Company Summary

| Imamura Securities Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Japan |

| Regulation | FSA |

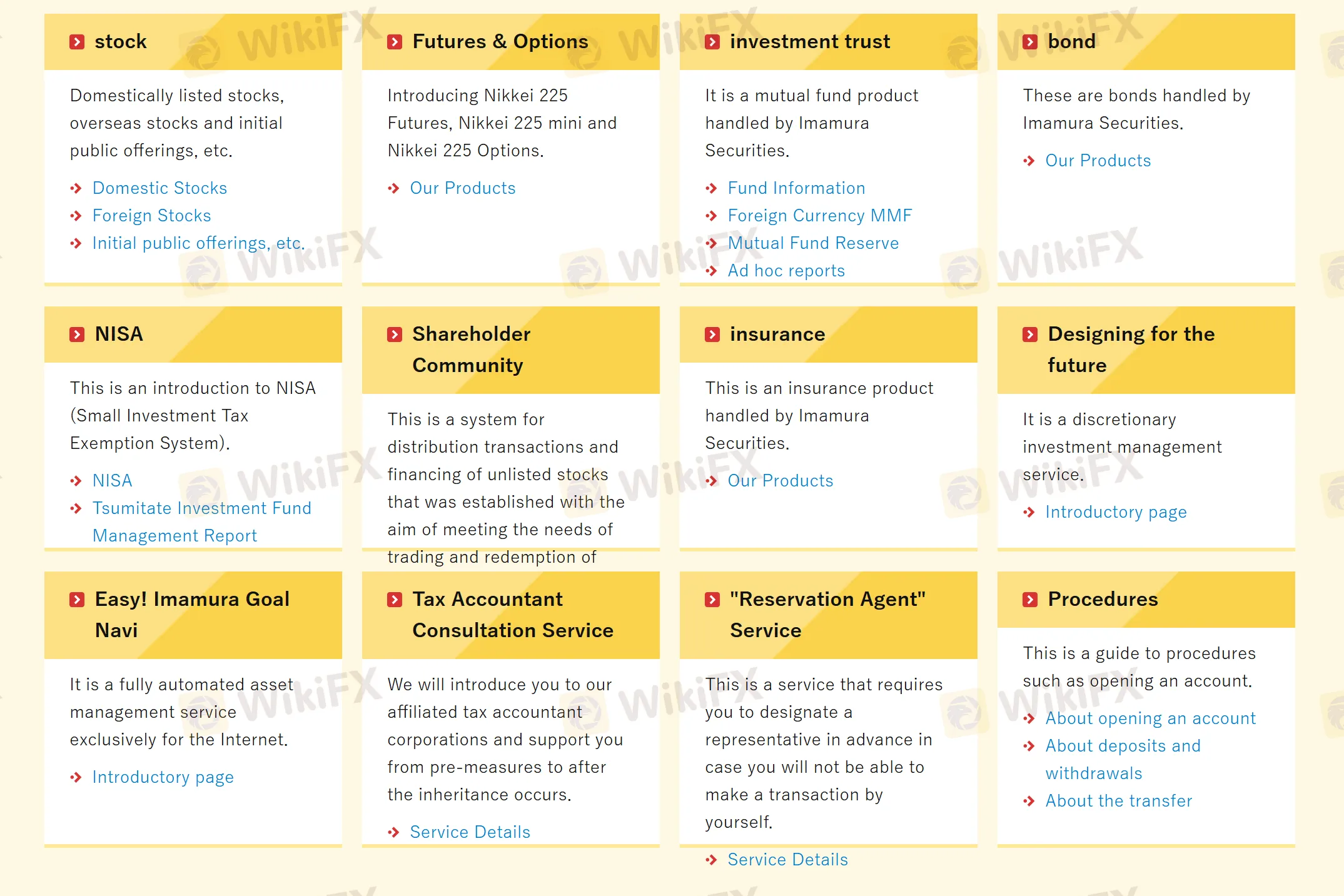

| Product & Service | Stocks, Futures & Options, Mutual Funds, bonds, NISA, Shareholder Community, insurance, Discretionary Investment Management Services, Gold Bullion Trading, iRoot Net Trading |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +81 076-263-5111 |

| Address: 〒920-0906 石川県金沢市十間町25番地 | |

Imamura Securities, established in 1997 and based in Japan, is a financial firm regulated by the Financial Services Agency (FSA). It offers various products and services, including stocks, futures and options, mutual funds, bonds, NISA, and gold bullion trading. The firm also provides discretionary investment management and iRoot Net Trading for online transactions. Moreover, it has a shareholder community and offers insurance services.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| A wide range of trading products | No demo accounts |

| Complex fee structure |

Is Imamura Securities Legit?

Yes, Imamura Securities is currently regulated by FSA, holding a Retail Forex License.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | 今村証券株式会社 | Regulated | Retail Forex License | 北陸財務局長(金商)第3号 |

What Can I Trade on Imamura Securities?

Imamura Securities provides clients with Stocks, Futures & Options, Mutual Funds, bonds, NISA, Shareholder Community, insurance, Discretionary Investment Management Services, Gold Bullion Trading, iRoot Net Trading.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

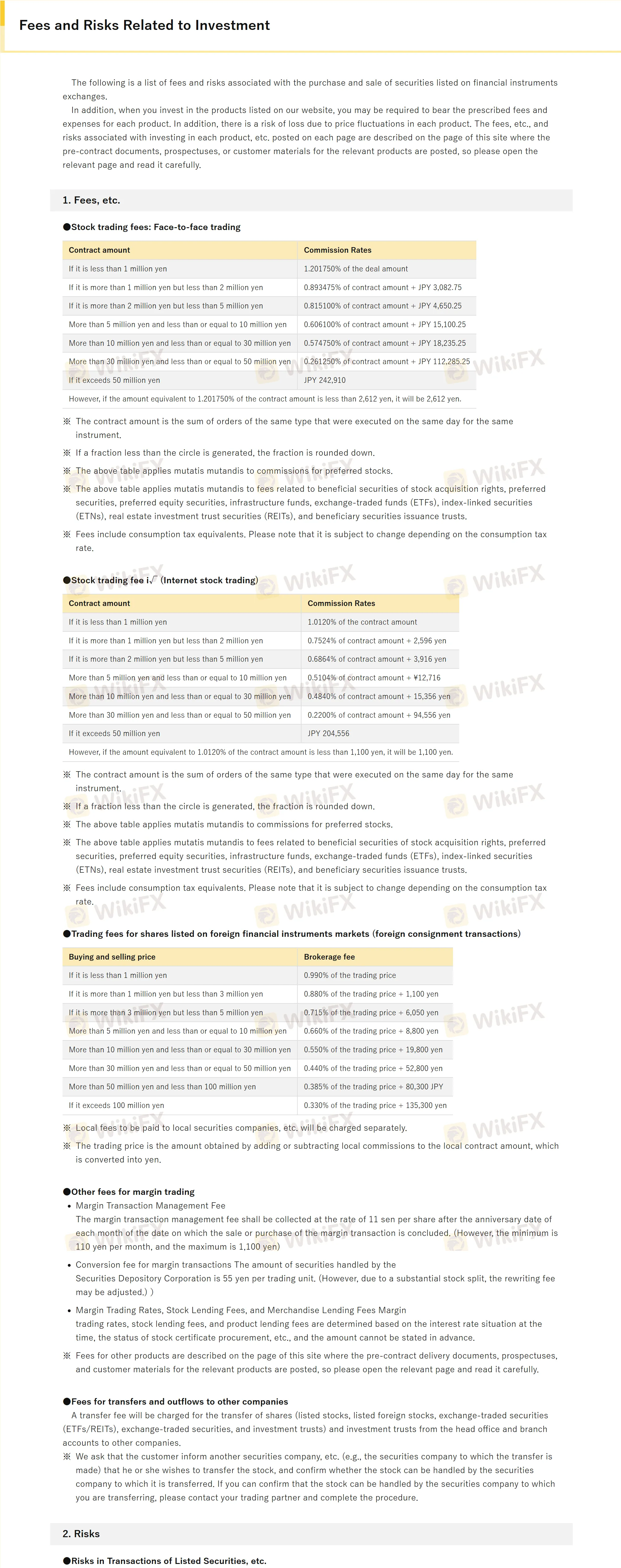

Fees

Domestic Stock Trading Fees (Face-to-Face Transactions)

| Transaction Amount | Fee Rate (Including Consumption Tax) | Minimum Fee |

| ≤ 1,000,000 JPY | 1.201750% of the transaction amount | 2,612 JPY (if the calculated amount is less than this) |

| 1,000,001 - 2,000,000 JPY | 0.893475% of the transaction amount + 3,082.75 JPY | - |

| 2,000,001 - 5,000,000 JPY | 0.815100% of the transaction amount + 4,650.25 JPY | - |

| 5,000,001 - 10,000,000 JPY | 0.606100% of the transaction amount + 15,100.25 JPY | - |

| 10,000,001 - 30,000,000 JPY | 0.574750% of the transaction amount + 18,235.25 JPY | - |

| 30,000,001 - 50,000,000 JPY | 0.261250% of the transaction amount + 112,285.25 JPY | - |

| > 50,000,000 JPY | 242,910 JPY | - |

Domestic Stock Trading Fees (Internet Stock Trading)

| Transaction Amount | Fee Rate (Including Consumption Tax) | Minimum Fee |

| ≤ 1,000,000 JPY | 1.0120% of the transaction amount | 1,100 JPY (if the calculated amount is less than this) |

| 1,000,001 - 2,000,000 JPY | 0.7524% of the transaction amount + 2,596 JPY | - |

| 2,000,001 - 5,000,000 JPY | 0.6864% of the transaction amount + 3,916 JPY | - |

| 5,000,001 - 10,000,000 JPY | 0.5104% of the transaction amount + 12,716 JPY | - |

| 10,000,001 - 30,000,000 JPY | 0.4840% of the transaction amount + 15,356 JPY | - |

| 30,000,001 - 50,000,000 JPY | 0.2200% of the transaction amount + 94,556 JPY | - |

| > 50,000,000 JPY | 204,556 JPY | - |

Foreign Stock Trading Fees (Foreign Entrusted Transactions)

| Transaction Amount | Handling Fee (Including Consumption Tax) |

| ≤ 1,000,000 JPY | 0.990% of the transaction amount |

| 1,000,001 - 3,000,000 JPY | 0.880% of the transaction amount + 1,100 JPY |

| 3,000,001 - 5,000,000 JPY | 0.715% of the transaction amount + 6,050 JPY |

| 5,000,001 - 10,000,000 JPY | 0.660% of the transaction amount + 8,800 JPY |

| 10,000,001 - 30,000,000 JPY | 0.550% of the transaction amount + 19,800 JPY |

| 30,000,001 - 50,000,000 JPY | 0.440% of the transaction amount + 52,800 JPY |

| 50,000,001 - 100,000,000 JPY | 0.385% of the transaction amount + 80,300 JPY |

| > 100,000,000 JPY | 0.330% of the transaction amount + 135,300 JPY |

Other Fees Related to Margin Trading

| Fee Type | Fee Details |

| Margin Trading Management Fee | Charged at a rate of 11 sen per share (minimum 110 JPY per month, maximum 1,100 JPY) for each month after the settlement date of the margin trading buy or sell transaction. |

| Margin Trading Book - Transfer Fee | 55 JPY per trading unit for securities held in the securities depository and clearing system. May be adjusted in case of significant stock splits. |

| Margin Trading Interest, Stock - Lending Fees, and Commodity - Lending Fees | Determined based on the current interest rate situation and stock - sourcing conditions, and not specified in advance. |