Company Summary

| MUFG Review Summary | |

| Founded | 2001 |

| Registered Country/Region | Japan |

| Regulation | FCA, LFSA |

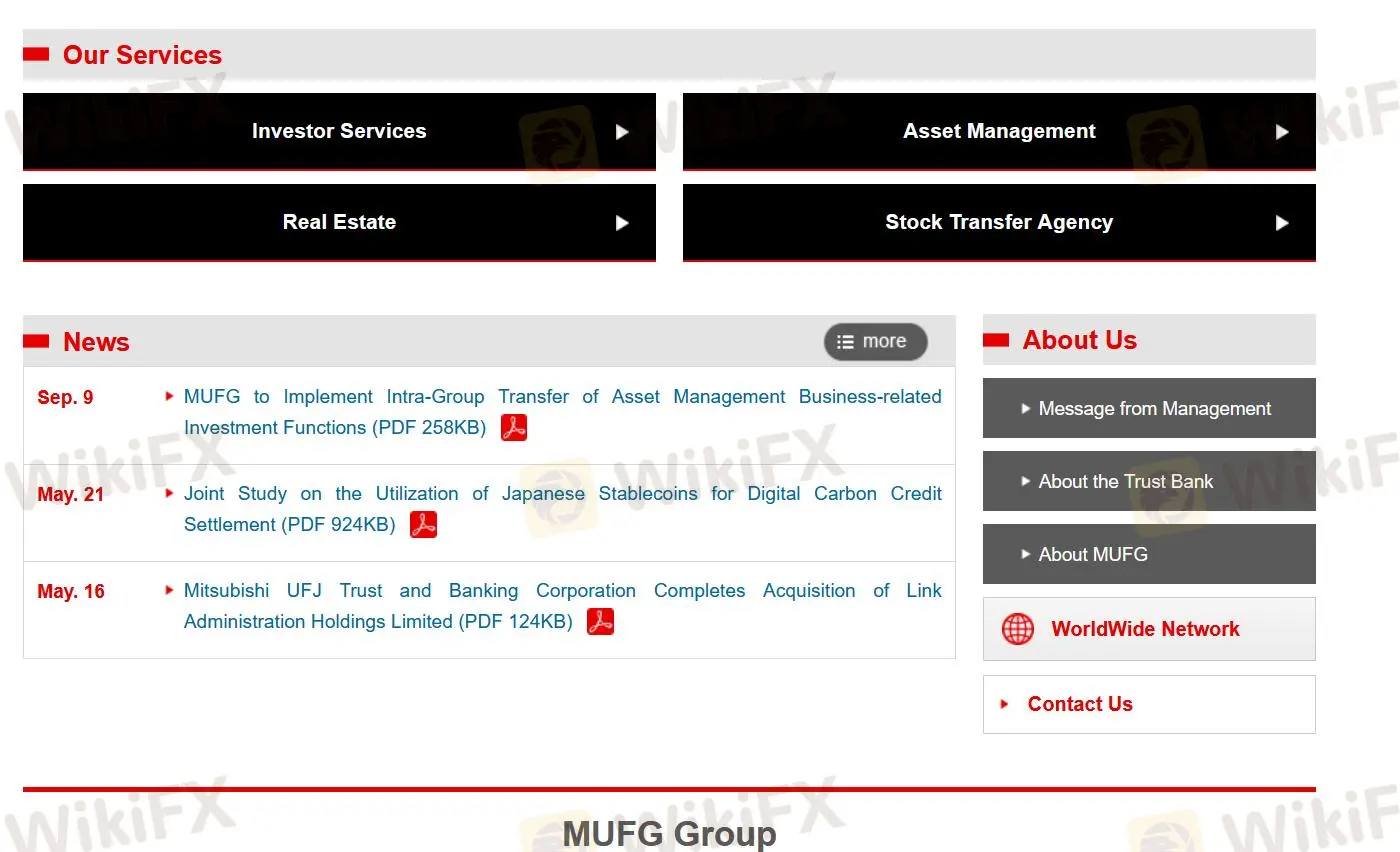

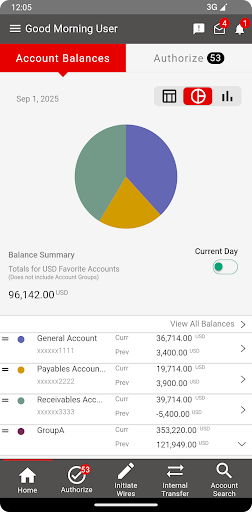

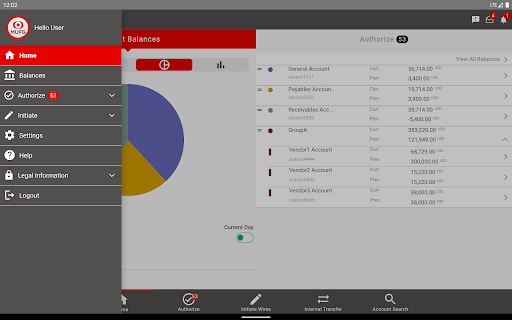

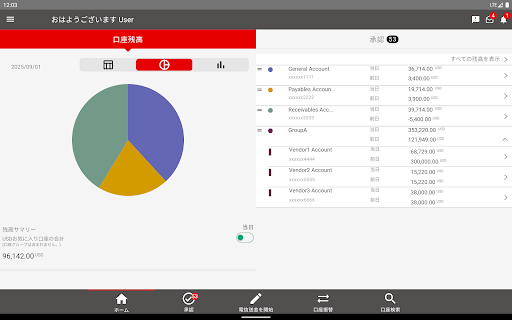

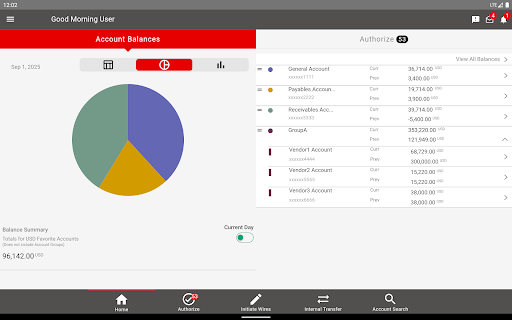

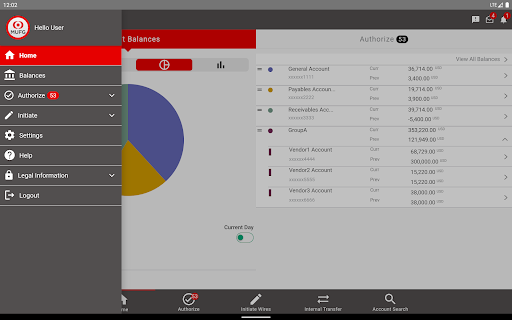

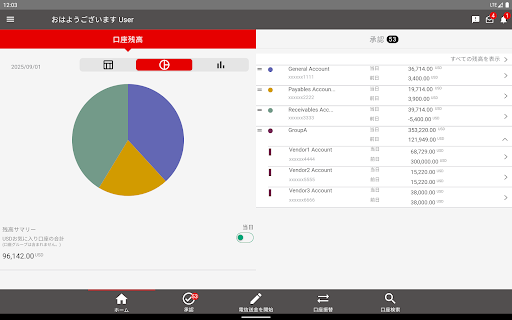

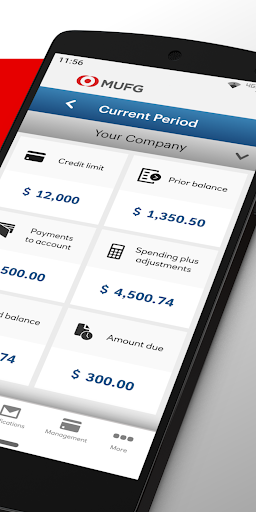

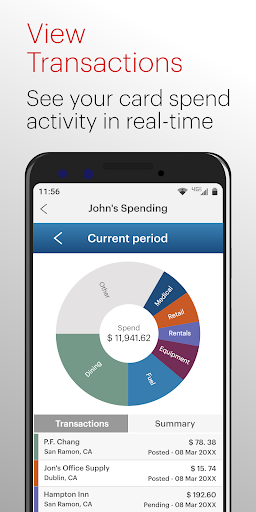

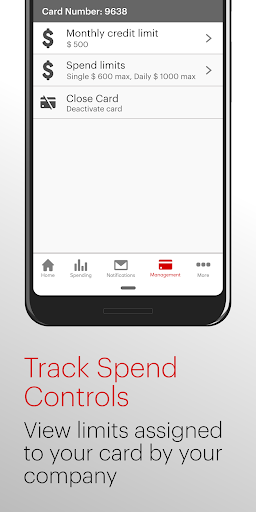

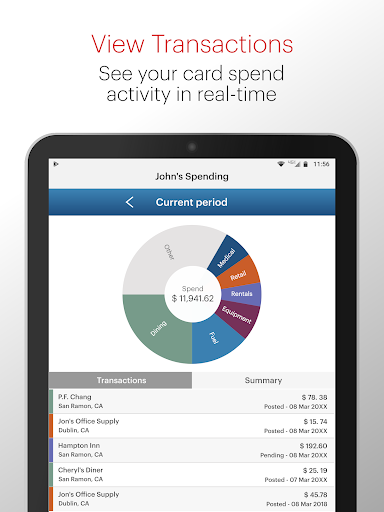

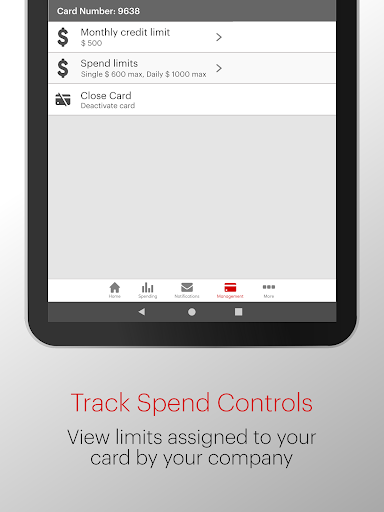

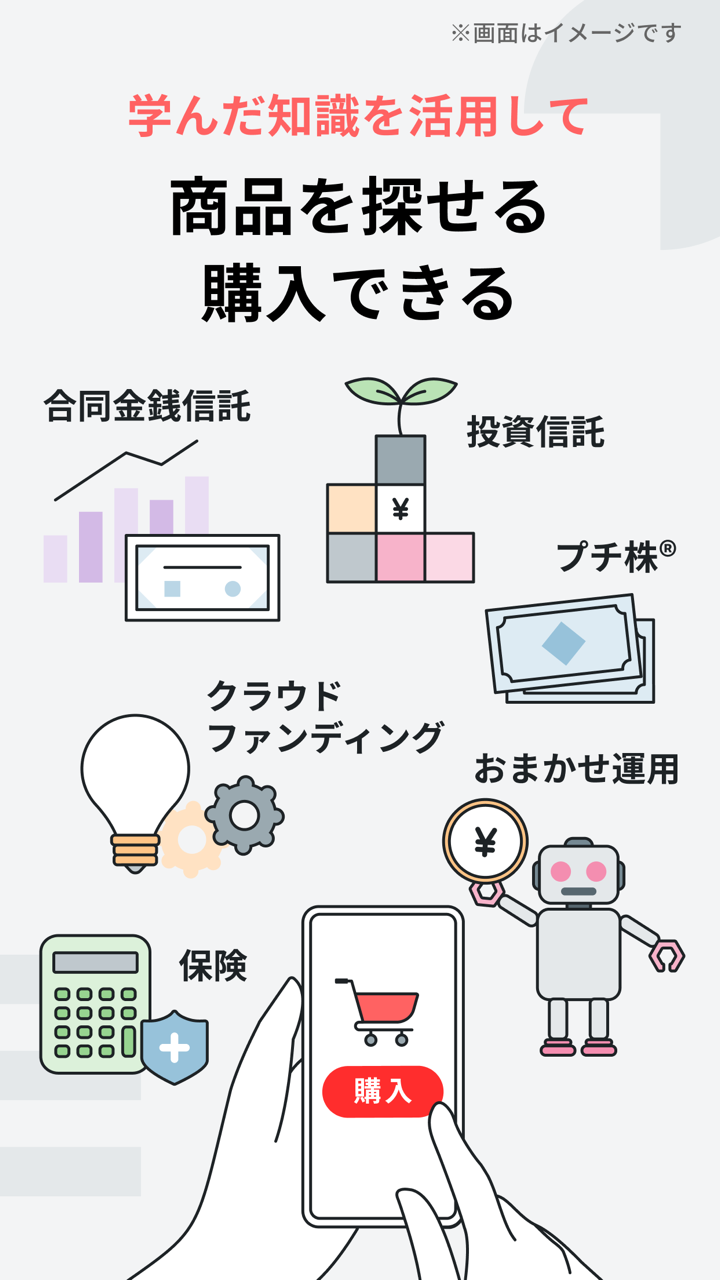

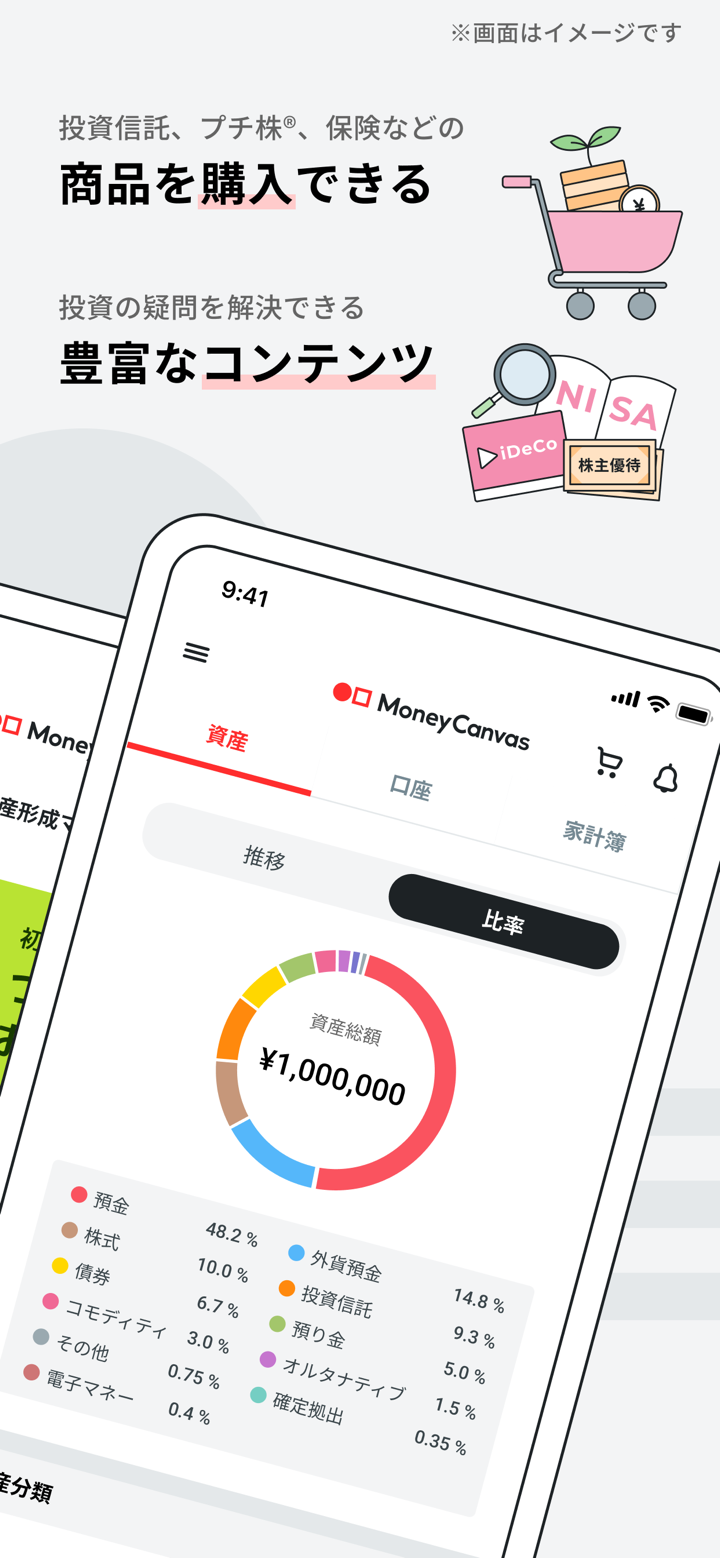

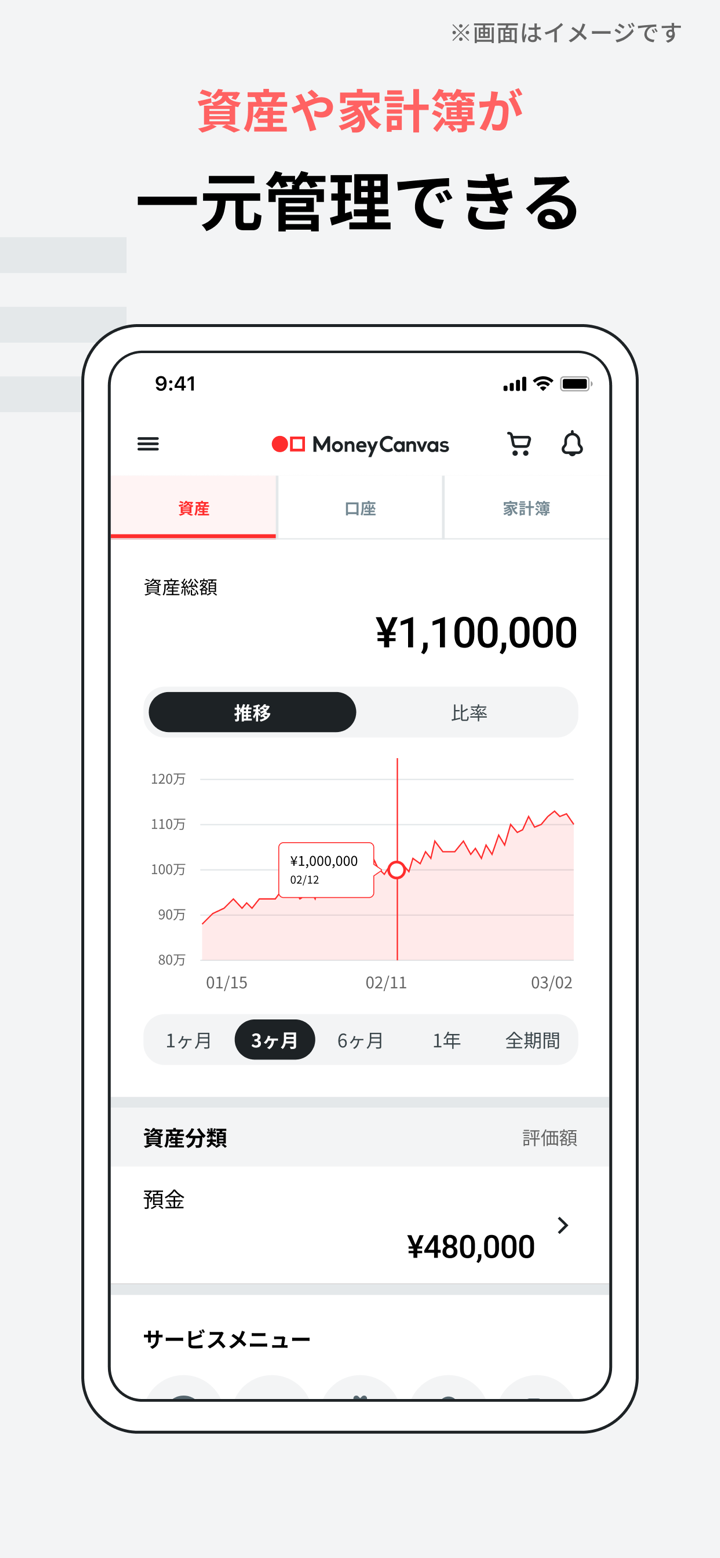

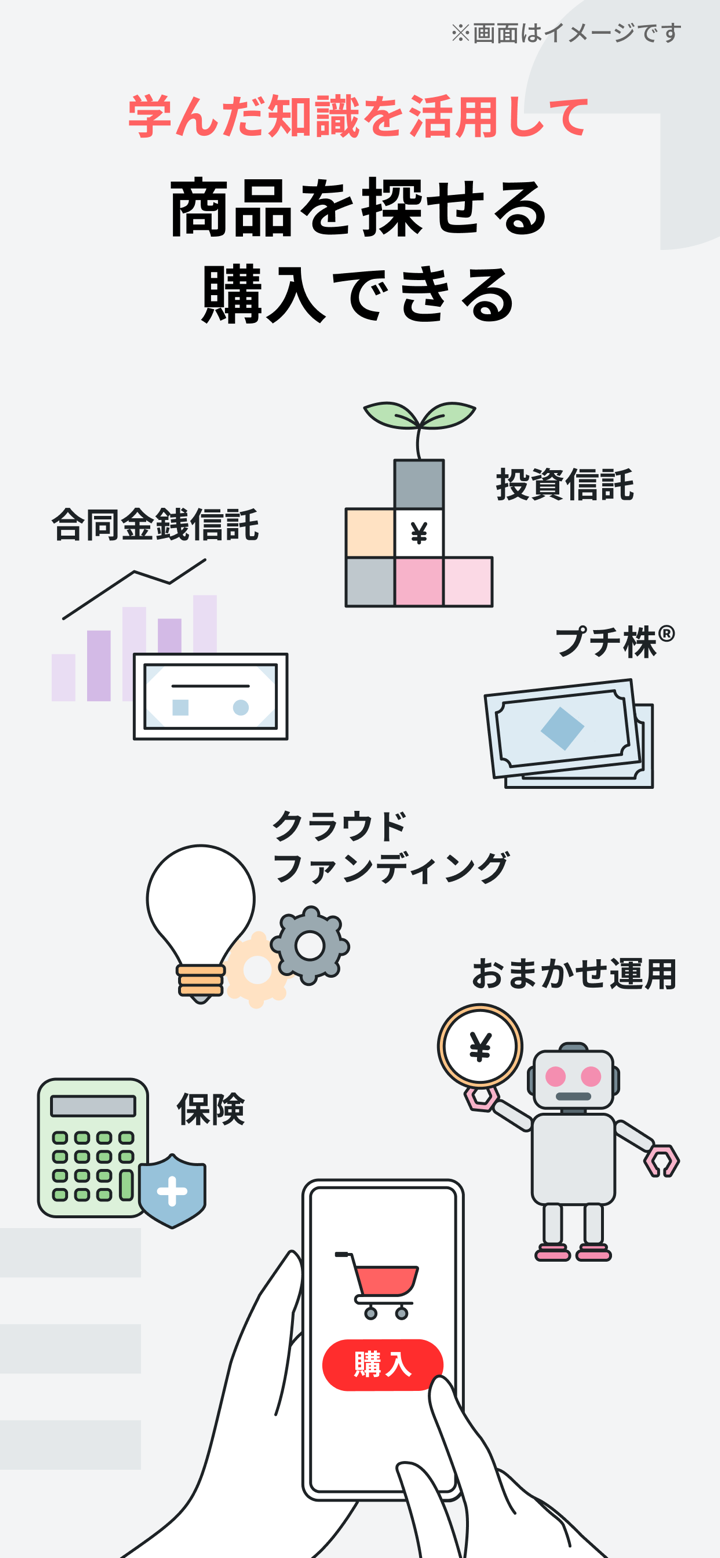

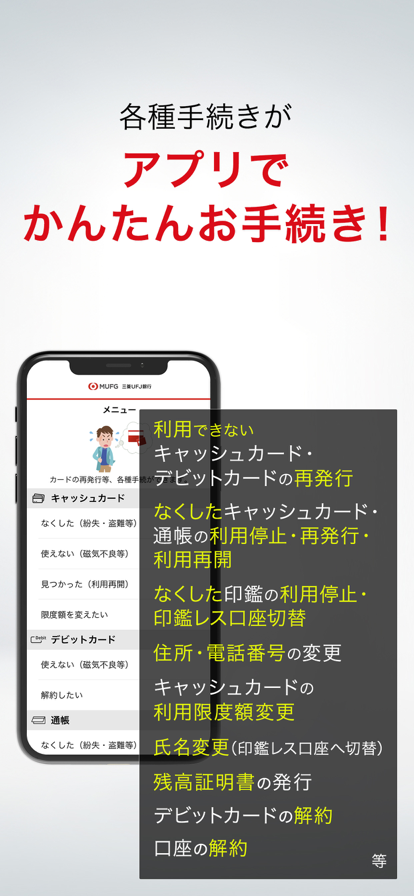

| Services | Investor services, Asset management, Real estate and Stock transfer agency |

| Customer Support | Contact form |

| Line, Facebook, Youtube | |

| Address: 1-4-5, Marunouchi, Chiyoda-ku, Tokyo, Japan | |

Founded in 2001, Mitsubishi UFJ Financial Group (MUFG) is one of the world's largest and most diversified financial groups. The Group's stock is listed on the Tokyo, Nagoya, and New York stock exchanges. MUFG's services include commercial banking, trust banking, securities, credit cards, consumer finance, asset management, leasing and many more fields of financial services. The Group has the largest overseas network of any Japanese bank, comprising offices and subsidiaries, including Union Bank, in more than 50 countries.

Pros and Cons

| Pros | Cons |

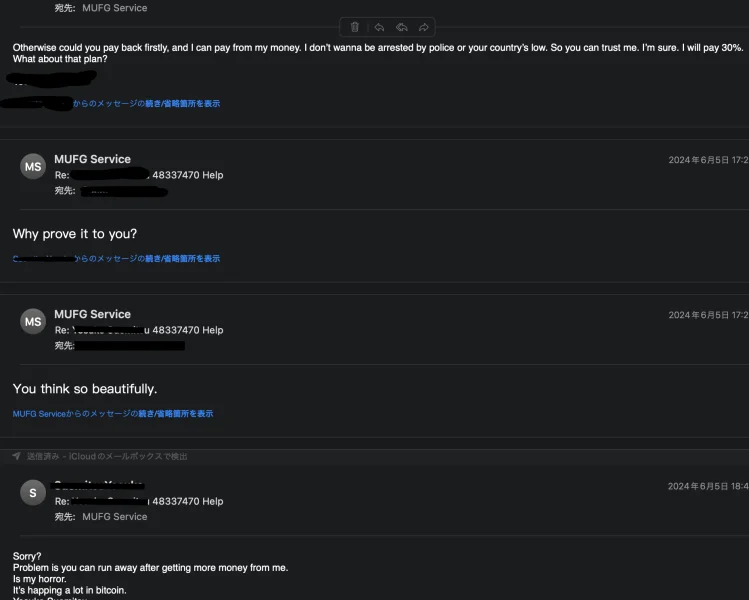

| Long history | No direct contact channels |

| Regulated by FCA and LFSA | |

| Various services provided |

Is MUFG Legit?

Yes. MUFG is a reputable company. It operates under the regulation of Financial Conduct Authority (FCA) and Labuan Financial Services Authority (LFSA).

| Regulatory Status | Regulated |

| Regulated by | Financial Conduct Authority (FCA) |

| Licensed Institution | Mitsubishi UFJ Trust and Banking Corporation |

| Licensed Type | Market Making (MM) |

| Licensed Number | 124708 |

| Regulatory Status | Regulated |

| Regulated by | Labuan Financial Services Authority (LFSA) |

| Licensed Institution | MUFG Bank, Ltd., Labuan Branch |

| Licensed Type | Market Making (MM) |

| Licensed Number | Unreleased |

Services

| Services | Supported |

| Investor Services | ✔ |

| Asset management | ✔ |

| Real estate | ✔ |

| Stock transfer agency | ✔ |