Company Summary

| Fidelity Review Summary | |

| Founded | 1969 |

| Registered Country/Region | USA |

| Regulation | SFC |

| Products & Services | Global mutual funds, MPF & ORSO retirement schemes, thematic and multi-asset investment solutions |

| Demo Account | ❌ |

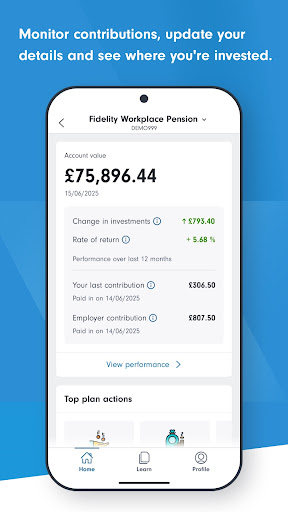

| Trading Platform | Fidelity Online, Fidelity Mobile App |

| Minimum Deposit | HK$1,000/month (Monthly Investment Plan) |

| Customer Support | Phone: (852) 2629 2629 |

| Email: hkenquiry@fil.com | |

Fidelity Information

Established in 1969, Fidelity is a financial company under regulation of SFC, offering international investment solutions. It does not provide FX or CFDs, but instead concentrates on mutual funds, retirement plans (MPF/ORSO), and thematic strategies.

Pros and Cons

| Pros | Cons |

| SFC regulated | No demo or Islamic (swap-free) account |

| Wide selection of mutual funds and retirement solutions | Relatively high fees |

| Tiered fee structure benefits high-balance investors | |

| Long operation time | |

| Various account types |

Is Fidelity Legit?

Yes, Fidelity is regulated. It is authorized by the Securities and Futures Commission (SFC) of Hong Kong with a Dealing in futures contracts license. The license number is AAG408.

Products and Services

Fidelity offers worldwide mutual funds, retirement schemes (MPF & ORSO), and themed investments to fit investors' financial goals. They offer income creation, sustainable investing, and multi-asset strategies.

| Products & Services | Feature |

| Mutual Funds | Global funds in various currencies and asset classes |

| Thematic Investing | Long-term investments based on global trends and innovation themes |

| Multi-Asset Solutions | Diversified portfolios combining different asset types |

| Sustainable Investing | Focused on ESG and responsible investment strategies |

| MPF (Mandatory Provident Fund) | Retirement funds tailored to different risk and income profiles |

| ORSO (Occupational Retirement Schemes Ordinance) | Employer-sponsored retirement investment plans |

| Income Strategies | Global income-focused investment options |

| Asia-Focused Investments | Funds targeting growth opportunities across Asian markets |

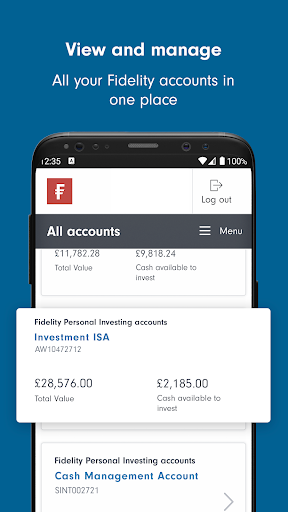

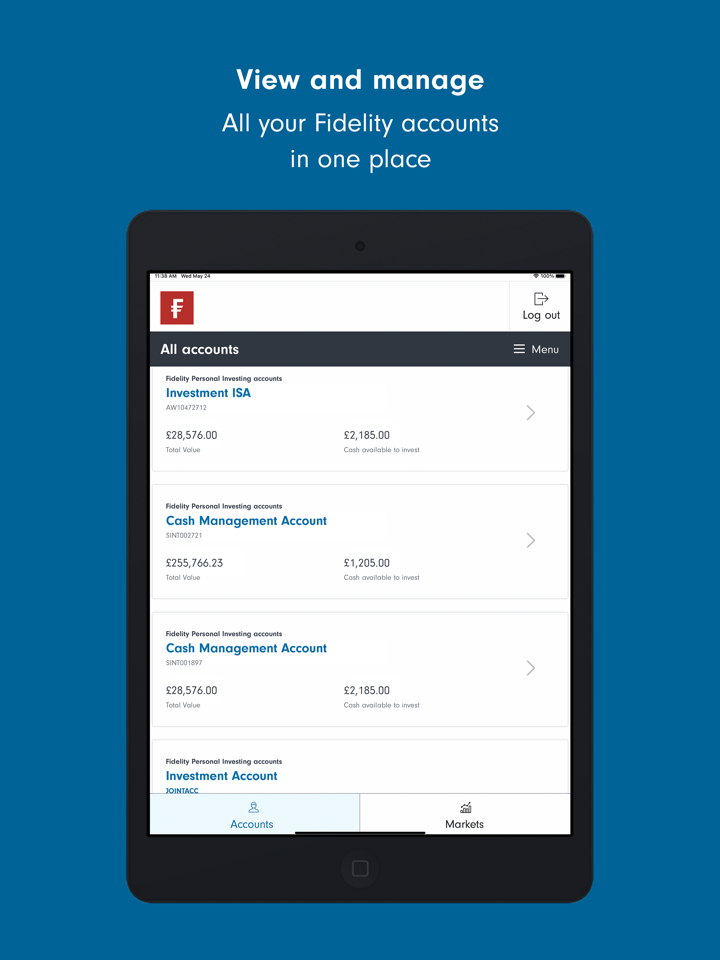

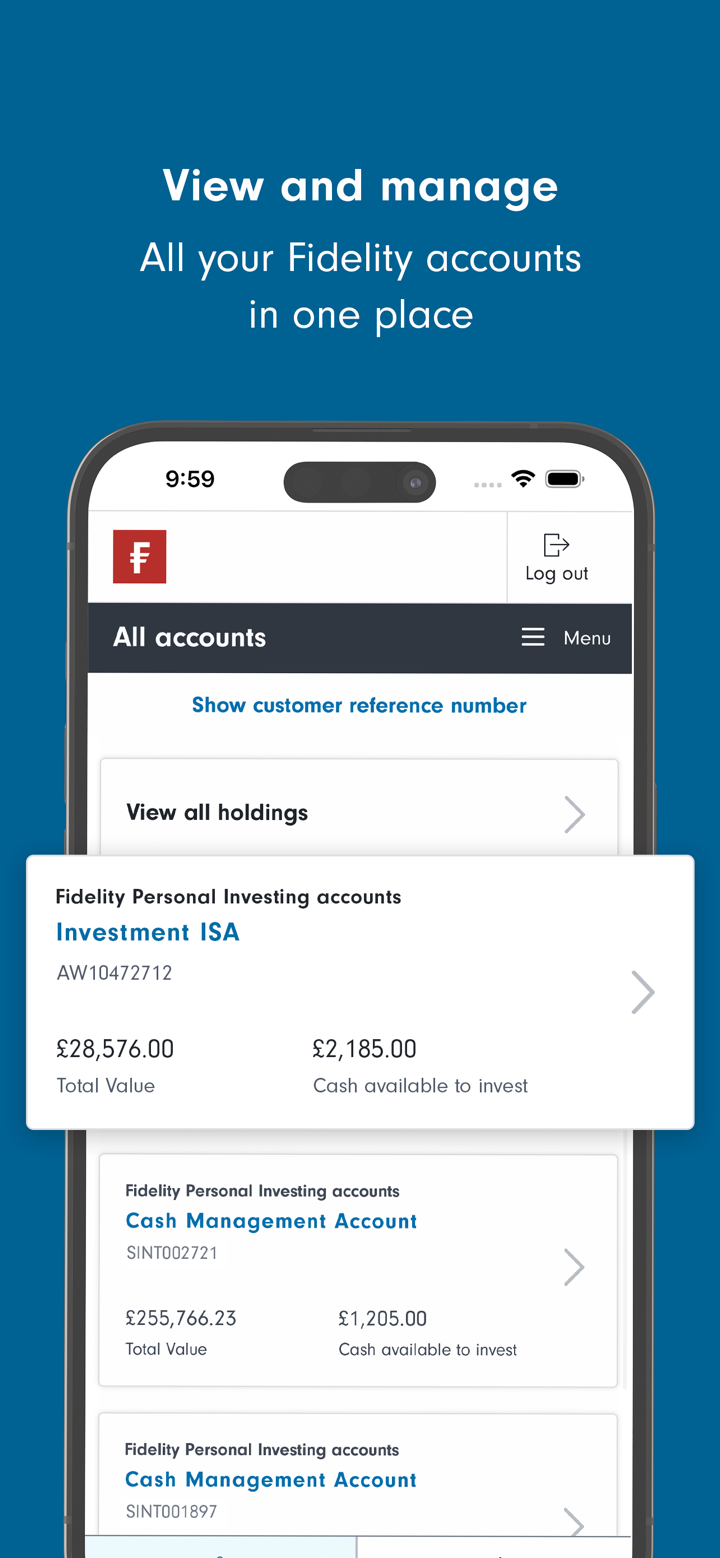

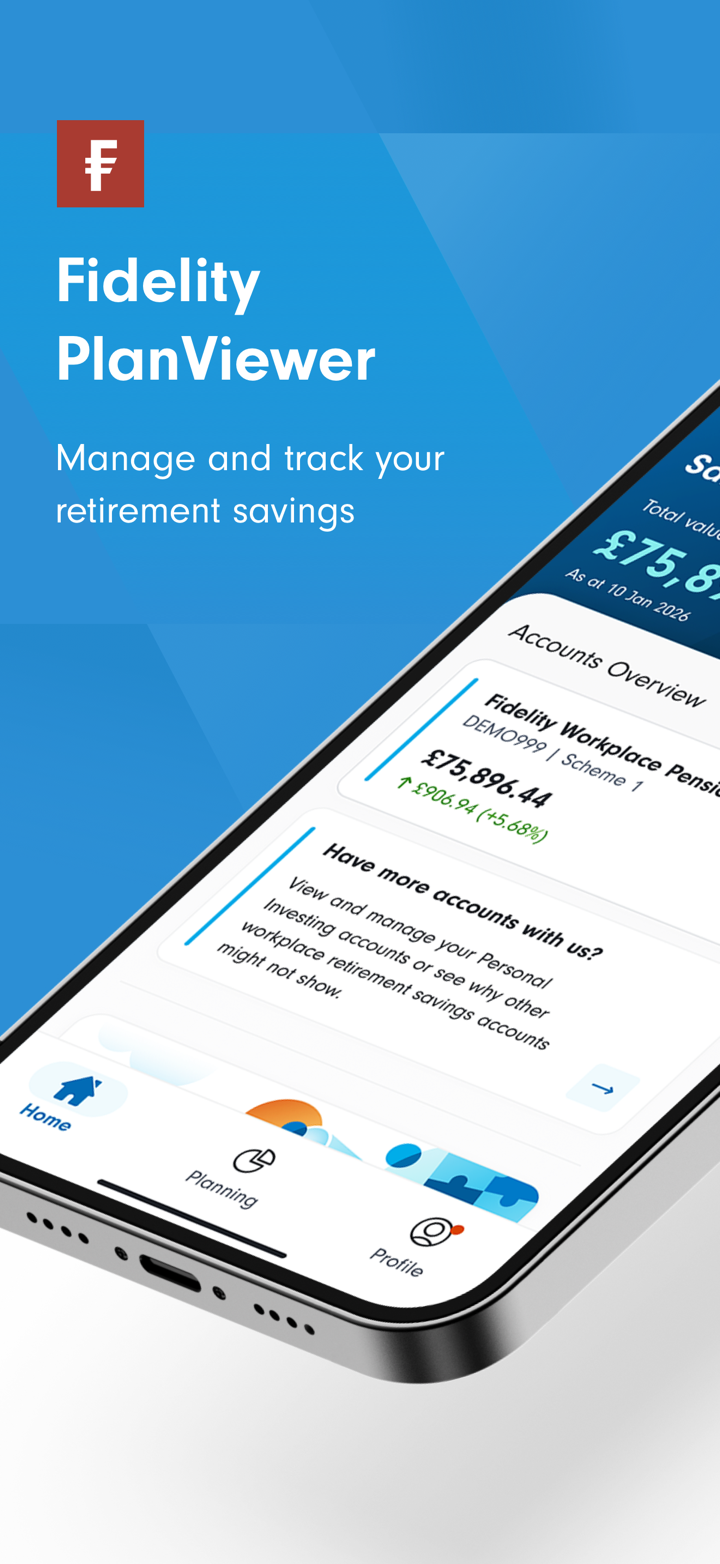

Account Type

Fidelity offers four types of live accounts: Personal Investors, MPF/ORSO members, Intermediaries, and Institutional Investors. There are no demo or Islamic (swap-free) accounts available.

| Account Type | Suitable for |

| Personal Investors | Individuals managing their own investments |

| MPF / ORSO Accounts | Employees and employers under Hong Kong retirement schemes |

| Intermediaries | Advisers, wealth managers, financial consultants |

| Institutional Investors | Institutions such as pensions, corporates, and family offices |

Fidelity Fees

Fidelitys fees follow a tiered structure—larger investment amounts enjoy lower charges, while smaller investments face higher fees. Overall,its cost structure is moderate to high by industry standards.

| Investment Method | Fee Type | Investment Balance (USD) | Cash Funds | Bond Funds | Equity & Other Funds |

| Lump Sum Investment | Sales Charge | ≥ 1,000,000 | 0.00% | 0.30% | 0.60% |

| 500,000 – <1,000,000 | 0.45% | 0.90% | |||

| 250,000 – <500,000 | 0.60% | 1.20% | |||

| 100,000 – <250,000 | 0.75% | 1.50% | |||

| 50,000 – <100,000 | 1.05% | 2.10% | |||

| <50,000 | 1.50% | 3.00% | |||

| Switching Fee | ≥ 1,000,000 | 0.10% | - | ||

| 500,000 – <1,000,000 | 0.15% | - | |||

| 250,000 – <500,000 | 0.20% | - | |||

| 100,000 – <250,000 | 0.25% | - | |||

| 50,000 – <100,000 | 0.35% | - | |||

| <50,000 | 0.50% | - | |||

| Monthly Investment Plan | Sales Charge | <HK$20,000/month | 1.00% | - | - |

| ≥HK$20,000/month | 0.00% | - | - |

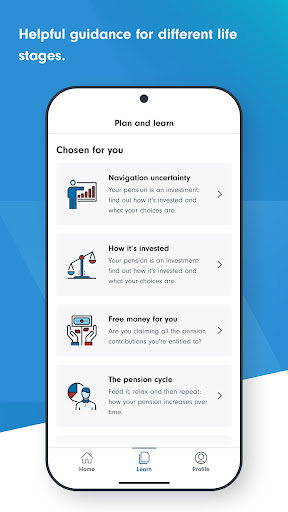

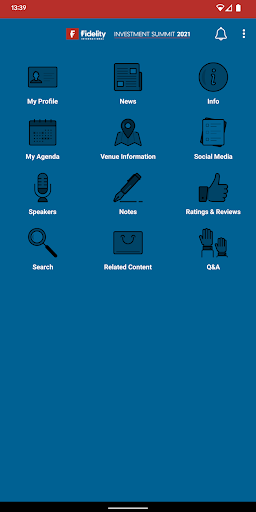

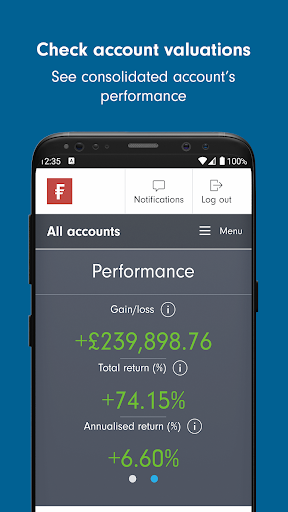

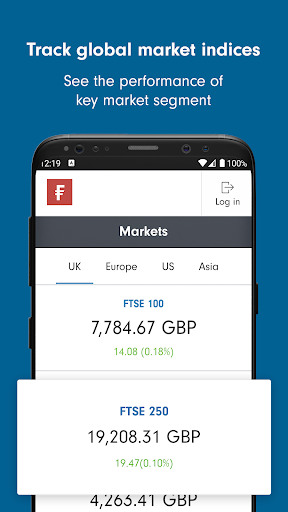

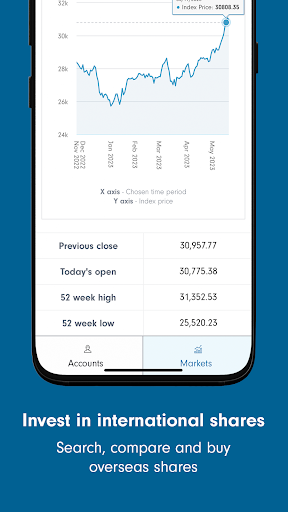

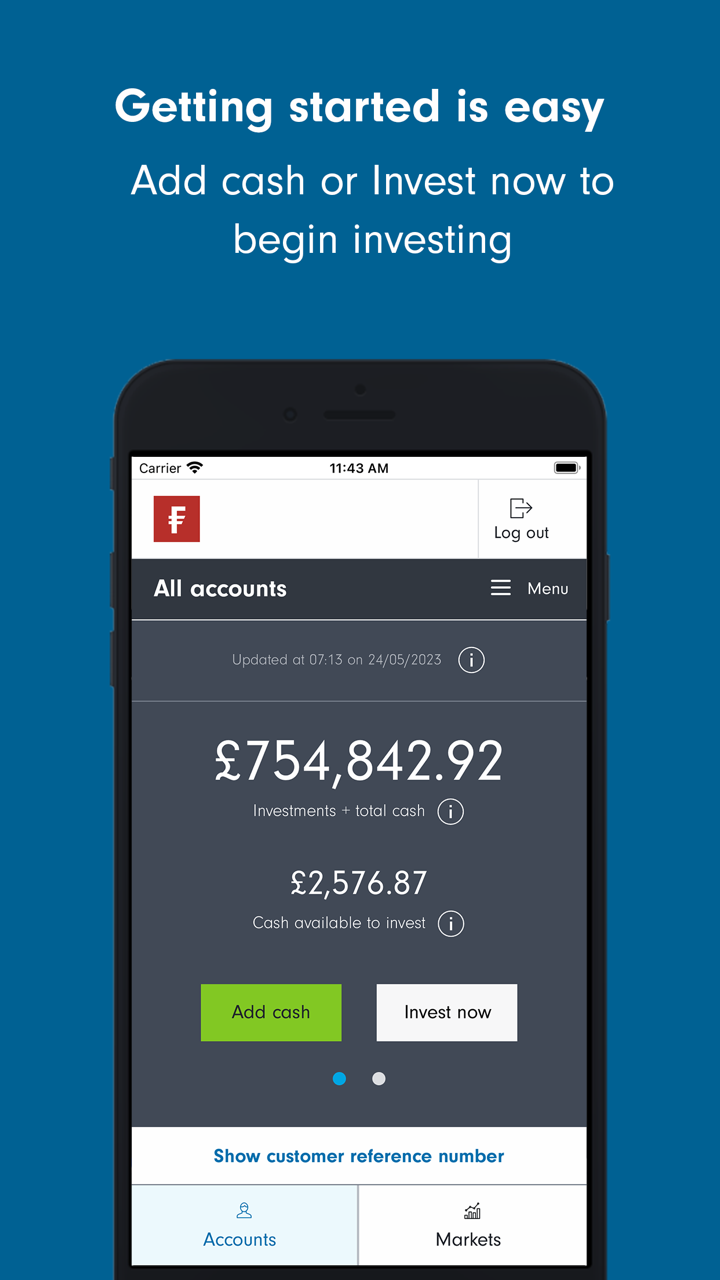

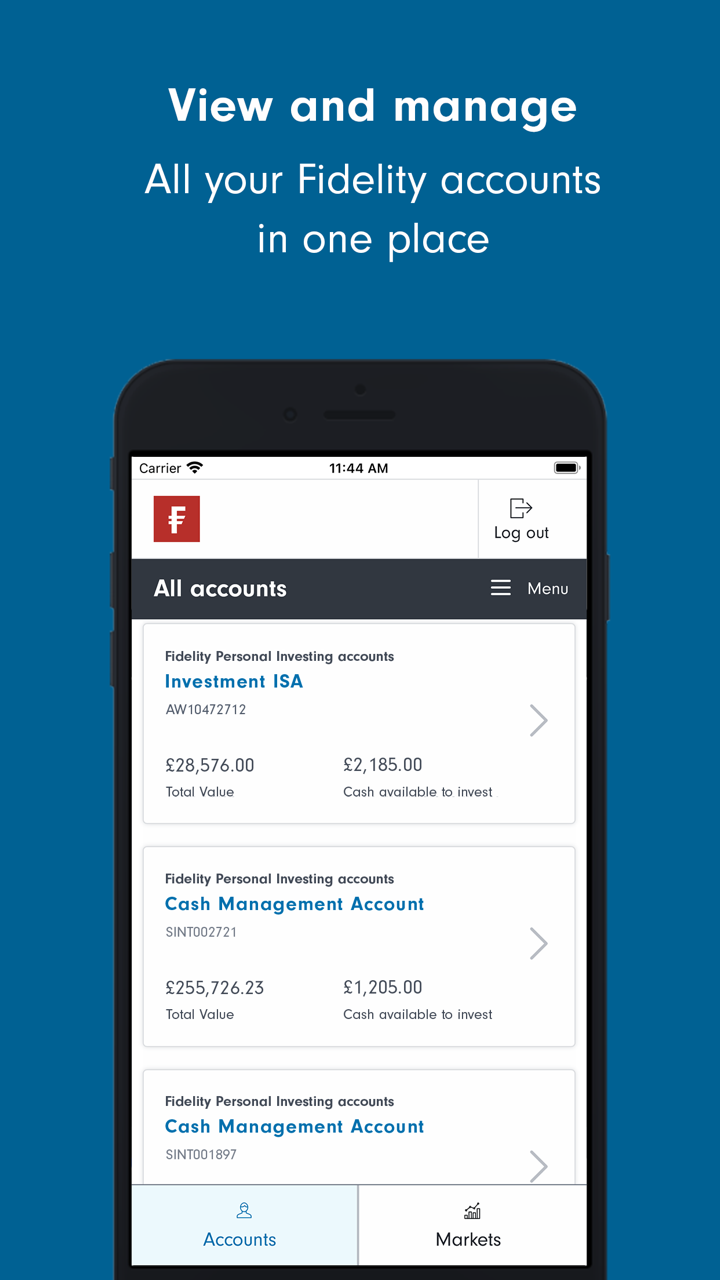

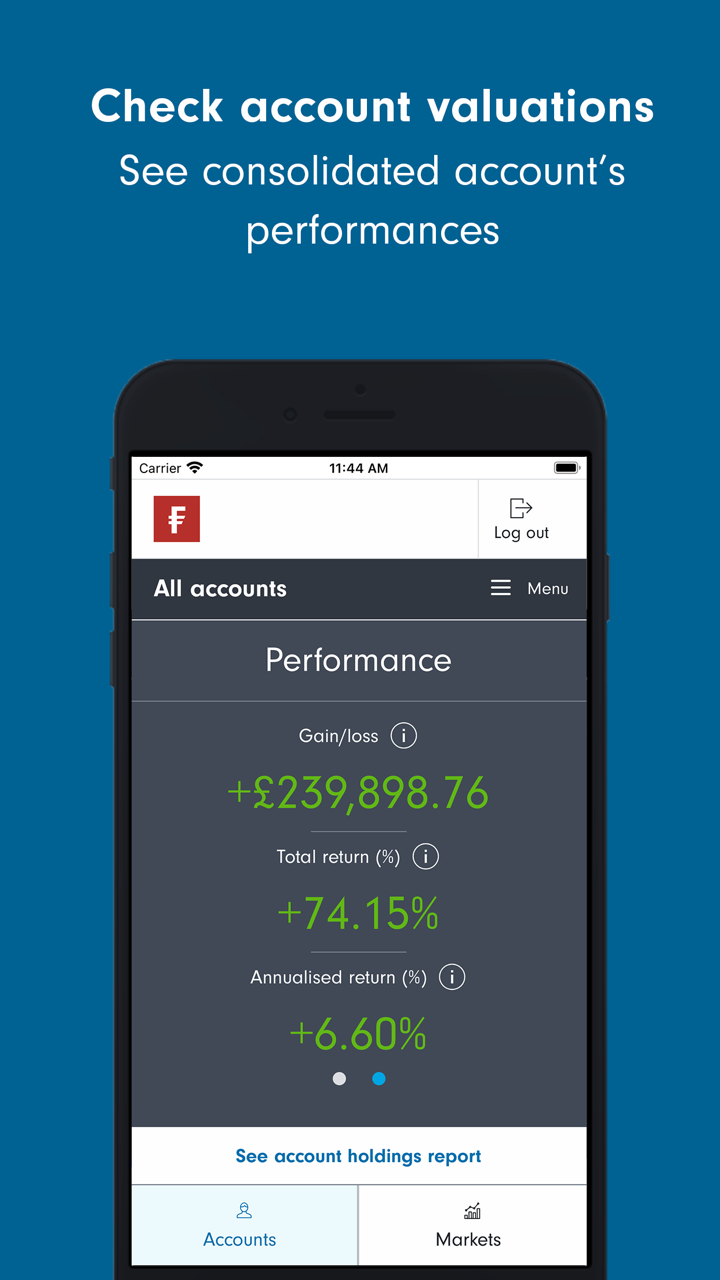

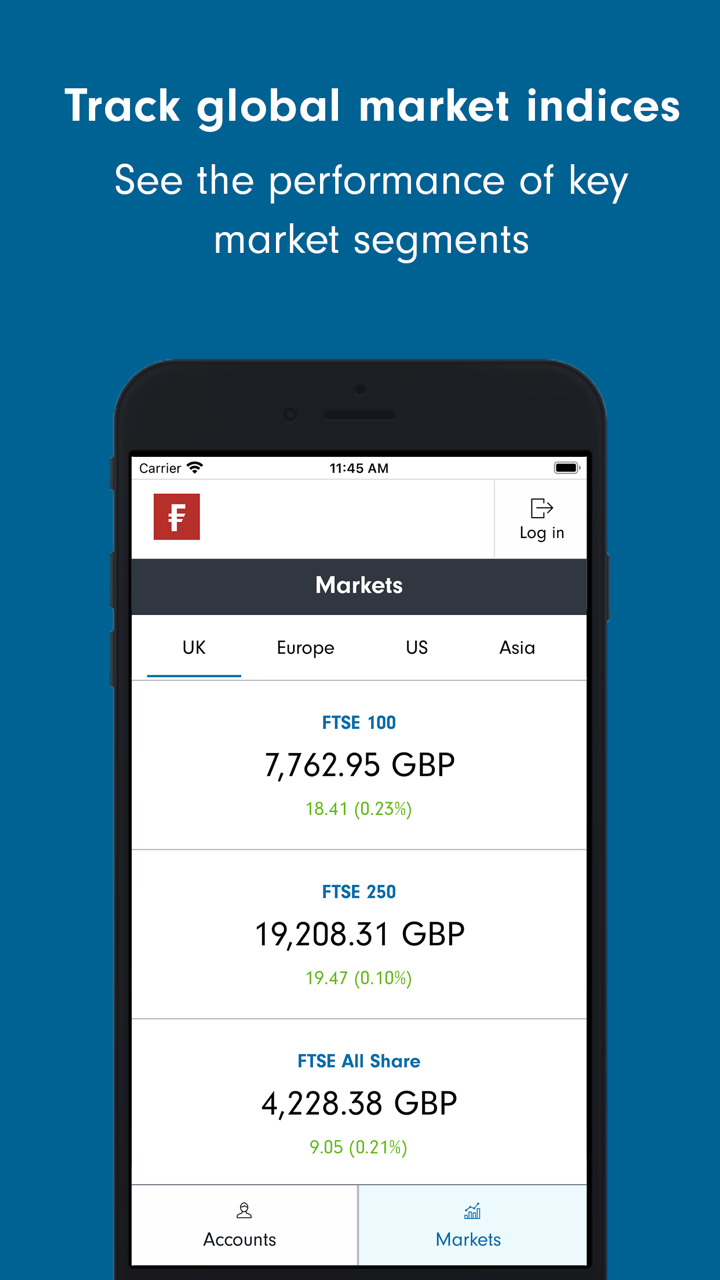

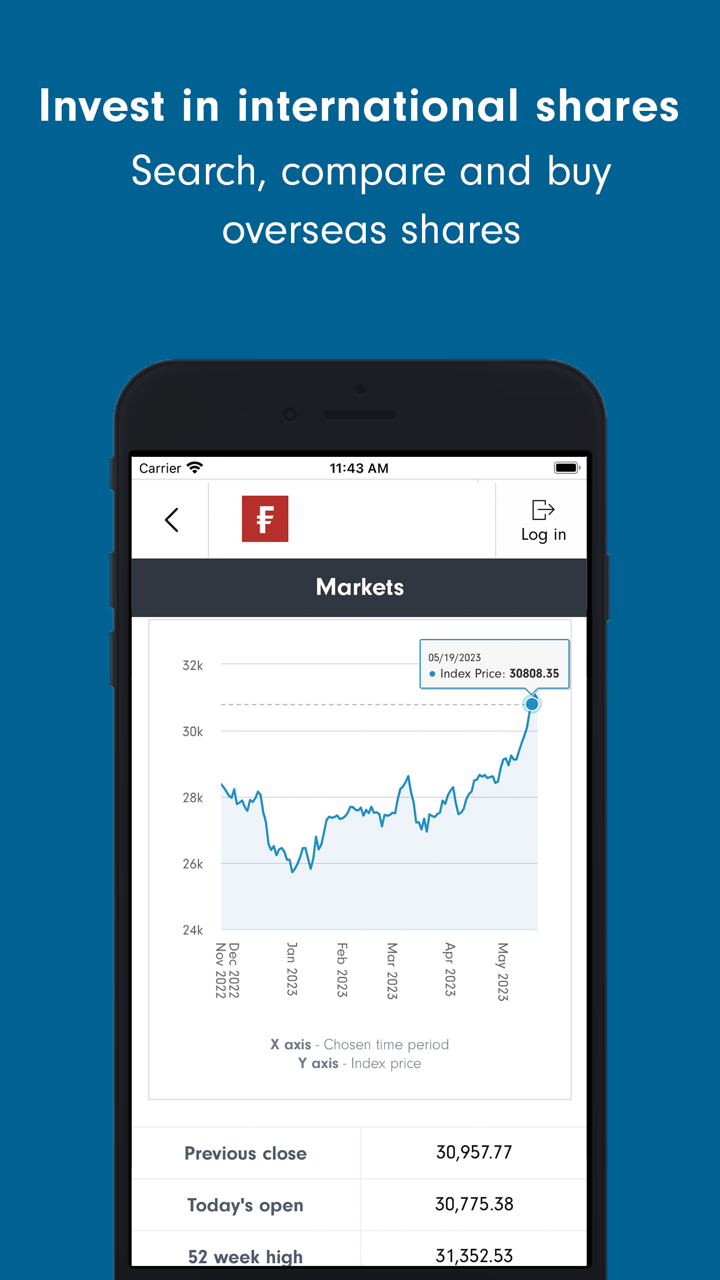

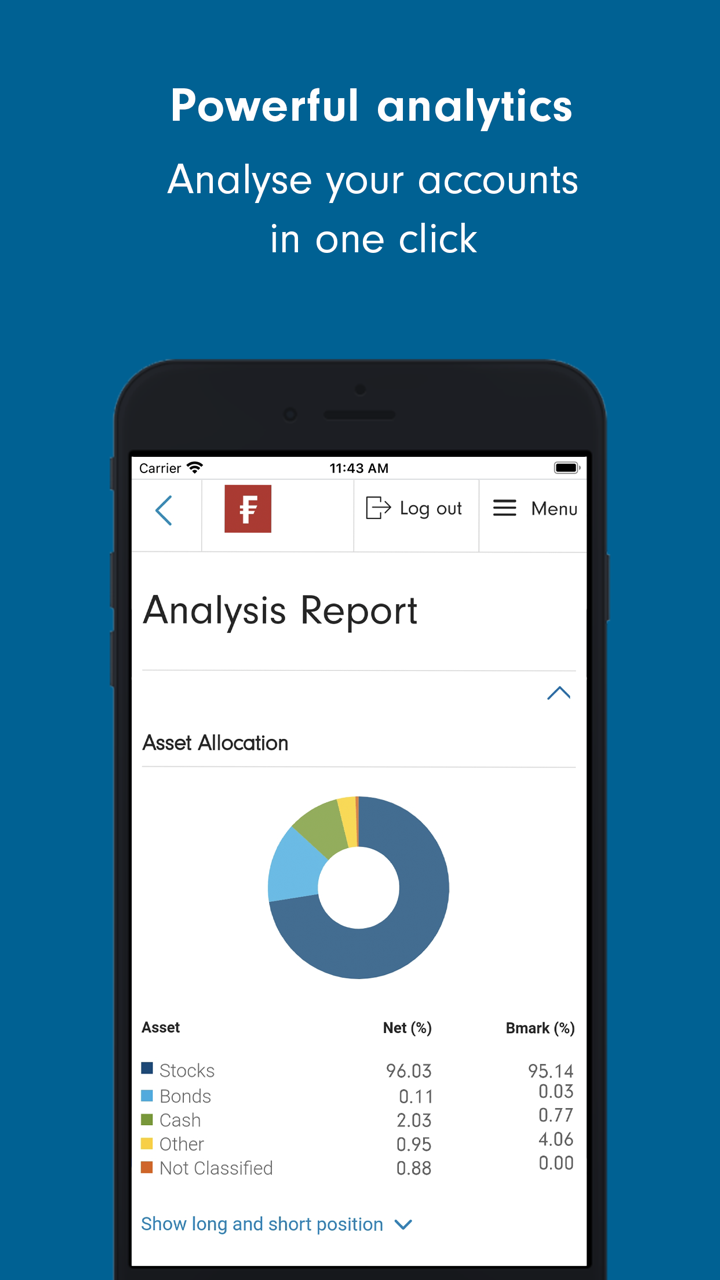

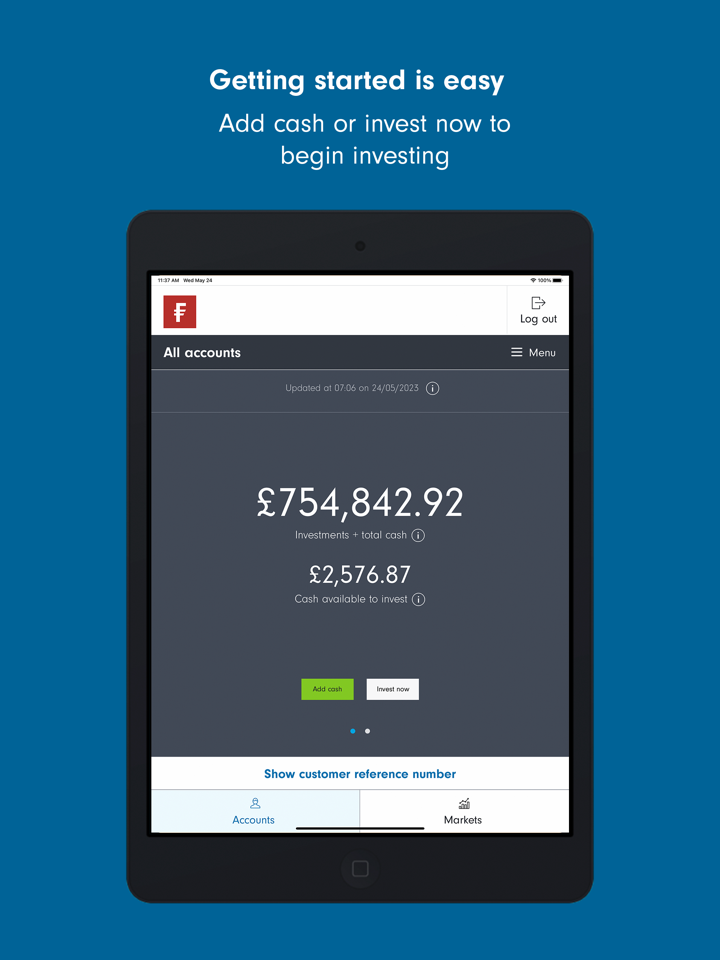

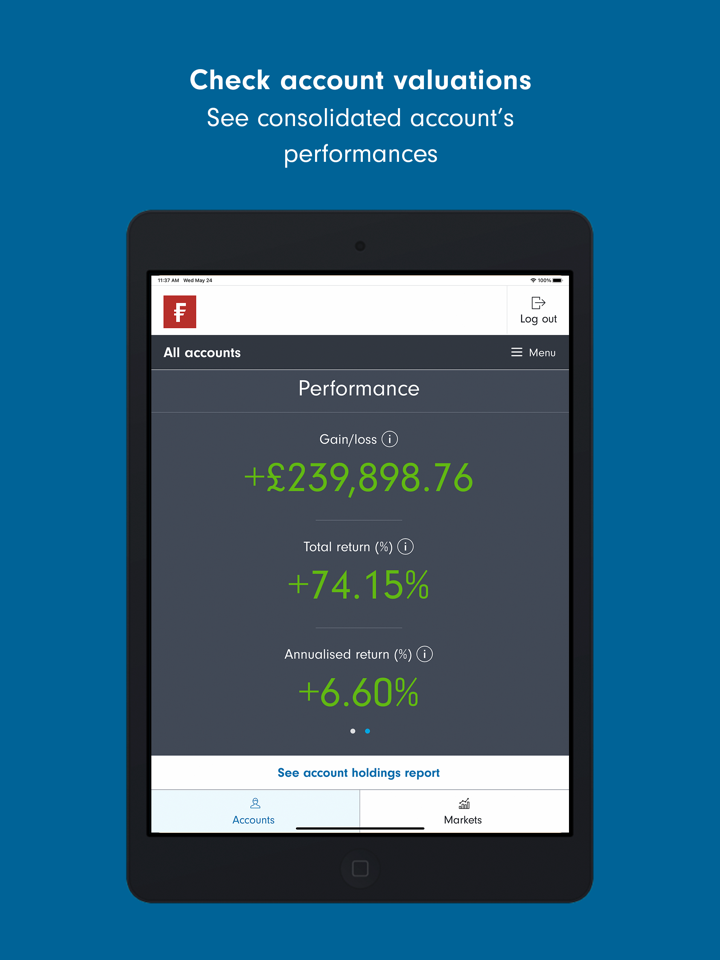

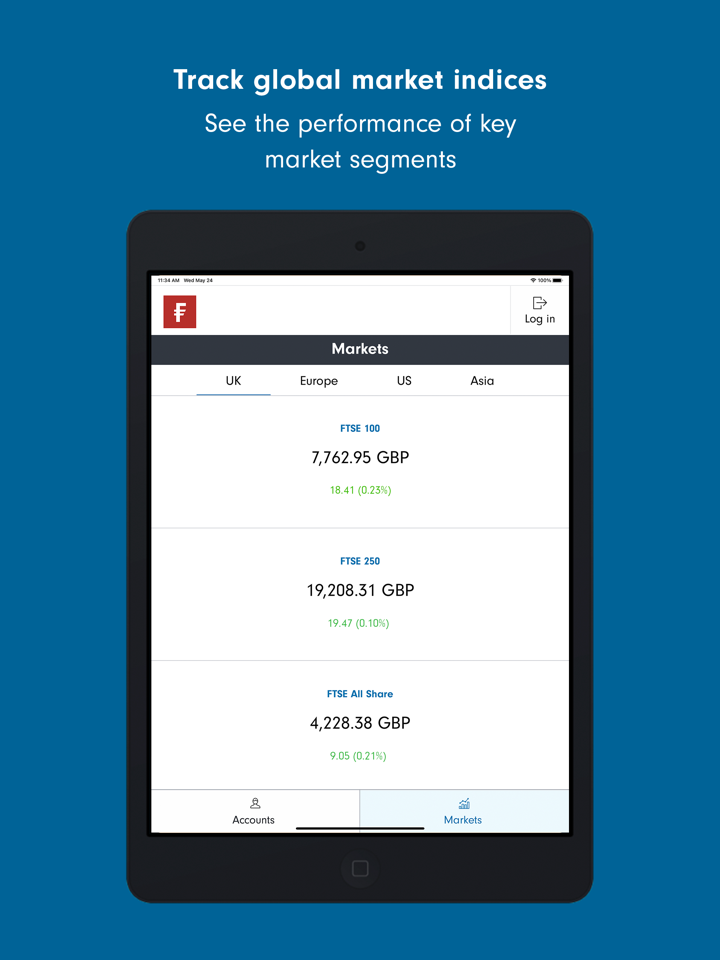

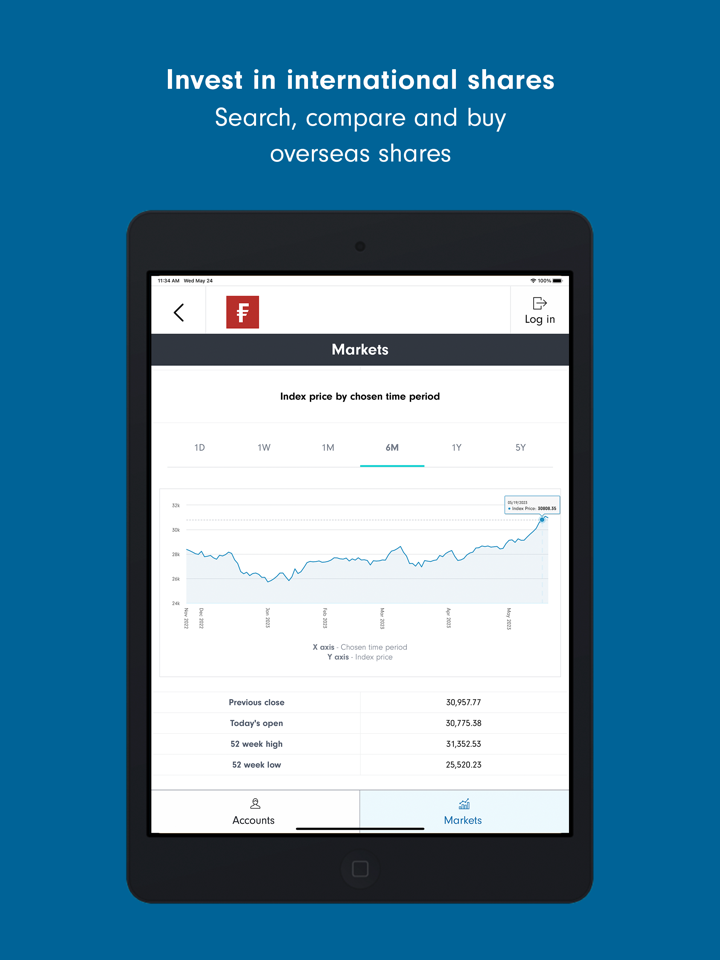

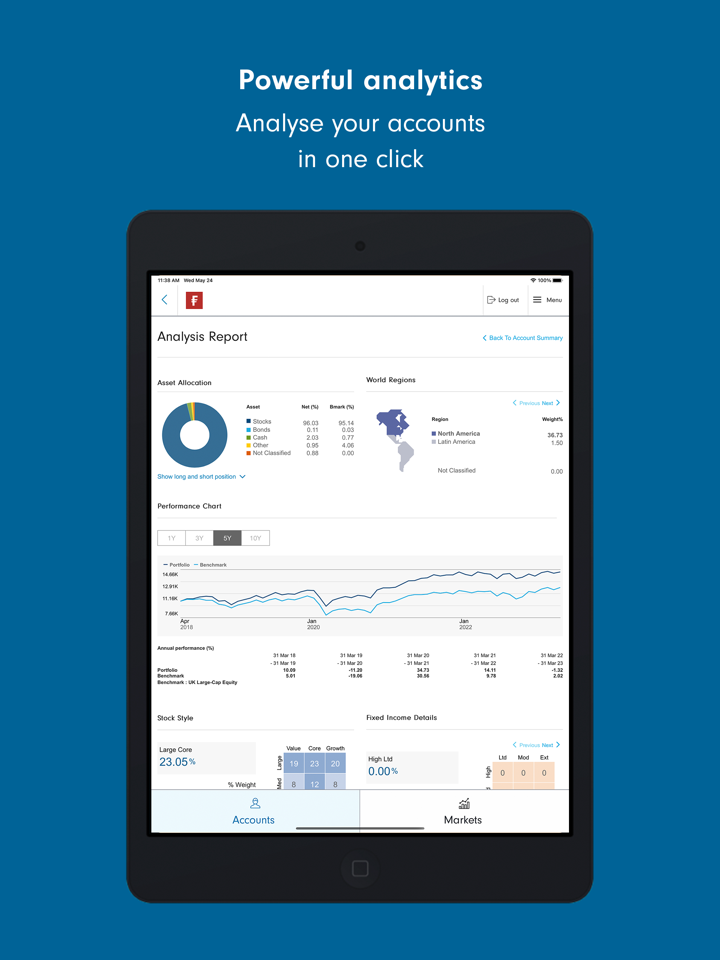

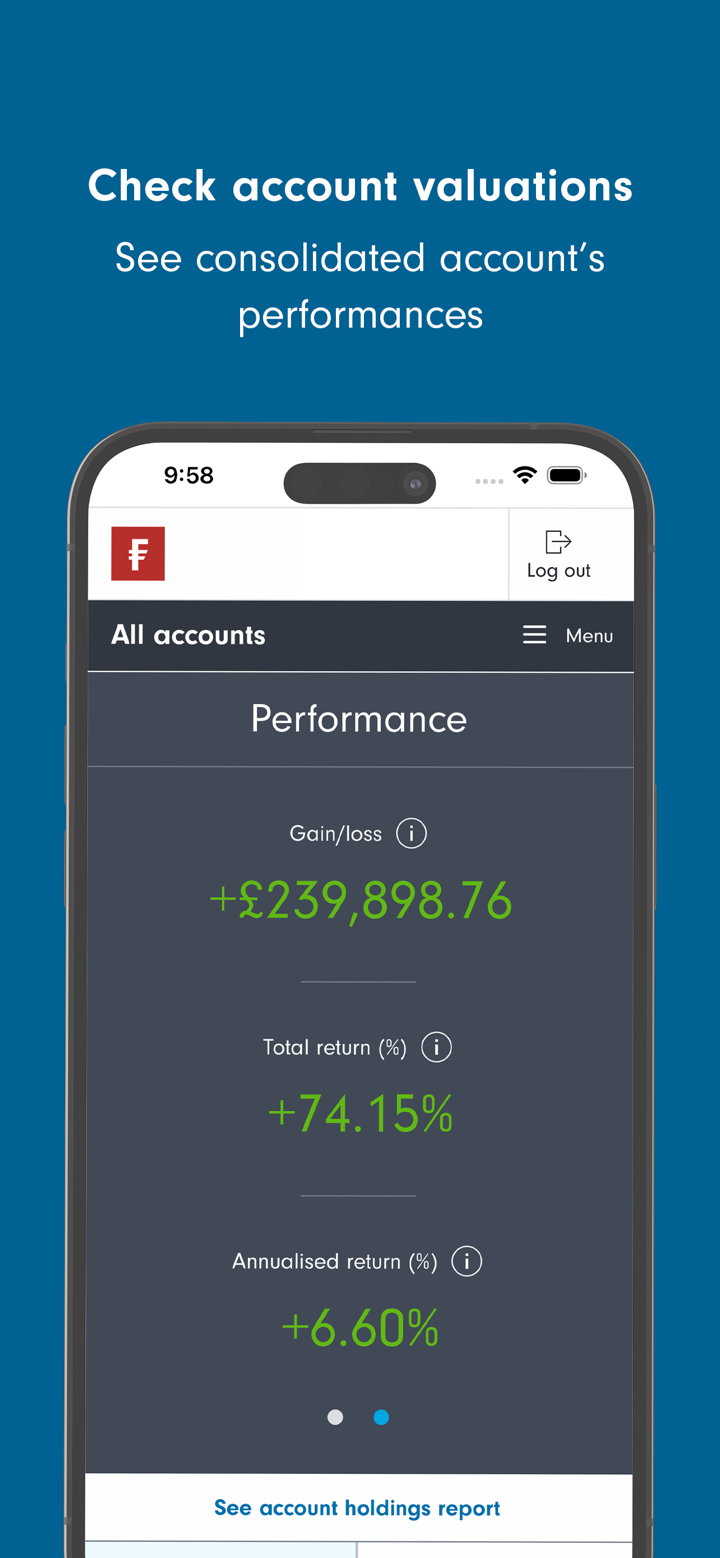

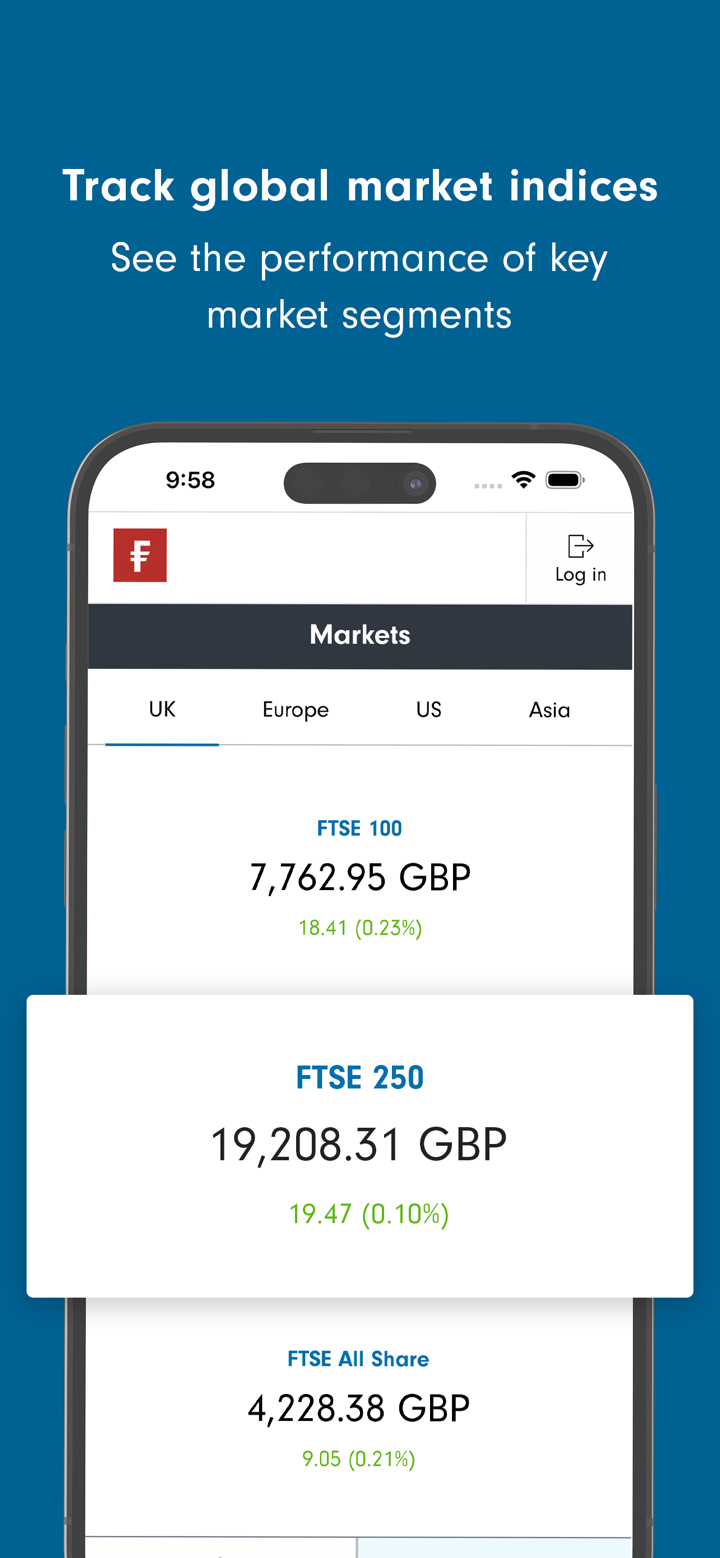

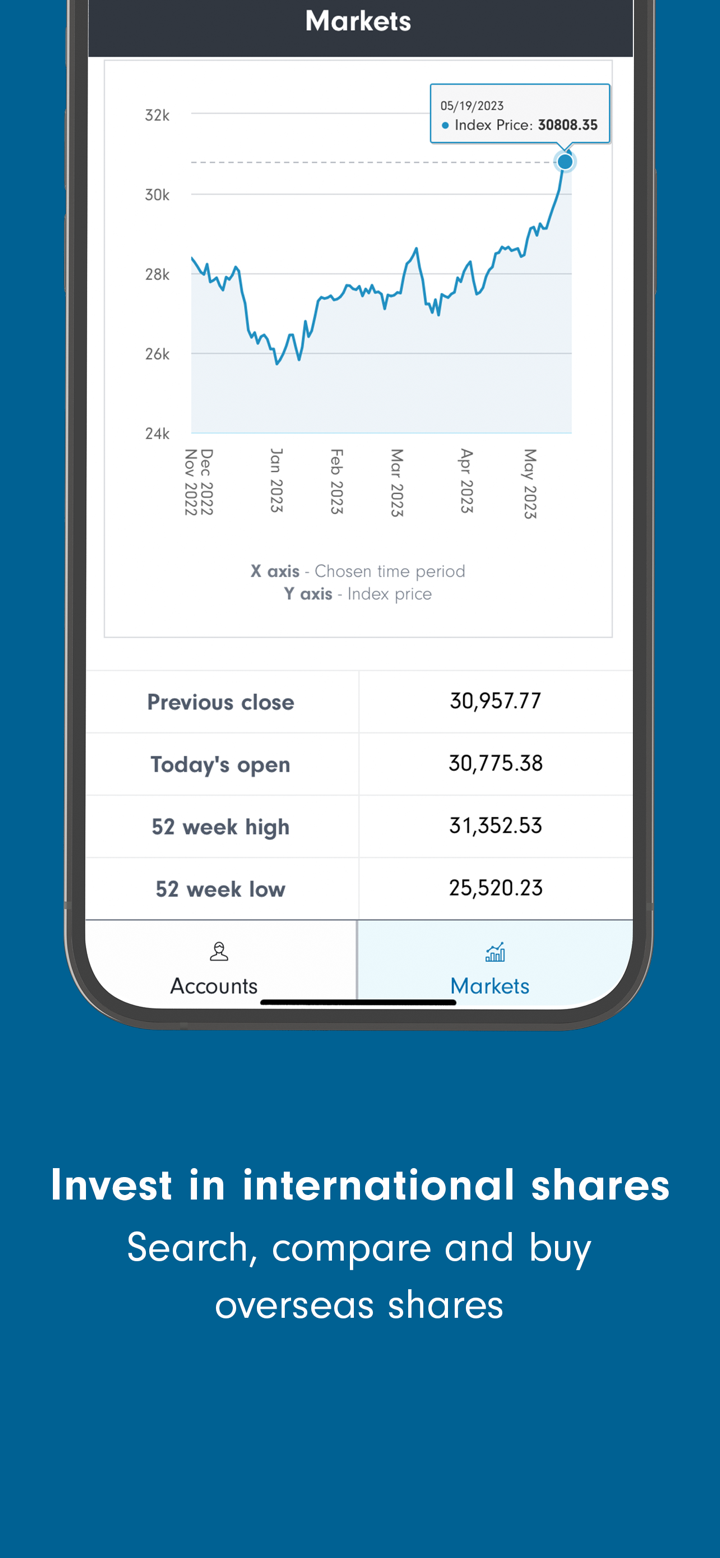

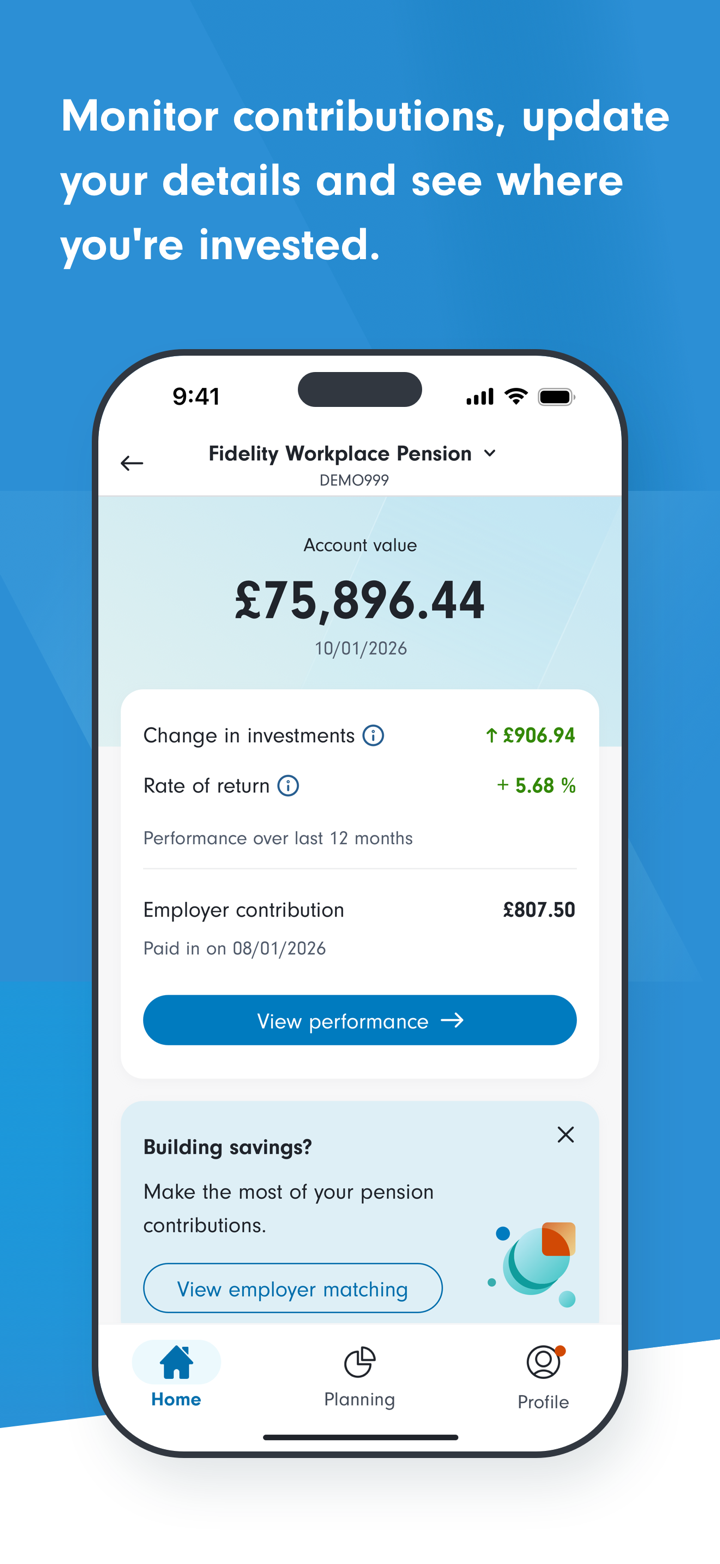

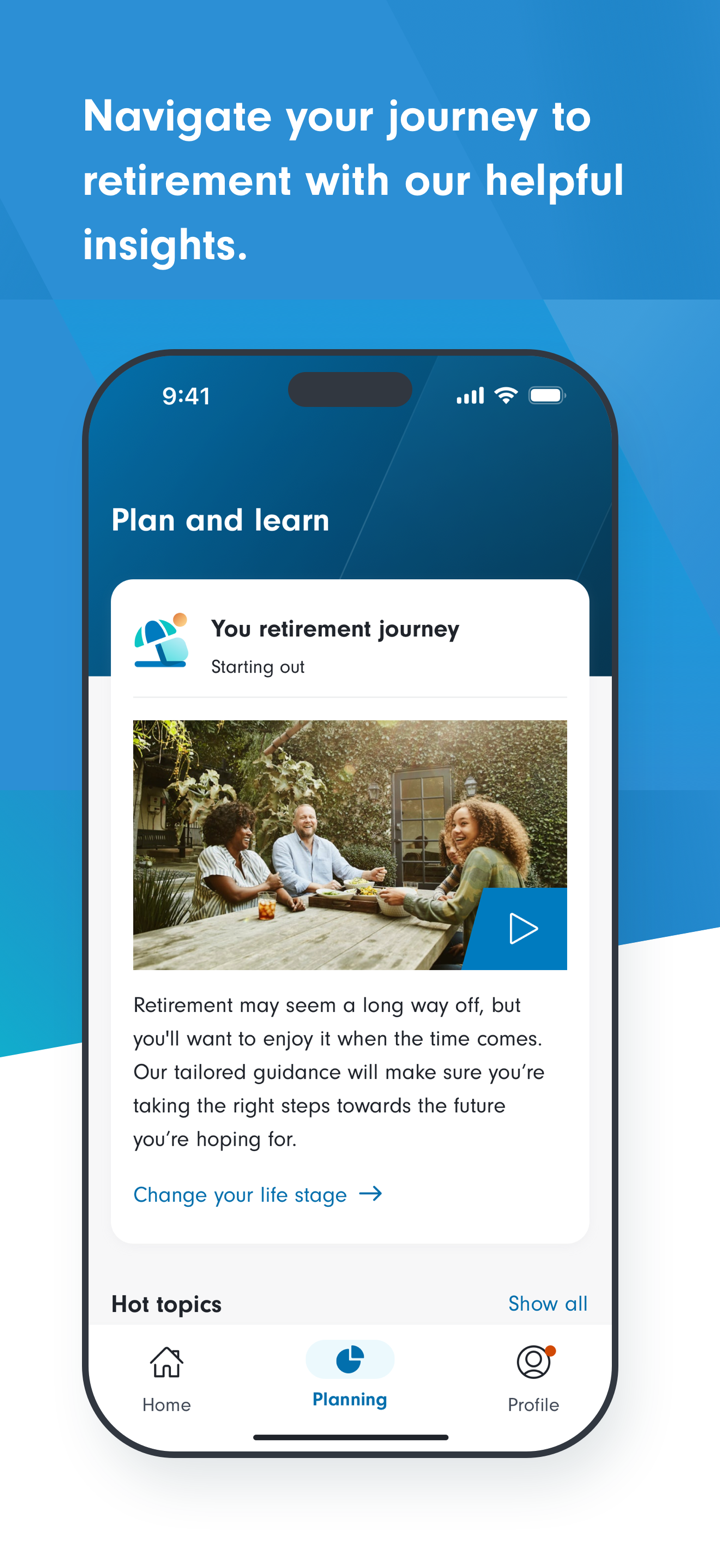

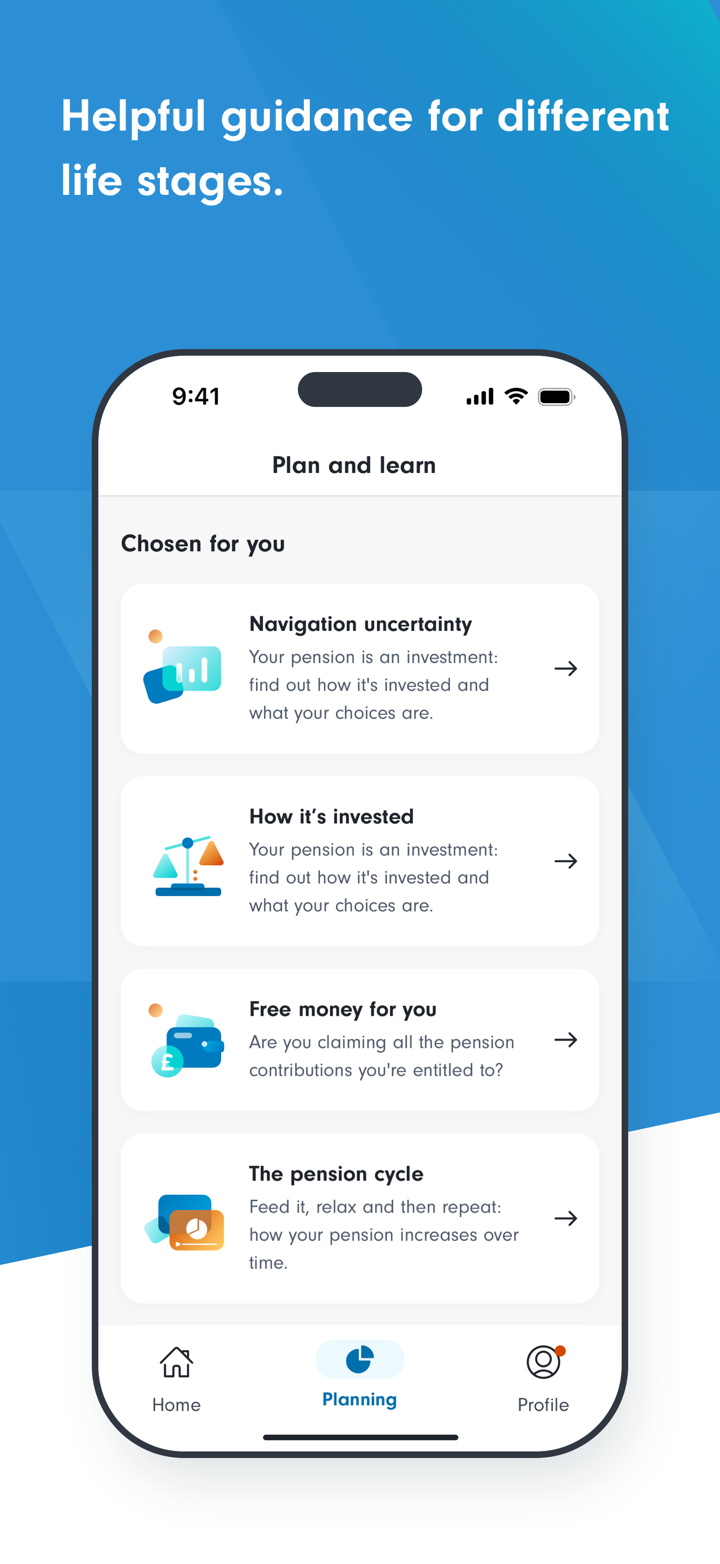

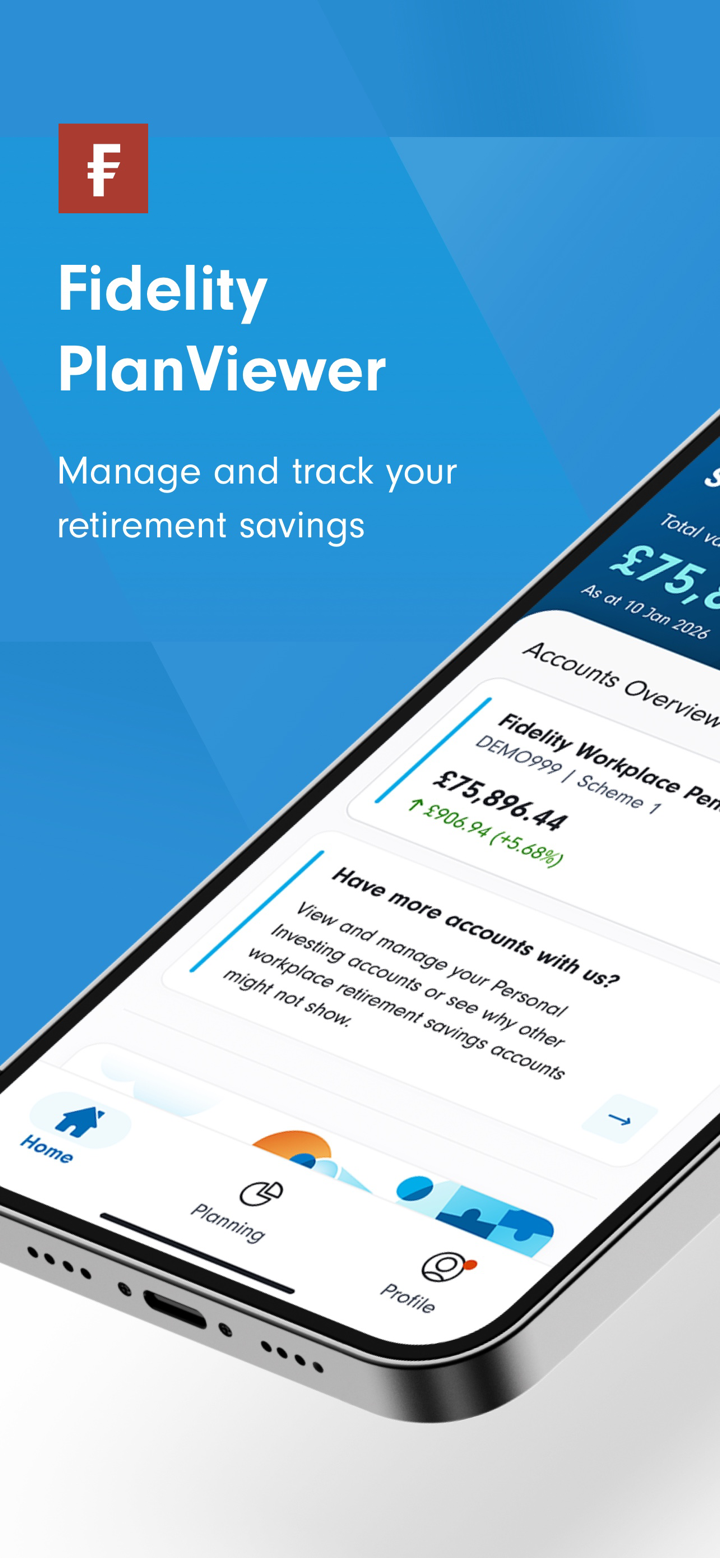

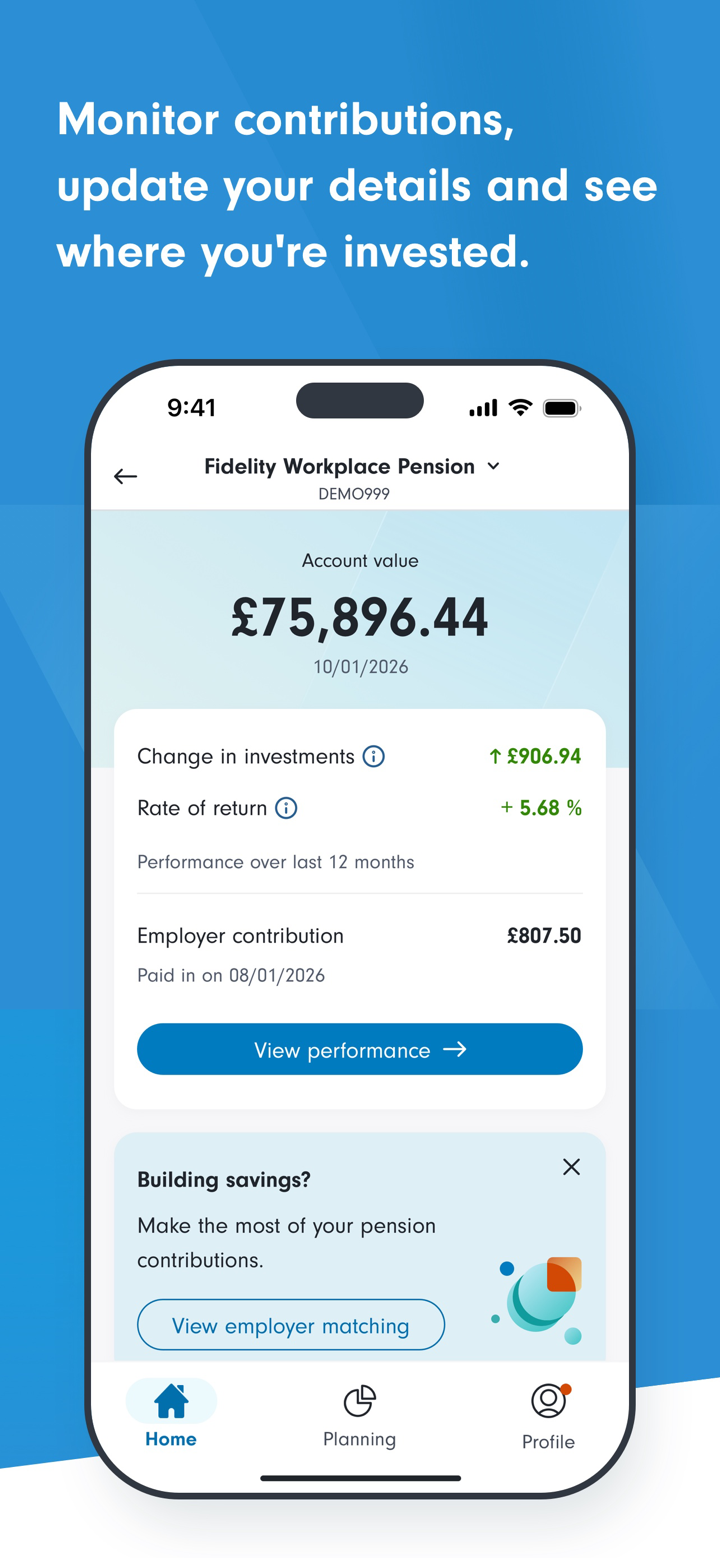

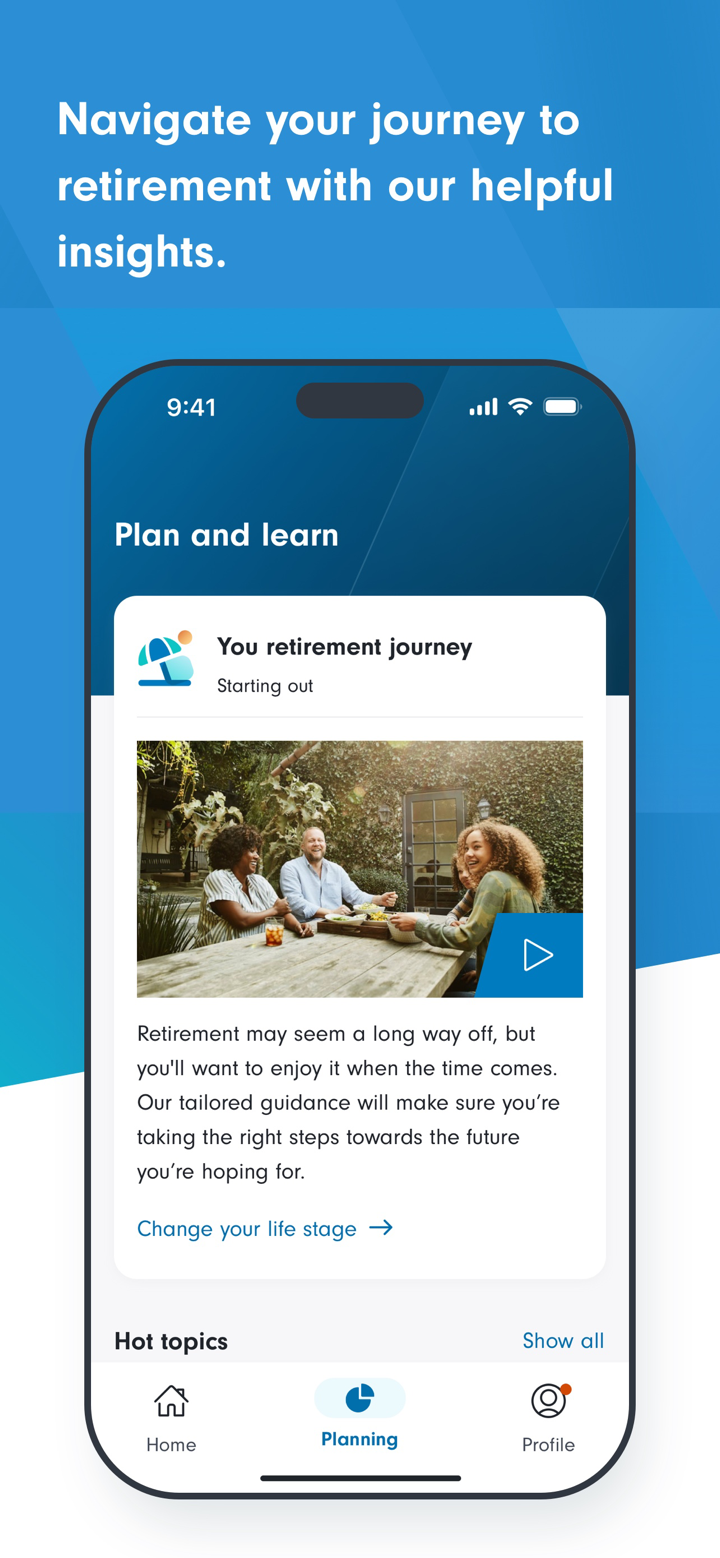

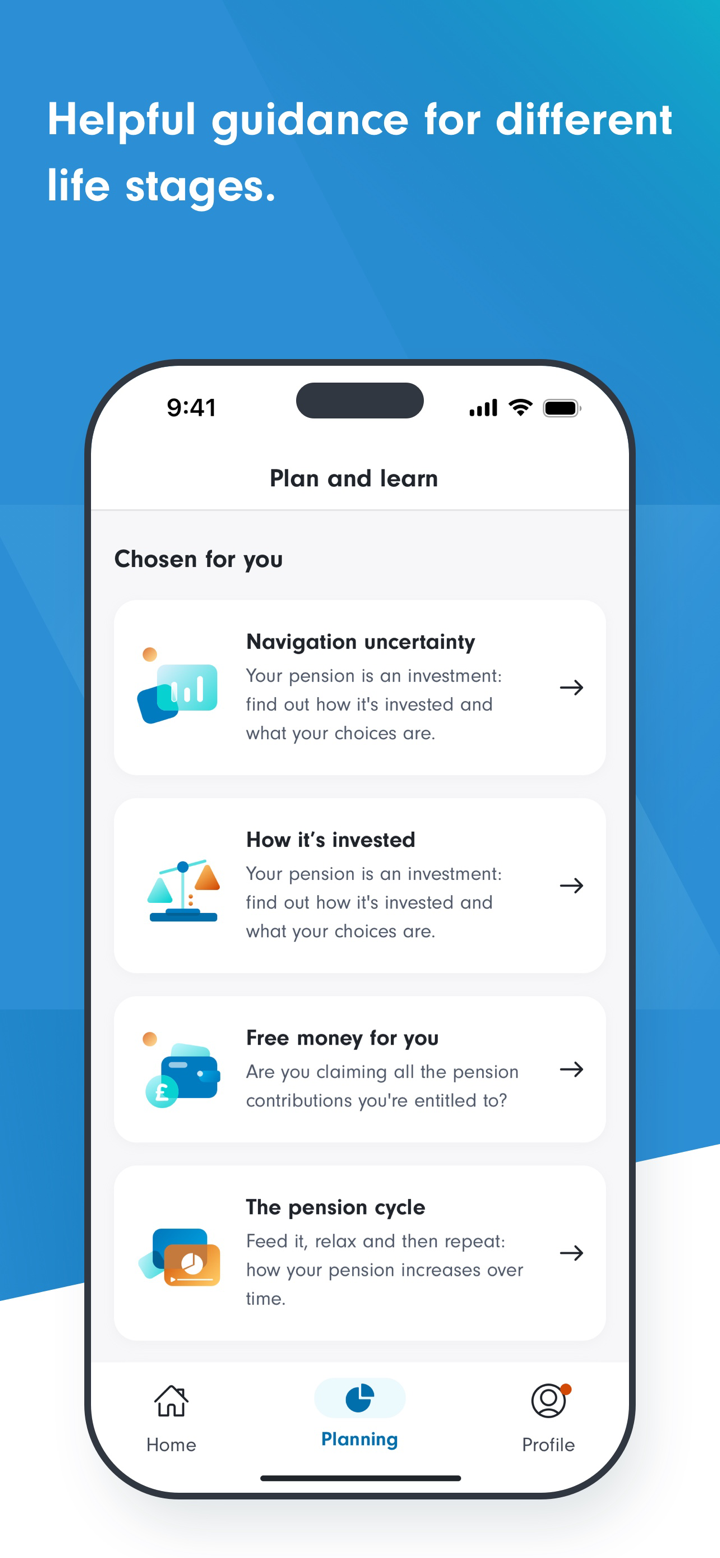

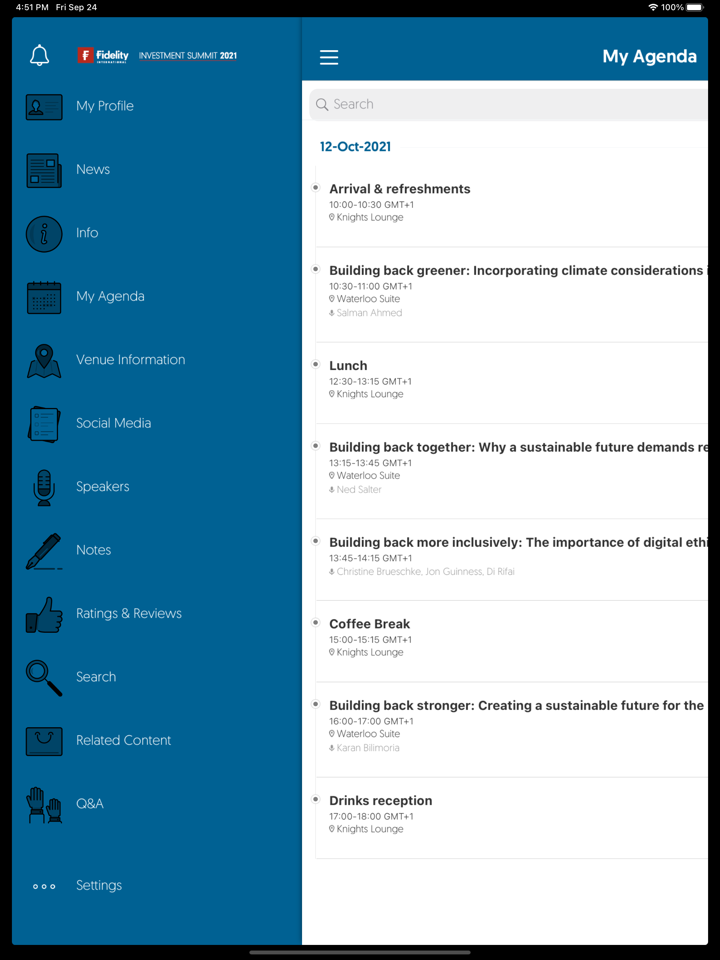

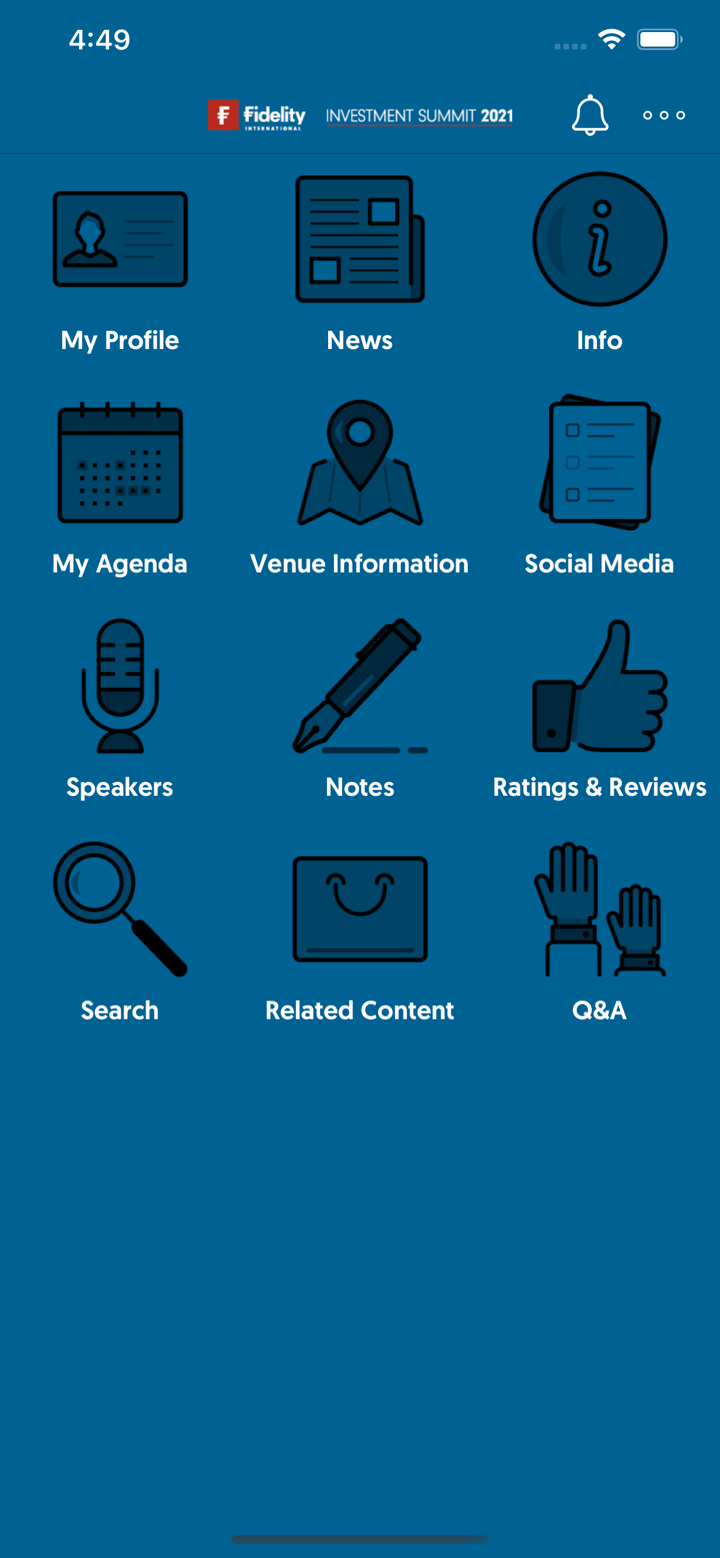

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Fidelity Online | ✔ | Web (PC, Mac) | Long-term investors managing portfolios online |

| Fidelity Mobile App | ✔ | iOS, Android | Investors needing on-the-go portfolio access |

Deposit and Withdrawal

Fidelity does not charge any additional fees for standard deposit or withdrawal methods. However, bank or intermediary charges may apply depending on the method used. The minimum deposit is HK$1,000 per fund per month for Monthly Investment Plans; no specific minimum is stated for lump sum investments.

| Payment Method | Minimum Amount | Fees | Processing Time |

| Telegraphic Transfer | / | Bank/intermediary fees | Upon receipt of cleared funds |

| HSBC Bill Payment (Internet Banking) | / | ❌ (except agent fees) | Immediate |

| Bank Draft / Cashier Order | / | Agent bank charges | |

| HSBC / Hang Seng Same-Day Direct Debit | / | ❌ (insufficient funds may incur bank fees) | |

| Personal Cheque (HK cleared) | HK$1,000,000 or less | ❌ | |

| Personal Cheque (non-HK cleared) | / | Collection charges may apply | After clearance |