Buod ng kumpanya

| DXtrade Buod ng Pagsusuri | |

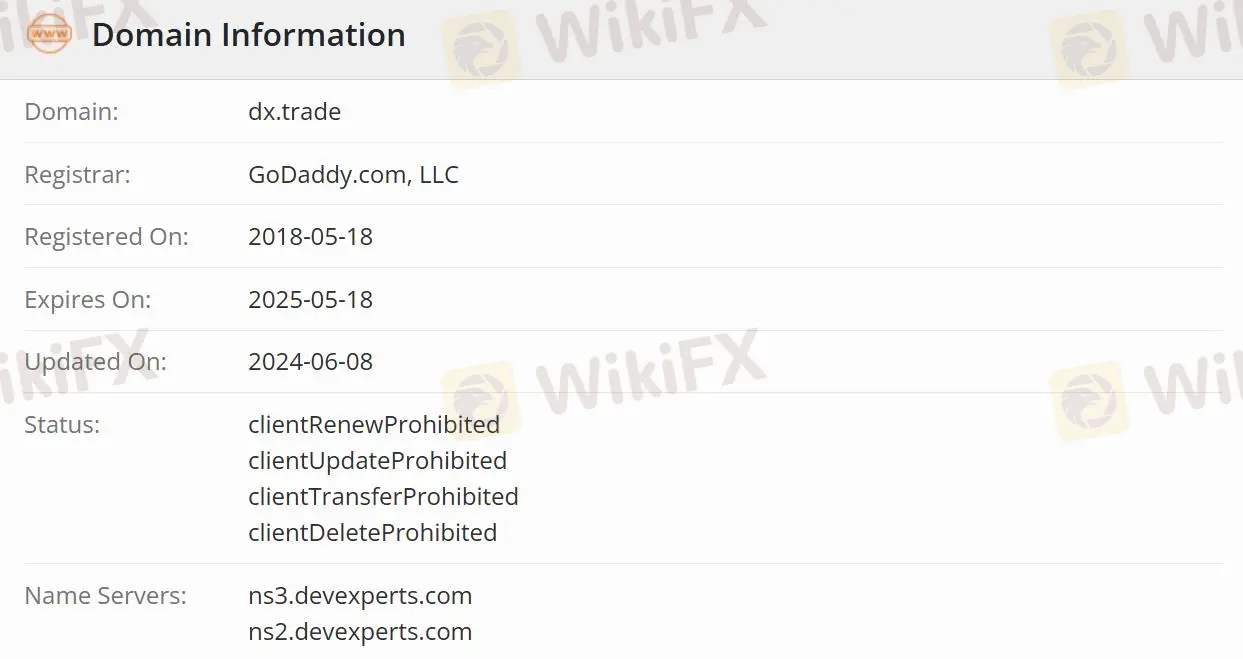

| Itinatag | 2018-05-18 |

| Rehistradong Bansa/Rehiyon | Ireland |

| Regulasyon | Hindi Regulado |

| Demo Account | ✅ |

| Plataforma ng Pagkalakalan | DXtrade CFD(Web/Mobile)/DXtrade XT((Web/Mobile)/Prop na teknolohiya sa pagkalakalan |

| Suporta sa Customer | Telepono: +1 201 685 9280 |

| Social Media: Facebook, Twitter, YouTube, LinkedIn | |

Impormasyon ng DXtrade

Ang DXtrade ay isang tagapagbigay ng software at isang kumpanya ng IT na produkto na nag-develop ng software para sa mga kumpanya sa industriya ng pananalapi mula noong 2002. Ang pangunahing kasanayan sa negosyo ay mga plataporma sa pagkalakalan, partikular na ang DXtrade XT para sa mga naka-listang securities at derivatives, DXtrade CFD para sa mga OTC asset classes, at DXtrade Crypto para sa mga cryptocurrencies. Ang demo account na ito ay hindi para sa mga mangangalakal. Ito ay isang serbisyo na dinisenyo para sa mga broker at prop firms upang subukan ang software ng DXtrade.

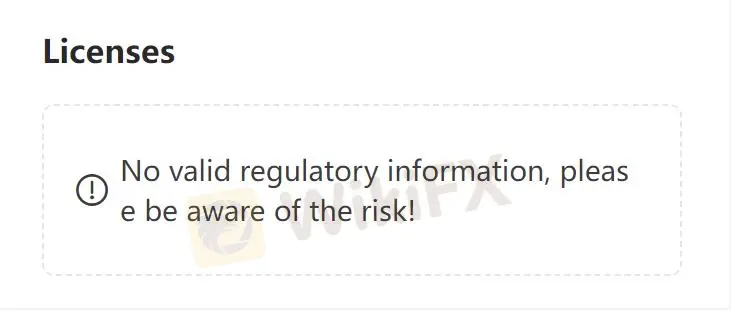

Totoo ba ang DXtrade?

Ang DXtrade ay hindi regulado, kaya mas hindi ligtas kumpara sa mga reguladong broker.

Anong plataporma sa pagkalakalan ang ibinibigay ng DXtrade?

Ang DXtrade ay nag-aalok ng access sa DXtrade CFD, DXtrade XT, at Prop na teknolohiya sa pagkalakalan. Available ang mga ito sa web at mobile. Ang DXtrade CFD trading platform para sa mga FX, CFD, crypto, at spread-betting brokers; ang DXtrade XT trading platform para sa mga broker na nag-aalok ng mga stocks, options, futures, mutual funds, at bonds; ang DXtrade ay isang platform para sa prop trading at mga paligsahan sa pagkalakalan. Nagbibigay ito ng propesyonal na karanasan sa mga kliyente ng Startup brokers, Established brokers, at Prop trading firms kapag nagtatrabaho sa FX, CFDs, at futures.

| Plataforma ng Pagkalakalan | Supported | Available Devices |

| DXtrade CFD | ✔ | Web/Mobile |

| DXtrade XT | ✔ | Web/Mobile |

| Prop na teknolohiya sa pagkalakalan | ✔ | - |

Mga Pagpipilian sa Suporta sa Customer

Maaaring sundan ng mga mangangalakal ang platform sa Facebook, Twitter, YouTube, at LinkedIn at makipag-ugnayan dito sa pamamagitan ng telepono.

| Mga Pagpipilian sa Pakikipag-ugnayan | Mga Detalye |

| Telepono | +1 201 685 9280 |

| Social Media | Facebook, Twitter, YouTube, LinkedIn |

| Supported Language | Ingles/Espanyol |

| Website Language | Ingles/Espanyol |

| Physical Address |