Huge Surge In New Orders Sends US Manufacturing Activity Near 4 Year Highs

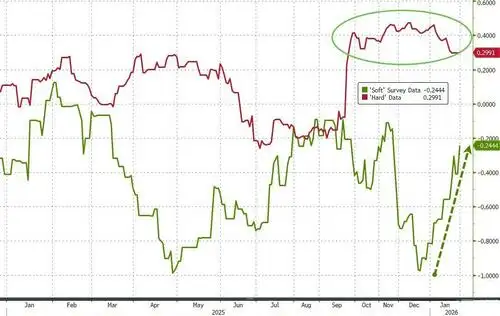

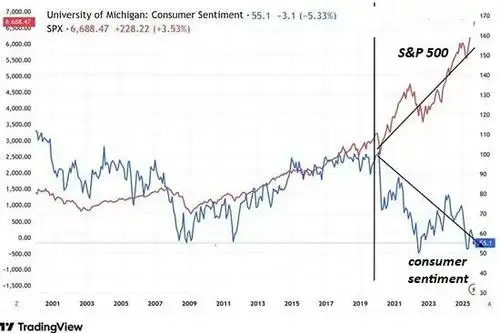

With 'hard' data sustaining signs of solid growth (e.g. factory orders and jobless claims), 'soft' s

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

With 'hard' data sustaining signs of solid growth (e.g. factory orders and jobless claims), 'soft' s

The term has entered the lexiconto describe the divergence of the top tier of earners and owners of

The NEC director, once considered a clear frontrunner for the next Fed chair, said he is fine with his current role.

Economic indicators suggest a stabilization in Germanys services sector. Yet the apparent improvemen

President Donald Trump said Thursday that he will be naming his pick Friday for the new Federal Reserve chair.

President Donald Trump said Thursday that he will be naming his pick Friday for the new Federal Reserve chair.

Narrative control works by having a pat answer for every skepticism and every doubt.Boiled down, the

Narrative control works by having a pat answer for every skepticism and every doubt.Boiled down, the

The U.S. deficit with its global trading partners nearly doubled in November as the shortfall with the European Union swelled.

The U.S. deficit with its global trading partners nearly doubled in November as the shortfall with the European Union swelled.

While sentiment is sagging to multi-year lows, 'hard' data is pushing growth forecasts higher (GDPNO

While sentiment is sagging to multi-year lows, 'hard' data is pushing growth forecasts higher (GDPNO

President Donald Trump announced on Jan. 27 that farm equipment maker John Deere will invest $70 mil

Shopping malls, long an economic and cultural fixture of American life,are facing sustained pressure

A five-month process of finding the next Fed chair appears to be down to its final days, with one candidate emerging as the betting favorite.

A five-month process of finding the next Fed chair appears to be down to its final days, with one candidate emerging as the betting favorite.

A much-anticipated trade deal between India and the U.S. is at "a very advanced stage," India's oil and natural gas minister told CNBC Tuesday.

A much-anticipated trade deal between India and the U.S. is at "a very advanced stage," India's oil and natural gas minister told CNBC Tuesday.

The long-awaited deal comes as both Delhi and Brussels contend with economic and geopolitical pressure from the US.

Winter storm Fern is mostly over, its resulting damage, however, will linger for a long time.To asse