Company Summary

| Levels Review Summary | |

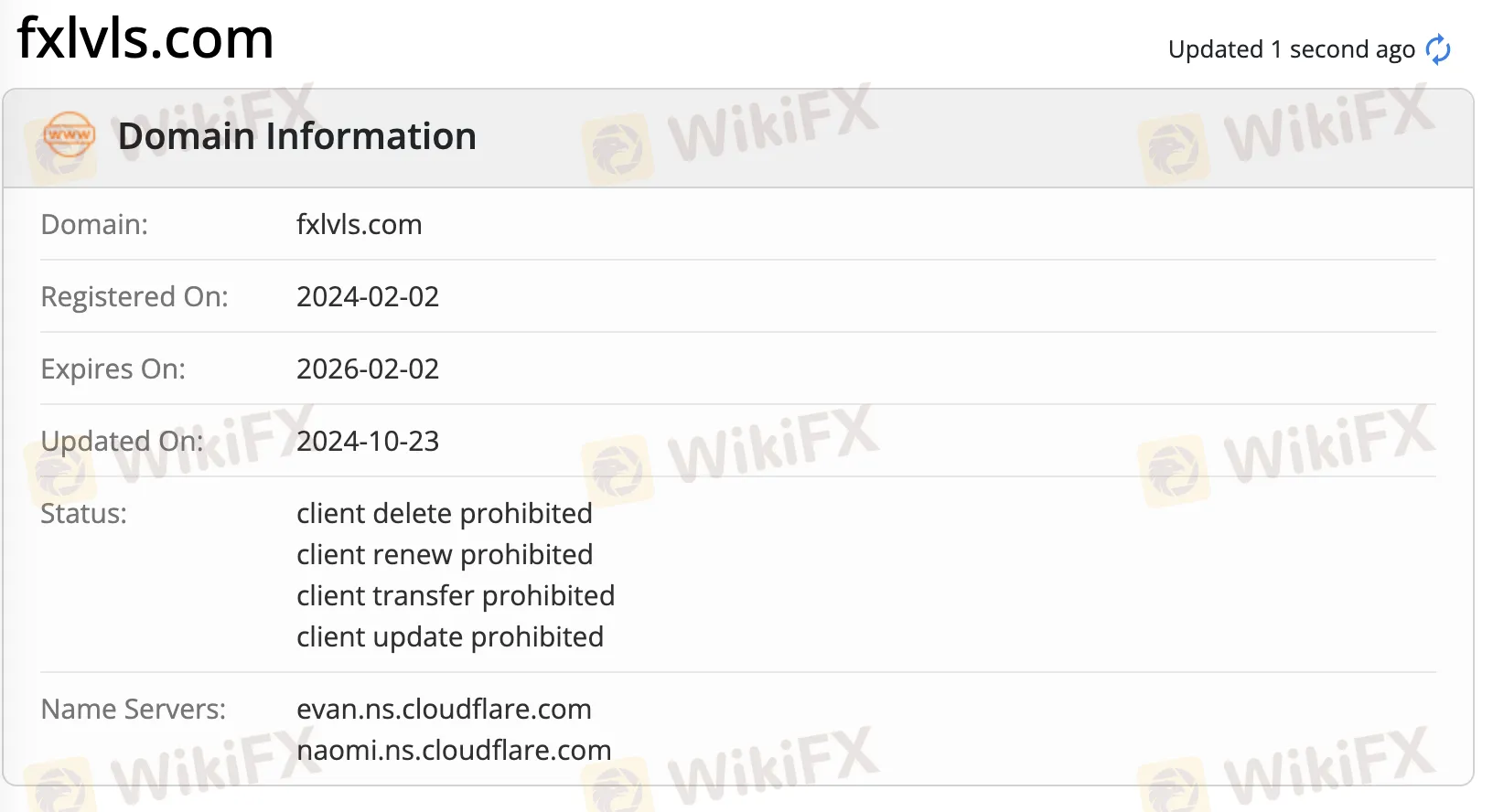

| Founded | 2024 |

| Registered Country/Region | Saint Lucia |

| Regulation | No regulation |

| Market Instruments | Forex, commodities, stocks, indices, cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.9 pips (STP account) |

| Trading Platform | MT5/cTrader |

| Minimum Deposit | $100 |

| Customer Support | 24/5 support |

| Live chat, contact form | |

| Tel: +20 34245867 | |

| Email: support@fxlvls.com | |

| Regional Restrictions | Iran, Cuba, Sudan, Syria, North Korea, United States, and Hong Kong |

Levels Information

Levels is an unregulated broker, offering trading on forex, commodities, stocks, indices and cryptos with leverage up to 1:1000 and spread from 0.9 pips on MT5 and cTrader trading platform. The minimum deposit requirement is $100.

Pros and Cons

| Pros | Cons |

| Tight spreads | Commission fees charged |

| Demo account | No regulation |

| Various trading products | Regional restrictions |

| MT5 platform | |

| Various account choices | |

| Popular payment options |

Is Levels Legit?

No. Levels currently has no valid regulations. Please be aware of the risk!

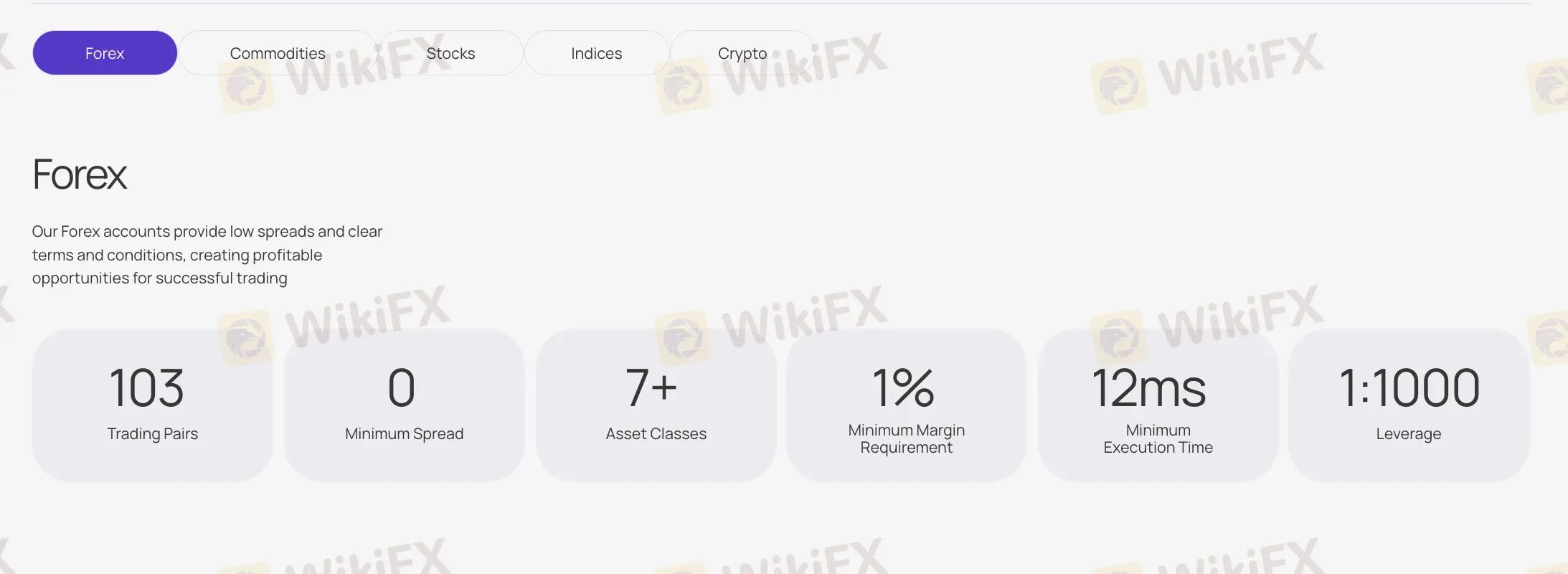

What Can I Trade on Levels?

Levels offers trading on forex, commodities, stocks, indices and cryptos.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

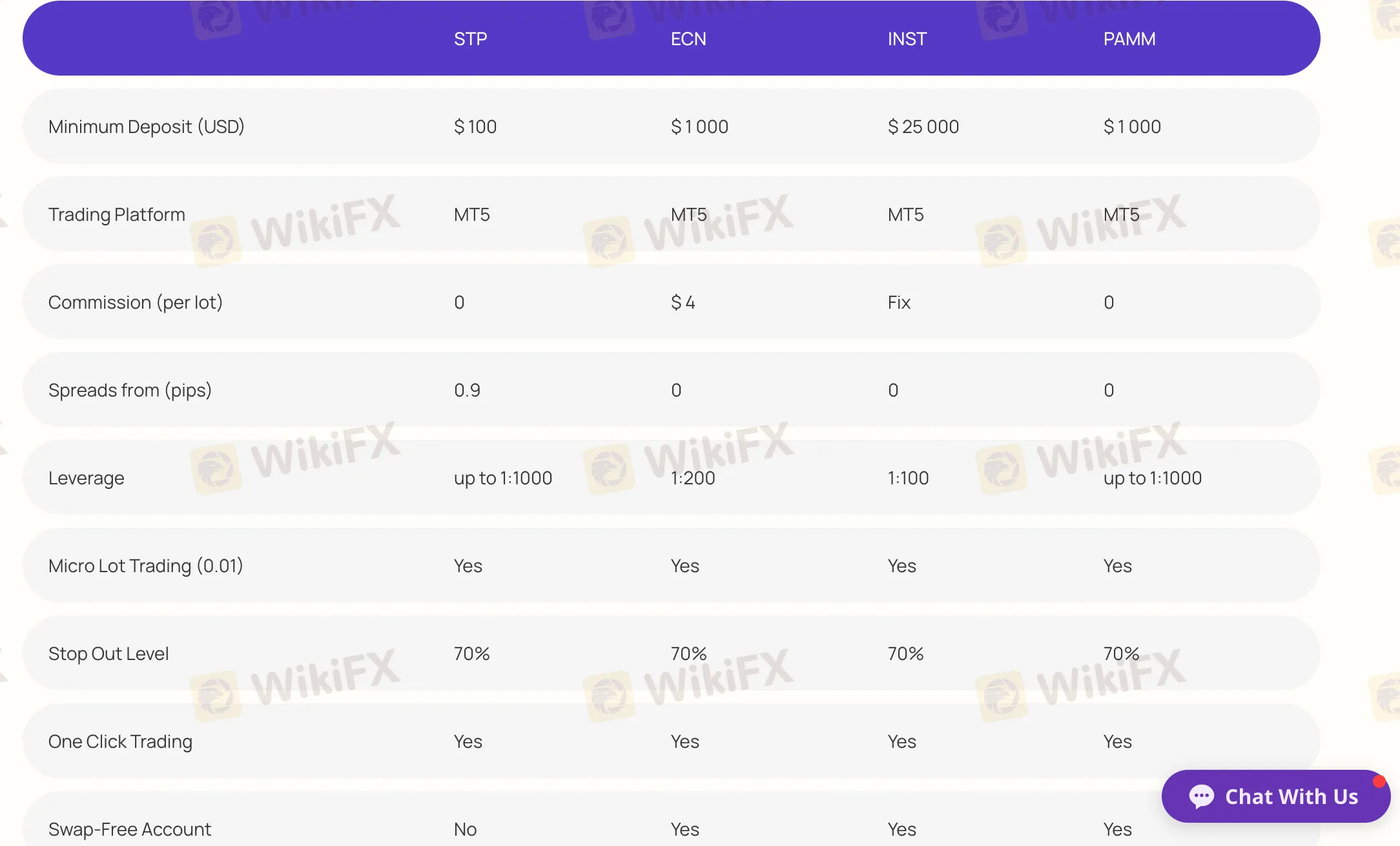

Here are four account types Levels offers:

| Account Type | Minimum Deposit |

| STP | $100 |

| ECN | $1,000 |

| INST | $25,000 |

| PAMM | $1,000 |

Leverage

| Account Type | Maximum Leverage |

| STP | 1:1000 |

| ECN | 1:200 |

| INST | 1:100 |

| PAMM | 1:1000 |

Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

Levels Fees

Trading Fees

| Account Type | Spread | Commission |

| STP | From 0.9 pips | ❌ |

| ECN | From 0 pips | $4 |

| INST | Fix | |

| PAMM | ❌ |

Swap Rates

Levels provides swap-free accounts.

| Account Type | Swap-free acocunt |

| STP | ❌ |

| ECN | ✔ |

| INST | ✔ |

| PAMM | ✔ |

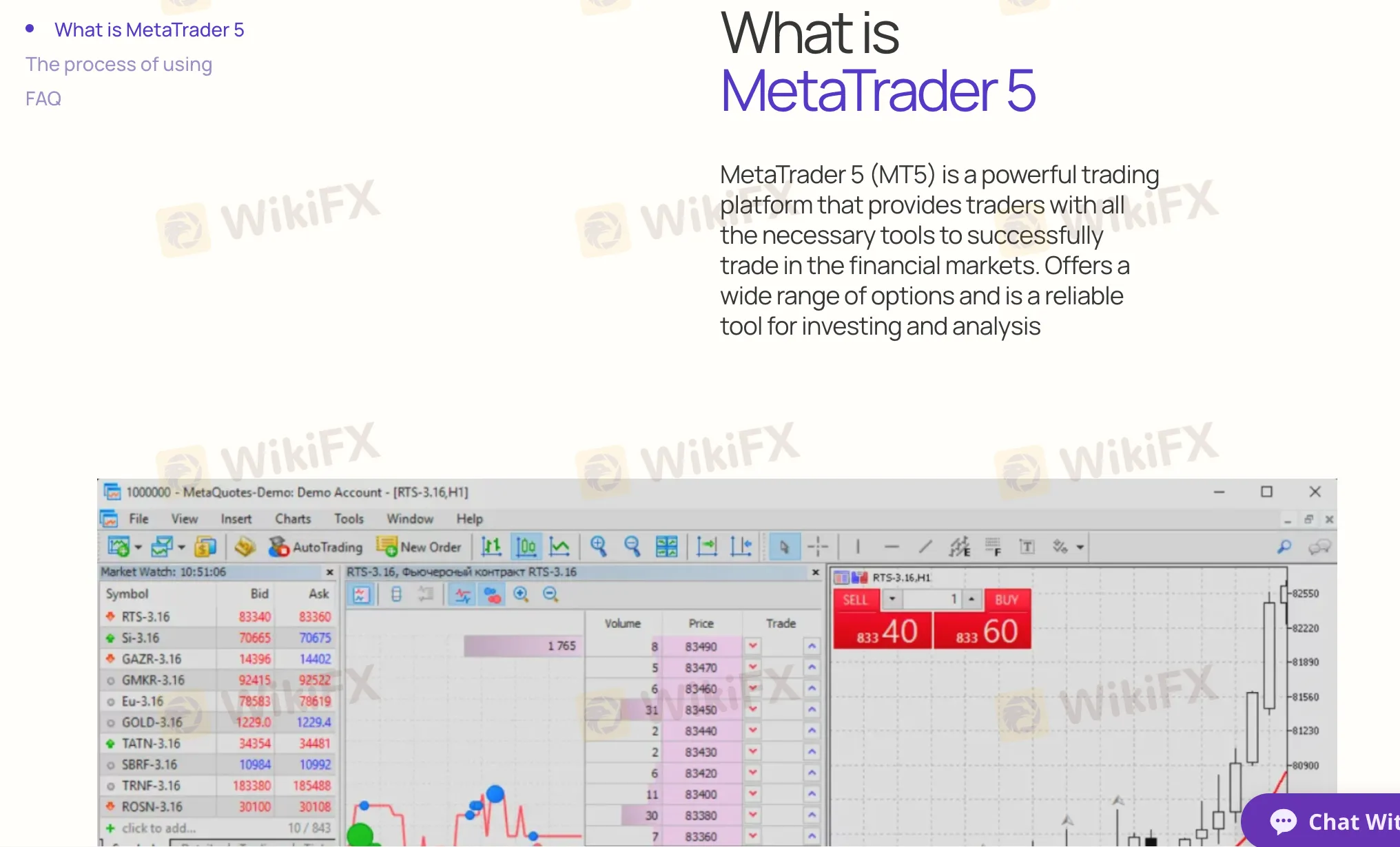

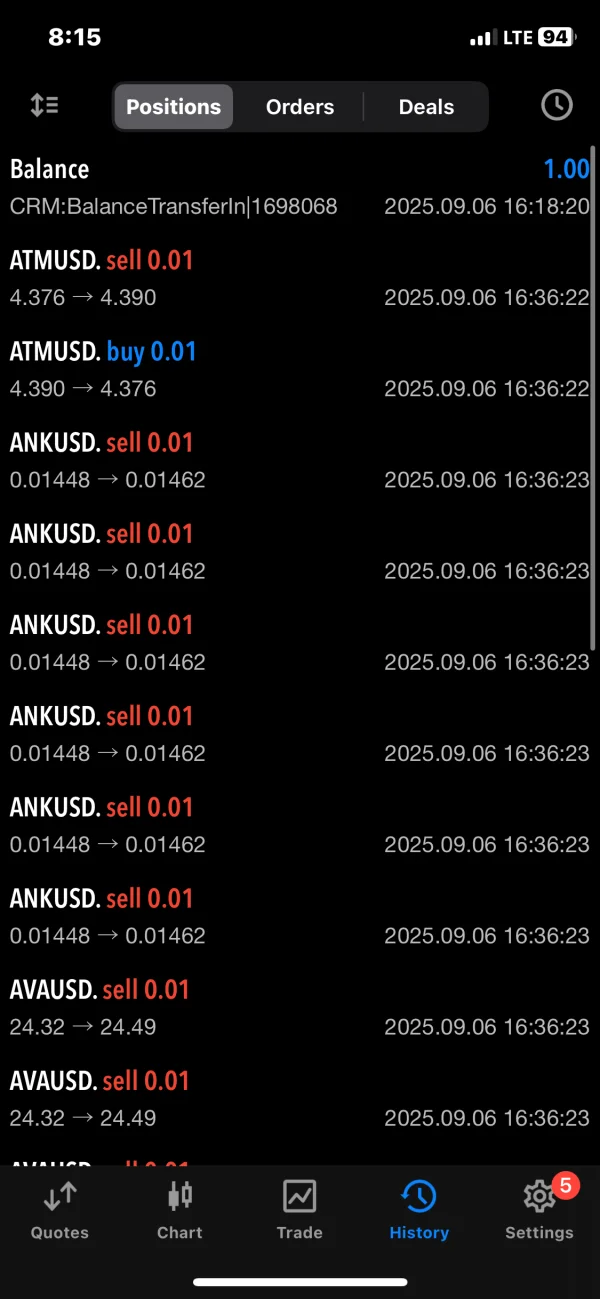

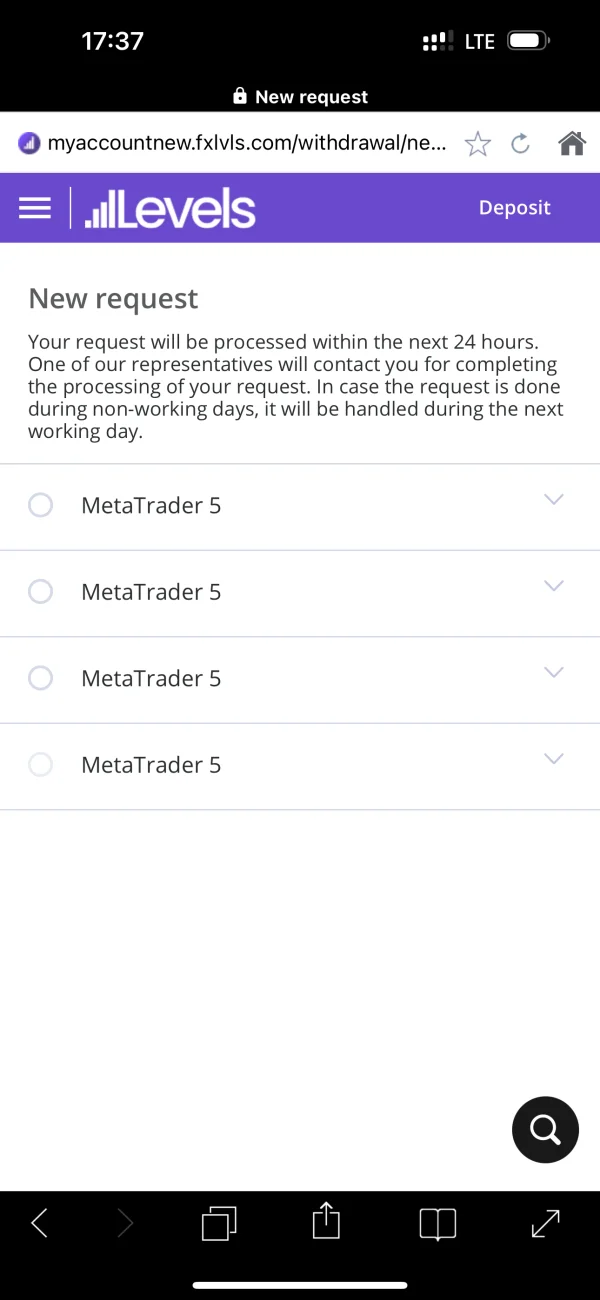

Trading Platform

The website shows that it offers MT5 and cTrader as trading platform. However, cTrader seems unavailable now.

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | / | All traders |

| MT5 | ✔ | Desktop, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

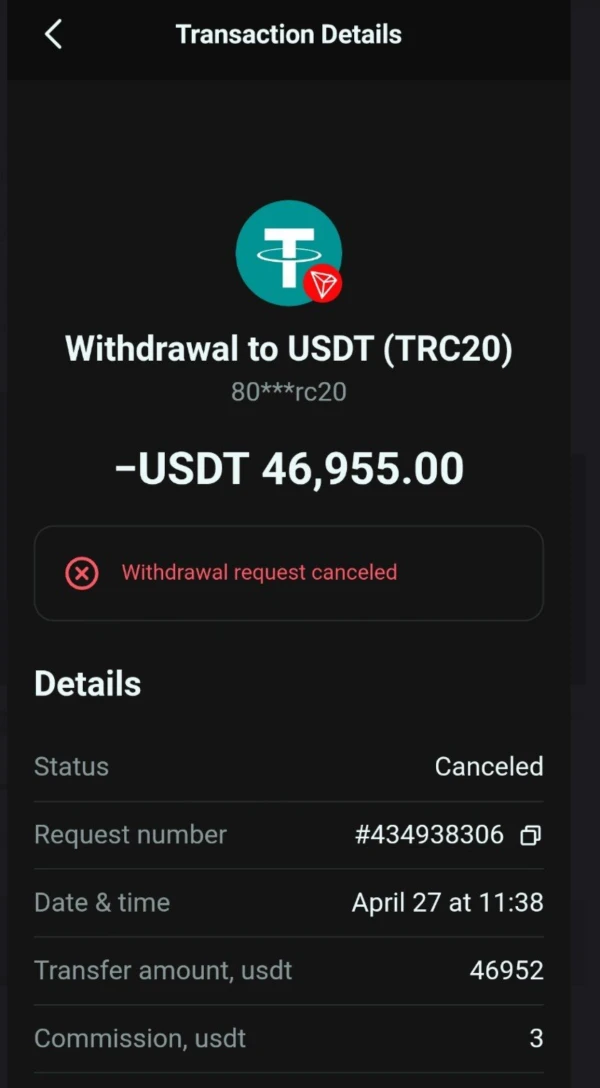

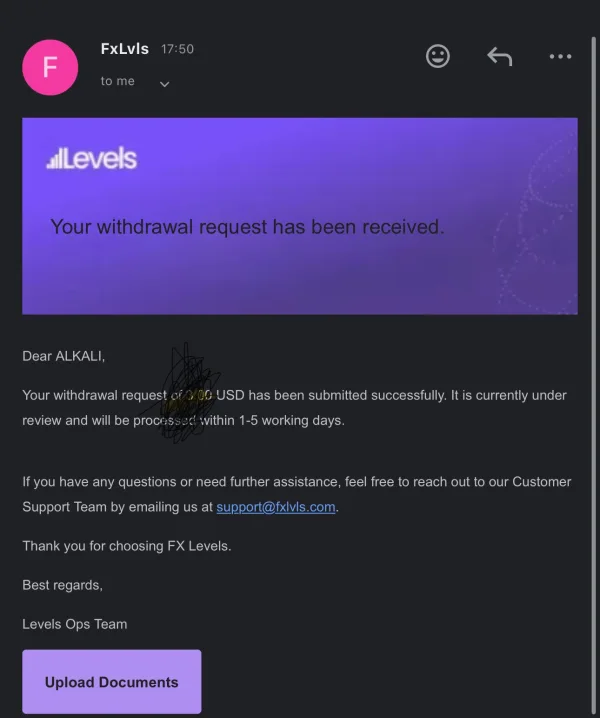

Deposit and Withdrawal

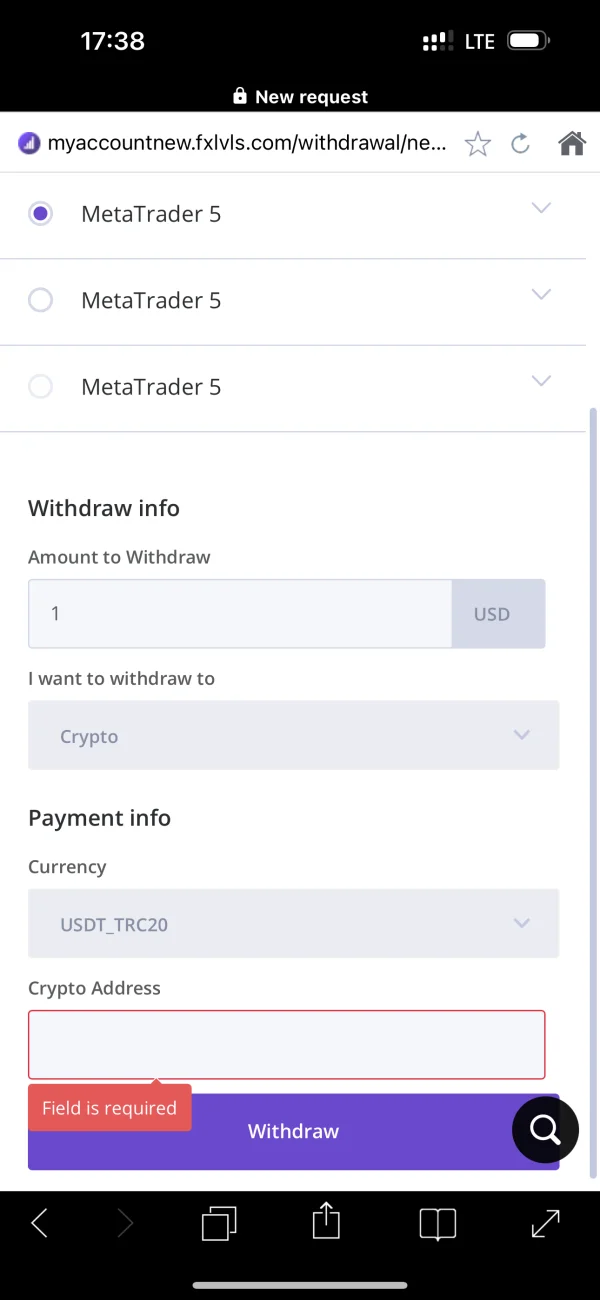

Levels accepts payments via credit card, visa/master card, bank wire, Neteller, Skrill, online banking, crypto currency BTC/USDT and WebMoney.

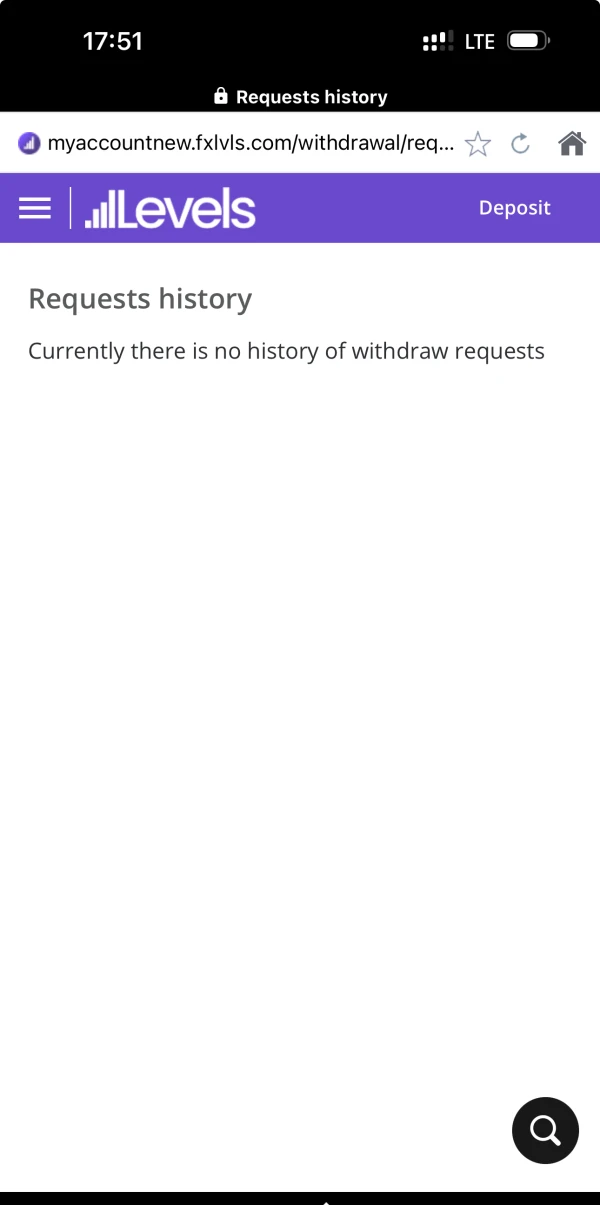

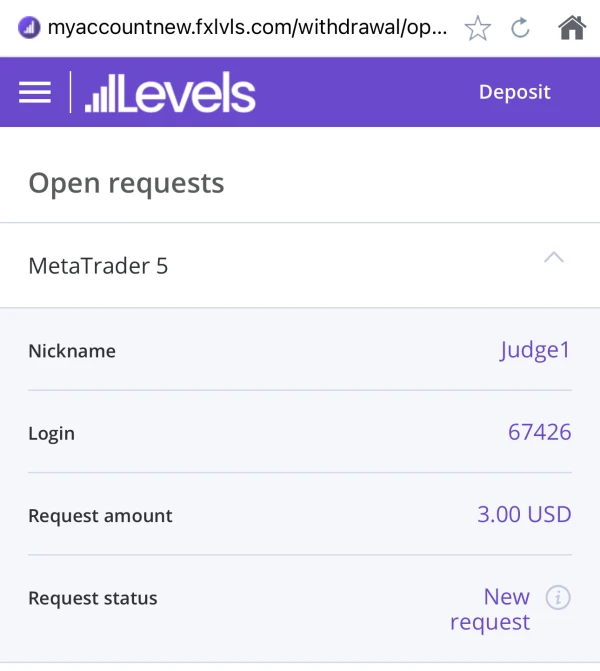

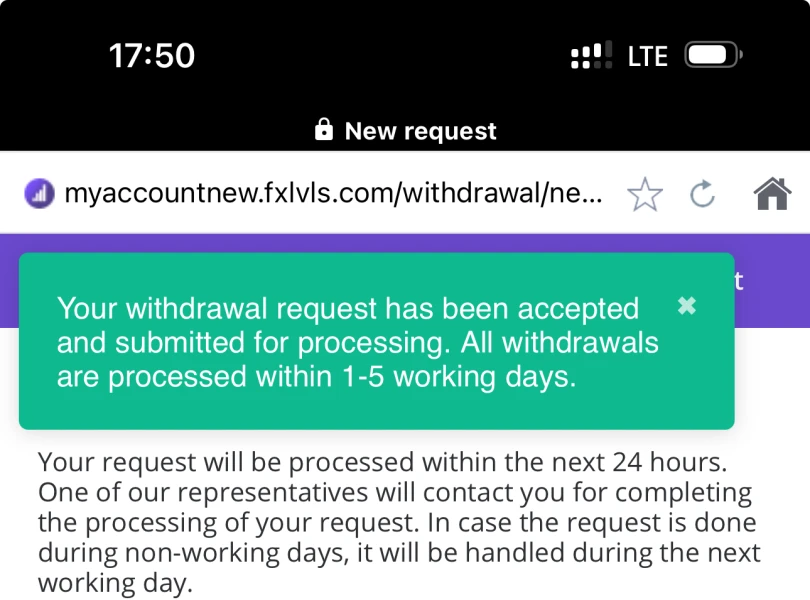

The website shows that it offers instant withdrawal, but not further information specified. No minimum withdrawal amount defined and no fees or charges specified.

FX2407671454

Vietnam

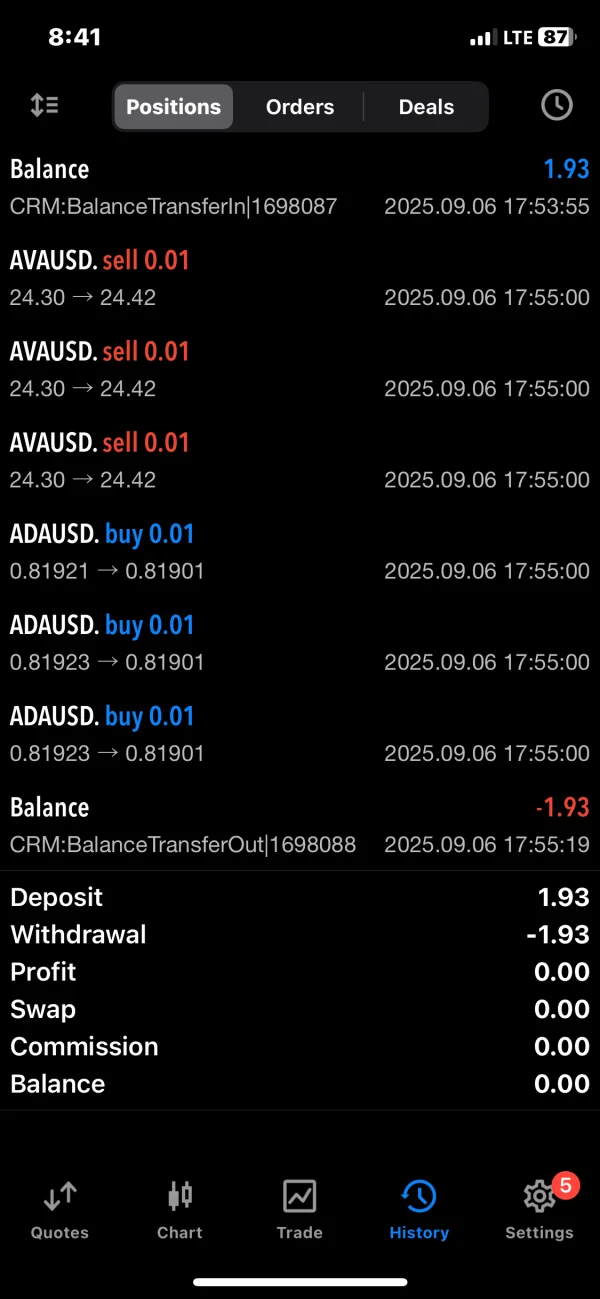

The Levels platform suffers from severe slippage. During a relatively stable gold market, where I frequently trade, I placed a buy order at $1,850 per ounce. Normally, slippage should be around $3-5. However, on Levels, the actual transaction price reached $1,858 per ounce, a staggering $8 in slippage. I carefully reviewed my gold trading history on the platform over the past two months. Of my 80 trades, 50, or 62.5%, experienced abnormal slippage (slippage exceeding $6). Furthermore, the platform's spreads are extremely unreasonable. While other reputable platforms typically offer spreads of $2-3 on gold trading, Levels' spreads frequently hover between $5-8, significantly increasing my trading costs. Beyond trading issues, the platform's customer service is also abysmal. Their customer service was extremely perfunctory, offering no substantive solutions to my issues. This platform has absolutely no regard for investors' interests and is a thoroughly deceptive platform.

Exposure

abhamas

Germany

Levels broker promotes low spreads, but when I started trading, I quickly realized it was misleading. The spreads widen too often, especially at crucial moments, adding hidden costs to every trade. It feels unfair and unprofessional, making it very difficult to trust their platform.

Exposure

FX2622002020

Germany

My experience with Levels broker has been frustrating because their spreads are not stable at all. They constantly widen during trades, even when the market isn’t highly volatile. This makes trading unnecessarily expensive and stressful. What they advertise about tight spreads doesn’t match the reality, and it feels very misleading.

Exposure

FX5992799642

Germany

Levels broker’s spreads are a big disappointment. They advertise competitive, low spreads, but once you’re trading, it’s a completely different story. The spreads suddenly widen during active sessions or even normal conditions, making it very hard to maintain profitability. It feels misleading and unfair because these hidden costs keep eating into profits, leaving me frustrated and doubting their transparency.

Exposure

FX8082210102

Germany

Levels broker claims to offer tight spreads, but in reality, they widen unexpectedly, especially during peak market hours. This constant change makes trading costly and frustrating. It feels deceptive because the spreads are nothing like what they advertise, cutting deep into potential profits

Exposure

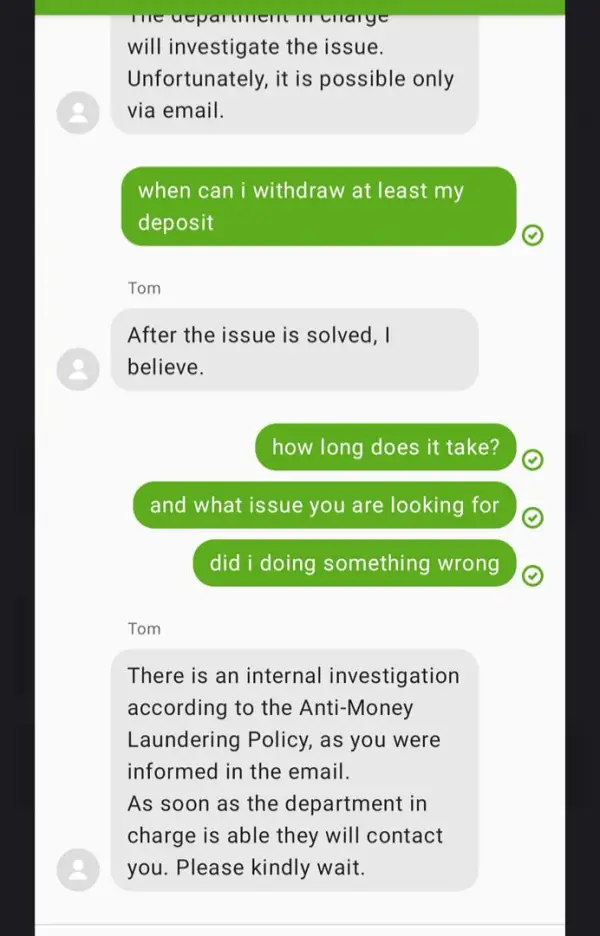

Teejay-MK

Germany

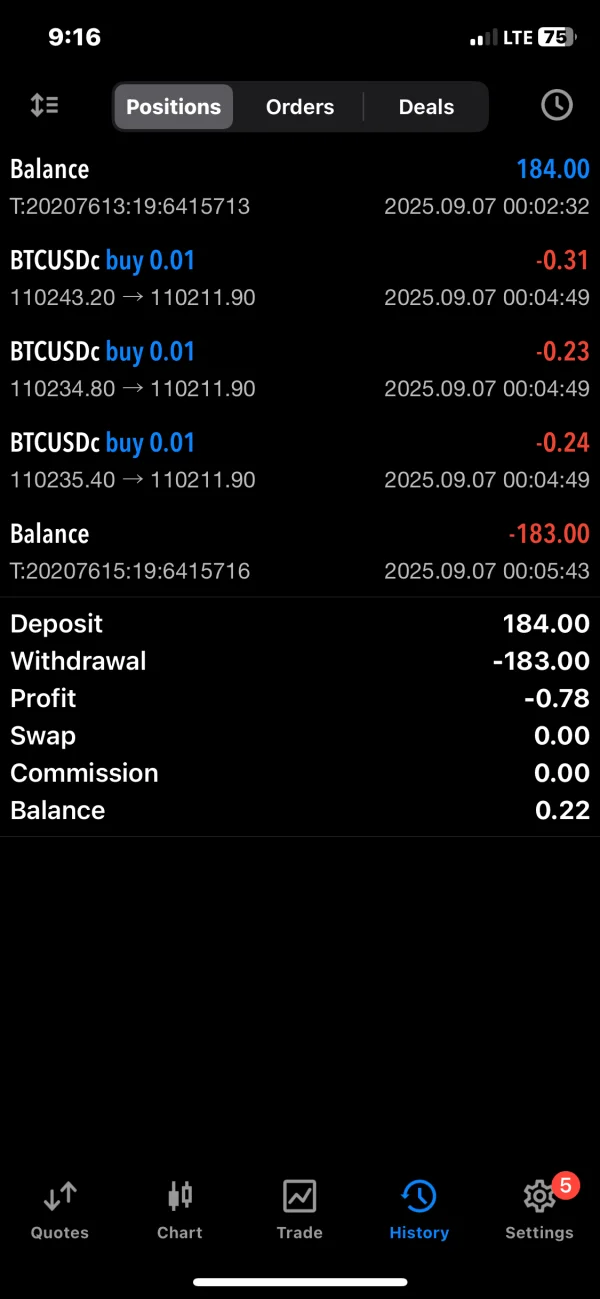

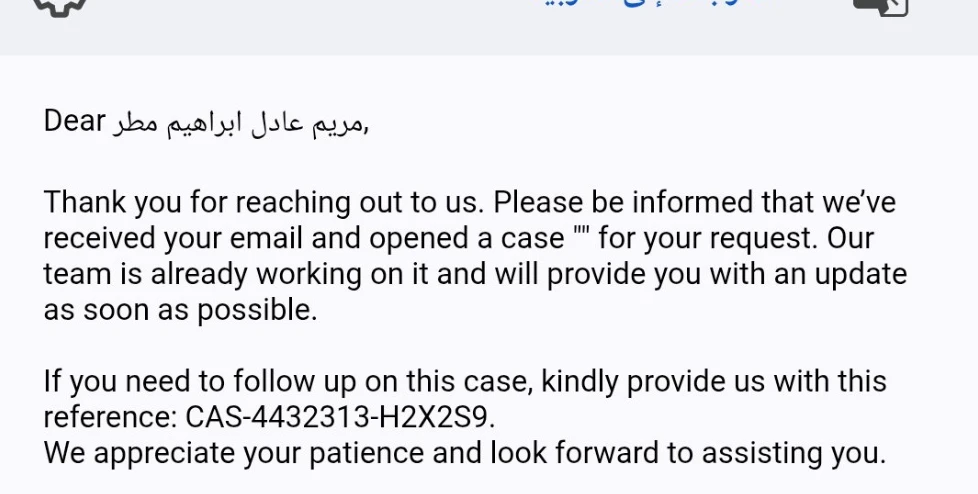

I traded here for sometime but then decided to withdraw my funds. I requested my withdraw on 27th March. They promised that it will arrive with 5 working days. I waited and it didn’t arrive in 5 working days. Then i tried to contact the customer service team, which is just a telegram message. There is no other channel to get help, a phone number is on the website but nobody picks it ever. You can’t call the telegram either since they have disabled calling. Anyway I kept asking through text and sometimes the telegram message didn’t get any response. After two more weeks when my money didn’t arrive I got much worried and tried to contact the legal firm where it has been registered. However I found out that this broker is not registered anywhere.

Exposure

Leesham90

Germany

I have tried to make a withdrawal on my account but it is always rejected, customer service always says it will be processed by accounting but my withdrawal is always rejected. I have tried to withdraw dozens of times but the result is the same never processed.

Exposure

D-tor33

Germany

I made withdrawal request around 25 days ago. They mailed me to settled my fund within 5 to 7 working days but still they don’t reply my mail and back my fund, and their website mentioned instant withdrawal. Totally scam broker. I have prove copy of email. Please everyone don’t wast your hard earned money to put in this broker. If possible all are requesting to set complain against them. Very bad this broker and their trading system.

Exposure

FX2160455570

Vietnam

scam, can not make withdrawal

Exposure

Sara.

New Zealand

Their platforms are user-friendly, and I appreciate the transparency with no hidden fees. The customer support is responsive, and the security measures, like negative balance protection, give me peace of mind while trading. Overall, a trustworthy platform for my trading needs.

Positive