Profil perusahaan

| MUFG Ringkasan Ulasan | |

| Didirikan | 2001 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FCA, LFSA |

| Layanan | Layanan Investor, Manajemen Aset, Real Estate, dan Agen Transfer Saham |

| Dukungan Pelanggan | Formulir Kontak |

| Line, Facebook, Youtube | |

| Alamat: 1-4-5, Marunouchi, Chiyoda-ku, Tokyo, Jepang | |

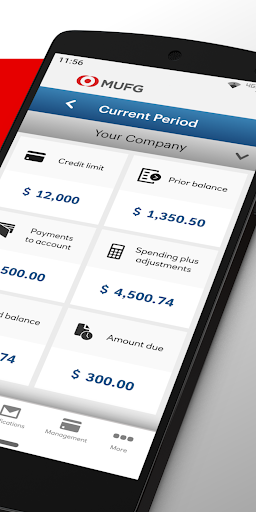

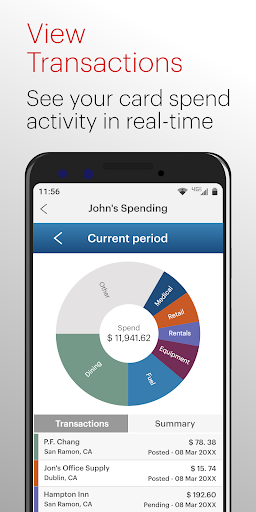

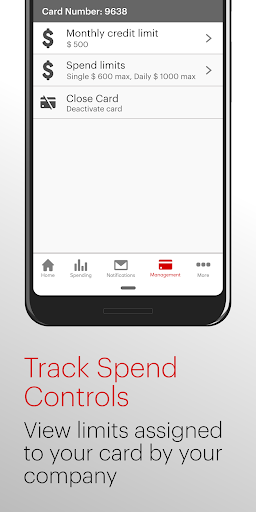

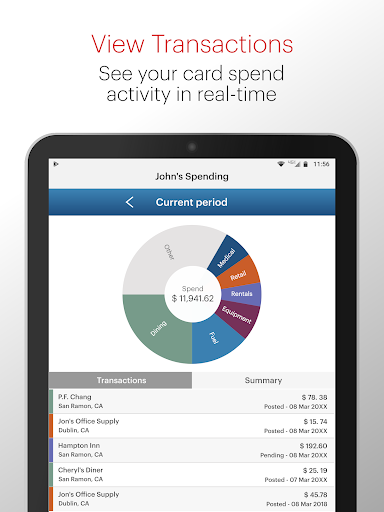

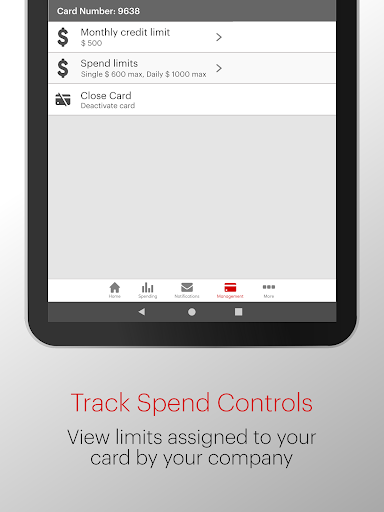

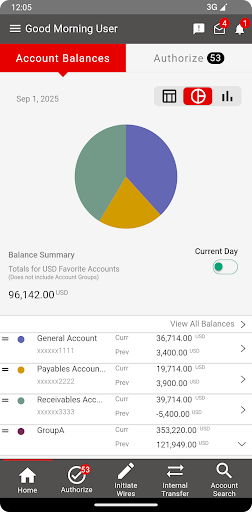

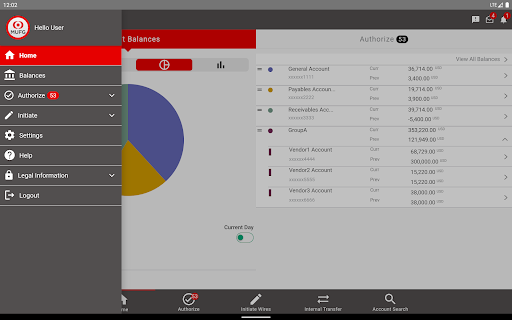

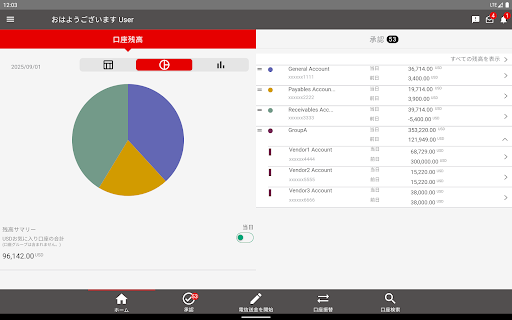

Didirikan pada tahun 2001, Mitsubishi UFJ Financial Group (MUFG) adalah salah satu kelompok keuangan terbesar dan paling beragam di dunia. Saham Grup ini terdaftar di bursa saham Tokyo, Nagoya, dan New York. Layanan MUFG meliputi perbankan komersial, perbankan kepercayaan, sekuritas, kartu kredit, pembiayaan konsumen, manajemen aset, leasing, dan banyak bidang layanan keuangan lainnya. Grup ini memiliki jaringan luar negeri terbesar dari bank Jepang manapun, yang terdiri dari kantor dan anak perusahaan, termasuk Union Bank, di lebih dari 50 negara.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Sejarah panjang | Tidak ada saluran kontak langsung |

| Diatur oleh FCA dan LFSA | |

| Berbagai layanan yang disediakan |

Apakah MUFG Legal?

Ya. MUFG adalah perusahaan terpercaya. Perusahaan ini beroperasi di bawah regulasi Otoritas Perilaku Keuangan (FCA) dan Otoritas Layanan Keuangan Labuan (LFSA).

| Status Regulasi | Teregulasi |

| Teregulasi oleh | Otoritas Perilaku Keuangan (FCA) |

| Institusi Berlisensi | Mitsubishi UFJ Trust and Banking Corporation |

| Tipe Lisensi | Market Making (MM) |

| Nomor Lisensi | 124708 |

| Status Regulasi | Teregulasi |

| Teregulasi oleh | Otoritas Layanan Keuangan Labuan (LFSA) |

| Institusi Berlisensi | MUFG Bank, Ltd., Cabang Labuan |

| Tipe Lisensi | Market Making (MM) |

| Nomor Lisensi | Belum Dirilis |

Layanan

| Layanan | Didukung |

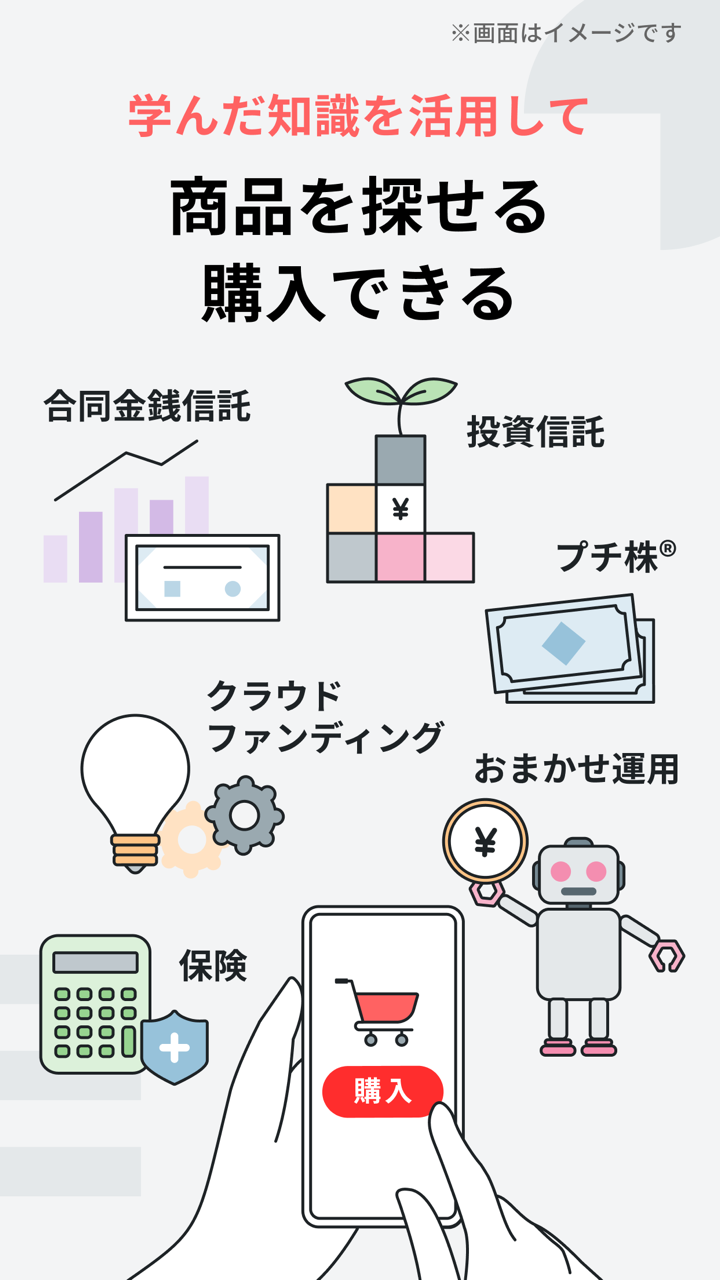

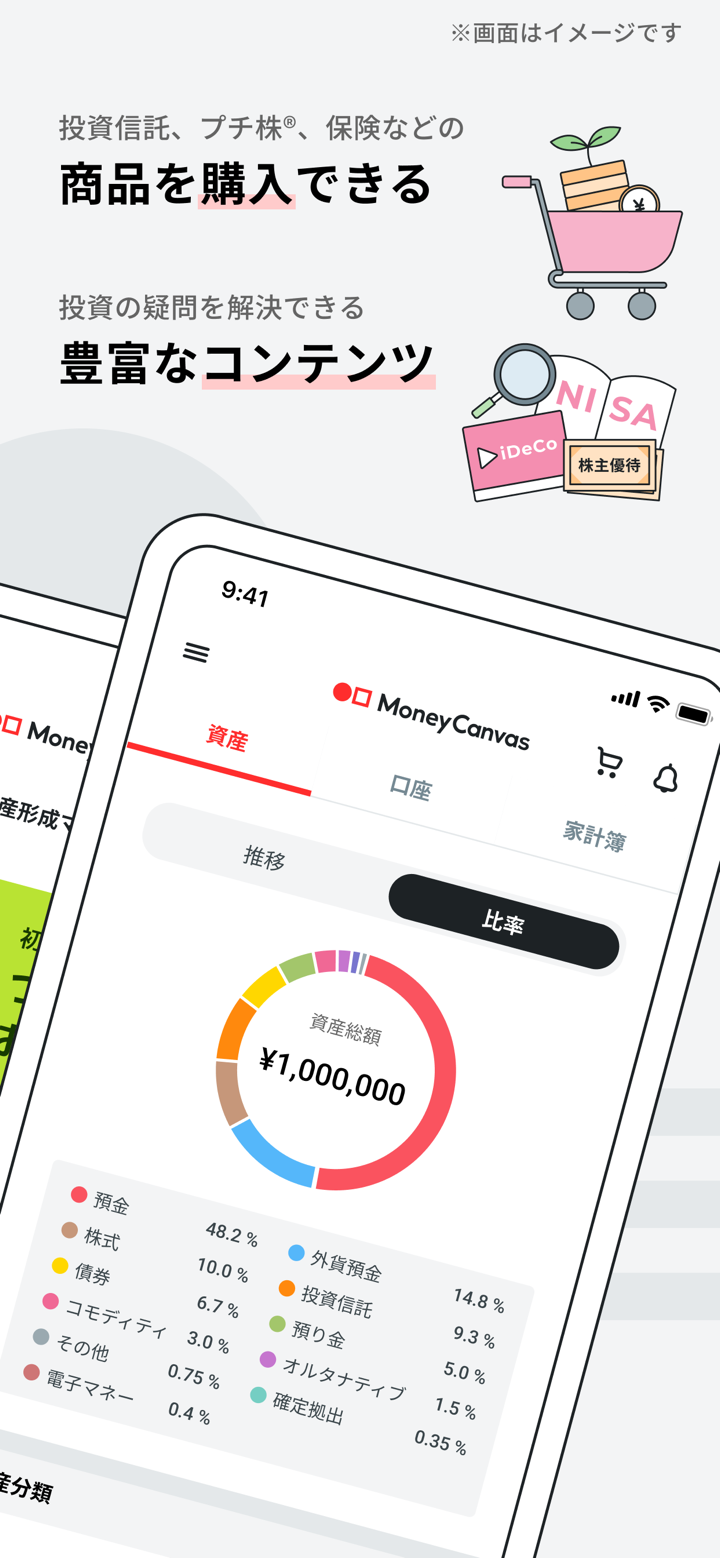

| Layanan Investor | ✔ |

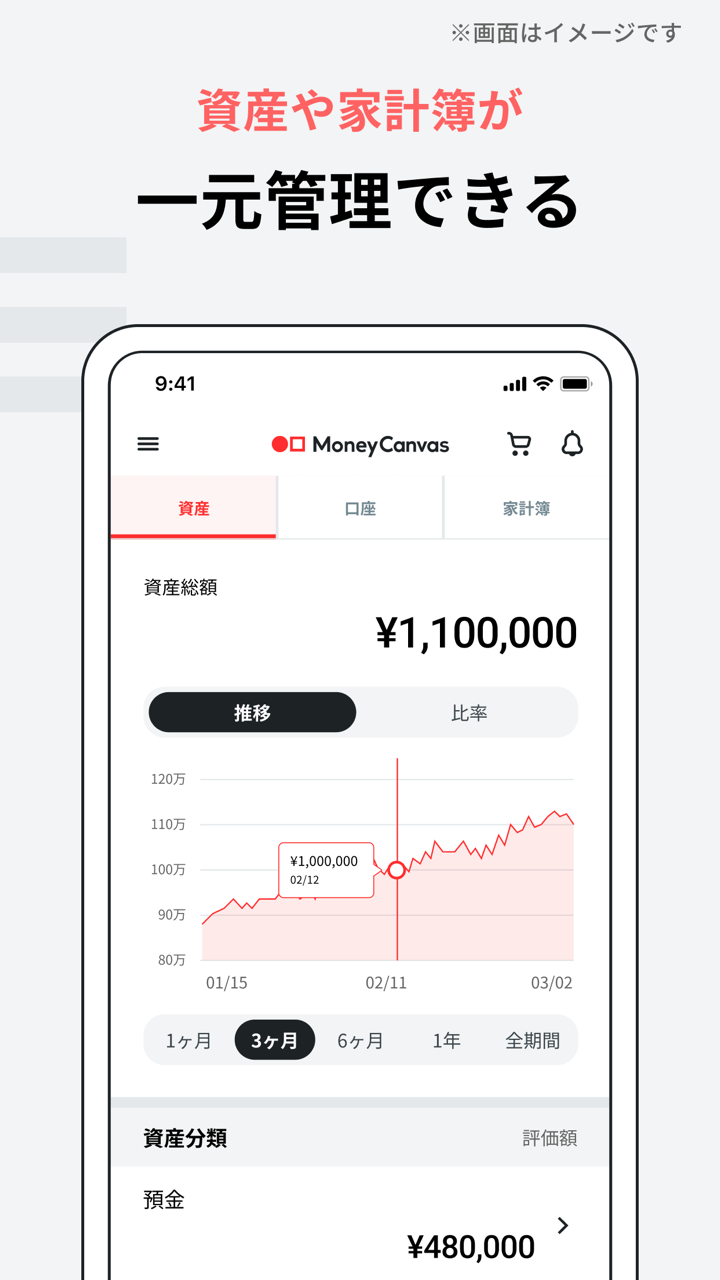

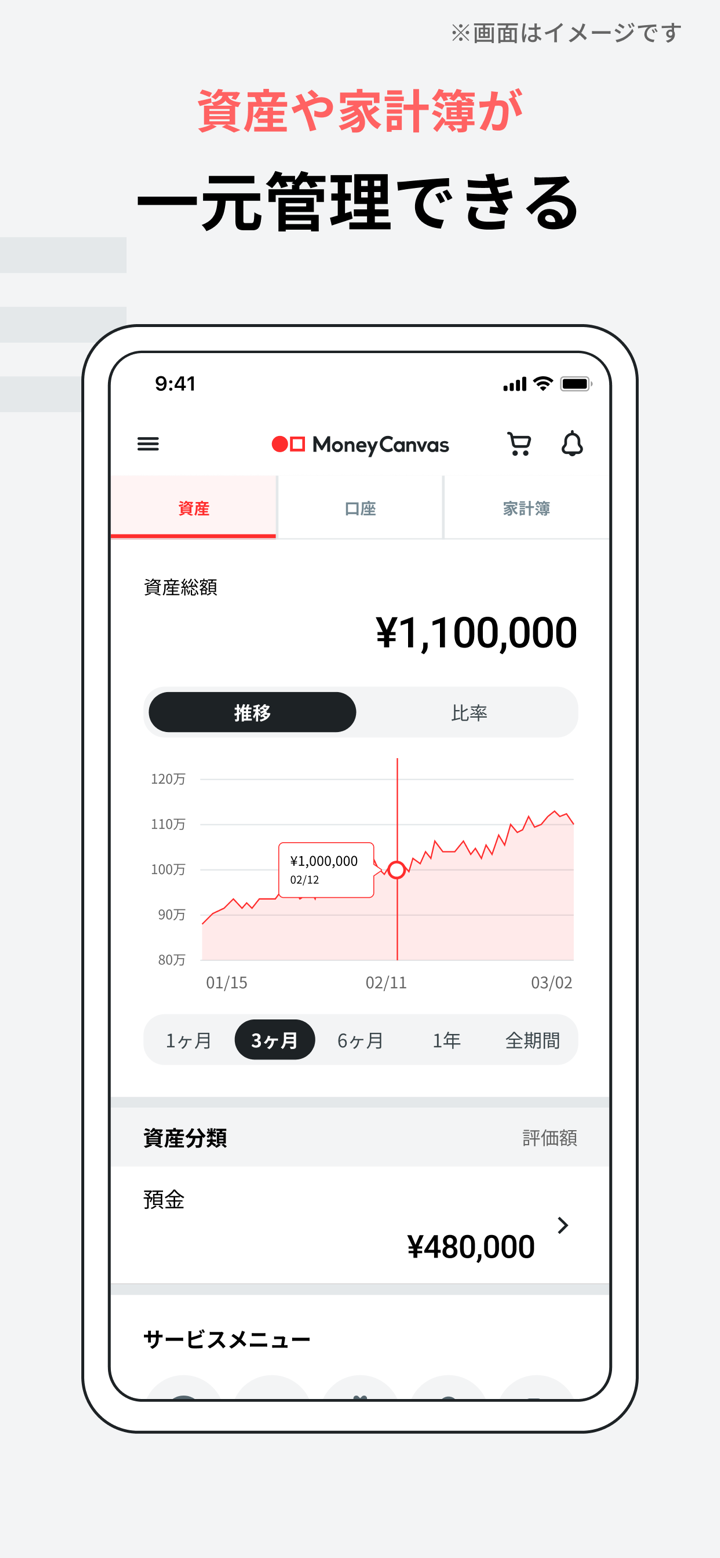

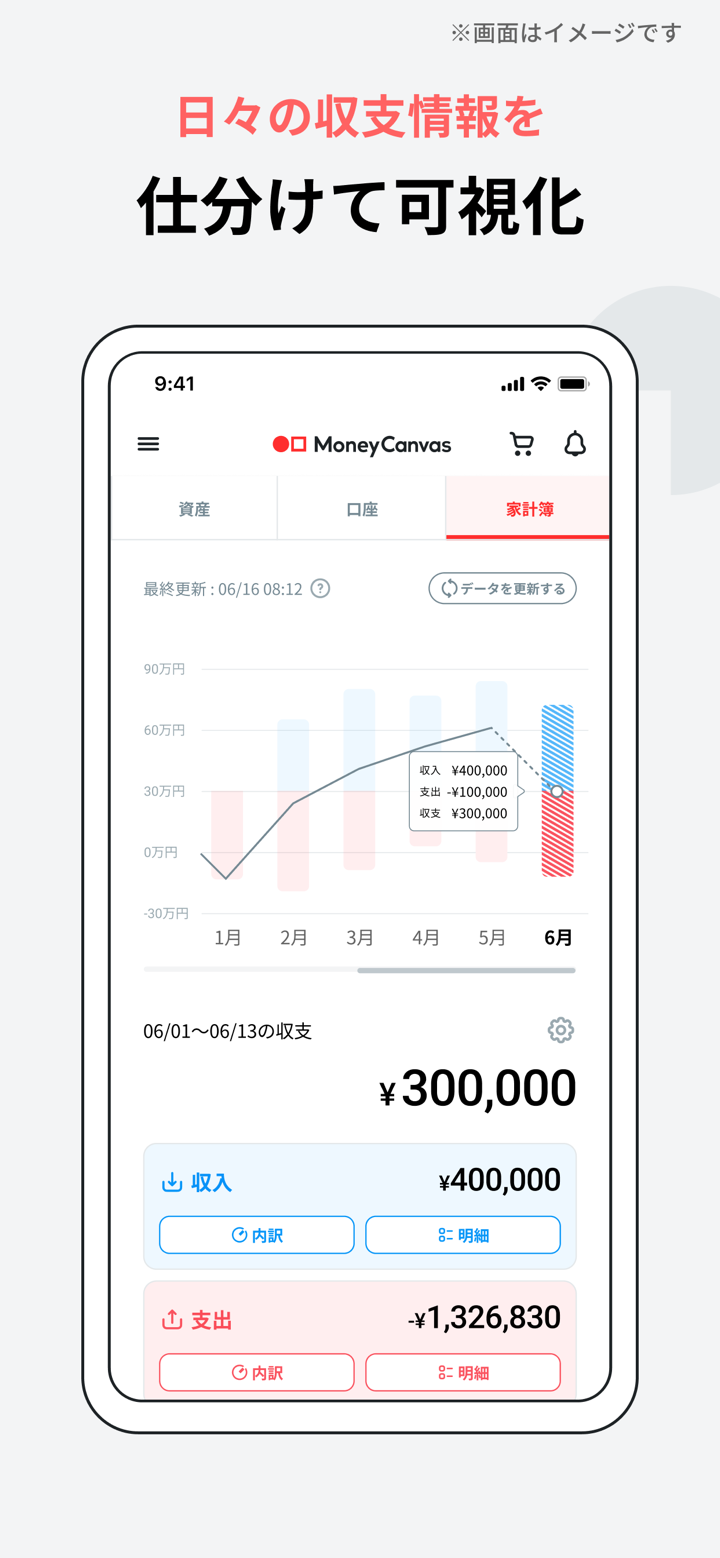

| Manajemen Aset | ✔ |

| Real estate | ✔ |

| Agen Transfer Saham | ✔ |