Rockfort

United Kingdom

United Kingdom

Time Machine

Check whenever you want

Download App for complete information

Exposure

8 pieces of exposure in totalUnable to withdraw. The capital chain has broken.

It was a ponzi scheme and bet against customers.

Unable to withdraw. Have to deposit funds but can't withdraw. Then the customer service ignored you

Unable to withdraw. Have to deposit funds but can't withdraw. Then the customer service ignored you

Unable to withdraw. Account: 200001575. Balance: 1100. I only withdrew 1000 in the 1 year. The customer center was unavailable. I sent email to them or contacted wechat, but there was no response. They delayed until the withdrawal failed.

Unable to withdraw in Rockfort. It delayed for 1 year. Now I totally could not contact it. The customer center was unavailable.

Unable to withdraw

Now the app is disabled. I'm cheated of depositing 10,000. After I profited, I was asked to add money of 50,000. Then they said I couldn't withdraw funds until there is 300,000 in my account. So I deposited 50,000 again. Later, I was aked to add money continuously with a series of reasons since I wanna withdraw my money. But I'm unable to withdraw, either. Now, I can't log in

Fraud company which beguile you to use it

Can’t withdraw for a month and the customer service just ignored you.

Unable to withdraw

I withdrew yesterday but it hasn’t arrived till now. The customer service didn’t reply to me. It may be a fraud platform.

Fraud deposit

I applied for a deposit of $2500 in February and April 2021, and sent my bank remittance bill to the platform, but the company has not yet helped to complete my deposit. And they also changed the bank account in the United States.

Scam

My account is 20005228. I applied for a deposit of $2500 USD on February 4, 2021, and sent my bank transfer slip to them (I am a local transfer, from the Chase bank in New York to the American bank account of Rockfort in New York ). But the company has not yet processed the deposit. They pretended that the U.S. bank account in New York City was frozen and asked me to transfer money to another California bank account. It is now July, and the money I sent has not been returned to my bank account. Obviously their bank account has not been frozen. Help.

Rockfort · Company Summary

| Aspect | Information |

| Registered Country/Area | UK |

| Founded Year | Not specified |

| Company Name | Rockfort |

| Regulation | Unregulated |

| Minimum Deposit | $100 (Basic Account), $1,000 (Pro Account), $10,000 (Elite Account) |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.5 pips (Elite Account) |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Tradable Assets | Forex, indices, commodities, cryptocurrencies |

| Account Types | Basic, Pro, Elite |

| Demo Account | Available (not specified in the original text) |

| Islamic Account | Not specified (not provided in the original text) |

| Customer Support | Limited and inefficient customer support |

| Payment Methods | Limited deposit options: bank wire transfers, credit/debit cards, and a few e-wallets |

| Educational Tools | Not specified (not provided in the original text) |

Overview

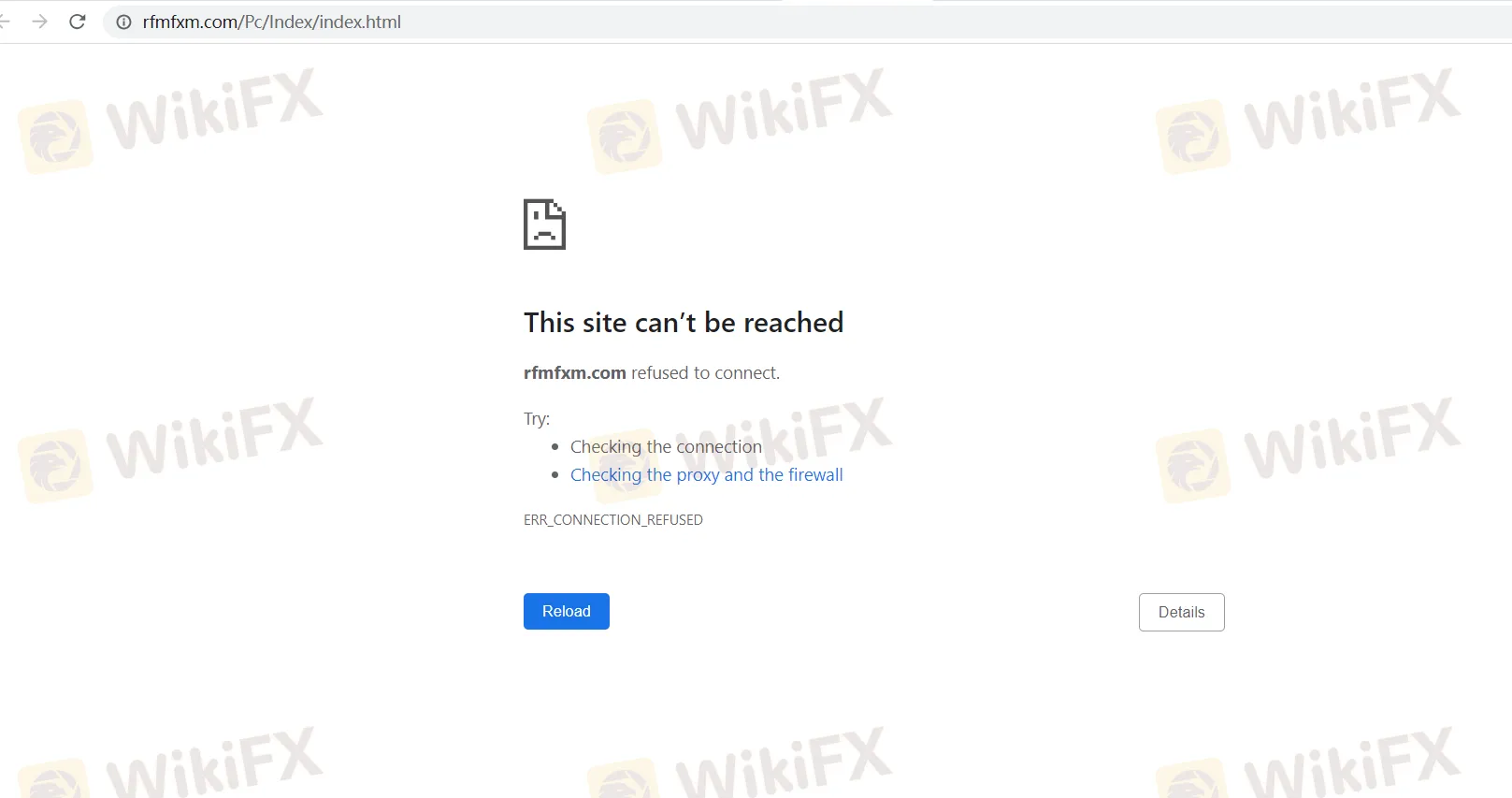

Warning:Rockfort appears to be an online brokerage offering trading services in Forex, indices, commodities, and cryptocurrencies. They claim to provide high leverage of up to 1:500 and competitive spreads starting from 0.0 pips. However, crucial information about their Standard Account, including minimum deposits and account tiers, lacks transparency. Furthermore, the absence of disclosed regulatory information and the fact that their website is currently inaccessible raise significant concerns about the company's reliability and trustworthiness.

Potential indications of a scam are evident in the lack of regulatory oversight and the unavailability of their website. Dealing with unregulated offshore brokers like Rockfort comes with significant risks, and it's essential to exercise caution and thoroughly research any financial service provider before engaging in business with them. It is advisable to choose regulated and well-established brokers that prioritize transparency and adhere to industry standards to safeguard your investments and financial interests.

Regulation

None.Rockfort is an unregulated online brokerage, which raises concerns about the safety and protection of investors. Unregulated brokers may not adhere to industry standards, potentially exposing clients to scams and disputes. It is essential to be cautious when dealing with such brokers and consider regulated alternatives for greater security and peace of mind.

Market Instrument

Rockfort offers a diverse range of market instruments to cater to its clients' trading preferences. Traders have access to various financial markets, including:

Forex: Traders can speculate on the exchange rate movements between major, minor, and exotic currency pairs. Major pairs include well-known currencies like USD, EUR, GBP, and JPY, while minor pairs consist of less commonly traded currencies paired with major ones. Exotic pairs involve currencies from emerging or smaller economies.

Indices: Rockfort provides access to widely followed indices such as NASDAQ, S&P500, Dow Jones, DAX30, CAC40, FTSE100, and Nikkei225. Trading indices allows investors to speculate on the overall performance of specific markets or sectors without buying individual stocks.

Commodities: Popular choices like Gold, Silver, Oil, and Natural Gas are available for trading. Commodities offer a way for traders to diversify their portfolios and hedge against inflation or economic uncertainties. Gold and Silver are considered safe-haven assets, while Oil and Natural Gas are influenced by global supply and demand dynamics.

Cryptocurrencies: Cryptocurrency enthusiasts can trade major digital assets such as Bitcoin, Ethereum, and Litecoin. Cryptocurrencies have gained popularity due to their decentralized nature and potential for high volatility, presenting both opportunities and risks for traders.

Rockfort's wide range of market instruments accommodates both novice and experienced traders, providing opportunities to engage in various markets and diversify trading strategies.

| Market Instruments | Examples | Description |

| Forex | USD/EUR, GBP/JPY, AUD/CAD | Speculate on exchange rate movements between major, minor, and exotic currency pairs. |

| Indices | NASDAQ, S&P500, DAX30 | Access widely followed indices to speculate on overall market or sector performance. |

| Commodities | Gold, Silver, Oil, Nat Gas | Trade popular commodities for portfolio diversification and hedging against economic uncertainties. |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin | Trade major digital assets with potential for high volatility and decentralized nature. |

Account Types

Basic Account:

The Basic Account is designed for traders who are new to the financial markets or prefer a simple and accessible trading experience. It requires a minimum deposit of $100, offering competitive spreads starting from 1.0 pips and leverage of up to 1:500. This account provides access to a wide range of market instruments, including Forex, indices, commodities, and cryptocurrencies. Traders can use popular platforms like MetaTrader 4, MetaTrader 5, web-based platforms, and mobile trading apps. The Basic Account is an excellent choice for beginners looking to get started with ease.

Pro Account:

The Pro Account caters to experienced traders seeking advanced trading conditions and additional benefits. It requires a minimum deposit of $1,000, offering tighter spreads starting from 0.5 pips and leverage of up to 1:300. With reduced trading costs compared to the Basic Account, traders can optimize their strategies for potential higher profits. Similar to the Basic Account, the Pro Account provides access to a diverse range of market instruments and popular trading platforms, such as MetaTrader 4, MetaTrader 5, web-based platforms, and mobile apps. The Pro Account is ideal for traders with some experience who aim to enhance their trading activities.

Elite Account:

The Elite Account is tailored for professional traders and high-net-worth individuals seeking top-tier services and personalized support. With a minimum deposit of $10,000, the Elite Account offers the tightest spreads starting from 0.0 pips and leverage of up to 1:100. Traders with an Elite Account receive priority access to exclusive features and resources, ensuring a tailored and premium trading experience. Similar to the other account types, the Elite Account grants access to a diverse range of market instruments and popular trading platforms, providing seasoned traders with the tools they need for successful and strategic trading. This account is designed for experienced traders who demand the highest level of service and trading conditions.

| Basic Account | Pro Account | Elite Account | |

| Min. Deposit | $100 | $1,000 | $10,000 |

| Spreads | Starting from 1.0 pips | Starting from 0.5 pips | Starting from 0.0 pips |

| Leverage | Up to 1:500 | Up to 1:300 | Up to 1:100 |

| Accessible Market Instruments | Forex, indices, commodities, cryptocurrencies | Forex, indices, commodities, cryptocurrencies | Forex, indices, commodities, cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, web, mobile apps | MetaTrader 4, MetaTrader 5, web, mobile apps | MetaTrader 4, MetaTrader 5, web, mobile apps |

| Ideal For | Beginners | Experienced traders | Professional traders and high-net-worth individuals |

| Additional Features | Simple and accessible trading | Advanced trading conditions, reduced trading costs | Top-tier services, personalized support, exclusive features and resources |

Leverage

Leverage is a key offering by Rockfort, allowing clients to trade with a maximum leverage of up to 1:500. Leverage is a commonly used feature in forex and CFD trading that enables traders to control larger positions in the market with a smaller amount of capital. With a leverage ratio of 1:500, traders can control positions that are 500 times the size of their account balance.

For instance, if a trader has $1000 in their account and utilizes the maximum leverage of 1:500, they can open a position equivalent to $500,000. While leverage has the potential to magnify profits, it also significantly amplifies the risk of losses. High leverage requires careful risk management and a thorough understanding of the associated risks.

It is essential for traders to exercise caution and use leverage prudently, considering their trading strategy and risk tolerance. While leverage can offer increased trading opportunities, it should be employed responsibly to maintain a sustainable approach to trading. Being mindful of the risks associated with high leverage can help traders make well-informed decisions and protect their capital in the volatile financial markets.

Spreads & Commissions

Rockfort's account types offer varying spreads and commission structures to cater to the diverse needs of traders:

Basic Account:

The Basic Account provides traders with a straightforward and accessible option for entering the markets. With spreads starting from 1.2 pips for major currency pairs, 1.5 pips for minor currency pairs, and 2.0 pips for exotic currency pairs, this account type ensures competitive pricing for traders. One of the notable features of the Basic Account is that it offers commission-free trading, making it an attractive choice for beginners and those who prefer a simplified fee structure. Traders with the Basic Account gain access to a wide range of market instruments, including Forex, indices, commodities, and cryptocurrencies, as well as popular trading platforms like MetaTrader 4, MetaTrader 5, and mobile trading apps.

Pro Account:

The Pro Account is tailored for more experienced traders seeking enhanced trading conditions. With spreads starting from 0.8 pips for major currency pairs, 1.2 pips for minor currency pairs, and 1.5 pips for exotic currency pairs, the Pro Account offers tighter spreads than the Basic Account, enabling traders to potentially optimize their trading strategies. While enjoying the same diverse range of market instruments and popular trading platforms, traders using the Pro Account are subject to a commission of $2.5 per lot traded (round-turn). This commission-based structure allows for potentially lower overall trading costs, making it attractive for frequent traders or those employing high-volume strategies.

Elite Account:

The Elite Account is designed to cater to professional traders and high-net-worth individuals who require top-tier services and personalized support. With spreads starting from 0.5 pips for major currency pairs, 1.0 pip for minor currency pairs, and 1.2 pips for exotic currency pairs, the Elite Account offers the tightest spreads among all the account types at Rockfort, ensuring highly competitive pricing for traders. Moreover, the commission for traders using the Elite Account is reduced to $1.5 per lot traded (round-turn), further enhancing cost-efficiency for high-volume traders. In addition to the same diverse market offerings and popular trading platforms, the Elite Account provides traders with priority access to exclusive features and resources, creating a tailored and premium trading experience.

Each account type caters to specific trader needs, and traders are encouraged to carefully consider the spreads, commissions, and other features offered by each account type before making a decision. By understanding their individual trading preferences and risk tolerance, traders can select the most suitable account type to achieve their trading goals.

Deposit & Withdrawal

Rockfort's deposit methods are limited, which may inconvenience traders looking for flexibility when funding their trading accounts. The available options include bank wire transfers, credit/debit card payments, and a few e-wallet services. However, the lack of more diverse payment methods raises concerns about the broker's commitment to accommodating an international clientele.

Bank Wire Transfers: While accepted, this method may not be the most convenient due to potential delays and additional fees from both the sending and receiving banks. Traders seeking quicker and cost-effective deposits may find this option less appealing.

Credit/Debit Card Payments: Rockfort accepts credit/debit card payments, but major credit card companies may impose extra fees for international transactions. The lack of clarity on potential charges adds to the frustration for traders using this method.

E-Wallet Services: While supporting some e-wallets, the limited options may not satisfy traders who prefer other popular providers. Transaction fees and currency conversion charges imposed by e-wallet services can add to the inconvenience for clients.

Withdrawal Methods: Rockfort's claimed one-business-day withdrawal processing time is questionable, as there are reports of delays and complications. This inefficiency raises concerns about accessing funds promptly.

Bank Wire Transfers: Withdrawals through bank wire transfers can be time-consuming and subject to delays due to multiple banks and international processes. Additional fees imposed by intermediary banks may lead to unexpected charges for clients.

Credit/Debit Card Refunds: Uncertainty about potential restrictions imposed by card issuers leaves clients unsure about the reliability of this withdrawal method. Delays in receiving funds add to trader frustration.

E-Wallet Withdrawals: While faster, e-wallet withdrawals may have fees that reduce the amount received by clients, affecting the overall withdrawal experience.

Overall, Rockfort's limited and inefficient deposit and withdrawal methods reflect poorly on their commitment to providing a seamless trading experience. Lack of transparency on fees and delays may discourage traders from trusting this broker. It is advisable for traders to consider alternative brokers with more reliable and diverse payment options for a smoother and secure financial transaction process.

Trading Platforms

Rockfort's selection of trading platforms seems unimpressive and lacking in innovation, failing to differentiate itself from competitors. While they offer the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, these choices appear outdated and uninspired. Many other brokers provide the same platforms, leaving Rockfort without a unique selling point in this aspect.

The MetaTrader 4 platform, although suitable for beginners, may not meet the needs of experienced traders seeking advanced tools and features. The absence of proprietary platforms or exclusive trading tools suggests a lack of investment in research and development to offer traders cutting-edge solutions.

Additionally, while mobile trading apps for Android and iOS devices are mentioned, there is no guarantee of their reliability or performance. Traders may face frustrations with subpar mobile trading experiences, potentially leading to missed opportunities in fast-moving markets.

Overall, Rockfort's choice of trading platforms appears lackluster and outdated, leaving much to be desired for traders seeking modern and innovative solutions. With limited options and the absence of unique features, potential clients may find other brokers more appealing, offering a wider array of cutting-edge trading platforms and tools. As the trading industry continues to evolve, brokers that fail to keep up with technological advancements may struggle to meet the expectations of savvy traders looking for advanced trading experiences.

Customer Support

Rockfort's customer support is disappointing and lacks responsiveness, indicating a lack of consideration for a broader international clientele. With only two contact numbers available, one for English-speaking clients and the other for Chinese (Simplified) speakers, the broker falls short in accommodating customers from other regions.

The absence of toll-free numbers for clients outside of the UK or China further raises concerns about accessibility and potential additional charges for seeking support. This limited availability may leave clients feeling undervalued and neglected.

Moreover, the lack of 24/7 customer support further hampers the overall experience. Traders may encounter difficulties during critical market hours or emergencies, without the assurance of timely assistance. The non-business hour availability leaves customers vulnerable to potential issues without immediate resolution.

Email support, with the address Rockfortw@gmail.com, raises questions about specialized support teams or departments and the efficiency of handling customer inquiries. The lack of clear direction on where to direct specific queries may lead to delays in response or generic and unhelpful replies.

Overall, Rockfort's customer support leaves much to be desired. The limited contact options, absence of toll-free numbers, and non-availability 24/7 indicate a lack of commitment to providing top-notch support to clients. Traders may feel frustrated and unsupported, prompting them to explore alternative brokers that prioritize customer care and satisfaction. In the competitive trading industry, responsive and reliable customer support is essential to maintain client trust and loyalty.

Summary

Rockfort is an online brokerage that offers trading services in Forex, indices, commodities, and cryptocurrencies. While they claim to provide high leverage and competitive spreads, there are several red flags and concerns about their operations.

Pros:

Diverse Range of Market Instruments: Rockfort offers a variety of financial instruments, including Forex, indices, commodities, and cryptocurrencies, allowing traders to diversify their portfolios.

Three Account Types: Traders have the option to choose from Basic, Pro, and Elite accounts, catering to different experience levels and trading preferences.

Maximum Leverage: The broker provides a high leverage of up to 1:500, enabling traders to control larger positions with a smaller amount of capital.

Cons:

Lack of Regulation: Rockfort is an unregulated broker, raising concerns about the safety and protection of investors. Trading with unregulated brokers carries significant risks.

Lack of Transparency: Crucial information, such as minimum deposits and account tiers for the Standard Account, is not disclosed, suggesting hidden fees or unfavorable terms.

Outdated Trading Platforms: The broker offers only MetaTrader 4 and MetaTrader 5, which may not meet the needs of experienced traders seeking advanced tools and features.

Limited Deposit and Withdrawal Methods: The available options for funding and withdrawing from trading accounts are limited, potentially inconveniencing traders seeking more diverse payment options.

Inefficient Customer Support: The broker's customer support lacks responsiveness and accessibility, with limited contact options and non-availability 24/7.

Conclusion

Rockfort's lack of regulation, transparency issues, outdated trading platforms, and inefficient customer support are significant concerns for potential investors. Trading with unregulated brokers poses considerable risks, and the lack of transparency raises questions about the broker's reliability.

Traders are strongly advised to exercise caution and thoroughly research any financial service provider before engaging in business with them. It is advisable to choose regulated and well-established brokers that prioritize transparency, offer modern trading platforms, and provide efficient customer support to safeguard investments and financial interests.

FAQs

Q1: Is Rockfort a regulated broker?

A: No, Rockfort is an unregulated broker. It lacks regulatory oversight, which raises concerns about the safety and protection of investors. Trading with unregulated brokers carries significant risks.

Q2: What are the minimum deposits for each account type?

A: The Basic Account requires a minimum deposit of $100, the Pro Account requires $1,000, and the Elite Account requires $10,000.

Q3: Are there any additional charges for using credit/debit card payments?

A: Some credit card companies may impose extra fees for international transactions, potentially leading to unexpected costs for traders.

Q4: What trading platforms are available at Rockfort?

A: Rockfort offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. However, there are no proprietary platforms or exclusive trading tools, indicating a lack of innovation.

Q5: Does Rockfort provide 24/7 customer support?

A: No, Rockfort's customer support is not available 24/7. The absence of round-the-clock assistance may leave traders vulnerable to potential issues during non-business hours.

News

No data