Company Summary

| IM Markets Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | ASIC (Suspicious Clone) |

| Market Instruments | 700+, forex, commodities, cryptocurrencies and indices |

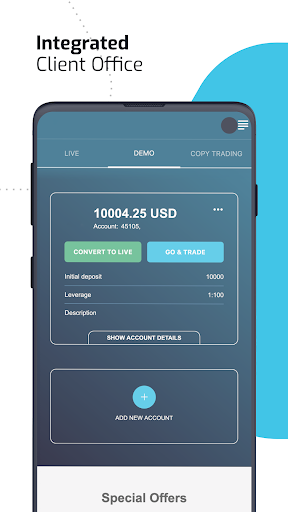

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 0.1 pips |

| Trading Platform | Web & Mobile App |

| Min Deposit | $15 |

| Customer Support | 24/5 live chat |

| Tel: 2304634500 | |

| Instagram: https://www.instagram.com/im.markets/ | |

| YouTube: https://www.youtube.com/channel/UCu_IpjO0NDXsR-V5phtxqjw | |

| Email: support@IM Markets.com | |

| Address: Suite 305, Griffith Corporate Center, Beachmont, Kingstown, St. Vincent and the Grenadines | |

| Regional Restrictions | Afghanistan, Belarus, Botswana, Burundi, Congo, Cuba, Egypt, Guinea, Guinea-Bissau, Iran, Iraq, Japan, Lebanon, Liberia, Libyan Arab Jamahiriya, Mali, Nicaragua, Nigeria, North Korea, Pakistan, Singapore, Somalia, Somali Republic, South Africa, Spain, Sudan, Syrian Arab Republic, Togo, United States of America, Venezuela, Yemen, Zimbabwe |

IM Markets was registered in 2023 in Saint Vincent and the Grenadines, but it is suspected fake clone now. It claims to offer 700+ trading instruments, including forex, commodities, cryptocurrencies and indices. The company uses web and mobile apps as its trading platforms, and there are two types of accounts available, including Standard and ECN.

Pros and Cons

| Pros | Cons |

| Various trading products | Suspicious clone ASIC license |

| Low minimum deposit | Regional restrictions |

| 24/5 live chat support | No MT4/5 |

Is IM Markets Legit?

No, IM Markets currently has no valid regulations. Traders should carefully consider the risks it brings when choosing to trade with it.

| Regulatory Status | Suspicious Clone |

| Regulated by | Australia Securities & Investment Commission (ASIC) |

| Licensed Institution | MGF CAPITAL PTY LTD |

| Licensed Type | Institution Forex License (STP) |

| Licensed Number | 421246 |

What Can I Trade on IM Markets?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

IM Markets provides incredibly high leverage up to 1:1000, which is very high. Customers must exercise caution when investing, since high leverage might pose significant dangers.

Account Type

| Account Type | Standard | ECN |

| Min Deposit | $1 | $1 |

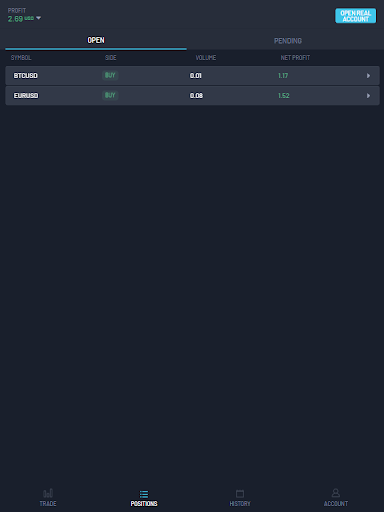

Trading Platform

IM Markets only provides its clients web platform and apps on Android devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | Web | / |

| Mobile Trading App | ✔ | Android | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

IM MARKETS allows their clients to instantly convert cryptocurrencies in their platform accounts into cash and transfer them to their personal bank cards, such as VISA/MASTER CARD and USDT.

Qutancl

Belarus

We struggled last night and sent an email requesting help. Today they were brilliant with their communication and helping us sorting out our issue. Thank you so much :)

Positive

Hnsjkk

Kazakhstan

Great company but my only criticism is they are very customer unfriendly when it comes to outstanding balances. They are too quick to issue curt reminders and threats of closing positions if a balance is not paid.

Neutral

LaLa123

Netherlands

At IM Markets, I found a selection of assets including Forex, Indices, Commodities, and Cryptocurrencies and spreads starting from 0.1 pip appealing. They're regulated by Canadian and Australian authorities, and support multiple payment methods. They offer mobile-friendly platforms and educational resources. However, lack of clarity on minimum deposit, demo, and Islamic accounts concerns me.

Neutral

BDSW

Nigeria

Trading is largely about strategy, edge, percent points but it's also about clarity. And in terms of clarity, IM Markets seemed more like a foggy morning in London, lack of explicit commission values. You buy a significant lot size, 10 lots of EUR/USD, thinking you've calculated all the costs with the minimal and vague information on commissions provided by IM Markets. Your trade goes just as planned and you're predicting a substantial profit. You close the trade, feeling like a victorious warrior as you wait for the profits to reflect in your account. And then, bam! Out of nowhere, a significant chunk of your profit gets snipped off as commission.

Neutral