Profil perusahaan

| Fidelity Ringkasan Ulasan | |

| Didirikan | 1969 |

| Negara/Daerah Terdaftar | USA |

| Regulasi | SFC |

| Produk & Layanan | Dana investasi global, skema pensiun MPF & ORSO, solusi investasi tematik dan multi-aset |

| Akun Demo | ❌ |

| Platform Perdagangan | Fidelity Online, Fidelity Aplikasi Seluler |

| Deposit Minimum | HK$1.000/bulan (Rencana Investasi Bulanan) |

| Dukungan Pelanggan | Telepon: (852) 2629 2629 |

| Email: hkenquiry@fil.com | |

Informasi Fidelity

Didirikan pada tahun 1969, Fidelity adalah perusahaan keuangan di bawah regulasi SFC, yang menawarkan solusi investasi internasional. Perusahaan ini tidak menyediakan FX atau CFD, namun lebih fokus pada dana investasi, rencana pensiun (MPF/ORSO), dan strategi tematik.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh SFC | Tidak ada akun demo atau akun Islami (bebas swap) |

| Pilihan dana investasi dan solusi pensiun yang luas | Biaya relatif tinggi |

| Struktur biaya berjenjang menguntungkan investor dengan saldo tinggi | |

| Waktu operasi yang panjang | |

| Berbagai jenis akun |

Apakah Fidelity Legal?

Ya, Fidelity diatur. Perusahaan ini diotorisasi oleh Komisi Sekuritas dan Berjangka (SFC) Hong Kong dengan lisensi Perdagangan kontrak berjangka. Nomor lisensi adalah AAG408.

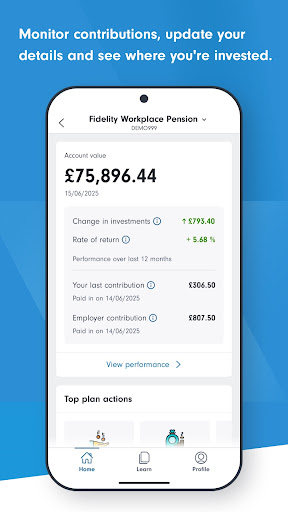

Produk dan Layanan

Fidelity menawarkan dana investasi global, skema pensiun (MPF & ORSO), dan investasi tematik secara global untuk mencocokkan tujuan keuangan investor. Mereka menawarkan penciptaan pendapatan, investasi berkelanjutan, dan strategi multi-aset.

| Produk & Layanan | Fitur |

| Dana Investasi | Dana global dalam berbagai mata uang dan kelas aset |

| Investasi Tematik | Investasi jangka panjang berdasarkan tren global dan tema inovasi |

| Solusi Multi-aset | Portofolio diversifikasi yang menggabungkan berbagai jenis aset |

| Investasi Berkelanjutan | Difokuskan pada strategi investasi ESG dan bertanggung jawab |

| MPF (Mandatory Provident Fund) | Dana pensiun yang disesuaikan dengan profil risiko dan pendapatan yang berbeda |

| ORSO (Occupational Retirement Schemes Ordinance) | Rencana investasi pensiun yang disponsori oleh pengusaha |

| Strategi Pendapatan | Opsi investasi fokus pendapatan global |

| Investasi Berfokus Asia | Dana yang menargetkan peluang pertumbuhan di pasar Asia |

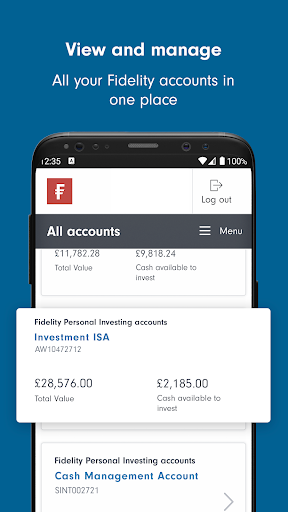

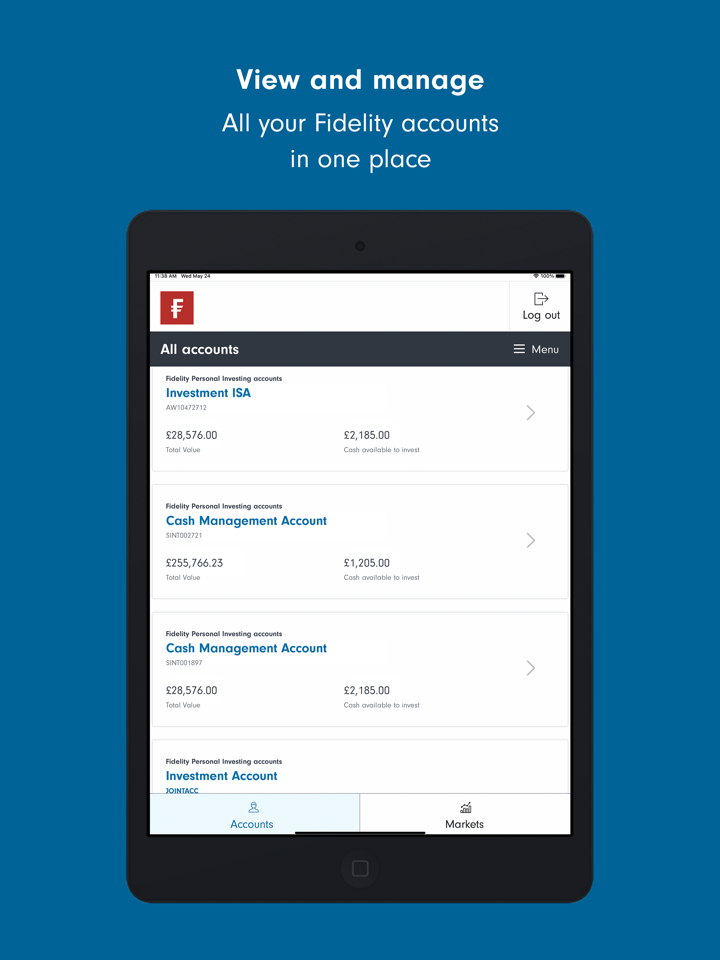

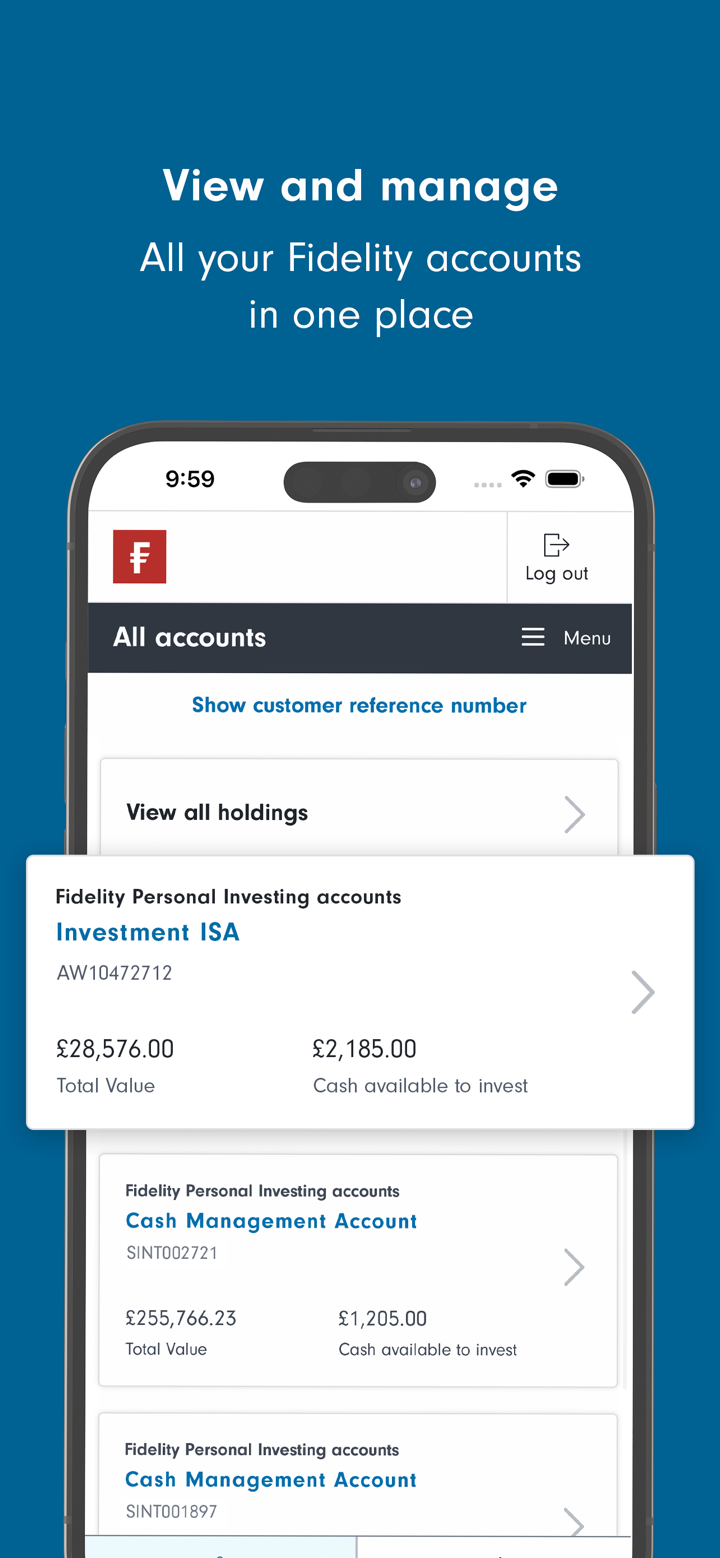

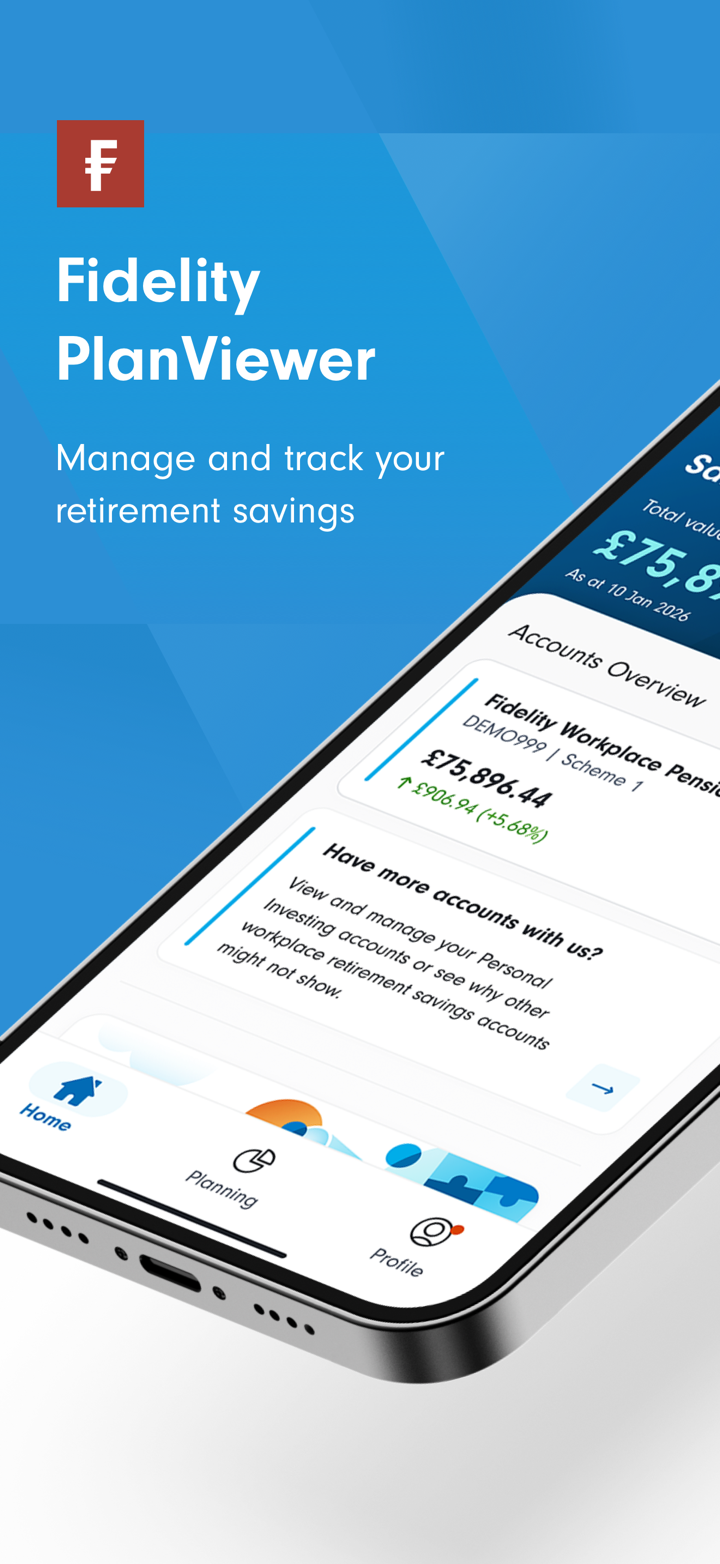

Jenis Akun

Fidelity menawarkan empat jenis akun live: Investor Perorangan, anggota MPF/ORSO, Perantara, dan Investor Institusional. Tidak ada akun demo atau Islami (bebas swap) yang tersedia.

| Jenis Akun | Cocok untuk |

| Investor Perorangan | Individu yang mengelola investasi mereka sendiri |

| Akun MPF / ORSO | Karyawan dan pengusaha di bawah skema pensiun Hong Kong |

| Perantara | Konsultan, manajer kekayaan, konsultan keuangan |

| Investor Institusional | Institusi seperti pensiun, perusahaan, dan kantor keluarga |

Biaya Fidelity

Biaya Fidelity mengikuti struktur bertingkat—jumlah investasi yang lebih besar menikmati biaya lebih rendah, sementara investasi yang lebih kecil menghadapi biaya lebih tinggi. Secara keseluruhan, struktur biayanya moderat hingga tinggi menurut standar industri.

| Metode Investasi | Jenis Biaya | Saldo Investasi (USD) | Dana Tunai | Dana Obligasi | Dana Ekuitas & Lainnya |

| Investasi Sekaligus | Biaya Penjualan | >= 1.000.000 | 0,00% | 0,30% | 0,60% |

| 500.000 – <1.000.000 | 0,45% | 0,90% | |||

| 250.000 – <500.000 | 0,60% | 1,20% | |||

| 100.000 – <250.000 | 0,75% | 1,50% | |||

| 50.000 – <100.000 | 1,05% | 2,10% | |||

| <50.000 | 1,50% | 3,00% | |||

| Biaya Penukaran | >= 1.000.000 | 0,10% | - | ||

| 500.000 – <1.000.000 | 0,15% | - | |||

| 250.000 – <500.000 | 0,20% | - | |||

| 100.000 – <250.000 | 0,25% | - | |||

| 50.000 – <100.000 | 0,35% | - | |||

| <50.000 | 0,50% | - | |||

| Rencana Investasi Bulanan | Biaya Penjualan | | 1,00% | - | - | |

| >=HK$20.000/bulan | 0,00% | - | - |

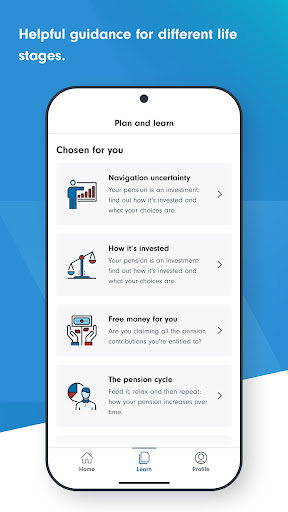

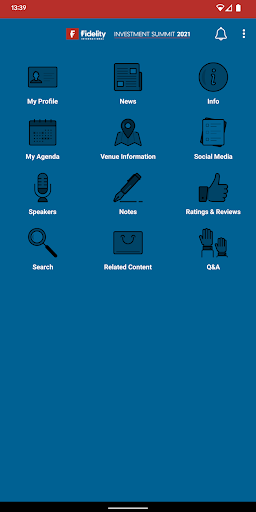

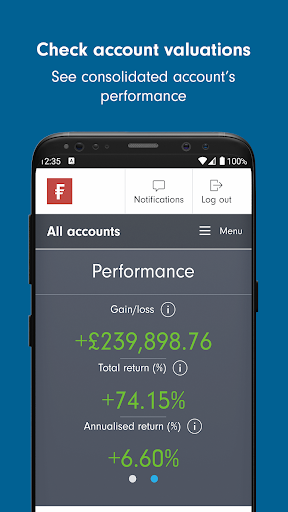

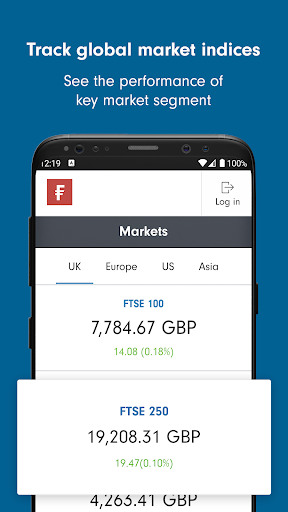

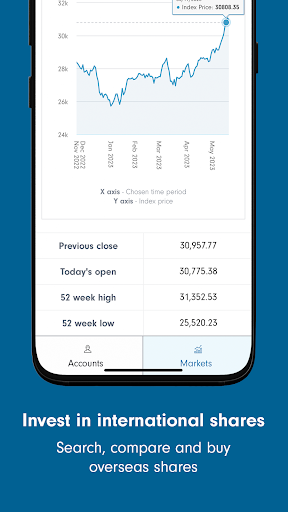

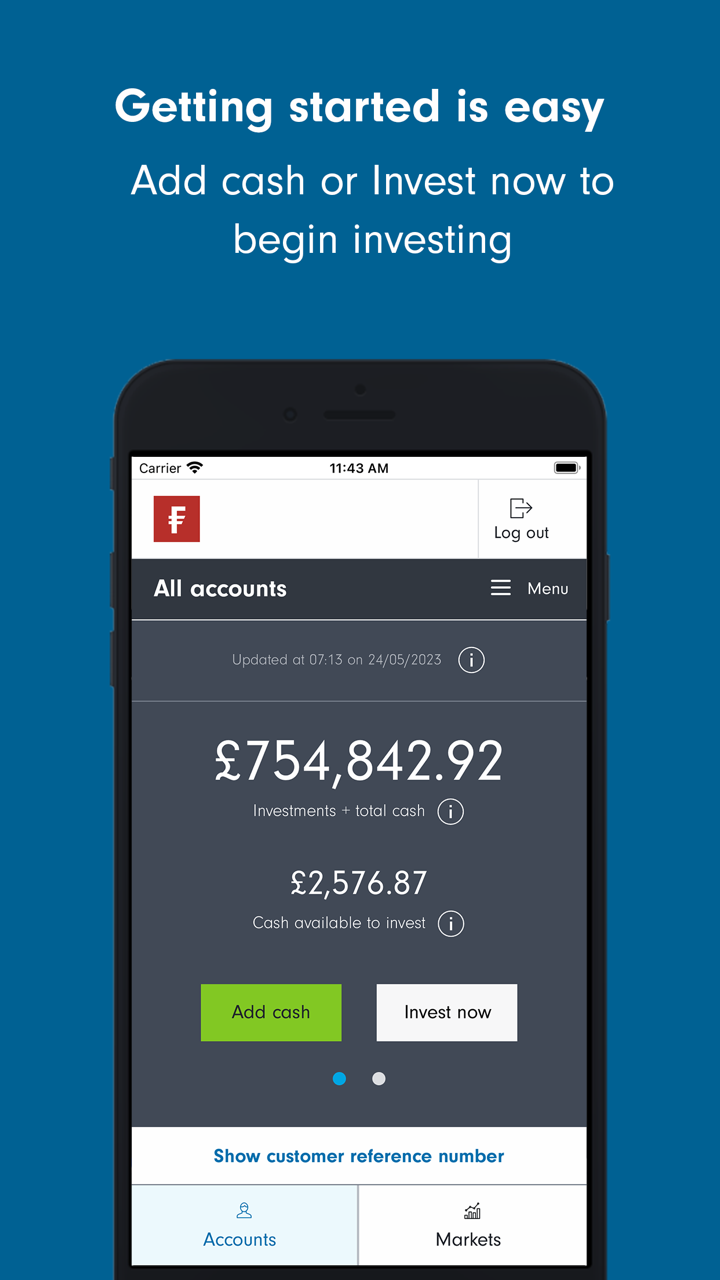

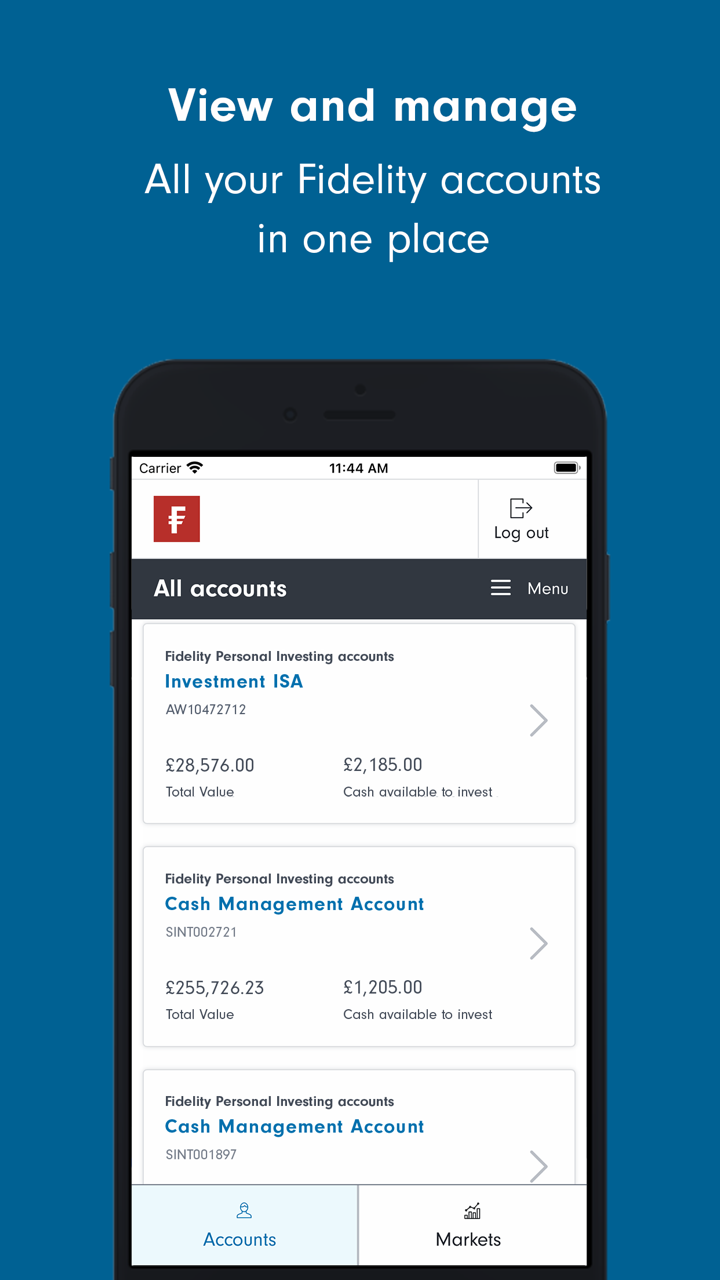

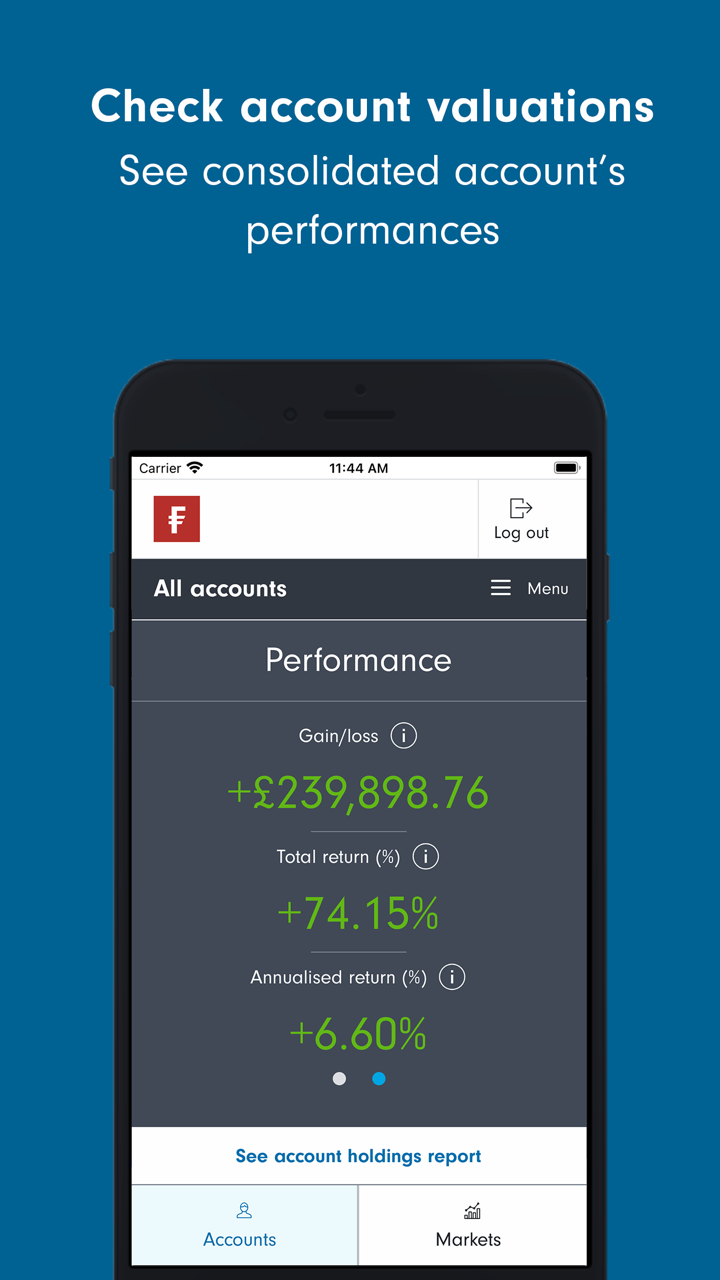

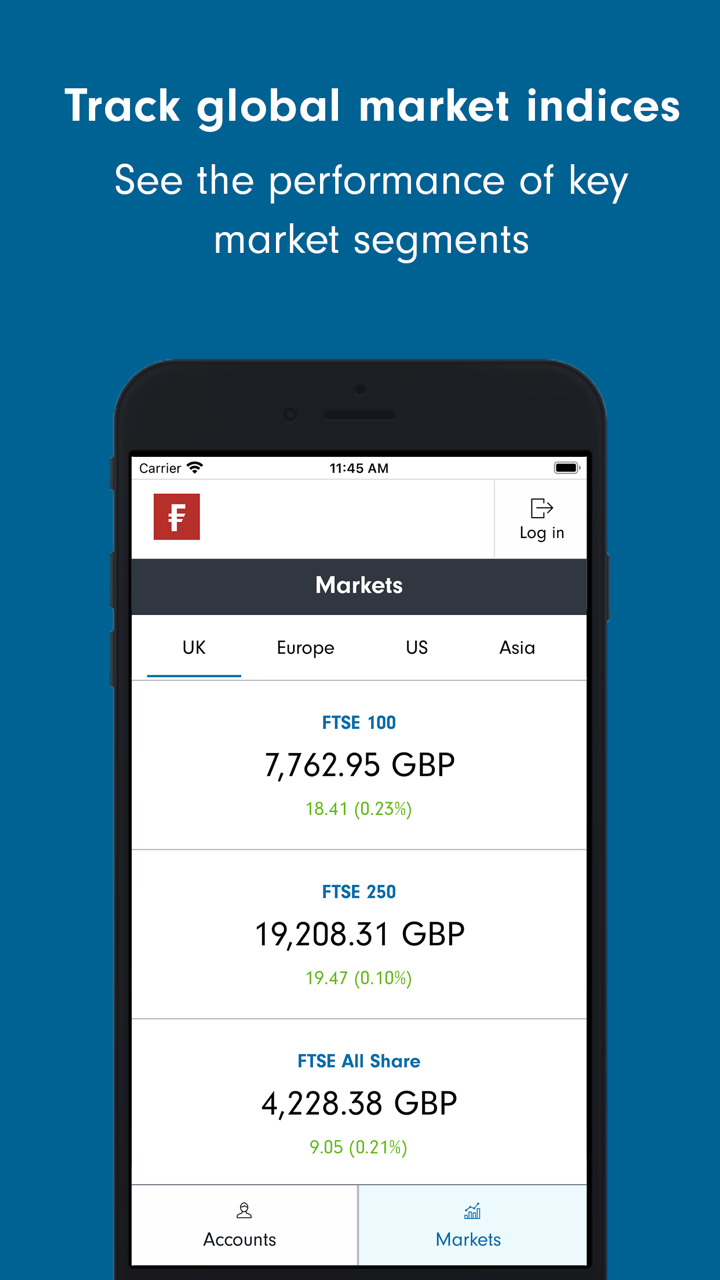

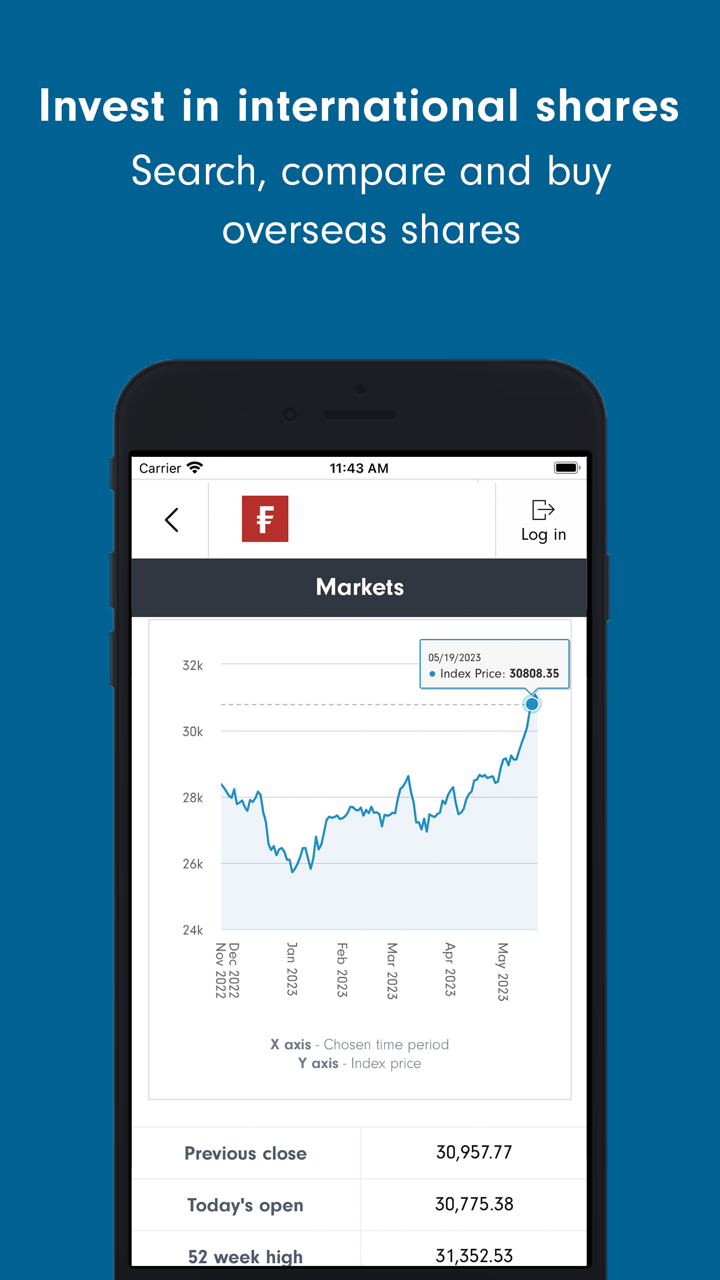

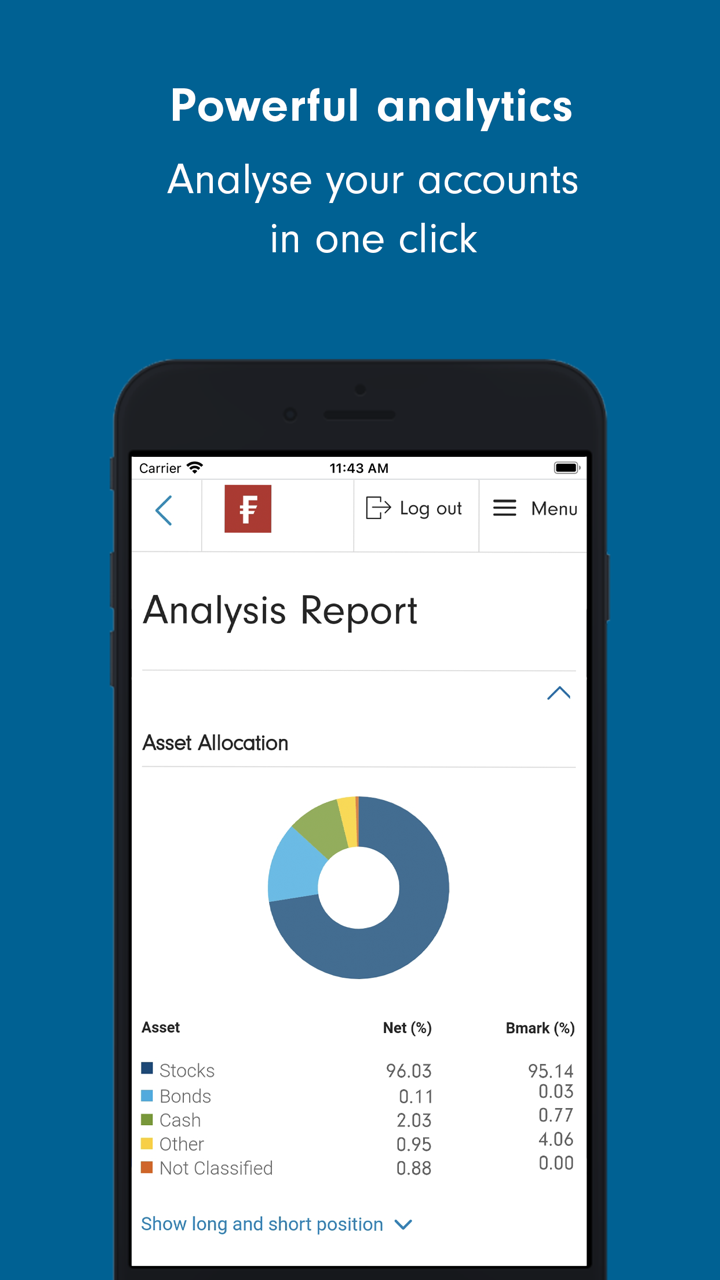

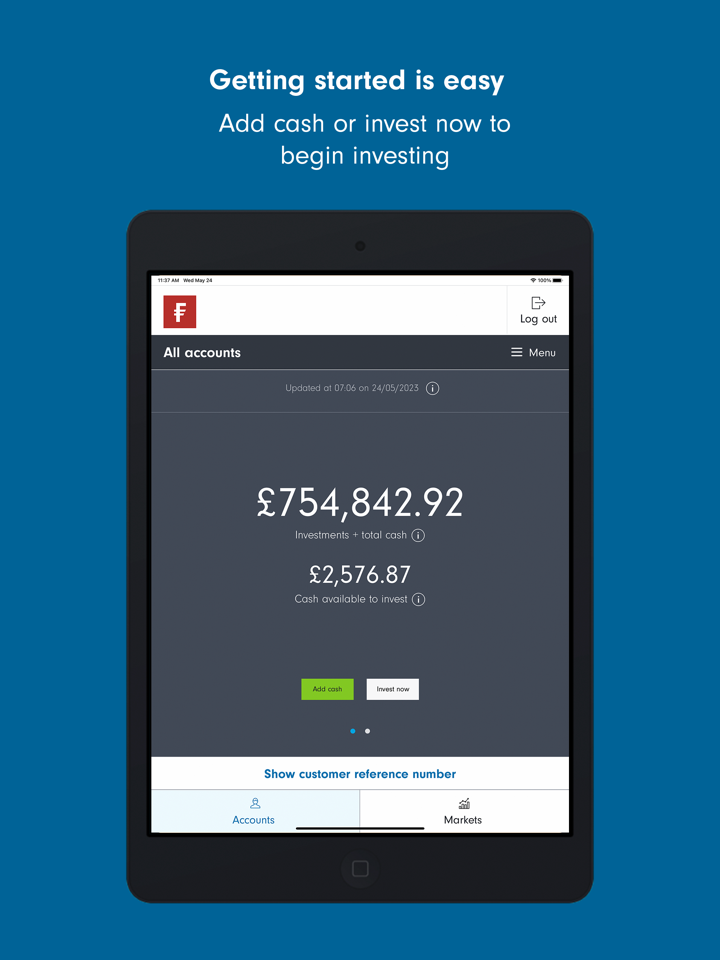

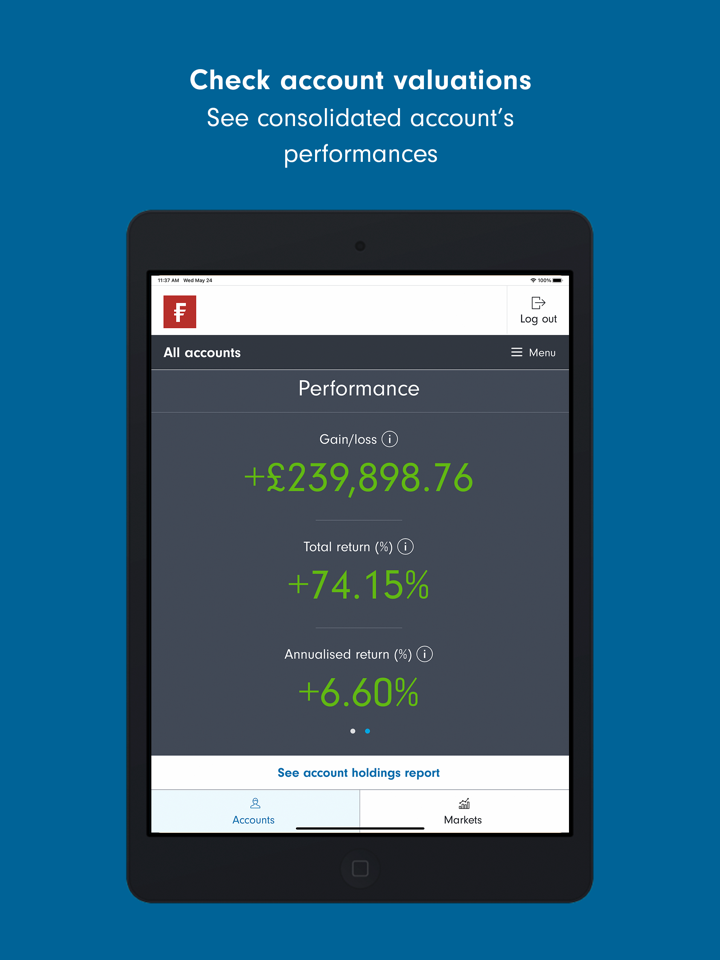

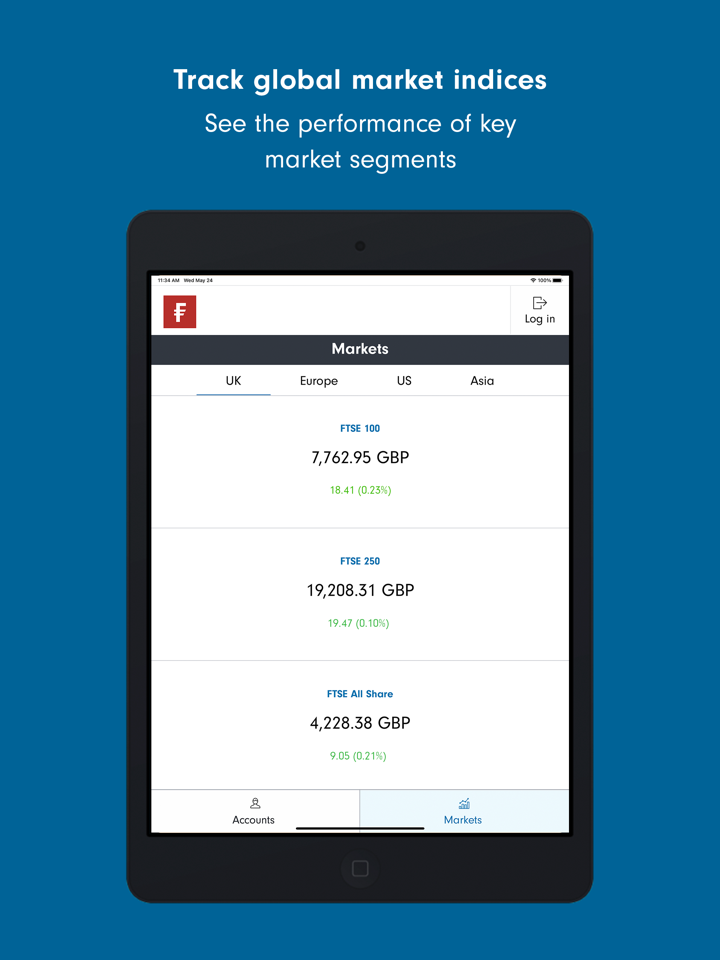

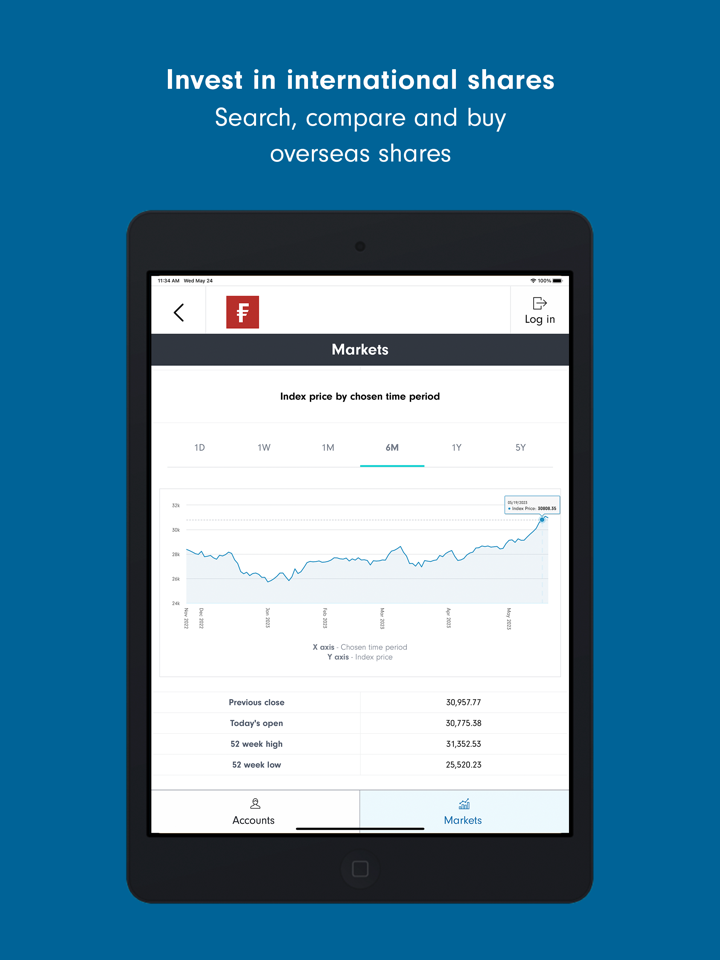

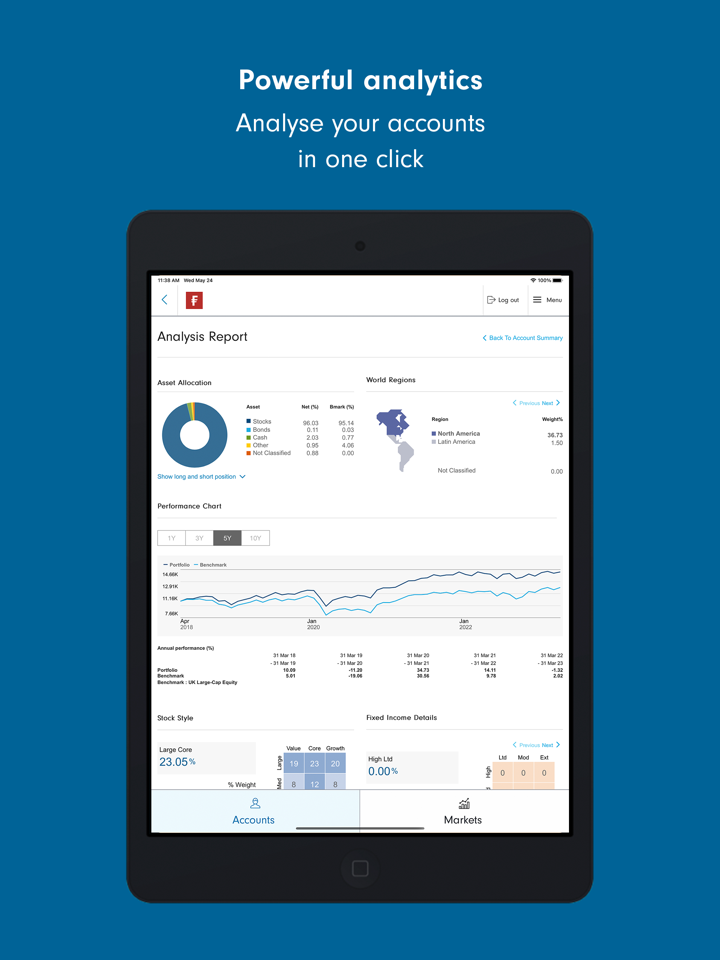

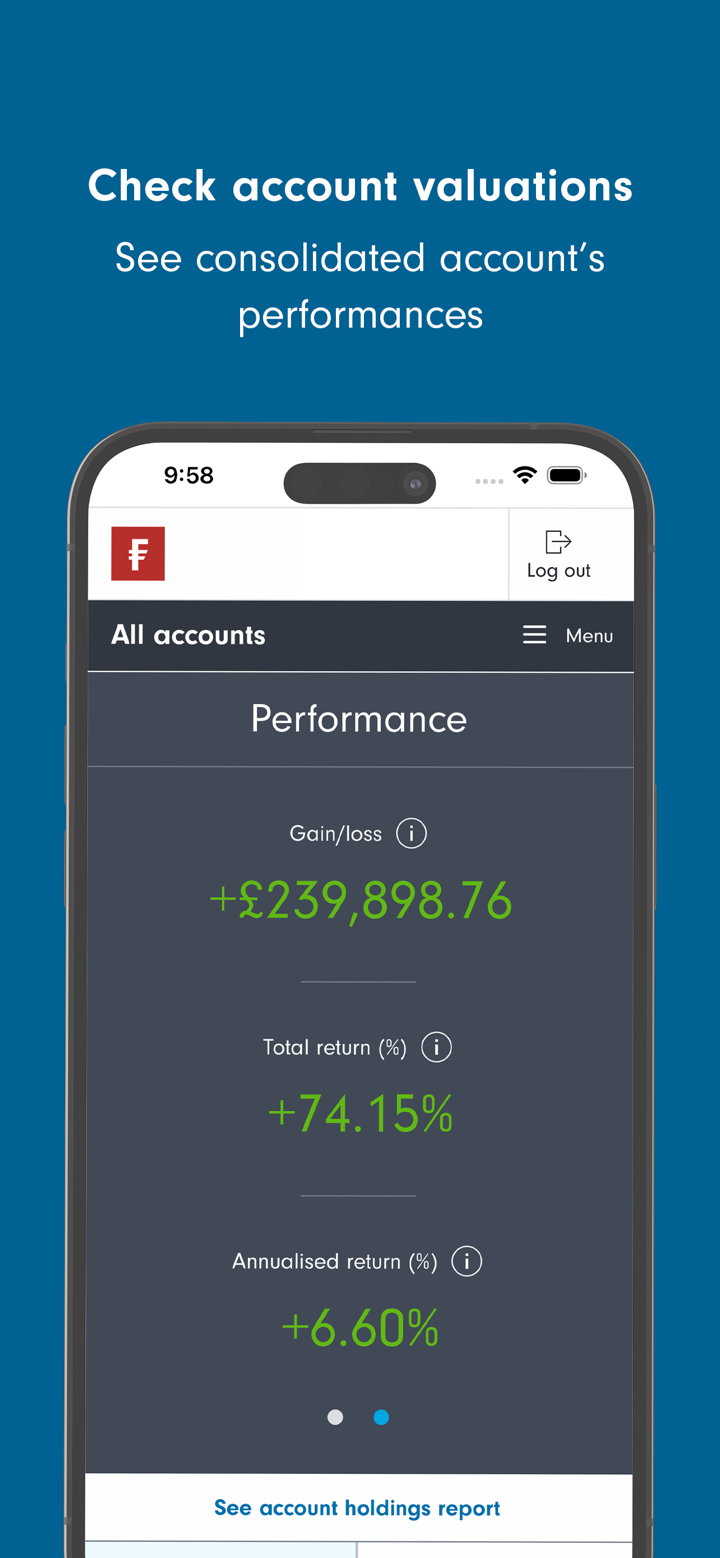

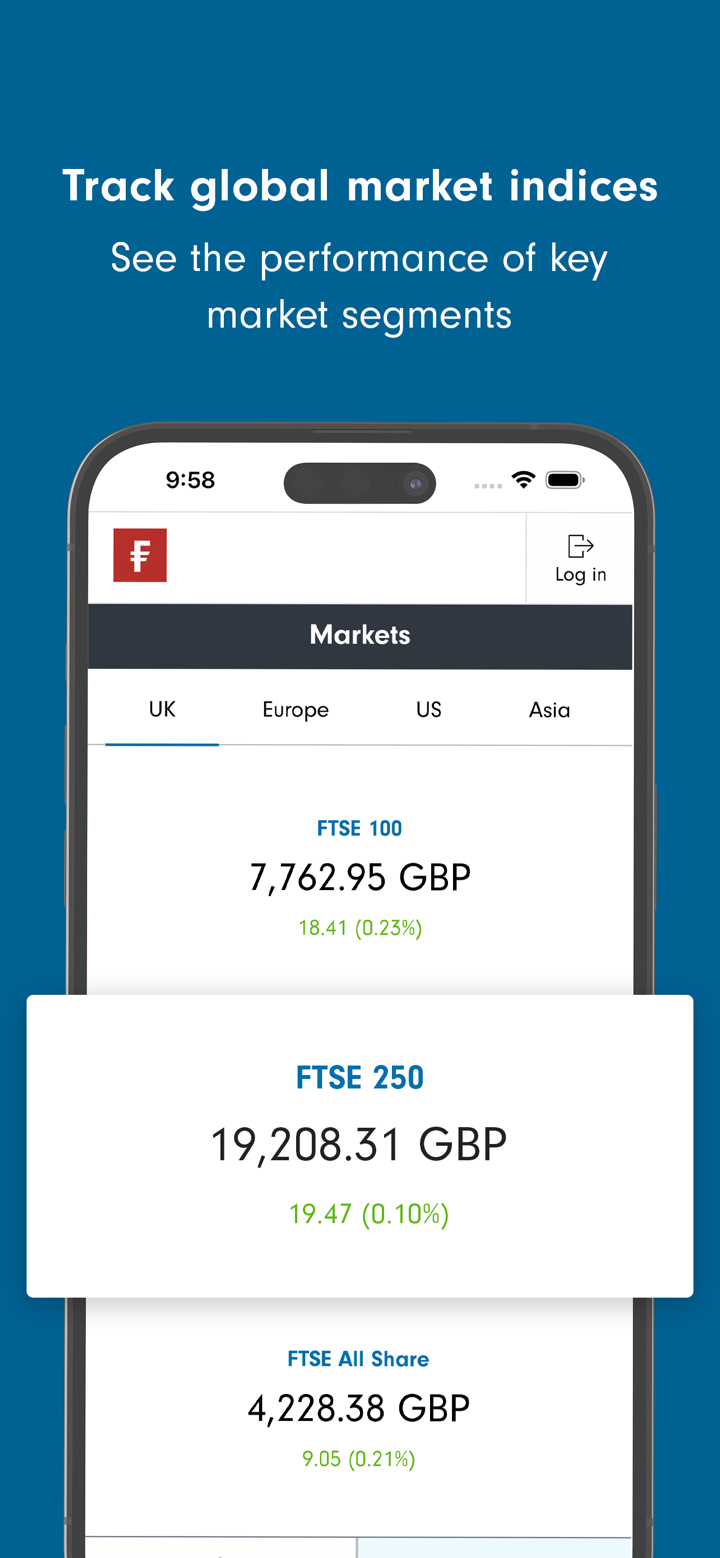

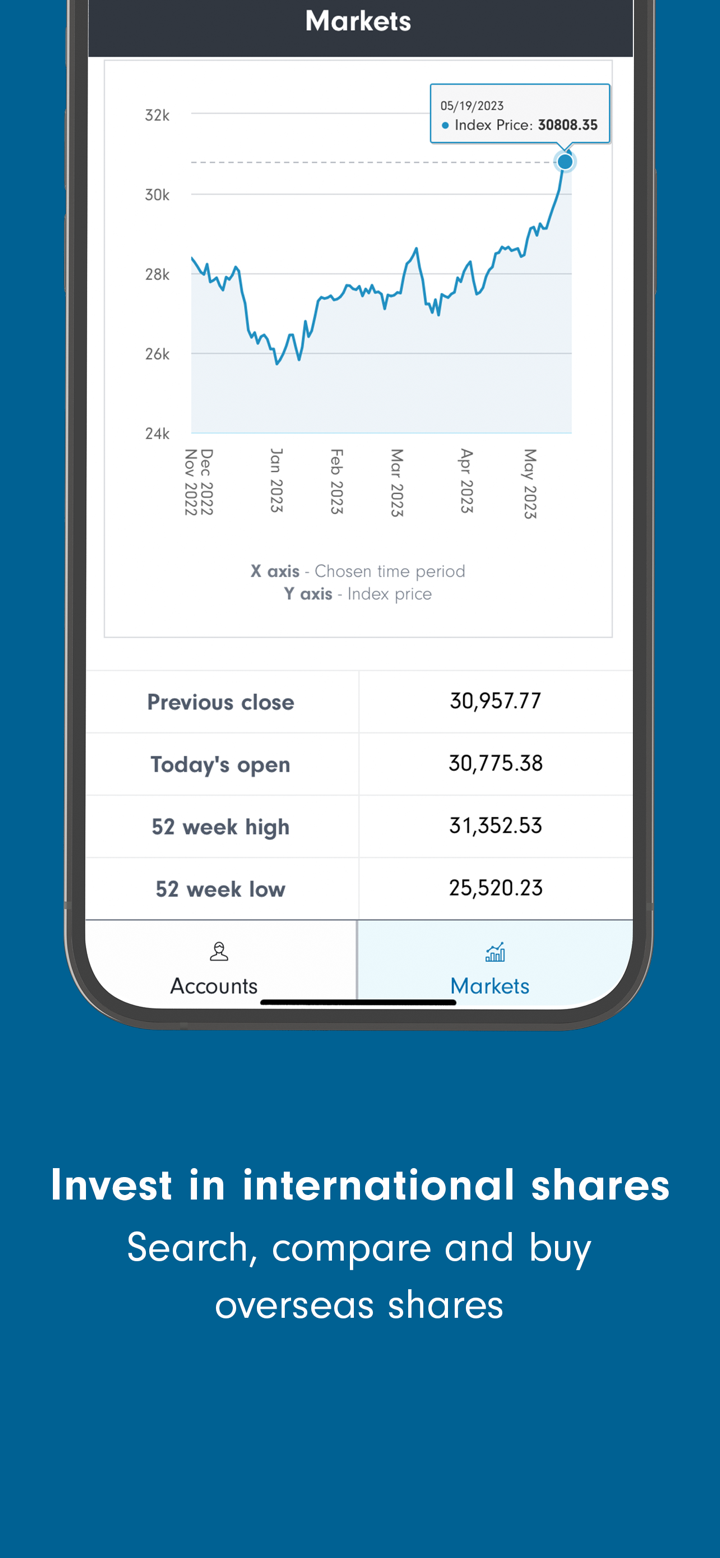

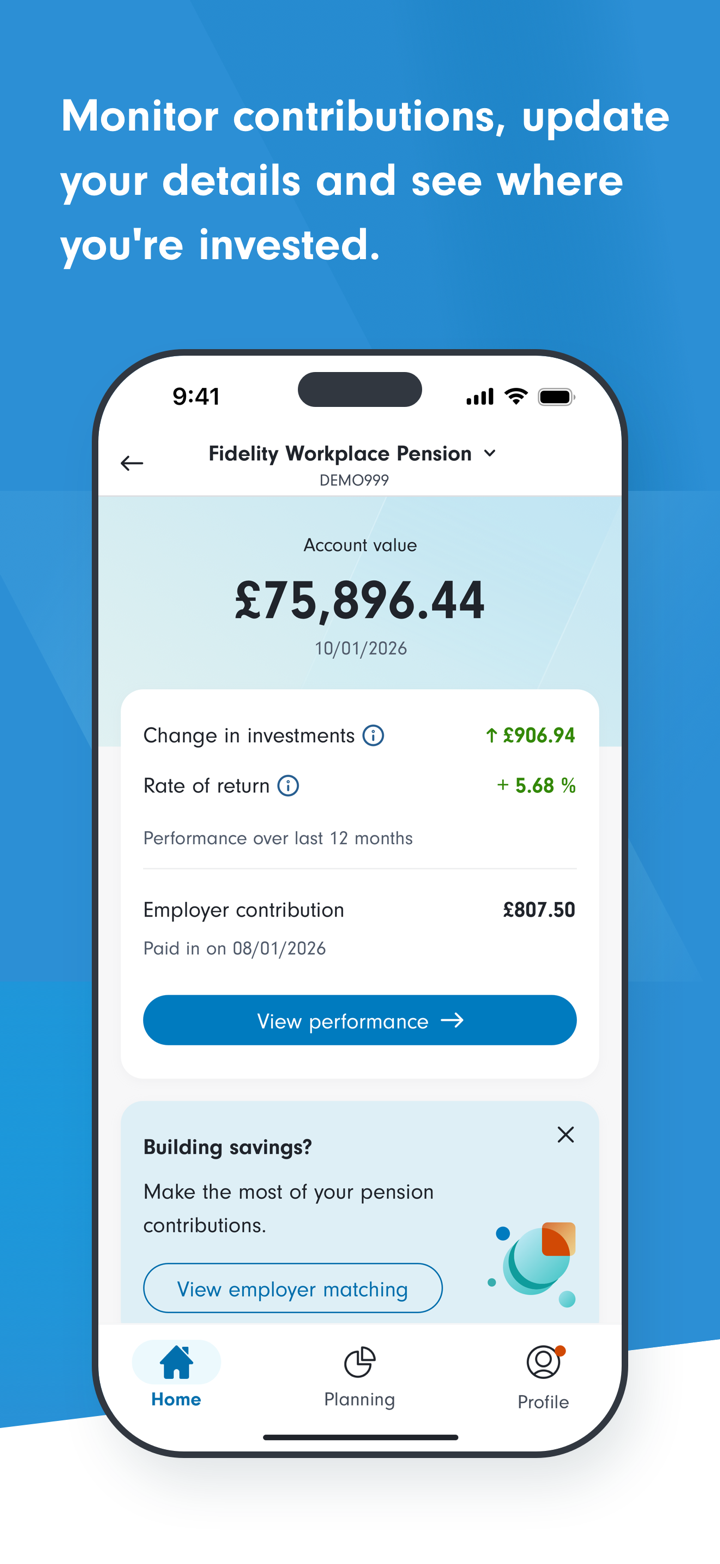

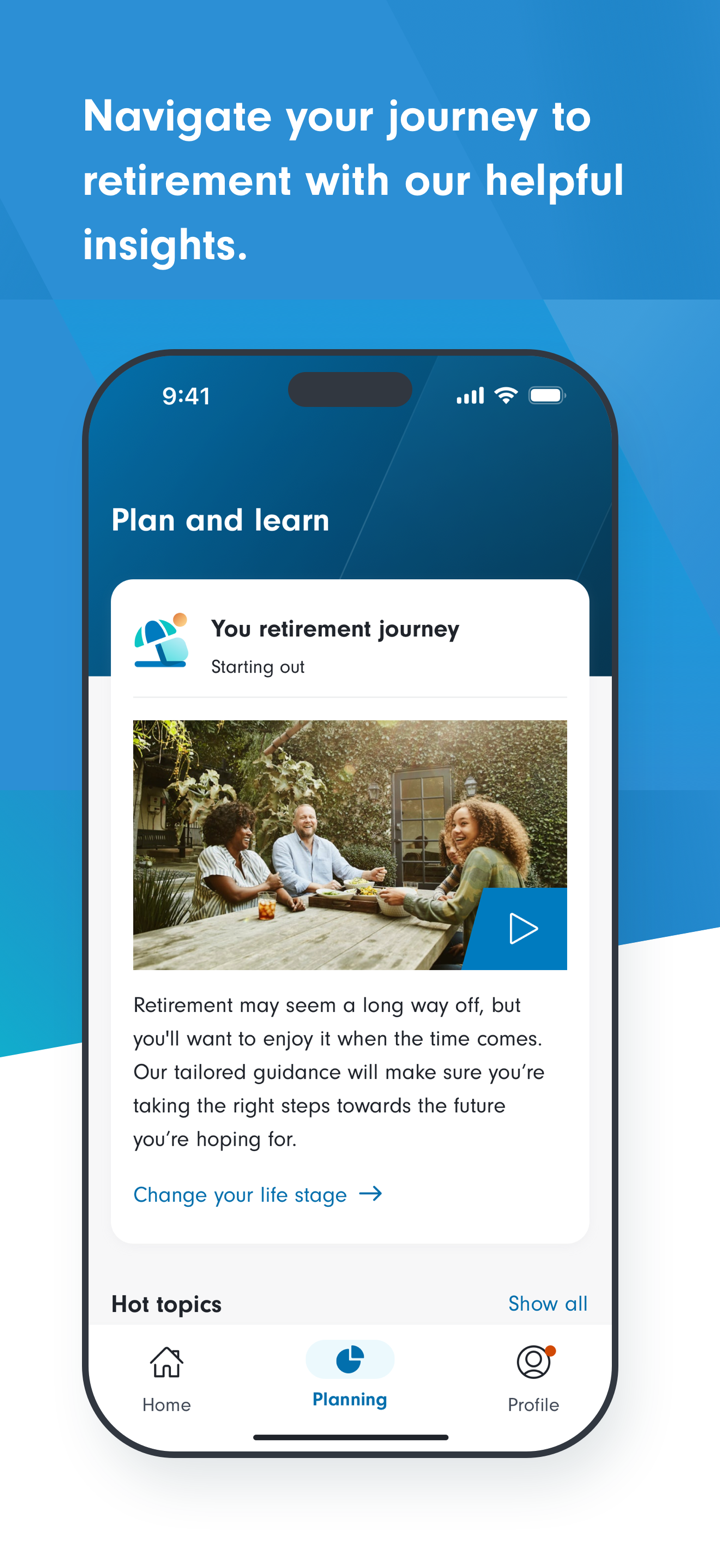

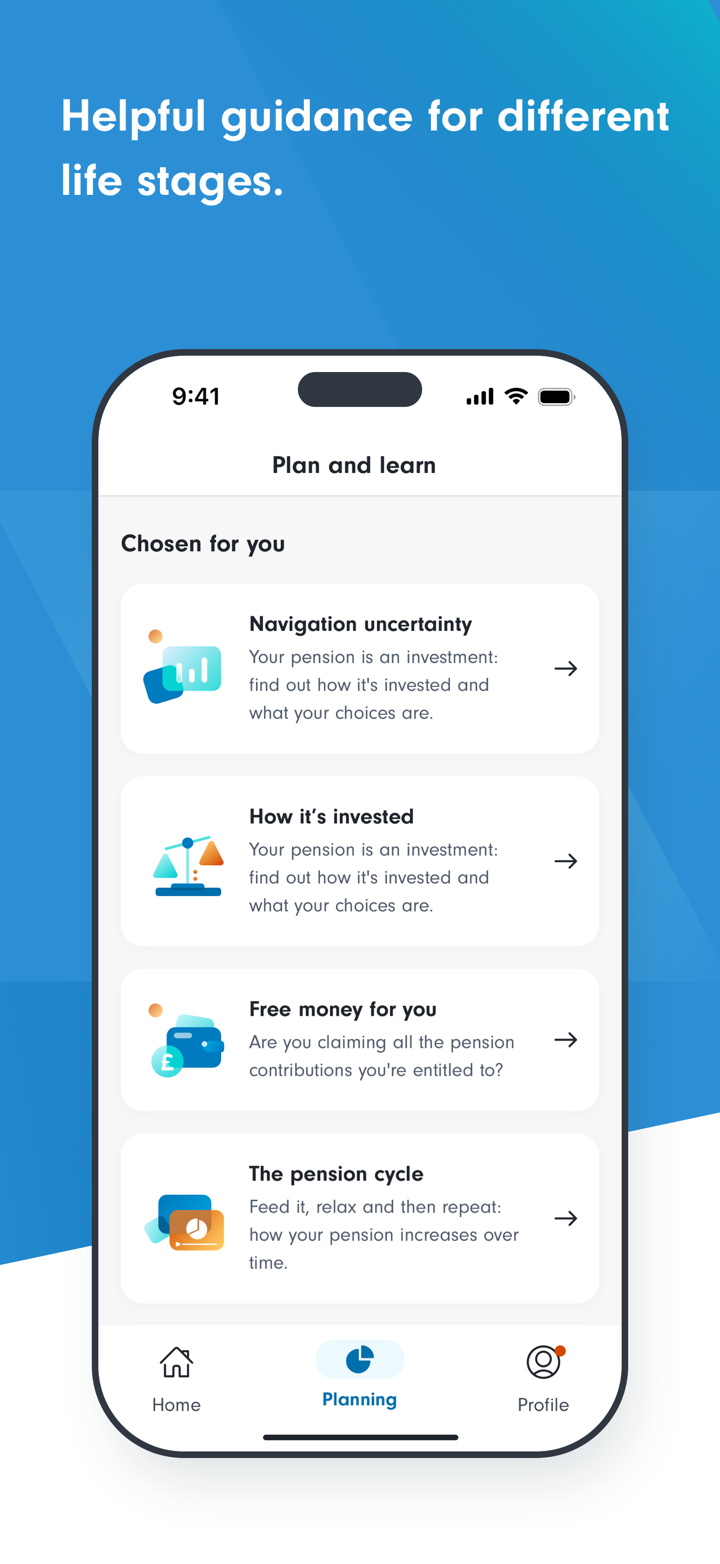

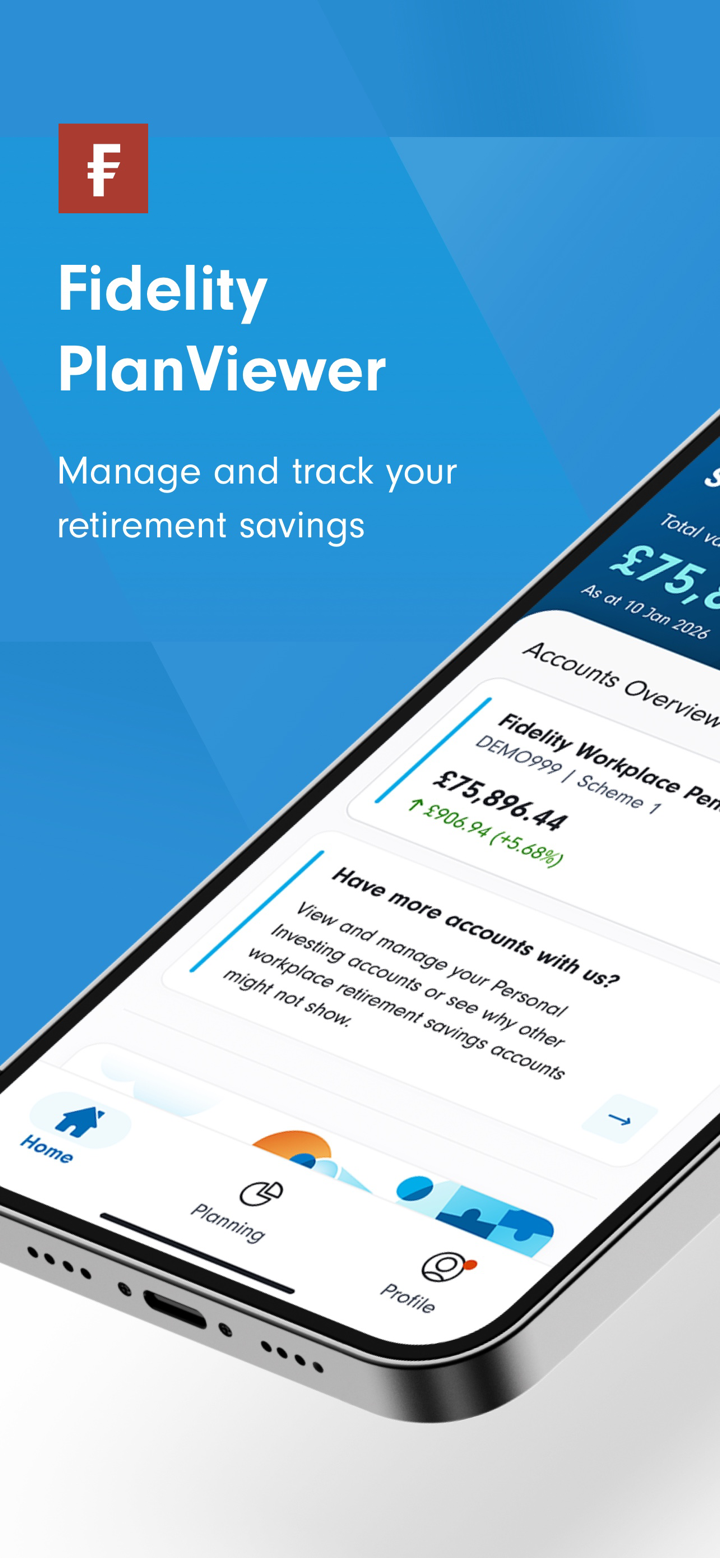

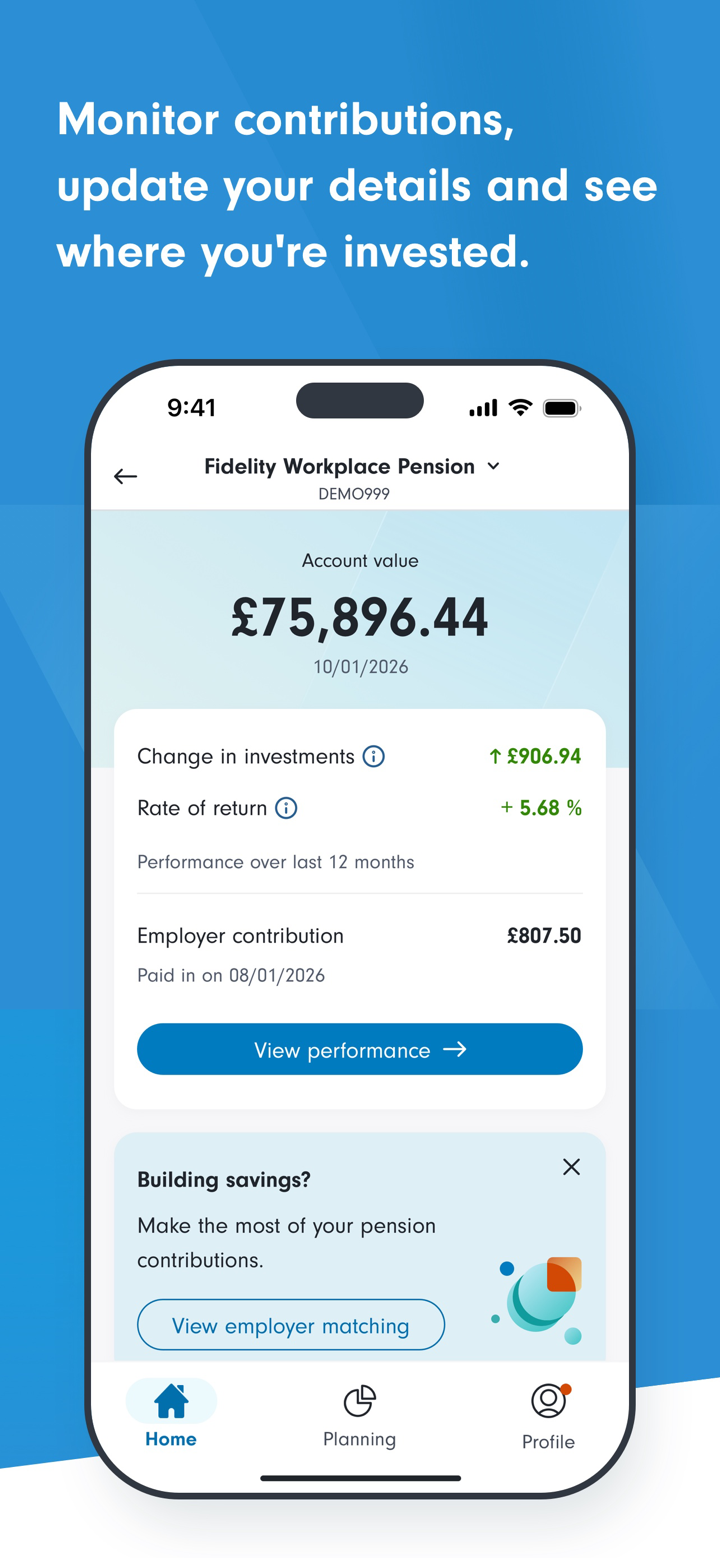

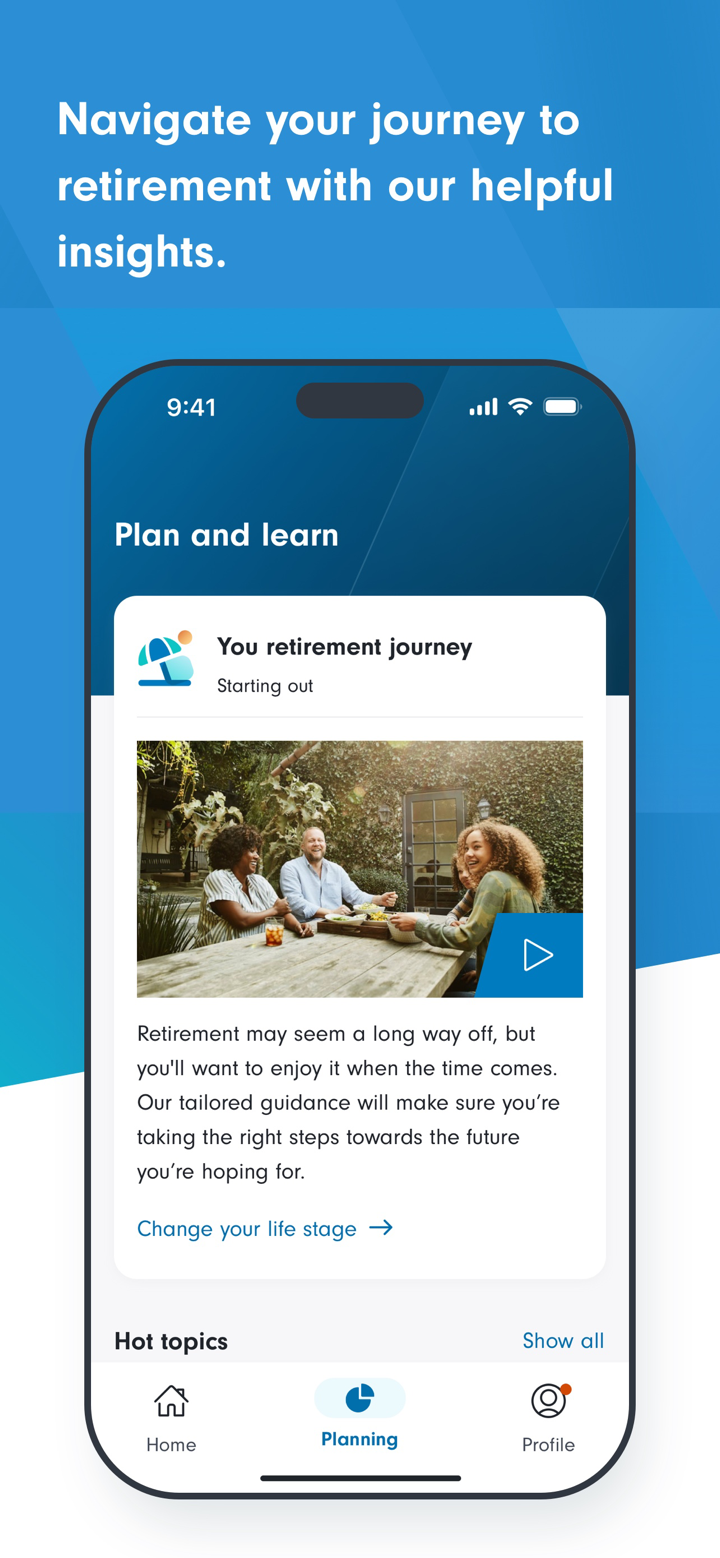

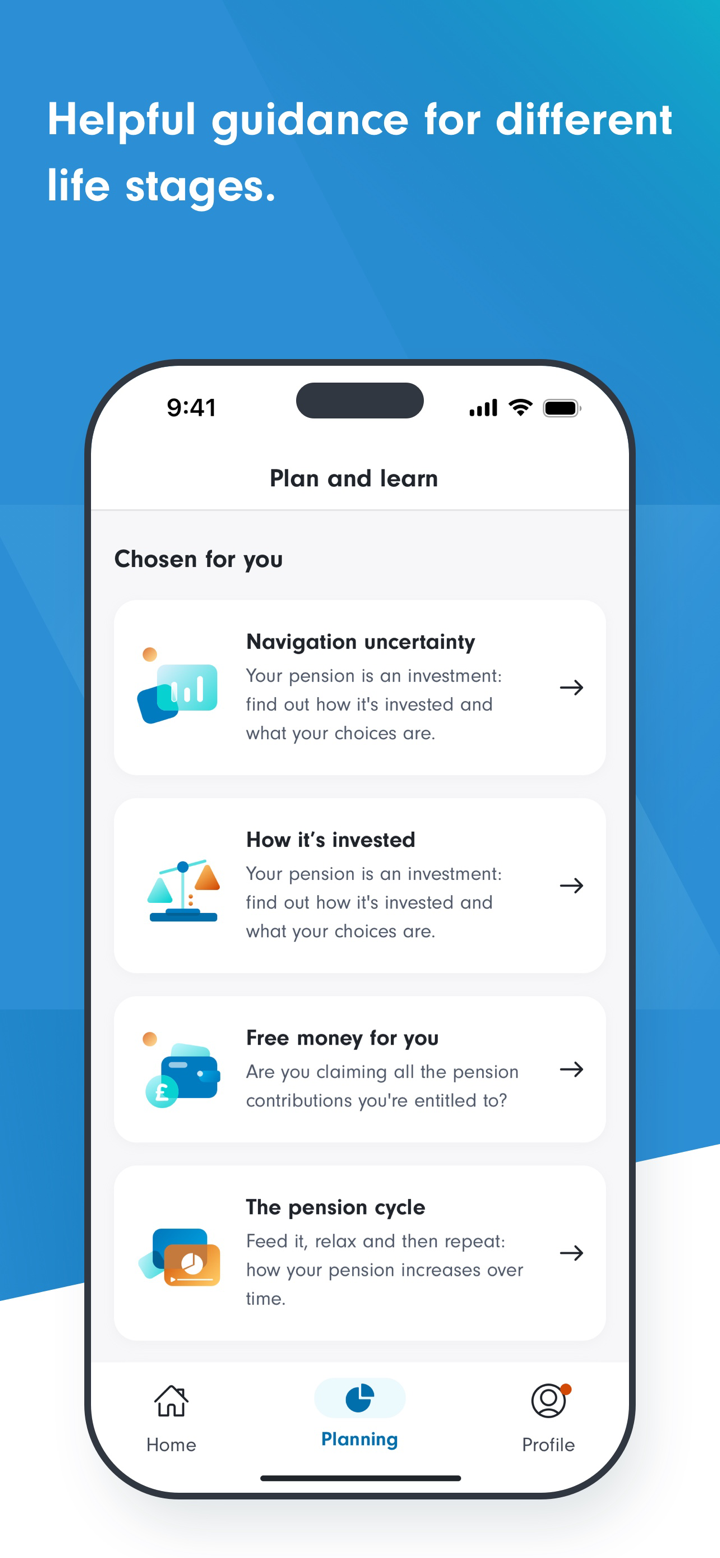

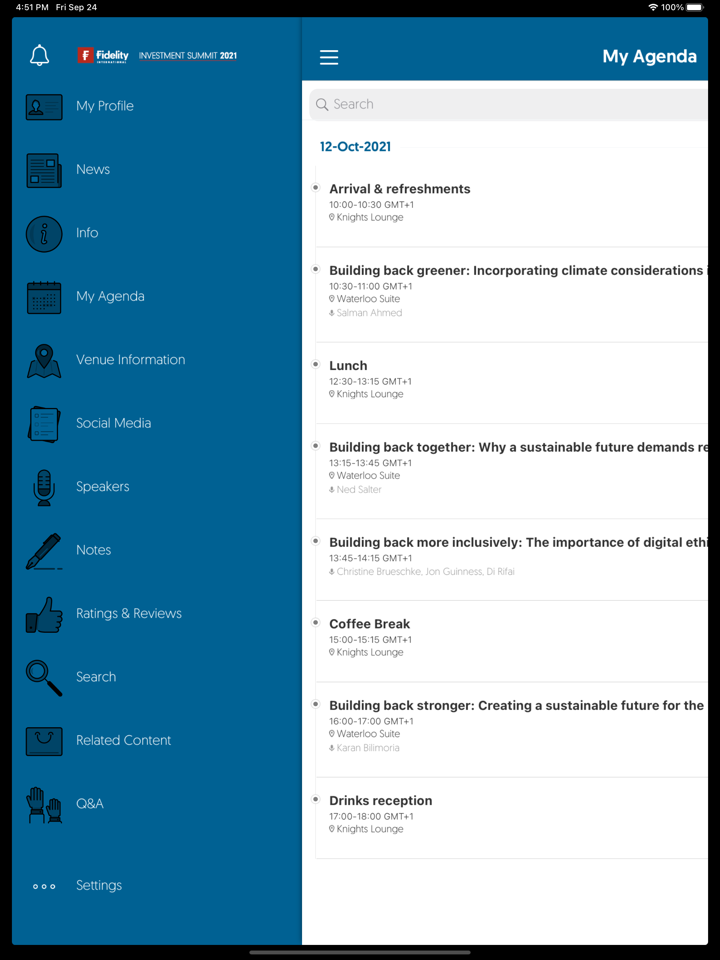

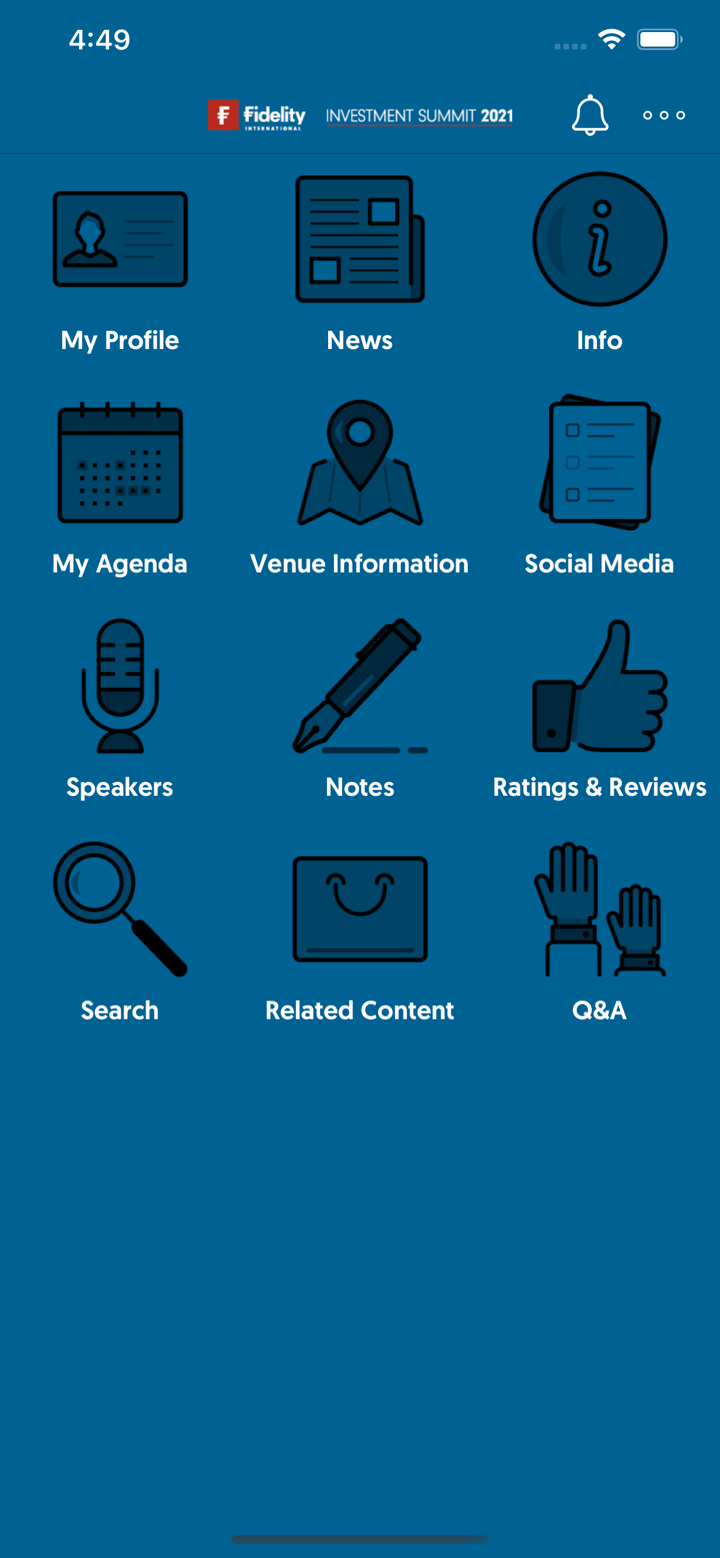

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Fidelity Online | ✔ | Web (PC, Mac) | Investor jangka panjang yang mengelola portofolio secara online |

| Fidelity Aplikasi Seluler | ✔ | iOS, Android | Investor yang membutuhkan akses portofolio saat bepergian |

Deposit dan Penarikan

Fidelity tidak mengenakan biaya tambahan untuk metode deposit atau penarikan standar. Namun, biaya bank atau perantara mungkin berlaku tergantung pada metode yang digunakan. Deposit minimum adalah HK$1.000 per dana per bulan untuk Rencana Investasi Bulanan; tidak ada minimum tertentu yang ditetapkan untuk investasi sekaligus.

| Metode Pembayaran | Jumlah Minimum | Biaya | Waktu Pemrosesan |

| Transfer Telegrafis | / | Biaya bank/perantara | Setelah dana bersih diterima |

| Pembayaran Tagihan HSBC (Internet Banking) | / | ❌ (kecuali biaya agen) | Segera |

| Cek Bank / Wesel Tunai | / | Biaya bank agen | |

| Debit Langsung HSBC / Hang Seng Sama Hari | / | ❌ (dana tidak mencukupi dapat dikenakan biaya bank) | |

| Cek Personal (HK bersih) | HK$1.000.000 atau kurang | ❌ | |

| Cek Personal (non-HK bersih) | / | Biaya pengumpulan mungkin berlaku | Setelah penyelesaian |