公司简介

| First State Futures 评论摘要 | |

| 成立时间 | 2022 |

| 注册国家/地区 | 印度尼西亚 |

| 监管 | 由ICDX监管 |

| 市场工具 | 美国个股、货币、金属和能源、股指、微多边、商品(CPO、Olein、可可、咖啡) |

| 模拟账户 | ✅ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | JAFeTS NOW和MT4交易平台 |

| 最低存款 | / |

| 客户支持 | 09:00 - 05:00 WIB |

| 电话:+6231-505-5599(分机:212) | |

| 传真:+6231-503-8885 | |

| 电子邮件:info@firststate-futures.com | |

| Facebook、Twitter、Linkedin、Telegram | |

| 地址:印度尼西亚东爪哇省泗水市苏拉威西街48号PPFX+4F | |

| 地区限制 | 加拿大的不列颠哥伦比亚省、魁北克省和萨斯喀彻温省,以及朝鲜民主主义人民共和国(朝鲜)、伊朗、美国和香港。 |

总部位于泗水的PT. First State Futures在巴厘岛、詹贝尔和索罗等城市设有多个分支机构。作为期货交易所的持牌会员,并获得BAPPEBTI认可,该公司提供JAFeTS NOW和MT4等交易平台。

这是该经纪商官方网站的首页:

优点和缺点

| 优点 | 缺点 |

| 由ICDX监管 | 被吊销的BAPPEBTI许可证 |

| 提供安全措施 | 可疑的克隆JFX许可证 |

| 多样化的市场工具 | 地区限制 |

| 模拟账户 | 有关交易条件的信息有限 |

| MT4平台 | 收取不活跃费用 |

| 存取款无手续费 | 支付选项有限 |

| 多种联系渠道 |

First State Futures是否合法?

First State Futures受印度尼西亚商品和衍生品交易所(ICDX)监管。它持有零售外汇牌照,编号为037/SPKB/ICDX/Dir/VIII/2010。此外,它还提供包括隔离账户在内的安全措施。

| 印度尼西亚商品和衍生品交易所(ICDX) |

| 监管状态 | 受监管 |

| 监管机构 | 印度尼西亚 |

| 牌照机构 | First State Futures, PT |

| 牌照类型 | 零售外汇牌照 |

| 牌照编号 | 037/SPKB/ICDX/Dir/VIII/2010 |

然而,他们的Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan(BAPPEBTI)许可证被吊销,而雅加达期货交易所(JFX)则是可疑克隆。

| Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan(BAPPEBTI) |

| 监管状态 | 吊销 |

| 监管机构 | 印度尼西亚 |

| 牌照机构 | PT. First State Futures |

| 牌照类型 | 零售外汇牌照 |

| 牌照编号 | 18/BAPPEBTI/PN/3/2010 |

| 雅加达期货交易所(JFX) |

| 监管状态 | 可疑克隆 |

| 监管机构 | 印度尼西亚 |

| 牌照机构 | First State Futures |

| 牌照类型 | 零售外汇牌照 |

| 牌照编号 | SPAB-058/BBJ/01/04 |

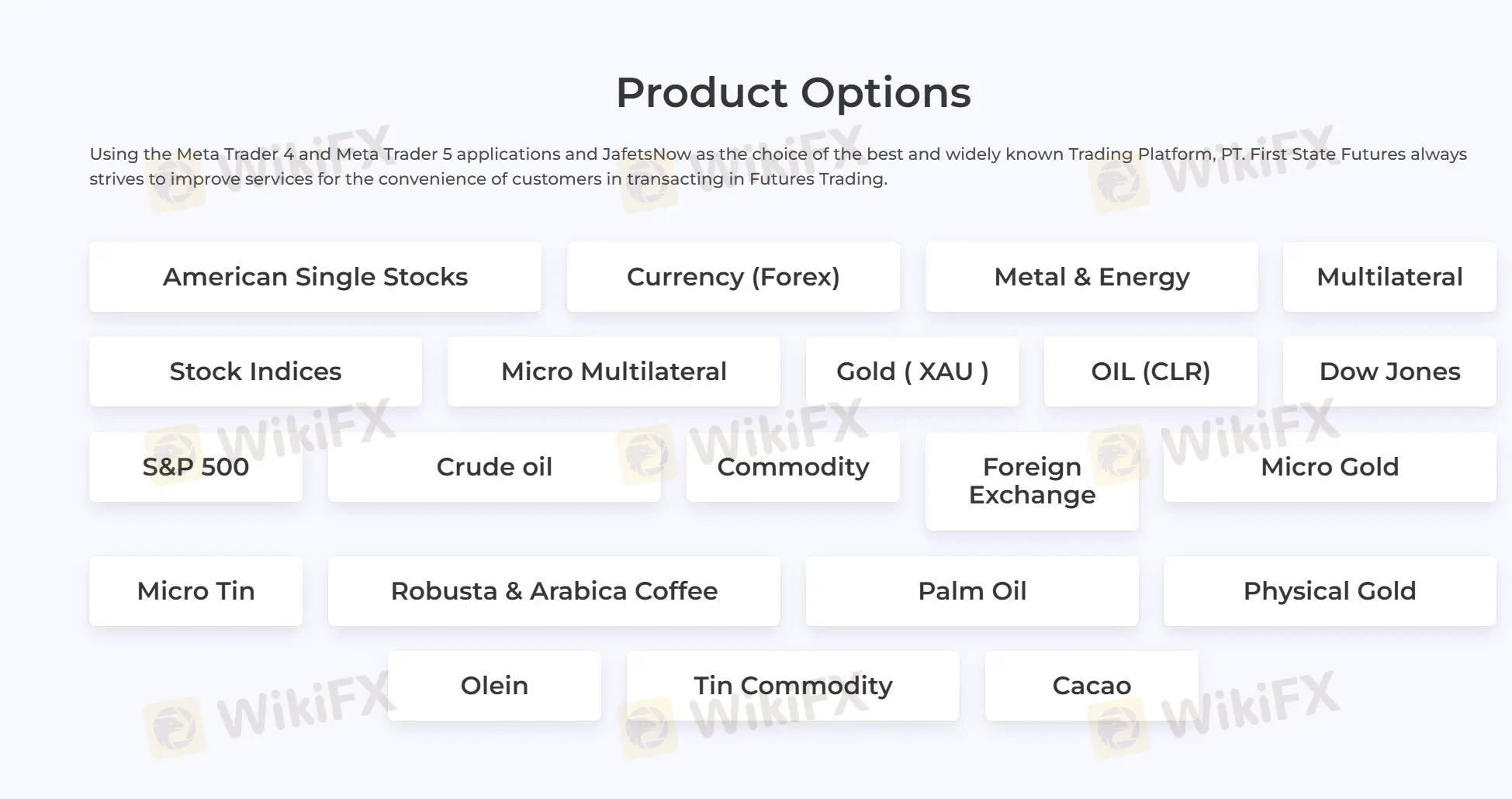

我可以在First State Futures上交易什么?

First State Futures 提供美国个股、货币、金属和能源、股票指数、微型多边和商品(CPO、Olein、Cocoa、coffee)。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 商品 | ✔ |

| 金属 | ✔ |

| 能源 | ✔ |

| 美国个股 | ✔ |

| 股票指数 | ✔ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金(ETFs) | ❌ |

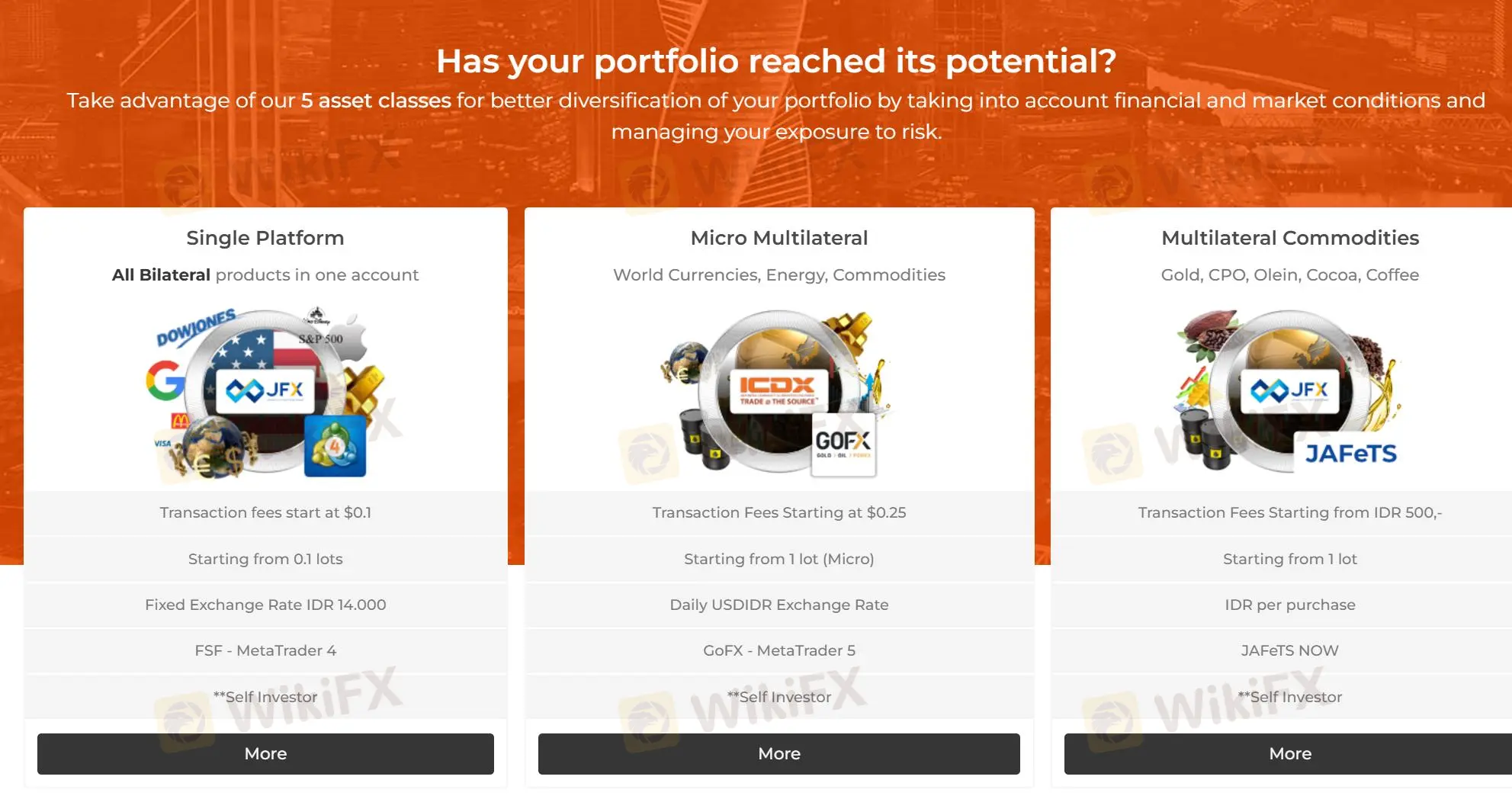

账户类型

First State Futures 提供三种类型的账户:单平台账户、微型多边账户和多边商品账户。此外,还提供演示账户。

| 账户类型 | 涵盖的产品 | 手数 | 汇率/货币 |

| 单平台账户 | 所有双边产品 | 从0.1手起 | 固定为IDR 14,000 |

| 自营投资者-微型多边账户 | 世界货币、能源、商品 | 从1手(微型)起 | 每日USDIDR汇率 |

| 自营投资者-多边商品账户 | 黄金、CPO、Olein、Cocoa、Coffee | 从1手起 | 每次购买的IDR |

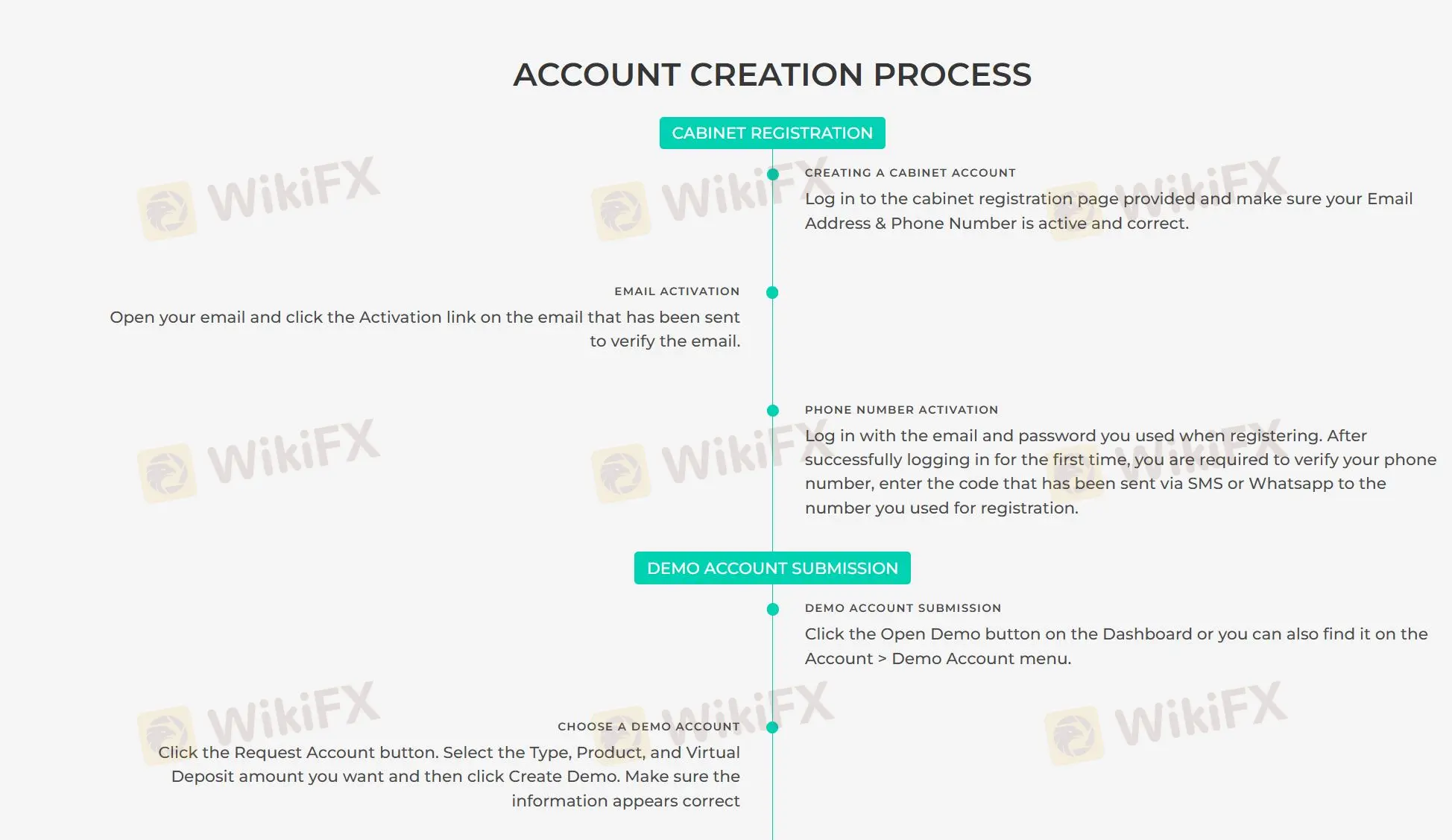

要开设First State Futures的账户,您需要先拥有演示账户,然后申请真实账户。此外,还需要登录提供的柜台注册页面。打开您的电子邮件,点击已发送的激活链接以验证电子邮件。

First State Futures 费用

| 账户类型 | 费用 |

| 单平台账户 | 从$0.1起 |

| 自营投资者-微型多边账户 | 从$0.25起 |

| 自营投资者-多边商品账户 | 从IDR 500起 |

此外,当客户账户连续30(三十)天不活跃时,还会收取50美元的不活跃费用。

交易平台

First State Futures 提供JAFeTS NOW和MT4交易平台。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| JAFeTS NOW | ✔ | 基于电子 | / |

| MT4 | ✔ | Web、桌面、手机 | 初学者 |

| MT5 | ❌ | / | 有经验的交易者 |

JAFeTS NOW交易平台:

该平台基于最新技术构建,支持未来技术发展,并可根据市场需求进行进一步开发。它还支持多边商品交易的模拟。

MetaTrader 4(MT4)交易平台:

基于Metaquotes Software Corp的软件,MT4是一款功能强大的平台,支持各种类型的设备。该平台提供实时报价、图表、市场新闻,并提供全面的即时交易执行。

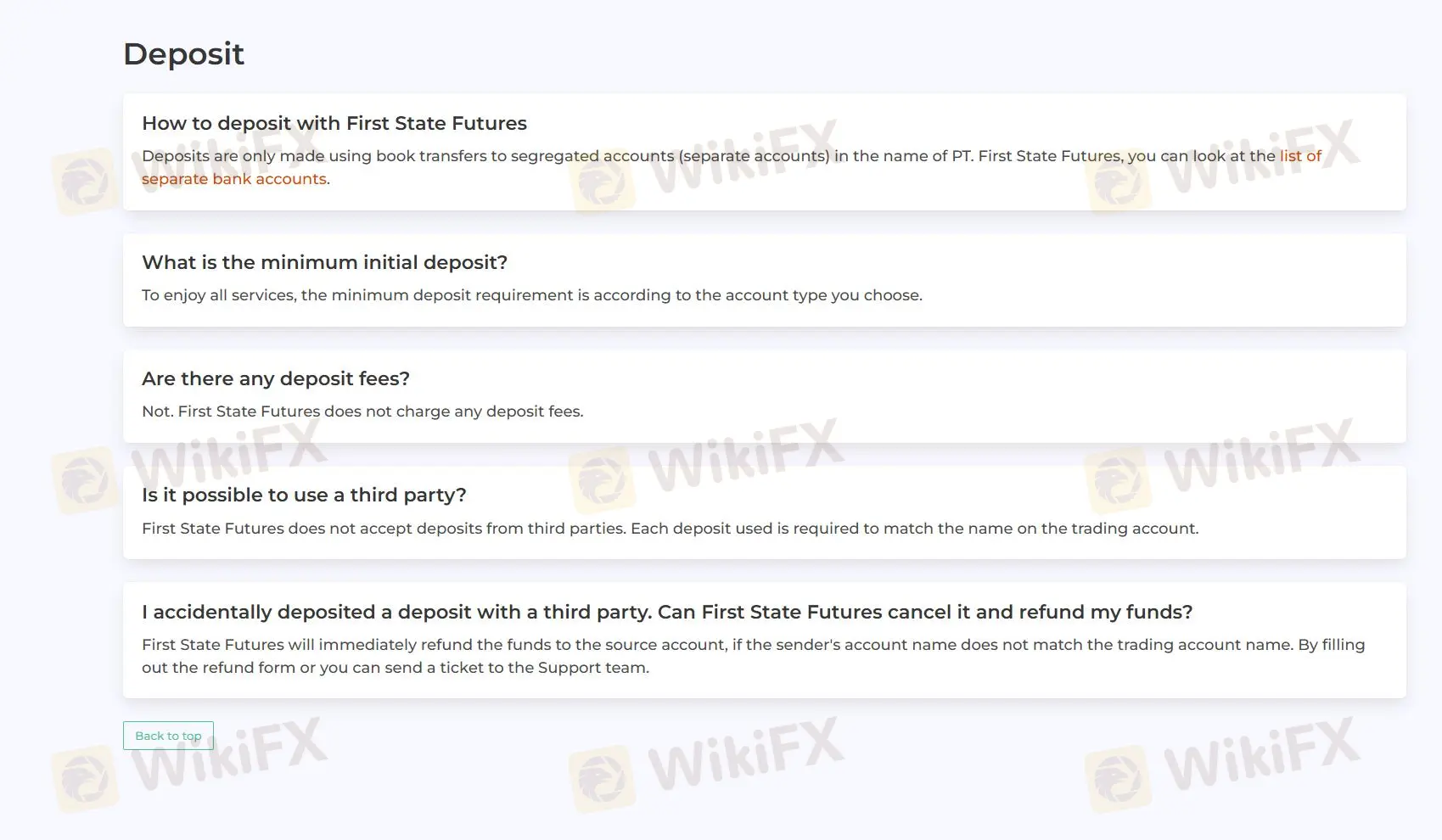

存款和取款

在First State Futures,存款只能通过以PT名义进行的独立账户账户进行账簿转账。它不收取存款或取款费用手续费。

取款只能通过您用于存款的支付方式进行处理和转账。