公司简介

| Ebury评论摘要 | |

| 成立时间 | 2009 |

| 注册国家 | 英国 |

| 监管 | FCA(超出) |

| 服务 | 支付、外汇风险管理、商业贷款、大宗支付、行业特定解决方案(电子商务、非政府组织、海事、机构) |

| 数字平台 | 在线门户、移动应用、应用程序接口 |

| 客户支持 | 电话:+44 (0) 20 3872 6670 |

| 电子邮件:info@ebury.com | |

| 地址:100 Victoria Street, SW1E 5JL, 伦敦 | |

Ebury信息

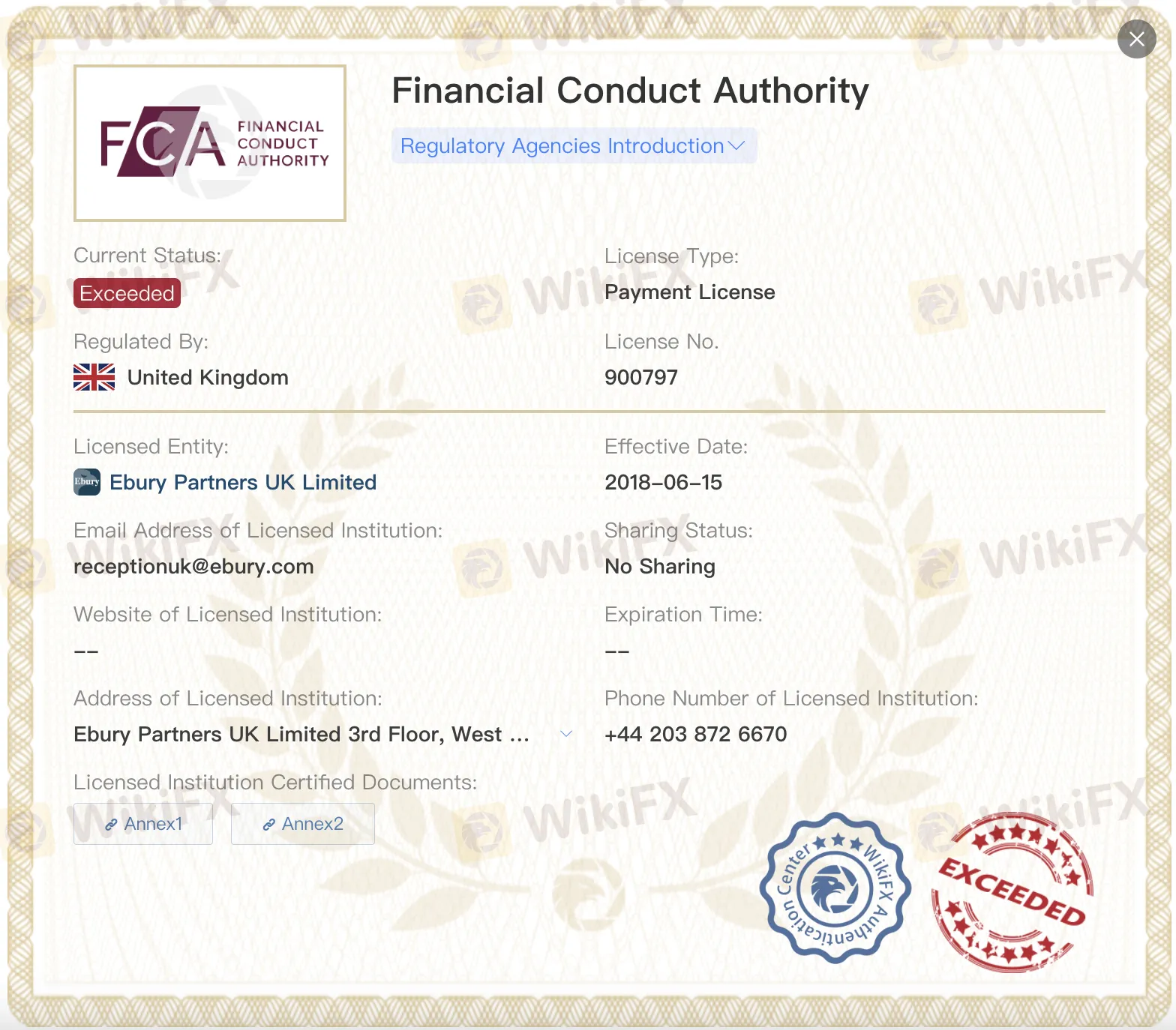

Ebury是一家受英国金融行为监管局认可的受监管金融机构,成立于2009年,总部位于英国。然而,监管状态为“超出”。它利用数字技术为跨国组织和机构投资者提供广泛的服务,如跨境支付、货币风险管理和商业融资。

优缺点

| 优点 | 缺点 |

| 受英国FCA监管 | 许可证“超出” |

| 全球金融服务范围广泛 | 关于手续费的信息有限 |

| 支持企业和机构客户 |

Ebury是否合法?

是的,它受英国金融行为监管局监管,持有两个许可证:支付许可证(编号900797)和投资咨询许可证(编号784063)。然而,这两个许可证均标注为“超出”。

产品和服务

Ebury提供全球金融解决方案,包括支付、外汇风险管理和企业贷款。它还在电子商务、慈善事业和海事等领域提供专业服务。

| 部门 | 类别 | 服务 |

| 企业 | 产品 | 支付与收款 |

| 外汇风险管理 | ||

| 商业贷款 | ||

| 大宗支付 | ||

| 行业解决方案 | 电子商务 | |

| 慈善机构和非政府组织 | ||

| 海事(新) | ||

| 机构 | 机构 | Ebury机构解决方案 |

| 全球账户 | ||

| 风险管理 | ||

| 全球支付 | ||

| 基金融资匹配(新) |

数字平台

通过其网站、移动应用和应用程序接口连接,Ebury提供了一个安全且易于使用的数字平台。各种规模的公司可以利用这些工具在全球开展业务,跟踪资金情况,并自动化任务。

| 平台 | 主要特点 |

| Ebury 在线 | 简单界面,增强报告,安全的全球支付,专家支持 |

| 移动应用 | 随时管理现金流,跟踪交易,双因素认证 |

| 应用程序接口 | 快速集成,自动化管理任务,扩展产品供应,可扩展工具 |