Company Summary

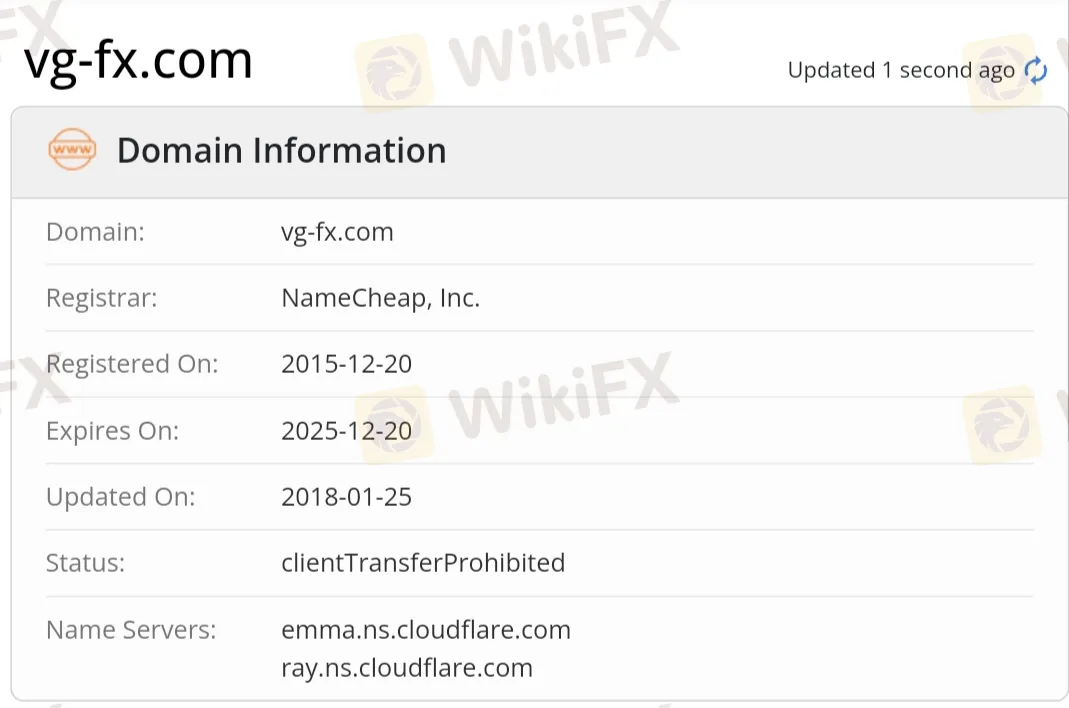

Note: Valour FX's official website - https://vg-fx.com/ is inaccessible, so the relevant information is incomplete. We will do our best to collect some information about it.

| Valour FXReview Summary | |

| Founded | 2015 |

| Registered Country/Region | United Kingdom |

| Regulation | VFSC (Revoked) |

| Market Instruments | CFDs on major equity indices, stocks and commodities |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | Fixed from 2.5 pips |

| Trading Platform | MT4 |

| Min Deposit | $100 |

| Customer Support | Tel: +44 2036082021 |

| Email: help@vg-fx.com | |

Valour FX is a forex broker founded in 2015 and based in the UK, providing CFDs trading on major equity indices, stocks and commodities. Its leverage is up to 1:500 and the spread is fixed from 2.5 pips. The platform MT4 provided is popular and functional.

Pros and Cons

| Pros | Cons |

| MT4 support | Inaccessible website |

| Popular payment options | Revoked VFSC license |

| No demo accounts | |

| High fixed spreads |

Is Valour FX Legit?

No, the status of the VFSC license is revoked. Please be aware of the risk!

| Vanuatu Financial Services Commission (VFSC) |

| Current Status | Revoked |

| Regulated by | Vanuatu |

| Regulated Entity | VALOUR GLOBAL LIMITED |

| License Type | Retail Forex License |

| License No. | 14806 |

What Can I Trade on Valour FX?

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Major equity indices | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Forex | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

The leverage is high to 1:500, which means that investors can control larger trading positions with less capital, increasing both potential returns and risks.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Valour FX offers several payment methods: Bank Transfer, Credit Card, UnionPay, and Skrill.