Company Summary

| Beirmancapital Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Saint Lucia |

| Regulation | Regulated by FinCEN |

| Market Instruments | ForexSpot MetalsIndicesSpot EnergiesNDFsCrypto CFDETFsStocks CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.01 pips |

| Trading Platform | MT5 |

| Min Deposit | / |

| Customer Support | Phone: +447888869545 |

| Email: Support@beirmancapital.com | |

| Online Chat: 24/7 | |

| Social Media: Quora, Facebook, Twitter, Instagram | |

| Physical Address: Ground Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O. Box 838, Castries, Saint Lucia | |

Beirmancapital Information

Beirmancapital, a brokerage incorporated in Saint Lucia in 2021. It mainly provides Forex, Spot Metals, Indices, Spot Energies, NDFs, Crypto CFD, ETFs, Stocks CFDs for traders, and supports the use of MT5. There are also 3 types of accounts.

Pros and Cons

| Pros | Cons |

| Support MT5 | No regulation |

| Offer demo account | No account details |

| 6 payment methods | Bonds unavailable |

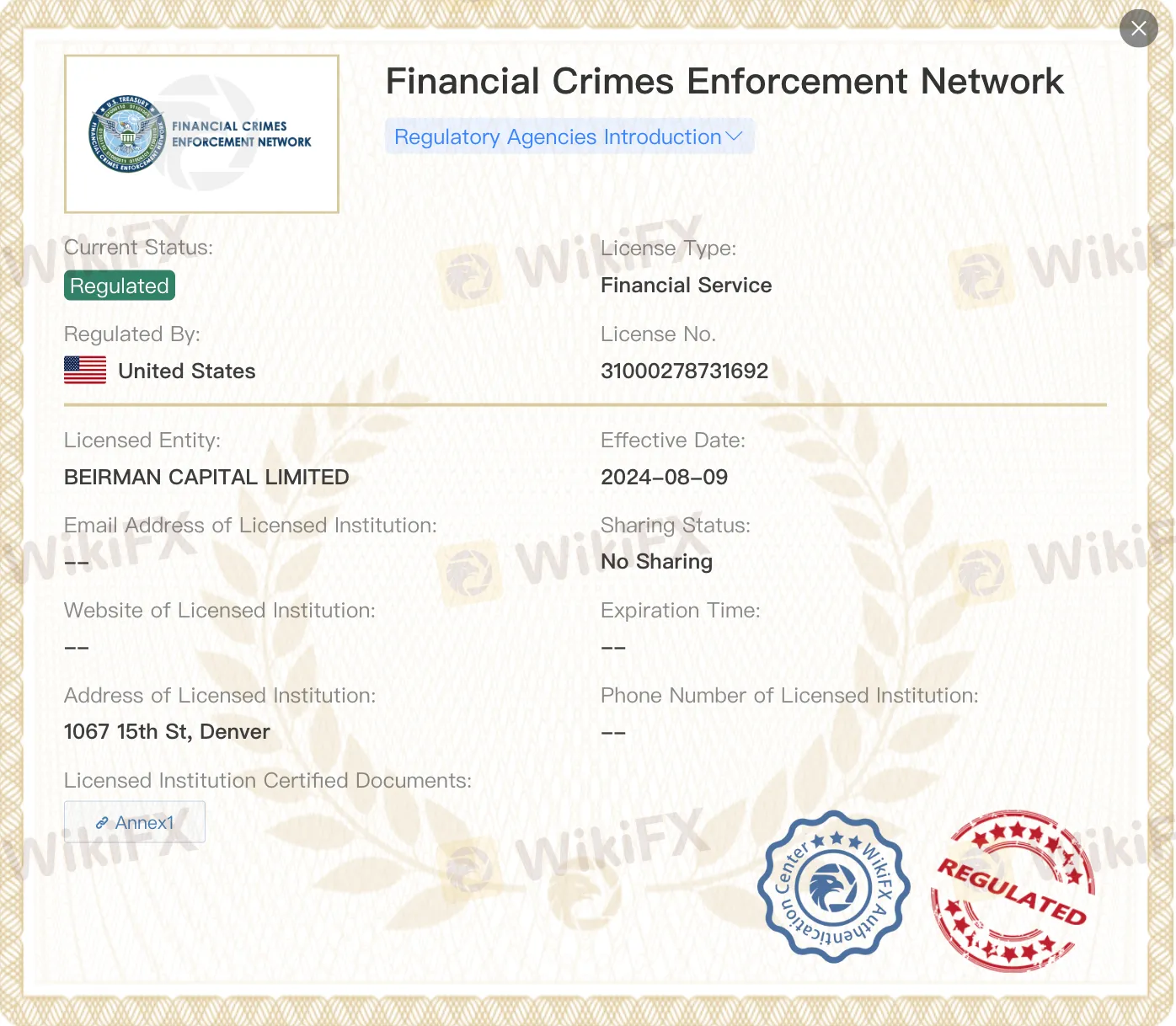

Is Beirmancapital Legit?

Beirmancapital is regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States. It holds a Financial Service license (License No. 31000278731692), indicating its authorization to provide financial services within the US regulatory framework.

What Can I Trade on Beirmancapital ?

Beirmancapital says it serves 7,000+ markets, including Forex, Spot Metals, Indices, Spot Energies, NDFs, Crypto CFD, ETFs CFD, Stocks CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Spot Metals | ✔ |

| Indices | ✔ |

| Spot Energies | ✔ |

| NDFs | ✔ |

| Crypto CFD | ✔ |

| ETFs | ✔ |

| Stocks CFDs | ✔ |

| Bonds | ❌ |

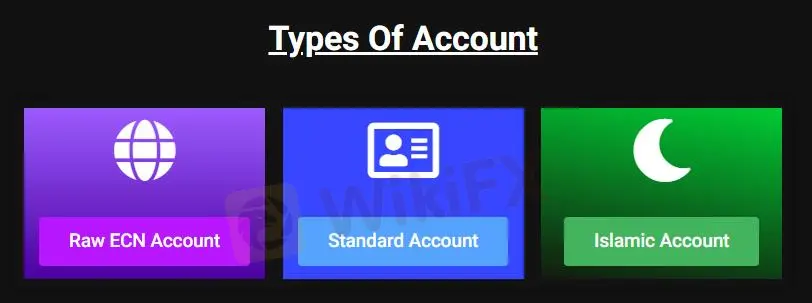

Account Types

Beirmancapital offers 3 types of accounts: Raw ECN Account, Standard Account and Islamic Account. But details are not available.

Leverage

Beirmancapital says it offers leverage of 1:1000.

Beirmancapital Fees

Beirmancapital BeirmanCapital provides spreads from 0.01 pips. Beirmancapital also claims to offer low commissions.

Trading Platform

Beirmancapital enables you to use MT5 on the web or mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, Mobile | Skilled Traders |

| MT4 | ❌ |

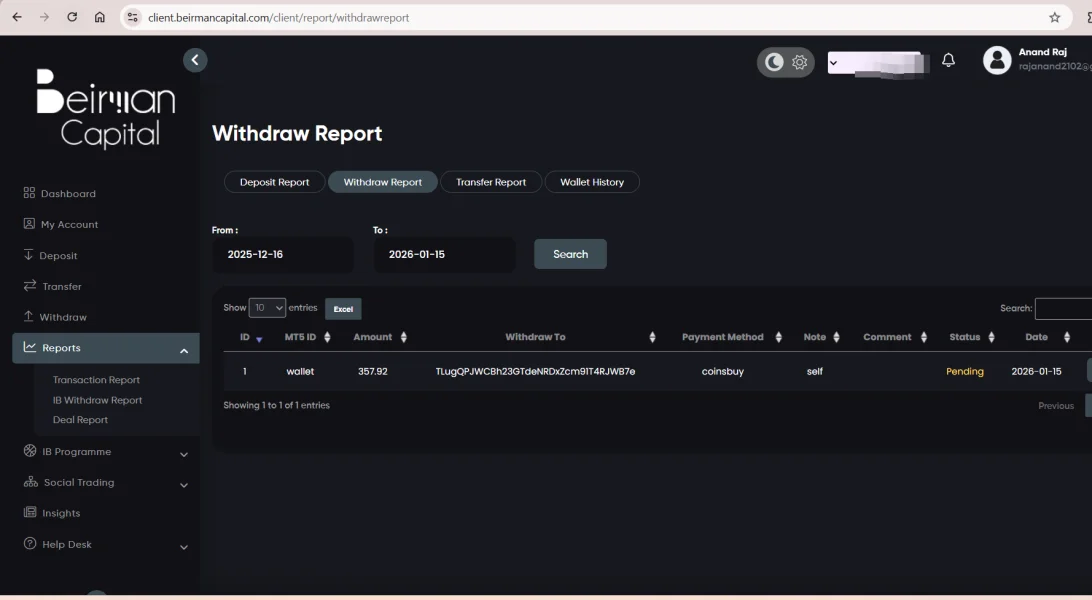

Deposit and Withdrawal

Beirmancapital offers 6 payment options: VISA, MasterCard, Skrill, BANK TRANSFER, Bitcoin, Perfect Money. And there are no deposit fees.

FX3182210251

United Arab Emirates

even the support team is not able to reply, they keep swiytcginh teams, for a simple crypto withdrwal for just 3 digit of witgdrwal, its a scam company.

Exposure

Adam Jhonson

United States

I had an exceptional experience with Beirman Capital. Their team is professional, knowledgeable,& genuinely dedicated to understanding client needs. From start to finish, they guided me through the process with clarity & care, always keeping my best interests in mind. Their strategic insights & attention to detail exceeded my expectations. I highly recommend Beirman Capital to anyone looking for a trusted Broker in navigating financial opportunities.

Positive

JohnWilson

India

Beirman Capital offers competitive spreads and fast order execution, making it a good choice for active traders. Their platform is user-friendly and offers a variety of trading tools. However, their educational resources could be more comprehensive, especially for beginners.

Positive

Mordekhai

United Arab Emirates

I am really impressed by the withdrawal services. I wanted my money back due to some personal issues. And I got my withdrawal within an hour. Good Withdrawal Policy.

Positive

Elaxi Flora

United States

For me, Beirman Capital is the best platform if you are looking for tight spreads broker. Being a short term trader spreads matter a lot and i am satisfied with its spread. I can surely recommend it for trading forex pairs.

Positive

Nubia Guedes

United States

I have been using Beirman Capital as my Forex broker for a while now. Their website is super easy to navigate, and everything I need whether its Forex market updates, trading tools, or customer support is right there. What really stands out is their professionalism and the personal touch they bring to their services. I have always felt supported, and their insights have genuinely helped me make better trading decisions. Highly recommend them to anyone looking for a reliable and trustworthy broker

Positive

FX3462580812

India

Fast withdrawal and deposit. Smooth execution for trading. It is very easy to use. Overall very good experience.

Positive

Jankal

United States

During the process of account opening, I have a good experience of advise and coordination and step by step guidance... A representative contacted me and assure his full support all the times.

Positive

Antonio G

Italy

The deposit and withdrawal process at Beirmancapital is smooth and fast.

Positive

Bambang Soeprijanto

Indonesia

Beirmancapital's charting tools and indicators are comprehensive. The mobile app is easy to use and withdrawing funds is straightforward. By the way, withdrawals here are fast 👍👍👍.

Positive