Company Summary

| MIB SecuritiesReview Summary | |

| Founded | Above 20 years |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Market Instruments | HK Securities/Warrants & CBBCs/Margin Financing/Foreign Stocks/Global Securities Markets/Futures and Options/MlB Trade/ETF |

| Trading Platform | MIB Trade(Mobile)/Java/ADOBE READER |

| Customer Support (9:00 am to 6:00 pm (Mon – Fri), excluding holidays) | Client Services Hotline:+852 2268 0660 |

| Securities Trading Hotline:+852 2268 0688 | |

| Futures Trading Hotline:+852 2268 0699 | |

| Email: customerservices@mib.com.hk | |

| Fax:+852 2521 2289 | |

MIB Securities Information

MIB Securities is a Securities & Investment Broker that comprises businesses stretching around the globe. It provides services in corporate finance, debt markets, equity capital markets, derivatives, retail and institutional securities broking, and research.

Is MIB Securities Legit?

MIB Securities is authorized and regulated by the Securities and Futures Commission of Hong Kong(SFC) with license NO.ABH686, making it safer than unregulated brokers.

What Products and Services does MIB Securities provide?

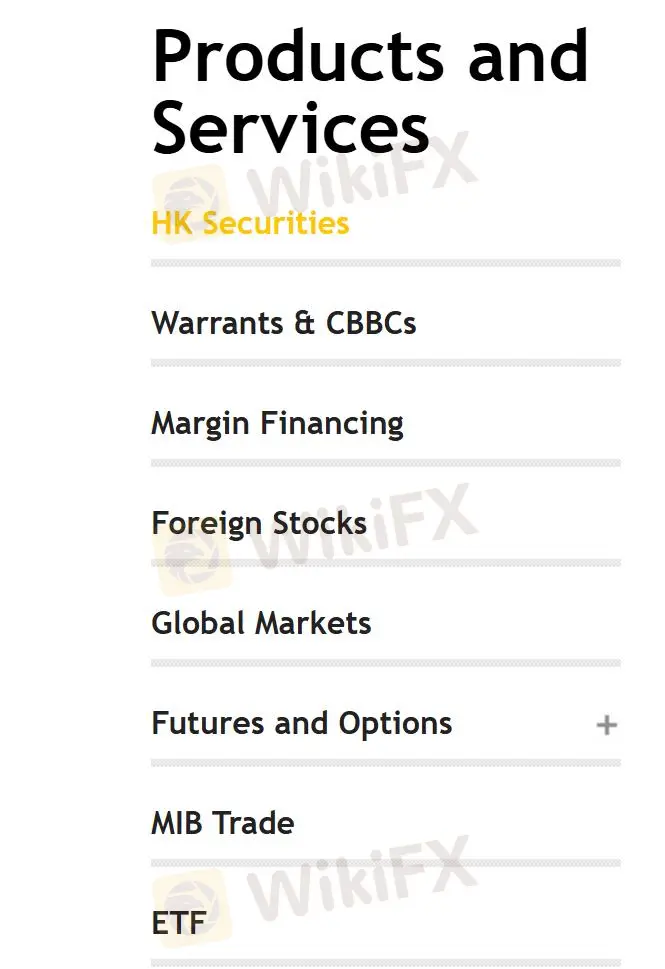

MIB Securities offers access to various products and services, including HK Securities, Warrants & CBBCs, Margin Financing, Foreign Stocks, Global Securities Markets, Futures and Options, MlB Trade, and ETF.

Account Type

Users can open individual/ joint accounts or corporate accounts. MIB Trade also provides Securities and Commodities Accounts.

Software

MIB Securities provides MIB Trade, which is available on mobile or downloaded APK directly. Users also need to download Java and ADOBE READER.

Deposit and Withdrawal

Clients can deposit funds into your MIBHK account via the following methods: bank transfer and cheque deposit (including through bank counters, ATMs, and cheque deposit machines), telegraphic transfer (for overseas clients), Faster Payment System (FPS) and MIBHK designated bank accounts.

Withdrawals are not supported to any third-party credit card accounts or bank accounts, but you can use the “Withdraw” function of MIB Trade (only applicable to local stock trading), contact your account manager; or contact the Customer Service Department (hotline: +852 2268 0660 or email: customerservices@mib.com.hk )