IG Boosts Cash Interest, Drops Account Fees for UK Investors

IG raises rates on uninvested cash and removes inactivity fees, joining a growing trend among brokers targeting UK retail investors.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:you should always Scam Alert in forex market. If something seems too good to be true, it often hides red flags behind it. Therefore, We reviewed InstaForex and reveal hidden risks associated with it. Whether you are an Indian trader, a potential user, or an existing client, it is crucial to understand the risks associated with InstaForex .

InstaForex heavily promotes itself through ads, promotional campaigns, and various offers targeted at traders and investors. But remember — not everything that glitters is gold. This is the era of sophisticated marketing techniques, and you should always Scam Alert in forex market. If something seems too good to be true, it often hides red flags behind it. Therefore,

We reviewed InstaForex and reveal hidden risks associated with it. Whether you are an Indian trader, a potential user, or an existing client, it is crucial to understand the risks associated with InstaForex .

5 Major Drawbacks of InstaForex

There are several concerns surrounding its operations—especially for Indian traders. Below, are the top 5 drawbacks of InstaForex India that every trader should be aware of.

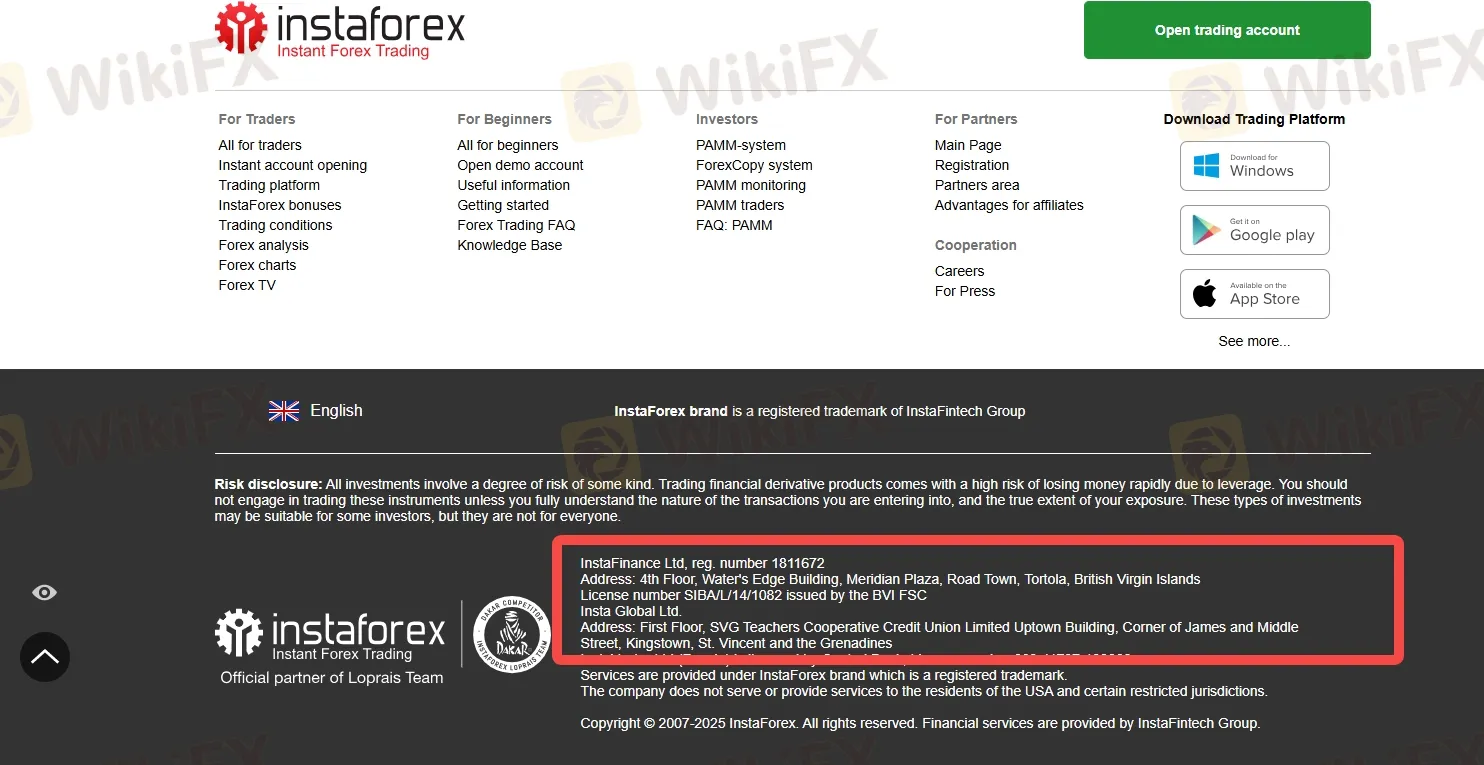

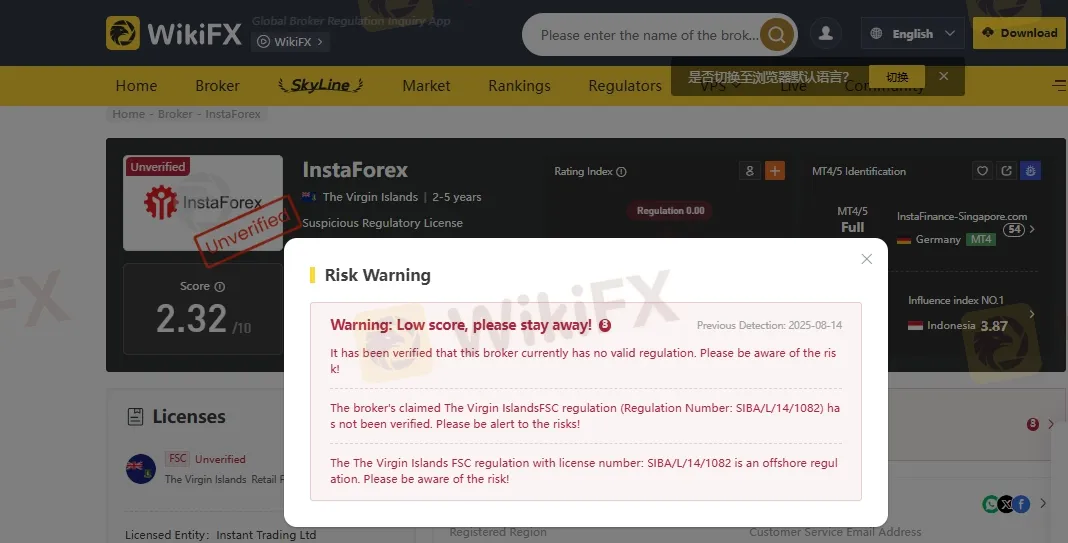

1. Offshore Regulation Raises Concerns

InstaForex operates under several offshore entities. Instant Trading Ltd. is licensed in the British Virgin Islands by the BVI Financial Services Commission (BVI FSC). Other associated companies, such as Insta Service Ltd. and Insta Global Ltd., are registered in St. Vincent and the Grenadines.

While these jurisdictions allow brokers to operate globally, they are known for lenient regulatory oversight compared to Tier-1 regulators like FCA (UK) or ASIC (Australia). This lack of strict regulation raises red flags for Indian investors looking for financial transparency and security.

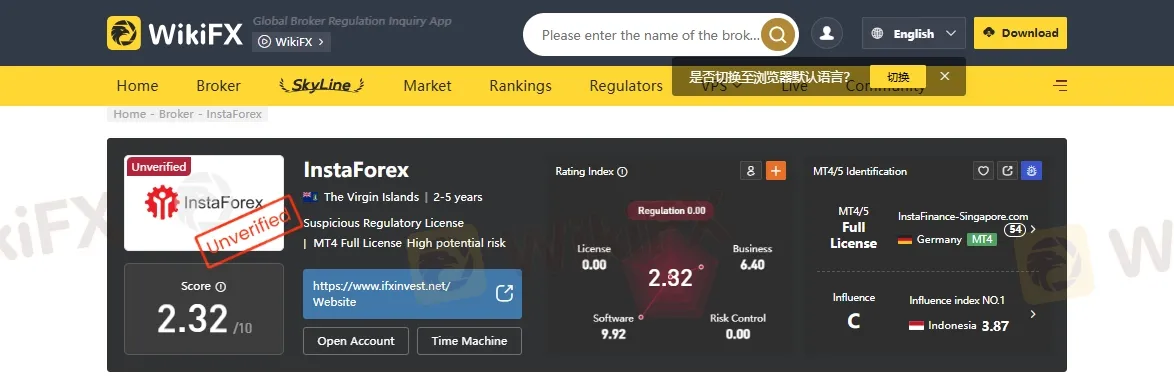

2. Disappointing WikiFX Score

Another critical issue is InstaForexs low rating on WikiFX which is 2.32 out 0f 10. A poor WikiFX score often reflects potential problems with transparency, withdrawal issues, or overall service quality.

3. Restricted Jurisdictions

Another significant drawback of InstaForex is its limited availability in several jurisdictions. The broker explicitly states that it does not offer services to residents of certain countries, including the United States, United Kingdom, Japan, Belgium, Israel, and North Korea, among others. This restriction not only raises questions about the brokers regulatory compliance in major financial regions but also highlights its inability to meet the legal and financial standards required by top-tier regulators.

4. WikiFX Warning Issued

Another Red flag , is warning issued by WikiFX against InstaForex. Such warnings usually stem from unresolved customer complaints, lack of regulatory compliance, or questionable business practices. If you're an Indian trader looking for a secure and reputable broker, a WikiFX warning is a major red flag that shouldn't be ignored.

5. Limited Market instruments

Another drawback is the limited variety of trading instruments available on the InstaForex platform. While they do offer access to forex, CFDs, and a few commodities, the range of tradable assets is narrower compared to other leading platforms. Indian traders who are looking for exposure to a broader portfolio—including cryptocurrencies, bonds, ETFs, or local Indian stocks—might find the platform restrictive.

Conclusion

These five critical drawbacks about offshore regulation, low WikiFX rating, limited customer support, low market diversity, and a WikiFX warning—make it less appealing for Indian traders. Before investing your hard-earned money, its vital to consider brokers with strong regulatory backing, transparent policies, and a proven track record.

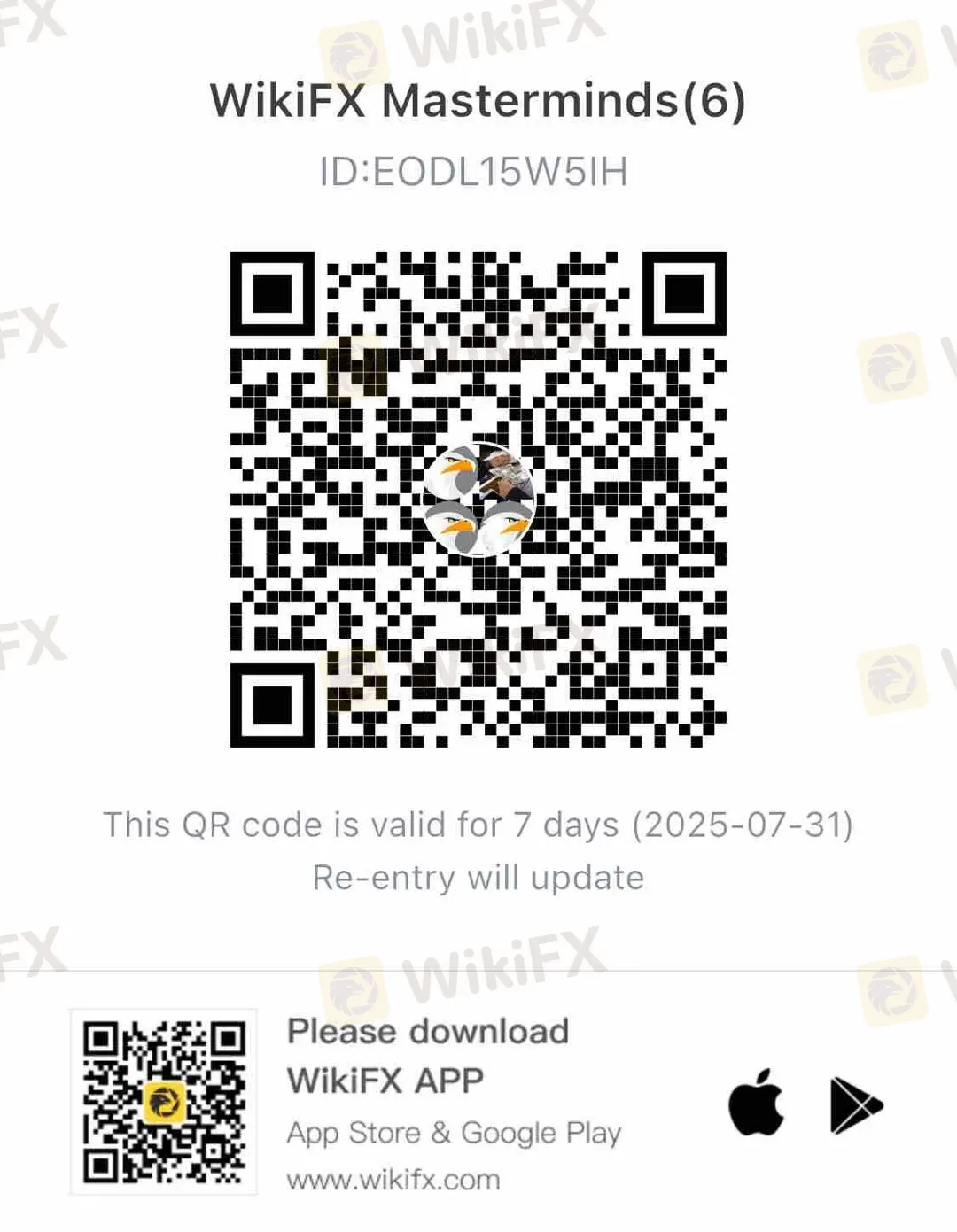

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

IG raises rates on uninvested cash and removes inactivity fees, joining a growing trend among brokers targeting UK retail investors.

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

If you are looking for an "SGFX Review" or want to know the "SGFX Pros and Cons," you have found an important resource. You probably want to know, "Is SGFX a safe and trustworthy broker?" Based on our detailed research, the answer is clearly no. While SGFX (also called Spectra Global) looks modern and professional, we have found serious warning signs that every potential investor needs to know about before investing. This review will get straight to the point. We will immediately discuss the main problems that make this broker extremely risky. These include weak and misleading regulation from offshore locations, questionable trading rules designed to get large deposits, and a worrying pattern of serious complaints from users, especially about not being able to withdraw. This article will give you a complete, fact-based analysis of how SGFX operates to help you make a smart and safe decision.