Rustam R

1-2年

Which documents do I usually need to provide in order to make my initial withdrawal from DXtrade?

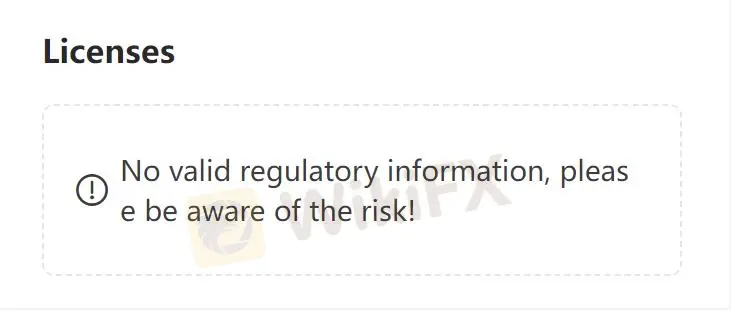

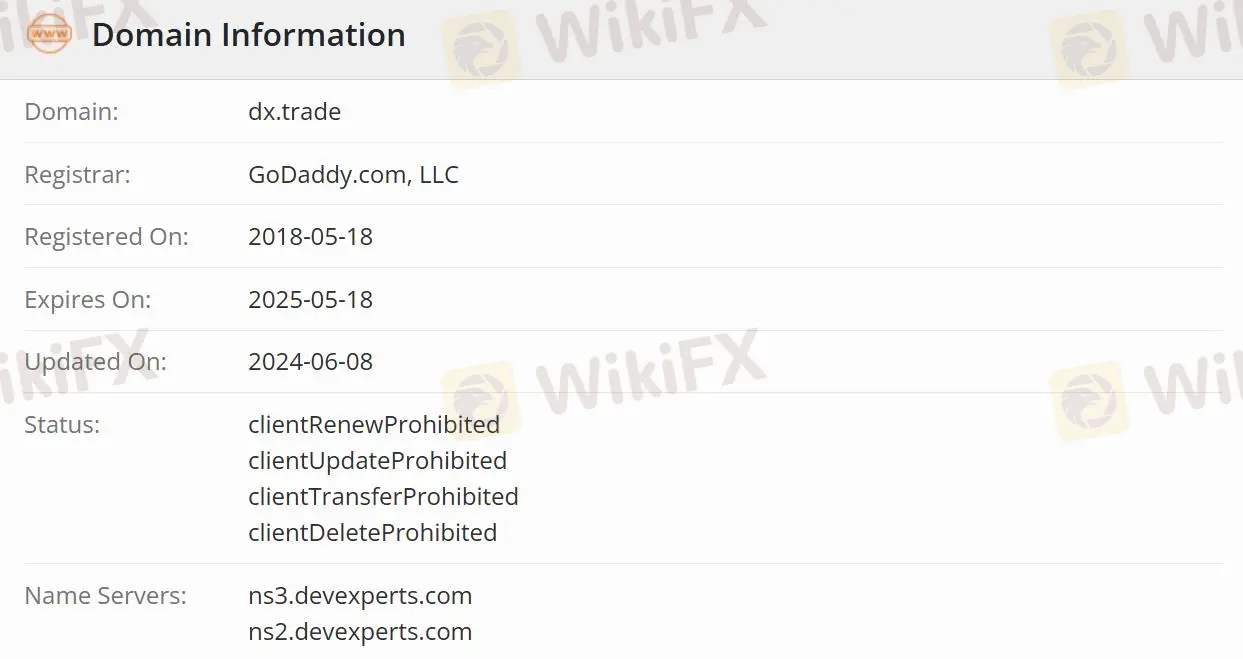

In my experience as a forex trader, when considering making an initial withdrawal from a broker like DXtrade, my first step is always to look into the firm's regulatory status and legitimacy. For me, transparency and regulatory oversight are paramount, especially when entrusting a broker with my funds. According to information about DXtrade, the platform is not regulated and is flagged for high potential risk, which is a significant concern in forex trading. In unregulated environments, the required withdrawal documentation is not always clearly outlined, and expectations can be inconsistent.

Typically, legitimate brokers—even those offering demo platforms—will require standard Know Your Customer (KYC) documents before processing any withdrawal. For DXtrade or similar platforms, I would expect to provide a government-issued ID, such as a passport or driver’s license, and a proof of address, like a utility bill or bank statement, dated within the last three months. In some cases, there might be requests for additional verification if the withdrawal is substantial or if there are discrepancies in account details.

However, since DXtrade operates mainly as a software provider for brokers and is unregulated, I would exercise heightened caution before submitting personal documents or initiating financial transactions. If I were to proceed, I would make sure to confirm all requirements directly with their customer support and remain alert for any red flags. In summary, while the standard documents would likely suffice elsewhere, the lack of regulatory oversight here means I am even more deliberate and protective of my personal and financial information.

Broker Issues

Deposit

Withdrawal

kennis2244

1-2年

Which types of payment options are available for deposits and withdrawals on DXtrade, such as credit cards, PayPal, Skrill, or cryptocurrencies?

From my research and personal review of DXtrade, I was unable to find any clear information about available payment options for deposits and withdrawals such as credit cards, PayPal, Skrill, or cryptocurrencies. What really stands out to me is that DXtrade does not present itself as a retail forex broker in the traditional sense. It appears to function primarily as a software provider for trading platforms used by brokers, prop firms, and financial institutions, not as a direct retail brokerage where individual traders open accounts and manage funds through deposits or withdrawals.

The DXtrade platform offers demo access, but this is oriented towards brokers and firms evaluating the software, rather than traders funding live accounts. When trading with a brokerage built on DXtrade’s technology, the supported payment methods would depend entirely on that specific broker rather than DXtrade itself. Given that the company is unregulated and shows a high potential risk warning, I would be extremely cautious about any financial transactions involving this entity directly. For me, the absence of explicit information on funding methods, combined with the lack of regulatory oversight, is reason enough to avoid engaging in any kind of deposit or withdrawal activity with DXtrade. I recommend confirming payment options and regulatory status with any broker that uses DXtrade software before considering any funding or withdrawal, to ensure your personal and financial safety.

Broker Issues

Deposit

Withdrawal

Mansuber007

1-2年

Does DXtrade offer traders the choice of an Islamic (swap-free) account?

Based on my thorough review of DXtrade and careful consideration of the facts, I could not find any indication that DXtrade offers traders the choice of an Islamic (swap-free) account. In my own trading journey, the availability of swap-free or Sharia-compliant accounts is a significant factor, especially for those who must avoid interest due to religious reasons. With DXtrade, my due diligence revealed some important concerns: the firm is unregulated, carries a high potential risk warning, and is mainly a technology platform provider rather than a retail brokerage with direct trading services. It's also crucial to note that their platforms—such as DXtrade CFD and DXtrade XT—are positioned toward brokers and prop firms, not individual traders, and the demo account serves as a trial for institutions rather than for personal trading use.

When I compare this with established, well-regulated brokers, which are transparent about account types and features, DXtrade does not provide explicit details or assurances regarding account types such as Islamic accounts. For me, this lack of regulatory oversight and outright confirmation of swap-free options makes DXtrade a non-viable choice if avoiding interest-based transactions is essential. To trade safely and in accordance with one’s requirements, I would recommend seeking regulated brokers that clearly state their support for Islamic accounts, as caution and transparency are always my priorities in the forex industry.

Broker Issues

Platform

Leverage

Instruments

Account

Xxpro

1-2年

Could you break down what the total trading costs are when trading indices such as the US100 on DXtrade?

As an experienced forex trader, when I assess a platform like DXtrade for trading indices such as the US100, I prioritize transparency around direct trading costs and the overall safety of my funds. It's important to note that, based on the most recent information available, DXtrade is not a regulated broker and primarily positions itself as a software provider rather than a traditional brokerage. For me, this is a significant consideration, as unregulated environments tend to lack the oversight I rely on for capital protection and transparent fee structures.

Because DXtrade does not operate as a typical broker but rather as a technology provider for brokers and prop trading firms, there isn’t publicly available, trader-focused detail about spread sizes, commission rates, overnight financing charges (swap/rollover), or other explicit costs for trading indices like the US100. I personally hesitate to engage with platforms where the total cost per trade—spreads, commissions, and any hidden fees—isn’t laid out clearly and verifiably.

Even if a demo is available, it's intended for broker evaluations, not retail trading, so simulated costs may not reflect real trading. For my own trading, I only consider venues where regulation and fee transparency are strict, and where trading costs are fully disclosed before any commitment. For DXtrade, due to the current lack of regulation and cost transparency, I cannot confidently evaluate or recommend their offering for US100 index trades.

Broker Issues

Fees and Spreads