Şirket özeti

| MasterLink Securitiesİnceleme Özeti | |

| Kuruluş | 1989 |

| Kayıtlı Ülke/Bölge | Tayvan |

| Düzenleme | Taipei Borsası tarafından düzenlenir |

| Piyasa Araçları | Komisyonculuk, Varlık Yönetimi, Sigorta, Hisse Senedi Kaydı ve Transferi, Özel Ticaret, Vadeli İşlem Özel Ticareti, Sabit Gelir, Türevler, MasterLink Securities Yatırım Danışmanlığı, MasterLink Vadeli İşlemler, MasterLink Sigorta Ajansı, MasterLink Girişim Sermayesi ve MasterLink Girişim Yönetimi |

| Deneme Hesabı | Belirtilmemiş |

| Kaldıraç | 1:600'e kadar |

| Spread | 0.5 pip'ten düşük |

| İşlem Platformu | MetaTrader 4 |

| Min Deposit | $100 |

| Müşteri Desteği | Telefon: +886-2-27313888 |

| E-posta: sylvia0704@masterlink.com.tw | |

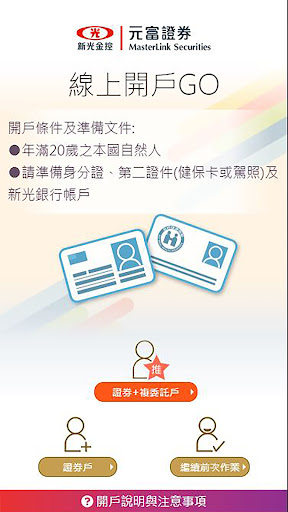

MasterLink Securities Bilgileri

MasterLink Securities, Tayvan merkezli olup 1989 yılında kurulmuştur. Bu aracı kurum Forex, CFD'ler, emtialar ve endeksler sunmaktadır. Ayrıca 1:600'e kadar kaldıraç, 0.5 pip ile 1.5 pip arasında değişen spreadler ve seçilebilecek üç hesap türü sunmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| Çeşitli işlem varlıkları sunar | Canlı sohbet desteği eksikliği |

| Hesap türleri sunar | |

| Taipei Borsası tarafından düzenlenir | |

| Rekabetçi 1:600 kaldıraç sunar | |

| MetaTrader 4 işlem platformu sunar |

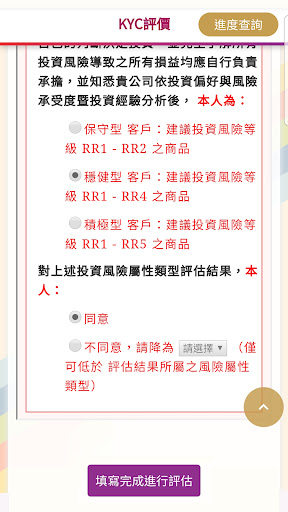

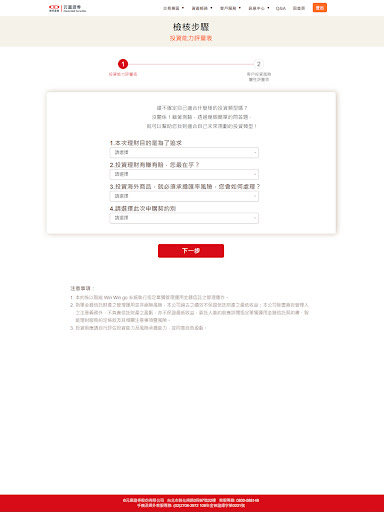

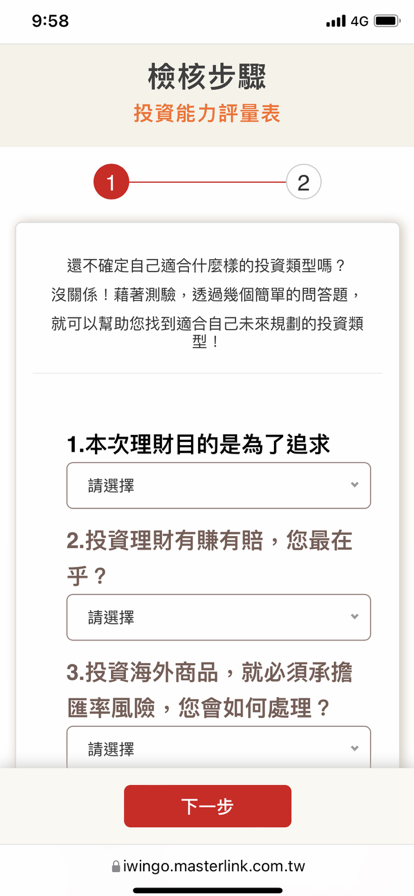

MasterLink Securities Güvenilir mi?

MasterLink Securities, Taipei Borsası tarafından düzenlenmektedir. Lisans türü No Sharing'dir.

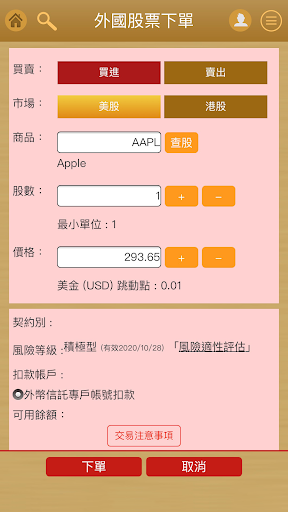

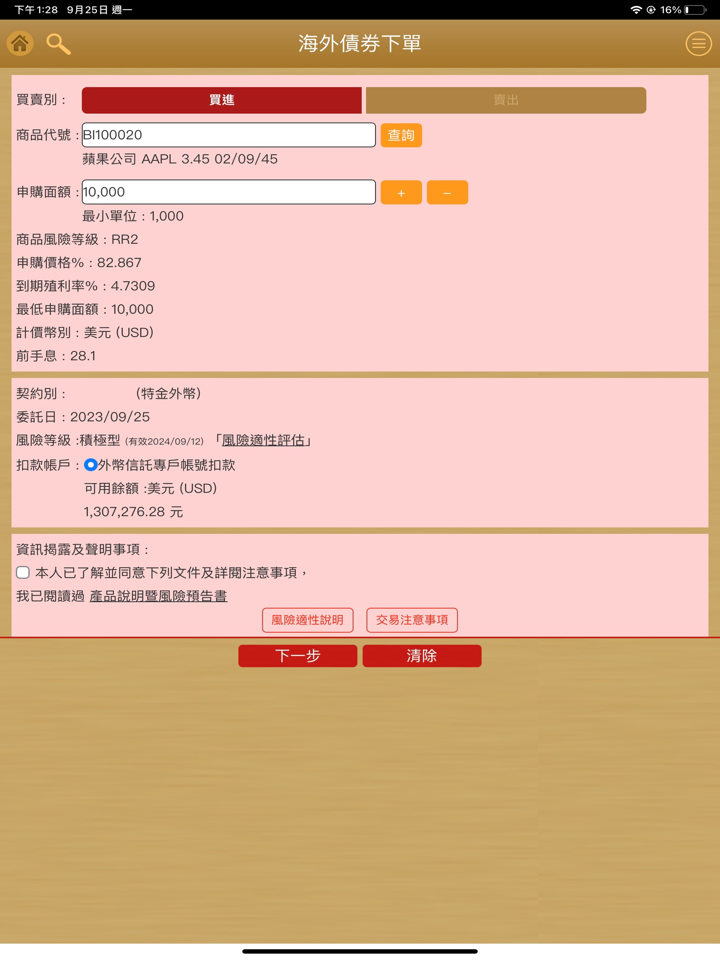

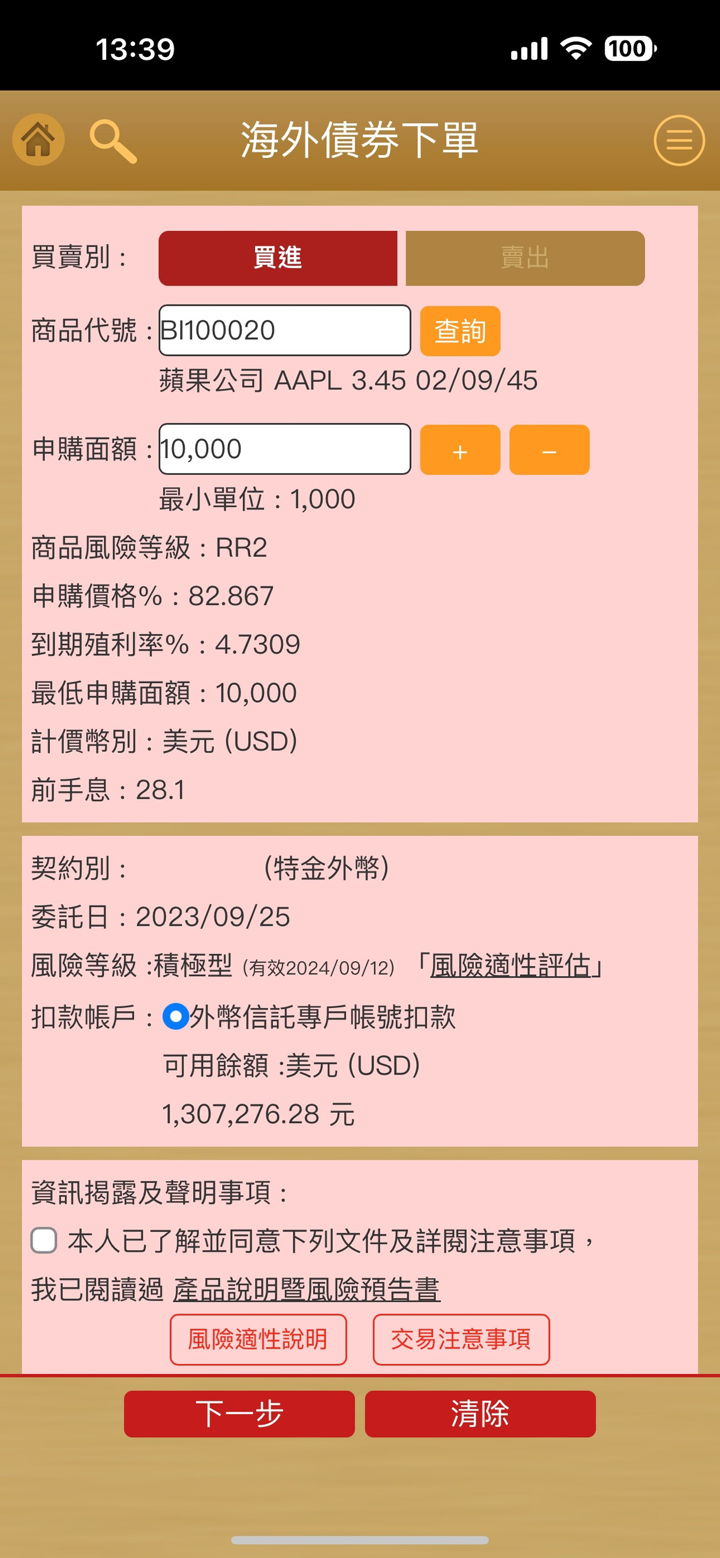

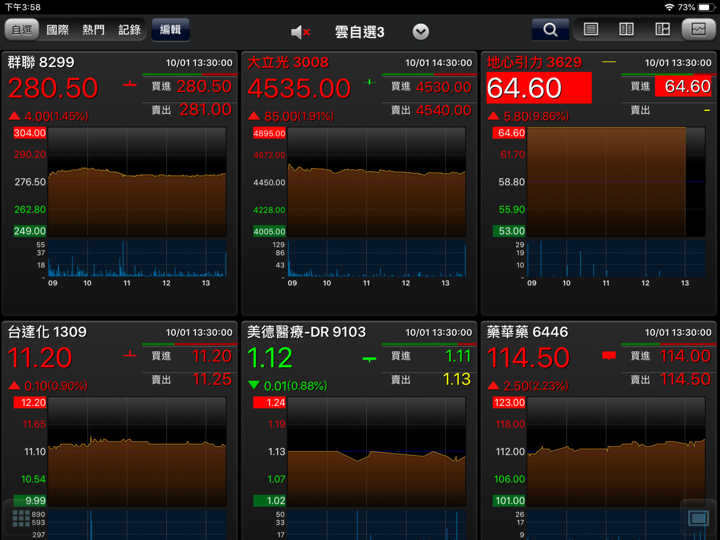

MasterLink Securities Üzerinde Ne İşlem Yapabilirim?

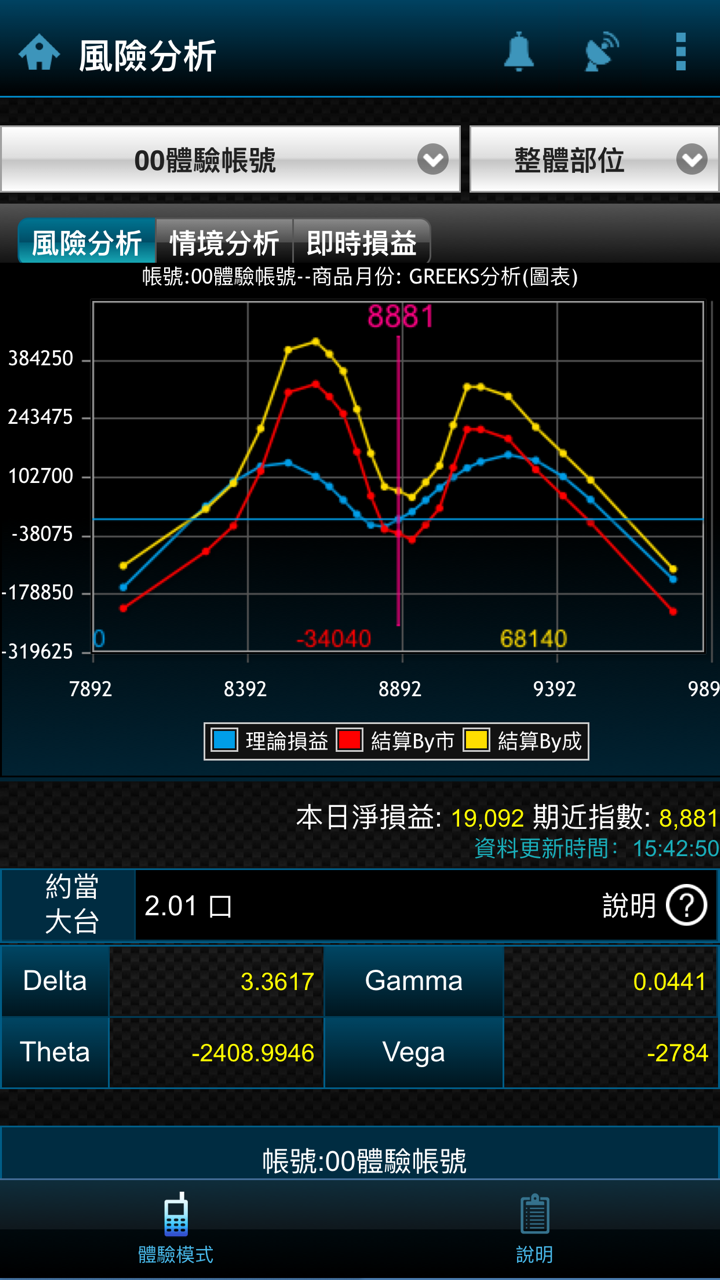

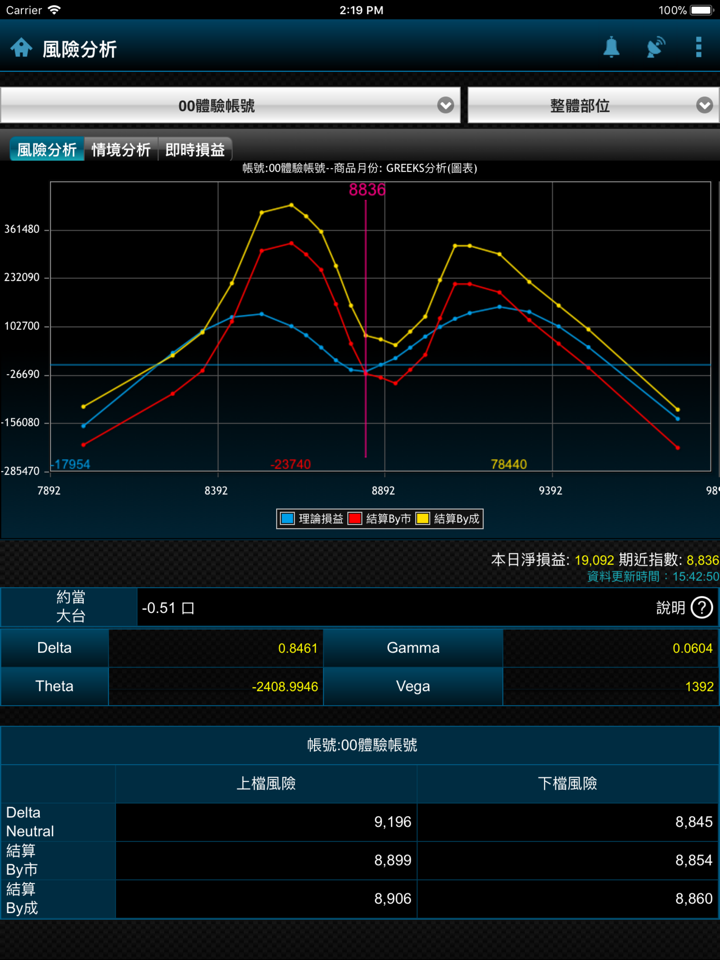

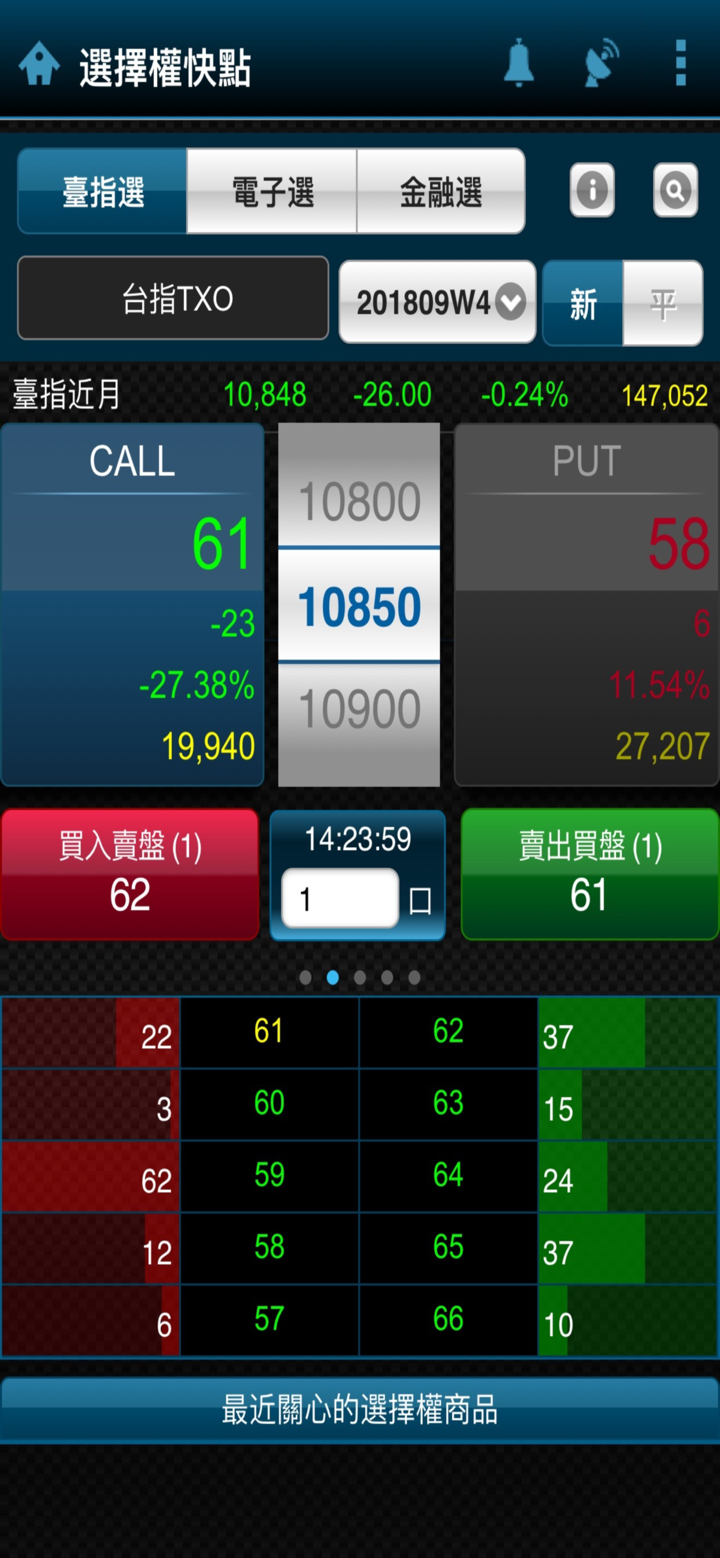

MasterLink Securities, Forex, endeksler ve emtialar üzerinde CFD'ler, emtialar ve endeks ticareti dahil olmak üzere Komisyonculuk, Varlık Yönetimi, Sigorta, Hisse Senedi Kaydı ve Transferi, Özel Ticaret, Vadeli İşlem Özel Ticareti, Sabit Gelir, Türevler, MasterLink Securities Yatırım Danışmanlığı, MasterLink Vadeli İşlemler, MasterLink Sigorta Ajansı, MasterLink Girişim Sermayesi ve MasterLink Girişim Yönetimi gibi hizmetler sunmaktadır.

| İşlem Yapılabilir Enstrümanlar | Desteklenir |

| Forex | ✔ |

| Emtialar | ✔ |

| Kripto | ❌ |

| CFD | ✔ |

| Vadeli İşlemler | ✔ |

| Hisse Senedi | ✔ |

| Endeks | ✔ |

| Opsiyonlar | ❌ |

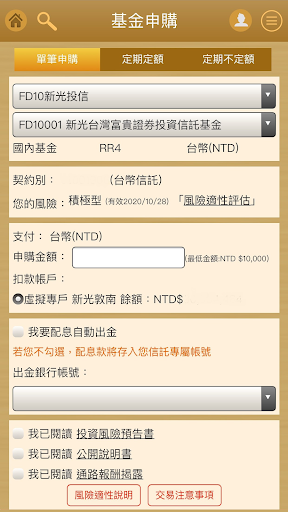

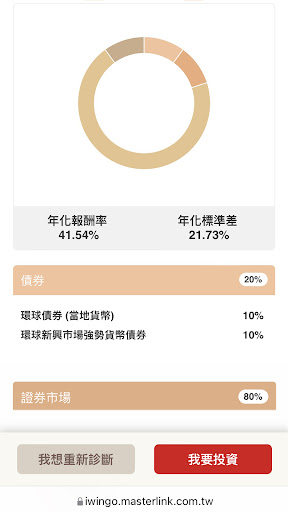

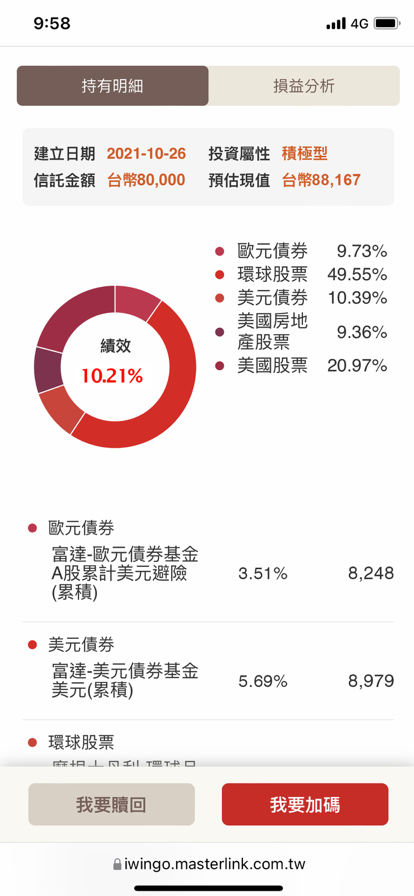

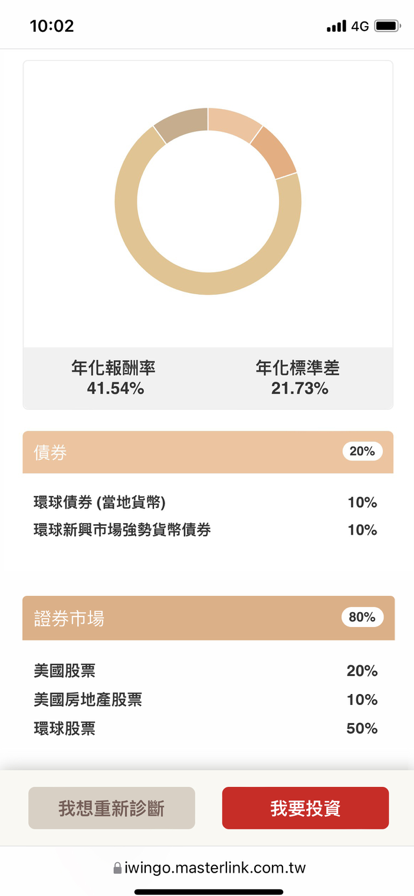

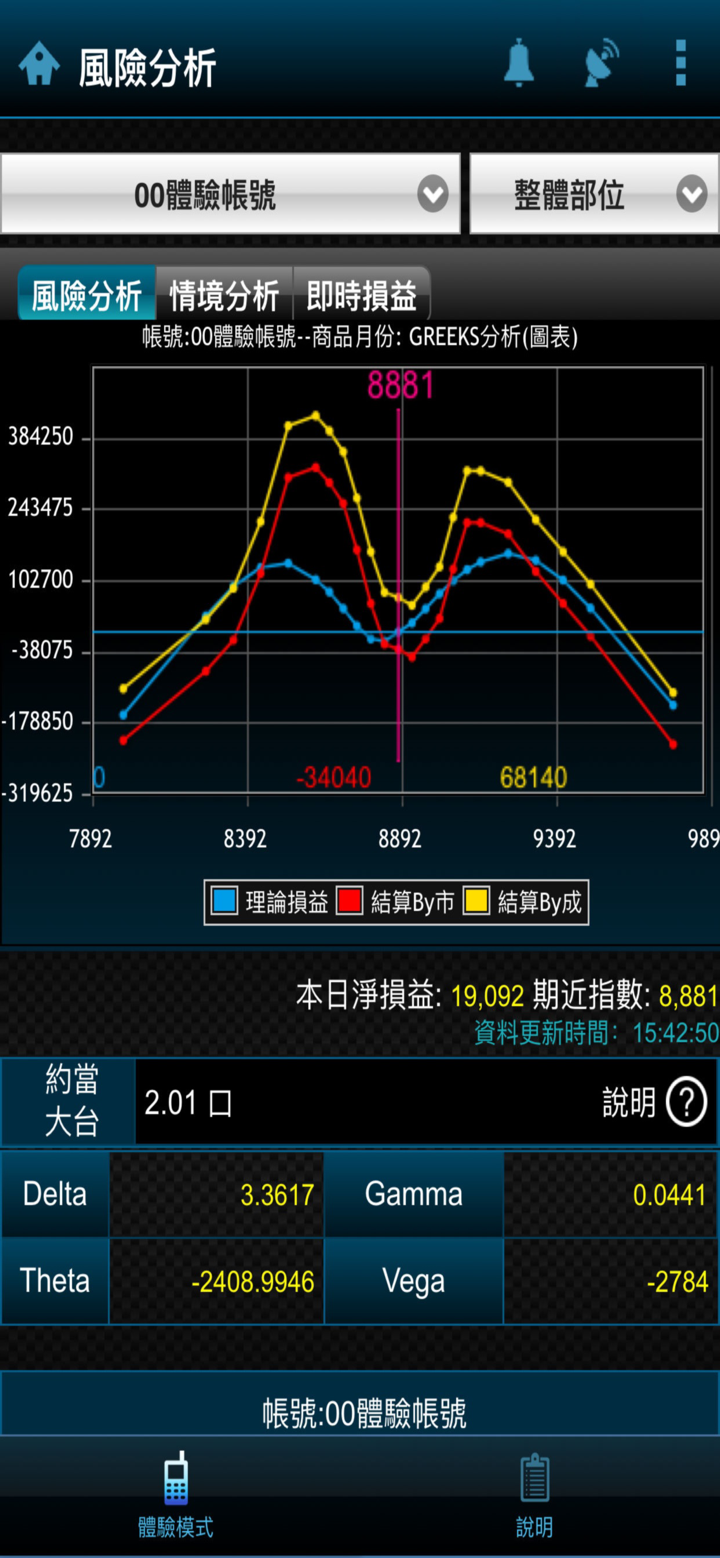

Hesap Türleri

MasterLink Securities Standart, Gold ve Platin hesaplar dahil olmak üzere üç hesap türü sunmaktadır.

Standart Hesap:

Standart hesap, minimum $100 depozito sağlar, ayrıca 1.5 pip spread ve komisyon içermez. Ayrıca, 1:600'e kadar kaldıraç sunar.

Gold Hesap:

Gold hesap, minimum $500 depozito gerektirir ve komisyon içermeyen 1.0 pip spread sunar. Ayrıca, 1:600'e kadar kaldıraç sunar.

Platin Hesap:

Platin hesap, minimum $1,000 depozito sağlar ve spreadler 0.5 pip'ten başlar. Diğer hesap türleri gibi, 1:600'e kadar kaldıraç sunar.

| Özellik | Standart | Gold | Platin |

| Kaldıraç | 1:600'e kadar | 1:600'e kadar | 1:600'e kadar |

| Spreadler | 1.5 pip'ten başlayarak | 1.0 pip'ten başlayarak | 0.5 pip'ten başlayarak |

| Komisyonlar | Yok | Yok | Yok |

| Minimum Depozito | $100 | $500 | $1,000 |

| İşlem Araçları | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

Kaldıraç

MasterLink Securities tarafından sunulan maksimum kaldıraç oranı 1:600'e kadar. Bu, işlem sermayelerinin 600 katına kadar piyasadaki pozisyonları kontrol edebilecekleri anlamına gelir.

MasterLink Securities Ücretler

Standart hesapta, traderlar başlıca döviz çiftlerinin spreadinden en düşük 1.5 puan faydalanabilirler.

Gold hesaplarda, spread 1.0 pip'ten başlar.

Platin hesapta, başlıca döviz çiftlerinin spreadi 0.5 pip'ten başlar.

Ve tüm hesaplar için komisyon gerekmektedir.

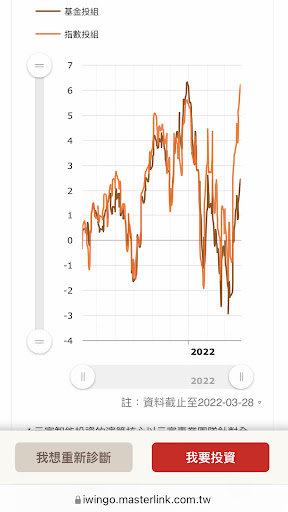

İşlem Platformu

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar | Hangi Yatırımcılar İçin Uygun |

| MetaTrader 4 | ✔ | Windows, MAC, IOS ve Android | Tüm deneyim seviyelerindeki yatırımcılar |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

Para Yatırma ve Çekme

MasterLink Securities ile bir işlem hesabı açmak için gereken minimum depozito miktarı standart hesaplar için $100, Gold hesaplar için $500 ve Platin hesaplar için $1,000'dir.