iq option

Antigua and Barbuda

Antigua and Barbuda

Time Machine

Check whenever you want

Download App for complete information

Exposure

No Data

iq option · Company Summary

| IQ Option Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Antigua and Barbuda |

| Regulation | Suspicious Clone |

| Market Instruments | Forex/stocks/Cryptocurrencies/Commodities/ETFs/Indices |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | IQ Option APP |

| Minimum Deposit | / |

| Customer Support | Email: support@iqoption.com |

| Twitter/Instagram/YouTube | |

| Address: The Colony House, 41 Nevis Street, Saint Johns, Antigua and Barbuda | |

IQ Option Information

IQ Option is a broker that is registered in Antigua and Barbuda. The tradable instruments include forex, CFD stocks, cryptocurrencies, commodities, ETFs, and indices. IQ Option is still risky due to its Suspicious Clone status.

Pros and Cons

| Pros | Cons |

| Multilingual support | Suspicious clone licenses |

| Demo account available | MT4/MT5 unavailable |

| Various tradable instruments | Lack of transparency |

Is IQ Option Legit?

| Regulated Country | Regulated Status | Regulated Authority | Regulated Entity | License Type | License Number |

| Suspicious Clone | Cyprus Securities and Exchange Commission (CYSEC) | IQOPTION EUROPE LTD | Market Maker (MM) | 247/14 |

| Suspicious Clone | Financial Conduct Authority (FCA) | IQOPTION EUROPE LTD | European Authorized Representative (EEA) | 670182 |

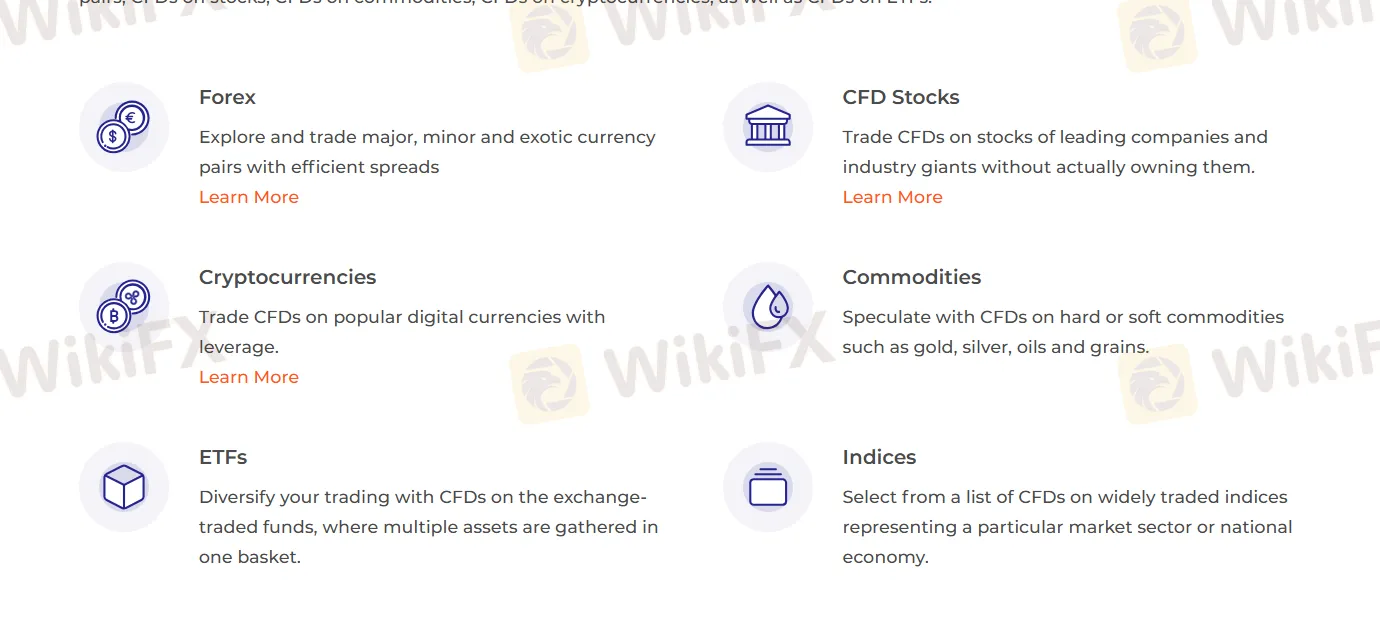

What Can I Trade on IQ Option?

IQ Option offers a wide range of market instruments, including forex, CFD stocks, cryptocurrencies, commodities, ETFs, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Futures | ❌ |

| Options | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

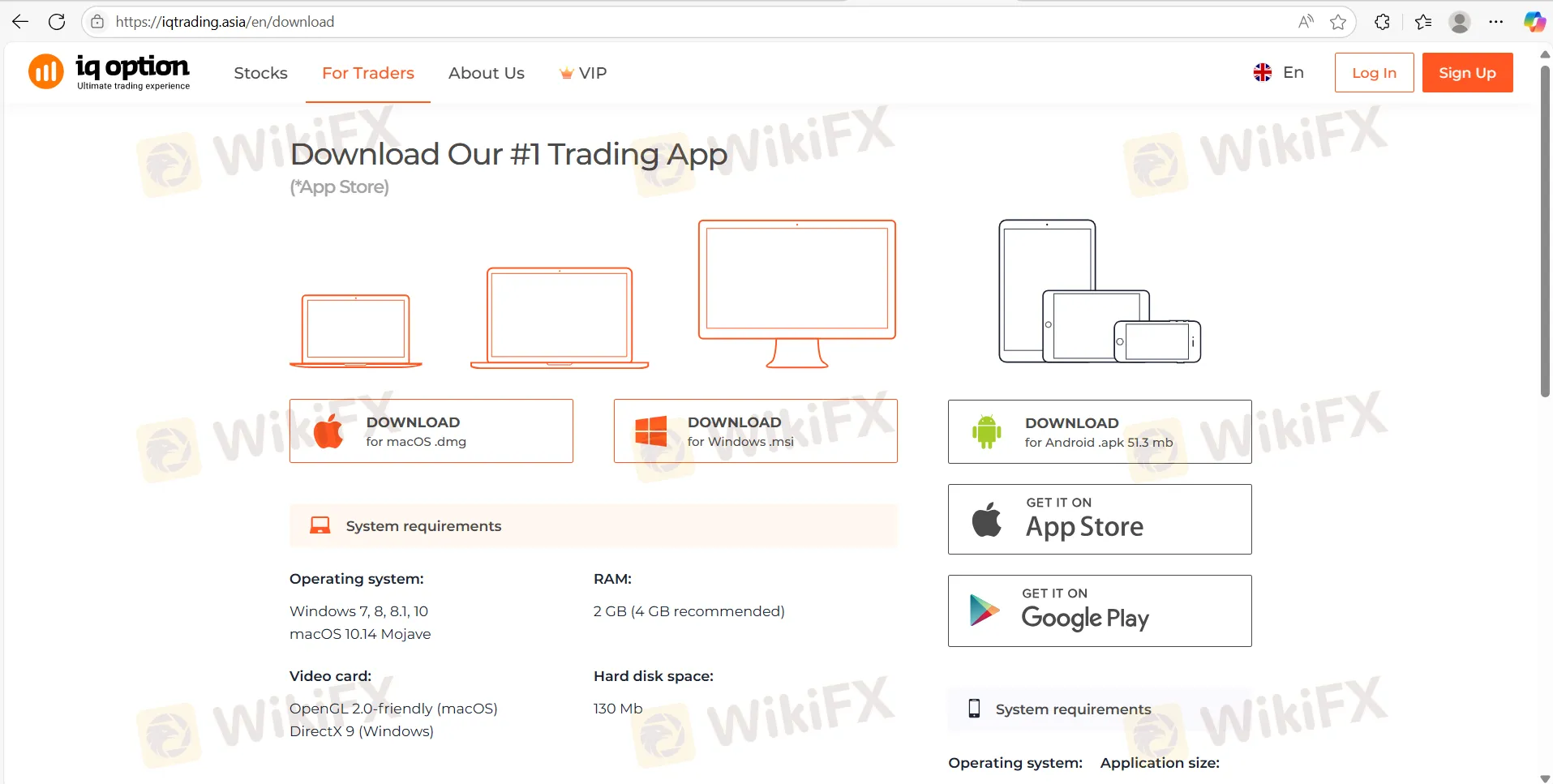

Trading Platform

IQ Option provides a proprietarytrading platform available in MacOS, Windows, and Mobile to trade, instead of the authoritative MT4/MT5 with mature analysis tools and EA intelligent systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| IQ Option APP | ✔ | MacOS/Windows/Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

The minimum withdrawal amount is $2. IQ Option accepts Visa, Mastercard, or Maestro (with CVV only) debit, and credit card for deposit and withdrawal. The withdrawal processing times are usually no more than 3 working days, and the deposit processing times are no more than 2 business days. However, the associated fees are unknown.

News

No Data