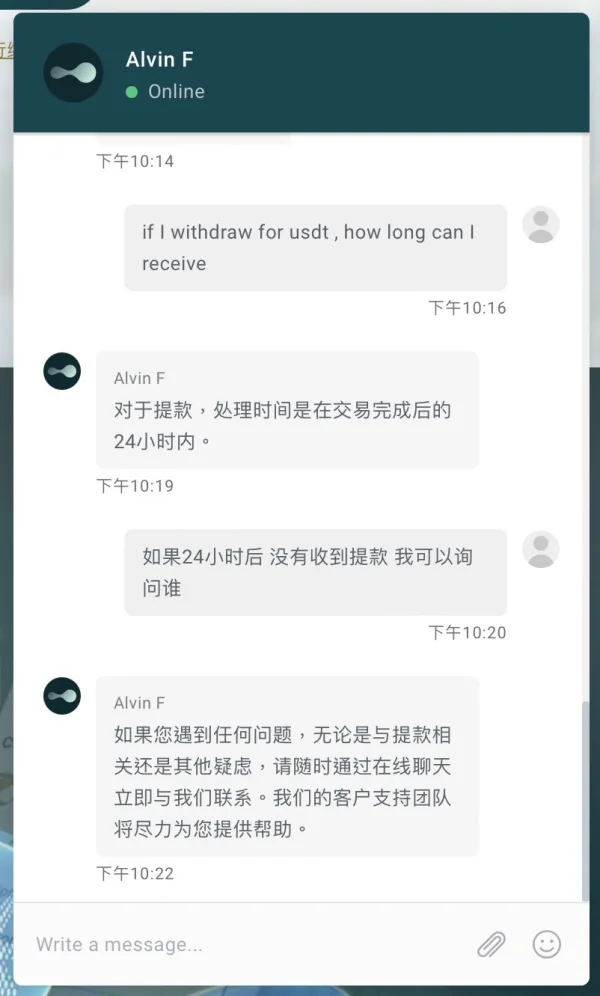

FX4018429438

Taiwan

Recently, I engaged in trading on this platform but unfortunately became a victim of a scam. I invested hundreds of dollars to purchase a service or product, only to encounter significant issues during the transaction process. Firstly, after making the payment, I did not receive any goods or services as promised, and the customer service response was extremely slow and unhelpful, failing to provide effective solutions to my concerns. Moreover, the operational details of the platform showed a lack of adequate protective measures, making me feel utterly deceived. This experience has been profoundly disappointing and has led me to seriously doubt the credibility of the platform. I urge the platform to address these issues promptly, improve its customer service system, and enhance transaction transparency to prevent others from suffering losses like mine. Additionally, I hope that my refund issue can be resolved quickly and that I receive fair compensation for my losses. Repeated attempts to contact customer support have always resulted in being told to wait 24 hours, yet the outcome remains unresolved regarding withdrawals. I advise everyone not to open accounts here as it is impossible to withdraw funds and it simply wastes time! I strongly recommend other consumers to be cautious when conducting transactions to avoid being deceived. A platform that refuses even to release a few hundred dollars is utterly reprehensible!

Exposure

Black7ks Channel

Thailand

Withdraw crypto veryfast Profit 5400$ Thank you Connext Broker

Positive

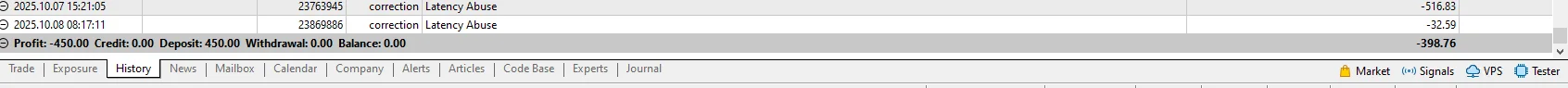

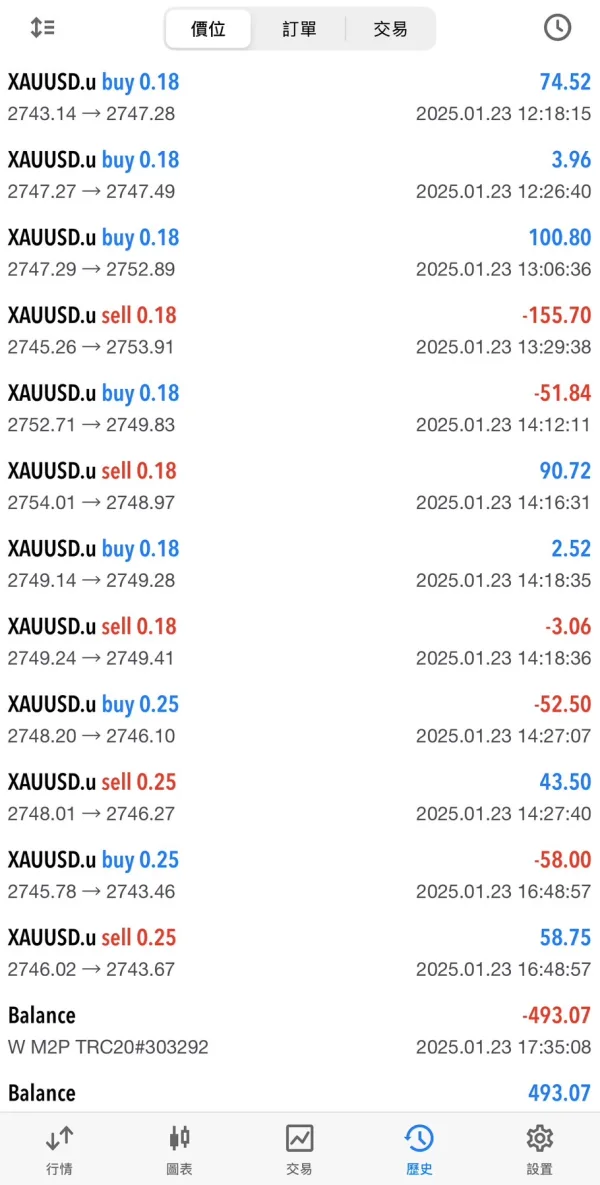

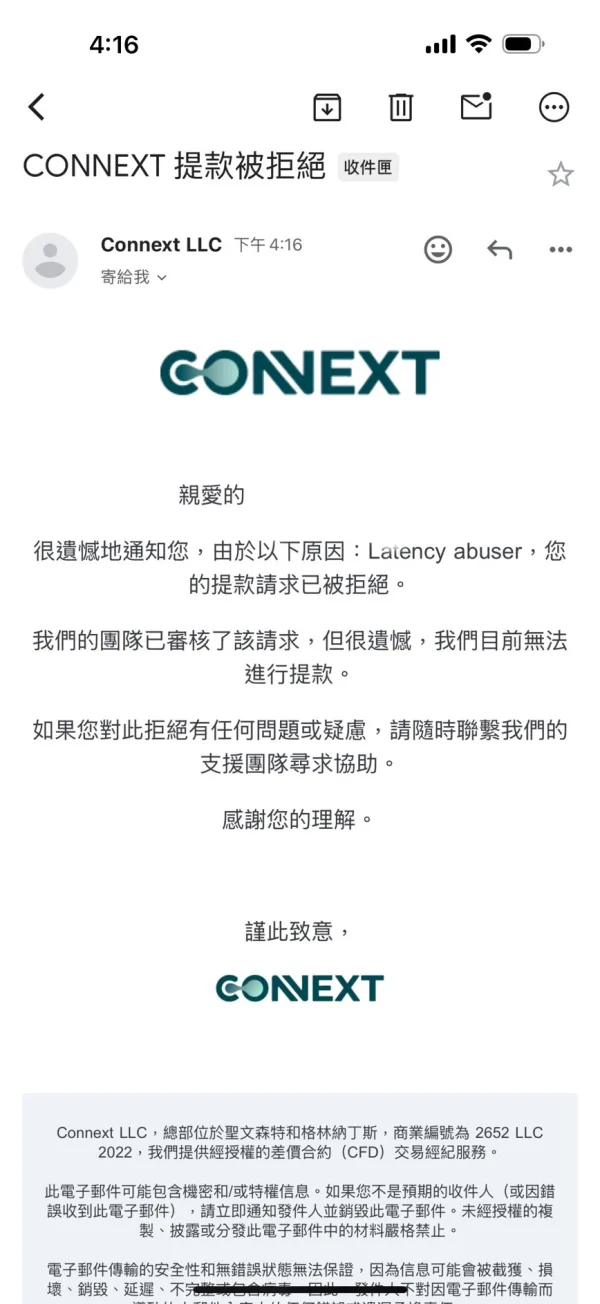

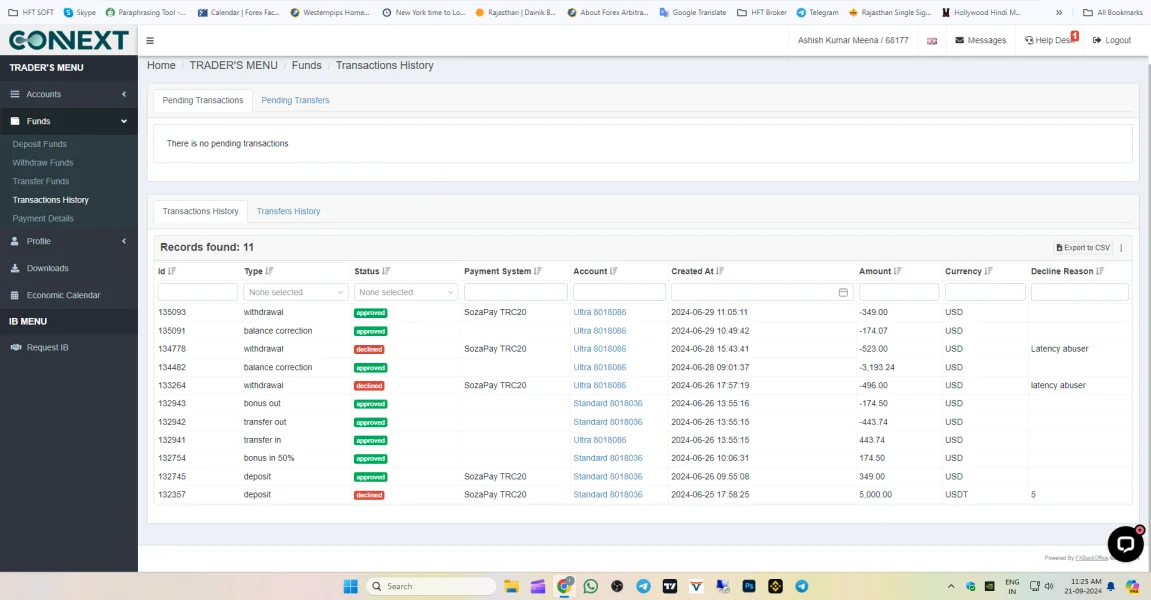

Toprak Ç.

Turkey

''Latency Abuse''With a ridiculous excuse, the principal and all my profits were blocked and they did not send me.. No one should invest here, it is completely fraudulent activity.

Exposure

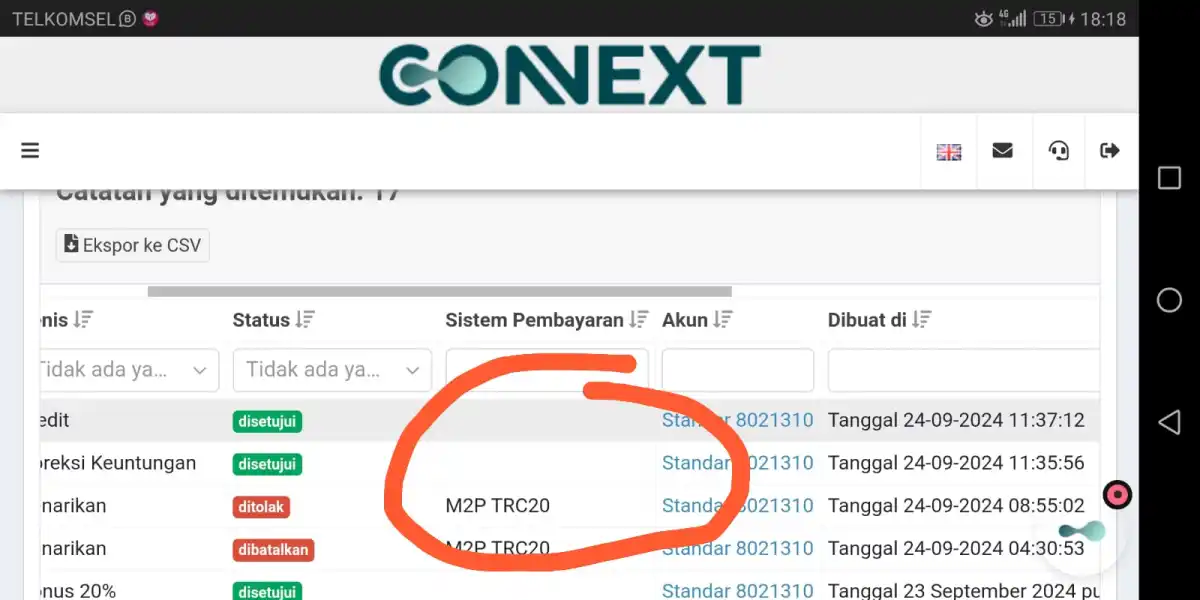

FX4343195962

Indonesia

I just want my capital back, but with this platform all my money is taken. Capital and profit are taken. Be careful with this platform, it's better to use another platform with clear regulations. And all the complaints from those who have used this platform are the same. And below is the proof that my withdrawal was rejected, and they transferred my funds to their wallet.

Exposure

Ashish7595

India

this is a total scam broker. I don't waste your hard earn money here

Exposure

Xray

Hong Kong

Connext's got a diverse range of tradable assets, perfect for any investor's portfolio. Plus, their customer support is top-tier, super responsive.

Positive

IanO4852

Peru

HOLY MOLY, this broker is indeed a versatile one and to be honest I was surprised by how many useful services they provide for customers. The trading platform is convenient to use and there are so many valuable features for fundamental and technical analysis. I really love combining these two methods of analysis for successful trading and it’s unreal for me to use only one type of analysis. By the way, the user interface of the platform is beautiful and intuitive. It was easy peasy to adjust to it. The support team is always available and they respond quickly to my questions. I appreciate it!

Positive

Hugo Ramírez

Mexico

I think the score should be higher. They are pretty modern, and offer a lot. Low fees, low minimal deposit, huge possible leverage if you want that, 4 diffrent accounts. Its funny that

Positive

patricio villar

Argentina

Among four popular trading markets, i’m only interested in forex so it’s all good. Also there is a raw account with almost ZERO spreads and relatively low commissions. I think I heard that Connext has plans to launch more asset classes in the future and that's great. It would be cool to have shares, bonds or some tokens at my disposal.

Positive

Diego López19

Mexico

I have been experimenting with EAs for some time and one of the reasons why I joined this platform is the fact they allow using EAs in the first place, they don’t have any limitations regarding the trading strategies, offer trading through the MT5 app, which is one of the best engines for trading with EAs and finally, they have a Micro account. I am focused on trading forex, and I enjoy its range for this asset category. The trading terms are also favourable. The spreads on my instruments are narrow; there are no additional commissions except for the swap fees; and the leverage of 1000x is quite generous. The integration of the MT5 is fine. The app is working perfectly smoothly even with high frequency trading style.

Positive

Simon Pena

Argentina

I want to admit that I opened trading account with this company for three reasons. 1) commissions 2) spreads 3) leverage Most likely, leverage is the main reason. After all, I still have small deposit amount. But at the same time, I want to quickly increase it in size so that it is about $3 000 - $ 5 000. Then I plan to trade smaller lot in to reduce risks. And at the same time, my monthly profit will be quite large. Such plan can be implemented only with large leverage. And I got 1:1000 from this broker. This is the most sutable leverage size for my purposes. I think that in about 12-24 months I will be able to achieve my goal. And I hope that my trading strategy will be reliable enough

Positive

Cristian Vazquez

Colombia

Choosing the right broker is a daunting task for every trader, but what matters the most in this regard is that you choose the one that you can trust with your funds and focus on your trading. There are plenty of reliable brokers, and among them is Connext. I spent almost a month trading on this platform and what I can share about them is that they are regulated, trustworthy and honest and transparent brokers. It was easy to understand its trading terms, and they truly delivered on their promises. Nothing surprised me when I started trading. I like that they are focused on MT5 app 👍

Positive

Alejandro Martinez

Mexico

It kinda tough for me to get why the broker isn't recognized in the community yet. Actually, after trading metals here for a while I confirm that trading conditions are competitive and even advantageous compared to other platforms. It new, and maybe this the reason why it haven't gained its recognition yet, but all ahead. Btw, gold traded with 1:1000 leverage, that's cool.

Positive

Alejandro Sanchez

Mexico

They approved my real tarding accont the same day I filled out the forms and uploaded the docs.

Positive

Carlos H.

Mexico

Min depo is just $10 and that's cool!! But it were tough to find info about deposit methods ;(

Positive

Juan Ramirez4812

Dominica

From the first perspective the broker isn’t so convincing tbh. I wasn’t sure about the overall quality, but I was attracted by the services and the commissions in particular. You know, $6 per whole lott is quite a low commissions. Usually forex brokers charge $10 per whole lot. Sometimes even 0.15 percent of the trade value. as for the payments I suppose they were fine. My credit card deposit was funded almost instantaneous.

Positive

FX1668672624

Kazakhstan

All these years I have been trading on ZERO accounts and using the robot on a cent account. Order execution is instant, which is great. And I love the input and output methods, there are so many options. USDT withdrawal will always be instant.

Positive

Yokilala

Nigeria

While the access to various markets is appealing, the potential risks overshadow the benefits. The limited customer support availability is frustrating, and the absence of clear information on deposit and withdrawal methods raises concerns. I wouldn't recommend Connext to anyone who prioritizes the safety of their investments. It's crucial to consider the risks associated with the lack of regulation before diving into trading with them.

Neutral

Taunton-Smith

United Kingdom

While the access to various markets is appealing, the potential risks overshadow the benefits. The limited customer support availability is frustrating, and the absence of clear information on deposit and withdrawal methods raises concerns. I wouldn't recommend Connext to anyone who prioritizes the safety of their investments. It's crucial to consider the risks associated with the lack of regulation before diving into trading with them.

Neutral

firefists

New Zealand

Regarding their trading services, Connext offers a range of currency pairs and trading products, including CFDs on stocks, indices, and commodities. The trading conditions are average, with moderate leverage and spreads. However, there are no details provided about their trading fees or commissions, which may be a red flag for some traders.

Neutral

firefists

New Zealand

Connext has a low minimum deposit requirement of only $10, which is attractive to new traders. However, there are several factors that make me hesitant to trade with them. Firstly, the lack of reliable regulation is a significant concern, as it increases the risk of fraud and misconduct. Secondly, the company's short operating history and registration in Saint Vincent and the Grenadines, a known offshore tax haven, also raises questions about their credibility and transparency.

Neutral