Company Summary

| Aspect | Information |

| Company Name | FINFLOW X |

| Registered Country/Area | Switzerland |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Forex, Cryptocurrencies, Stocks, Indices, Commodities |

| Account Types | Basic, SILVER, GOLD, PLATINUM, VIP |

| Minimum Deposit | Basic: $1,500 SILVER: $25,000 GOLD: $50,000 PLATINUM: $150,000 VIP: Manager Ask |

| Maximum Leverage | Basic, SILVER, GOLD: 1:25 PLATINUM: 1:25, 1:100, 1:200 VIP: Manager Ask |

| Trading Platforms | Finflow-x website, terminal and app |

| Customer Support | Phone at +44 1903497009 and email at support@finflow-x.io |

| Deposit & Withdrawal | Bank transfers, Credit/Debit cards, E-wallets |

Overview of FINFLOW X

Established in Switzerland in 2023, FINFLOW X introduces a comprehensive trading platform featuring an array of assets such as forex, cryptocurrencies, stocks, indices, and commodities. The platform prioritizes user accessibility through its intuitive interface, serving traders with various levels of experience.

While fostering a global presence, a notable aspect is the absence of regulatory oversight, prompting considerations regarding investor protection within the unregulated operational framework. This aspect introduces a crucial element of caution for users, emphasizing the need for a thorough evaluation of the platform's strengths and potential drawbacks before engaging in trading activities.

Is FINFLOW X legit or a scam?

FINFLOW X operates without regulatory oversight. The absence of supervision poses potential risks such as fraud and mismanagement, with users lacking essential protection. Market integrity is compromised, as FINFLOW X operates unchecked, potentially leading to unfair practices.

The unregulated status undermines transparency, making it challenging to ensure compliance with ethical standards, creating an environment prone to exploitation.

Pros and Cons

| Pros | Cons |

| User-friendly trading platform interface | Unregulated |

| Various trading instruments | Customer support challenges |

| Educational resources | Lack of responsiveness to emails |

| Accessible payment methods | High minimum deposit requirements ($1500) |

| Various payment options include traditional bank transfers, credit/debit cards, and popular e-wallets. |

Pros:

User-friendly Trading Platform Interface:

The platform features a user-friendly interface, facilitating easy navigation and a friendly trading experience for users of different experience levels.

2. Various Trading Instruments:

Finflow-x offers a variety of trading instruments, providing users with the flexibility to diversify their portfolios across different asset classes, including forex, cryptocurrencies, stocks, indices, and commodities.

3. Educational Resources:

The platform provides educational resources to enhance users' knowledge of financial markets and trading strategies.

4. Accessible Payment Methods:

Users have access to a range of payment methods for both deposits and withdrawals, including traditional bank transfers, credit/debit cards, and popular e-wallets.

Cons:

Unregulated:

Finflow-x operates without regulatory oversight, exposing users to potential risks and lacking the investor protection typically provided by regulatory authorities.

2. Customer Support Challenges:

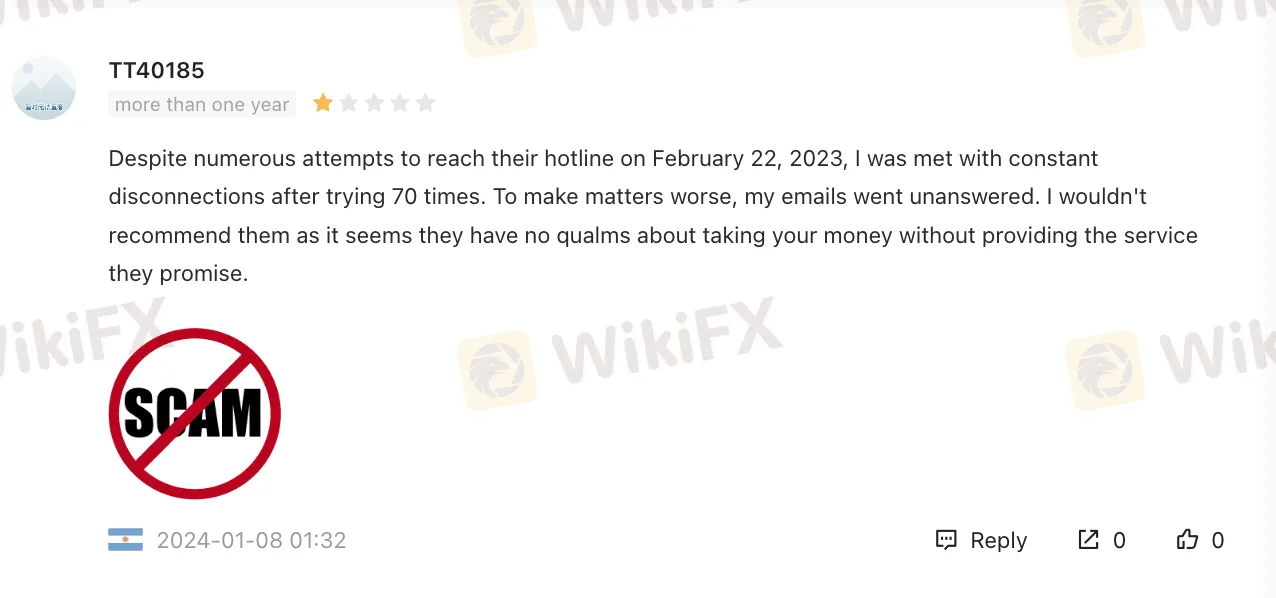

Some users have reported challenges in reaching customer support, including disconnection issues with the hotline, potentially leading to difficulties in addressing urgent issues.

3. Lack of Responsiveness to Emails:

The platform has faced criticism for a lack of responsiveness to emails, with users expressing dissatisfaction over unanswered inquiries, impacting timely issue resolution.

4. High Minimum Deposit Requirements ($1,500):

The Basic account type requires a minimum deposit of $1,500, which is considered relatively high for traders seeking entry-level or more cost-effective options.

5. Variability in Account Manager Access:

The availability and accessibility of account managers, particularly for the VIP account, vary and require inquiry with the platform, potentially leading to uncertainty for users.

Market Instruments

At FINFLOW X, traders have access to a wide range of six asset classes.

1. Forex:

FINFLOW X provides a well-established and liquid forex market, allowing traders to engage in thousands of currency pairs. From major currencies to emerging ones, the platform facilitates secure trading with the latest digital tools.

2. Cryptocurrencies:

Explore the dynamic world of cryptocurrencies on FINFLOW X. From blue-chip to emerging coins, the platform accommodates a variety of digital assets for trading, providing a secure environment for investors.

3. Stocks:

Investors can trade a range of stocks on FINFLOW X, from well-established blue-chip companies to emerging opportunities. The platform offers a secure space for stock trading, ensuring ease and accessibility.

4. Indices:

Trade with confidence in indices on FINFLOW X, which includes both established indices and emerging ones. The platform accommodates the various needs of traders looking to invest in a variety of market indices.

5. Commodities:

Whether you're interested in traditional assets like gold or other commodities, FINFLOW X allows you to efficiently trade commodities on a secure platform.

6. NFTs (Non-Fungible Tokens):

Stay at the forefront of digital collectibles by trading NFTs on FINFLOW X. The platform enables users to buy and sell the latest NFTs, providing access to unique digital assets.

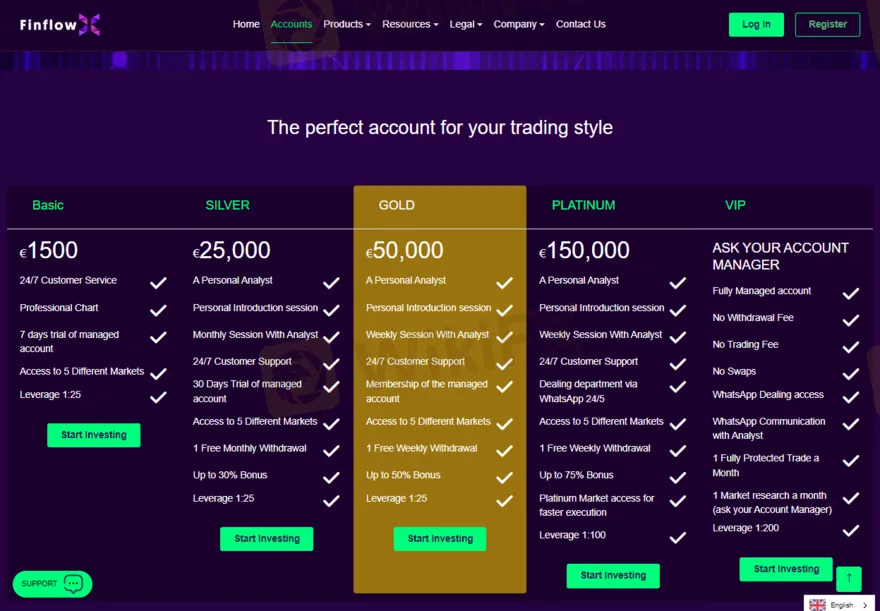

Account Types

Basic Account:

The Basic account at this trading platform requires a minimum deposit of $1,500. This entry-level account offers 24/7 customer service and provides traders with access to 5 different markets. It includes a leverage of 1:25, a monthly free withdrawal, and a bonus of up to 30%. Traders opting for the Basic account have access to professional charts and utilize communication via WhatsApp.

SILVER Account:

The SILVER account, requiring a minimum deposit of $25,000, is suitable for traders seeking a more personalized experience. It includes a personal analyst, professional charting tools, and 24/7 customer service. Like the Basic account, SILVER provides access to 5 different markets with a 1:25 leverage. Traders benefit from weekly free withdrawals and can communicate with the platform through WhatsApp.

GOLD Account:

With a minimum deposit of $50,000, the GOLD account is suitable for traders looking for enhanced features. It offers a personal analyst, professional charting, and 24/7 customer service. Traders enjoy 5 market accesses, a 1:25 leverage, and weekly free withdrawals. The GOLD account comes with a higher bonus of up to 50% and utilizes WhatsApp for communication.

PLATINUM Account:

The PLATINUM account, requiring a substantial $150,000 deposit, targets experienced traders. It includes a personal analyst, professional charting, and 24/7 customer service. With access to 5 markets and a unique 1:25, 1:100, 1:200 leverage, this account provides a fully protected trade each month. Monthly research is offered, and communication is facilitated through WhatsApp.

VIP Account:

The VIP account, with a minimum deposit specified by contacting the manager, is suitable for traders seeking a fully managed experience. It includes a personal analyst, professional charting, and 24/7 customer service. Traders have access to 5 markets and enjoy a customized, manager-assisted approach to their trading activities. The VIP account offers unique features, and specific details are available upon inquiry with the account manager.

| Account Type | Basic | SILVER | GOLD | PLATINUM | VIP |

| Minimum Deposit | $1,500 | $25,000 | $50,000 | $150,000 | MANAGER ASK |

| Customer Service | 24/7 | A Personal Analyst | A Personal Analyst | A Personal Analyst | Fully Managed account |

| Professional Chart | √ | Personal Introduction session | Personal Introduction session | Personal Introduction session | No Withdrawal Fee |

| Access to Markets | 5 | 5 | 5 | 5 | 5 |

| Leverage | 1:25 | 1:25 | 1:25 | 1:25, 1:100, 1:200 | MANAGER ASK |

| Free Withdrawals | 1 Monthly | 1 Weekly | 1 Weekly | 1 Fully Protected Trade a Month | MANAGER ASK |

| Bonus | Up to 30% | Up to 50% | Up to 75% | MANAGER ASK | MANAGER ASK |

| Market Access | Basic 5 | Basic 5 | Basic 5 | Platinum | Platinum |

| Monthly Research | No | No | No | 1/month | Ask Account Manager |

| Swaps | No | No | No | No | No |

| Communication | |||||

| Support | Start Investing with Analyst | Start Investing | Start Investing | Start Investing | MANAGER ASK |

How to Open an Account?

Visit Finflow-x Website:

Navigate to the official Finflow-x website using a web browser.

2. Click on “Register”:

Locate and click on the “Register” button prominently displayed on the website.

3. Complete Personal Information:

Fill in the required personal details accurately, including your full name, email address, phone number, and residential address.

4. Choose Account Type:

Select the preferred account type based on your trading preferences and financial goals. Options typically include Basic, SILVER, GOLD, PLATINUM, and VIP.

5. Submit Identification Documents:

Upload the necessary identification documents for KYC (Know Your Customer) verification. This often includes a government-issued ID (passport or driver's license) and proof of address (utility bill or bank statement).

6. Deposit Funds and Start Trading:

After successful verification, deposit the required funds into your newly created Finflow-x account. The minimum deposit varies based on the chosen account type.

Once the funds are deposited, you can start trading on the Finflow-x platform using the provided trading tools and resources.

Leverage

The maximum leverage for each account type in FINFLOW X is as follows:

Basic Account:

Leverage: 1:25

2. SILVER Account:

Leverage: 1:25

3. GOLD Account:

Leverage: 1:25

4. PLATINUM Account:

Leverage: 1:25, 1:100, 1:200

5. VIP Account:

Leverage: MANAGER ASK

The leverage represents the ratio of the trader's own funds to borrowed funds, indicating the potential size of a trading position relative to the trader's capital. While the lower leverage in the Basic, SILVER, and GOLD accounts is fixed at 1:25, the PLATINUM account offers flexibility with leverage options of 1:25, 1:100, and 1:200. The VIP account's leverage is subject to negotiation with the account manager, emphasizing a more personalized approach.

Trading Platform

Finflow-x's Trading Platform is user-friendly and accessible designed, suitable for both novice and experienced traders.

The platform boasts an intuitive interface that simplifies navigation, ensuring a straightforward experience even for those less acquainted with trading software. This emphasis on ease of use removes potential barriers for traders who will find complex platforms challenging.

Available through the Finflow-x website, terminal, or app, the platform offers friendly trading experiences across various devices. This accessibility contributes to a user-friendly trading environment, allowing traders to execute trades confidently and efficiently.

The platform's design fosters an environment conducive to learning and strategic decision-making in the dynamic world of trading.

Deposit & Withdrawal

Finflow-x provides users with various payment methods for both deposits and withdrawals. Accepted options include traditional bank transfers, credit/debit cards, and popular e-wallets. However, Finflow-x does not support PayPal as a payment option. Users can fund their accounts and withdraw funds using the available payment methods, ensuring flexibility in managing their trading capital.

The minimum deposit requirement varies based on the chosen account type:

Basic Account: $1,500

SILVER Account: $25,000

GOLD Account: $50,000

PLATINUM Account: $150,000

VIP Account: MANAGER ASK

Traders should carefully consider their account type and associated minimum deposit based on their financial goals and trading preferences. While Finflow-x offers a range of payment methods, the absence of PayPal might be a consideration for users who prefer this particular payment option.

Customer Support

Finflow-x's customer support, reachable at +44 1903497009 and support@finflow-x.io, provides assistance through both phone and email channels.

However, the quality of support has been a point of question for some users. Reports indicate challenges in reaching the support hotline, with users facing disconnections and unanswered calls, leading to frustration. Additionally, communication via email appears to lack responsiveness.

These issues highlight potential limitations in the customer support system, impacting users' ability to promptly address issues and receive assistance.

Educational Resources

Finflow-x offers an educational center curated by financial experts, providing users with valuable resources to enhance their understanding of financial markets and trading strategies.

The educational center serves traders of varying experience levels, offering a comprehensive range of materials to empower both novice and seasoned investors. The platform's commitment to education is demonstrated through content created by financial experts, ensuring accuracy and relevance.

Exposure

The user exposure of Finflow-x, as exemplified by the experience shared, raises significant dissatisfaction regarding customer support and communication. The user highlights a frustrating scenario where multiple attempts to reach Finflow-x's hotline resulted in constant disconnections, reaching an astounding 70 unsuccessful tries. Additionally, the user expressed dissatisfaction with unanswered emails, indicating a lack of responsiveness from the platform.

Such an experience, lasting over a year, suggests a persistent issue with the platform's customer service, potentially impacting the user's ability to seek assistance and resolve issues.

Conclusion

In conclusion, FINFLOW X offers a trading platform with a wide range of assets, providing traders access to forex, cryptocurrencies, stocks, indices, and commodities. The platform emphasizes a user-friendly interface, enhancing accessibility for traders of varying experience levels.

However, the absence of regulatory oversight poses a significant disadvantage, introducing questions about investor protection within an unregulated environment. This regulatory gap impacts the confidence of potential users, requiring careful consideration before engaging in trading activities.

FAQs

Q: What assets can I trade on FINFLOW X?

A: FINFLOW X offers a wide range of trading instruments, including forex, cryptocurrencies, stocks, indices, and commodities.

Q: Is FINFLOW X regulated?

A: No, FINFLOW X operates in an unregulated environment, which will impact investor protection.

Q: What is the minimum deposit required for a Basic account?

A: The minimum deposit for a Basic account on FINFLOW X is $1,500.

Q: Are there educational resources available on the platform?

A: Yes, FINFLOW X provides educational resources to enhance users' knowledge of financial markets and trading strategies.

Q: What payment methods are accepted for deposits and withdrawals?

A: FINFLOW X accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets, but does not support PayPal.