Company Summary

Company Summary

Company Profile

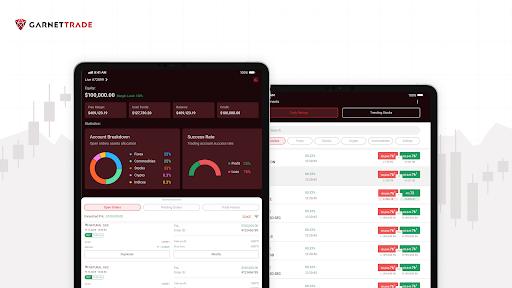

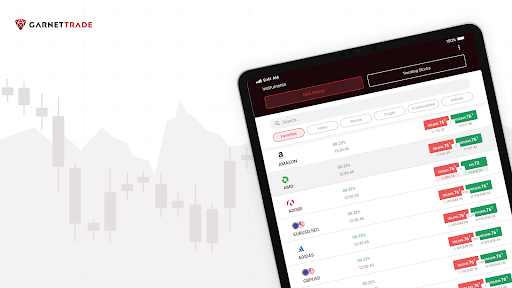

Who we are?

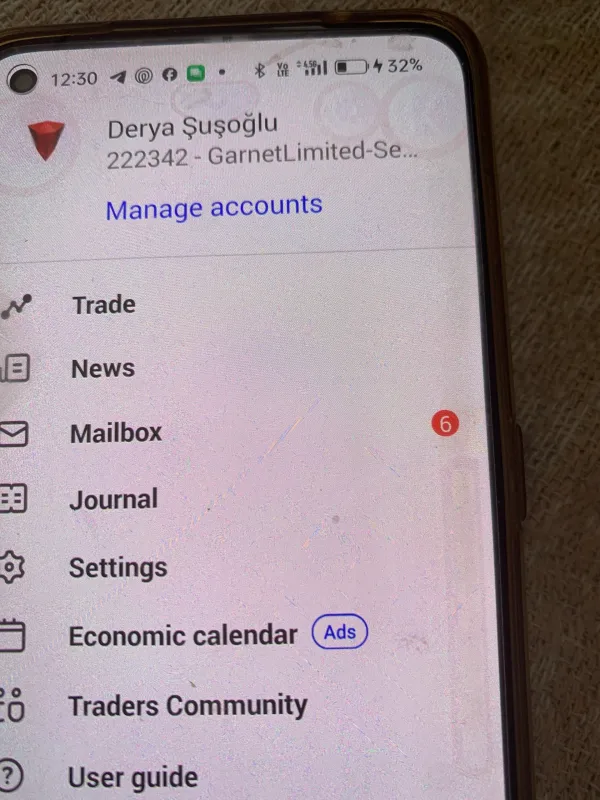

Garnet Trade is a brokerage firm operating in the Forex market based in Sydney, Australia since 2010. We have back offices in the UK, Canada and Macedonia.

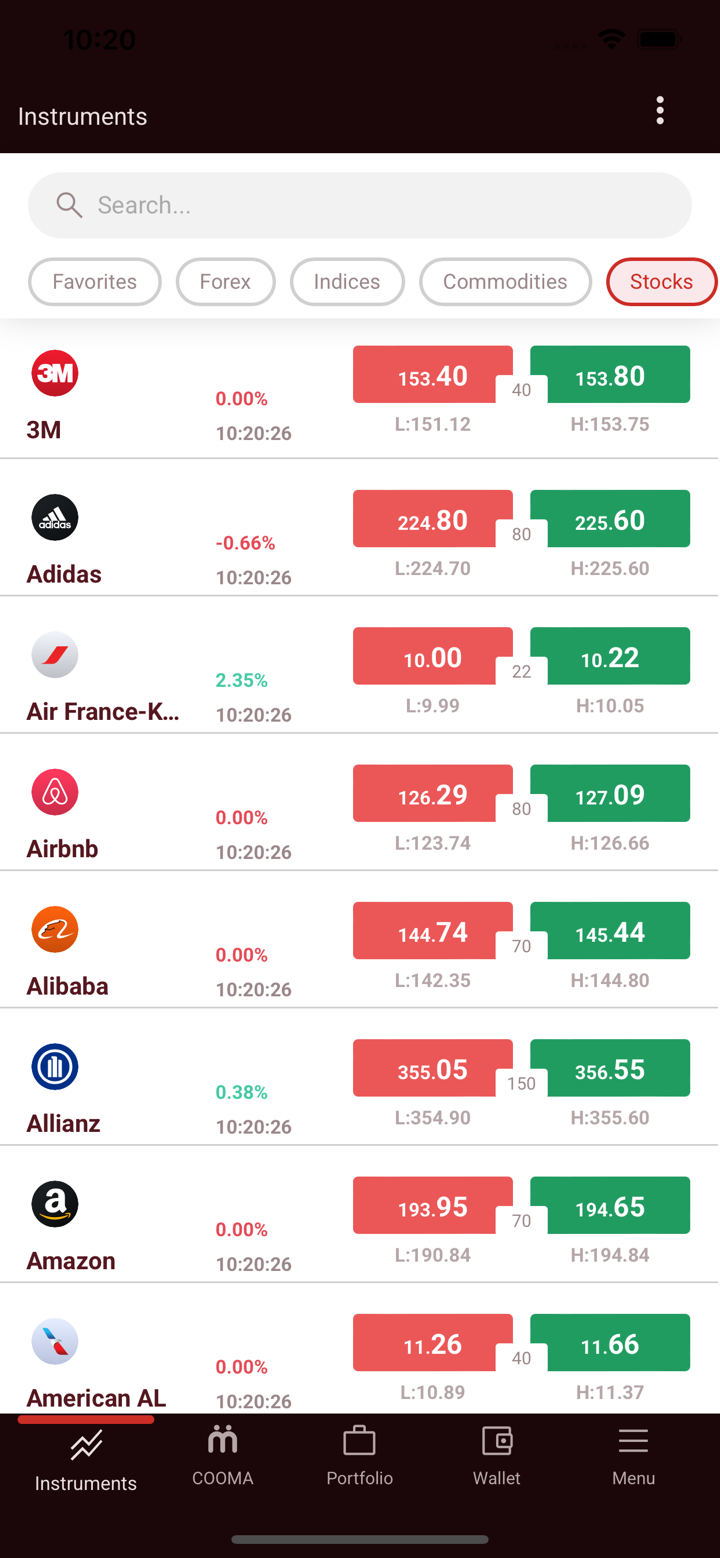

Operating in more than 50 marketplaces, Garnet Trade provides trade execution and clearing services to institutional, retail and professional investors with direct access (on-line) for a wide range of electronically traded products including equities, CFDs, energies, metals and Forex worldwide. Garnet Limited and its affiliates execute more than 1,454,000 trades per day.

With more than 350 employees, Garnet Trade is a member of the Financial Commission. In this Financial Service Commission, traders capital is secured up to €20,000 and in case of any dispute/victimization, they are entitled to claim direct compensation of funds.

We also have an ASIC license, which is considered the most trusted regulation in the world.

Our license number is: 670976977. You can learn more about our license at asic.gov.au.

In addition to all these, we have the license of MWALI INTERNATIONAL SERVICES AUTHORITY (M.I.S.A.).

Our license number is: T2023429. You can query our license at mwaliregistrar.com.

Garnet Trade;

Sponsorship of Portugal Braga Team between 2020-2022

Sponsorship of HONDA LCR in MOTO GP races since 2022

Sponsorship of Galatasaray womens volleyball team 2022-2023

In the 2024-2025 season, it is the official sponsor of the French professional basketball team A.S Monaco.

sus7957

Turkey

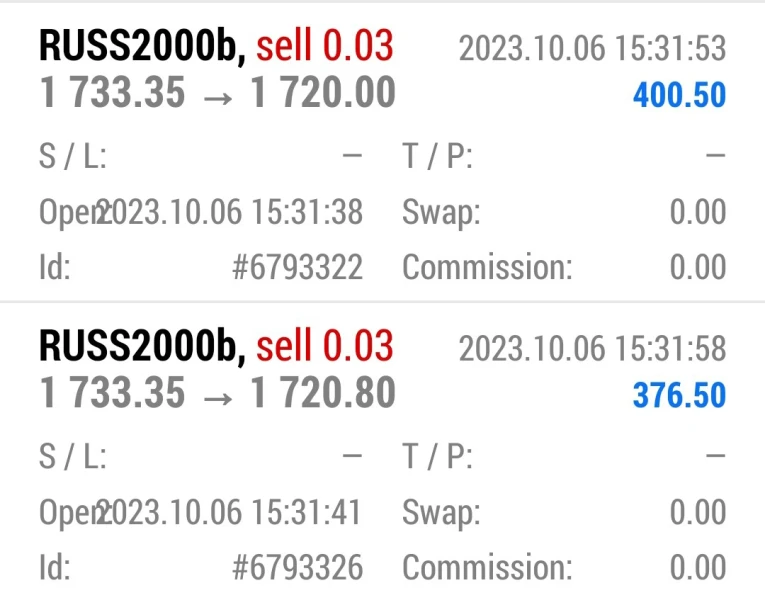

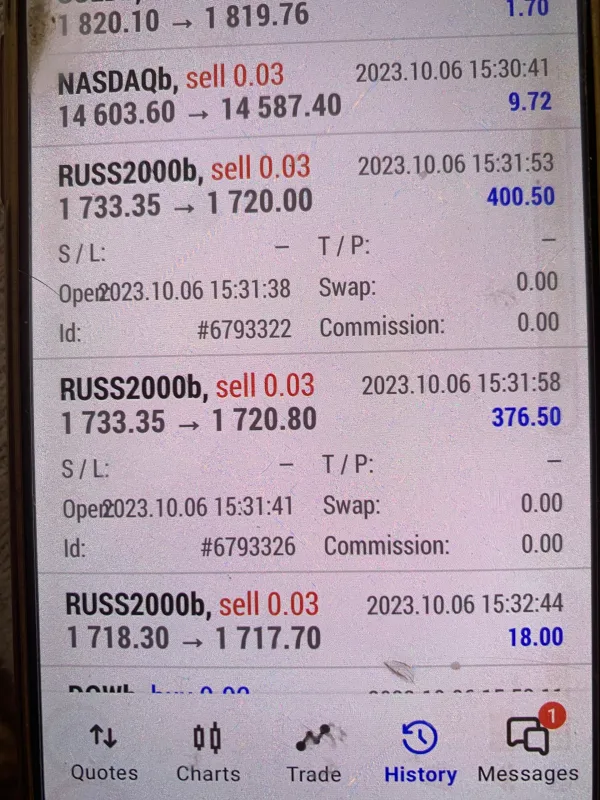

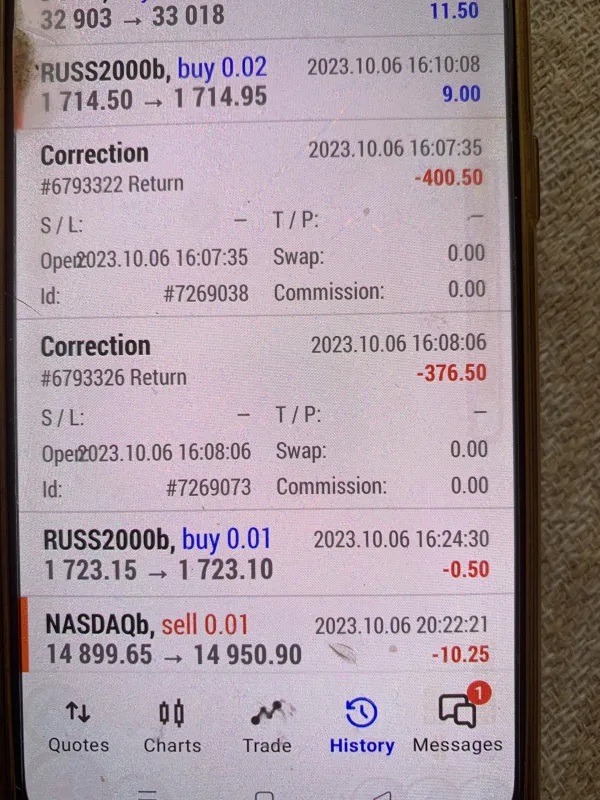

please help me get my money back from this company. I entered into two RUSS2000 transactions earning Total of $777 on October 6. After a few minutes this company took the money back from my account. The Transaction İD 6793322 is $400.50 The Transaction İD 6793326 is $376.50. please help me

Exposure

dee2134

Turkey

On October 6, 2023 I entered 2 Sell Transactions for RUSS2000. From Transaction ID #6793322 I earned $400.50. From Translation ID #6793326 I earned $376.50. After 35 minutes this company took the money away from my account. I want my money

Exposure

esra3129

Turkey

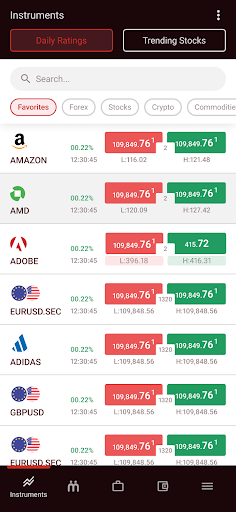

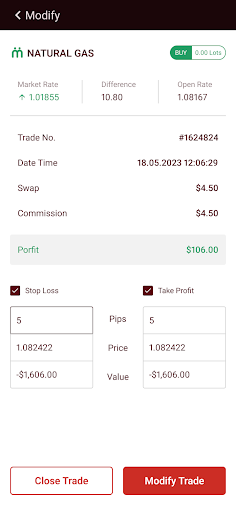

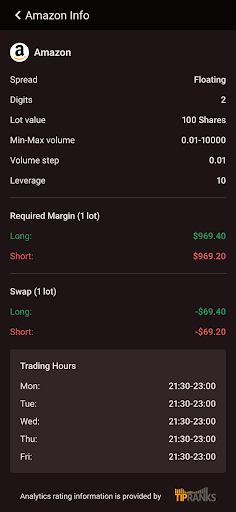

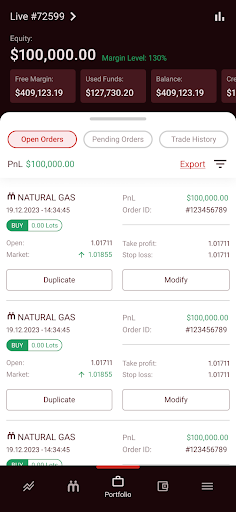

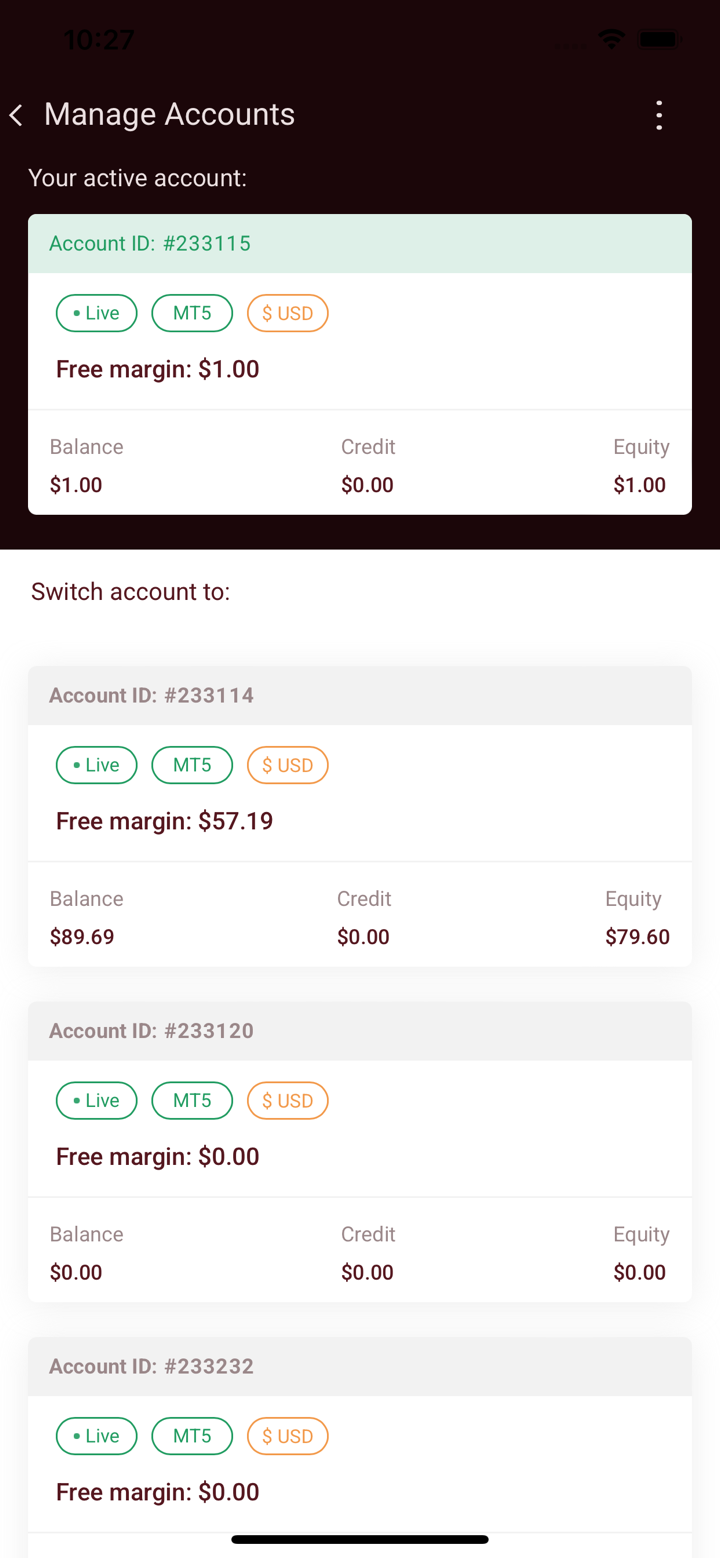

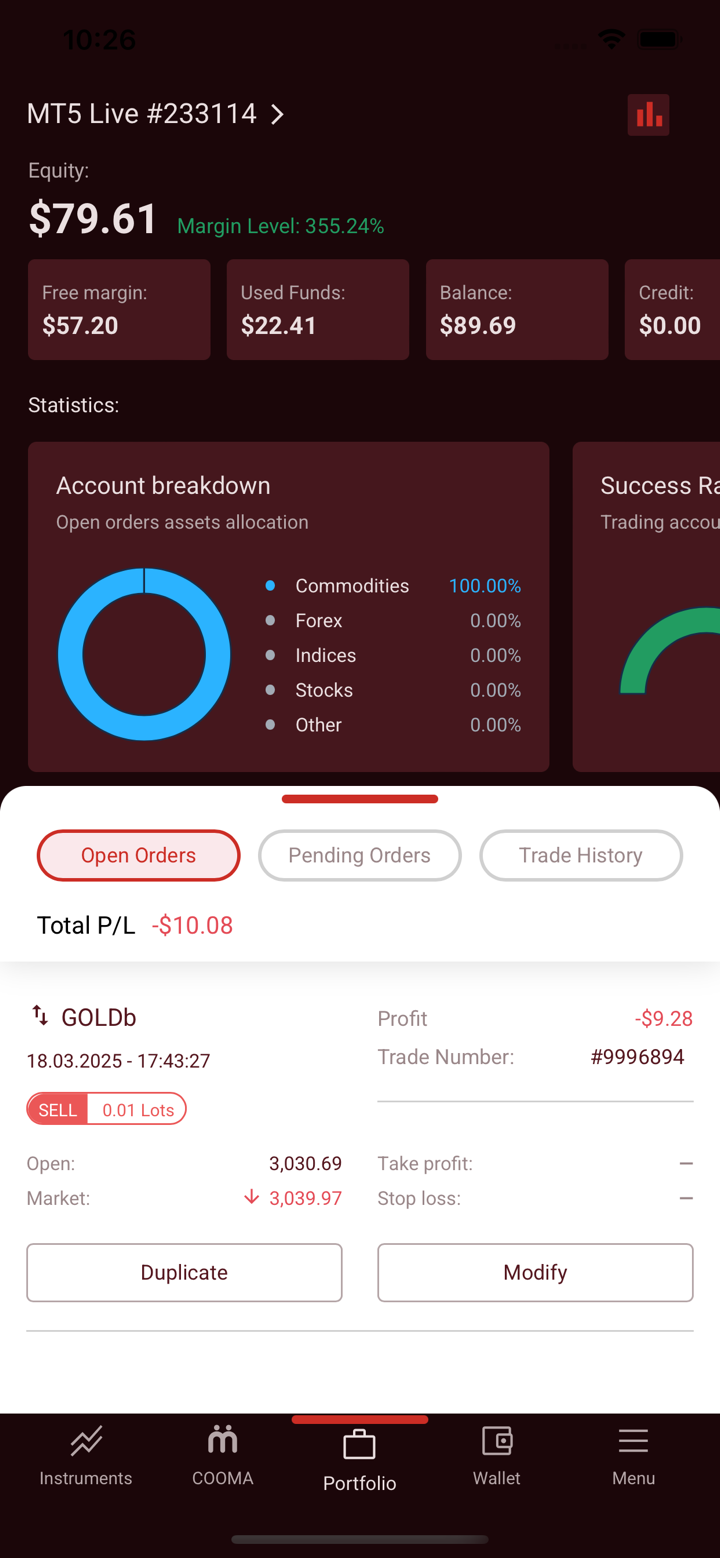

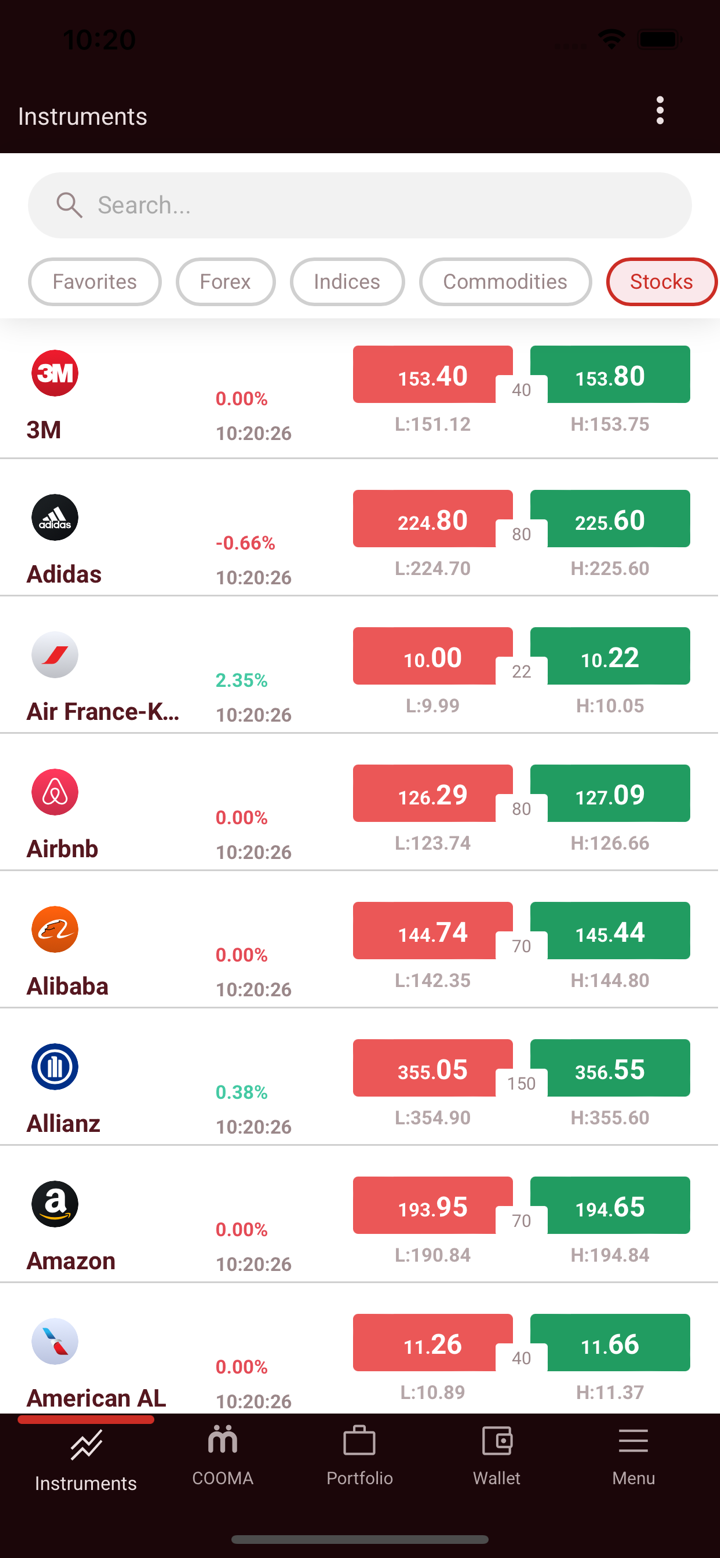

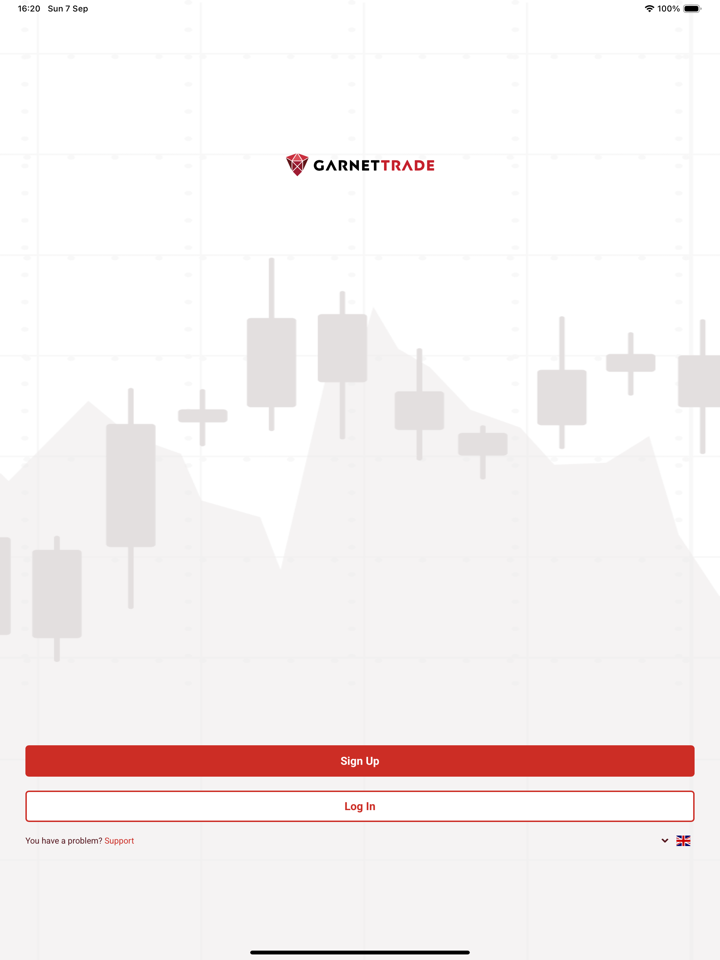

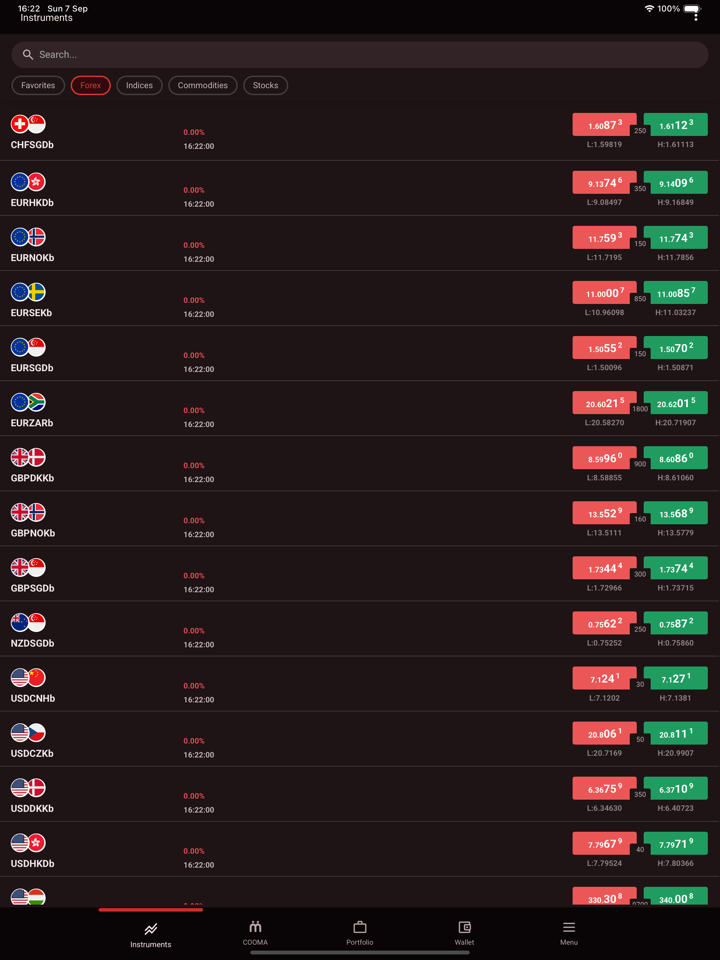

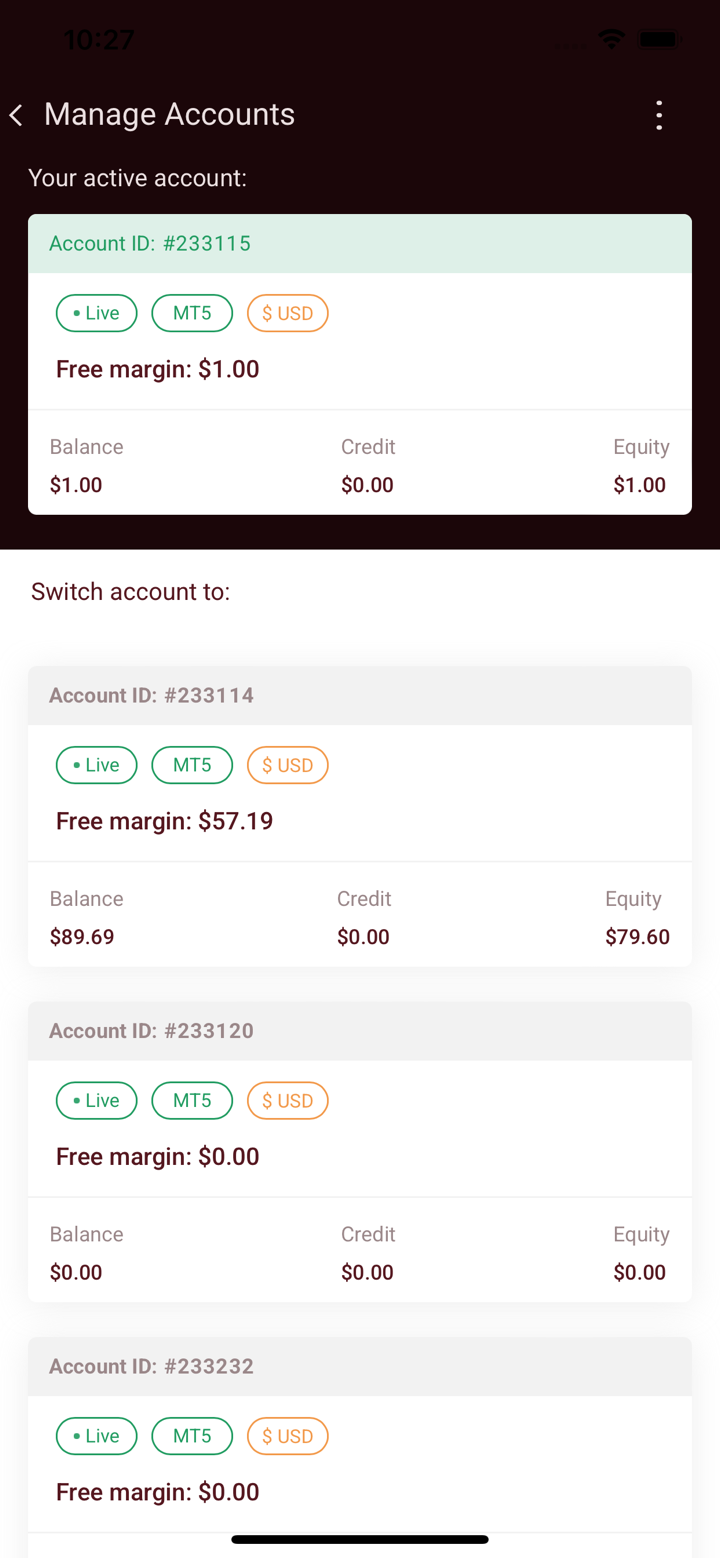

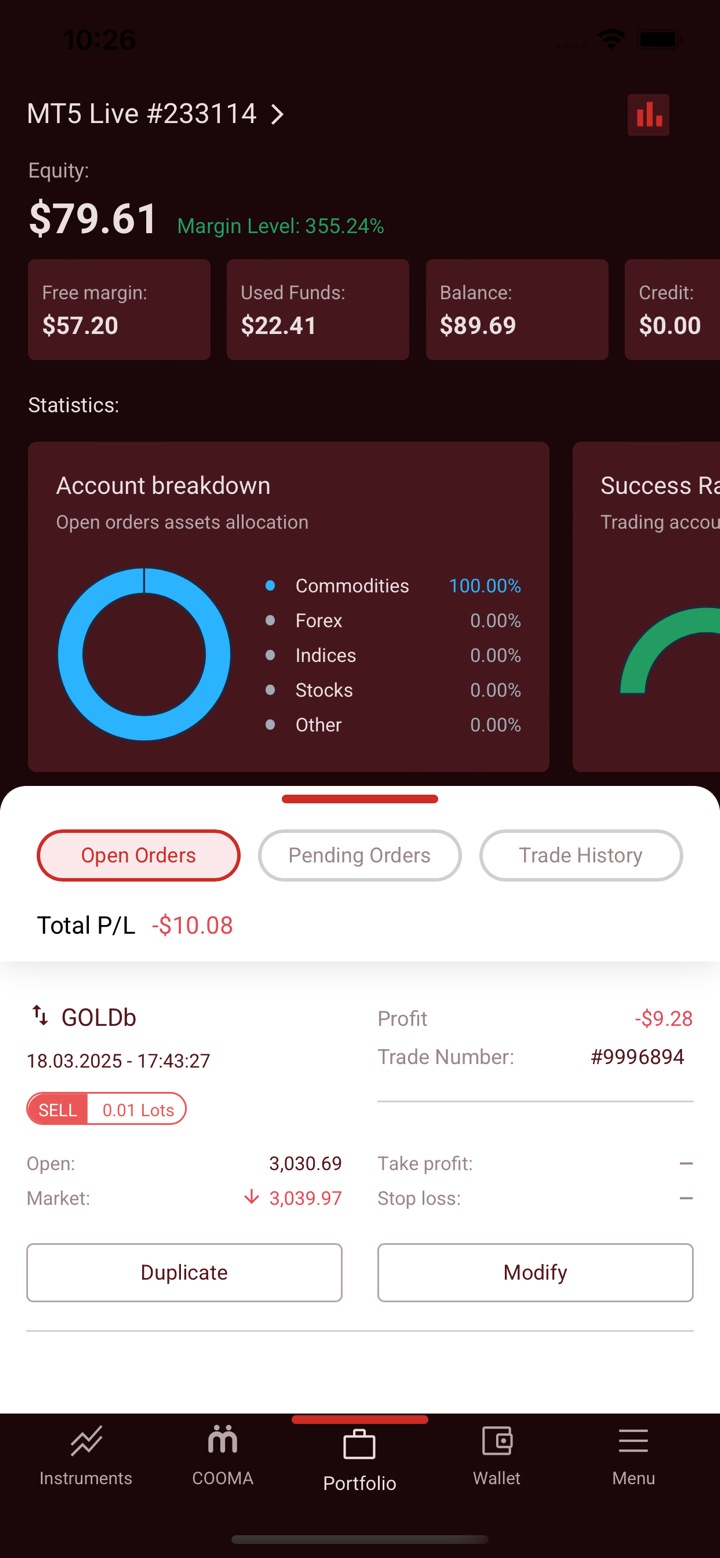

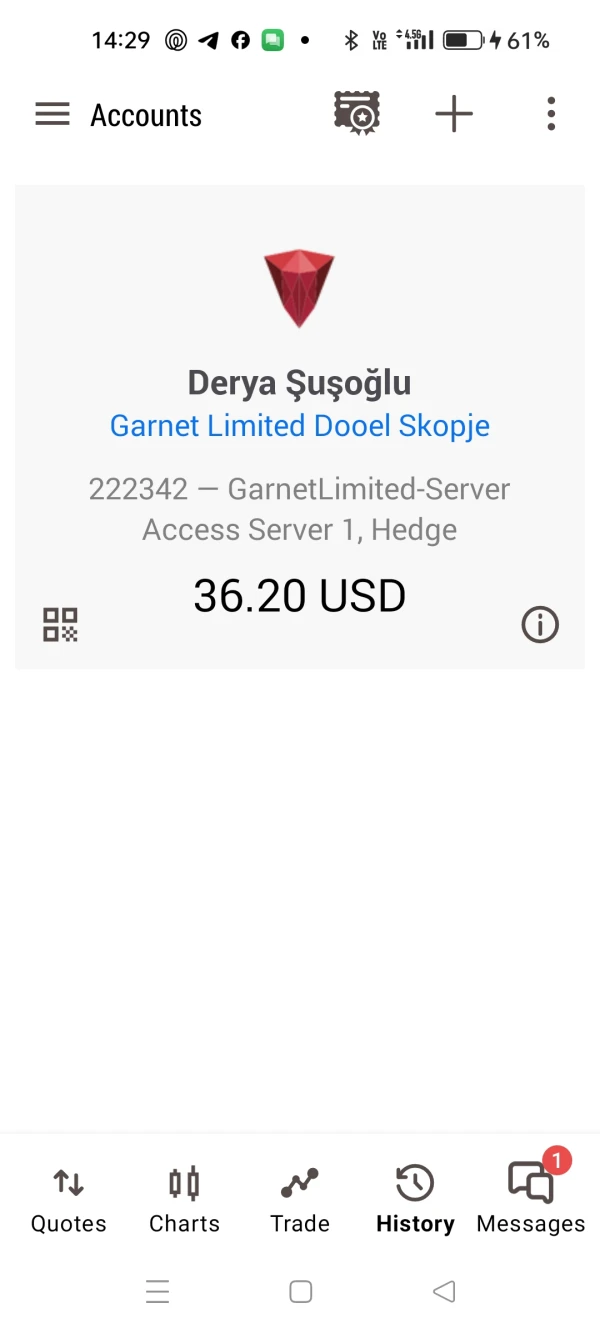

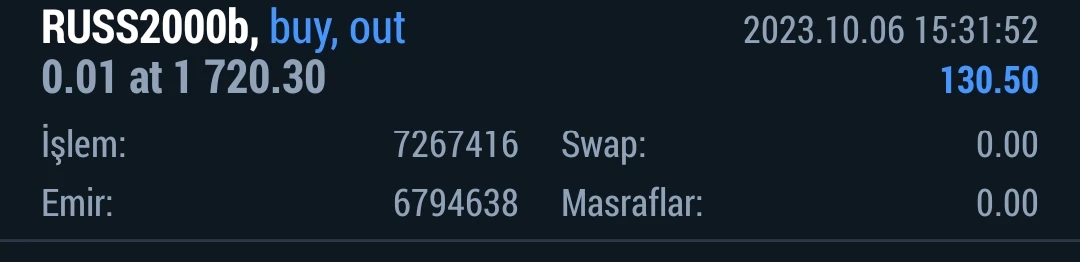

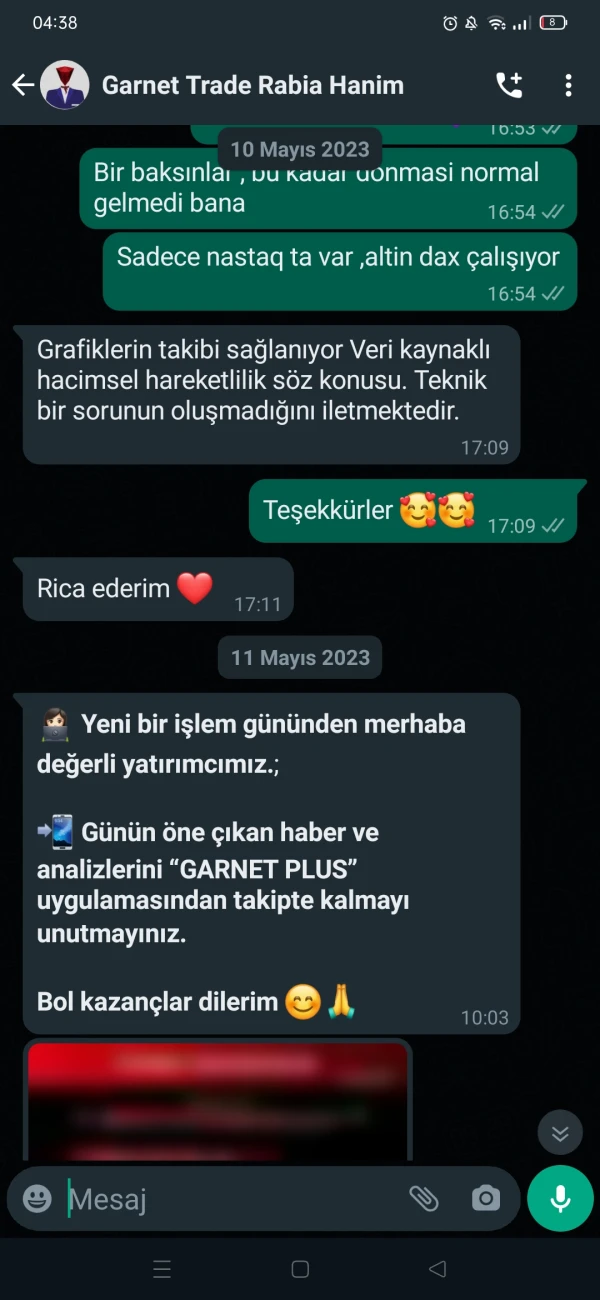

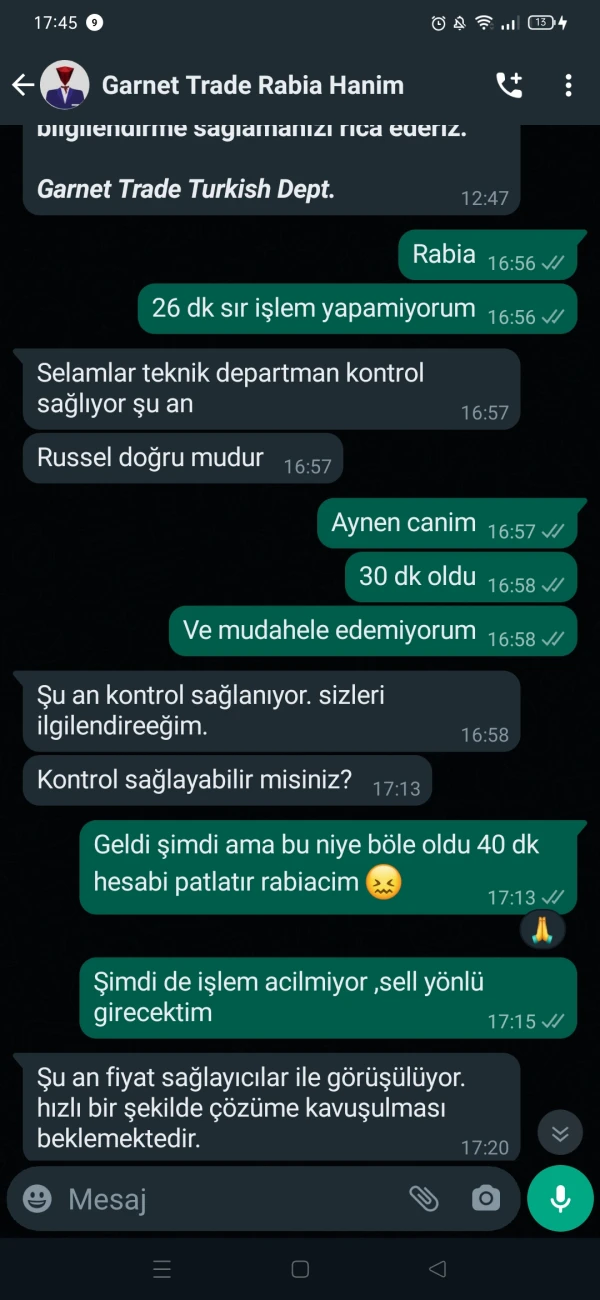

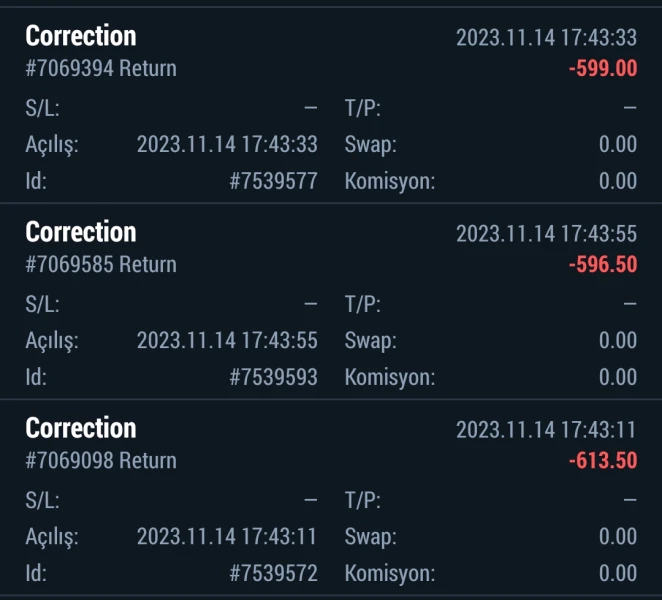

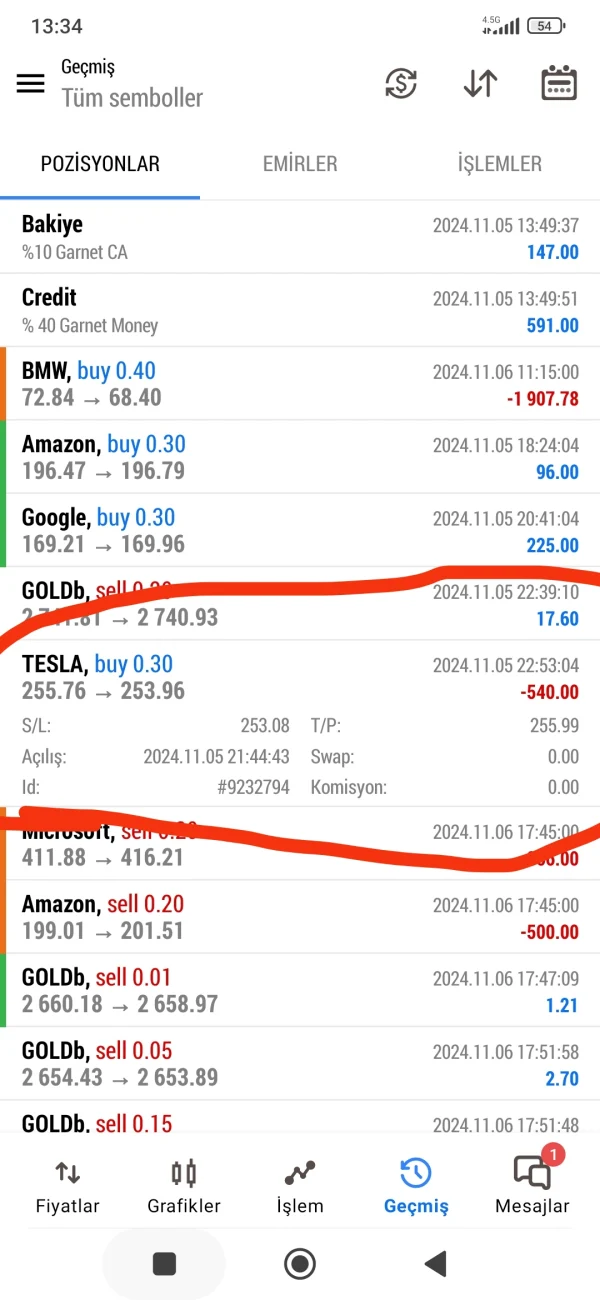

I had the same problem last month, my earnings were withdrawn from my account without any explanation (image 1). Then there was a freeze. They said there was no such price, and an explanation was made that the system has been freezing many times since last year, even though I asked you to take care of it (image 2-3). The same trading I entered during the 14 November data time. I was treated, my earnings are 1900 USD, they do not give me (image 4-5). This is a company that blames us for the errors of their systems freezing for 40 minutes while there is data flow in all companies. They are also not willing to compromise, they went further and locked the friends' accounts and gave the access permission in return for them writing a petition saying 'I am satisfied' about the institution. .. I will inform the auditors, such as Asic, Financial Commission and Turkey's Cimer and Masak, about the issue with my visuals and receipts. Best regards.

Exposure

FX4091107561

Turkey

Hello, I am Jef Kaan Zengin. My Meta Id Number is 225223. Although the trade I opened reached Tp, the trade was not closed and Garnett trade put me at a loss. My receipt number is 923794. My trade pair is Tesla. My loss is 540 dollars. And at the same time, this institution gives investment advice through individuals via telegram and resets people's balances. Merhaba Ben Jef Kaan Zengin. Meta Id Number is 225223. Although the trade I opened reached Tp, the trade was not closed and Garnett trade put me at a loss. My receipt number is 923794. My trade pair is Tesla. My loss is 540 dollars. And at the same time, this institution gives investment advice through individuals via telegram and resets people's balances.

Exposure

Karacatrader

United States

A broker that I can definitely recommend for Garnet trade with low rates and low commission rates

Positive

MRSTrader

United States

The broker I worked with before was not trading with crypto. But Garnet is very good at this...

Positive

FX3672686891

United States

As a broker, low commission rates always surprise me. With tight spreads and fast customer support, I will not give up on Garnet.

Positive

FX2977783756

United States

I met Garnet trade on the recommendation of my friend. I've been using it for years and haven't had any problems. They have a very fast and transparent platform.

Positive

FX4113409719

Turkey

I am very satisfied with garnet trade. It works very well, everything is very good. They are very quick to respond with their financial advisors and technical support.

Positive

FX1507707376

Germany

I met Garnet recently. I decided to try it on a friend's recommendation. I find it very transparent and reliable. I'm happy with the commission rates and transaction speeds. I haven't had any problems that bother me.

Positive

FX1841028729

United States

I can say that Garnet Trade is the most profitable brokerage house for me. I haven't had any problems so far. A successful and reliable brokerage firm in support.

Positive

FX1343135338

United States

I have been using the garnet trading platform as a forex brokerage firm for a long time. The commission fees are low and I had no problems with withdrawals and deposits. Spreads are reasonable and I am very satisfied.

Positive

FX2977783756

United States

I signed up and tried their system in a really objective way. there seems to be no problem or problem. It is also very fast, especially for withdrawals.

Positive

FX3159266618

United Kingdom

I have been trading and trading with garnet trade for 3 years. I've had no problems and I'm really happy with it.

Positive

FX2977783756

Turkey

garnet trade is a very good trading company. I am happy to trade here, thanks to the safe and low commission amounts.

Positive

默白

United States

GARNET TRADE is an excellent broker. I recommend everyone use this broker. I have witnessed many of my friends use this for many years I tried it and their words are true. more thumbs up to them. God bless.

Positive