Company Summary

| TRAZEReview Summary | |

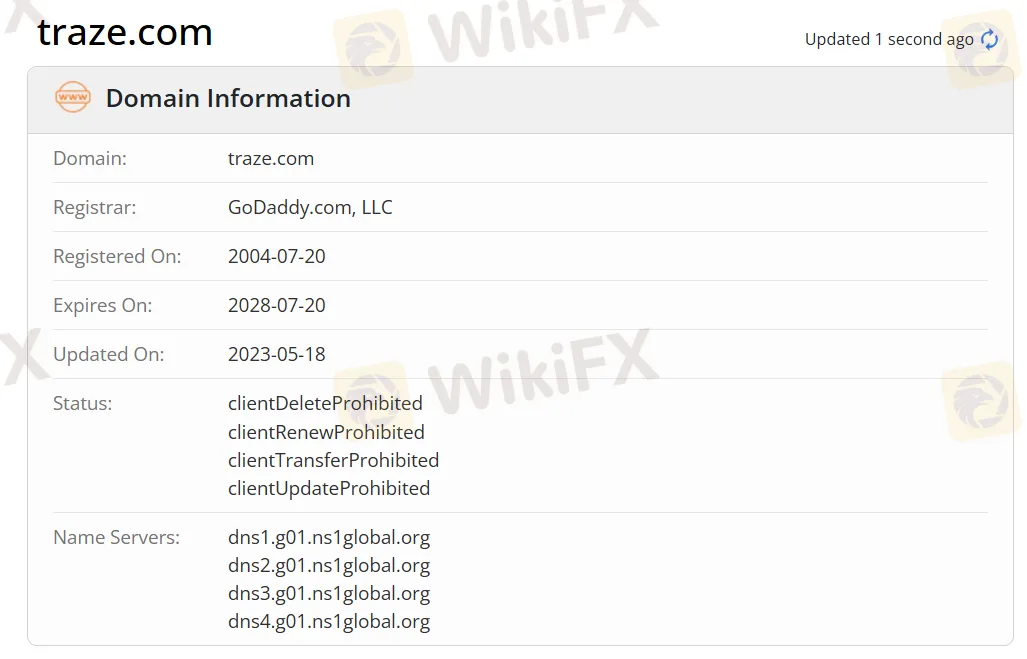

| Founded | 2004-07-20 |

| Registered Country/Region | Seychelles |

| Regulation | Regulate(FCA), General Registration(FSCA) |

| Market Instruments | Forex/Commodities/Shares/Cryptocurrencies/Metals/Indices |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | From 0.2 |

| Trading Platform | MT4(iOS/Android/Windows/Mac) |

| Min Deposit | $50 |

| Customer Support | Email: cs@traze.com |

| 24-hour hotline: 400-8692-878 | |

| Twitter/Facebook/Instagram/LinkedIn | |

TRAZE Information

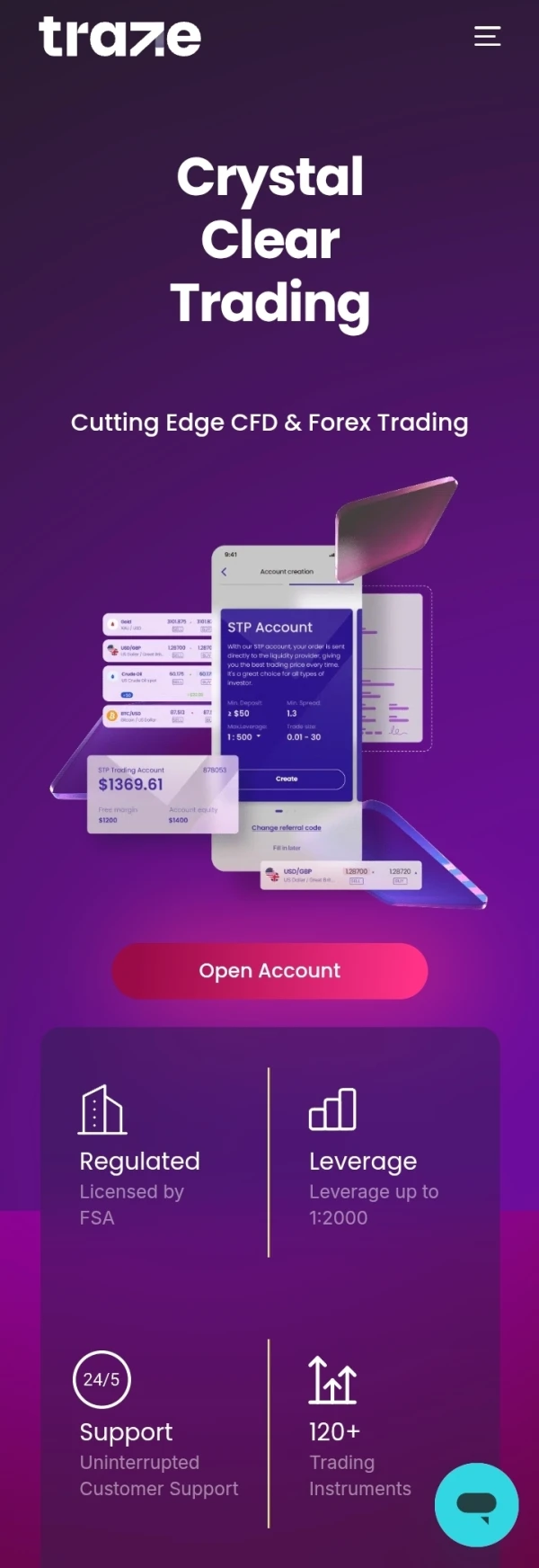

TRAZE is a FCA-licensed broker. The tradable instruments with a maximum leverage of 1:2000 include forex, commodities, shares, cryptocurrencies, metals, and indices. The broker also provides two accounts, including STP Trading and ECN Trading. The minimum spread is from 0.2 pips and the minimum deposit is $50. Traders can also access the MT4 trading platform through TRAZE.

Pros and Cons

| Pros | Cons |

| Regulated | No specific transfer method |

| Leverage up to 1:2000 | No specific transfer time and fee information |

| 24/5 customer support | Unclear swap fee |

| Spread as low as 0.2 | |

| Demo account available | |

| MT4 unavailable |

Is TRAZE Legit?

FSCA regulates TRAZE with license number 48248, but its current status is General Registration. FCA also regulates TRAZE under license number 768451 and the Straight Through Processing(STP) type.

What Can I Trade on TRAZE?

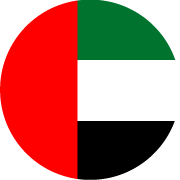

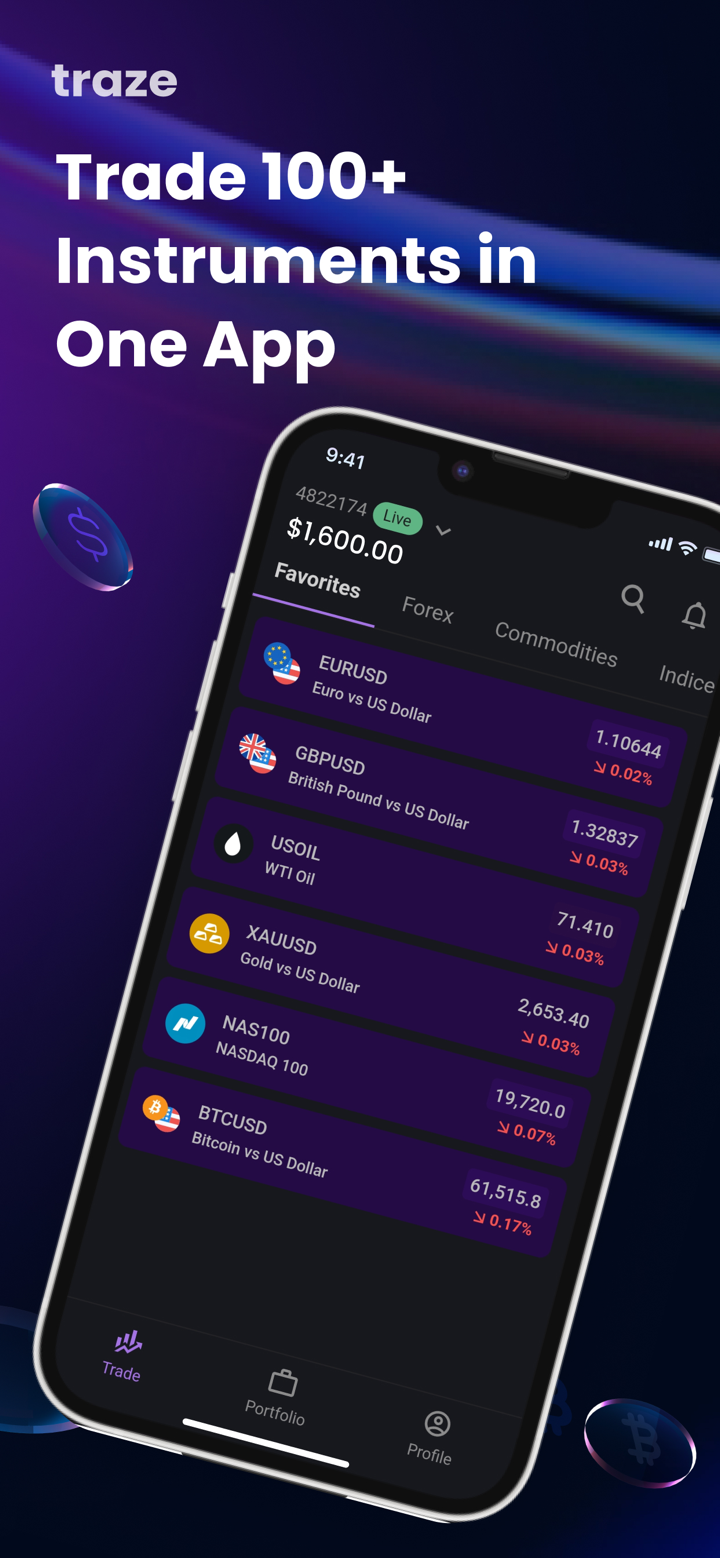

TRAZE offers over 120 market instruments, including forex, commodities, shares, cryptocurrencies, metals, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

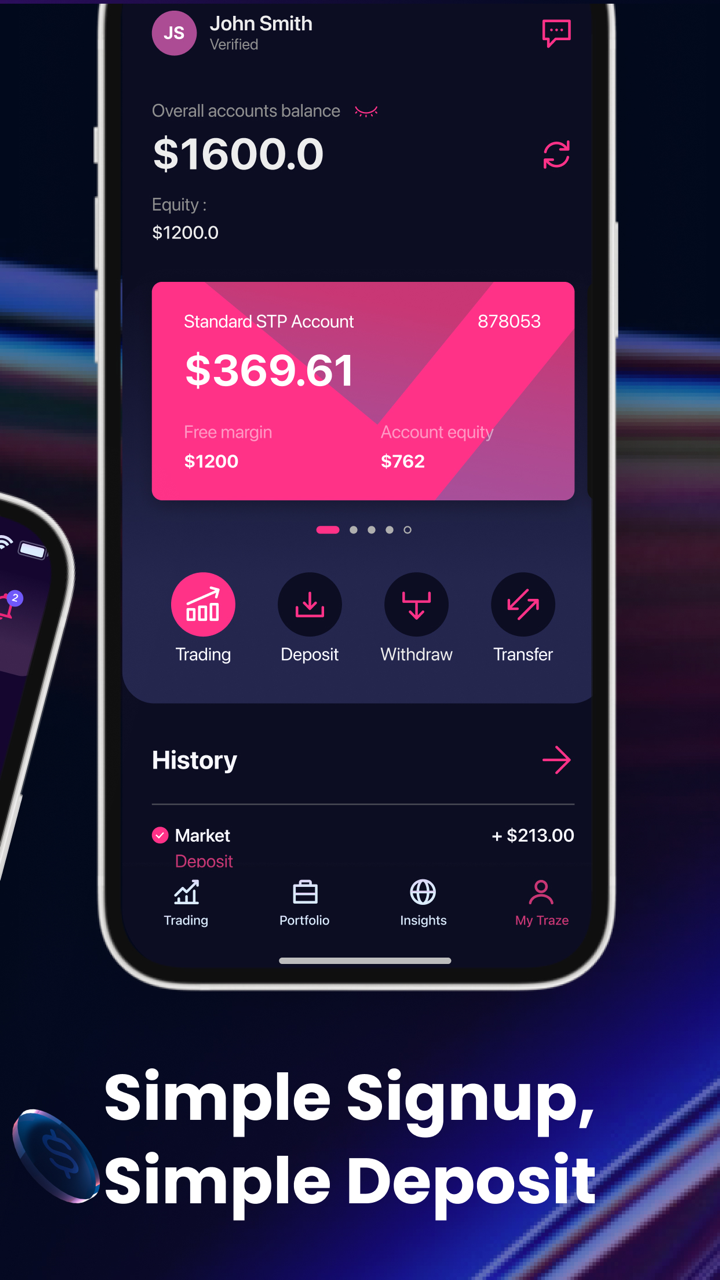

| Commodities | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

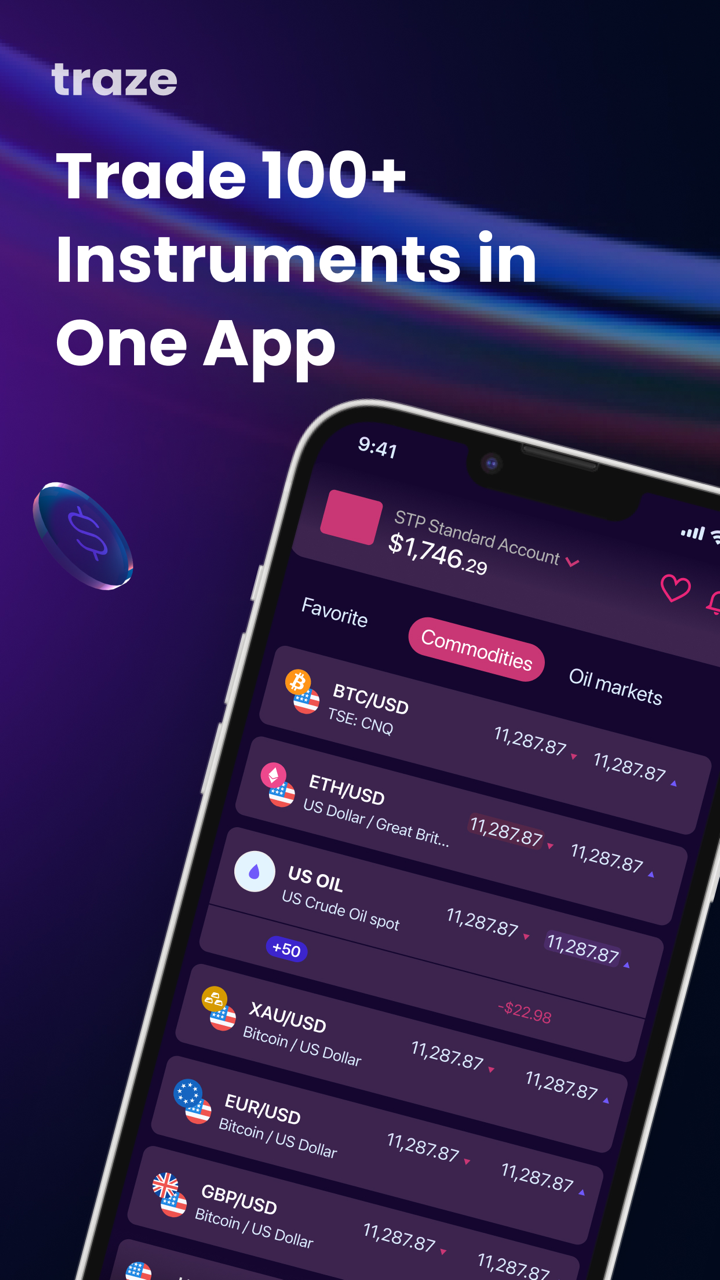

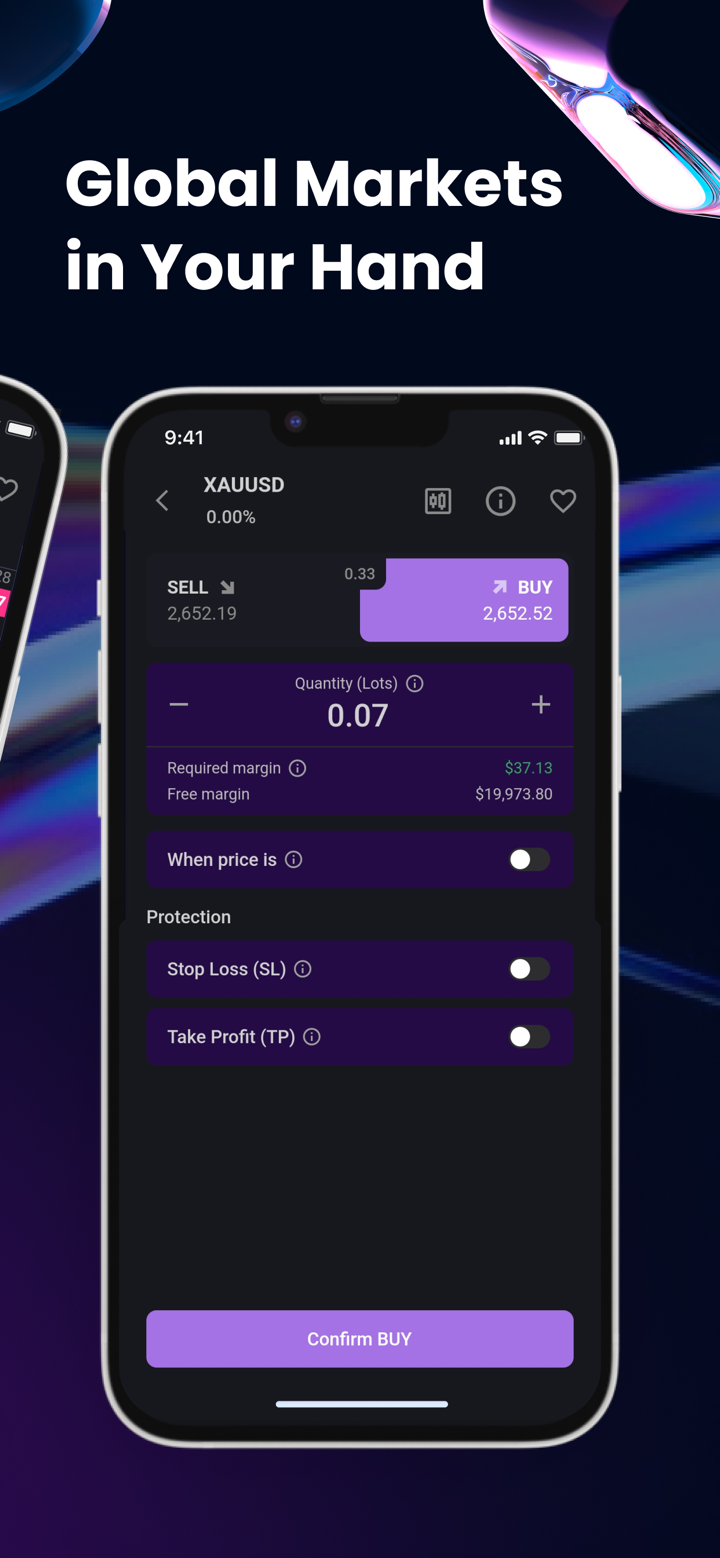

TRAZE has two account types: STP Trading and ECN Trading. Traders who want low spreads can choose an ECN Trading account, while those with a small budget can open an STP Trading account. In addition, the demo account is predominantly used for familiarizing traders with the trading platform and for educational purposes only.

| Account Type | STP Trading | ECN Trading |

| Minimum Deposit | ≥$50 | ≥$200 |

| Minimum FX Spread | 1.3 | From 0.2 |

| Maximum Leverage | 1:2000 | 1:2000 |

| Standard Lot Contract Units (FX) | 100000 | 100000 |

| Stop-Out Level | 30% | 50% |

| Minimum Trade Size (Standard Lot) | 0.01 | 0.01 |

| Maximum single order in Standard Lots | 30 | 50 |

TRAZE Fees

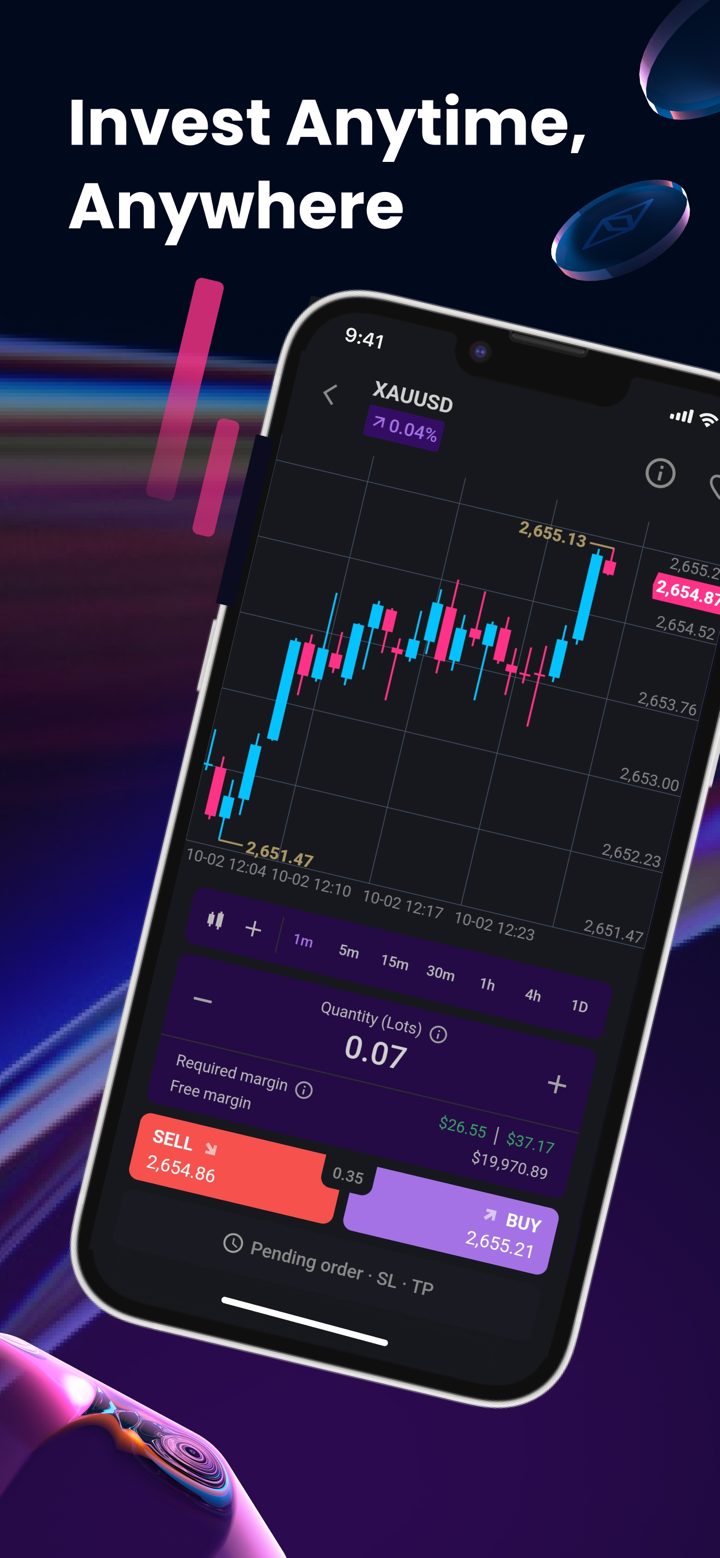

The spread is from 0.2. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:2000 meaning that profits and losses are magnified 2000 times.

Trading Platform

TRAZE provides the Traze Mobile Application and the authoritative MT4 trading platform available in iOS, Android, Windows, and Mac. Junior traders prefer MT4 over MT5. MT4 not only provides various trading strategies but also implements EA systems. In addition, Copy-Trading Platform can save time customizing trading strategies

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | iOS/Android/Windows/Mac | Junior traders |

| Traze Mobile Application | ✔ | Mobile | - |

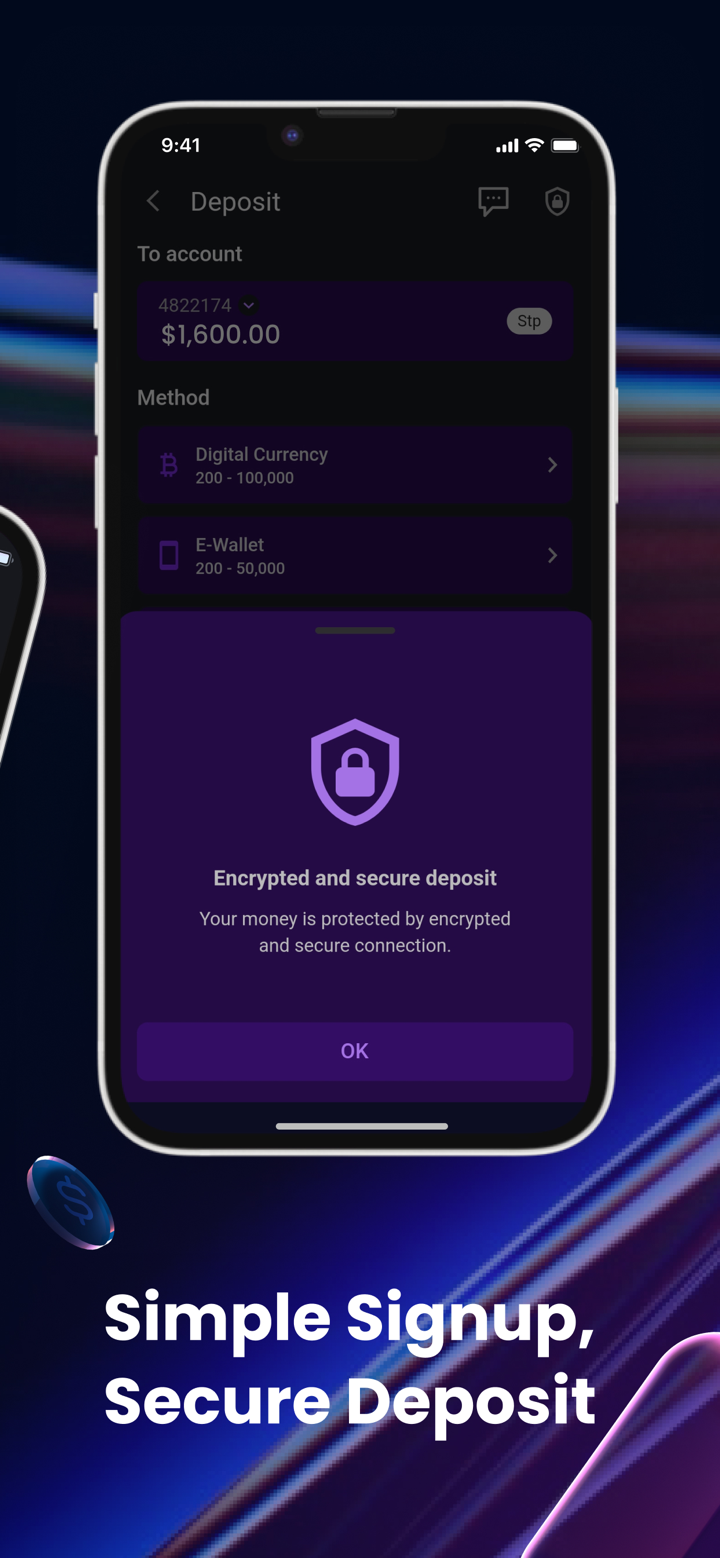

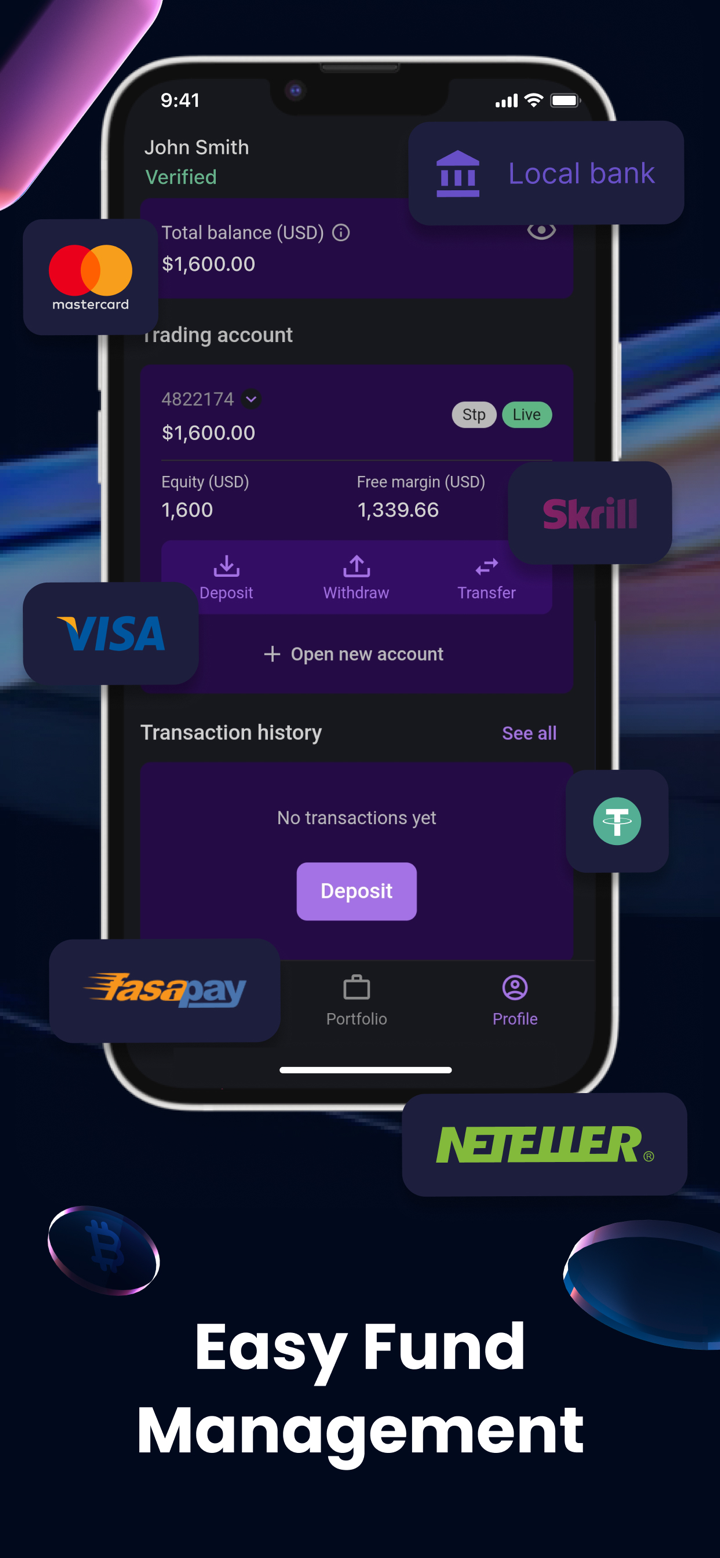

Deposit and Withdrawal

The minimum deposit is $50. However, transfer processing times, methods, and associated fees are unknown.

FX2482787111

India

Excellent Broker. Good service. No issue regarding deposit🌼😋😆 and withdrawal . I have been working as IB since a year, promoting Traze, but so far no such loop falls I have came across.

Positive

FX2490625354

India

Trade gives me the feeling that it is safe to put my money here. Trading with them seems to be secure and that I don’t have to worry about being cheated. They also have a good regulatory record and offer a comprehensive range of products and services, including various stock-related transactions as well as foreign exchange trading services.

Positive

FX1113810591

India

This forex broker stands out for its exceptional service and reliability. The platform is user-friendly, offering a seamless trading experience with advanced tools and real-time data. Their customer support is highly responsive, providing prompt assistance whenever needed. Competitive spreads and low transaction costs make it an attractive choice for both novice and experienced traders. The broker also offers a wide range of educational resources, helping users to enhance their trading skills. Overall, it’s a trustworthy and efficient broker that prioritizes client satisfaction and success in the forex market. Highly recommended!

Positive

MDM

India

The trading experience is very good, and the deposit and withdrawal speed is very fast. It is my favorite broker at present.

Positive

TradeMax11

United States

It offers solid trading conditions and their support team is really on the ball. However, the withdrawal times could be faster

Positive