Company Summary

| IQCent Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Marshall Islands |

| Regulation | Not regulated |

| Market Instruments | Forex, Commodities, Crypto, Indices, CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | Not disclosed (no specific EUR/USD spread found) |

| Trading Platform | IQCent Web Platform, IQCent Mobile Platform |

| Min Deposit | $250 |

| Customer Support | Live chat, phone, and email (24/7 availability) |

IQCent Information

Founded in 2017, IQCent is registered in the Marshall Islands. It provides simplified web and mobile interfaces, enables crypto and fiat funding methods, and caters to traders of different skill levels via tiered accounts. Its absence of regulation and expanded openness, meanwhile, is a drawback.

Pros and Cons

| Pros | Cons |

| Wide range of account types and features | Not regulated |

| Leverage up to 1:500 | No MetaTrader platform support |

| Instant deposits and fast withdrawals (within 1 hour) | Lack of clarity on spreads and swap fees |

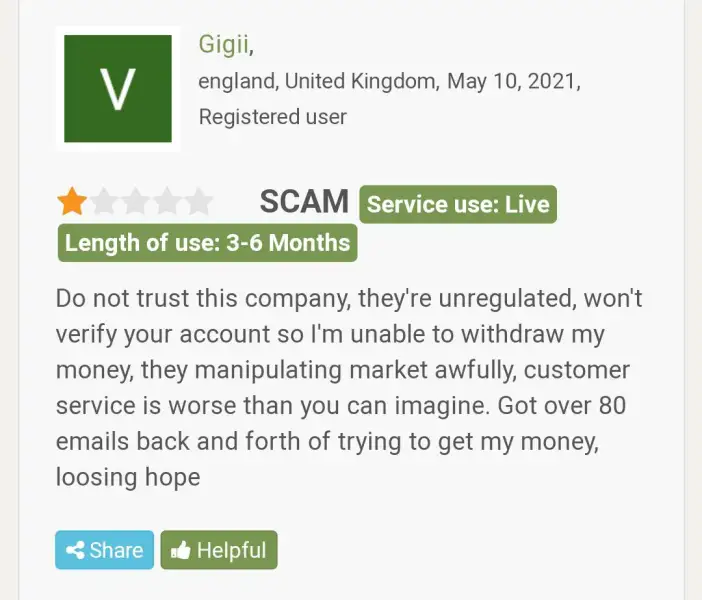

Is IQCent Legit?

IQCent is an unregulated broker. Though it says to be registered in the Marshall Islands, it is not licensed or monitored by the Marshall Islands Financial Services Authority (FSA) or any other acknowledged financial authority.

WHOIS records show the domain iqcent.com was registered on January 30, 2017 and now expires January 30, 2026. Last updated the domain was April 24, 2024. Its present condition is “client transfer prohibited,” which means it is shielded from unapproved modifications including domain transfers.

What Can I Trade on IQCent?

Covering a range of markets including currency pairs, cryptocurrencies, commodities, and indices, IQCent says to provide access to more than 100 trading assets.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ❌ |

| ETF | ❌ |

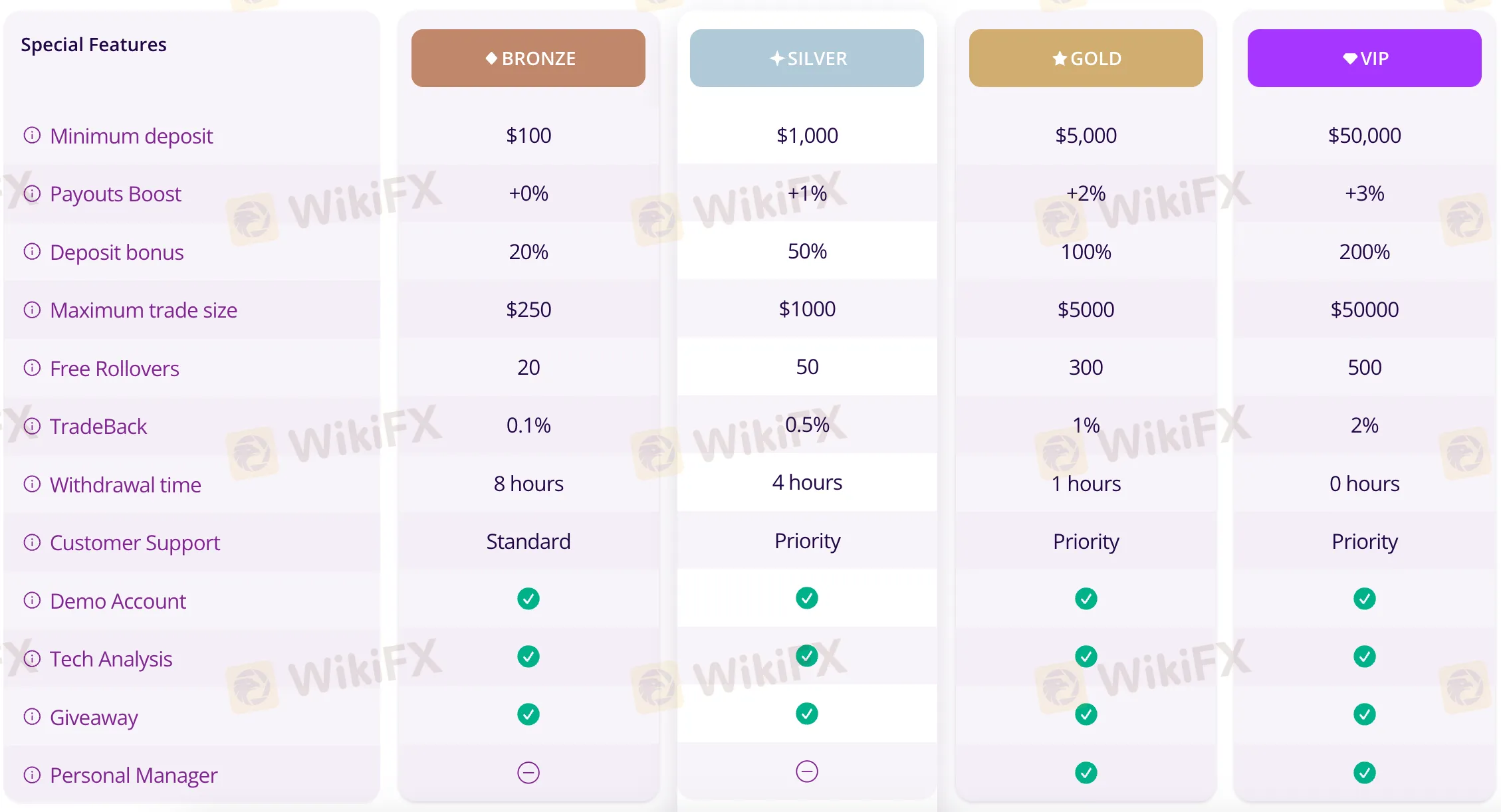

Account Types

IQCent offers four types of live trading accounts: Bronze, Silver, Gold, and VIP, each tailored to different levels of trading experience and deposit sizes. While an Islamic (swap-free) account option is not mentioned, a demo account is clearly available starting from the Bronze level.

| Account Type | Min Deposit | Key Features | Best For |

| Bronze | $100 | 20% bonus, 0.1% TradeBack, 8h withdrawals | Beginners |

| Silver | $1,000 | 50% bonus, 0.5% TradeBack, 4h withdrawals, personal manager | Intermediate traders |

| Gold | $5,000 | 100% bonus, 1% TradeBack, 1h withdrawals, higher limits | Advanced traders |

| VIP | $50,000 | 200% bonus, 2% TradeBack, instant withdrawals, personal support | High-net-worth or professional traders |

Leverage

IQCent offers leverage of up to 1:500, allowing traders to control positions that are 500 times larger than their actual investment.

IQCent Fees

QCent provides zero registration and maintenance fees, which lowers the barrier for entry. However, lack of transparency around actual spreads and overnight swap fees (for holding positions past market close) could be a limitation for cost-sensitive traders.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| IQCent Web Platform | ✔ | Web browser (desktop/mobile) | Beginners and intermediate traders seeking a simple interface |

| IQCent Mobile Platform | ✔ | iOS, Android (web-based, possibly app) | Traders preferring to trade on-the-go |

| MetaTrader 4 (MT4) | ❌ | – | Not supported |

| MetaTrader 5 (MT5) | ❌ | – | Not supported |

Deposit and Withdrawal

IQCent does not charge any deposit or withdrawal fees.

The minimum deposit amount is $250, and the minimum withdrawal amount is $20.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Credit Card (VISA/MasterCard) | $250 | Free | Instant upon confirmation |

| Bank Wire Transfer | $250 | Free | Instant upon confirmation |

| Bitcoin / Ethereum / Litecoin | $250 | Free | Instant upon confirmation |

| Credit Card (VISA/MasterCard) | $250 | Free | Instant upon confirmation |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| All Supported Methods (same as above) | $20 | Free | Within 1 hour (after ID verification) |

Shafee Khorasanee

Pakistan

I was brought to IQcent by one of IQcent man who deals in signals and attracting people across the web. _trader and started earning, when the profit reached 28,000$ then I requested a withdrawal but it was rejected and was alleged that my account is involved in some suspicious activity. I asked them to clarify or share any evidence but was left unattended till date. Stay away from this fraudulent platform.

Exposure

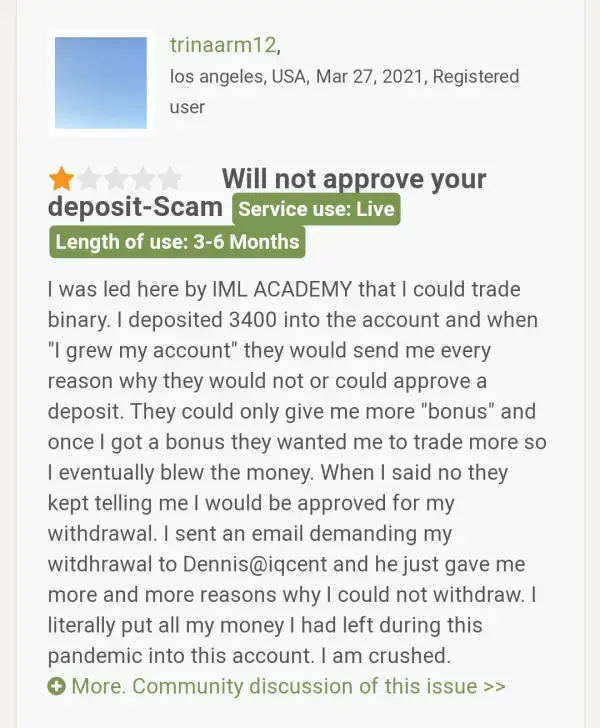

FX3326872628

Chile

Scam!!!!. I wanted to work with them and to test it out, I deposited $100. In demo mode, you win every minute and it's very fast to go from $100 to $500. They pay you 95%, but when you switch to the real account, it's not the same. Only a couple of currency pairs pay you 90% and it's not as easy to win anymore. Could it be that they manipulate the charts in demo mode? Then, when you want to withdraw the funds, they ask for 1000 requirements. And when you fulfill all of them, they say they did it, but they don't provide any valid document, certificate, or code. They made me open a bitcoin wallet and they told me they deposited the money there, but it didn't arrive. Then they tell me they sent it to the bank (and I didn't give them any bank account), and they sent me a code that doesn't exist when I verify it at the bank. Then they tell me they returned it to the credit card, but they couldn't tell me which credit card, at least the last 4 digits. The support only says that I have to wait, and it's been 3 months already! And now they're closing the account.

Exposure

Mayaz Ahmad

Bangladesh

IQCent had scammed many clients by not allowing them withdrawals and their customer service is very poor and unresponsive.

Exposure

ToddSims

United States

After trying a few platforms I settled on this one because of its simplicity and low starting amount. I trade occasionally and use crypto to deposit and withdraw. So far everything has been processed within a few hours and I have had no problems accessing my funds.

Positive

RobertBaker

United States

As someone who trades part-time, I need something that fits into my schedule. This does. I can log in, make a few trades, and log out with no fuss. Tried copy trading one night just for fun, and it worked out way better than expected. And yes—withdrawals are quick, which always boosts confidence.

Positive

DavidGomez2832

United States

I’ve only been at it for a few months, but already feel way more confident. Copy trading has taught me tricks I’d never figure out alone, and the tournaments make everything more fun. Plus, getting withdrawals processed quickly is a big bonus. I’ve had my ups and downs, but overall, this has been a super rewarding experience.

Positive

KennethMcGee

United States

I was drawn to this platform because of its high leverage, which goes up to 1:500. That’s not something you see on every broker, especially one this simple to use. Withdrawals also impressed me—they happen much faster than I expected. If there’s one area that could be improved, it’s the range of technical analysis tools. I prefer more advanced indicators, but for standard trading, the available features are enough.

Positive

RoyFerguson

United States

I joined this platform on a whim, and it’s been one of the best decisions I’ve made. Trading has turned into a hobby that I genuinely enjoy, and the platform’s features make it easy to stay engaged. The tournaments add an exciting layer to the experience, and I’ve even managed to win a small prize. Copy trading has been the main advantage of this platform for me. I’ve been trying out strategies from professional traders, which helps me understand the market faster. This feature is ideal for beginners. I also noticed that account deposits are processed without delays. However, I found that the selection of stocks here is too small. If you want to work with stocks, it might be better to look for alternatives. But for forex and cryptocurrency, the platform works well.

Positive

AntonioKing

Croatia

I enjoy using this platform for its copy trading feature and high leverage options. The guaranteed quick withdrawal processing is a major plus. The regular updates on market analysis are very informative. But there are things I would like the creators of the platform to change. To start with the limited stock selection is a downside. Also, the lack of MetaTrader 4 and the quick imposition of inactivity fees are drawbacks. Despite these cons, the ability to use cryptocurrency for transactions and the fast deposit and withdrawal times are great features.

Positive

JamesWilliams

United States

They provide an impressive selection of over 200 financial instruments to trade, including cryptocurrencies and stock indices, which allows for great portfolio diversification. Their copy trading service has truly transformed my learning process. While I did notice they only offer four stocks, which might limit some traders, it hasn't affected me significantly. Overall, IQCent's diverse offerings and copy trading capabilities make it a fantastic option for many traders.

Positive

AlbertPena

United States

IQCent's leverage options have really boosted my trading potential. Last week, I used the 1:500 leverage on a forex trade and saw some impressive returns. Of course, I'm always cautious with leverage, but it's great to have that option when I spot a promising opportunity. I'm also a fan of their economic calendar. Just yesterday, it helped me anticipate a market shift due to a major economic announcement. The only downside I've experienced is the short period before they charge an inactivity fee. I had to take a two-week break for personal reasons, and nearly got charged. It's something to watch out for.

Positive

MikeMiller

United States

As someone who values privacy, I appreciate IQCent's support for cryptocurrency deposits and withdrawals. The process is seamless and adds an extra layer of security to my transactions. The copy trading feature has been a revelation, allowing me to learn from successful traders and adapt their strategies to my own style. However, I've noticed that during high volatility periods, the platform can lag slightly, which can be frustrating when trying to execute time-sensitive trades. Despite this, the overall reliability and user-friendly interface keep me coming back.

Neutral

FX8667922082

Switzerland

I was attracted to IQCent's ultra-high leverage of up to 1:500, which allows substantial gains with less capital. Last month, using 1:500 leverage, my $2,000 trade controlled over $1 million in gold, capturing an 800 pip gain. While risky, proper risk management balances potential rewards. My only gripe is the lack of MetaTrader 4, yet IQCent's unparalleled leverage compensates.

Positive

RyanDavis

United States

As an active trader, having 24/7 customer support at IQCent gives me peace of mind during non-market hours. Trading at odd times means I rely on their round-the-clock assistance. Recently, on a Sunday night, I faced an order issue and received prompt help from Samuel via live chat, resolving the issue in just two minutes.

Positive

RobertGonzales

United States

I've focused on forex trading, and this broker provides everything I need: high leverage, low minimum stake, and a reliable platform. The guaranteed fast withdrawals are crucial, avoiding the shady practices of other brokers. Occasionally, there are system glitches, but overall, it's a solid broker for forex traders.

Positive

MatthewMoore

South Africa

I've been trading with this broker for years, and their prompt payout of winnings sets them apart. The copy trading features are also very convenient when I don’t have time to plan trades. The limited stock selection is a drawback, but for forex and crypto, they are fast and reliable.

Positive

AlbertFerguson

United States

I've been trading with this broker for a few months and love their copy trading feature. It’s great to mirror the strategies of professional traders and potentially profit without doing all the analysis myself. The guaranteed one-hour withdrawal processing is a major plus, eliminating long wait times. Initially, I missed MetaTrader 4, but their web trader works well enough once you get used to it.

Positive

Robert Anderson

United States

Their integration with cryptocurrency for deposits and withdrawals is seamless. The fast execution and minimal platform downtime are reliable. The mobile app could use some improvement, but overall, they offer a robust trading experience with elite web-based platforms.

Positive

Gabriel Hodges

United States

As a newbie trader, I appreciate how this broker lets you get started with just a $0.01 minimum stake. It's a great way to get your feet wet without risking too much capital upfront. The technical analysis they publish has also been really helpful for learning market patterns and trends. My only real gripe is the inactivity fee - it feels like they're nickel-and-diming you if you take a break from trading for a while. But overall, the low minimum stake and educational resources make this a solid choice for beginners like me.

Positive

David Collins

United States

Let me just say upfront - this broker's guaranteed 1-hour withdrawal processing has got to be the fastest in the game. I've never had to wait longer than 60 minutes to get paid out after requesting a crypto withdrawal. And in this industry where shady practices run rampant, that's just a total breath of fresh air. You'd be shocked how many brokers I've used in the past that constantly ****** me around when it came time to withdraw funds. But these guys are 100% legit. Their trading contests are also a fun way to try and win back some extra cash on top of my regular profits. Only real negative for me is the limited number of stocks/equities they offer, since that's one asset class I like to trade.

Positive

Tom940

United States

I have greatly benefited from using a copy-trading tool from IQCent and it has completely changed my performance. Now, after becoming a member, I can copy the successful strategies of these traders. It doesn't even matter that I've reflected $4,000 over 6 months of doing nothing. Copy trading itself is an easy way for me, the newbie trader, to gain from advanced-level trading techniques and skills. The only problem that I cannot agree with is the practice of charging inactivity fees within the first two months if the trade account remains dormant. However, it has also been quite rewarding for the industry.

Positive

Marshall Wood

United States

When IQCent advertises their "guaranteed 1-hour withdrawal" processing times, they aren't exaggerating whatsoever. I've personally tested and experienced this game-changing benefit after several profitable trades already. Just recently, after closing a winning AUD/CAD binary options position for $500 profit, those funds appeared back in my bank account in less than 45 minutes following my withdrawal request. Outrageous! Most brokers make you wait days or even weeks to access trading profits, but with IQCent, a lightning-fast turnaround is a consistent reality. Having such rapid access to my capital provides crucial flexibility in my trading routines.

Positive

Cody Elliott

United States

I recently participated in one of IQCent's week-long trading contests, even though my chances of finishing in the money prize positions were slim. However, I still enjoyed competing on the public leaderboard and pushing myself to execute as many solid trades as possible daily. Ultimately, I did not win the top prize, but seeing my name on the scoreboard for that week and following my progress against other traders motivates me. Although I didn't win any cash this time, the fun competition aspect brought out my A-game and forced me to level up my trading skills to stand out. I'll be participating in more of IQCent's exciting trading contests in the future for the challenge it brings out in me as a trader.

Positive