Company Summary

| Khwezi Trade | Basic Information |

| Company Name | Khwezi Trade |

| Founded | 2013 |

| Headquarters | South Africa |

| Regulations | FSCA (Exceeded) |

| Tradable Assets | Forex, Metals, Indices, Commodities |

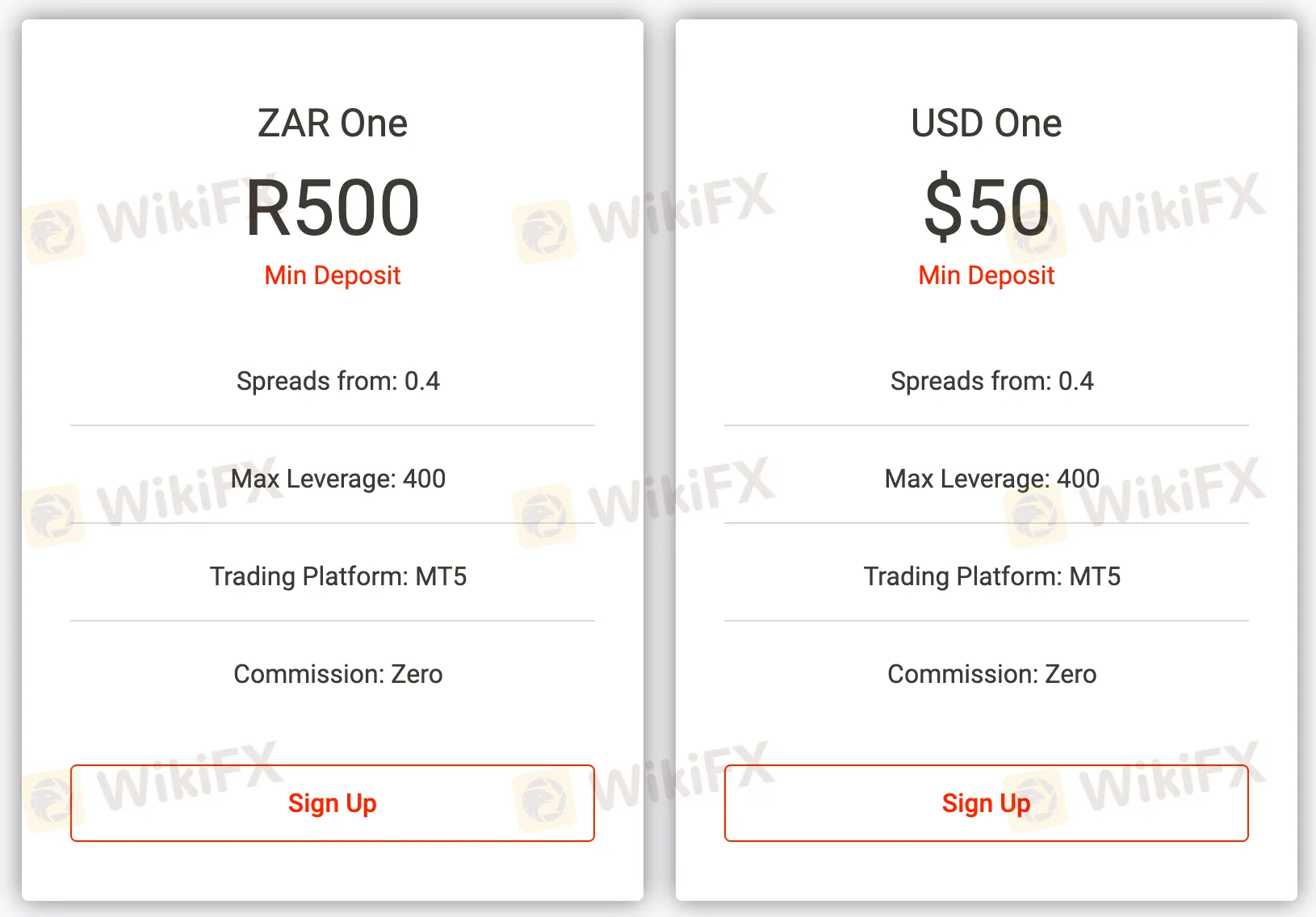

| Account Types | ZAR One, USD One |

| Minimum Deposit | ZAR One: 500 ZAR, USD One: $50 |

| Maximum Leverage | Up to 400:1 |

| Spreads | Starting from 0.4 pips |

| Commission | None |

| Deposit Methods | Bank transfers, online banking, credit/debit cards, instant EFT |

| Trading Platforms | MetaTrader 5 (MT5) |

| Customer Support | Cape Town and Johannesburg offices, email, phone |

| Education Resources | Free Forex education course |

| Bonus Offerings | None |

Overview of Khwezi Trade

Khwezi Trade is a South African-based brokerage firm that has been operating since 2013. Headquartered in South Africa, it offers trading services primarily in the Forex market, as well as other financial instruments. Khwezi Trade provides traders with access to a range of assets, including Forex currency pairs, precious metals, stock indices, and commodities, all tradable on the MetaTrader 5 (MT5) platform.

One notable aspect of Khwezi Trade is its flexibility in catering to traders with different preferences. It offers two main account types: ZAR One, denominated in South African Rand (ZAR), and USD One, denominated in United States Dollars (USD). These accounts cater to traders of varying experience levels and capital sizes, with the ZAR One account allowing for smaller trade volumes and lower minimum deposits, while the USD One account offers the convenience of trading in a widely accepted offshore currency.

However, it's important to note that Khwezi Trade lacks regulatory oversight from the South African FSCA (Financial Sector Conduct Authority), which raises concerns about the security of traders' funds and the overall safety of the trading environment. Traders considering Khwezi Trade should exercise caution and conduct thorough due diligence before engaging in trading activities with the broker.

Is Khwezi Trade Legit?

Khwezi Trade is not regulated by the South Africa FSCA (Financial Sector Conduct Authority) for its trading activities, only registered with this authority. The broker's license number, 44816, does not fall under the regulations provided by the FSCA. Traders and investors should be cautious when considering Khwezi Trade as a brokerage option, as the absence of proper regulation can pose significant risks in the financial industry.

Pros and Cons

Khwezi Trade offers a range of advantages, including a diverse selection of trading instruments, access to Forex, metals, indices, and commodities, spreads that aim to be favorable, and a user-friendly MetaTrader 5 platform. Traders can also benefit from free Forex education to enhance their skills. However, it's important to note the absence of regulation, which can pose risks, as well as the limited account types, customer support channels, and deposit/withdrawal options. Additionally, Khwezi Trade does not offer bonus incentives to its clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Trading Instruments

Khwezi Trade provides traders with access to a variety of trading instruments across global markets, all of which can be traded on the same MT5 platform in South African Rands (ZAR). These instruments include:

1. Currency CFDs (FX): The Forex market is the world's largest and most liquid financial market, where currencies are bought and sold. Khwezi Trade allows traders to participate in Forex trading, enabling them to profit from both rising and falling currency prices. The Forex market operates 24 hours a day, five days a week, offering flexibility for traders to fit trading into their schedules.

2. Metals: Gold and silver are considered safe-haven assets, particularly during times of economic uncertainty and inflation. Khwezi Trade provides access to trading in these precious metals, allowing traders to diversify their portfolios and seek protection from market volatility.

3. Indices: Khwezi Trade offers a diverse range of stock indices, enabling traders to express their opinions on various global markets, including the US, Europe, Asia, and Australia. Traders can speculate on the performance of these indices, such as the DOWUSD, NASUSD, SPXUSD, 100GBP, and 200AUD, with specific session breaks for trading.

4. Commodities: Khwezi Trade offers a selection of commodity instruments on the MT5 platform, all denominated in South African Rands. Traders can access energy commodities, including Brent Crude, West Texas Intermediate (WTI), and OILUSD, providing opportunities to trade these essential resources.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| Khwezi Trade | Yes | Yes | No | Yes | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

Khwezi Trade offers live trading accounts designed to cater to a wide range of traders, from beginners to experienced professionals. These accounts can be customized to suit different trading styles, including hedging, scalping, day trading, and the use of Expert Advisors (EAs).

1. ZAR One (South African Rand): This account type is well-suited for beginner traders who may prefer lower minimum deposits and the ability to trade in micro-lots. The account typically offers slightly wider spreads compared to accounts with higher minimum deposits. Khwezi Trade requires a minimum deposit of 500 South African Rand (ZAR) for this account, allowing beginners to start trading with smaller trade volumes, often measured in micro-lots. The maximum leverage offered is 400, and the trading platform available is MetaTrader 5 (MT5). Importantly, there is no commission associated with this account.

USD One (United States Dollar): For traders looking for the convenience of trading in a widely accepted offshore currency while keeping their funds securely stored in a local segregated bank account, the USD One account is an option. Khwezi Trade allows for currency conversion at daily bank rates, allowing traders to deposit in South African Rands (ZAR) and get funded in United States Dollars (USD). The minimum deposit required for this account is $50, with spreads starting from 0.4 pips. Similar to the ZAR One account, the maximum leverage available is 400, and the trading platform provided is MT5. Importantly, there are no commissions associated with this account.

How to Open an Account?

To open an account with Khwezi Trade, follow these steps.

Visit the Khwezi Trade website. Look for the “Open an account” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

Khwezi Trade offers a maximum leverage of up to 400:1 on its trading accounts. Leverage is a crucial aspect of forex and CFD trading, as it allows traders to control larger positions in the market with a relatively smaller amount of capital. While higher leverage can amplify potential profits, it also magnifies potential losses, making it a double-edged sword in trading.

With a maximum leverage of 400:1, Khwezi Trade provides traders with the opportunity to control significant positions with a relatively small initial investment. This can be advantageous for traders seeking to maximize their trading potential. However, it's essential to use leverage cautiously, as it increases the risk of substantial losses if trades move against the trader.

Khwezi Trade's 400:1 leverage option can be suitable for experienced traders who are well-versed in risk management and have a clear understanding of how to use leverage effectively. It's important for traders to assess their risk tolerance and only use leverage that aligns with their trading strategies and risk management plans to avoid excessive losses.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Khwezi Trade | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:400 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions

Khwezi Trade offers spreads without imposing commissions on its trading accounts, providing a straightforward fee structure for its clients. Spreads, denoting the difference between the buying (ask) and selling (bid) prices of a trading instrument, can significantly impact a trader's overall trading expenses. Khwezi Trade aims to maintain these spreads, starting at a minimum of 0.4 pips.

For both the ZAR One and USD One accounts, traders can access spreads that are designed to minimize their trading expenses. This could potentially benefit traders utilizing various trading strategies, including scalping and day trading, where narrow spreads are crucial for minimizing losses.

By refraining from applying commissions to trades, Khwezi Trade allows traders to concentrate on their trading strategies without the additional burden of commission expenses. This fee structure might be of interest to traders seeking clear and straightforward pricing, simplifying the assessment of potential trading expenses.

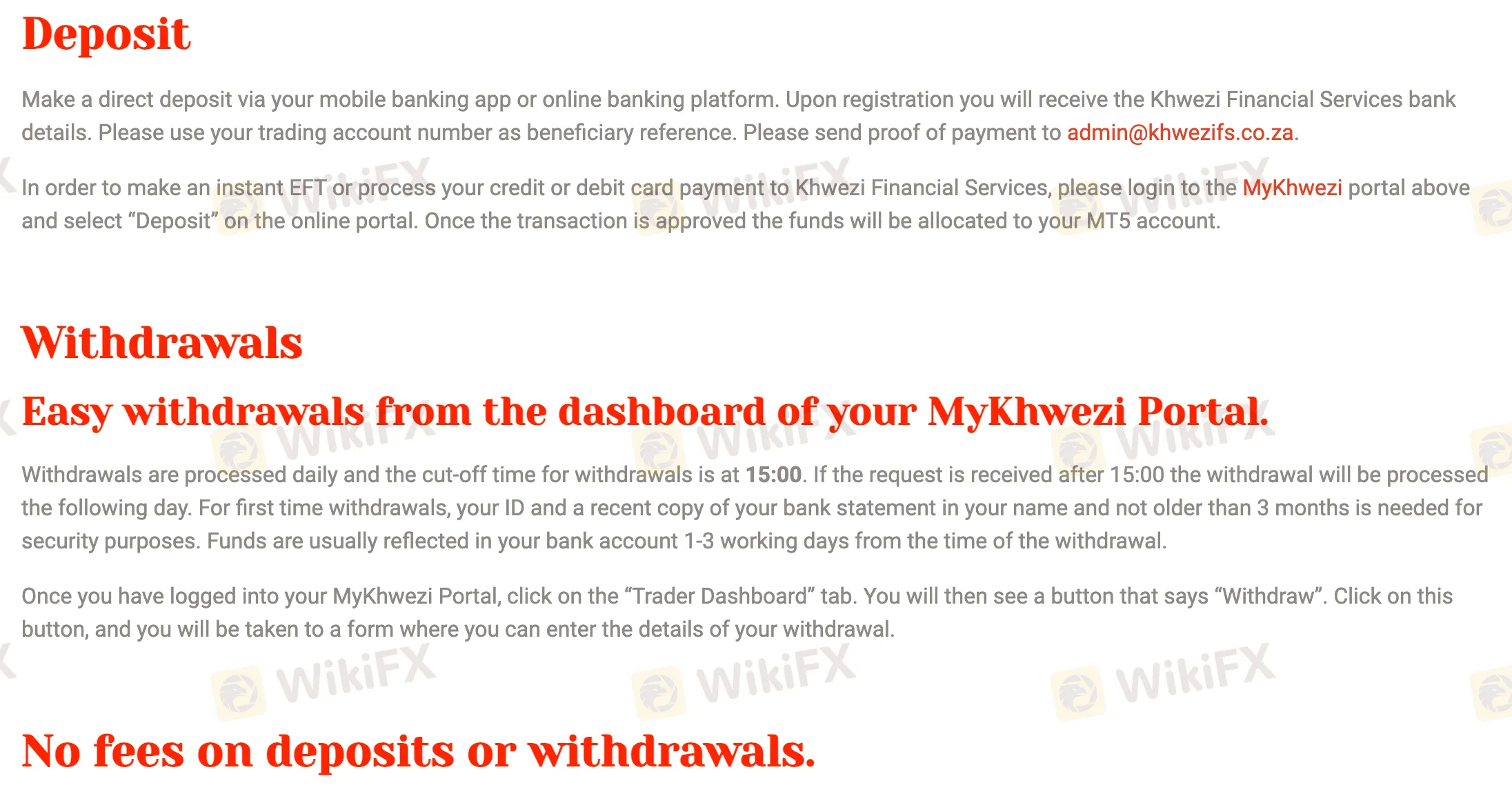

Deposit & Withdrawal

Deposits can be made through direct bank transfers or online banking platforms. Upon registration, traders receive Khwezi Financial Services' bank details, and they can use their trading account number as the beneficiary reference when making a deposit. Proof of payment should be sent to admin@khwezifs.co.za. Additionally, traders can opt for instant EFT or credit/debit card payments by logging into the MyKhwezi portal and selecting the “Deposit” option. Once approved, the funds will be allocated to the trader's MT5 account, enabling quick access to the trading capital.

Withdrawals from Khwezi Trade are hassle-free and can be initiated directly from the MyKhwezi Portal. Withdrawals are processed daily, with a cutoff time at 15:00. Any withdrawal requests received after 15:00 will be processed the following day. To ensure security, first-time withdrawals require traders to provide their ID and a recent copy of their bank statement, reflecting their name and not older than three months. Typically, funds are reflected in the trader's bank account within 1-3 working days from the time of the withdrawal request.

Khwezi Trade prides itself on offering fee-free deposits and withdrawals, making it cost-effective for traders to manage their accounts. The minimum deposit amount is 500 ZAR, providing accessibility to traders with various capital sizes. These deposit and withdrawal options aim to simplify the financial aspects of trading for Khwezi Trade clients, enhancing their overall trading experience.

Trading Platforms

Khwezi Trade relies on the MetaTrader 5 (MT5) platform, which is renowned as one of the most popular and user-friendly trading platforms globally. MT5 offers traders a comprehensive set of features and tools, making it easy to use and highly versatile for various trading styles. Some notable features of the MT5 platform include:

1. Charting Tools: MT5 provides a wide selection of charting tools and indicators, allowing traders to conduct in-depth technical analysis and make informed trading decisions. These tools enable users to analyze market trends, patterns, and price movements effectively.

2. Customization: Traders have the flexibility to customize the MT5 platform to their personal preferences. Whether it's arranging the layout, setting up watchlists, or choosing color schemes, MT5 offers a high degree of personalization to suit individual trading needs.

3. Built-In Programming Language: MT5 comes equipped with a built-in programming language called MQL5, which empowers traders to create custom trading strategies, scripts, and indicators. This feature allows for the development of automated trading systems and the implementation of specific trading rules.

4. Mobile Trading: The platform offers mobile trading options, with dedicated apps available for smartphones, tablets, and Pocket PCs. This mobility ensures that traders can manage their accounts, execute trades, and stay updated on market developments while on the go.

Customer Support

Khwezi Trade offers comprehensive customer support to assist its clients, with physical offices in Cape Town and Johannesburg, South Africa. Here are the contact details for both locations:

Cape Town Branch:

- Address: 1020 Manhattan Place, 130 Bree Street, Cape Town, 8001.

- Phone: +27 (0) 21 300 3117.

- Email: info@khwezifs.co.za.

Johannesburg Office:

- Address: Office 9012, 9th Floor, Atrium on 5th, 5th Street, Sandton, 2196.

- Phone: +27 (0) 10 312 5194.

- Email: info@khwezifs.co.za.

Clients can reach out to these physical offices for inquiries, assistance, and support related to their trading accounts, account management, and any other trading-related concerns. Additionally, Khwezi Trade provides multiple channels for contacting their support team, ensuring accessibility and prompt assistance for their clients.

Educational Resources

Khwezi Trade offers free Forex education, making it accessible to traders of all levels, from beginners to experienced individuals looking to enhance their skills.

The primary course offered by Khwezi Trade is designed to serve as a comprehensive guide for traders. This course covers essential concepts that are crucial for successful trading, including risk management, understanding market trends and channels, and effectively utilizing technical indicators. By providing traders with these fundamental tools and guidance, Khwezi Trade empowers them to develop the knowledge and skills necessary for profitable Forex trading.

With their commitment to education, Khwezi Trade aims to help traders build a strong foundation and gain confidence in their trading abilities. Whether you're new to Forex trading or seeking to improve your expertise, Khwezi's educational resources can be a valuable asset on your trading journey.

Conclusion

Khwezi Trade, operating in South Africa since 2013, offers traders access to various financial instruments through its MetaTrader 5 (MT5) platform. While it provides flexibility in account types and aims to offer competitive spreads without commission charges, one significant drawback is the absence of regulatory oversight by the South African FSCA, potentially exposing traders to increased risks. It's crucial for traders to exercise caution and consider alternative, regulated brokers to ensure the safety of their investments and trading activities.

FAQs

Q: Is Khwezi Trade a regulated broker?

A: No, Khwezi Trade is not regulated by the South African FSCA for its trading activities.

Q: What trading instruments are available on Khwezi Trade?

A: Khwezi Trade offers Forex currency pairs, precious metals, stock indices, and commodities.

Q: What are the minimum deposit requirements for Khwezi Trade accounts?

A: The ZAR One account requires a minimum deposit of 500 South African Rand (ZAR), while the USD One account has a minimum deposit of $50.

Q: What is the maximum leverage offered by Khwezi Trade?

A: Khwezi Trade offers a maximum leverage of up to 400:1 on its trading accounts.

Q: How can I deposit funds into my Khwezi Trade account?

A: You can deposit funds through bank transfers, online banking, credit/debit cards, and instant EFT.