Company Summary

| FAIR MARKETS Review Summary | |

| Founded | 2012 |

| Registered Country/Region | Australia |

| Regulation | ASIC (Suspicious Clone) |

| Market Instruments | Forex (36 pairs), Commodities (gold, silver, oil), Cryptos, CFDs, Indices, Stocks |

| Demo Account | ✅ |

| Leverage (forex) | Up to 30:1 |

| Spread | From 0.6 pips (Standard account) |

| Trading Platform | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Webtrader4, Webtrader5 |

| Minimum Deposit | 0 |

| Customer Support | Phone: +61 2 9510 0073 |

| Email: support@fair.markets | |

| Address: Level 26, 1 Bligh St, Sydney NSW 2000 | |

FAIR MARKETS Information

FAIR MARKETS, which was founded in 2012 and claims to be licensed in Australia, operates under suspicious cloned ASIC license. The broker provides a diverse selection of trading assets, including forex, indices, commodities, equities, and cryptocurrencies, through MT4, MT5, and online platforms, with both Aussie Premium and Standard accounts available, as well as demo accounts for practice.

Pros and Cons

| Pros | Cons |

| Offers both MT4 and MT5 platforms | Suspiciously cloned ASIC license |

| Tight spreads on Aussie Premium account | No Islamic (swap-free) accounts |

| Supports multiple account types | |

| No minimum deposit | |

| No deposit/withdrawal fees |

Is FAIR MARKETS Legit?

FAIR MARKETS holds a suspicious cloned license. FAIR MARKETS claims to be regulated by Australia Securities & Investment Commission (ASIC), but the official license with the number 000424122 belongs to TRIVE FINANCIAL SERVICES AUSTRALIA PTY LTD, not FAIR MARKET.

| Regulatory License | Australia Securities & Investment Commission (ASIC) |

| Regulatory Status | Suspicious clone |

| Regulated by | Australia |

| Licensed Institution | TRIVE FINANCIAL SERVICES AUSTRALIA PTY LTD |

| Licensed Type | Market Maker (MM) |

| Licensed Number | 000424122 |

What Can I Trade on FAIR MARKETS?

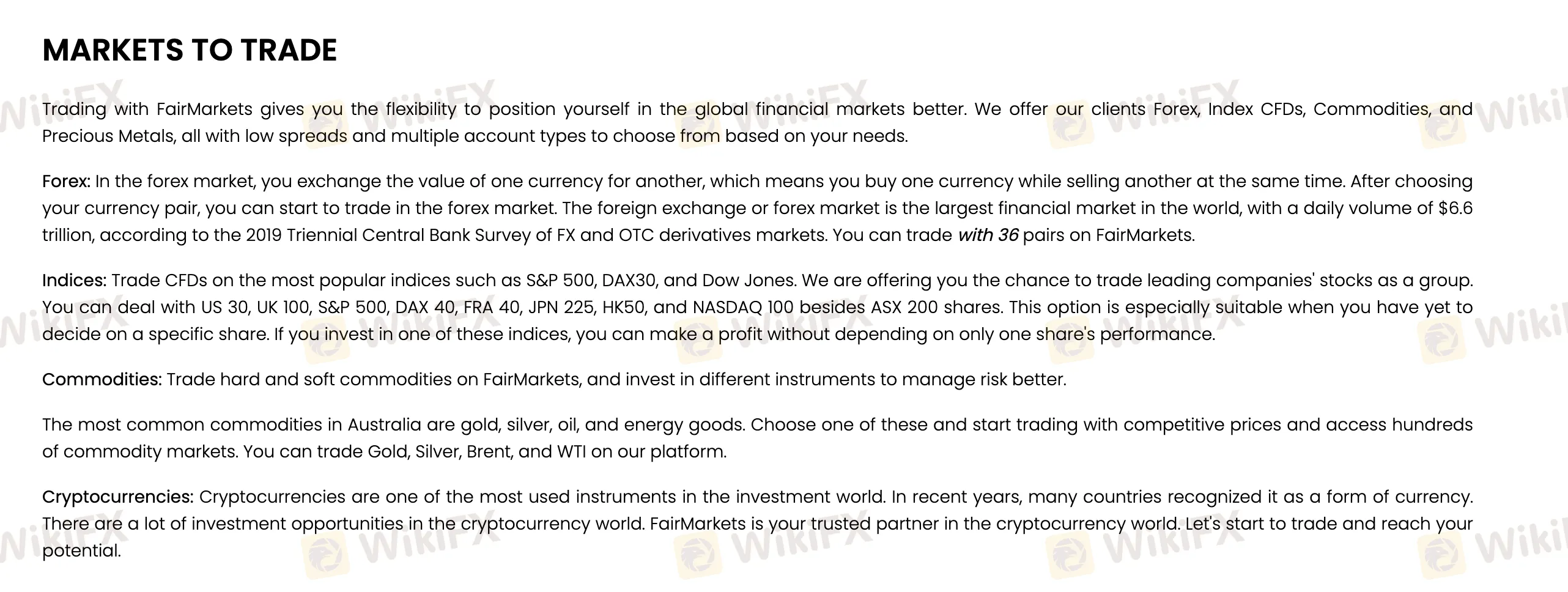

FairMarkets provides access to a wide range of goods, including forex (36 currency pairs), key global indexes, commodities (such as gold, silver, and oil), stocks, and cryptocurrencies, allowing traders to diversify their portfolios across asset classes.

| Tradable Instruments | Supported |

| Forex | ✓ |

| Commodities | ✓ |

| Cryptos | ✓ |

| CFDs | ✓ |

| Indices | ✓ |

| Stocks | ✓ |

| Bonds | ✗ |

| Options | ✗ |

| ETFs | ✗ |

Account Type

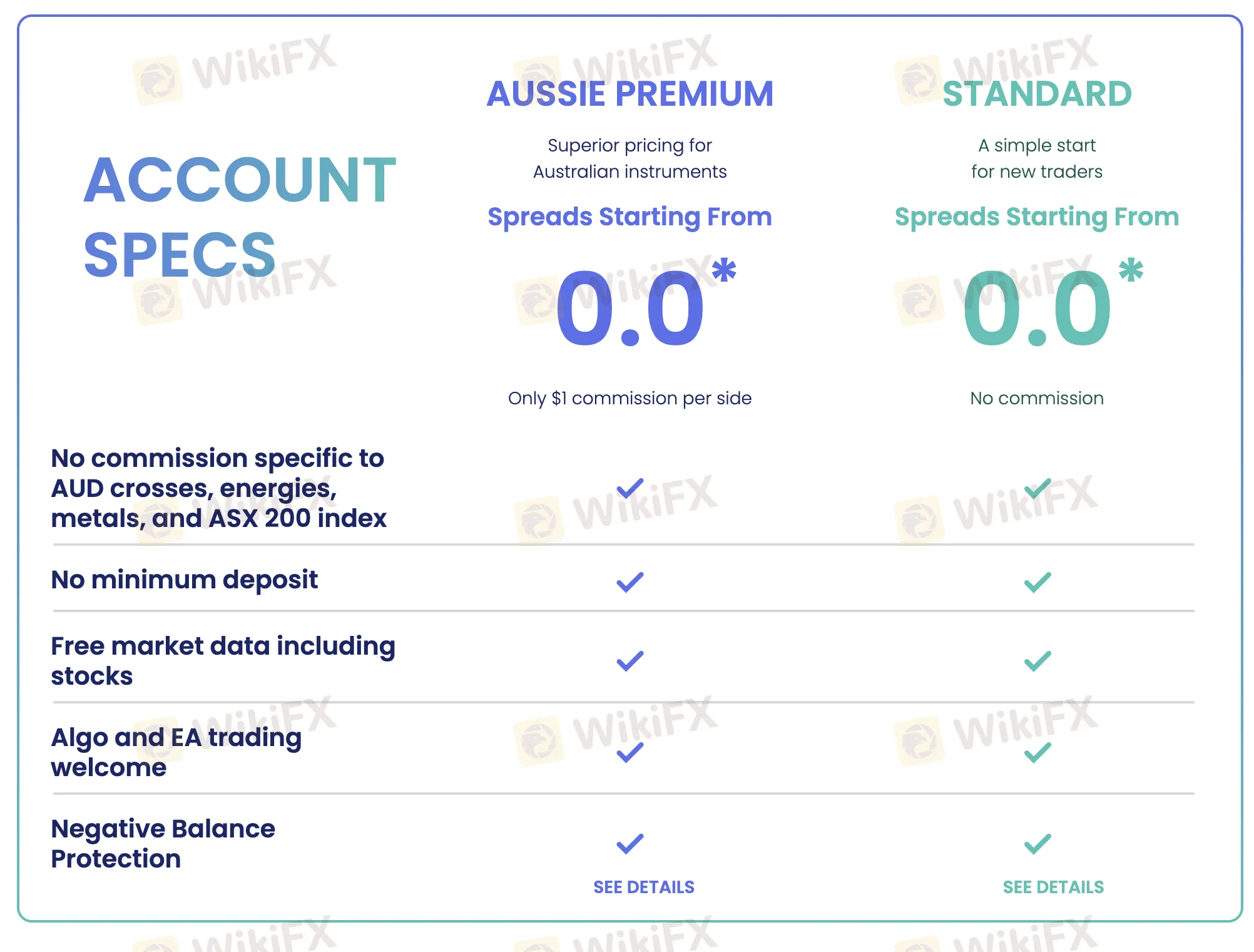

FairMarkets offers two types of live trading accounts to fulfill diverse trader needs. Both accounts provide free market data, support algo and EA trading, require no minimum deposit, and have negative balance protection. FairMarkets also provides demo accounts for traders to practice, however there is no clear indication of Islamic (swap-free) account availability.

| Account Type | Minimum Deposit | Spread | Commission | Suitable for |

| Aussie Premium | 0 | From 0.0 pips | $1 per side | Experienced or professional traders focused on Australian markets |

| Standard | From 0.6 pips | 0 | Beginners or casual traders wanting zero-commission trading |

Leverage

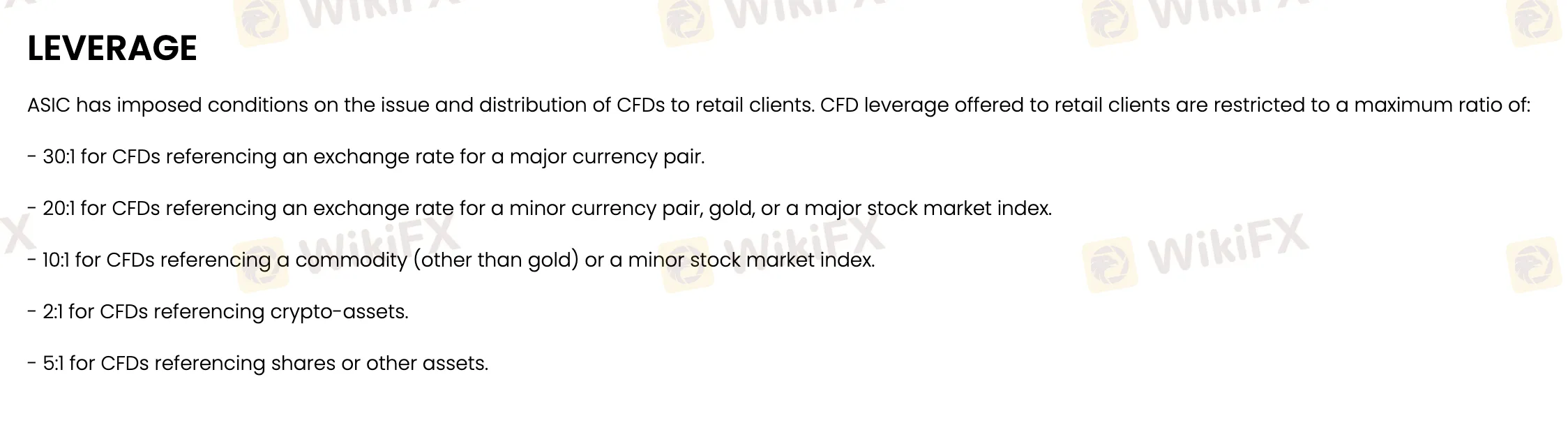

FairMarkets provides leverage in accordance with ASIC regulation limitations, including up to 30:1 for major forex pairs, 20:1 for minor pairs, gold, and major indices, 10:1 for commodities (except gold) and minor indices, 5:1 for stocks, and 2:1 for crypto CFDs. While greater leverage might boost prospective profits, it also raises the danger of loss.

| Asset Class | Maximum Leverage |

| Major forex pairs | 30:1 |

| Minor forex pairs | 20:1 |

| Gold | |

| Major indices | |

| Commodities (except gold) | 10:1 |

| Minor indices | |

| Stocks | 2:1 |

| Crypto CFDs |

FAIR MARKETS Fees

FAIR MARKETS' total fees are lower than industry standards, with tight spreads on its Aussie Premium account (starting at 0.0 pips + $1 commission) and no-commission trading on its Standard account (spreads beginning at 0.6 pips).

| Account Type | Spread | Commission |

| Aussie Premium | From 0.0 pips | $1 per side (on select AUD crosses, oil, gold, silver, ASX 200) |

| Standard | From 0.6 pips | 0 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows, macOS, iOS, Android, Web | Beginners |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, iOS, Android, Web | Experienced traders |

| Webtrader4 | ✔ | Web | Traders prefer no software download (MT4) |

| Webtrader5 | ✔ | Web | Traders prefer no software download (MT5) |

Deposit and Withdrawal

FAIR MARKETS does not impose any deposit or withdrawal fees. The minimum deposit varies by method, however credit cards often have a modest minimum.

Deposit Options

| Deposit Method | Deposit Fees | Deposit Time |

| Credit Card | 0 | Instant |

| Bank Transfer | Longer (depends on bank) | |

| E-Wallet (Skrill) | Fast (depends on provider) |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| Credit Card | 0 | Funds returned to the same card used for deposit |

| Bank Transfer | Same method as deposit, time depends on bank |

弃我而去

Hong Kong

I heard from a friend that there is a 100 bonus for answering questions on this platform, so I immediately registered and participated in the answering activity of "Learning to Get Rich". I registered on August 17, 2023, and have not been reviewed since then. The activity was canceled suddenly during the review period, and it took 5 days to complete the review. The bonus was not given, so I sent an email saying that the event will end on the 16th. Then I am speechless, when I registered at 17, the homepage clearly showed this event. Isn't this a fraud? Don't go to this kind of untrustworthy platform. I registered for nothing and used my ID card and driver's license. I don't know if this kind of unscrupulous platform will be used to do bad things. Resolutely expose that there should be a "Learn to Get Rich" answering activity in the lower column of their interface, and it will be canceled at any time, and it will be handled without a trace.

Exposure

ojbk110

Hong Kong

Withdrawal of 50,000 US dollars will charge me a channel fee of 900 US dollars. Funding was also delayed by a month. I don't know why the channel fee is so expensive.

Exposure

828

Hong Kong

Now the scammer's TikTok account is still active. I hope everyone will not be tricked again! These two are members of the scam gang, everyone pay attention!

Exposure

Quket

Netherlands

FAIR MARKETS offers traders high leverage options, which is great for those looking to maximize their trading potential. Plus, their minimum deposit is very competitive, making it easy for traders to get started. I'm really impressed with their platform and would definitely recommend them to anyone looking for a reliable broker.

Positive

Marshall111

New Zealand

I opened a standard account with Fair Markets about a year ago, primarily focusing on trading a few simple currency pairs. My daily trading volume isn't particularly high, but I've found the overall experience to be quite satisfactory. While the spreads offered by Fair Markets aren't the most competitive in the market, they are reasonable and consistent. What I appreciate most is the lack of slippage.

Positive

JayLI

Hong Kong

The entry threshold is low, suitable for novices like me, and there are free live broadcasts to listen to, not bad!

Positive

FX3569213332

Malaysia

The platform recommended by an old friend has been trading for a while, and it is really good! The trading environment is stable and worth recommending!

Positive

Ava938

Malaysia

At the same time, I opened accounts on several platforms and wanted to test which platform is better. FairMarkets currently has a relatively good experience, and the account manager is very patient and hopes to continue to maintain it.

Positive

jj6935

Hong Kong

Account 63120265 has been frozen and cannot be withdrawn. Now the platform has been closed. Wang Tiancheng, Qiao Feng, Manager He has no news.

Exposure

jj6935

Hong Kong

Unable to withdraw, the fraud gang headed by Wang Tiancheng, Jun, Qiao Feng, Manager He, and Zhou Ziyang deceived people into making stock index gold, using so-called large funds and small positions to operate for people's full positions, constantly deceiving and misleading people into virtual trading. In the end, for various reasons, the US dollar will not be certified and will not be withdrawn from account.

Exposure

随心1431

Hong Kong

Unable to withdraw money from my account, unable to log in to 63120232, only after recharging to improve score can the money be given out, unfreezing, unreasonable.

Exposure

随心1431

Hong Kong

There was a woman who added friends on QQ and asked me to download WeChat after a while, and they pulled me into a group. At the beginning, I recommended individual stocks, and slowly they induced me to do international markets, indexes, and gold. I asked Manager He to open an international account. I opened it on May 30. Qiao and Wang in the group took everyone to buy up and down, and said that on June would be profitable. After doubling back, I transferred a total of 379,500 yuan to the account designated by Manager He. Due to loss, I didn’t want to do and plan to withdrawal my money on June 20th. I found that I couldn’t withdraw it. He said that the score of mine was insufficient and I needed to recharge to improve the score. I found out that it was a scam, and now I only ask for a refund of my money of 379,500 yuan, hoping to solve it!

Exposure

ojbk110

Hong Kong

My money was withdrawn from June 26, 2023 to July 3, but it still hasn't arrived. The salesman didn't respond, just said to wait for company to deal with it.

Exposure

55668323

Hong Kong

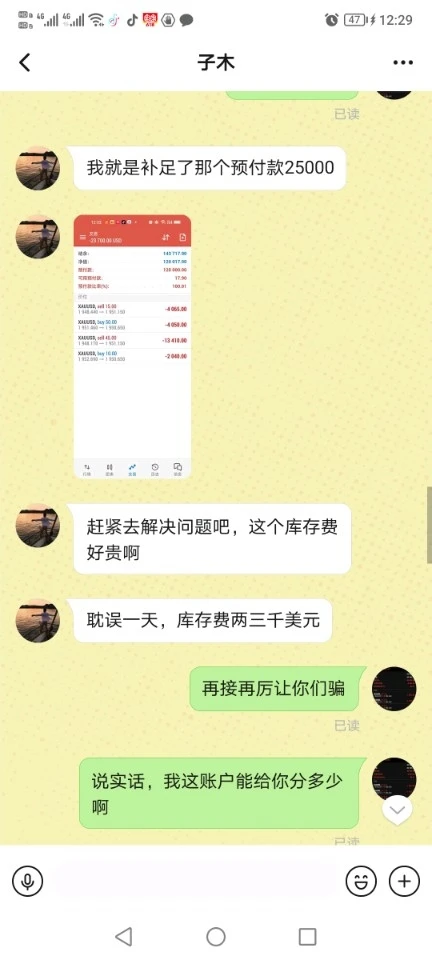

At the beginning, I used WeChat group to attract popularity. Wang Tiancheng, the group leader, said that the international gold market doubled his steady profit. He asked me to find Manager He to open an international account. He gave me a download URL. Ri find He to open an account, operate the account by himself, listen to Wang Tiancheng in the group, Qiao Feng commanded operation to buy up and buy down, Wang Tiancheng said that in June, the account funds can be directly doubled, so on June 12, the Japanese entrusted the account to Wang Tiancheng. Tiancheng operation. During this period, Wang has been inducing large funds to operate and earn more. He has injected 76,000 US dollars into the account, which is equivalent to RMB 532,000. Wang operated the account until early morning of June 20, and my account was locked and frozen. I couldn’t close the position. On 21st, the king asked me to find He and told me to recharge 25,000 US dollars to unfreeze and close the position. What about software and hardware problems, the prepayment ratio needs to exceed 130% to unfreeze and close the position, and you need to recharge 2 dollars, I said I have no money, and introduced the so-called Zhou Zixiang of the China Banking Regulatory Commission, let me loan usury, How did all deposits and withdrawals be operated? At this time, I feel that I have been cheated. The account has a total of 1,190.23 million U.S. dollars, which is equivalent to 833,161 yuan. The account has been frozen and cannot be withdrawn.

Exposure

5536

Hong Kong

Start to operate stocks with orders. When the stock market is not in a good mood, it is their fake trick to join the international market to open an account. Use bubble chat groups to lead everyone to operate. It is a drag. When everyone’s morale is up, start to engage in activities and add more gold. Finally, harvest . At first, it took me to trade stocks with their set orders. They induced me to open an account and trade in the global markets once the stock market was depressive, which was its fake trick. It took you to trade with the group named PaoPao, in which were shills. It started to carry out activities for strip-mining more of your principal when you were in high sprits.

Exposure

800824

Hong Kong

I'm a trading user of FAIRMARKETSLTD. According to netizen, it's a standard, reliable and ASIC regulated platform. Also because I believe this is a legitimate platform, I registered on the platform on May 30, and I haven't made any deposit yet. I followed the exchange group for a day and saw two so-called teachers guiding everyone on the buying and selling prices. Still others help conduct account custody and management. Many people in the group cheered to buy, increase positions, and then make a lot of money. Maybe it can be entrusted. On May 31, two teachers in the group induced that they transferred in June. In the case of making more money, I recommended a manager He who claimed to work in a bank. The person who handled the deposit and withdrawal for us was to exchange US dollars to buy international gold. So I started the purchase transaction. At first I didn't dare to buy more, because I didn't understand, so I went in and bought a little at the price recommended by the teacher in the group. I bought according to the ratio of 0.1-0.5, and then got a little profit, but very little. However, I was very satisfied. Because of the price recommended by the teacher Qiao Fengqiao, I could control a stable income every day until June 12, so that everyone can enter boldly and make money. However, I bought a short order, and then it continued to rise to a high level. Seeing that the account was losing more and more money, I asked the teacher to solve the problem. The so-called teacher Qiao, said that my account funds were too small to operate. I add up to $100,000 and let him do it. On the one hand, I was also worried about the risk of charging too much, so I gave up. I invested a total of 25,000 US dollars, plus a profit of 5,000, there would be 30,000 in total. I wanted to roll with existing funds. I also didn't want to save money. Later I found Mr. Wang who called himself Wang Tiancheng. He also said that my position was too small and asked me to increase my position to 50,000 to help me operate. I thought my position was the same as 50,000. The difference was not big, and the profit point of daily operation was also fast. There was still a price difference of about 5,000, so I borrowed 25,000 from my sister, and the credit card cash was 30,000 to recharge directly. On June 16, I asked him to help me with the problem. There was no income guarantee. How much moneywas the key to solve the problem. He said that professional things should be done by professional people. After the account was handed over to Wang Tiancheng, he made a lot of money on the first day. When I saw the account for the first time, the profit was over 4,000. But after refreshing, it was more than 11,000. I was a little surprised. The prepayment ratio was relatively safe, so I didn't ask too much. It was refreshed again around 10:00 in the evening, with a profit of more than 25,000. I panicked because I felt like my account was being swiped maliciously. At 12 o'clock, I refreshed again and found that the account showed that 30 short orders were placed and 30 long orders were hedged. The advance payment rate was 91%. I was terrified then. It was precisely because of the malicious heavy position operation that the account was blocked and the position could not be closed. On the morning of June 17th, I sent him a screenshot saying what exactly happened, and Wang Tiancheng said there was no problem. He told me to ask Manager He how to solve it, and I told Manager He the problem. Manager He said that my prepayment ratio was lower than 130%, and the platform automatically blocked my account. The position needed to be covered at the bottom before the position could be closed normally. That was to say, I needed to add more than 130,000 to get in, and basically all my money was put in, and there was also a loan. It was said that if the prepayment ratio was lower than 30%, the position would be liquidated. The platform would automatically close the position and asked me to make up the prepaid basic position of 19,000 as soon as possible. However, I was really out of money. I asked him whether the system would be automatically unlocked at 130% and could be traded normally, he said: Yes. So I also felt a little hopeful at the time, just waiting for the next day's rise. I noticed that my prepayment ratio also went up with the rising of gold price. On the third day, the ratio was 45%, which was still below 30%. That was to say, the account would not blow up. However, on the third day, the platform automatically froze it for me, saying that it was because I did not make up the bottom line in time. Would not it blow up if the ratio was higher tahn 30%? Why my account was frozen now. Even if it went up or down, it had nothing to do with me, and then the inventory fee would increase every day, and it would double on Thursday. I calculated that the inventory fee had been as high as 20,000 these days. This was clearly a scam. I had no choice in the future, and I kept looking for Manager He, and communicated with the two teachers to see if they could help me. And then Manager He, who helped me with withdrawal and deposit, recommended a person who claimed to be the Banking Regulatory Commission to help me deal with it, and then assisted me to contact the official to solve the problem. Later, it said that the capital flow needed to be 100,000. It was also reported that the money was not transferred to the platform, but to the account of the China Banking Regulatory Commission, otherwise the money would be returned within 30 seconds after the transfer. I asked him to show his ID and work pass to prove his identity. I asked for a video to show if the ID and work ID were the same person, but he didn't help me to verify. Then I checked the ID card and work permit, and they were all fake. Without this ID card, it could not be verified, and I have also raised my vigilance. Later, I knew about the situation of forex trading in this model, and found that many victims, like me, lost everything overnight. Relevant departments and platforms should pay attention to it. The money was hard earned for many years. I only need to get back the principal, and I don’t want other profits. Those accounts with high inventory fees have been frozen and are increasing every day, which is really unreasonable.

Exposure

街角陌路

Hong Kong

The person named Qiao Feng is the head of the scam. They are a scam gang. They started recommending stocks in a group and slowly induced us to enter the international market. They induces us to give them our accounts so that they can invest for us. They blocked our accounts later. I was unable to close the position and the account was banned. I knew I was cheated. Now I am really desperate. I hope the relevant departments will deal with it.

Exposure

5536

Hong Kong

At the beginning, it led investors to speculate in stocks and won the trust of the masses. After that, it started to lure people to open an international account to speculate in gold. Various promotions were issued to lure people to recharge and exchange for US dollars. The operation made you unable to close the position. The account was made impossible to close the position. I have put all my life's money in it. This is killing me. Please help.

Exposure

800824

Hong Kong

Wang Tiancheng is from Xiamen. He said that his child has just been admitted to Fudan University and he wants to buy an apartment for him in Shanghai. What I want to say is that this is our hard-earned money. He asked me to give him my account, saying that he could help me double my profit. I didn't expect to make much money, but my account got blocked after a night of operations. I asked a person claiming to be staff of the China Banking Regulatory Commission to help me deal with it, and waas told to pay more than 100,000. He said that there was a record of account changes. I also hope that the platform can handle the problem as soon as possible and return the principal to me. It's all hard-earned money. It cannot be ignored. The child's tuition fees for the next semester are included in it. Hope the platform handles it as soon as possible.

Exposure

VXbanqvxiansha

Hong Kong

I was told about gold investment. Wang Tiancheng operates the lock position. Non-agricultural market said double is possible. Margin is required after lock-up. After replenishing the deposit, it said that the credit score was not enough. Do not allow cash withdrawals, just recharge money.

Exposure

街角陌路

Hong Kong

A brother in the group used me, cheated my trust, and took the account to me for playing fees. He couldn’t close the position, and induced me to take a loan to recharge it. After closing the position, it returned to normal. After closing the position, he said that the account was frozen and needed to charge more than 110,000 to fill the bank statement. The trap was too covert.

Exposure

5536

Hong Kong

The platform induces you to invest and help you operate your account, but you will not be able to close the position later, and you will not be able to withdraw money after you add money to liquidate the position.

Exposure

800824

Hong Kong

Now no one can help me to solve it, they said that you must charge money to enter, I was afraid it is a routine.

Exposure