公司简介

| KKJSEC 评论摘要 | |

| 成立时间 | 1986 |

| 注册国家/地区 | 印度 |

| 监管 | 无监管 |

| 服务 | 股票和衍生品、大宗商品、保险、首次公开募股 |

| 模拟账户 | ❌ |

| 交易平台 | ODIN(金融科技)、COMTEK(后台办公) |

| 客户支持 | 一般信息:info@kkjsec.com |

| 投诉:grief@kkjsec.com | |

| 管理:nikhil@kkjsec.com | |

| 首席执行官:尼克尔·贾兰先生 - 手机:+91 9833915980 | |

KKJSEC 信息

成立于1986年,总部位于印度,KKJSEC提供一系列金融服务,包括共同基金、保险、大宗商品、BSE/NSE股票和衍生品交易。旨在为当地零售和机构客户提供服务,通过ODIN和COMTEK系统提供交易服务。然而,它缺乏印度证券交易委员会(SEBI)的监管。

优缺点

| 优点 | 缺点 |

| 悠久的运营历史 | 无监管 |

| 提供包括股票和存款在内的广泛金融服务 | 不提供演示账户 |

| 提供后台访问和在线交易工具 |

KKJSEC 是否合法?

不,KKJSEC 没有受到监管。它成立于印度,但没有获得印度任何公认的金融监管机构,包括印度证券交易委员会(SEBI)的监管许可。

kkjsec.com域名的最近修改日期为2025年4月11日,注册日期为2005年4月23日。该域名的到期日期为2028年4月23日。它使用ns1.cp-ht-10.webhostbox.net和ns2.cp-ht-10.webhostbox.net作为主机名服务器。

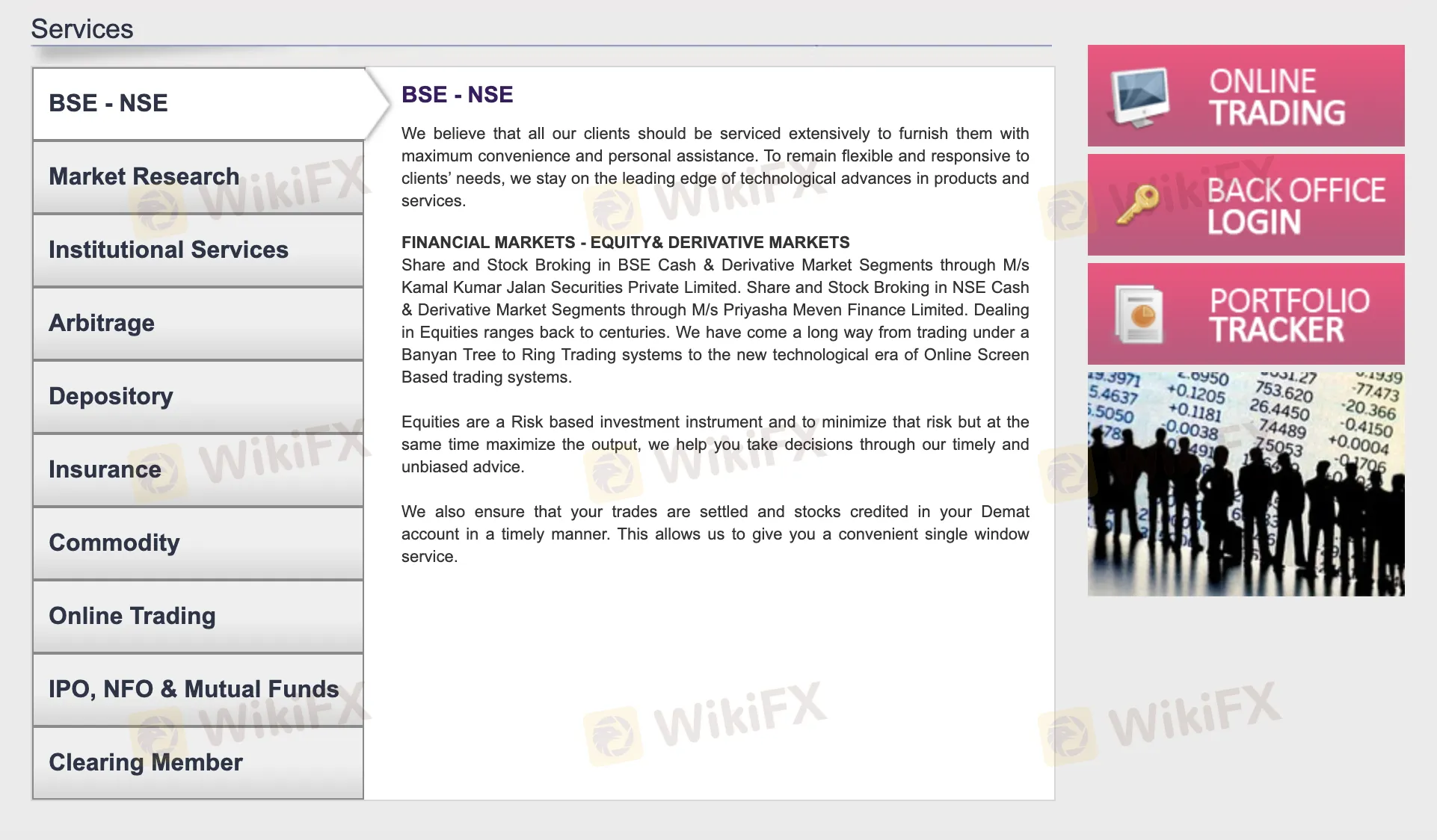

KKJSEC 服务

在线交易、商品、保险、存管服务以及股票和衍生品交易只是KKJSEC提供的众多金融服务中的几项。它通过其子公司使在BSE和NSE市场上交易更加便捷。

| 服务 | 特点 |

| BSE - NSE交易 | 在BSE和NSE市场上进行股票和衍生品交易 |

| 市场研究 | 市场分析和研究服务 |

| 机构服务 | 为机构客户提供定制的金融服务 |

| 套利 | 套利交易策略 |

| 存管服务 | 证券账户服务和股票结算 |

| 保险 | 保险产品和咨询 |

| 商品交易 | 在商品市场上的投资 |

| 在线交易 | 为用户提供的在线交易平台 |

| IPO、NFO和共同基金 | 与首次公开募股、新基金报价和共同基金投资相关的服务 |

| 结算会员 | 提供结算服务以确保及时交易结算 |

交易平台

KKJSEC提供基于ODIN的在线交易平台,使用户能够安全独立地进行交易。还包括基于COMTEK的后台办公室,用于检查交易报告和分类帐。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| ODIN(金融科技) | ✔ | 桌面,Web | 寻求更多直接交易输入控制的活跃交易者 |

| E-BackOffice(COMTEK) | ✔ | Web | 需要实时访问分类帐和交易摘要的投资者 |