BlackBull Information

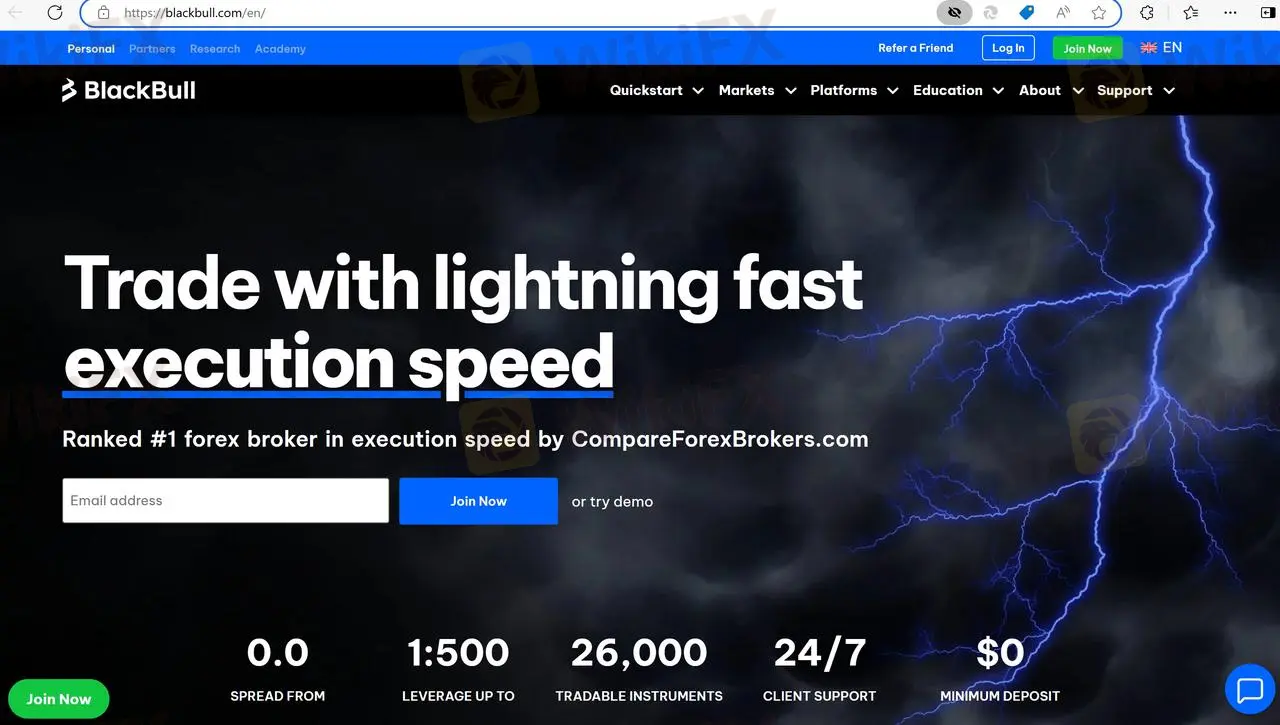

BlackBull is an STP (Straight Through Processing) forex broker that provides online trading services to retail and institutional clients. The company was founded in 2014 and is headquartered in Auckland, New Zealand. BlackBull is regulated by FMA in New Zealandand offshore regulated by FSA in Seychelles. It offers 26,000 tradable instruments including forex, commodities, equities, indices, metals, futures, and cryptos. The broker provides clients with multiple trading platforms such as MetaTrader 4/5 and various trading tools. The company also provides educational resources to assist traders in their trading journey.

Pros & Cons

BlackBull appears to be a reliable and well-regulated broker that offers a wide range of trading instruments, platforms, and educational resources. The broker's emphasis on security and transparency, such as offering segregated accounts and holding funds in Tier 1 New Zealand banks, is also a positive aspect.

However, clients from the European Union, the United Kingdom and any non-resident of New Zealand are not accepted.

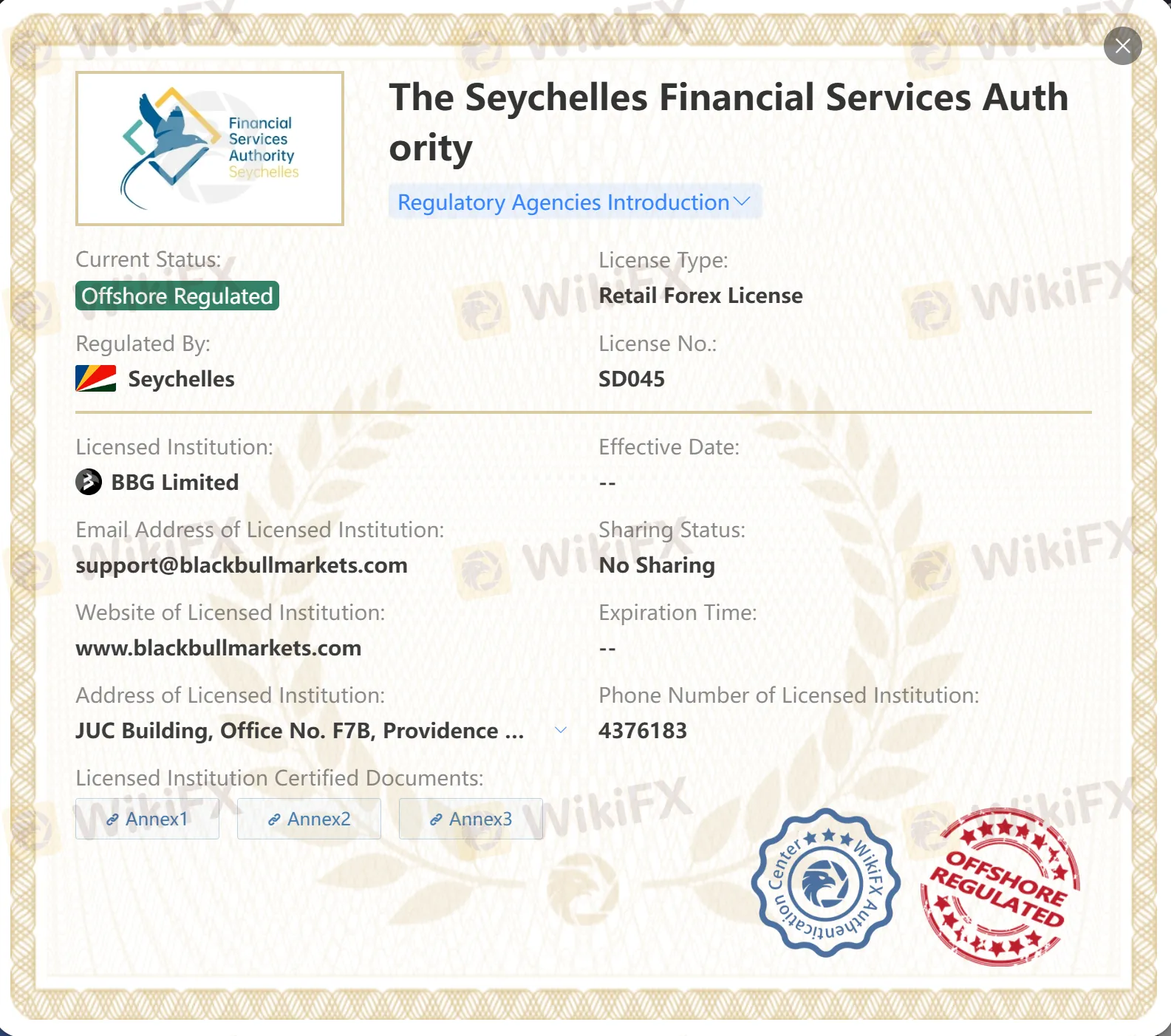

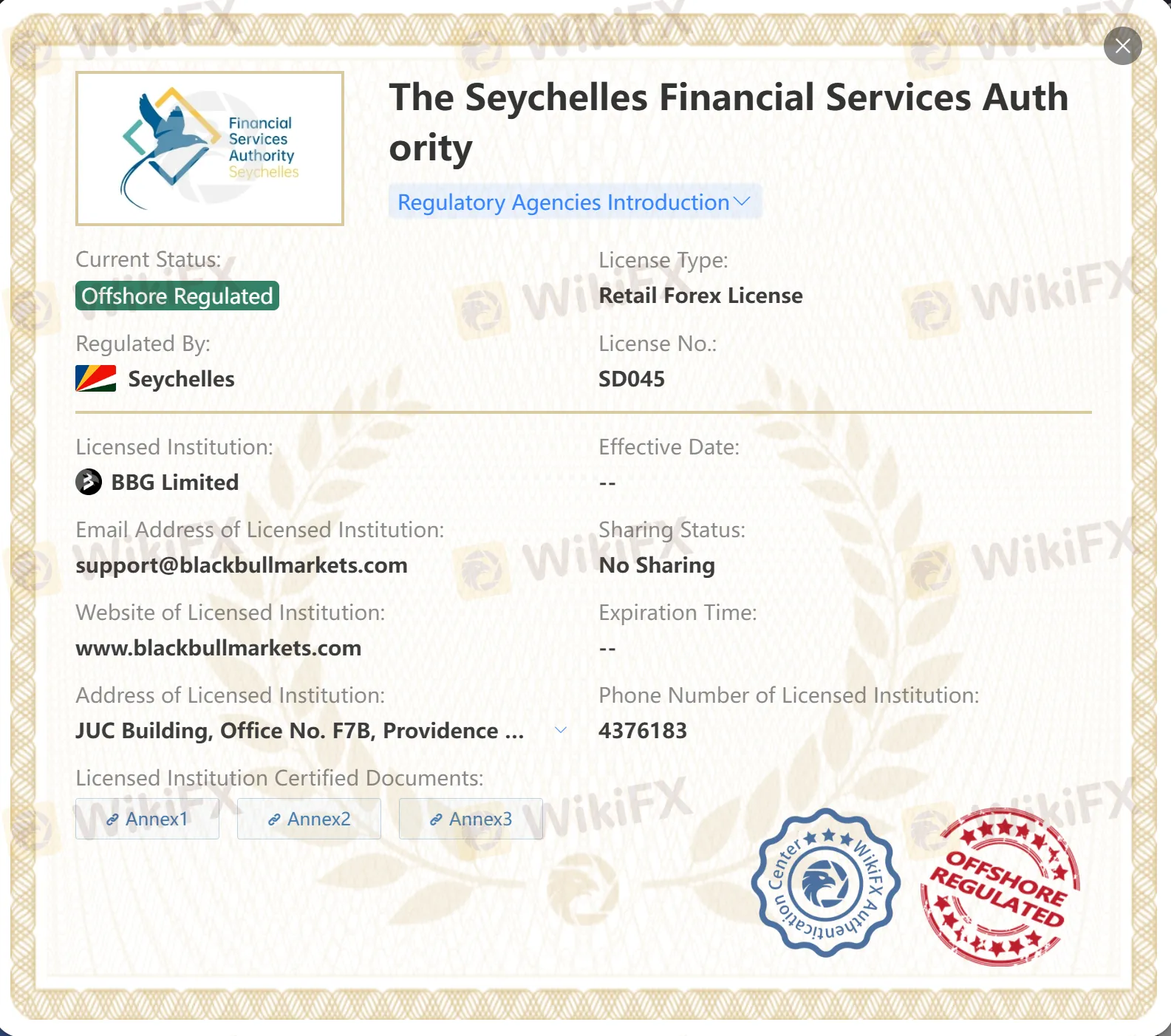

Is BlackBull Legit?

Yes. BlackBull is regulated by Financial Markets Authority (FMA) in Australia and offshore regulated by the Seychelles Financial Services Authority (FSA) in New Zealand.

It also claims to hold client funds in safe, Tier 1 New Zealand-based banks with segregated accounts.

However, the negative reviews from some clients who report issues with withdrawing their funds raise concerns. It's important for individuals to conduct their own research, carefully evaluate the broker's features and services, and exercise caution when investing their money.

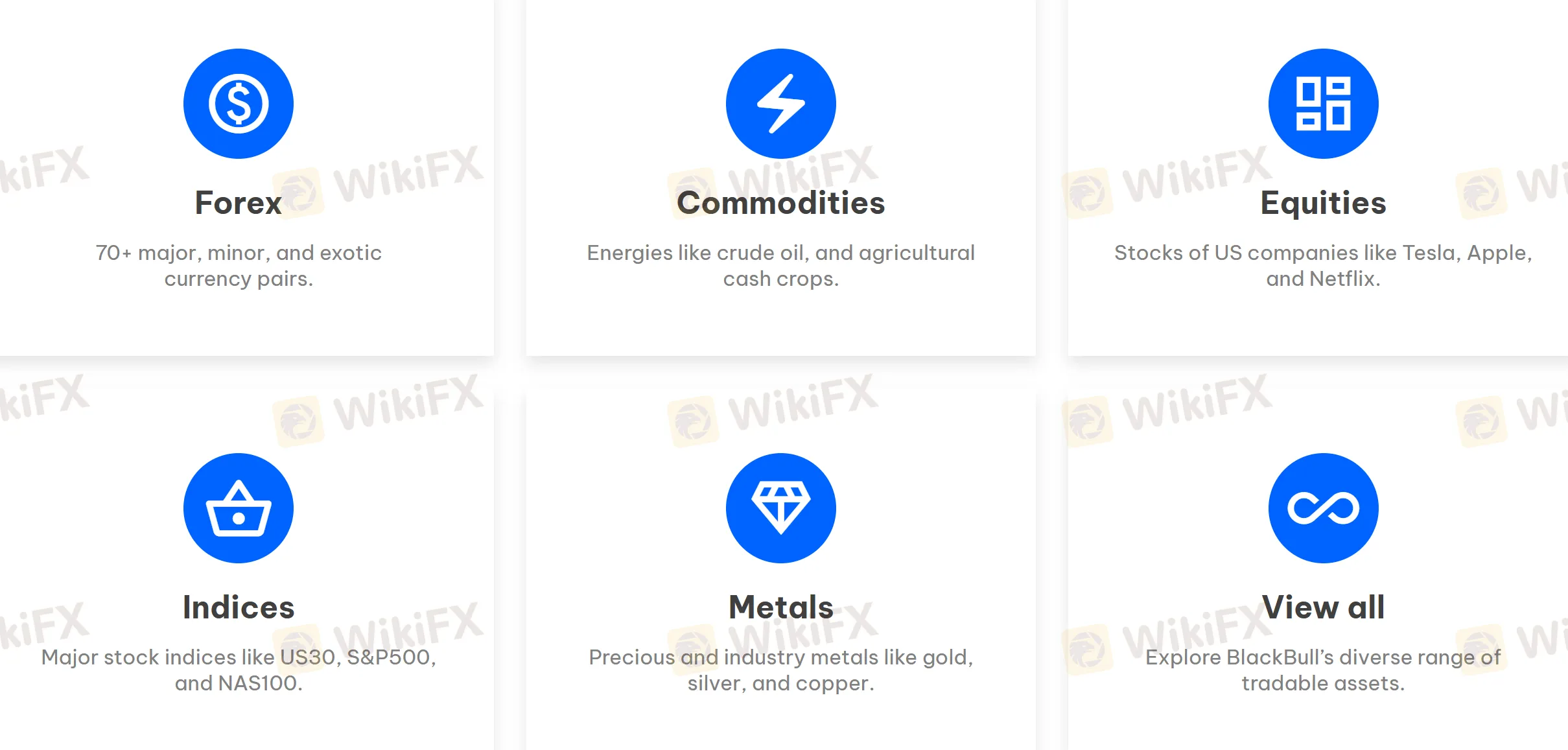

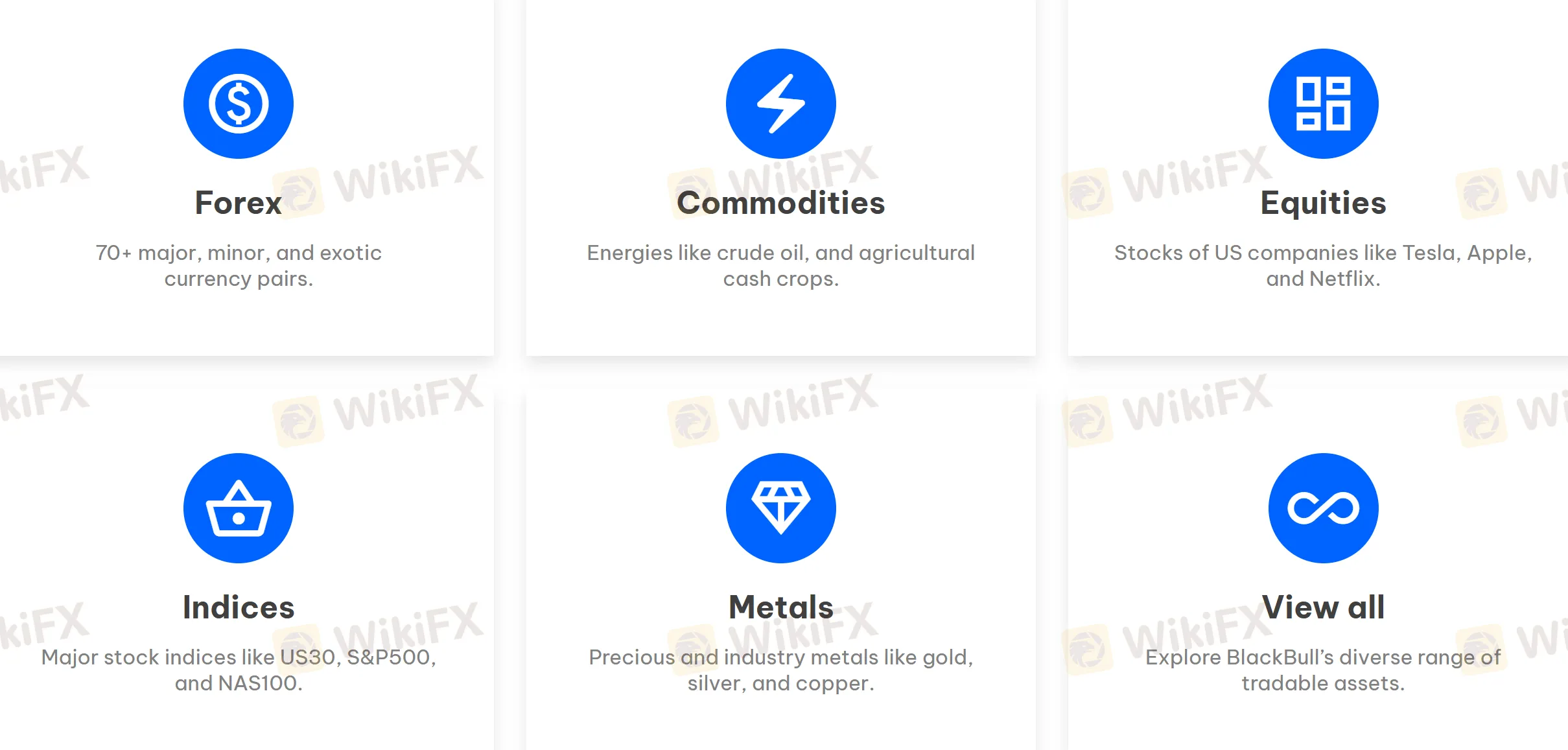

Market Instruments

BlackBull offers a diverse range of 26,000 financial instruments across various asset classes, including forex, commodities, equities, indices, metals, futures, and cryptos.

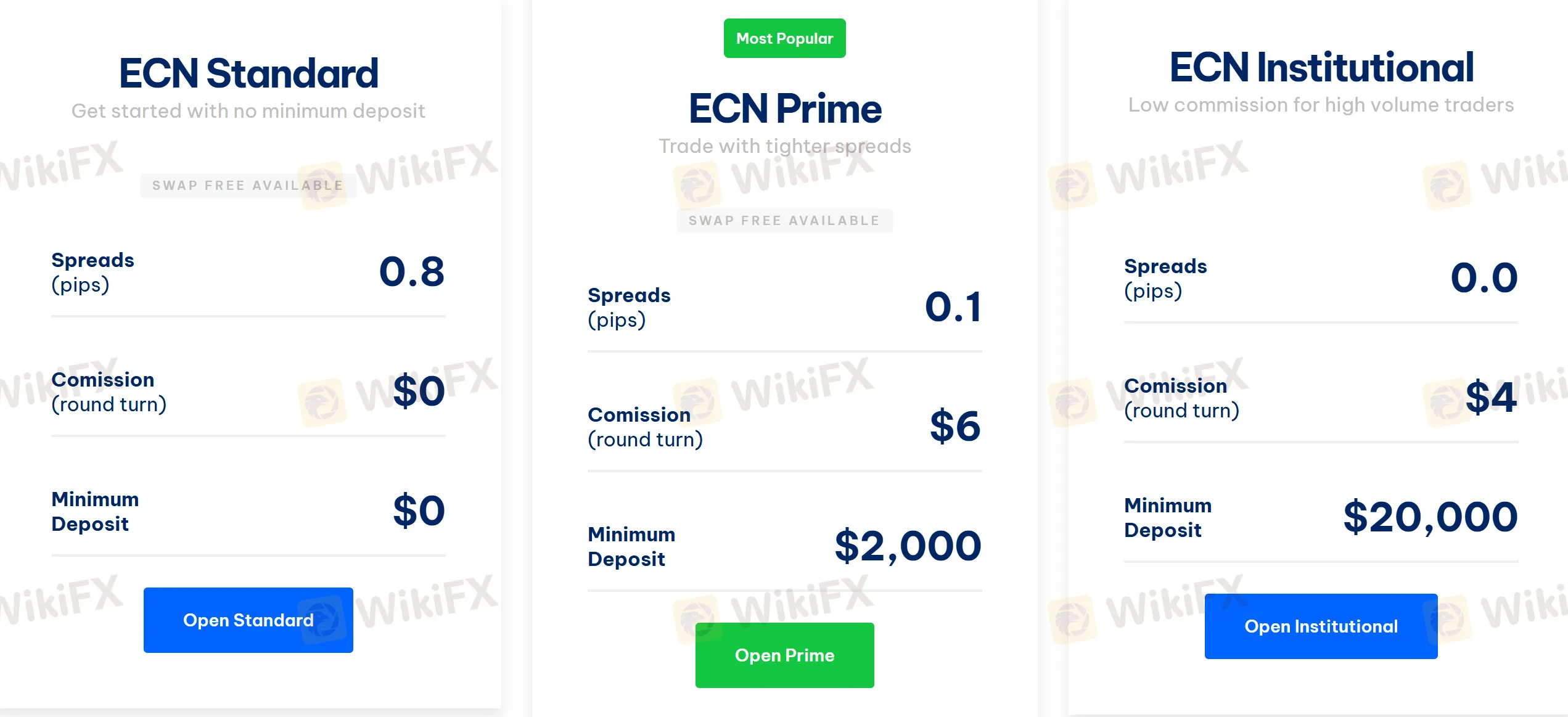

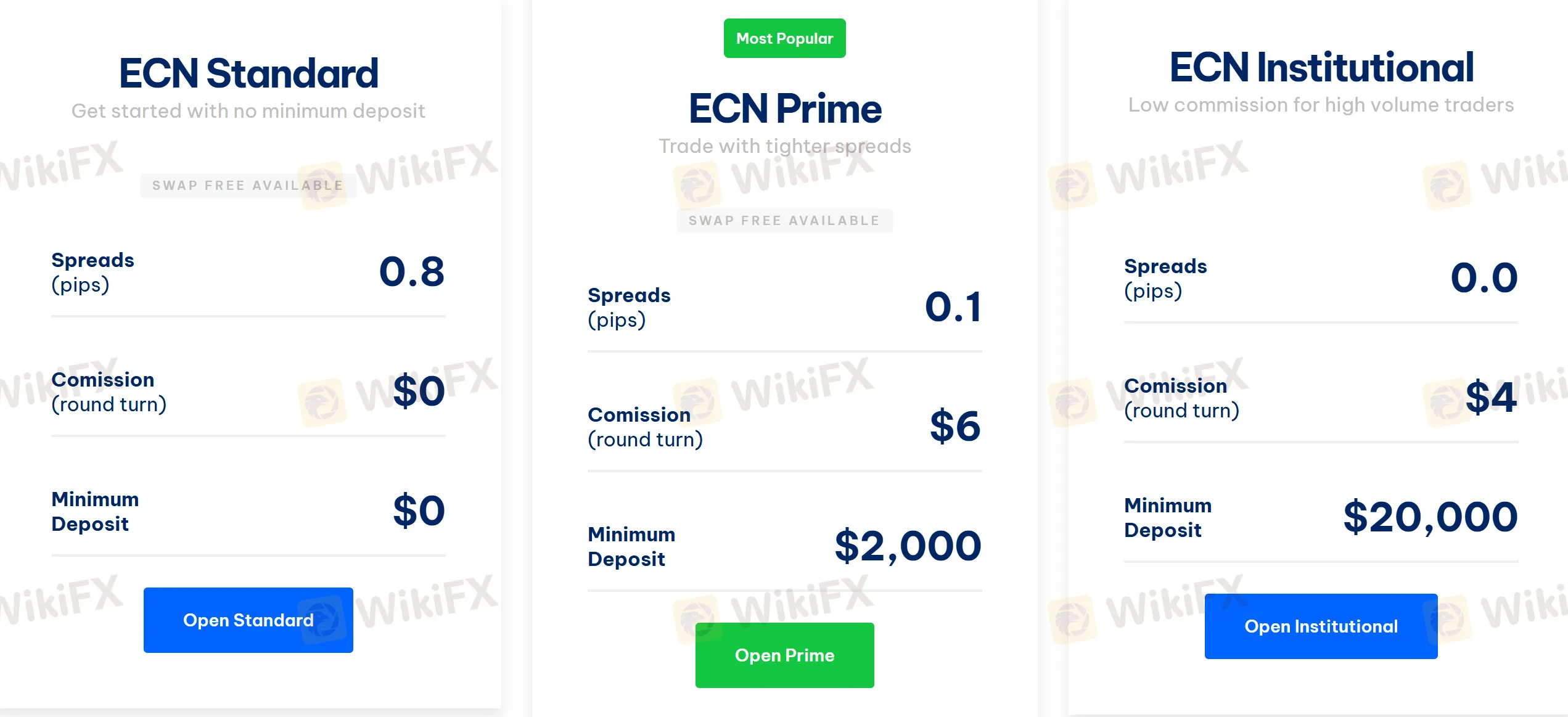

Account Type/Fees

Demo Account: BlackBull provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: BlackBull offers a total of 3 account types: ECN Standard, ECN Prime and ECN Institutional. The minimum deposit to open an account is $0, $2,000 and $20,000 respectively. If you are still a beginner and don't want to invest too much money in Forex trading, the ECN Standard account will be the most suitable option for you.

Leverage

BlackBull offers a maximum leverage of up to 1:500, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

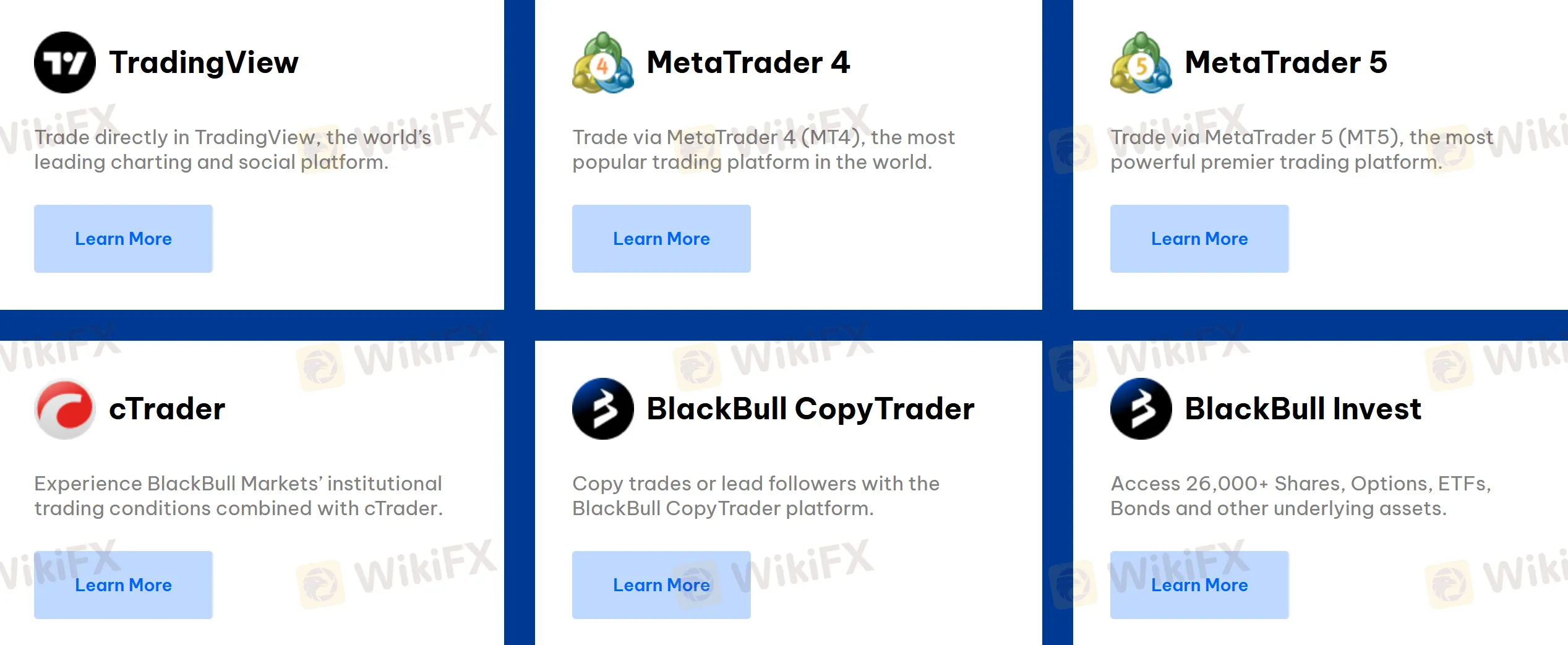

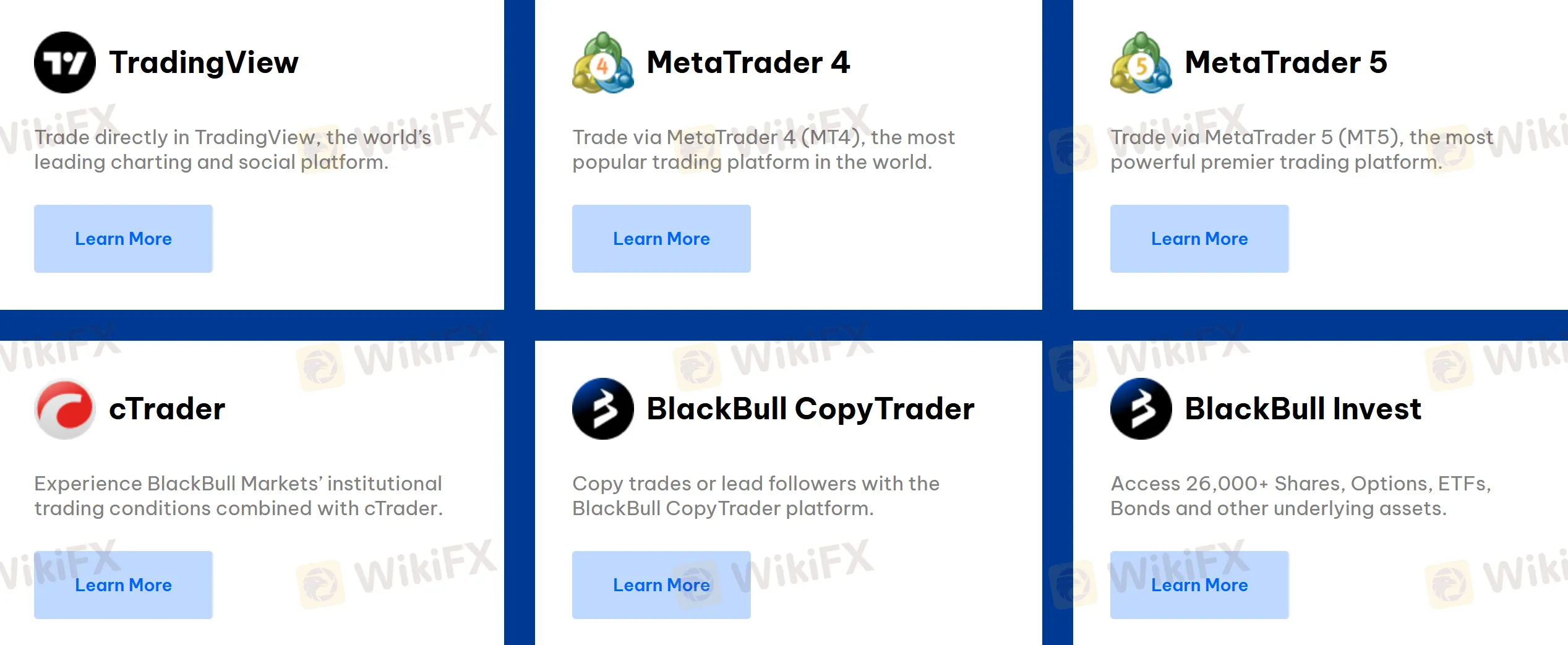

Trading Platforms

As for the trading platform, BlackBull provides its clients with many options. There are public platforms including TradingView, MT4/5, cTrader, BlackBull CopyTrader, and BlackBull Invest.

Deposits & Withdrawals

BlackBull accepts payments via Visa, MasterCard, Apple Pay, Google Pay, Bank Transfer, AIRTM, and Neteller.

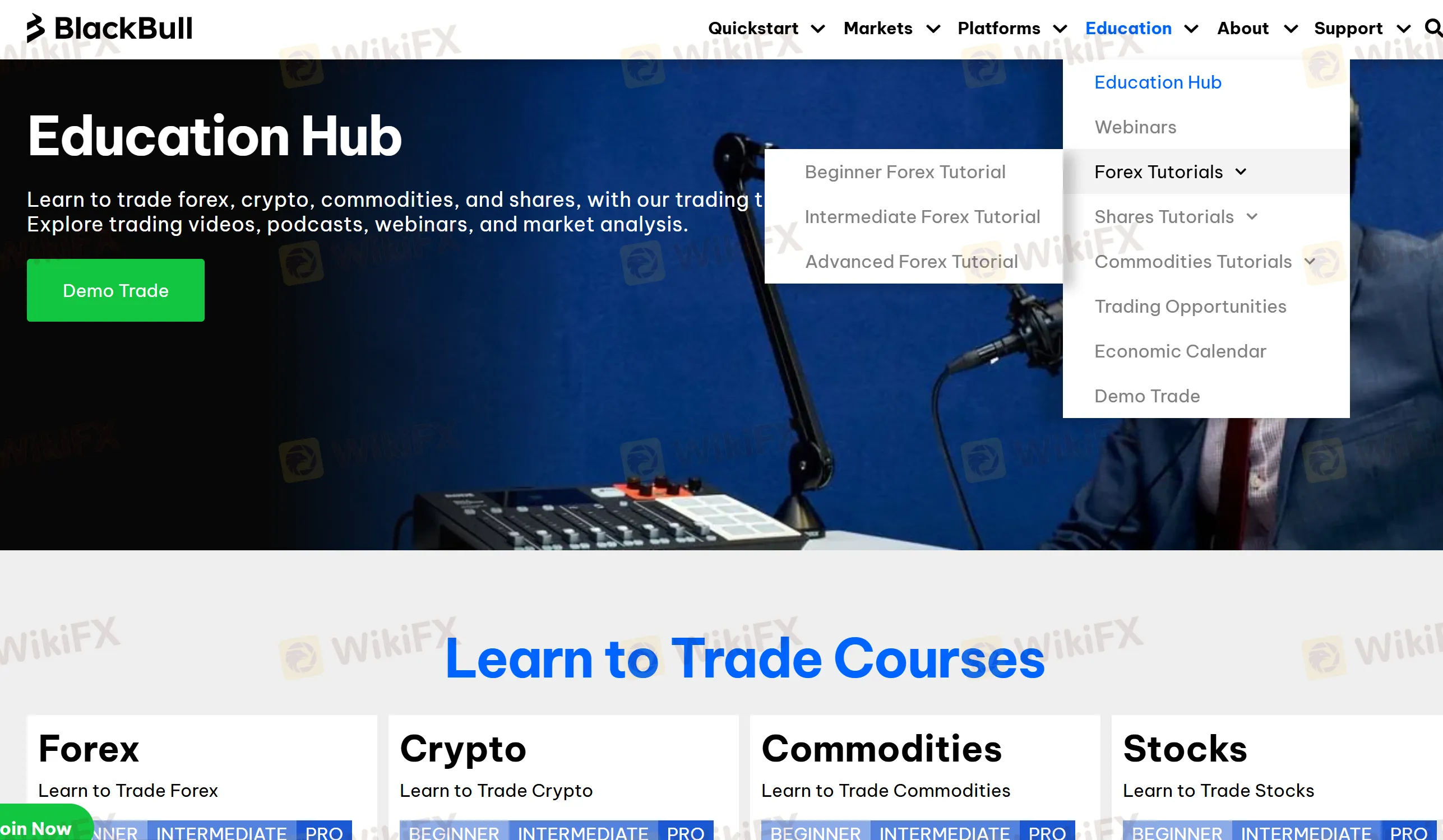

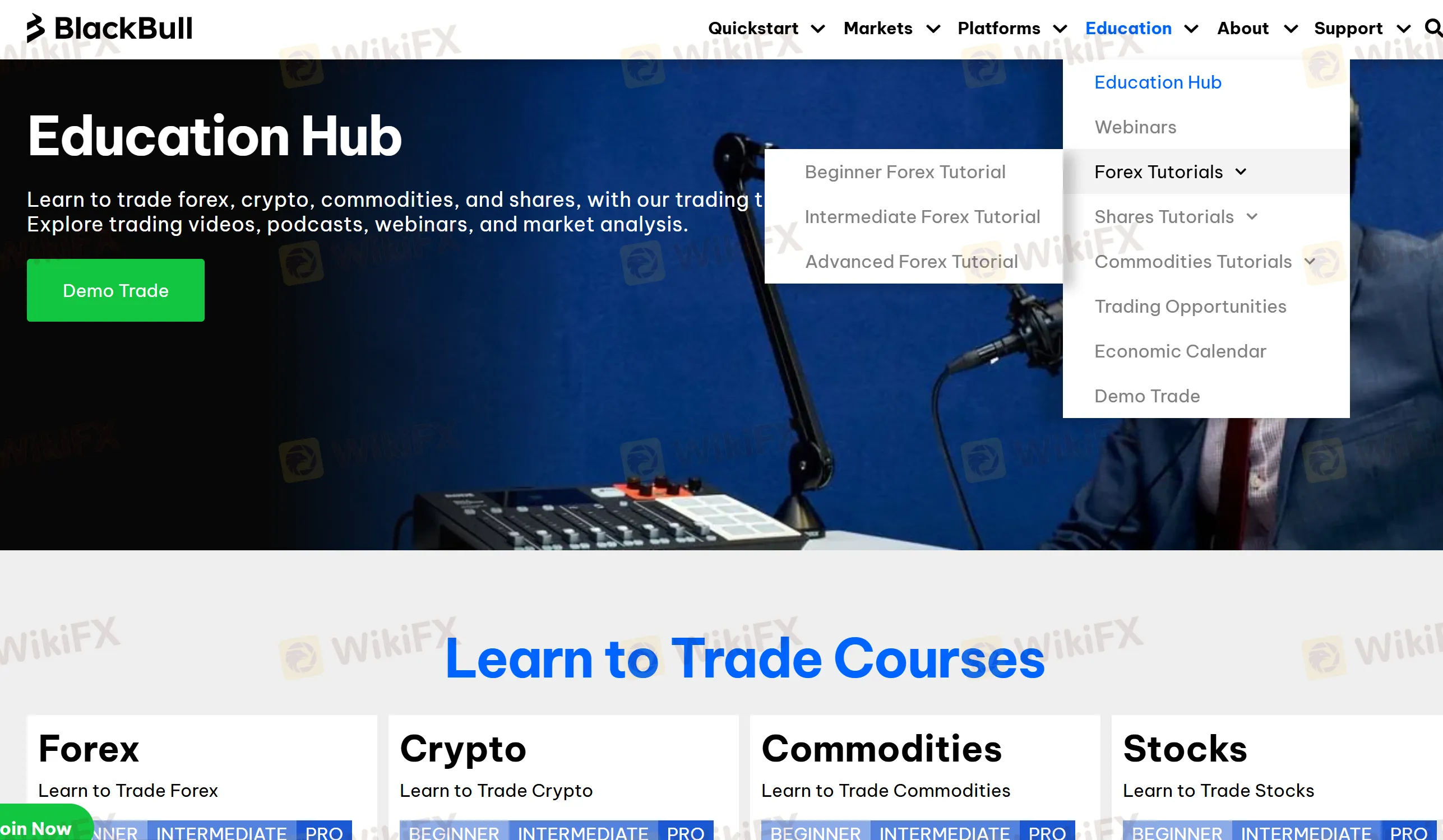

Education

A series of educational resources is available at BlackBull, such as trading courses, webinars, tutorials for forex, shares, and commodities.

The educational materials are categorized based on the clients level of experience, with Forex Beginner, Forex Intermediate, and Forex Advanced categories. The educational articles cover a wide range of topics, from the basics of trading to advanced strategies and technical analysis. These resources are designed to help traders develop a better understanding of the markets and improve their trading skills, which can ultimately lead to more successful trades.

Conclusion

Based on the information provided, BlackBull appears to be a well-regulated broker that offers a wide range of tradable instruments across multiple asset classes, as well as a variety of trading platforms and tools. The broker's educational resources and customer service are also noteworthy.

However, there are some negative reviews from clients regarding difficulty with withdrawals and accusations of being a scam platform, so traders should proceed with caution and do their own research before investing with BlackBull.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.