公司简介

| 西部期货 评论摘要 | |

| 成立时间 | 2008 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX |

| 市场工具 | 期货 |

| 模拟账户 | / |

| 交易平台 | 西部期货 交易平台 |

| 最低存款 | / |

| 客服支持 | 电话:400-688-6896,029-87406629 |

| 公司地址:陕西省西安市新城区东新街319号8号楼10000室9楼和10楼 | |

西部期货 信息

成立于2008年,注册于中国的西部期货有限公司是西部证券股份有限公司的全资子公司,注册资本8亿元人民币。它是中国金融期货交易所和上海国际能源交易所等几个主要交易所的成员。该公司在全国设有分支机构和销售办事处,并投资于上海西部永唐投资管理有限公司进行风险管理业务。

该公司还与西部证券在全国范围内进行创新和IB业务合作。它专注于提升核心竞争力,扩大业务覆盖经济调用发达地区,并建立一体化的研发和服务体系以适应国内金融市场,旨在最大化客户价值。

优点和缺点

| 优点 | 缺点 |

| 受CFFEX监管 | 市场产品有限 |

| 历史悠久 | 缺乏透明度 |

西部期货 是否合法?

是的。西部期货 受中国金融期货交易所监管,目前持有期货许可证(No.0160)。

| 监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 中国金融期货交易所(CFFEX) | 已监管 | 西部期货 期货有限公司 | 期货许可证 | 0160 |

我可以在西部期货上交易什么?

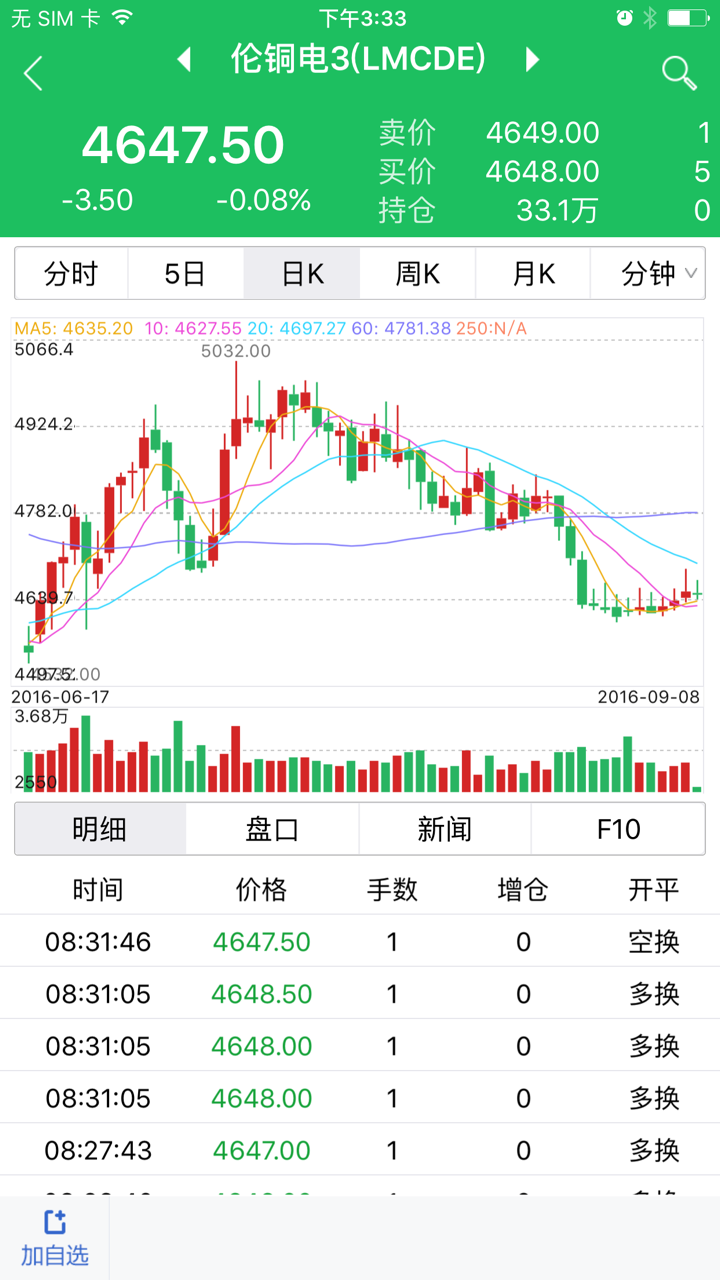

西部期货 提供期货交易作为其主要业务。针对海外交易者的特定期货产品包括原油、TSR 20、LSFO(低硫燃料油)、保税铜、铁矿石、棕榈油、PTA(聚对苯二甲酸乙二醇酯)和糖。

| 交易资产 | 可用 |

| 期货 | ✔ |

| 债券 | ❌ |

| 期权 | ❌ |

| 基金 | ❌ |

| ETF | ❌ |

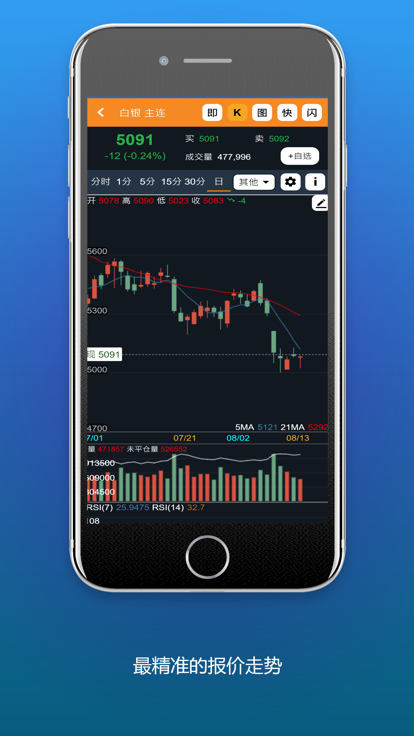

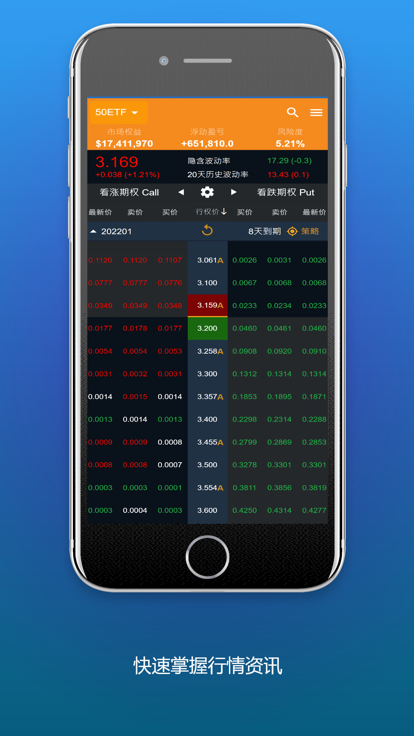

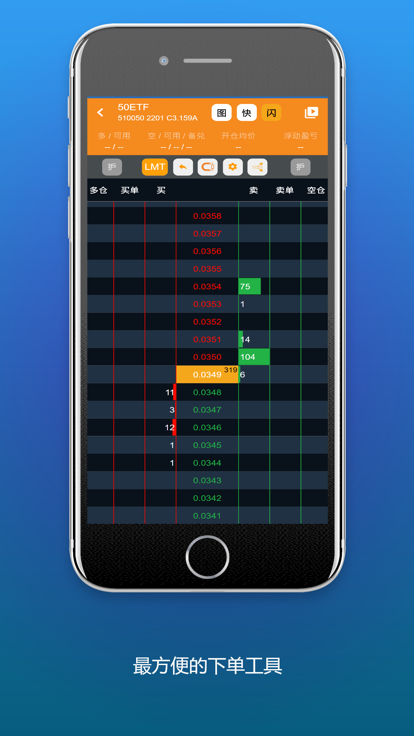

交易平台

西部期货 将其交易平台宣传为具有行业领先的性能,与全球市场同步,并满足各类专业客户的全市场和全时交易需求。