公司簡介

| 元富證券評論摘要 | |

| 成立年份 | 1989 |

| 註冊國家/地區 | 台灣 |

| 監管機構 | 台北交易所監管 |

| 市場工具 | 經紀業務、財富管理、承銷、股票登記轉讓、自營交易、期貨自營交易、固定收益、衍生品、元富證券投資諮詢、MasterLink期貨、MasterLink保險代理、MasterLink風險投資和MasterLink風險管理 |

| 模擬帳戶 | 未提及 |

| 槓桿 | 最高可達1:600 |

| 點差 | 最低為0.5點 |

| 交易平台 | MetaTrader 4 |

| 最低存款 | $100 |

| 客戶支援 | 電話:+886-2-27313888 |

| 電郵:sylvia0704@masterlink.com.tw | |

元富證券 資訊

元富證券總部位於台灣,成立於1989年。該經紀商提供外匯、差價合約、商品和指數交易。它還提供最高1:600的槓桿,點差範圍從0.5點到1.5點,並提供三種帳戶類型供選擇。

優點和缺點

| 優點 | 缺點 |

| 提供多種交易資產 | 缺乏即時聊天支援 |

| 提供帳戶類型 | |

| 受台北交易所監管 | |

| 提供競爭力的1:600槓桿 | |

| 提供MetaTrader 4交易平台 |

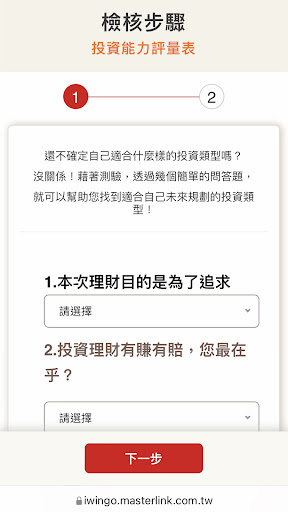

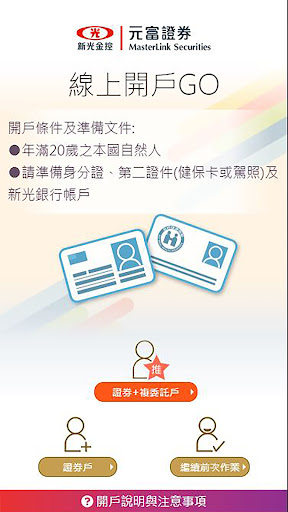

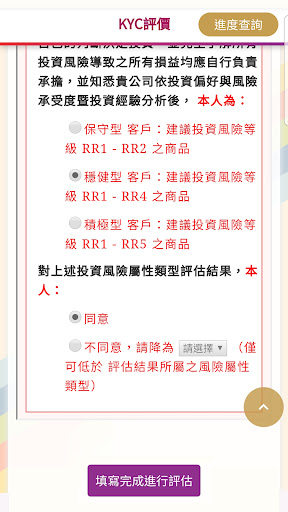

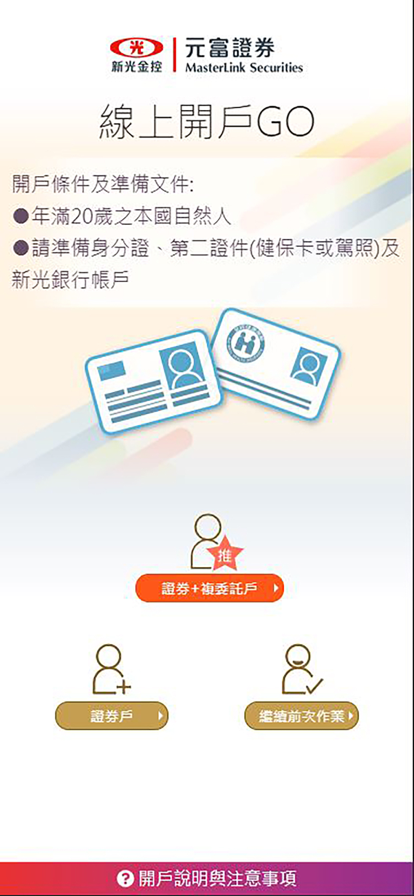

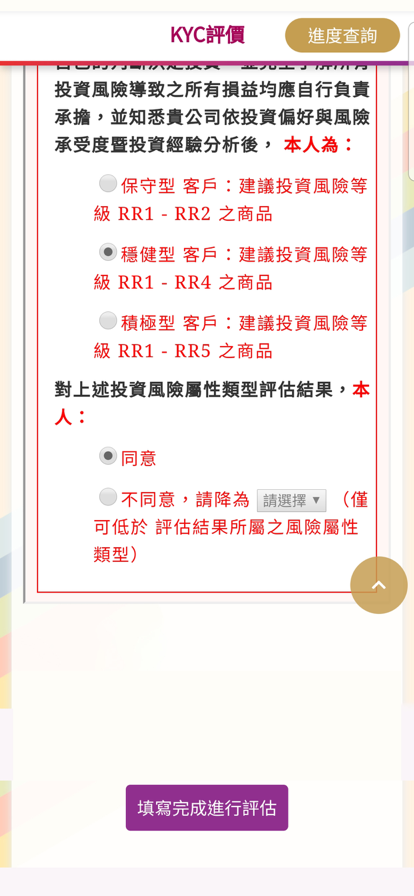

元富證券 是否合法?

元富證券 受台北交易所監管。其許可證類型為不共享。

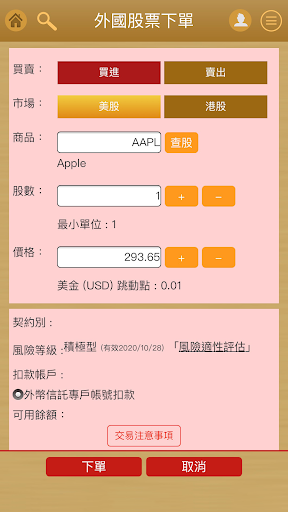

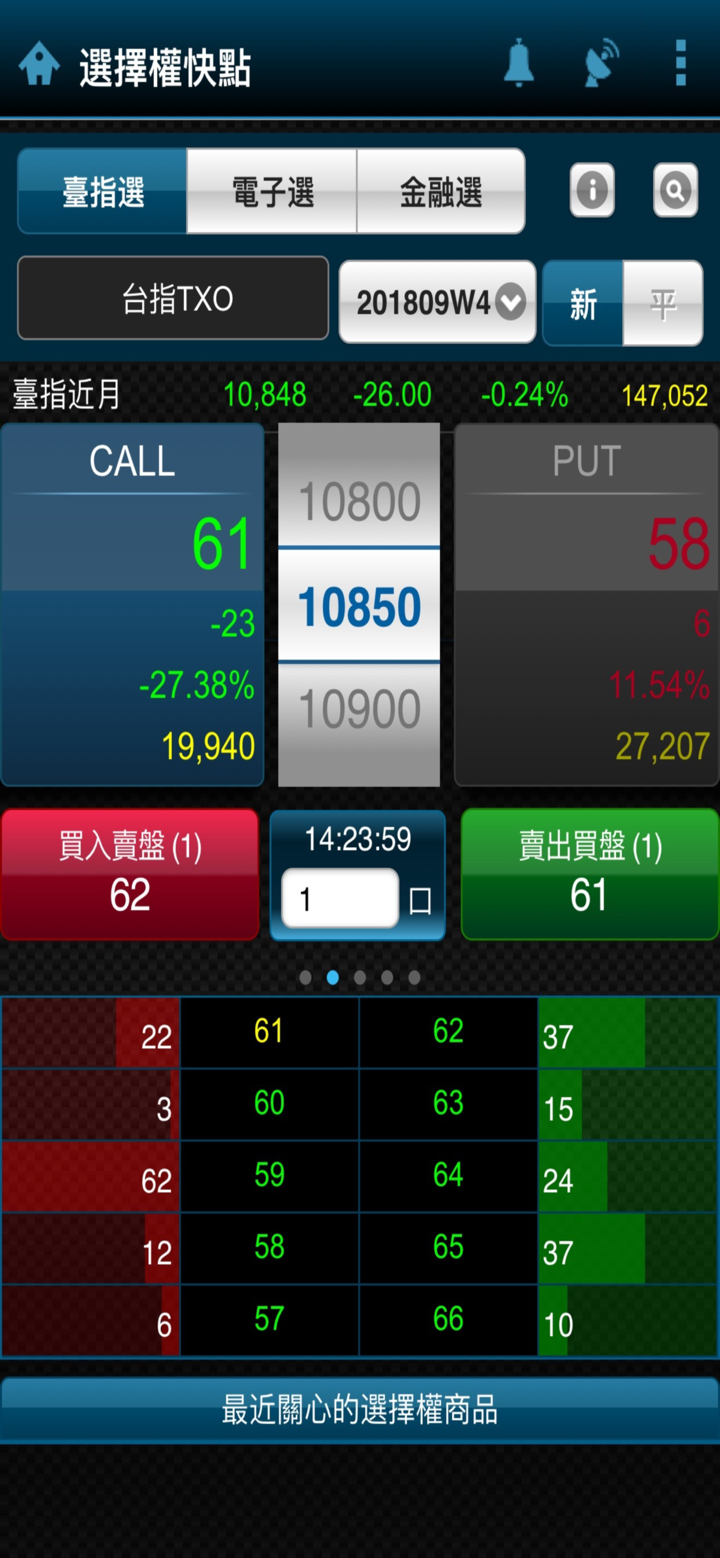

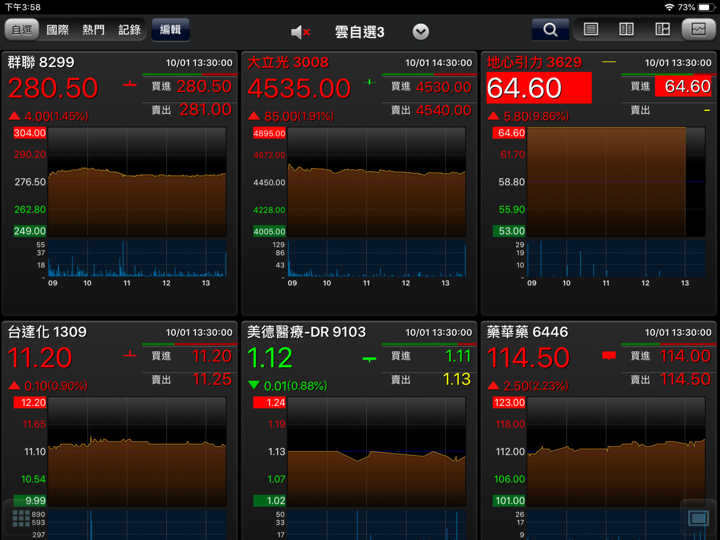

我可以在 元富證券 上交易什麼?

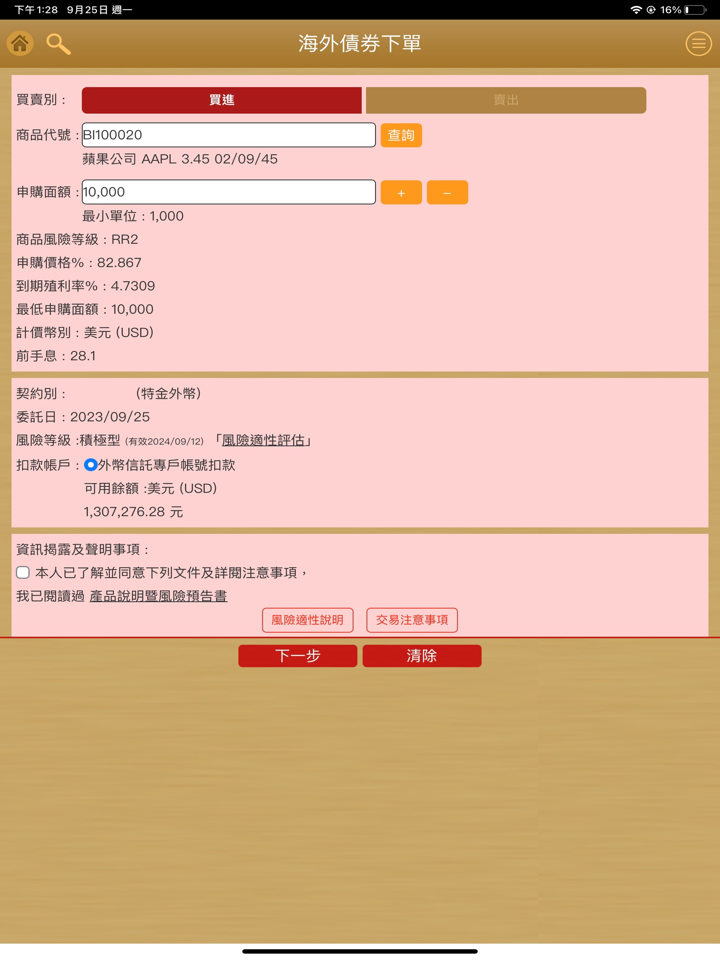

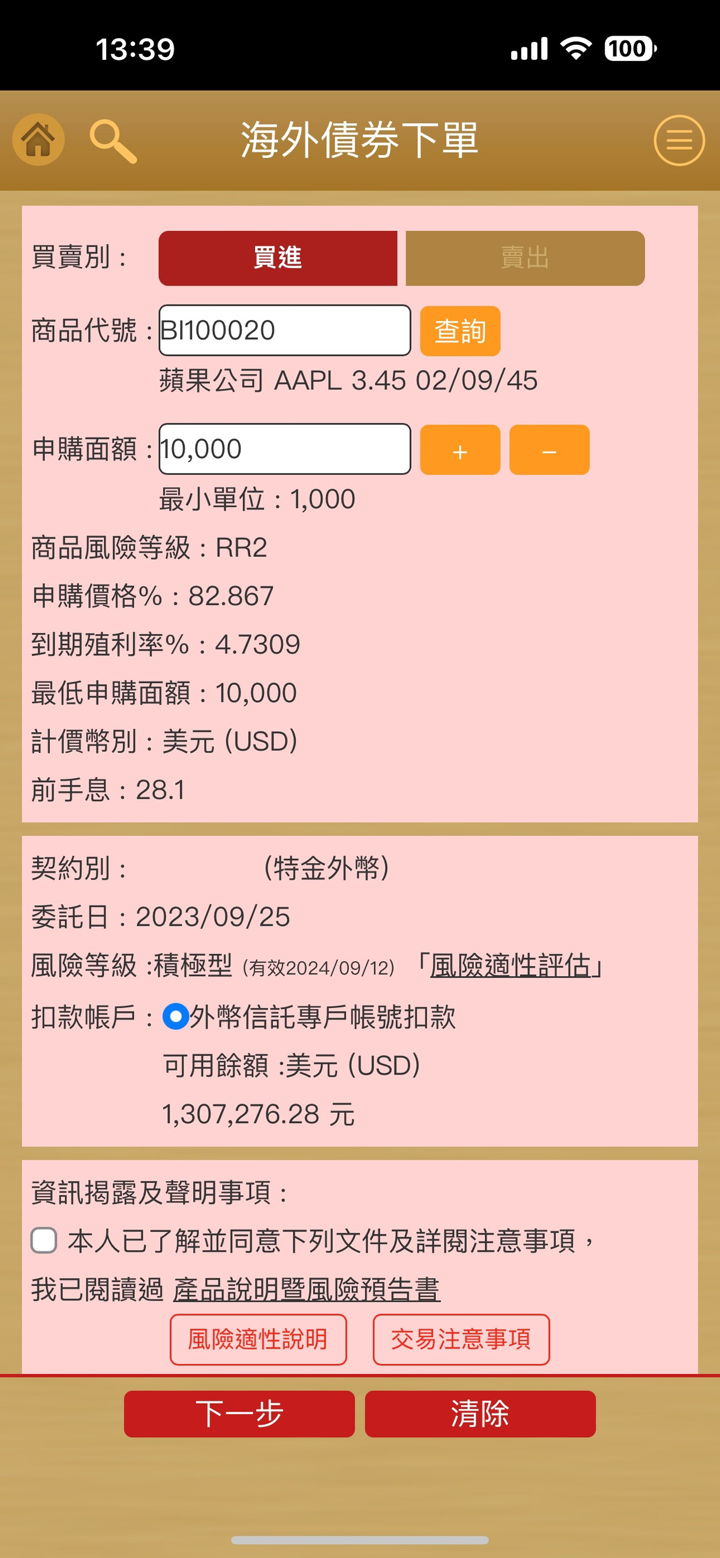

元富證券 提供經紀業務、財富管理、承銷、股票登記轉讓、自營交易、期貨自營交易、固定收益、衍生品、元富證券投資諮詢、MasterLink期貨、MasterLink保險代理、MasterLink風險投資和MasterLink風險管理等服務,包括外匯、指數和商品的差價合約、商品和指數交易。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 商品 | ✔ |

| 加密貨幣 | ❌ |

| 差價合約 | ✔ |

| 期貨 | ✔ |

| 股票 | ✔ |

| 指數 | ✔ |

| 期權 | ❌ |

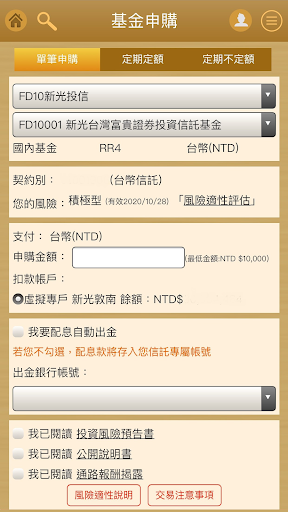

帳戶類型

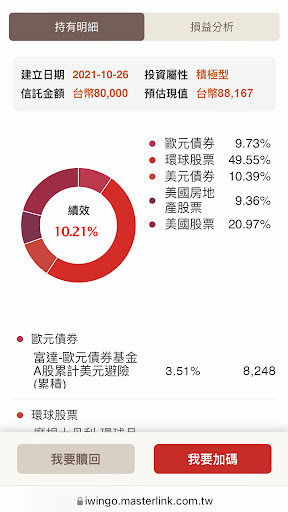

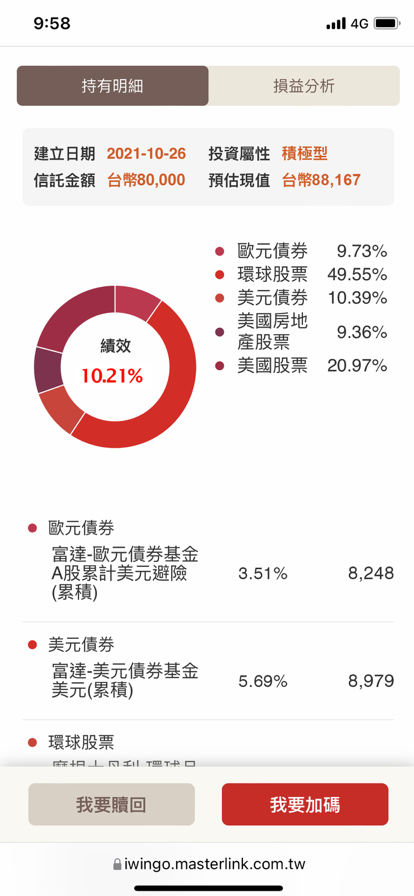

元富證券 提供三種帳戶類型,包括標準帳戶、黃金帳戶和白金帳戶。

標準帳戶:

標準帳戶最低存款為$100,提供1.5點差和零佣金。此外,它還提供高達1:600的槓桿。

黃金帳戶:

黃金帳戶最低存款為$500,提供更緊密的1.0點差和無佣金。同樣,它也提供高達1:600的槓桿。

白金帳戶:

白金帳戶最低存款為$1,000,點差從0.5點起。與其他帳戶類型一樣,它提供高達1:600的槓桿。

| 特點 | 標準 | 黃金 | 白金 |

| 槓桿 | 高達1:600 | 高達1:600 | 高達1:600 |

| 點差 | 從1.5點起 | 從1.0點起 | 從0.5點起 |

| 佣金 | 無 | 無 | 無 |

| 最低存款 | $100 | $500 | $1,000 |

| 交易工具 | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

槓桿

元富證券 提供的最大槓桿為1:600。這意味著交易者可以控制市場上多達600倍於其交易資本的倉位。

元富證券 費用

在標準帳戶中,交易者可以從主要貨幣對的點差低至1.5點。

在黃金帳戶中,點差從1.0點起。

在白金帳戶中,主要貨幣對的點差從0.5點起。

所有帳戶均不收取佣金。

交易平台

| 交易平台 | 支援 | 可用設備 | 適合的投資者 |

| MetaTrader 4 | ✔ | Windows、MAC、IOS和Android | 所有經驗水平的投資者 |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

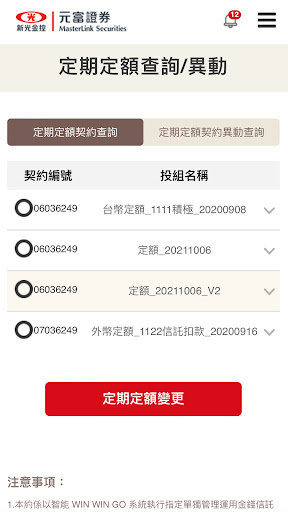

存款和提款

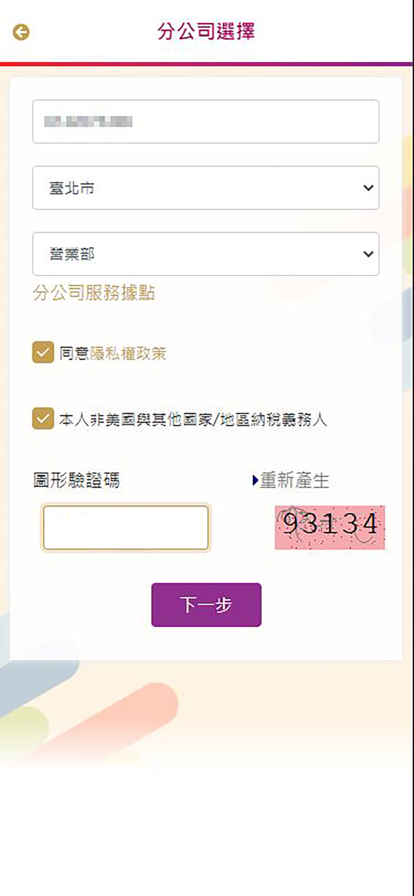

使用元富證券開設交易帳戶的最低存款金額為標準帳戶$100,黃金帳戶$500,白金帳戶$1,000。