Описание компании

| Cathay Futures Обзор | |

| Основана | 1993 |

| Страна/Регион регистрации | Тайвань |

| Регулирование | Биржа Тайбэя (TPEx) |

| Инструменты рынка | Фьючерсы |

| Торговая платформа | / |

| Поддержка клиентов | Тел: 02-7752-1699 |

Информация о Cathay Futures

Cathay Futures, основанная в Тайване в 1993 году и регулируемая Биржей Тайбэя, является компанией, предлагающей маржинальную торговлю как на внутренние, так и на иностранные товары. Компания предоставляет доступ к торговле фьючерсами на крупнейших международных биржах Азии, Европы и Америки.

Плюсы и минусы

| Плюсы | Минусы |

| Регулируется Биржей Тайбэя | Неясная структура комиссий |

| Доступ к крупным мировым биржам | Ограниченные контактные каналы |

| Длительное время работы |

Cathay Futures Легально?

Cathay Futures имеет лицензию на "Сделки с фьючерсами и торговлю на международном валютном рынке с кредитным плечом", регулируемую Тайбэйской биржей на Тайване.

| Орган регулирования | Текущий статус | Страна регулирования | Тип лицензии | Номер лицензии |

| Тайбэйская биржа (TPEx) | Регулируемый | Китай (Тайвань) | Сделки с фьючерсами и торговля на международном валютном рынке с кредитным плечом | не опубликован |

Cathay Futures Бизнес

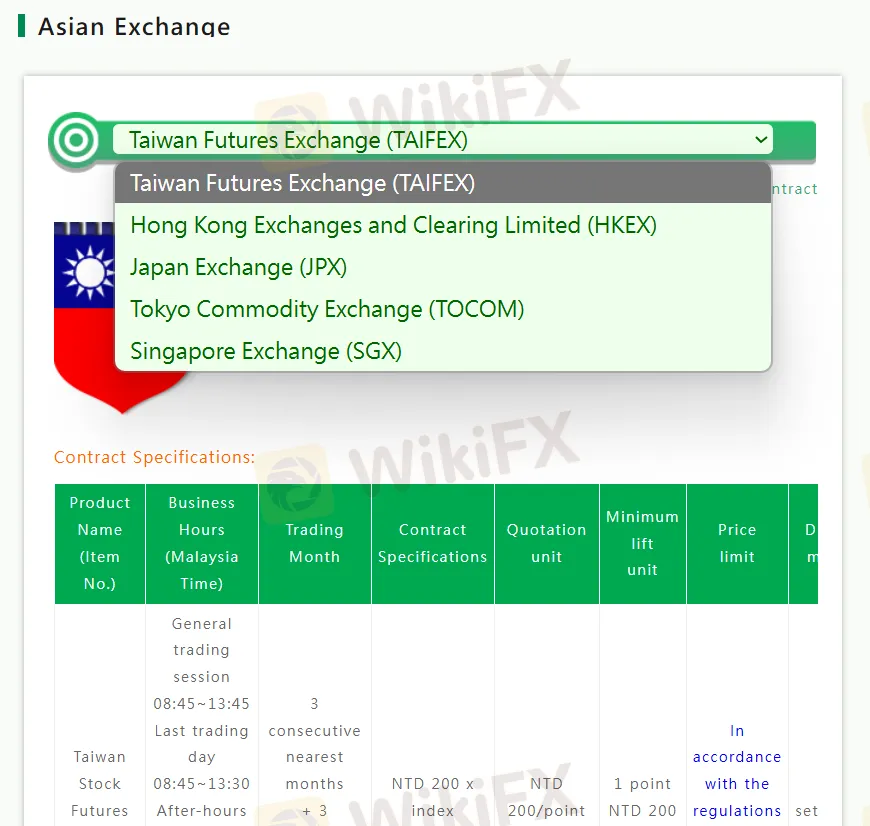

- Азиатские биржи: Cathay Futures предлагает торговые продукты на нескольких крупных азиатских биржах, включая Тайваньскую фьючерсную биржу (TAIFEX), Гонконгскую биржу и клиринговую палату (HKEX), Японскую биржу (JPX), Токийскую товарную биржу (TOCOM) и Сингапурскую биржу (SGX).

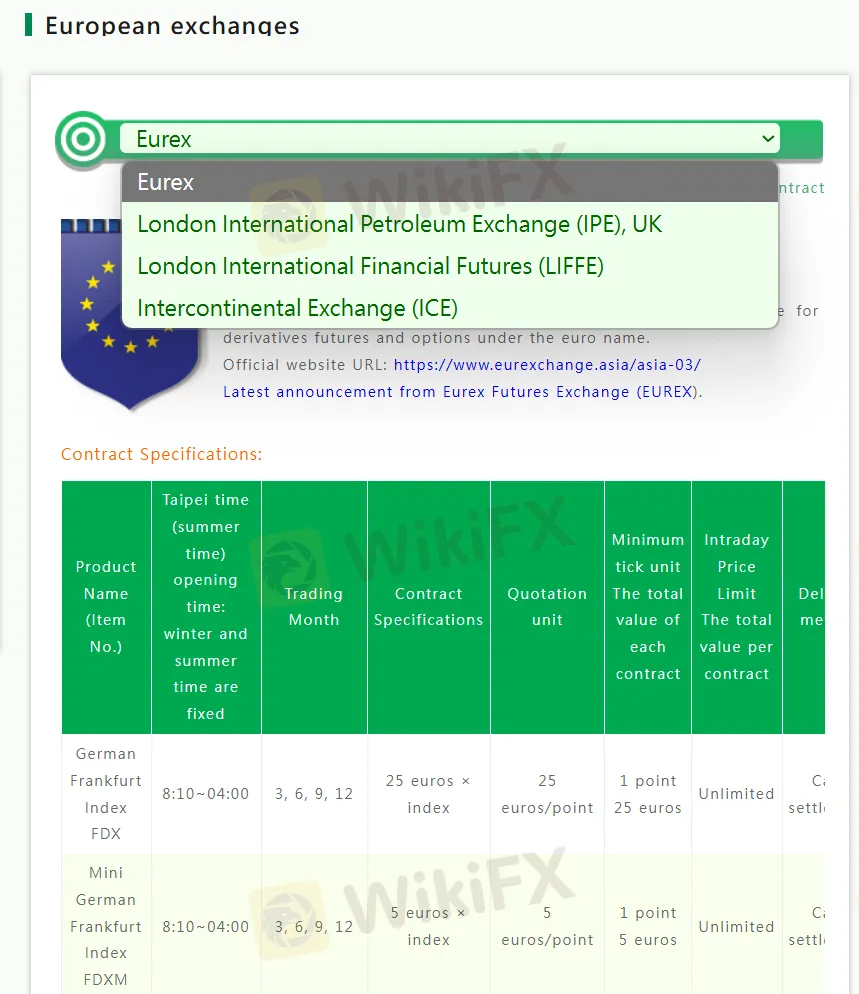

- Европейские биржи: Cathay Futures предоставляет доступ к европейским биржам, таким как Eurex, Лондонская международная нефтяная биржа (IPE), Лондонская международная финансовая фьючерсная биржа (LIFFE) и Межконтинентальная биржа (ICE) для торговли различными фьючерсами и опционами.

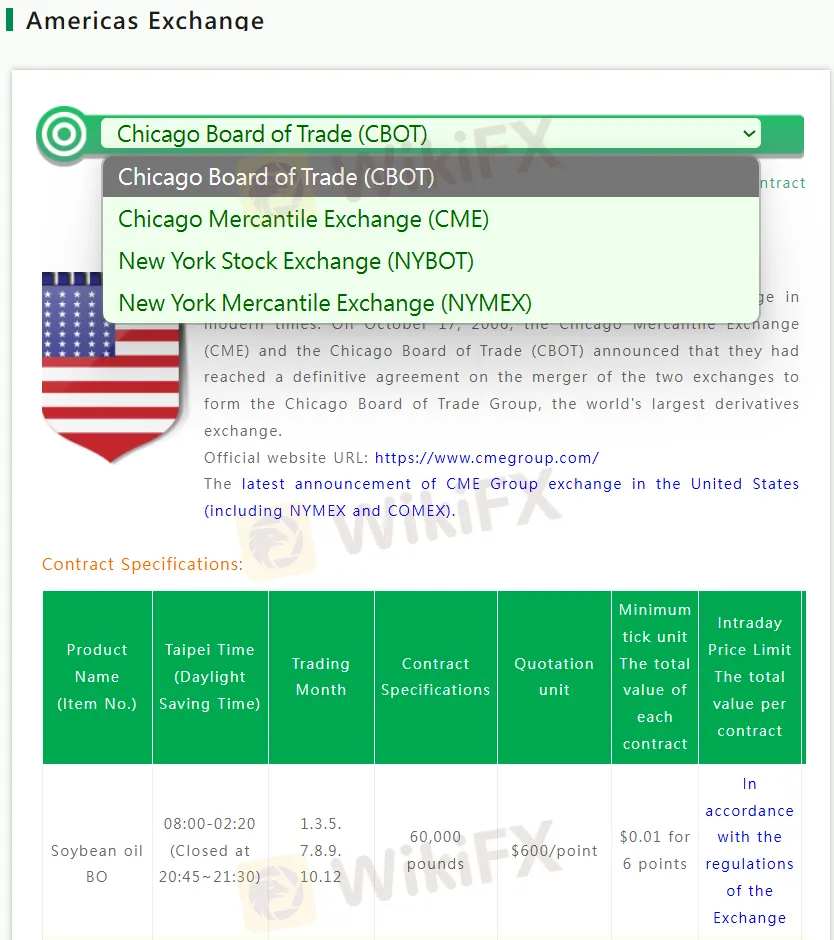

- Биржи Америки: Cathay Futures предлагает торговые продукты на крупных биржах Америки, включая Чикагскую товарную биржу (CBOT), Чикагскую товарную биржу (CME), Нью-Йоркскую фондовую биржу (NYBOT) и Нью-Йоркскую товарную биржу (NYMEX).

Маржа

- Внутренняя товарная маржа: Cathay Futures предоставляет маржинальную торговлю для разнообразных отечественных тайваньских фьючерсов, с первоначальными маржами, изменяющимися в зависимости от финансового продукта; например, для Тайваньского индекса акций (TX) требуется первоначальная маржа в размере NT$356,000.

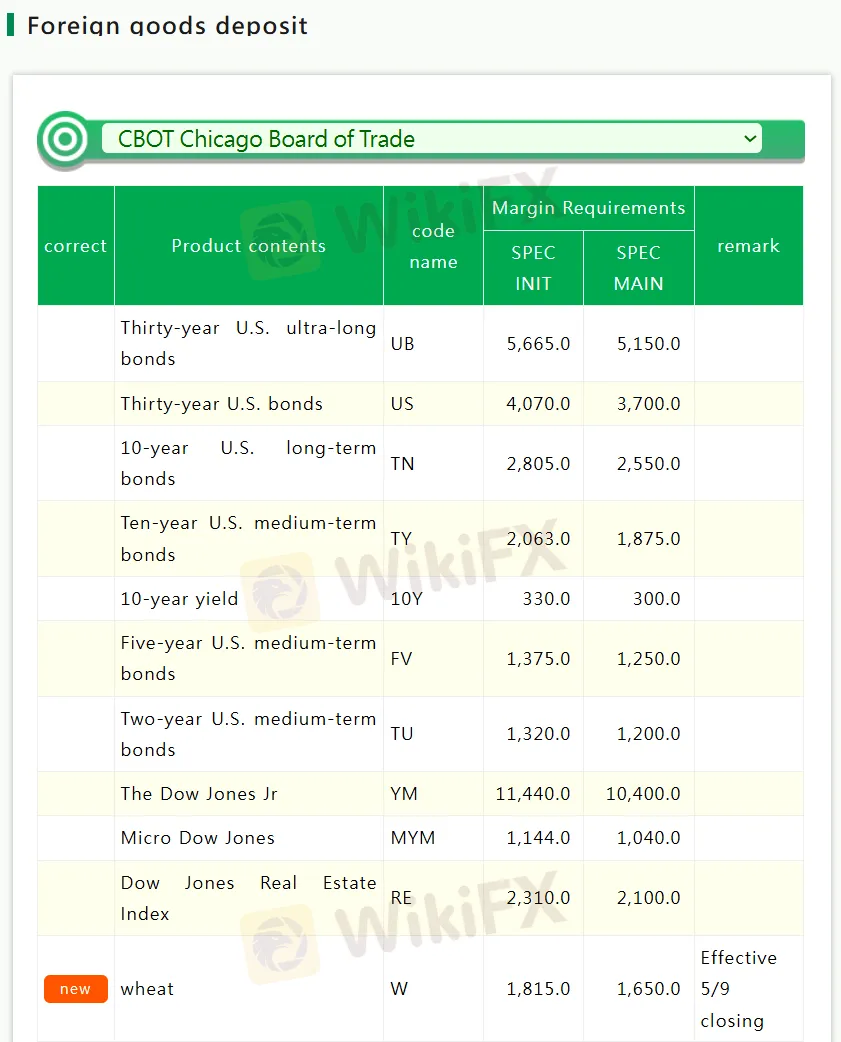

- Залог на иностранные товары: Cathay Futures предлагает залог на иностранные товары для торговых продуктов на Чикагской товарной бирже, Чикагской товарной бирже, с требованиями к марже, изменяющимися в зависимости от финансового продукта; например, первоначальная маржа для Тридцатилетних ультрадлинных облигаций США (UB) составляет SPEC INIT 5,665.0.