Company Summary

| Aspect | Information |

| Company Name | JMC Capital |

| Registered Country/Area | Hong Kong |

| Founded Year | 2017 |

| Regulation | Regulated by the Securities and Futures Commission (SFC) of Hong Kong |

| Market Instruments | Stocks, Futures |

| Products and Services | Financial consulting, global asset allocation, asset management |

| Account Types | Security Account, Futures Account, Wealth Management Account, Asset Management Account |

| Customer Support | Phone(+852 6888 8688), Email(cs@jmccapital.com.hk, jmci_cs@jmccapital.com.hk) |

Overview of JMC Capital

Established in 2017, JMC Capital is a Hong Kong-based financial and investment firm specializing in customized financial services for high-net-worth individuals and institutions.

The company offers a wide range of services, including global asset allocation, asset management, and financial consulting. With a headquarters in Hong Kong, JMC Capital operates under the regulatory oversight of the Securities and Futures Commission (SFC), ensuring compliance with established standards. While its tailored financial services are suitable for specific client needs, the platform's advantages include a wide range of trading assets and transparent fee structures.

However, users should consider potential disadvantages such as higher minimum fees for smaller transactions and the platform's focus on larger transactions or high-frequency trading.

Is JMC Capital legit or a scam?

JMC Capital operates under the supervision of the Securities and Futures Commission (SFC) of Hong Kong, holding a license for dealing in futures contracts (License No.: BNO569).

The regulatory oversight by the SFC ensures that JMC Capital complies with the established standards and regulations set forth by the regulatory body. This regulatory status provides traders on the platform with a sense of security and trust in the integrity of the services offered. The transparency and accountability mandated by regulatory oversight not only safeguard traders' interests but also promote fair trading practices and market stability.

JMC Capital not only operates under the supervision of the Securities and Futures Commission (SFC) of Hong Kong with a license for dealing in securities (License No.: BMR281), but it also exceeds the regulatory requirements set forth by the SFC.

This means that the platform goes above and beyond the standard regulatory obligations, demonstrating a commitment to maintaining the highest level of compliance and integrity in its operations. For traders, this elevated regulatory status provides an additional layer of confidence and assurance in the platform's reliability and trustworthiness.

Pros and Cons

| Pros | Cons |

| Regulatory oversight by SFC | Higher minimum fees for smaller transactions |

| Platform exceeds regulatory requirements | Prelisting trade commission adds to overall cost |

| Wide range of financial products and services | Platform may be more suitable for investors engaging in larger transactions or high-frequency trading |

| Comprehensive account types | |

| Transparent fee structure | |

| Comprehensive customer support |

Pros:

Regulatory Oversight by SFC: This ensures that JMC Capital operates within the regulatory framework set by the Securities and Futures Commission of Hong Kong, providing a sense of security and trust for traders.

Platform Exceeds Regulatory Requirements: Going beyond regulatory obligations showcases the platform's commitment to maintaining high standards of compliance and integrity.

Wide Range of Financial Products and Services: JMC Capital offers a wide variety of financial products and services Investors have access to a range of options, from securities trading to wealth management, providing flexibility and choice.

Comprehensive Account Types: The platform offers various account types tailored to different investment objectives and preferences. Whether users prefer individual stock trading, futures trading, or wealth management services, there's an account type suitable for their needs.

Transparent Fee Structure: The fee structure is transparent and clearly outlined, allowing users to understand the costs associated with their transactions. This transparency helps users make informed decisions and manage their investment expenses effectively.

Comprehensive Customer Support: JMC Capital provides comprehensive customer support, offering multiple channels for users to seek assistance and guidance. Whether through phone lines, email, or in-person visits, users can access timely support and resolve any queries or issues they encounter.

Cons:

Higher Minimum Fees for Smaller Transactions: Smaller transactions may incur relatively higher minimum fees, which can impact the overall cost-effectiveness for users.

Prelisting Trade Commission Adds to Overall Cost: Prelisting trade commissions, in addition to standard brokerage fees, contribute to the overall transaction costs for users.

Platform May be More Suitable for Larger Transactions or High-Frequency Trading: The fee structure and minimum requirements may favor investors engaging in larger transactions or high-frequency trading.

Product and Services

JMC Capital provides a wide range of financial products and services tailored to meet the unique needs of its clients. With a commitment to excellence and innovation, the platform offers solutions in security trading, external asset management, wealth management, family office services, and fund establishment and management.

Security Trading

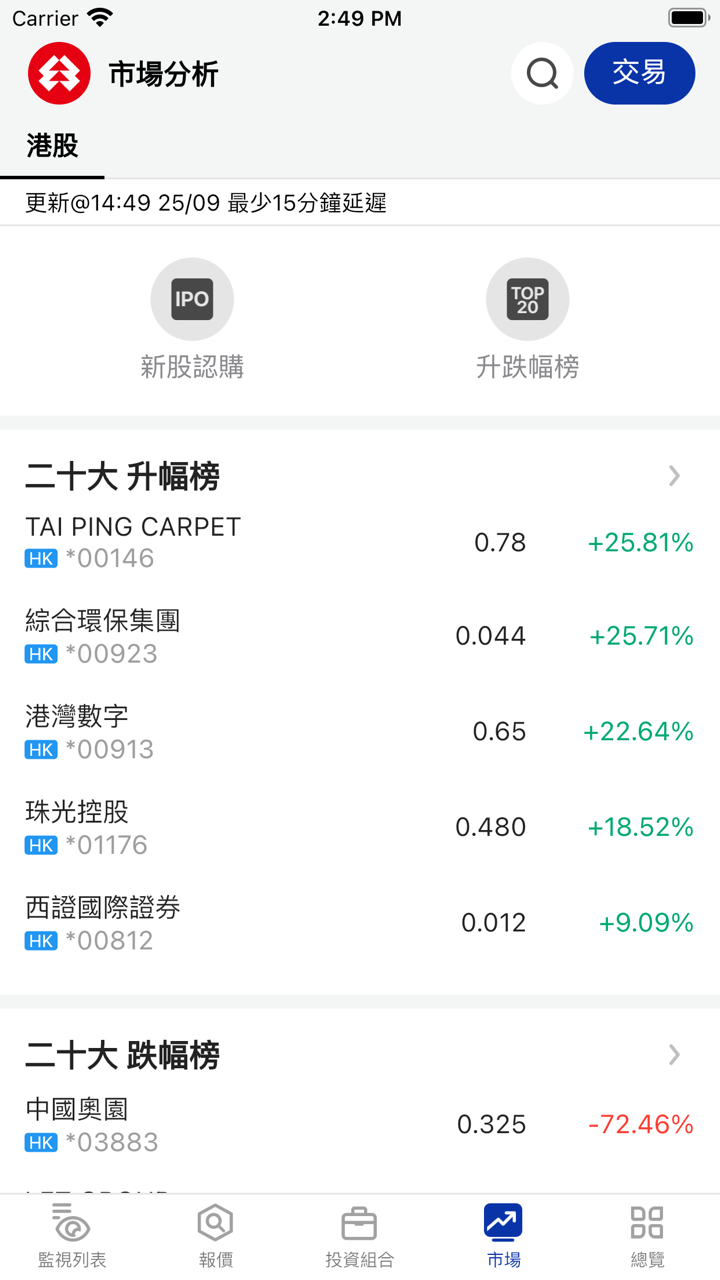

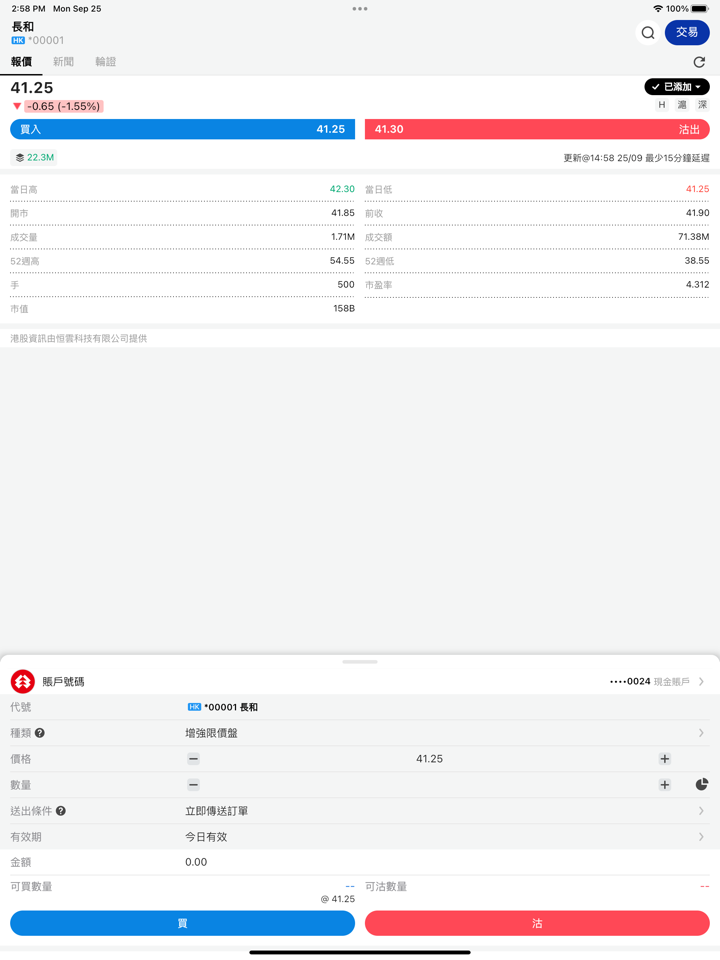

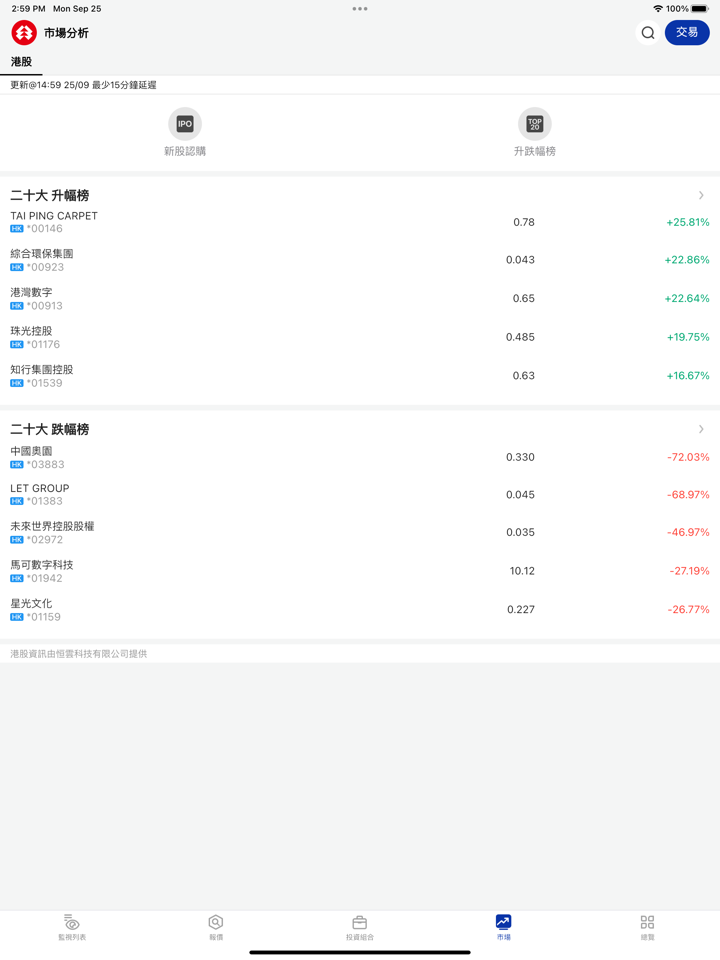

JMC Capital offers a comprehensive security trading platform that connects users to listed stocks and futures trading across 26 countries, encompassing major global markets such as Hong Kong, the United States, and China. With seasoned advisors guiding investments, the platform provides a reliable and stable environment for online trading, accommodating both Hong Kong and overseas futures.

External Asset Management

In collaboration with leading international private banks in Hong Kong and Singapore, JMC Capital's external asset management service offers elite investment advisory services. The platform strives to create a top-tier investment platform, maximizing client benefits through unique market insights and tailored recommendations on strategies, products, and asset allocation. The professional services encompass marketing report analysis, investment product selection, transaction execution, account performance tracking, strategy adjustment, and client-contract management.

Wealth Management

JMC Capital's wealth management services include discretionary asset management, empowering its elite investment team to trade under limited conditions. This arrangement saves clients time and energy by allowing experts to actively manage investments, evaluate them according to market dynamics, and maintain preferred allocations based on objectives and risk tolerance. The platform emphasizes diving into global markets, supported by a professional research team and a wide range of investments to ensure risk diversification. Personalized investment portfolios are tailored to fit client objectives while minimizing investment costs.

Family Office

Targeted at ultra-high net worth families, JMC Capital's family office consultancy team provides comprehensive wealth management services, including trust establishment, asset allocation, tax consultation, and value-added services such as overseas education. With a focus on discretionary investment services, the platform integrates corporate resources to ensure the continuation of financial and human capital across generations.

Fund Establishment and Management

JMC Capital offers a one-stop fund service platform to institutional investors, family offices, and enterprises. Beyond fund establishment, the platform provides advisory services on operations, compliance, and investments. Additionally, JMC Capital is set to launch an enhanced income fund, leveraging flexible investment strategies, diversified asset allocation, and effective risk management to secure long-term and stable returns for core clients.

Account Types

JMC Capital offers a variety of account types tailored to different investment needs.

The Security Account is suitable for users interested in individual stock trading. It provides a platform for buying and selling securities such as stocks or exchange-traded funds (ETFs). This account type suits investors who prefer to actively manage their portfolios and make decisions on specific securities.

The Futures Account is geared towards users interested in futures trading. Futures contracts involve agreements to buy or sell assets at predetermined prices on future dates. This account type serves traders looking to speculate on price movements in commodities, currencies, indices, or other futures contracts. It may appeal to investors seeking exposure to derivative products and utilizing margin for trading strategies.

The Wealth Management Account offered by JMC Capital provides a service where the platform manages a user's investments based on their financial goals and risk tolerance. This account type might involve a minimum investment threshold and is suitable for individuals, families, or institutions seeking professional investment guidance and portfolio management. It offers personalized investment strategies and ongoing monitoring to align with the client's objectives.

Similarly, the Asset Management Account is akin to the Wealth Management Account, with JMC Capital overseeing the management of a user's assets. This account type is suitable for clients who prefer to delegate the day-to-day management of their investments to professional asset managers. It offers a hands-off approach to investment management, allowing clients to benefit from the expertise of elite investment advisors while freeing up their time and resources for other endeavors.

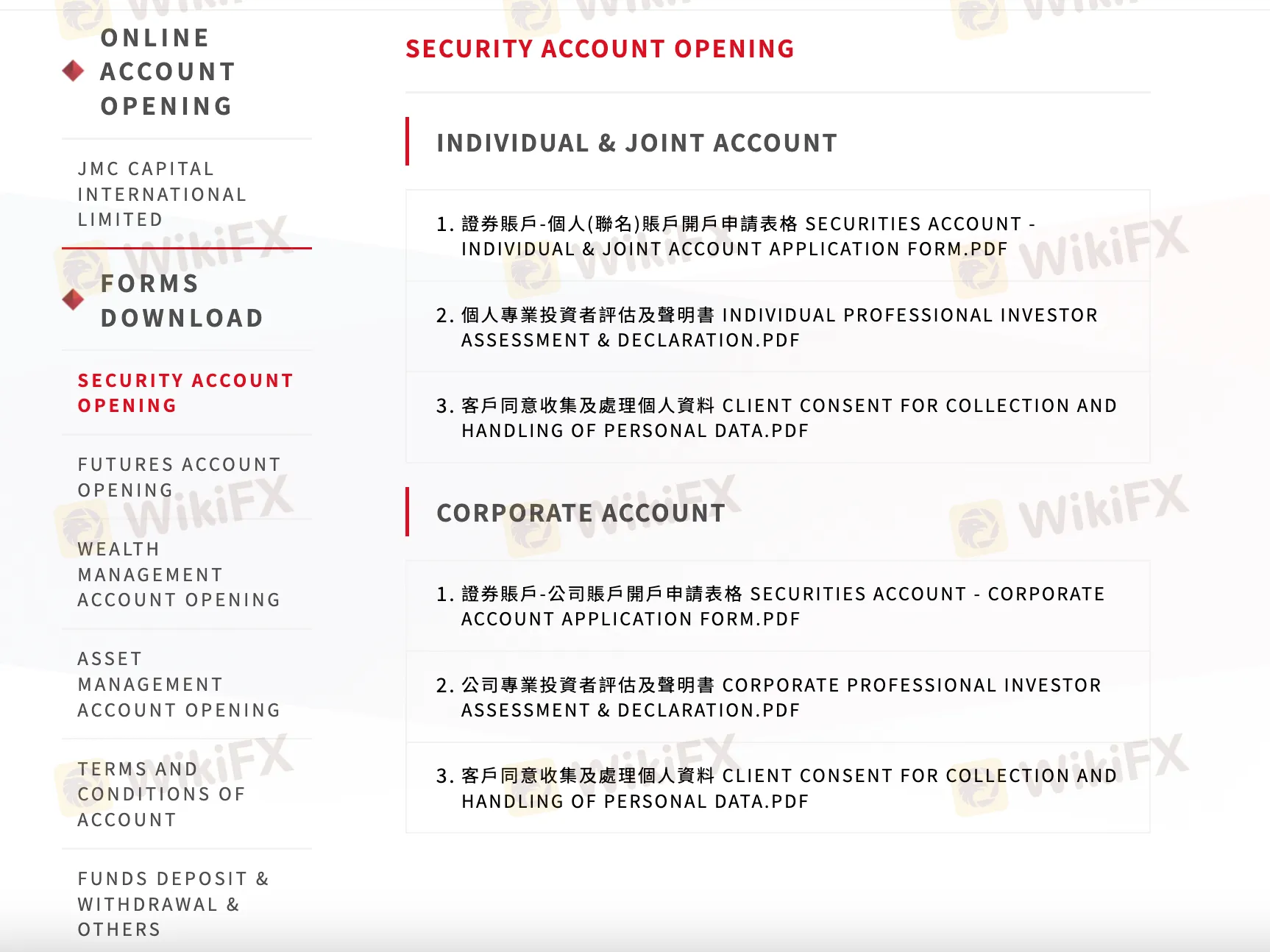

How to Open an Account?

The account opening procedures vary depending on the account type.

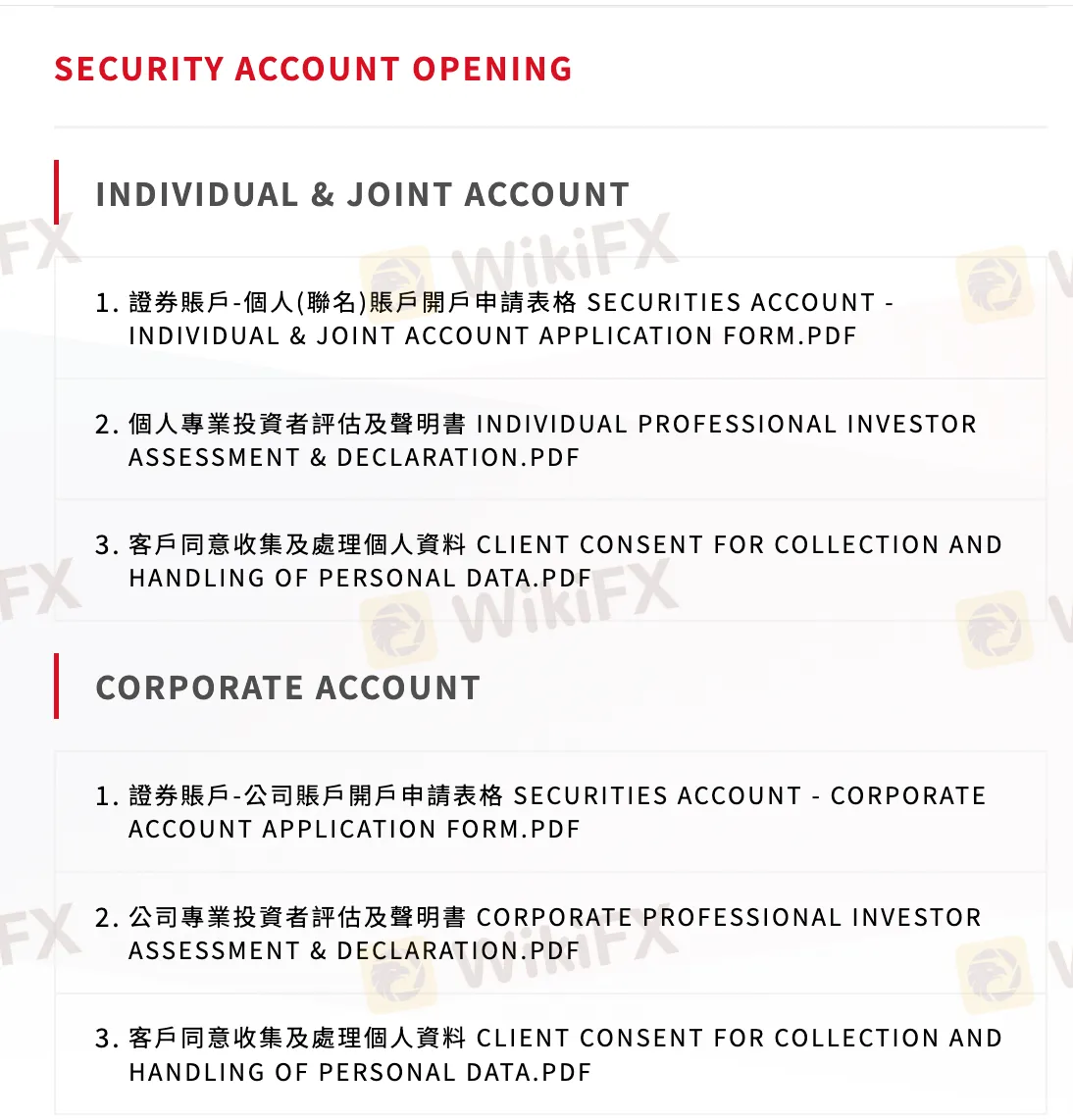

Security Account Opening - Individual & Joint Account

Download the “Securities Account - Individual & Joint Account Application Form” (PDF).

Fill out the “Individual Professional Investor Assessment & Declaration” form (PDF).

Review and sign the “Client Consent for Collection and Handling of Personal Data” form (PDF).

Security Account Opening - Corporate Account

Download the “Securities Account - Corporate Account Application Form” (PDF).

Complete the “Corporate Professional Investor Assessment & Declaration” form (PDF).

Review and sign the “Client Consent for Collection and Handling of Personal Data” form (PDF).

Futures Account Opening - Individual & Joint Account

Download the “Futures Account - Individual & Joint Account Application Form” (PDF).

Fill out the “Non-Professional Self-Certification Form” (PDF).

Complete the “Market Data Subscription Agreement” (PDF).

Submit the “Individual Professional Investor Assessment & Declaration” form (PDF).

Review and sign the “Client Consent for Collection and Handling of Personal Data” form (PDF).

Futures Account Opening - Corporate Account

Download the “Futures Account - Corporate Account Application Form” (PDF).

Complete the “Non-Professional Self-Certification Form” (PDF).

Fill out the “Market Data Subscription Agreement” (PDF).

Submit the “Corporate Professional Investor Assessment & Declaration” form (PDF).

Review and sign the “Client Consent for Collection and Handling of Personal Data” form (PDF).

Wealth Management Account Opening - Individual & Joint Account

Download the “Wealth Management Account - Individual & Joint Account Application Form” (PDF).

Fill out the “Individual Professional Investor Assessment & Declaration” form (PDF).

Review and sign the “Client Consent for Collection and Handling of Personal Data” form (PDF).

Fees

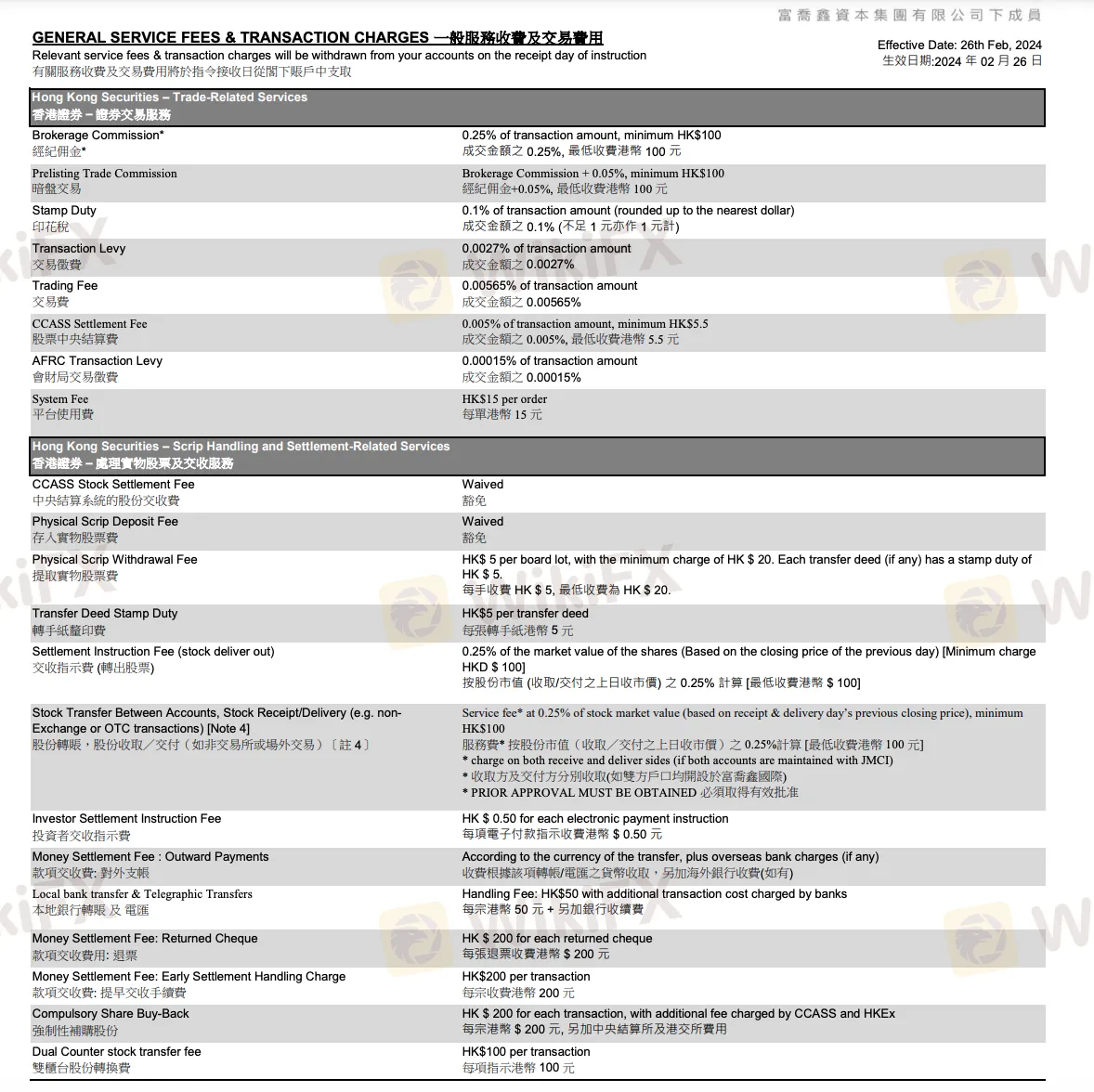

JMC CAPITAL's fee structure for its Securities Trading Services in Hong Kong encompasses various charges applicable to transactions.

These include the AFRC Transaction Levy, amounting to 0.00015% of the transaction value, the Transaction Levy at 0.0027% of the transaction amount, and the Trading Fee at 0.00565% of the transaction value. Additionally, there's a CCASS Settlement Fee, which is calculated at 0.005% of the transaction amount, with a minimum charge of HK$5.5. Brokerage Commission is set at 0.25% of the transaction amount, with a minimum fee of HK$100. For prelisting trades, the commission is the Brokerage Commission plus 0.05%, again with a minimum fee of HK$100. Stamp Duty is levied at 0.1% of the transaction amount, rounded up to the nearest dollar. Moreover, users are subject to a System Fee of HK$15 per order for platform usage.

Considering the fee structure, the platform may be more suitable for investors or traders engaging in larger transactions, as the minimum fees for brokerage commission and settlement can add up, particularly for smaller trades. Additionally, users who frequently engage in prelisting trades or utilize the platform for high-frequency trading may find the fee structure more favorable. Overall, investors looking for a platform with transparent fee structures and a range of services may find JMC CAPITAL's offering appealing, particularly if they are comfortable with the fee levels associated with their trading activities.

Customer Support

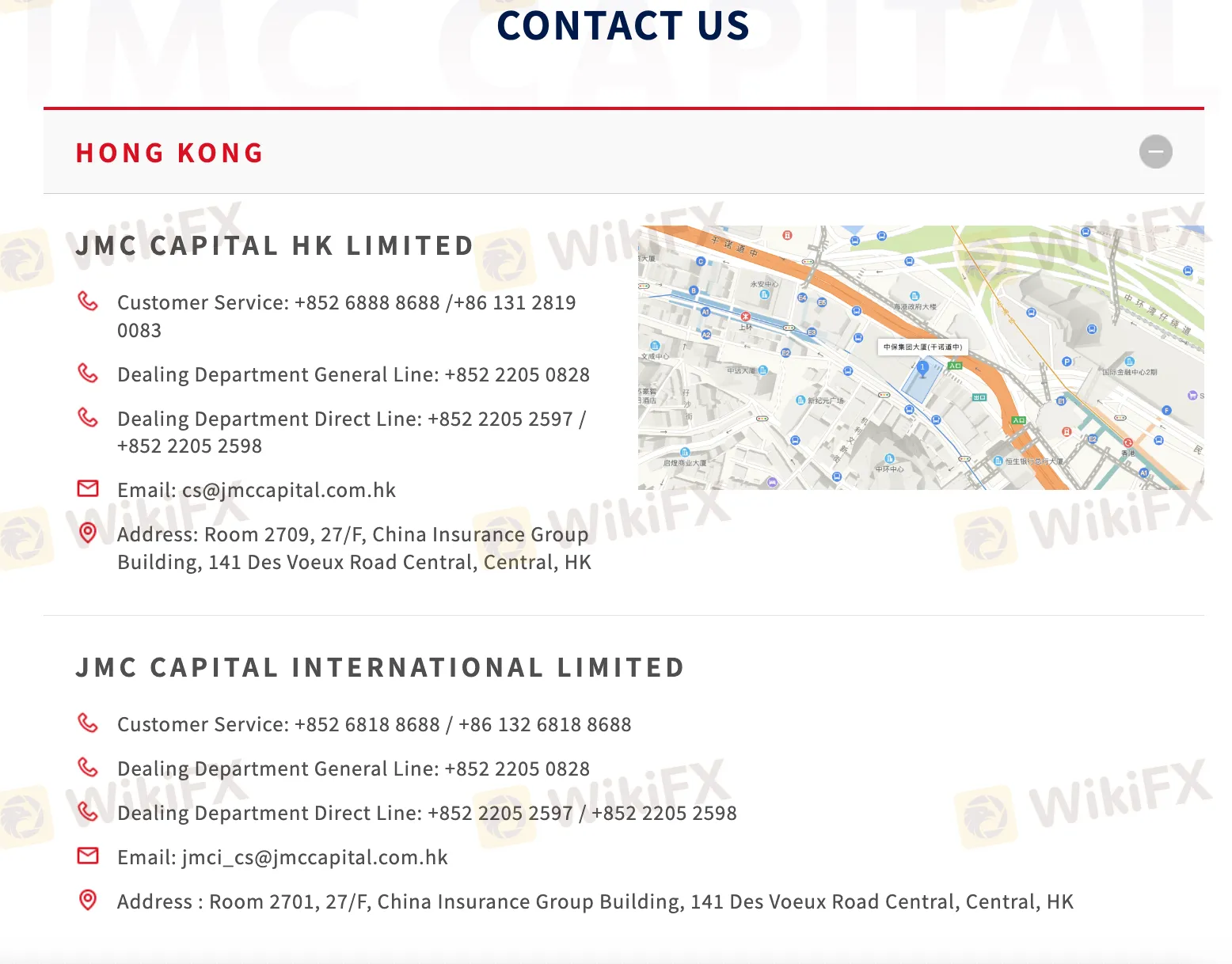

JMC Capital provides comprehensive customer support services to its clients.

For inquiries and assistance, customers can reach out to the Customer Service department at +852 6888 8688 or +86 131 2819 0083.

Additionally, the Dealing Department can be contacted via the General Line at +852 2205 0828 or through Direct Lines at +852 2205 2597 or +852 2205 2598.

For written correspondence, customers can email cs@jmccapital.com.hk for JMC Capital HK Limited and jmci_cs@jmccapital.com.hk for JMC Capital International Limited. The company's physical address is Room 2709, 27/F, China Insurance Group Building, 141 Des Voeux Road Central, Central, Hong Kong.

Conclusion

In conclusion, JMC Capital presents a compelling option for high-net-worth individuals and institutions seeking tailored financial services. Its comprehensive range of offerings, including financial consulting and asset management, suitable for various client needs.

While the platform benefits from regulatory oversight by the Securities and Futures Commission of Hong Kong, potential disadvantages such as higher minimum fees for smaller transactions and a focus on larger transactions or high-frequency trading may deter some users.

However, transparent fee structures and a wide range of trading assets serve as notable advantages, enhancing the platform's appeal to investors looking for reliability and flexibility in their financial endeavors.

FAQs

Q: What financial services does JMC Capital offer?

A: JMC Capital provides financial consulting, global asset allocation, and asset management services.

Q: Is JMC Capital regulated?

A: Yes, JMC Capital is regulated by the Securities and Futures Commission (SFC) of Hong Kong.

Q: What types of accounts can I open with JMC Capital?

A: You can open Security Accounts, Futures Accounts, Wealth Management Accounts, and Asset Management Accounts.