Company Summary

| AIMSReview Summary | |

| Founded | 2014 |

| Registered Country/Region | Australia |

| Regulation | ASIC and LFSA |

| Market Instruments | Forex, Stocks, Indices, Metals, and Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| EUR/USD Spread | From 1.5 pips |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $100 |

| Customer Support | Email: cs@aimsfx.com |

| Social Media: Facebook, LinkedIn, YouTube, TikTok | |

| Regional Restriction | USA |

AIMS Information

AIMS (Auric International Markets) is an Australian broker established on 15 September 2014, regulated by ASIC and LFSA, offering a wide range of trading assets such as Forex, Stocks, Indices, Metals and Commodities. It offers MT4 and MT5 trading platforms, a minimum deposit of $100, no trading commissions, and a negative balance protection policy to ensure the safety of customer funds. AIMS also offers a demo account for beginners to practice with, while supporting a variety of payment methods, including local bank transfers, credit cards, Bitcoin, etc., with no fees for deposits and withdrawals, and fast processing times.

Pros & Cons

| Pros | Cons |

| Regulated by ASIC and LFSA | Regional restrictions |

| Negative Balance Protected | Limited contact channels |

| Demo Account available | |

| No fees charged by AIMS | |

| Various payment options | |

| MT4 and MT5 provided |

Is AIMS Legit?

Auric International Markets (AIMS) related entities are regulated by local financial regulators in both Australia and Labuan and hold different types of financial licenses to carry out corresponding financial business activities.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission | Regulated | AURIC INTERNATIONAL MARKETS (AU) PTY LTD | Market Maker (MM) | 000526125 |

| Labuan Financial Services Authority | Regulated | Auric International Markets Limited | Straight Through Processing (STP) | MB/17/0017 |

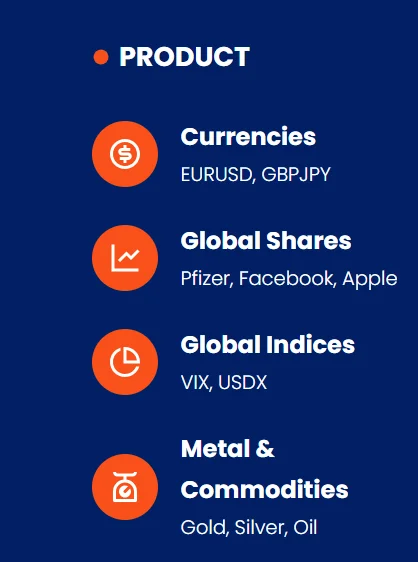

What Can I Trade on AIMS?

AIMS offers a wide range of tradable assets, including 70 Forex, Stocks/Shares, Indices, Metals, and Commodities.

| Tradable Instruments | Available |

| Forex | ✔ |

| Stocks /Shares | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

| ETFs | ❌ |

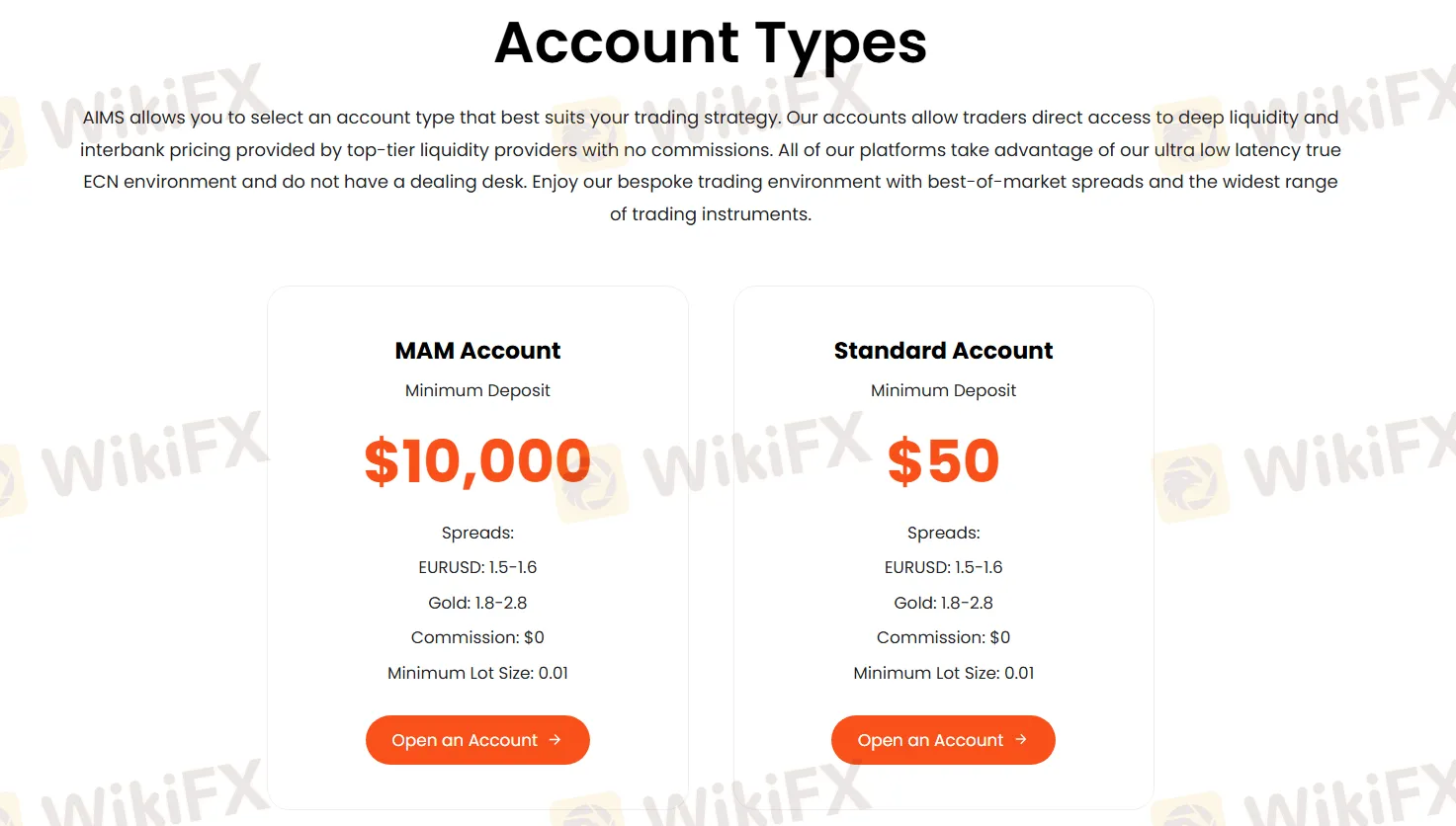

Account Types

AIMS provides a Demo Account. Traders can learn and practice trading without taking on any financial risks.

AIMS offers two types of live accounts: MAM Account and Standard Account. Here's some information about it.

| Account Type | Minimum Deposit | Spreads | Commission |

| MAM Account | $10,000 | EURUSD: 1.5–1.6 pips | $0 |

| Standard Account | $50 | EURUSD: 1.5–1.6 pips | $0 |

Leverage

AIMS offers flexible leverage from 1:1 to 1:200.

Fees

As regards the spreads, they usually fall within the range 1.0 – 1.5 pips per standard lot for the EUR/USD pair, while AIMS offers spreads above 1.5-1.6 pips for this pair, a little higher. The broker does not charge commissions on trading. The minimum deposit amount is $100. AIMS does not charge any fees for deposits and withdrawals. In order to protect the interests of all clients, AIMS has implemented a Negative Balance Protection Policy (NBPP) on a per-account basis to ensure that clients do not lose more than they have invested. Spreads vary depending on the asset, such as EUR/USD (1.5-1.6 pips), Gold (1.8-2.8 pips).

Trading Platform

AIMS supports both MT4 and MT5 trading platforms, both on desktop, mobile, and web devices. MT5 is mainly for experienced traders, while MT4 is more suitable for beginners.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

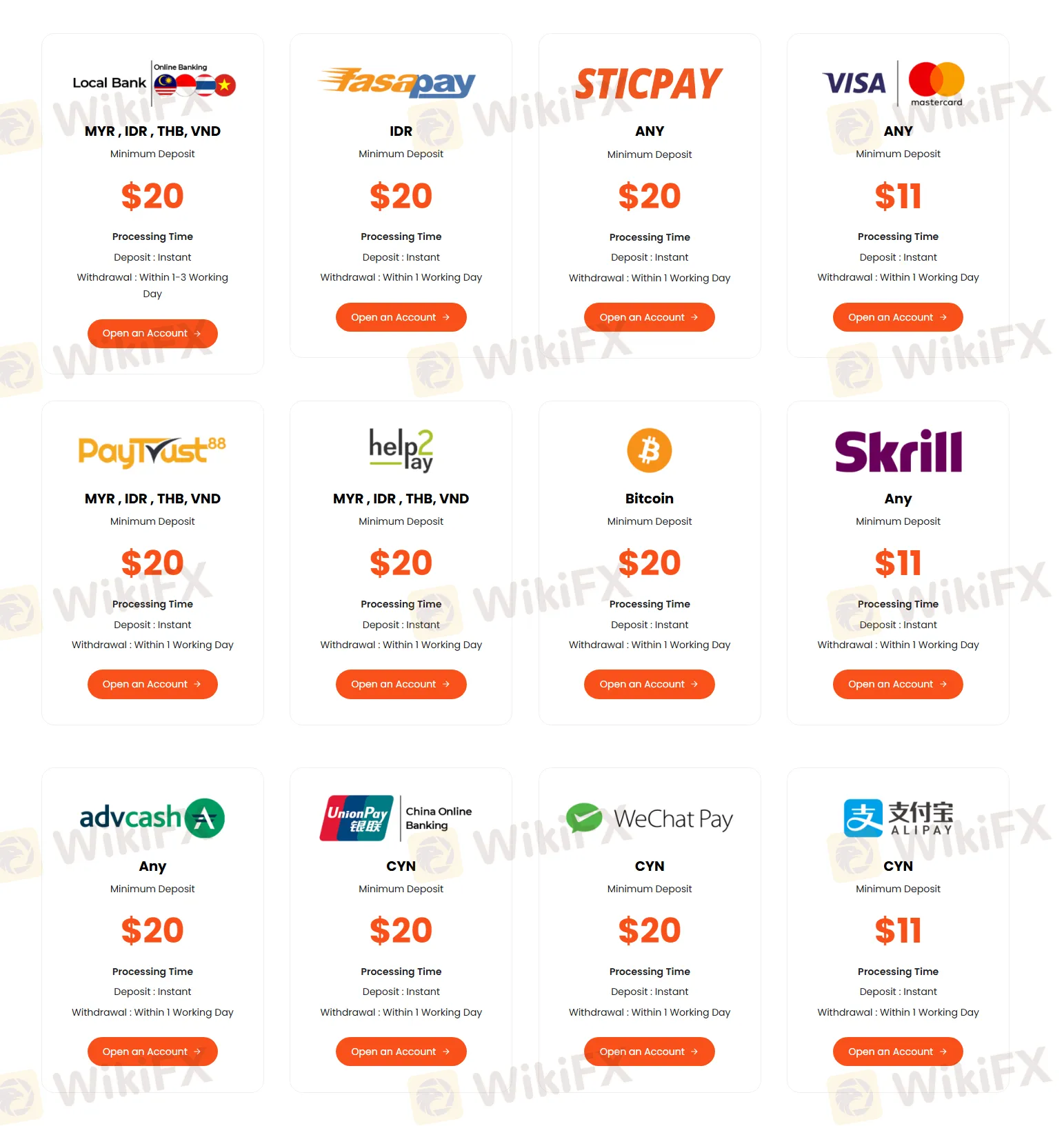

Deposit and Withdrawal

Here are all the payment methods offered by the AIMS company and their requirements:

| Payment Method | Supported Currencies | Minimum Deposit | Deposit Processing Time | Withdrawal Processing Time |

| Local Bank | MYR, IDR, THB, VND | $20 | Instant | Within 1–3 Working Days |

| Fasapay | IDR | $20 | Instant | Within 1 Working Day |

| STICPAY | ANY | $20 | Instant | Within 1 Working Day |

| VISA/Mastercard | ANY | $11 | Instant | Within 1 Working Day |

| PayTrust88 | MYR, IDR, THB, VND | $20 | Instant | Within 1 Working Day |

| help2pay | MYR, IDR, THB, VND | $20 | Instant | Within 1 Working Day |

| Bitcoin | Bitcoin | $20 | Instant | Within 1 Working Day |

| Skrill | Any | $11 | Instant | Within 1 Working Day |

| AdvCash | Any | $20 | Instant | Within 1 Working Day |

| UnionPay | CNY | $20 | Instant | Within 1 Working Day |

| WeChat Pay | CNY | $20 | Instant | Within 1 Working Day |

| Alipay | CNY | $11 | Instant | Within 1 Working Day |

FX1138568943

Malaysia

AIMS trading withdrawal, but I recently can't open the registration page. I was deceived and can't withdraw because I can't open the interface.

Exposure

Jiun Vincent

Taiwan

Trading Test The trading latency system shows approximately 200ms, allowing entry at reasonable positions. The gold spread is around 31 pips, with orders executed almost exactly at the requested price—no significant slippage and good stability. However, the author occasionally experienced noticeable delays when manually closing positions (the process from clicking the mouse to close the order to actual closure, not the process from order request to market execution). Withdrawal Experience Withdrawal options include international wire transfer, UnionPay withdrawal, and USDT (TRC-20/ERC-20/BEP-20). The only restriction is that the first withdrawal must match the deposit method, which the system enforces without adjustment. The author had already linked a fixed wallet address during deposit. Withdrawal requests are processed and credited on the same day, with normal speed. Additionally, there is a minimum withdrawal limit of 50 USDT. Customer Service Initially, inquiries about the registered email and trading account are handled by a virtual assistant with simple responses or forwarded to a live agent. To request a Chinese-speaking agent, basic details and a detailed description of the issue are required. The Chinese live chat support typically responds within about 2 minutes on weekdays, thoroughly understanding your needs and providing professional guidance—a positive experience. Overall Evaluation Category Description Account Opening ★★★★★ Smooth and user-friendly process Deposit/Withdrawal ★★★☆☆ Limited withdrawal options; interface not very intuitive Product Variety ★★★★★ Diverse offerings Trading Costs ★★★★★ Reasonable fee structure Trade Execution ★★★★★ Most trades execute stably, with occasional minor delays Regulatory License ★★★☆☆ Average licensing Customer Support ★★★★★ Fast service with Chinese live agents Educational Resources ★★★☆☆ Suitable only for complete beginners; advanced resources lacking Mobile Experience ★★☆☆☆ Supports original MT4/MT5 login but lacks a dedicated app

Neutral

Mahve

United States

AIMS is top-notch! Their trading platforms are advanced yet intuitive, making trading a seamless experience. Plus, they offer a wide variety of tradable assets, giving traders plenty of opportunities to grow their portfolios.

Positive

Augdjh

Australia

I recently came back to their platform and have to say that their service has improved. Vanya Gencheva has been especially helpful and attentive. She has been following up with me regarding my experience and has provided many helpful tips on using the platform.

Positive

FX1480512020

South Africa

The XAU spread is high, not great for traders. But the platform? Top stuff, super quick. Watch out for the spreads, guys!

Neutral

五月。

Australia

AIMS is a great investment company where you can trade with a wide range of trading products. They are real and reliable and have been doing great with them for a long time.

Positive

甜甜CG.Baby

Singapore

So far I think the service provided by this company is satisfactory to me. There is no perfect company, after all, everyone's trading habits are different, but this company is very suitable for me. In addition, the various educational resources they provided also helped me a lot.

Positive