S jonas

1-2年

How do Cathay Futures' overnight financing charges (swap fees) stack up against those of other brokers?

As someone who’s traded globally with a strong focus on risk management and transparency, evaluating overnight financing (swap) charges is always part of my diligence before choosing a broker. With Cathay Futures, however, one major drawback for me is the lack of clear, published information about their swap fees. While I appreciate that they are an established firm—regulated by the Taipei Exchange and active since 1993—the unclear fee structure genuinely presents caution for anyone serious about forecasting trading costs over time.

From my experience, leading international brokers tend to list their overnight financing rates openly or provide real-time calculators, which makes it far easier to manage leveraged positions overnight. In contrast, with Cathay Futures, I have not found sufficient detail about how their financing charges compare to peers—neither for domestic index futures nor for international products traded through their access to global exchanges. This lack of transparency means, for me, there’s an increased risk of unexpected costs, particularly for longer-term speculative or hedging strategies.

In summary, while I find Cathay Futures reliable in terms of regulation and product range, the opaque nature of their swap fees does not meet my standards for cost predictability. For traders who rely on precise fee structures to manage their margin and overnight exposure, I would exercise extra caution and seek explicit confirmation from their customer service before making any commitments.

Broker Issues

Fees and Spreads

Nagarjuna

1-2年

Is it possible to deposit funds into my Cathay Futures account using cryptocurrencies such as Bitcoin or USDT?

Based on my thorough review of Cathay Futures, I cannot confirm that cryptocurrency deposits, such as Bitcoin or USDT, are available options for funding an account with this broker. My experience tells me that the firm primarily operates within the regulated financial environment of Taiwan under the Taipei Exchange and focuses on futures and leveraged foreign exchange trading. Typically, regional regulations and compliance frameworks in markets like Taiwan tend to mandate stricter guidelines on client fund handling, and most traditional brokers in similar environments do not support cryptocurrency funding due to concerns around regulatory transparency, anti-money laundering obligations, and financial oversight.

From what I have observed, Cathay Futures emphasizes margin trading for a broad set of domestic and international futures offerings, but there is no concrete mention of support for digital asset deposits on their official channels. In my opinion, unless the broker explicitly states otherwise or unless there is an announcement about adopting virtual currencies for deposits and withdrawals, it is prudent to assume that only fiat currency methods are available.

I make it a rule in my trading practice to always confirm available funding methods directly with the broker's official customer service before attempting any fund transfer. For me, ensuring absolute clarity about deposit channels is vital for both security and compliance, particularly when it concerns regulated entities. As always, caution and verification are key to protecting both funds and trading objectives.

Broker Issues

Withdrawal

Deposit

Franko Knavs

1-2年

How much do you need to deposit at a minimum to start a live trading account with Cathay Futures?

As an experienced forex and futures trader, I’ve learned to prioritize regulatory standing and margin requirements over simple minimum deposit figures, especially with brokers like Cathay Futures. In my own review of their offering, I could not locate a clearly published “minimum deposit” for opening a live account—a detail that is sometimes standard with more retail-oriented forex brokers. Instead, Cathay Futures operates much like a traditional futures brokerage, where the decisive factor is the initial margin required to trade specific contracts.

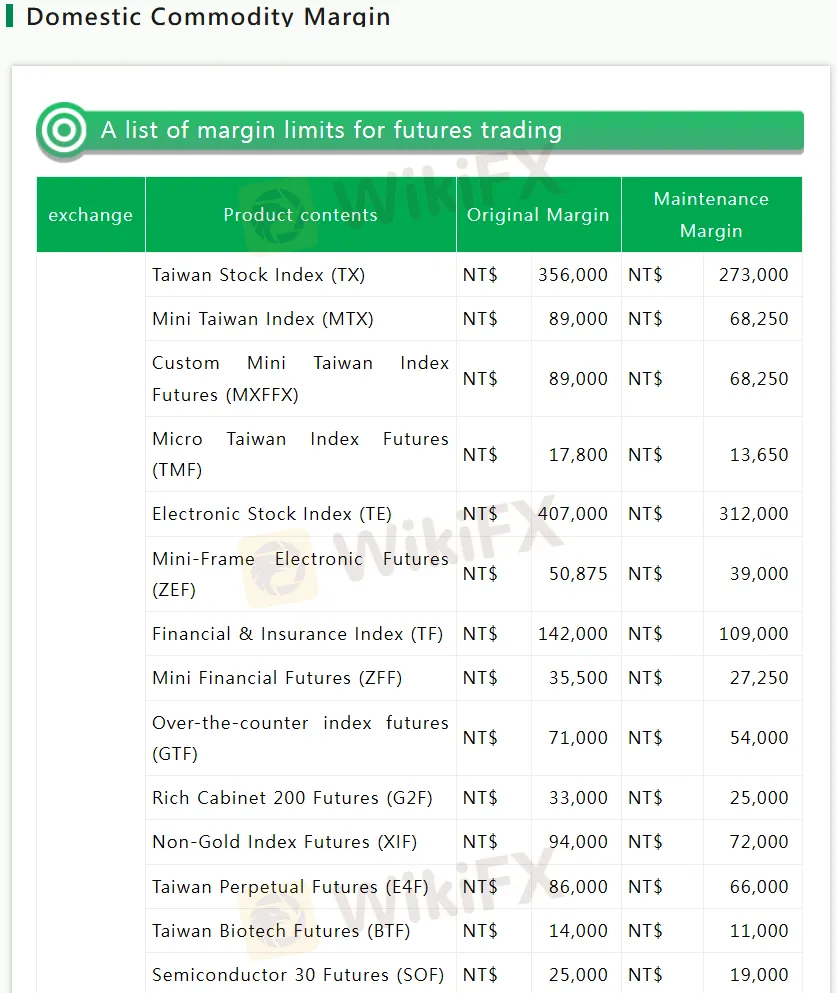

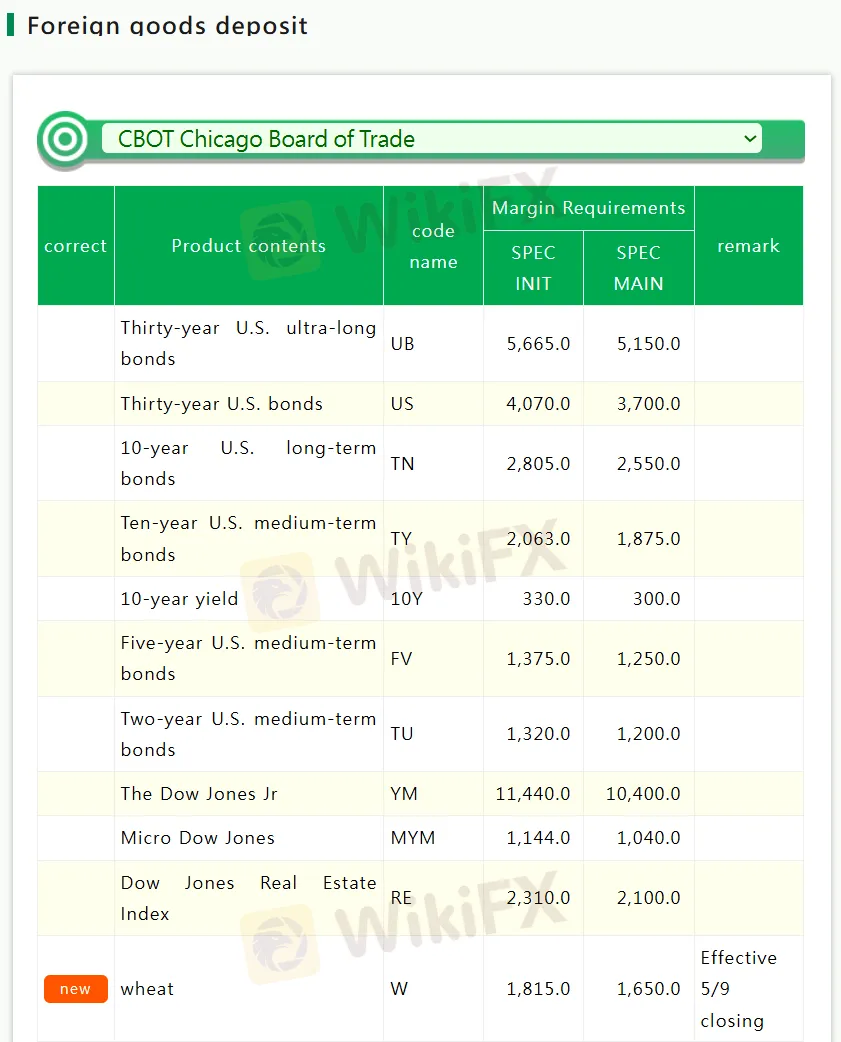

For example, if I wanted to trade the Taiwan Stock Index (TX) future, I’d be looking at an original margin set at NT$356,000, based on their current disclosures. Similarly, trading certain U.S. futures, such as the Thirty-year U.S. ultra-long bond (UB), currently requires an initial margin of SPEC INIT 5,665.0 (denominated in the relevant currency). These are substantial figures and underline that futures trading, particularly through a broker like Cathay Futures, is capital-intensive and generally better suited to more experienced or institutional participants.

What’s also important to me is that Cathay Futures is regulated by the Taipei Exchange, giving a degree of operational oversight and client protection. However, their lack of transparent information on general account minimums underscores the necessity of direct inquiry or careful consultation before funding an account. For anyone considering trading with Cathay Futures, I would urge a conservative approach—ensure you understand the margin requirements for your intended products and reach out personally to the broker to clarify all costs and account minimums before transferring any funds. This level of due diligence is essential, especially in the context of significant capital commitments.

Broker Issues

Deposit

Withdrawal

Chris hagerman

1-2年

Which documents do I need to provide in order to process my initial withdrawal with Cathay Futures?

In my experience as a long-term trader dealing with various regulated brokers, the documentation required for an initial withdrawal is a key concern, especially when working with firms like Cathay Futures that operate under the oversight of the Taipei Exchange in Taiwan. While the context doesn't explicitly list every required document for Cathay Futures, I have learned that regulated brokers like this typically adhere to financial regulations mandating identity verification and anti-money laundering protocols.

Based on these standards and regulatory expectations, I would expect Cathay Futures to require documents such as a valid government-issued photo ID (like a passport or national ID card), a proof of address (such as a recent utility bill or bank statement), and possibly confirmation of your bank account details to ensure that the withdrawal can only be sent to an account in your name. This set of documents is standard practice for withdrawals at reputable, regulated firms, particularly in jurisdictions like Taiwan.

Given that the broker is regulated and provides margin trading on major exchanges, I would proceed cautiously and ensure all my documents are clear, up to date, and consistent with the information I registered. It’s wise to directly contact their customer service via the official email or phone number provided on their website for any updates to the policy or for confirmation of specifics, as requirements can change over time and depending on the nature of your account. By taking these steps, I aim to avoid unnecessary delays and ensure full compliance with both broker and regulatory expectations.

Broker Issues

Deposit

Withdrawal