Company Summary

| KKJSEC Review Summary | |

| Founded | 1986 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Services | Equities & derivatives, commodities, insurance, IPOs |

| Demo Account | ❌ |

| Trading Platform | ODIN (Financial Technologies), COMTEK (BackOffice) |

| Customer Support | General: info@kkjsec.com |

| Grievance: grief@kkjsec.com | |

| Management: nikhil@kkjsec.com | |

| Principal Officer: Mr. Nikhil Jalan - Mobile: +91 9833915980 | |

KKJSEC Information

Founded in 1986 and based in India, KKJSEC provides a serious of financial services, including mutual funds, insurance, commodities, BSE/NSE stocks and derivative trading. Aiming at local retail and institutional customers, it offers trading services via the ODIN and COMTEK systems. However, it lacks regulation from India authority Securities and Exchange Board of India (SEBI).

Pros and Cons

| Pros | Cons |

| Long operational history | No regulation |

| Wide range of financial services including equity & depository | Demo accounts not offered |

| Provides back office access and online trading tools |

Is KKJSEC Legit?

No, KKJSEC is not regulated. It was found in India, but it does not have a regulatory license from any acknowledged Indian financial authority, including the Securities and Exchange Board of India (SEBI).

The most recent modification to the domain kkjsec.com was made on April 11, 2025, and it was registered on April 23, 2005. The expiration date of the domain is April 23, 2028. It makes use of the ns1.cp-ht-10.webhostbox.net and ns2.cp-ht-10.webhostbox.net hosting name servers.

KKJSEC Services

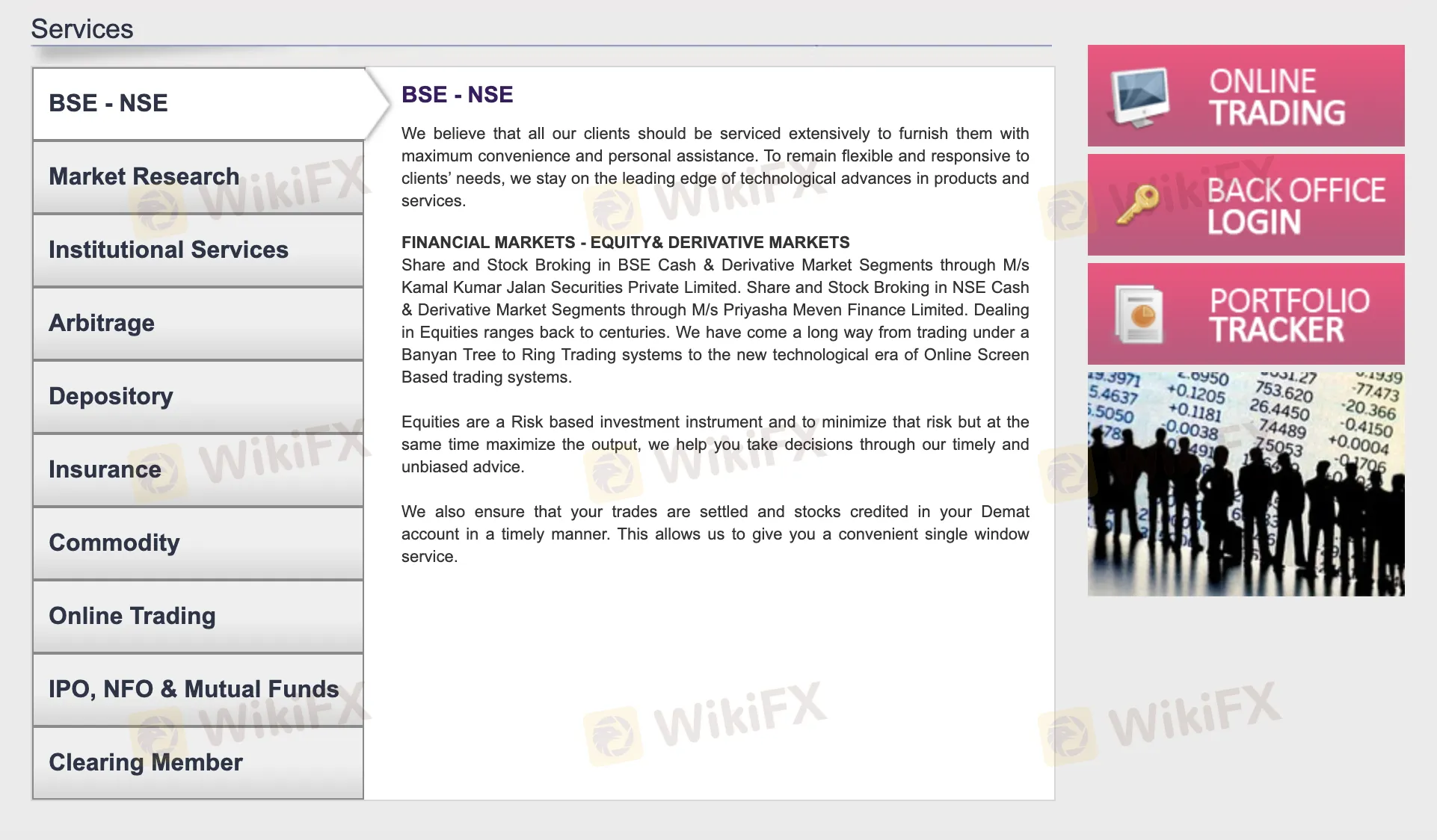

Online trading, commodities, insurance, depository services, and equities and derivative trading are just a few of the many financial services that KKJSEC provides. It makes trading on the BSE and NSE exchanges easier through its subsidiaries.

| Services | Feature |

| BSE - NSE Trading | Equity and derivatives trading on BSE and NSE markets |

| Market Research | Market analysis and research services |

| Institutional Services | Customized financial services for institutional clients |

| Arbitrage | Arbitrage trading strategies |

| Depository Services | Demat account services and stock settlement |

| Insurance | Insurance products and advisory |

| Commodity Trading | Investment in commodity markets |

| Online Trading | Online trading platform for user convenience |

| IPO, NFO & Mutual Funds | Services related to IPOs, New Fund Offers, and mutual fund investments |

| Clearing Member | Clearing services to ensure timely trade settlement |

Trading Platform

KKJSEC provides an ODIN-powered online trading platform that enables users to safely and independently place trades. A COMTEK-powered back office for examining trade reports and ledgers is also included.

| Trading Platform | Supported | Available Devices | Suitable for |

| ODIN (Financial Technologies) | ✔ | Desktop, Web | Active traders looking for more control over direct trade entry |

| E-BackOffice (COMTEK) | ✔ | Web | Investors needing real-time access to ledgers and trade summaries |