Amount resolved within one month(USD)

$184,789

Number of People Resolved

15414

Broker

FBS

Exposure Type

Severe Slippage

Indonesia

02-22

Indonesia

02-22

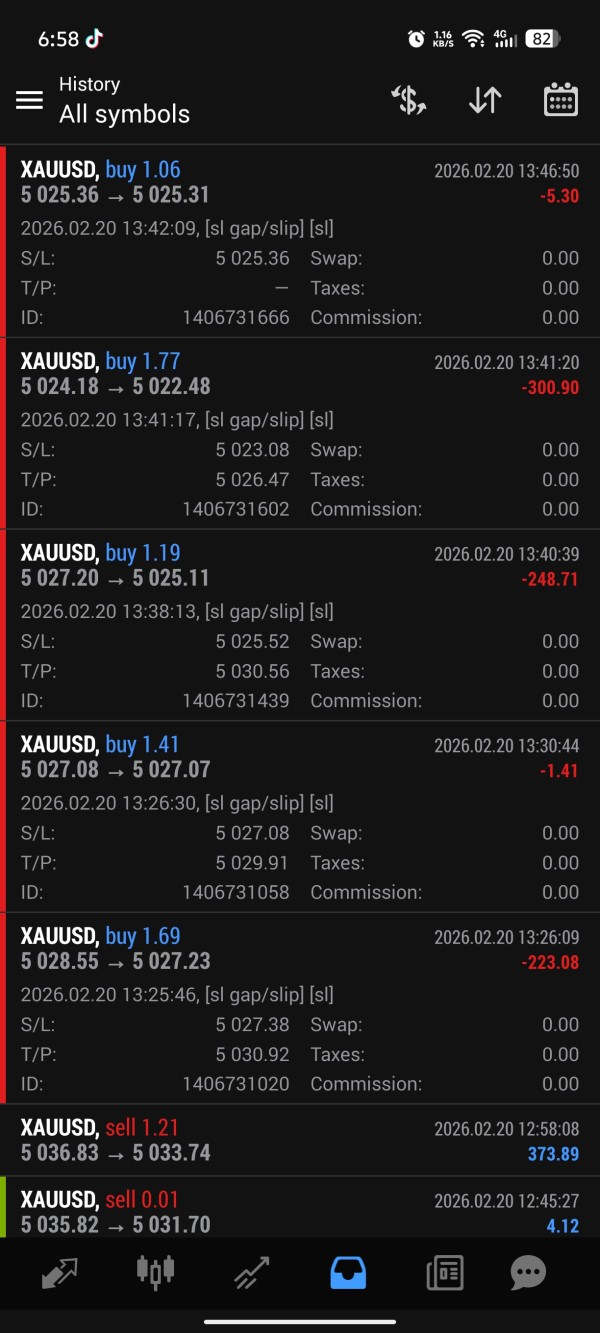

Broker

HFM

Exposure Type

Severe Slippage

Iraq

01-29

Iraq

01-29

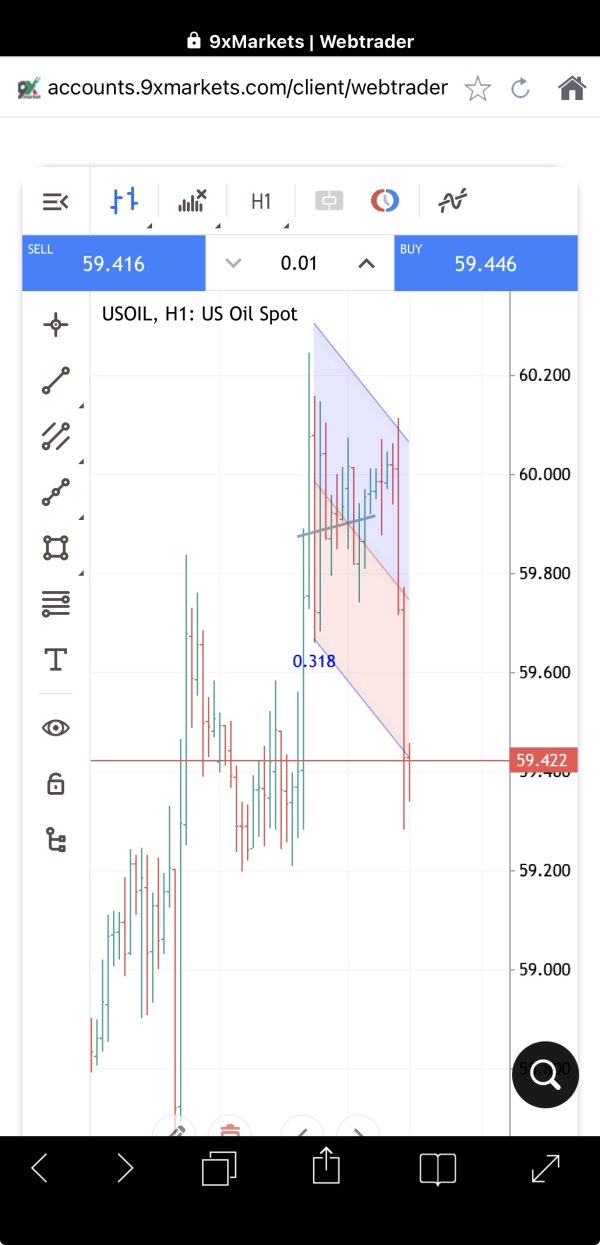

Broker

9X markets

Exposure Type

Severe Slippage

India

2025-12-11

India

2025-12-11

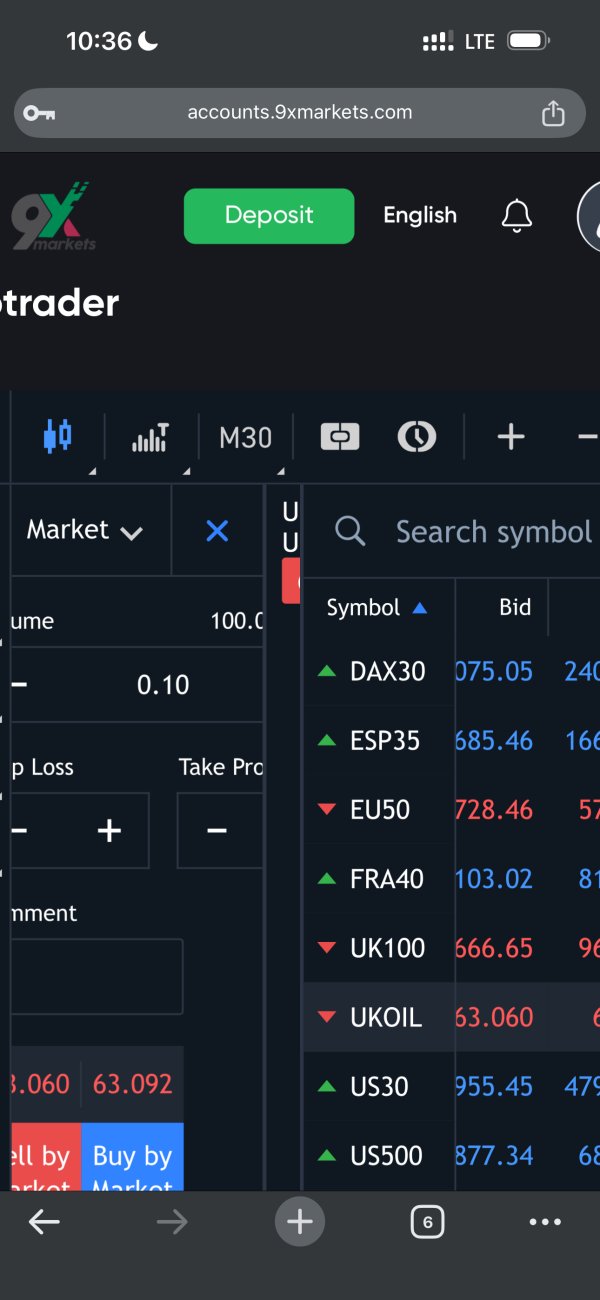

Broker

9X markets

Exposure Type

Severe Slippage

Pakistan

2025-12-09

Pakistan

2025-12-09

Broker

9X markets

Exposure Type

Severe Slippage

Pakistan

2025-12-08

Pakistan

2025-12-08

Broker

9X markets

Exposure Type

Severe Slippage

Pakistan

2025-12-08

Pakistan

2025-12-08

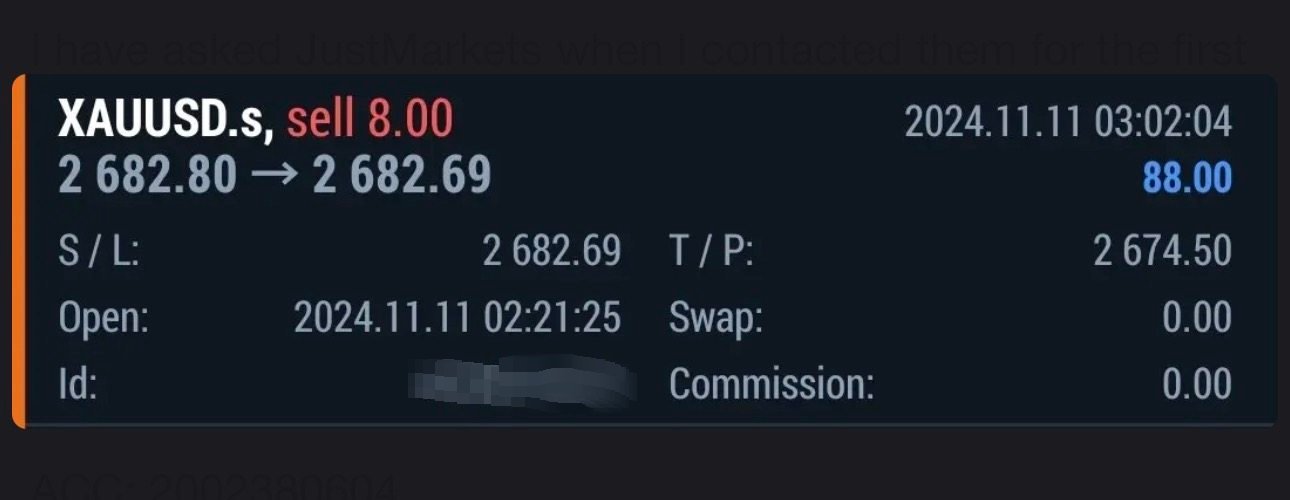

Broker

CARLTON

Exposure Type

Severe Slippage

Sri Lanka

2025-12-03

Sri Lanka

2025-12-03

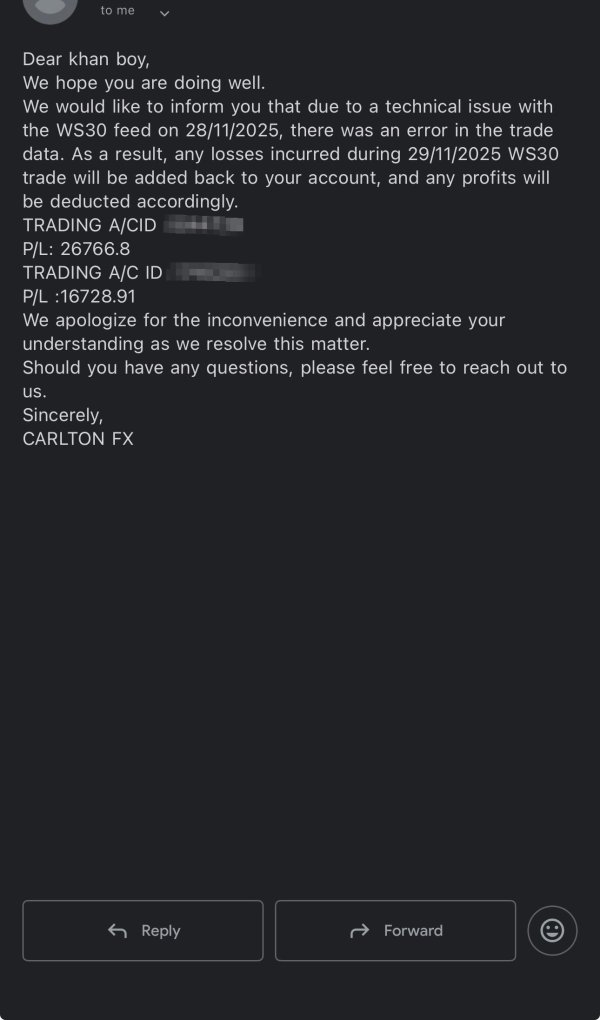

Broker

CARLTON

Exposure Type

Severe Slippage

Sri Lanka

2025-12-03

Sri Lanka

2025-12-03

Broker

CARLTON

Exposure Type

Severe Slippage

Pakistan

2025-12-03

Pakistan

2025-12-03

Broker

CARLTON

Exposure Type

Severe Slippage

Pakistan

2025-12-03

Pakistan

2025-12-03

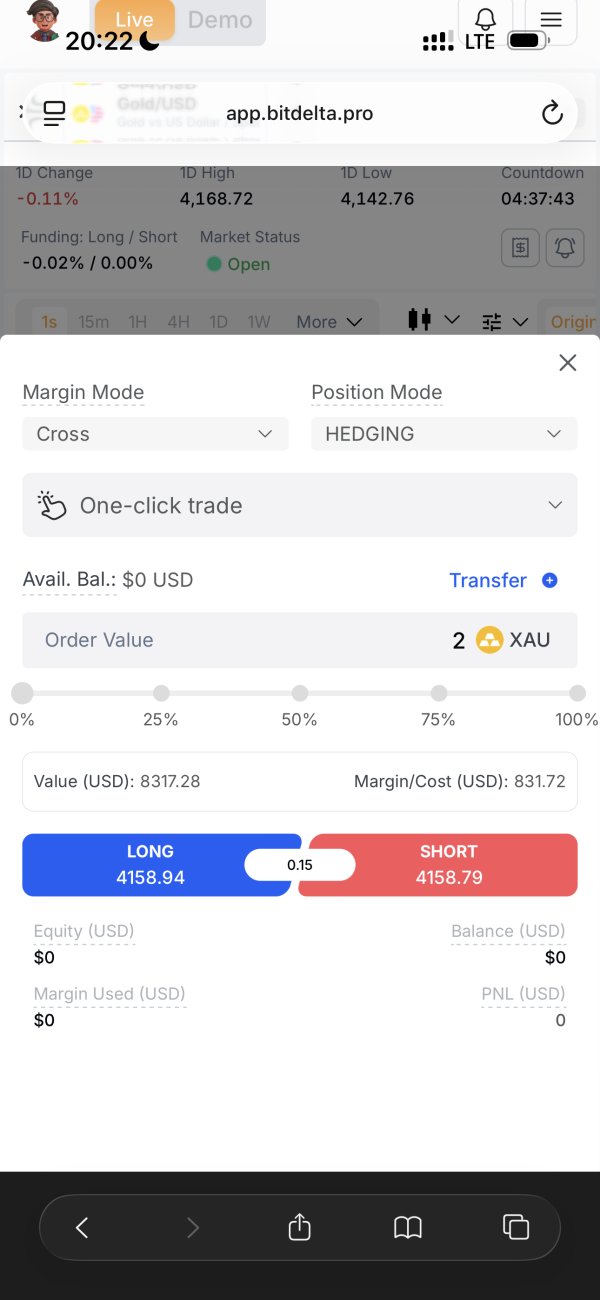

Broker

BitDelta Pro

Exposure Type

Severe Slippage

Bangladesh

2025-11-28

Bangladesh

2025-11-28

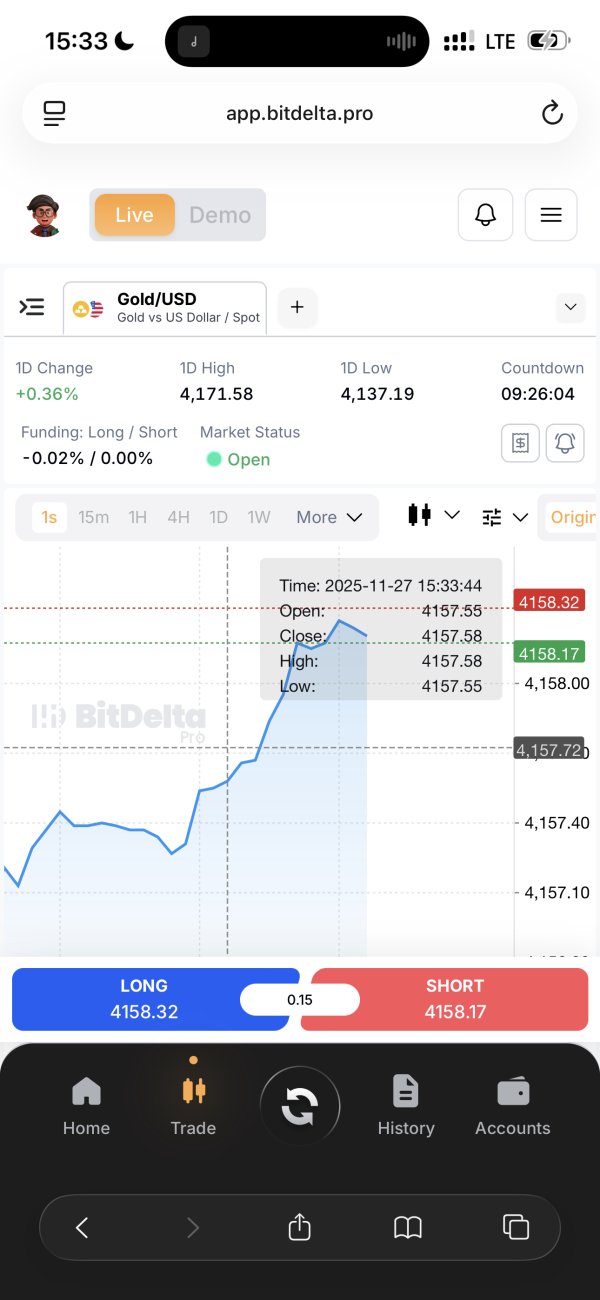

Broker

BitDelta Pro

Exposure Type

Severe Slippage

Bangladesh

2025-11-27

Bangladesh

2025-11-27

Broker

BitDelta Pro

Exposure Type

Severe Slippage

Bangladesh

2025-11-26

Bangladesh

2025-11-26

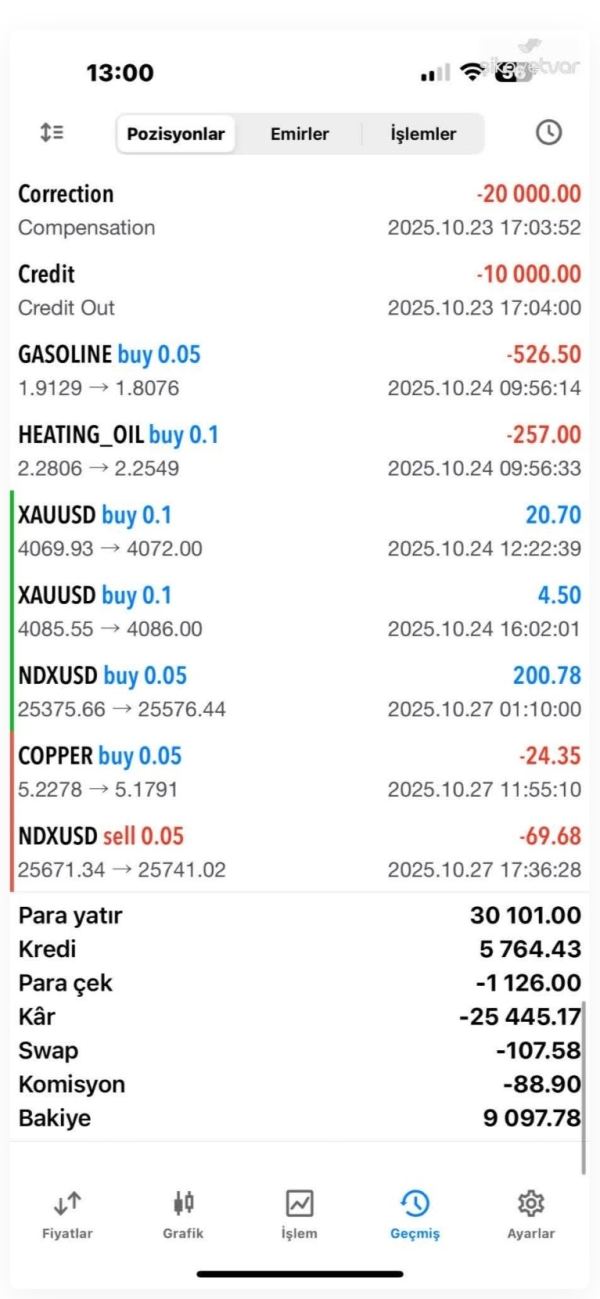

Broker

sardis

Exposure Type

Severe Slippage

Turkey

2025-11-21

Turkey

2025-11-21

Broker

GLOBAL GOLD & CURRENCY CORPORATION

Exposure Type

Severe Slippage

Bangladesh

2025-11-21

Bangladesh

2025-11-21

Broker

GLOBAL GOLD & CURRENCY CORPORATION

Exposure Type

Severe Slippage

India

2025-11-20

India

2025-11-20

Broker

GLOBAL GOLD & CURRENCY CORPORATION

Exposure Type

Severe Slippage

India

2025-11-20

India

2025-11-20

Broker

GLOBAL GOLD & CURRENCY CORPORATION

Exposure Type

Severe Slippage

Pakistan

2025-11-20

Pakistan

2025-11-20

Broker

deriv

Exposure Type

Severe Slippage

Pakistan

2025-11-19

Pakistan

2025-11-19

Broker

GLOBAL GOLD & CURRENCY CORPORATION

Exposure Type

Severe Slippage

Pakistan

2025-11-19

Pakistan

2025-11-19

Exposure

Unable to Withdraw

Severe Slippage

Scam

Others

Sync to personal posts

- The copy is concise and clear

- Link th right broker to get the exposure resolved more quickly

Amount resolved within one month(USD)

$184,789

Number of People Resolved

15414