Abstract:Forex trading has grown rapidly in India, and choosing the right broker is critical—especially when it comes to spreads. A low spread broker means lower trading costs and higher potential profits, especially for active traders and scalpers. In this article, we list the top 5 low-spread forex brokers in India for 2025, trusted for their tight spreads, fast execution, and strong global reputation.

Forex trading has grown rapidly in India, and choosing the right broker is critical—especially when it comes to spreads. A low spread broker means lower trading costs and higher potential profits, especially for active traders and scalpers. In this article, we list the top 5 low-spread forex brokers in India for 2025, trusted for their tight spreads, fast execution, and strong global reputation.

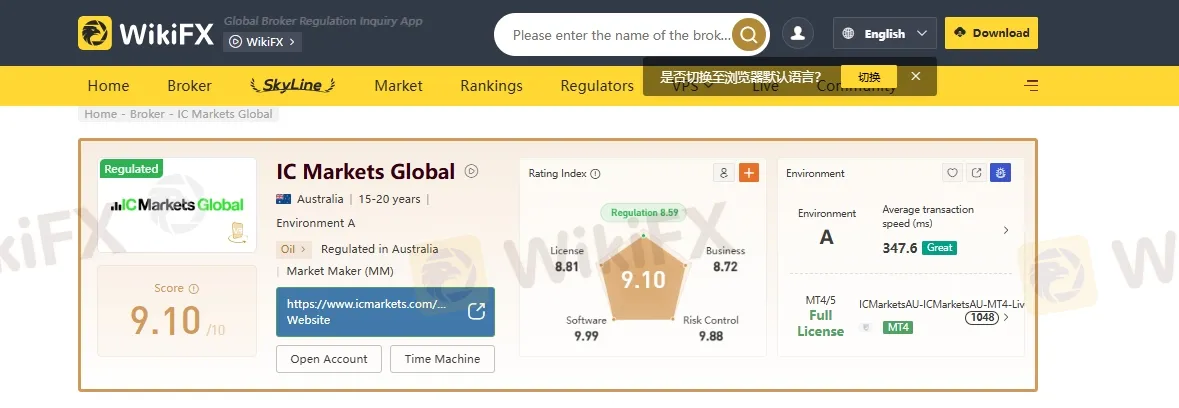

1. IC Markets Global – The Choice of Professional Traders

• Spreads: From 0.0 pips (Raw Spread Account)

• Regulated by: ASIC, FSA (Seychelles), CySEC

• Leverage: Up to 1:500

• Minimum Deposit: $200

• Best For: Scalpers, Algo Traders, High-Frequency Traders

IC Markets is a globally recognized ECN forex broker offering ultra-low spreads and lightning-fast execution. Popular for automated trading via MetaTrader 4/5 and cTrader, it's a top pick for serious traders in India looking for reliable execution and institutional-grade liquidity.

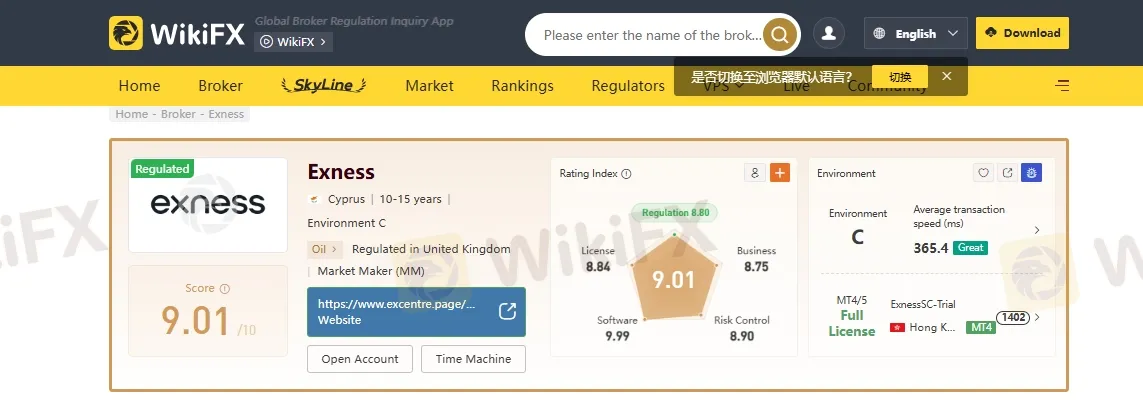

2. Exness – Transparent, Flexible & Trader-Friendly

• Spreads: From 0.1 pips (Standard & Raw Accounts)

• Regulated by: FCA (UK), CySEC, FSCA

• Leverage: Up to 1:Unlimited (Based on margin conditions)

• Minimum Deposit: Starts from $10

• Best For: Beginners and experienced traders

Exness has gained popularity in India due to its super low spreads, instant withdrawal options, and flexible leverage. Their intuitive interface, mobile app, and transparent pricing model make it a top choice for both new and experienced forex traders.

3. XM – Reliable, Regulated, and Rewarding

• Spreads: From 0.6 pips (Ultra Low Account)

• Regulated by: ASIC, CySEC, IFSC

• Leverage: Up to 1:1000

• Minimum Deposit: $5

• Best For: Traders looking for bonuses, tight spreads, and educational support

XM offers tight spreads, commission-free trading on most accounts, and frequent bonuses/promotions. Their strong focus on trader education, with free webinars and analysis tools, makes them ideal for Indian traders looking to learn and grow.

4. FBS – Flexible and Bonus-Focused Trading

• Spreads: From 0.3 pips (Zero Spread Account)

• Regulated by: CySEC, IFSC, FSCA

• Leverage: Up to 1:3000

• Minimum Deposit: $1

• Best For: Traders who prefer bonuses, low deposits, and high leverage

FBS stands out for its variety of account types, including zero spread and cent accounts. It also offers attractive trading bonuses, making it a great platform for Indian traders who want to start small and scale up.

5. FP Markets – ECN Precision with Low Spreads

• Spreads: From 0.0 pips (Raw ECN Account)

• Regulated by: ASIC, CySEC, FSCA

• Leverage: Up to 1:500

• Minimum Deposit: $100

• Best For: ECN trading with advanced tools

FP Markets is an ECN forex broker known for low spreads, fast execution, and support for MT4, MT5, and IRESS platforms. Indian traders value their transparent fee structure and professional trading environment.

Final Thoughts- All five brokers—IC Markets, Exness, XM, FBS, and FP Markets—offer competitive spreads, robust platforms, and global reliability. The best choice depends on your:

• Trading style (scalping, swing, long-term)

• Preferred platform (MT4/MT5/cTrader)

• Initial deposit

• Bonus preferences

Before choosing, always check the broker's regulatory status, customer support, and withdrawal options for Indian residents.

Frequently Asked Questions

Q1. Is forex trading legal in India?

Forex trading is legal when done through Indian exchanges for INR-based pairs. However, many Indian traders use global brokers at their own discretion for broader market access.

Q2. Which forex broker offers the lowest spreads?

IC Markets and FP Markets offer spreads starting from 0.0 pips on Raw ECN accounts.

Q3. Can Indian traders open accounts with these brokers?

Yes, Indian residents can register with these brokers, but it's essential to verify terms, regulations, and compliance with Indian laws.