Buod ng kumpanya

| Ebury Buod ng Pagsusuri | |

| Itinatag | 2009 |

| Rehistradong Bansa | United Kingdom |

| Regulasyon | FCA (Lumampas) |

| Mga Serbisyo | Mga Bayad, Panganib sa FX, Pautang sa Negosyo, Mga Bayarang Pangmasa, Solusyon para sa Partikular na Industriya (e-commerce, NGOs, maritime, mga institusyon) |

| Digital na Plataporma | Online Portal, Mobile App, API |

| Suporta sa Customer | Telepono: +44 (0) 20 3872 6670 |

| Email: info@ebury.com | |

| Address: 100 Victoria Street, SW1E 5JL, London | |

Impormasyon Tungkol sa Ebury

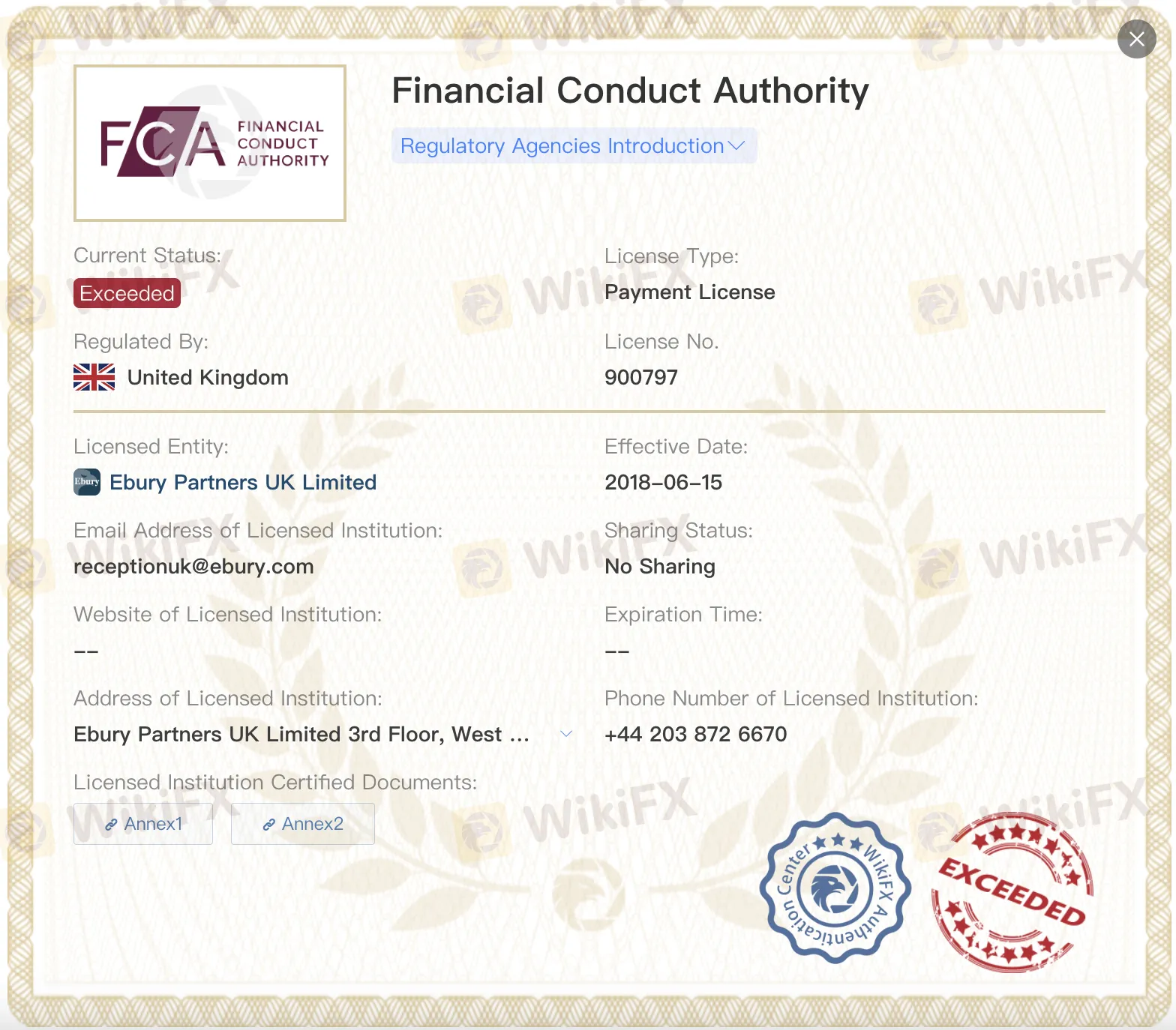

Ebury, isang pinatutunayang institusyon sa pananalapi na akreditado ng Financial Conduct Authority, ay itinatag sa United Kingdom noong 2009. Gayunpaman, ang status ng regulasyon ay "Lumampas". Gumagamit ito ng teknolohiyang digital upang magbigay ng malawak na hanay ng mga serbisyo sa mga multinasyonal na organisasyon at institusyonal na mga mamumuhunan, tulad ng mga bayad sa ibang bansa, pamamahala sa panganib ng pera, at pautang sa negosyo.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng FCA sa UK | Lisensya "Lumampas" |

| Malawak na hanay ng mga serbisyong pinansyal sa pandaigdig | Limitadong impormasyon tungkol sa mga bayad |

| Suporta sa korporasyon at institusyonal na mga kliyente |

Tunay ba ang Ebury?

Oo, ito ay regulado ng UK Financial Conduct Authority (FCA) sa ilalim ng dalawang lisensya: isang Lisensya sa Pagbabayad (Hindi. 900797) at isang Lisensya sa Payo sa Pamumuhunan (Hindi. 784063). Gayunpaman, parehong lisensya ay nakalista bilang "Lumampas".

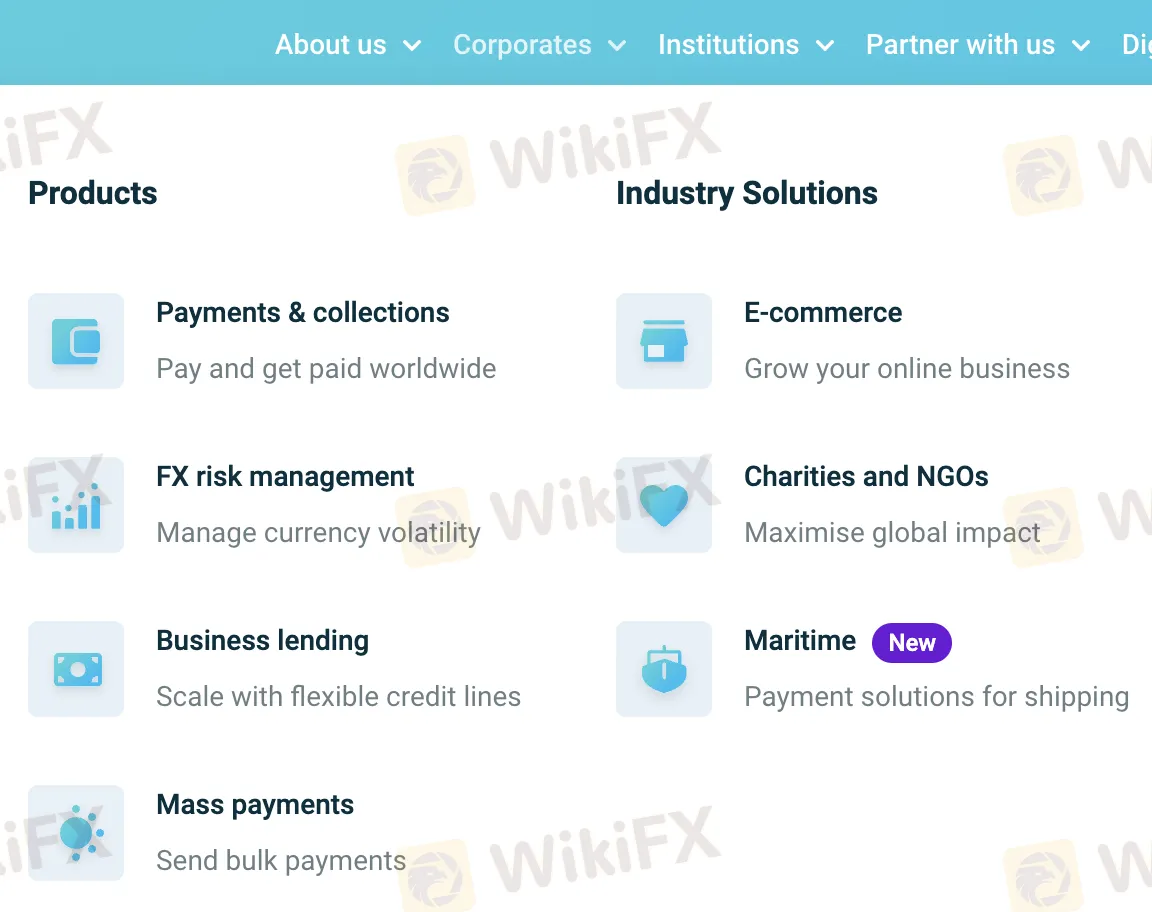

Mga Produkto at Serbisyo

Ang Ebury ay nagbibigay ng mga pandaigdigang solusyon sa pinansyal, kabilang ang mga bayad, pamamahala sa panganib ng FX, at mga pautang sa korporasyon. Nag-aalok din ito ng espesyalisadong mga serbisyo sa mga larangan tulad ng e-commerce, charity, at marine.

| Segmento | Kategorya | Serbisyo |

| Korporasyon | Mga Produkto | Mga Bayad at Koleksyon |

| Pamamahala sa Panganib ng FX | ||

| Pautang sa Negosyo | ||

| Mga Bayarang Pangmasa | ||

| Mga Solusyon sa Industriya | e-commerce | |

| Mga Charities at NGOs | ||

| Maritime (Bago) | ||

| Institusyon | Institusyonal | Ebury Institutional Solutions |

| Mga Global na Account | ||

| Pamamahala sa Panganib | ||

| Mga Global na Bayad | ||

| Pagtutugma sa Pondo para sa Pautang (Bago) |

Digital na Plataporma

Sa pamamagitan ng kanilang website, mobile app, at mga koneksyon sa API, Ebury ay nagbibigay ng ligtas at madaling gamiting digital na plataporma. Maaaring gamitin ng mga kumpanya ng lahat ng sukat ang mga tool na ito upang mag-negosyo sa buong mundo, subaybayan ang kanilang pera, at awtomatikong gawain.

| Plataporma | Mga Pangunahing Tampok |

| Ebury Online | Simpleng interface, pinabuting pag-uulat, ligtas na global na mga pagbabayad, suporta ng mga eksperto |

| Mobile App | Pamahalaan ang daloy ng pera habang nasa biyahe, subaybayan ang mga transaksyon, dalawang-factor na autentikasyon |

| API | Mabilis na integrasyon, awtomatikong mga gawain ng admin, palawakin ang mga alok ng produkto, scalable na mga tool |