Macron's India Trip Exposes EU Tech Overreach And Policy Failures

At times, it seems almost absurdly comical when senior European Union officials make conspicuous eff

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

At times, it seems almost absurdly comical when senior European Union officials make conspicuous eff

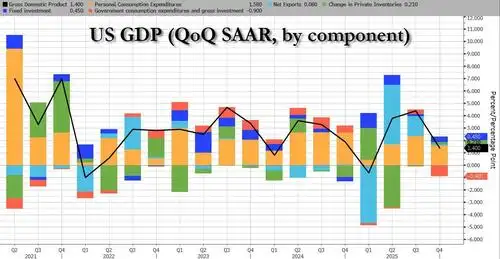

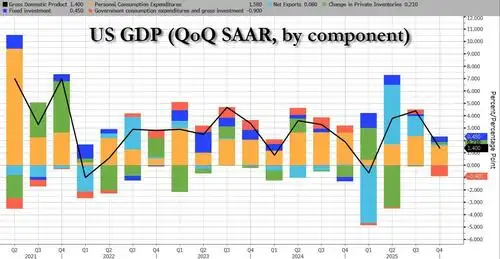

The core PCE price index was expected to increase 3% from a year ago in December. GDP was projected to rise at a 2.5% pace in Q4.

The core PCE price index was expected to increase 3% from a year ago in December. GDP was projected to rise at a 2.5% pace in Q4.

There was a big surprise at 8:30am ET when the BEA reported the (delayed) GDP print for the last qua

There was a big surprise at 8:30am ET when the BEA reported the (delayed) GDP print for the last qua

The U.S. trade deficit swelled in December, closing out a year in which the imbalance was essentially unchanged.

The U.S. trade deficit swelled in December, closing out a year in which the imbalance was essentially unchanged.

The U.S. trade deficit swelled in December, closing out a year in which the imbalance was essentially unchanged.

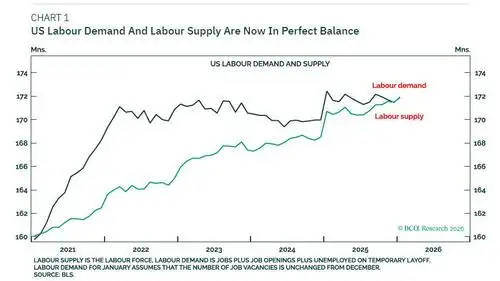

The Trump administration's crackdown on illegal immigration has resulted in an 80% collapse in net i

The NEC director ripped the report, saying that central bank researchers ignored key aspects of how the duties worked

The NEC director ripped the report, saying that central bank researchers ignored key aspects of how the duties worked

Despite slumping sentiment surveys, 'hard' data continues to suggest the US economy is ticking along

The U.K. inflation rate cooled to 3% in January, according to the latest figures from the Office for National Statistics (ONS).

The U.K. inflation rate cooled to 3% in January, according to the latest figures from the Office for National Statistics (ONS).

Inflation, bloating GDP with public spending and immigration and hidden unemployment are the ingredi

The consumer price index was expected to increase 2.5% from a year ago in January, according to the Dow Jones consensus.

Executive Summary:Some Like It Hot The US economy has reached a watershed. For the first time since

Investors got some good news this week on the state of the labor market, and more may be on the way Friday on inflation.

The U.K. economy grew a meager 0.1% in the fourth quarter, according to preliminary figures from the Office for National Statistics on Thursday.

The U.K. economy grew a meager 0.1% in the fourth quarter, according to preliminary figures from the Office for National Statistics on Thursday.