公司簡介

| 西部期貨 評論摘要 | |

| 成立年份 | 2008 |

| 註冊國家/地區 | 中國 |

| 監管 | CFFEX |

| 市場工具 | 期貨 |

| 模擬帳戶 | / |

| 交易平台 | 西部期貨 交易平台 |

| 最低存款 | / |

| 客戶支援 | 電話:400-688-6896,029-87406629 |

| 公司地址:陝西省西安市新城區東新街319號8幢10層10000室 | |

西部期貨 資訊

西部期貨有限公司成立於2008年,註冊地為中國,是西部證券股份有限公司的全資子公司,註冊資本為8億人民幣。該公司是中國金融期貨交易所和上海國際能源交易中心等幾個主要交易所的成員。該公司在全國各地設有分支機構和銷售辦事處,並投資於上海西部永唐投資管理有限公司進行風險管理業務。

該公司還與西部證券在全國范圍內進行創新和IB業務合作。它致力於提升核心競爭力,擴大在經濟發達地區的業務,并發展一個整合的研發和服務系統,以配合國內金融市場,旨在最大化客戶價值。

優缺點

| 優點 | 缺點 |

| 受CFFEX監管 | 市場產品有限 |

| 歷史悠久 | 缺乏透明度 |

西部期貨 是否合法?

是的。西部期貨 受中國金融期貨交易所監管,目前持有期貨牌照(編號0160)。

| 監管國家 | 監管機構 | 監管狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 中國金融期貨交易所(CFFEX) | 受監管 | 西部期貨 期貨有限公司 | 期貨牌照 | 0160 |

我可以在 西部期貨 交易什麼?

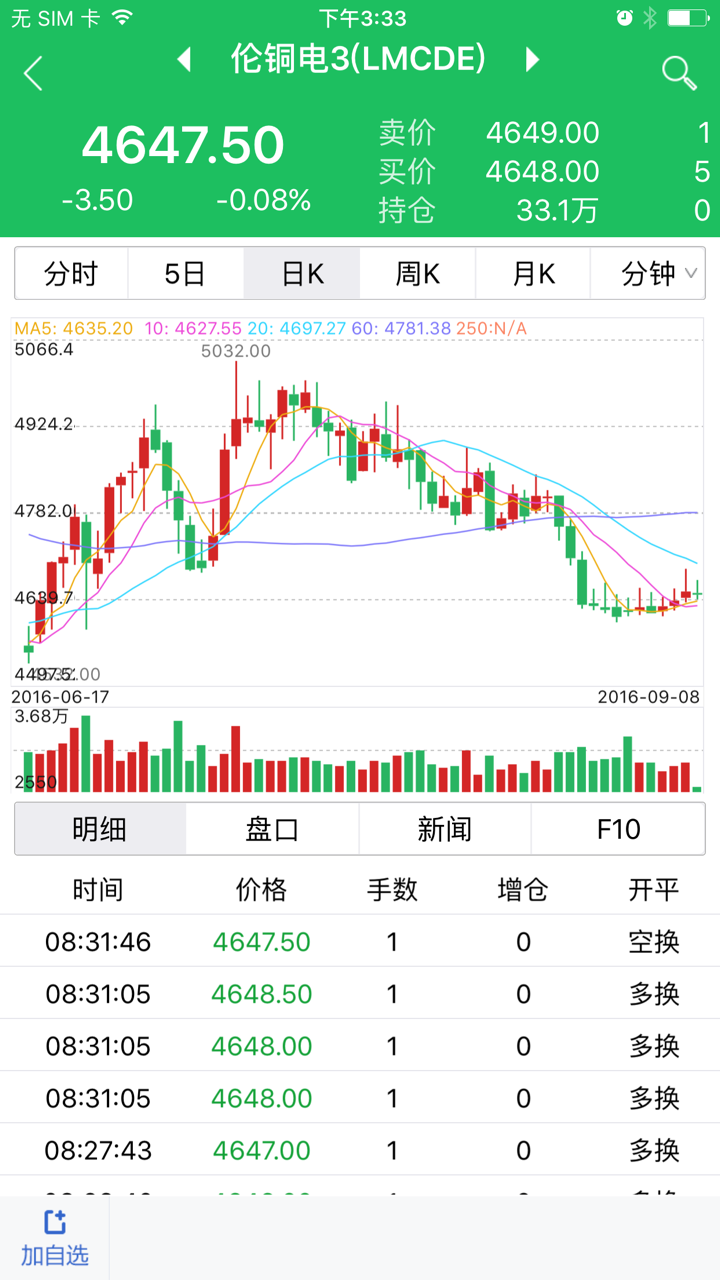

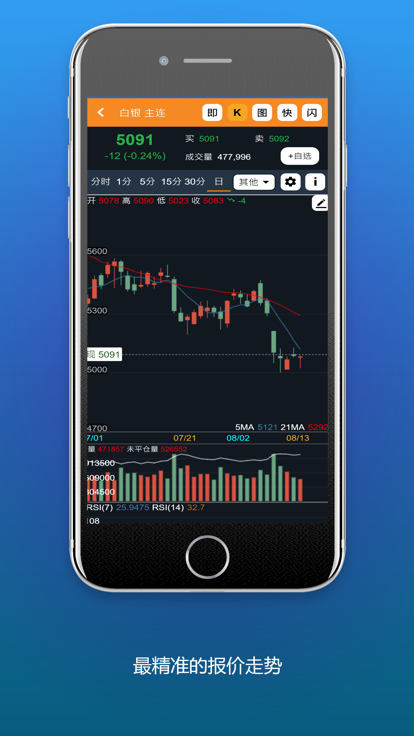

西部期貨 提供期貨交易作為其主要業務。海外交易者的特定期貨產品包括原油、TSR 20、LSFO(低硫燃料油)、保稅銅、鐵礦石、棕櫚油、PTA(聚對苯二甲酸乙二酯)和糖。

| 交易資產 | 可用 |

| 期貨 | ✔ |

| 債券 | ❌ |

| 期權 | ❌ |

| 基金 | ❌ |

| ETFs | ❌ |

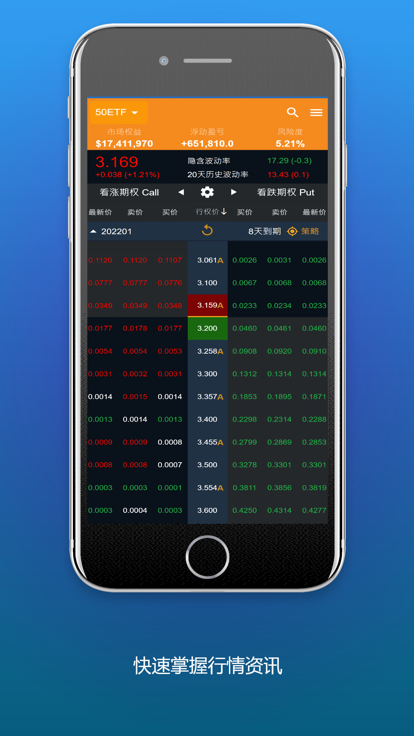

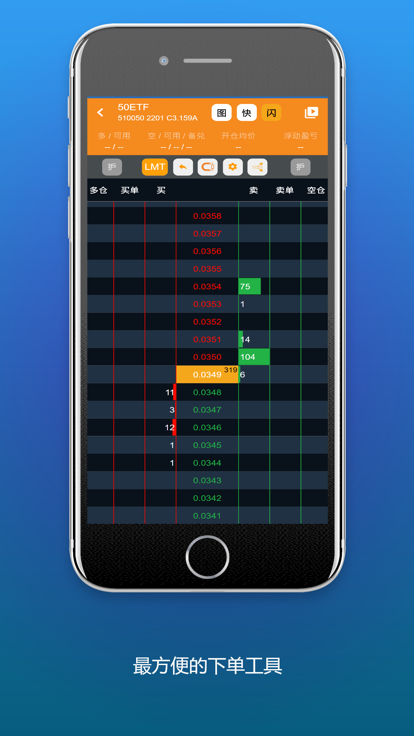

交易平台

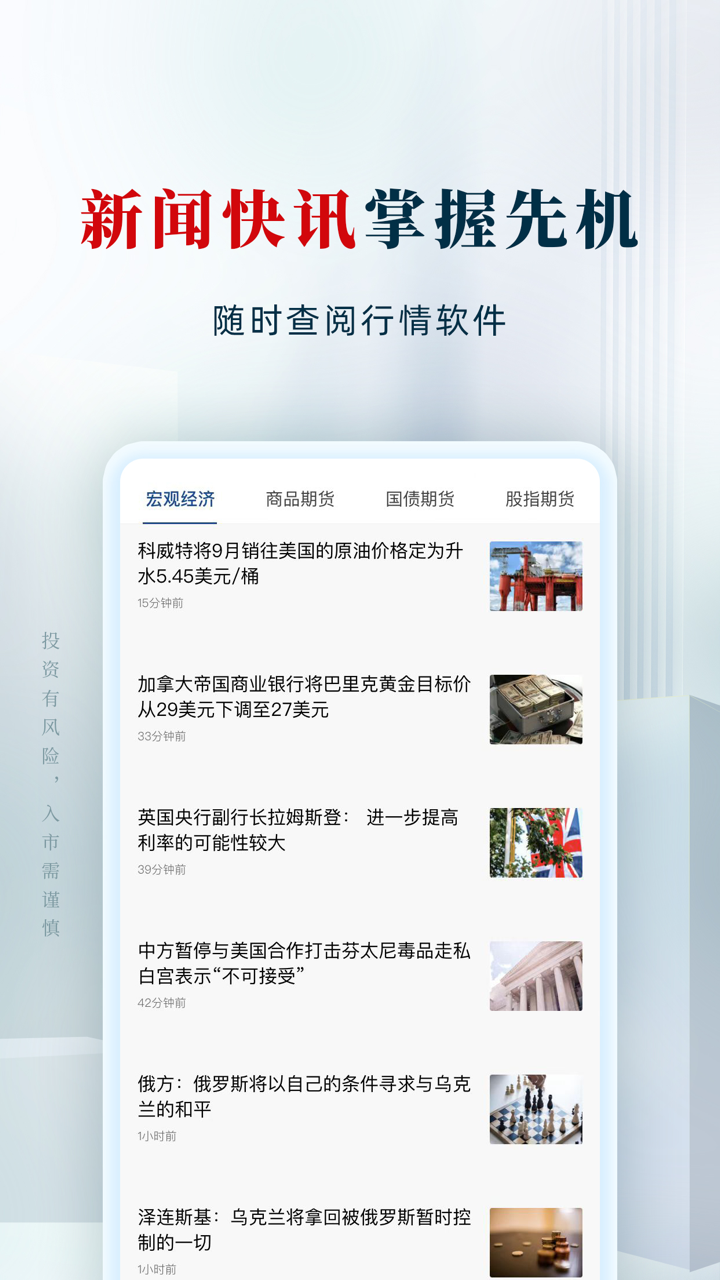

西部期貨 宣傳其交易平台具有行業領先的性能,與全球市場同步,滿足各種專業客戶的全市場和全天候交易需求。