Abstract:ECN stands for Electronic Communication Network. A technology-driven marketplace that directly connects buyers and sellers, including banks, hedge funds, brokers, and retail traders, allowing orders to be matched without the broker acting as the counterparty. In forex and CFD trading, ECN execution is prized for transparent pricing, raw spreads, and faster order matching.

ECN stands for Electronic Communication Network. A technology-driven marketplace that directly connects buyers and sellers, including banks, hedge funds, brokers, and retail traders, allowing orders to be matched without the broker acting as the counterparty. In forex and CFD trading, ECN execution is prized for transparent pricing, raw spreads, and faster order matching.

How ECN works

Instead of the broker taking the other side of your trade (the market-maker model), an ECN aggregates live quotes from multiple liquidity providers and market participants and matches compatible buy and sell orders. Think of it as an electronic order book: when someone‘s bid matches another’s ask, the trade executes.

Short takeaways:

- Orders are routed into a network where matching happens across participants.

- You often see Depth of Market (DOM) or Level II data — multiple price levels and sizes, not just the best bid/ask.

- Brokers using ECN typically show raw spreads and charge a separate commission per trade.

ECN vs STP vs Market Maker

- ECN: True order-book matching between participants with visible order flow and generally tighter raw spreads. Commissions are usually charged separately.

- Market Maker: Broker often takes the opposite side of client trades and may mark up prices. Spreads are typically fixed or widened by the broker. Potential conflicts of interest can exist.

- Straight Through Processing: Broker routes orders to liquidity providers. Prices may be aggregated, and the broker can still apply markups. STP is a broad term and not always the same as ECN.

Advantages of ECN trading

- Transparency: You see real market prices and order depth.

- Tighter raw spreads: Because youre seeing quotes from liquidity providers, spreads can be very low during liquid times.

- Less price manipulation: Brokers route to the network rather than acting as a counterparty.

- Good for scalpers and algos: Low spreads and fast matching help strategies that rely on very small price moves.

- Price improvement: Limit orders can be filled at better-than-expected prices if matched.

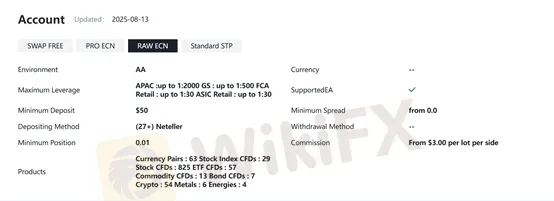

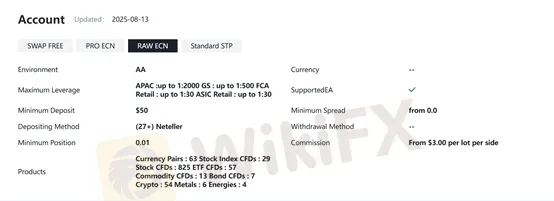

Reputable Brokers offering ECN

Vantage

VT Markets

Practical tips when trading on ECN

- Calculate total cost: Always add spread + commission (and consider swaps and slippage).

- Use limit orders when possible: They reduce slippage and may get price improvement.

- Test execution: Observe spreads and fills across sessions and during news with a demo or micro account.

- Monitor liquidity windows: London/New York overlaps usually offer the tightest spreads.

- Read the execution policy: Check how the broker handles latency, partial fills, and order routing.

Conclusion

ECN is a marketplace-style execution model offering clean access to real liquidity, transparent pricing, and fast matching — ideal for active traders and algos. Its not universally “better” for everyone: weigh the trade-offs (tight spreads versus commissions, speed versus complexity) and match the execution model to your strategy. Want a one-page checklist you can use when vetting ECN brokers? I can build it for you next.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.