Company Summary

| CloudfuturesReview Summary | |

| Founded | 2019 |

| Registered Country/Region | China |

| Regulation | CFFE |

| Market Instruments | Futures |

| Demo Account | ❌ |

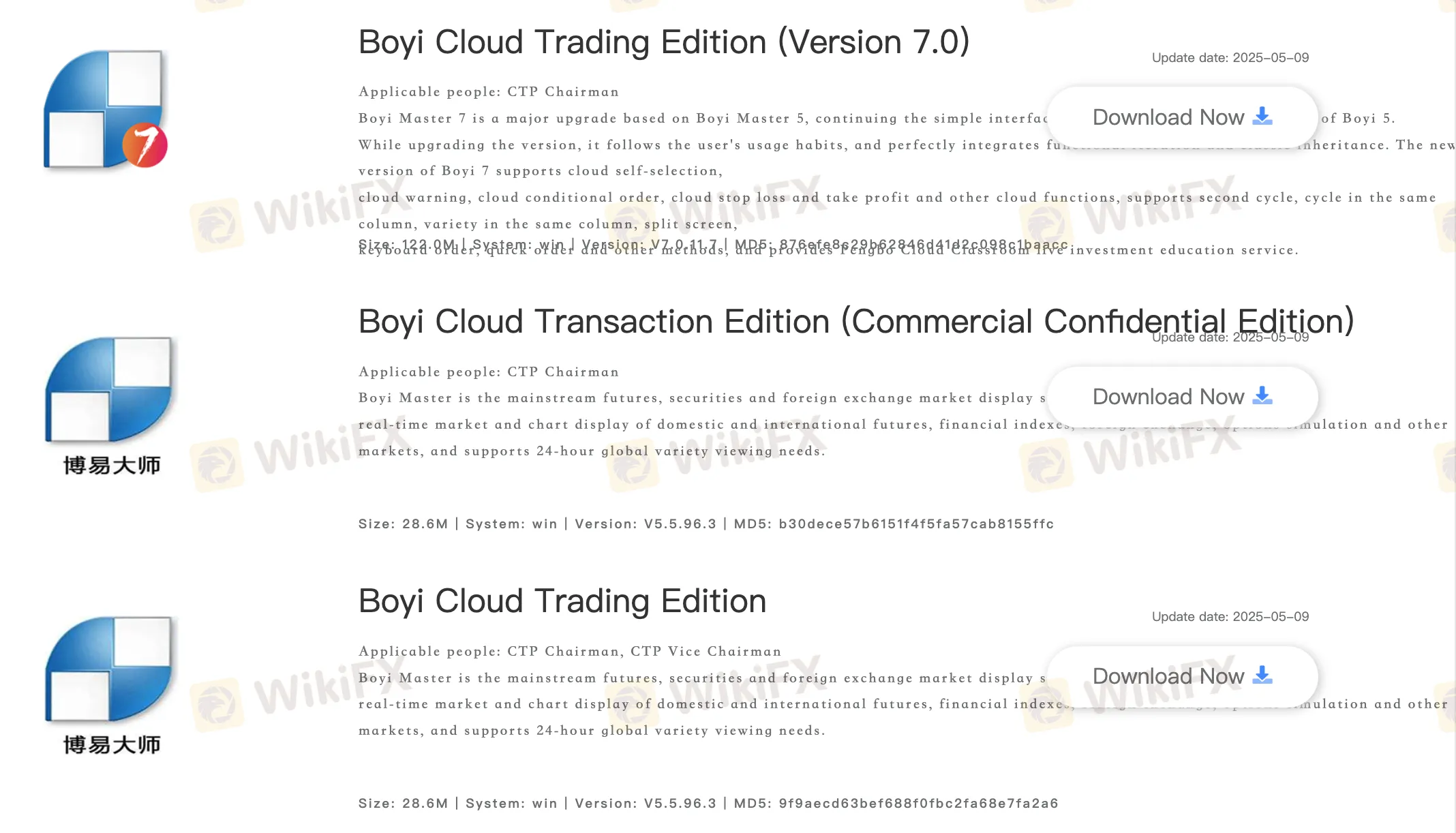

| Trading Platform | Boyi Cloud Trading Edition (Version 7.0), Boyi Cloud Transaction Edition (Commercial Confidential Edition), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Commercial Confidential Version), Quick Issue V3 (Commercial Confidential Version), Fast Issue V2, Quick Issue V3, etc. |

| Customer Support | Tel: 4001119992 |

| Email: YCFQH@cloudfutures.cn | |

Cloudfutures Information

Cloudfutures is a regulated broker, offering trading services on futures on various trading platforms. The broker offers no demo accounts and little information on trading conditions. Since little information is provided, there is a lack of transparency of the website.

Pros and Cons

| Pros | Cons |

| Various trading platforms | No demo accounts |

| Regulated well | Few contact channels |

| Lack of transparency |

Is Cloudfutures Legit?

Yes. Cloudfutures is licensed by CFFEX to offer services.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| China Financial Futures Exchange | Regulated | 云财富期货有限公司 | Futures License | 0240 |

What Can I Trade on Cloudfutures?

Cloudfutures offers trading on futures.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Trading Platform

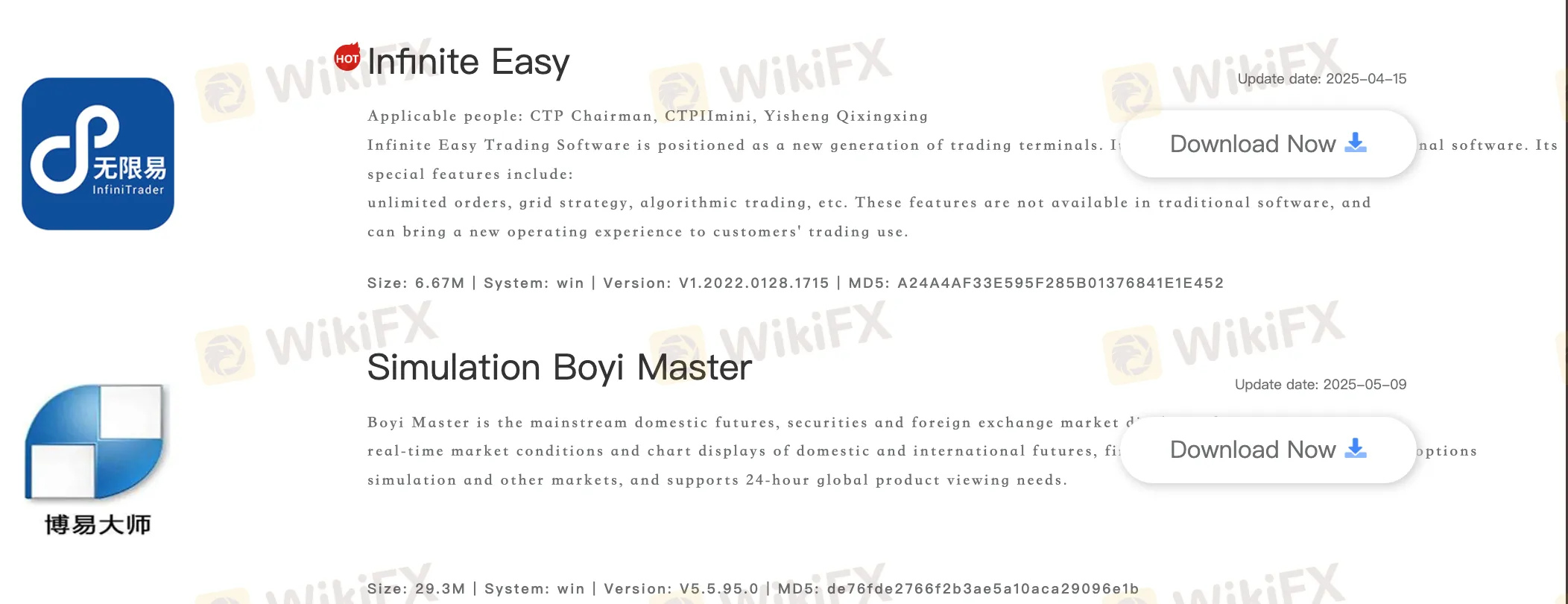

The broker provides various trading platforms, including Boyi Cloud Trading Edition (Version 7.0), Boyi Cloud Transaction Edition (Commercial Confidential Edition), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Commercial Confidential Version), Quick Issue V3 (Commercial Confidential Version), Fast Issue V2, Quick Issue V3, Fast Issue V2, Quick Issue V3, Winshun Cloud Trading Software (wh6), Cloud Wealth Futures, Travel, Disk Cube, Cloud Wealth Polestar 9.5, Cloud Wealth Polestar 9.5 MacOS, Cloud Wealth Polestar 8.5, Infinite Easy and Simulation Boyi Master.

Available devices: desktop and mobile.

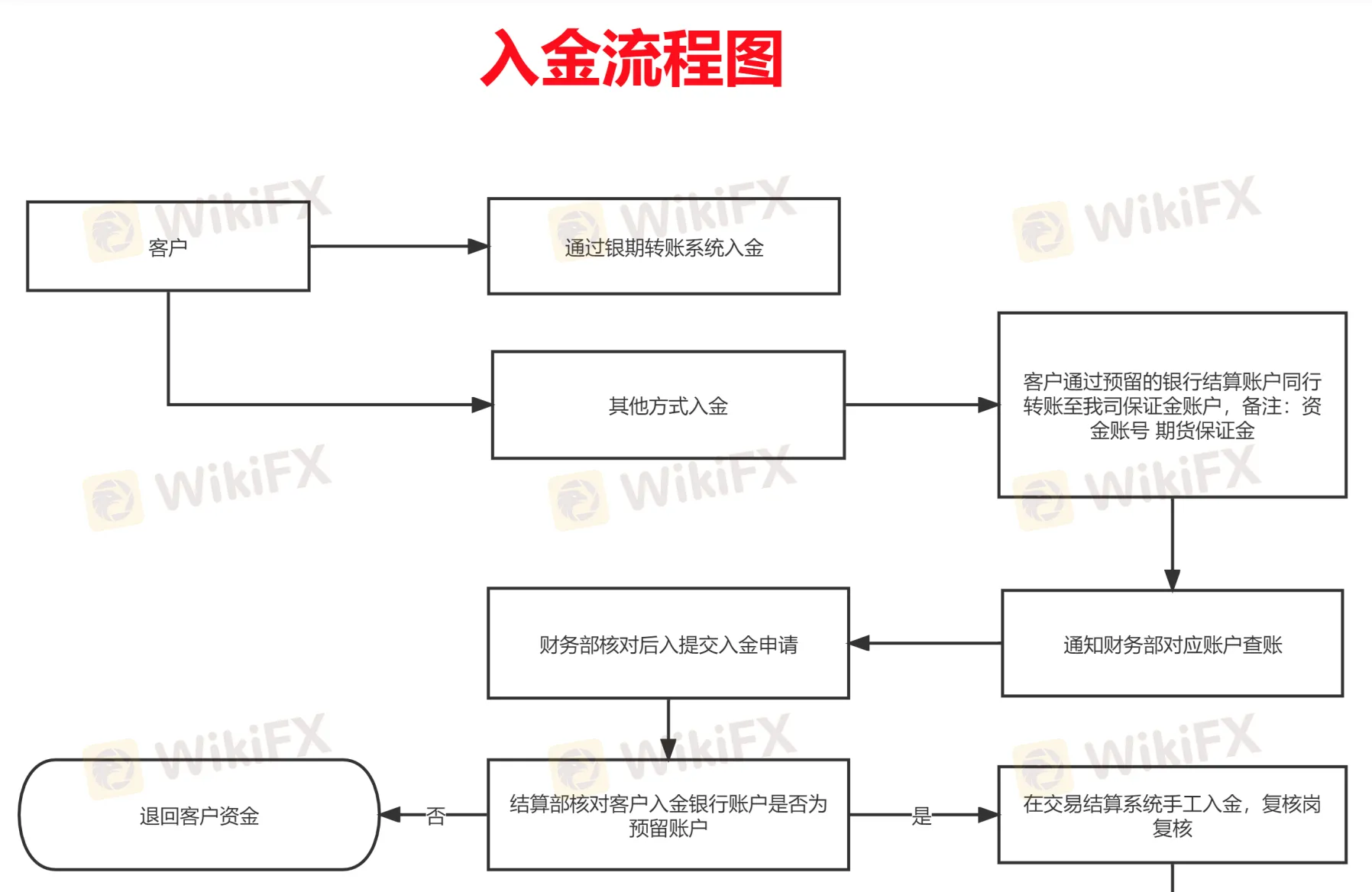

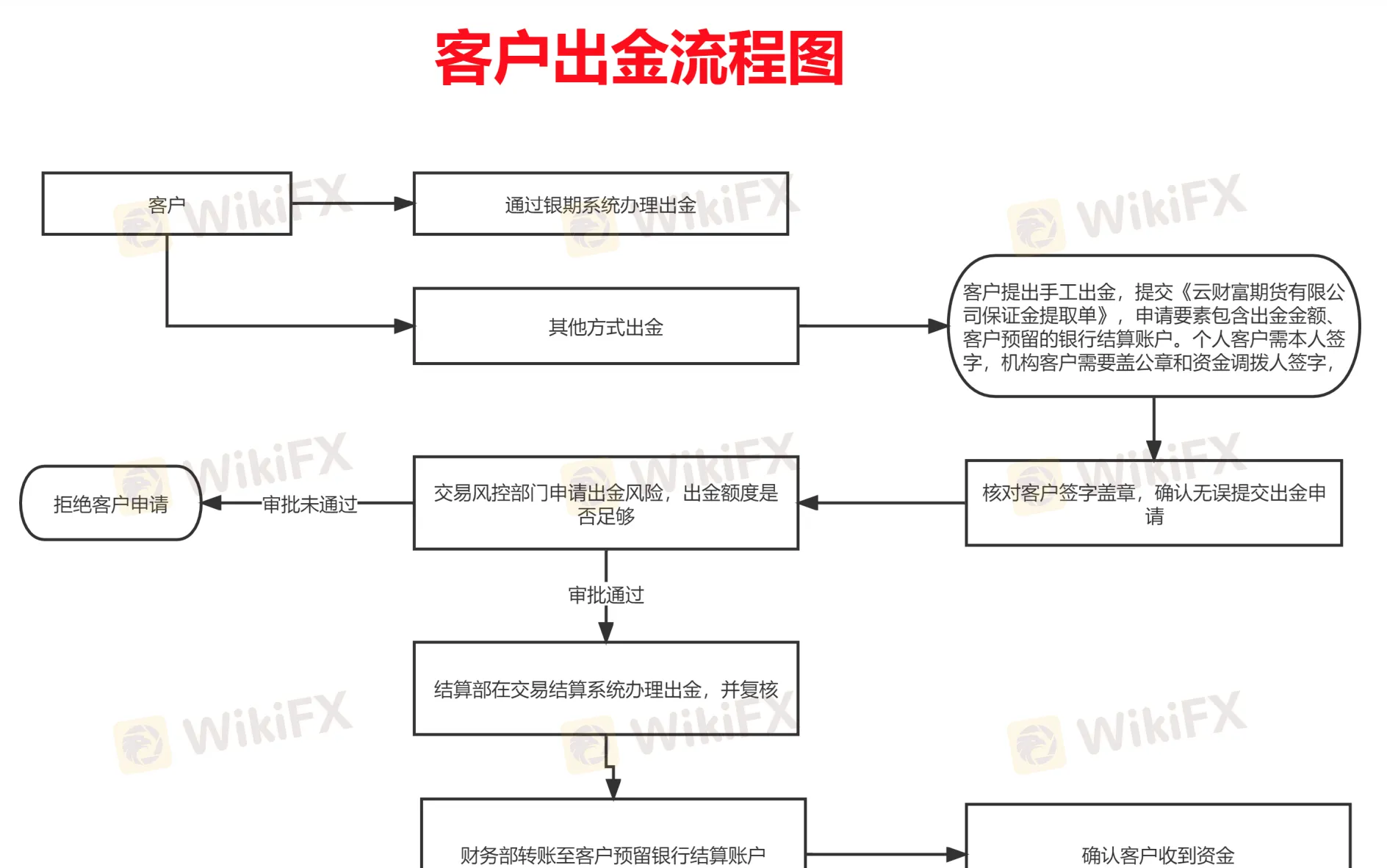

Deposit and Withdrawal

No minimum deposit or withdrawal amount defined and no fees or charges specified. The website only shows a deposit and withdrawal process.