Company Summary

| Autu Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Vanuatu |

| Regulation | VFSC (Offshore), ASIC (Revoked) |

| Market Instruments | Futures, commodities, stocks, indices, cryptos |

| Demo Account | / |

| Leverage | / |

| Spread | Zero |

| Trading Platform | cTrader, MT5 |

| Minimum Deposit | / |

| Customer Support | Online chat, contact form |

| Email: business@autu.global | |

| Australia: +61 4 26660218 | |

| Vanuatu: +678 29283 | |

| Address: Transpacific Building, Level 01, Lini Highway, Port Vila, Republic of Vanuatu. | |

| Regional Restrictions | Afghanistan, Canada, Congo (Kinshasa), Cuba, Cyprus, Hong Kong, Indonesia, Iran, Malaysia, North Korea, Singapore, Spain, Sudan, Syria, United Arab Emirates, United States, and Yemen |

Autu Information

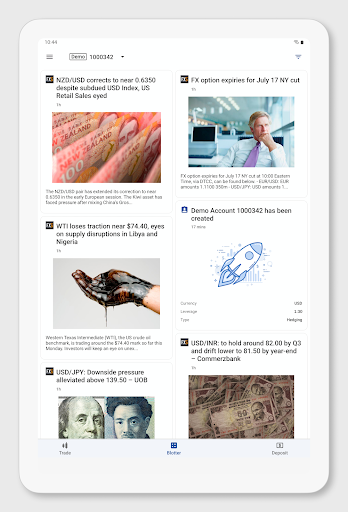

Autu Securities is an offshore regulated broker that was founded in 2024 and is based in Vanuatu. It gives you access to global financial markets through derivatives like futures, commodities, stocks, indices, and cryptos. It also has competitive trading conditions with zero-spread models and modern platforms like cTrader and MT5.

Pros and Cons

| Pros | Cons |

| Competitive zero-spread model | Offshore regulation risks |

| Supports both cTrader and MT5 | Revoked license |

| Various trading products | Lack of transparency |

| Live chat support | Regional restrictions |

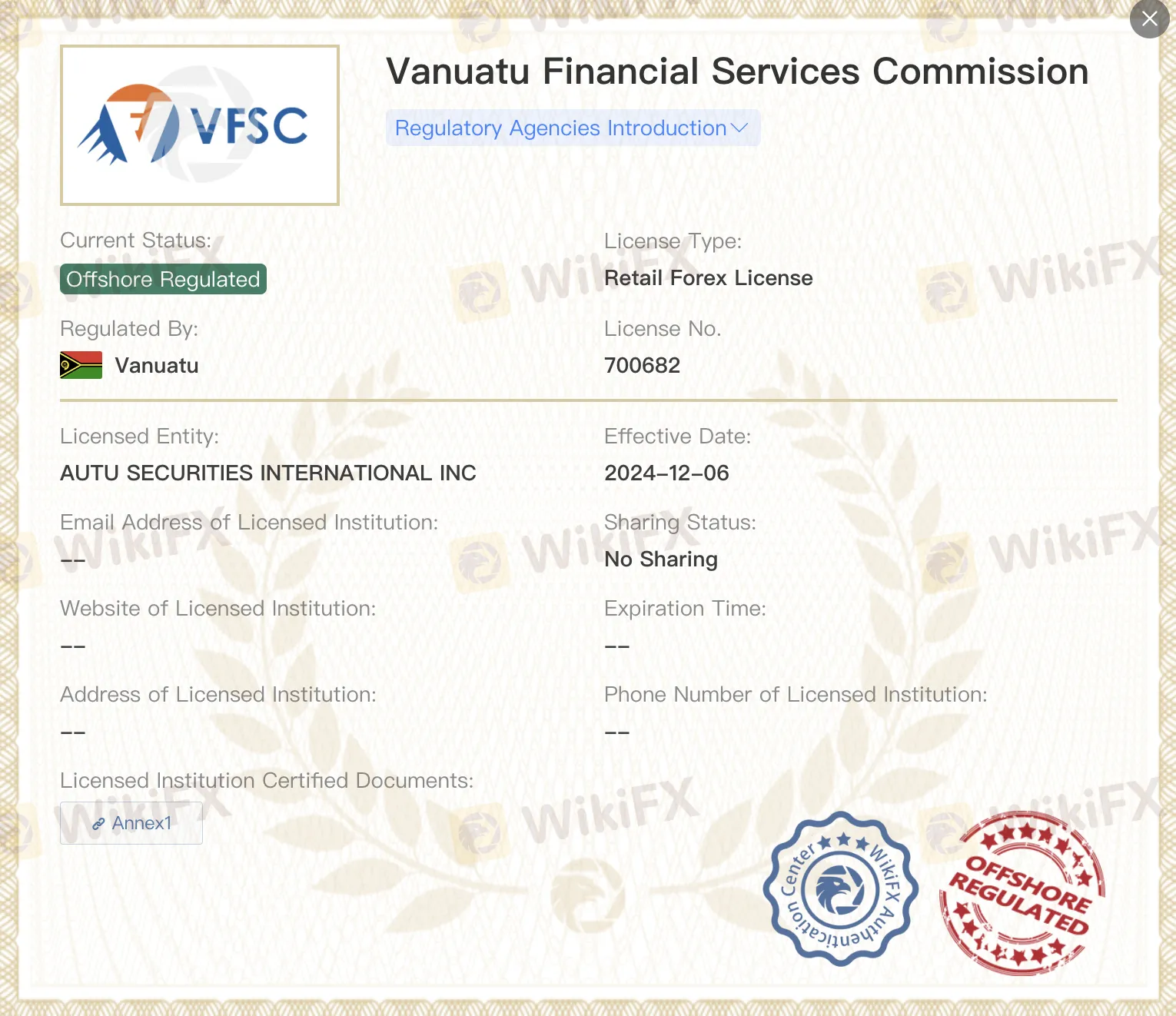

Is Autu Legit?

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australia Securities & Investment Commission (ASIC) | Revoked | AUTU MARKETS PTY LIMITED | Australia | Appointed Representative(AR) | 001311215 |

| The Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | AUTU SECURITIESINTERNATIONAL INC | Vanuatu | Retail Forex License | 700682 |

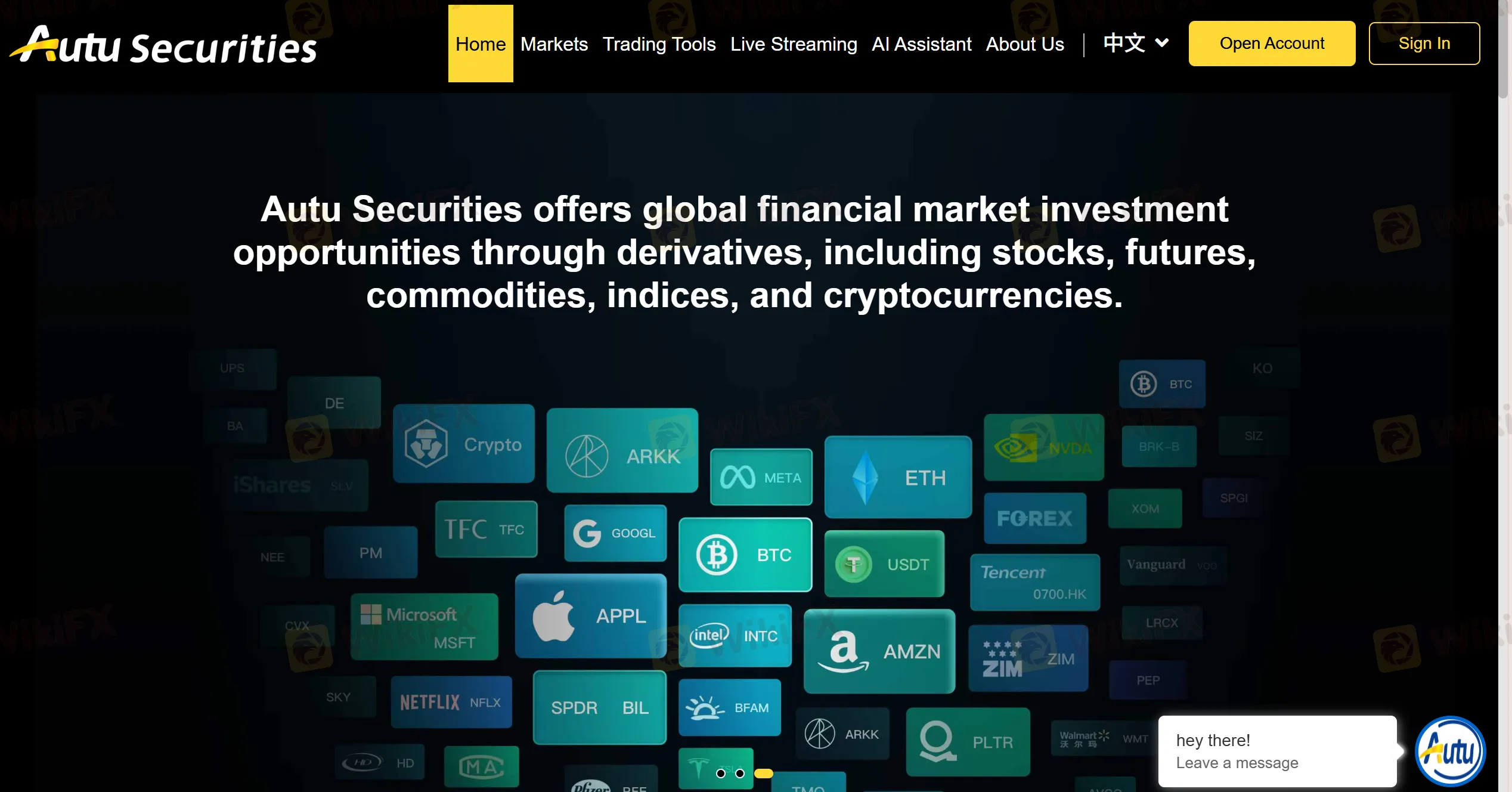

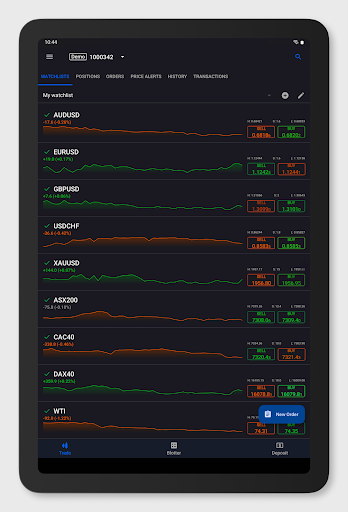

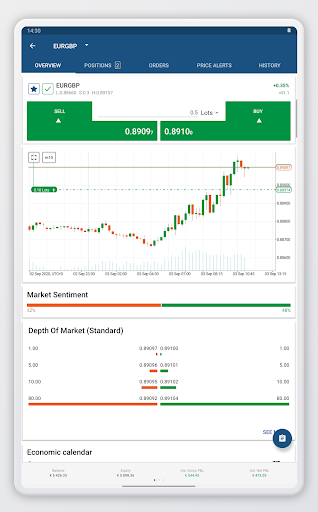

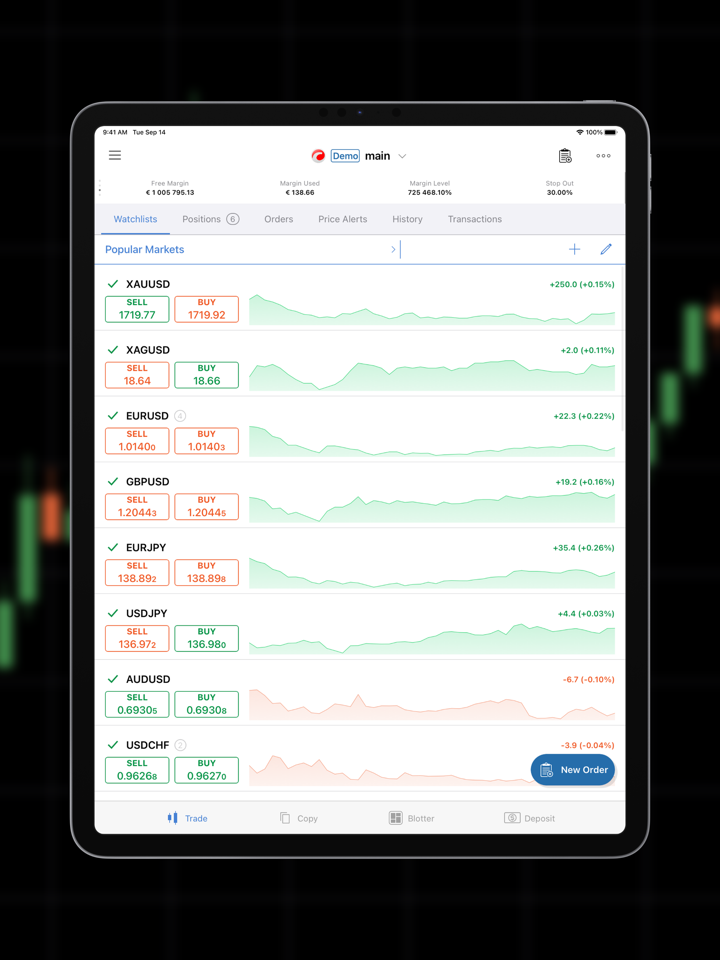

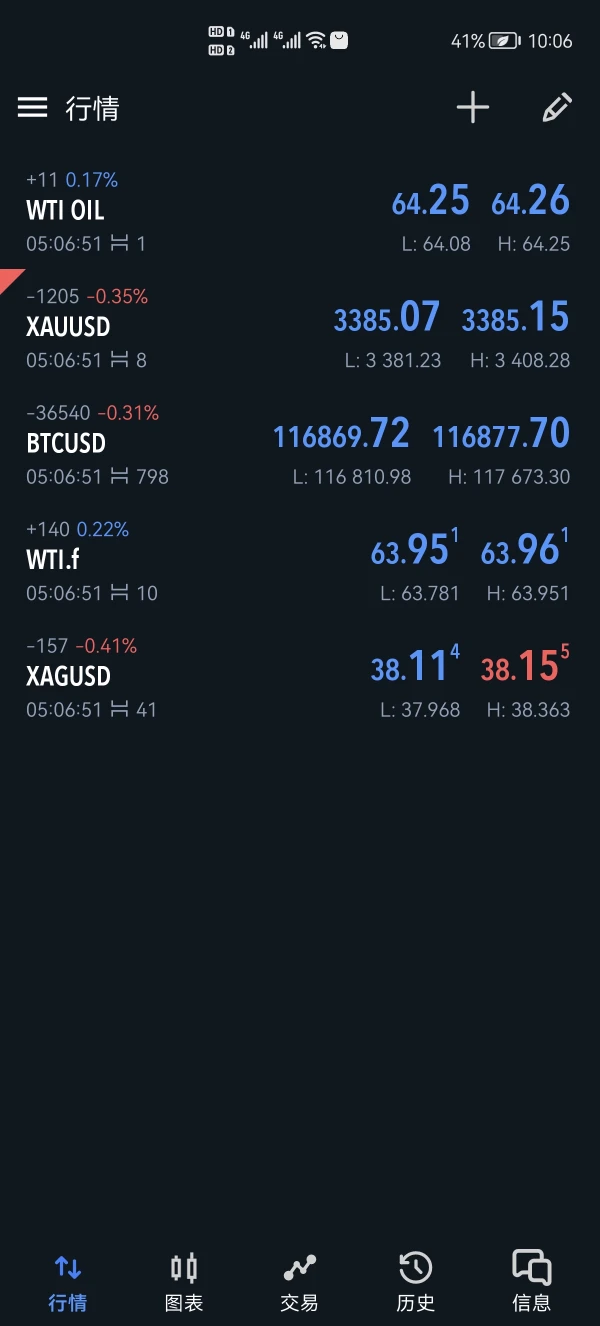

What Can I Trade on Autu?

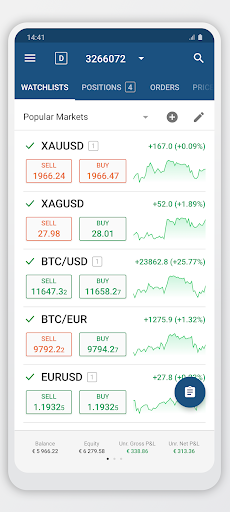

Autu Securities gives you access to global financial markets mostly through derivatives including futures, commodities, cryptos, indices, and stocks.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

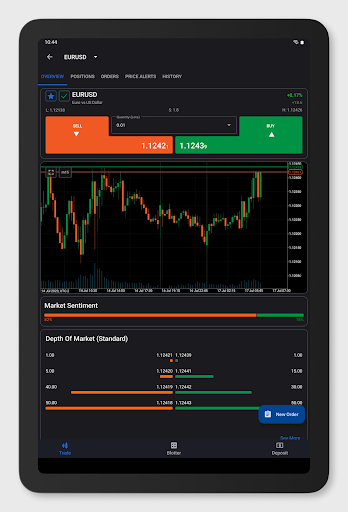

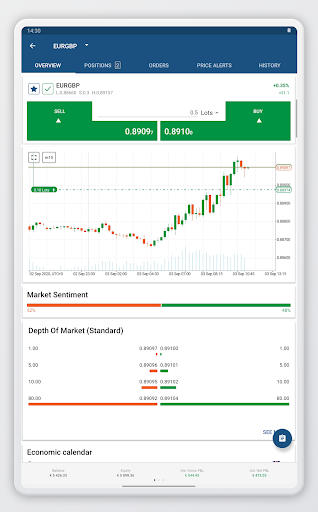

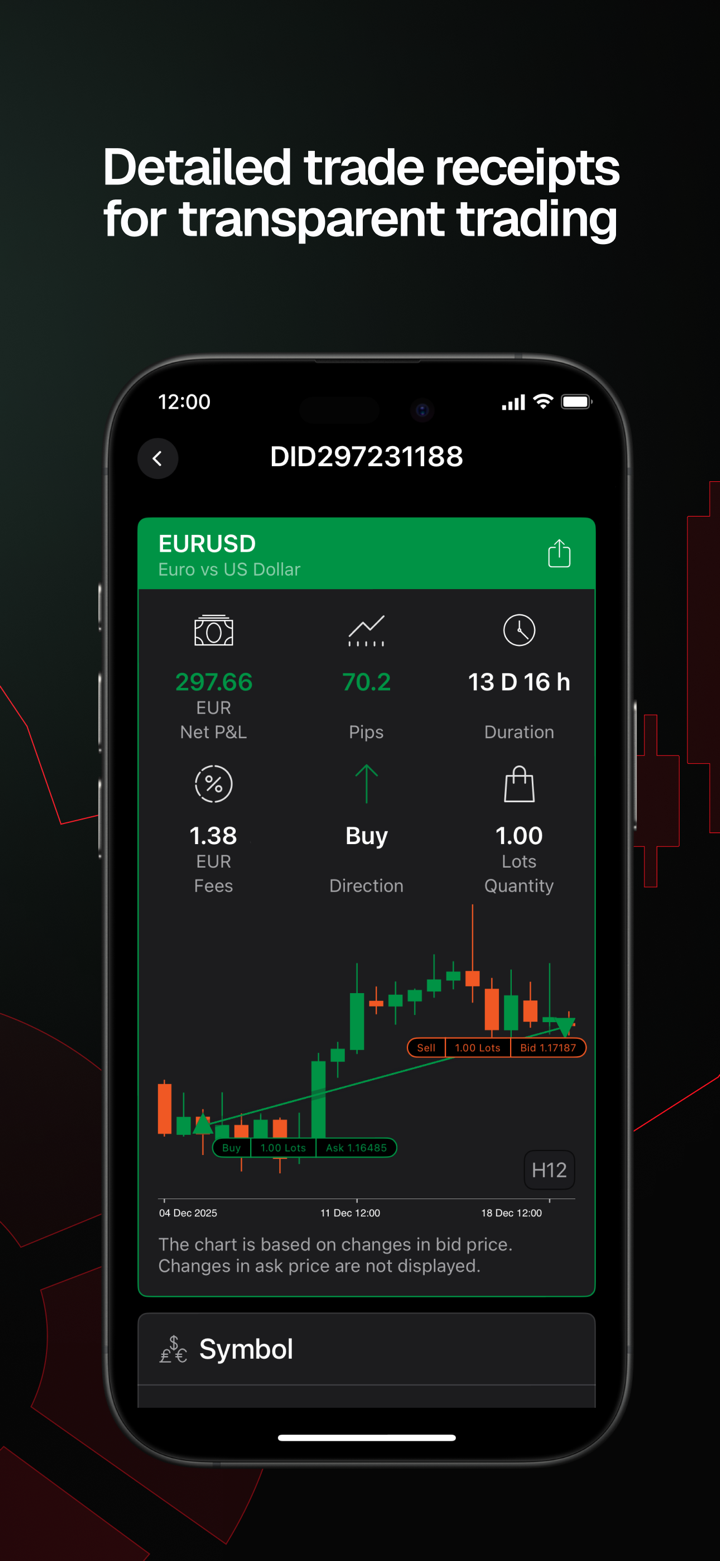

Autu Fees

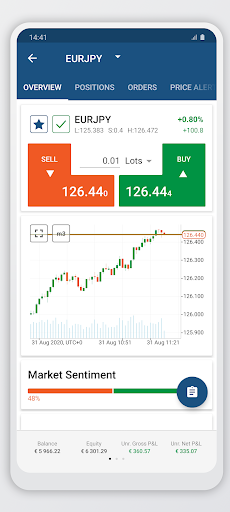

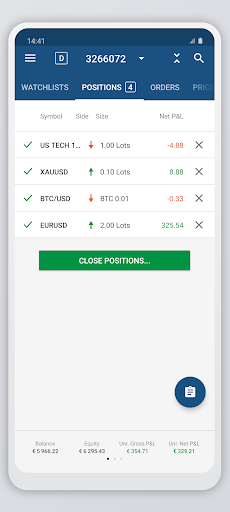

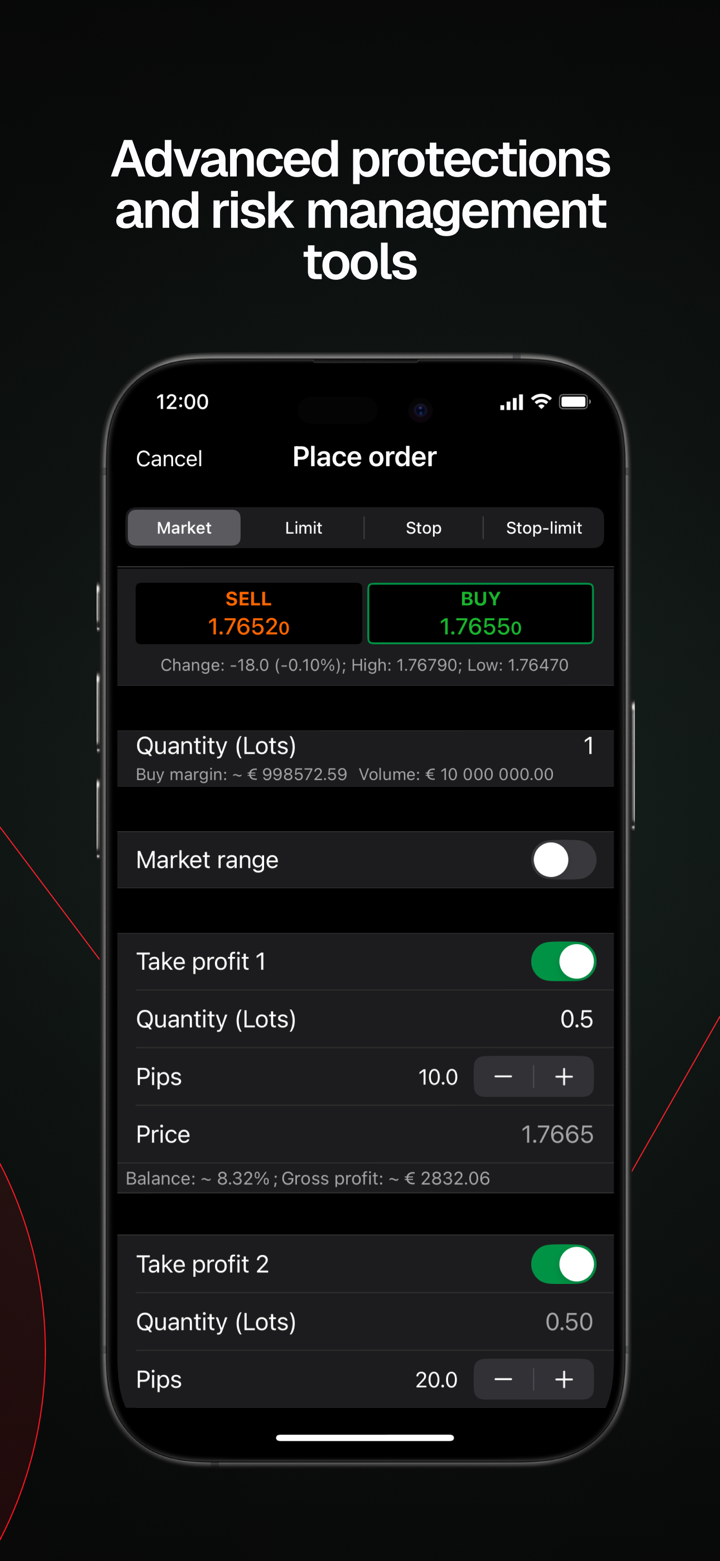

Compared to other companies in the same field, Autu Securities has low trading costs. It supports a zero-spread trading approach, which is one of the most competitive in the business. The platform also gives traders direct access to exchanges, a clear quote history, and customizable leverage to help them get the most out of their investments.

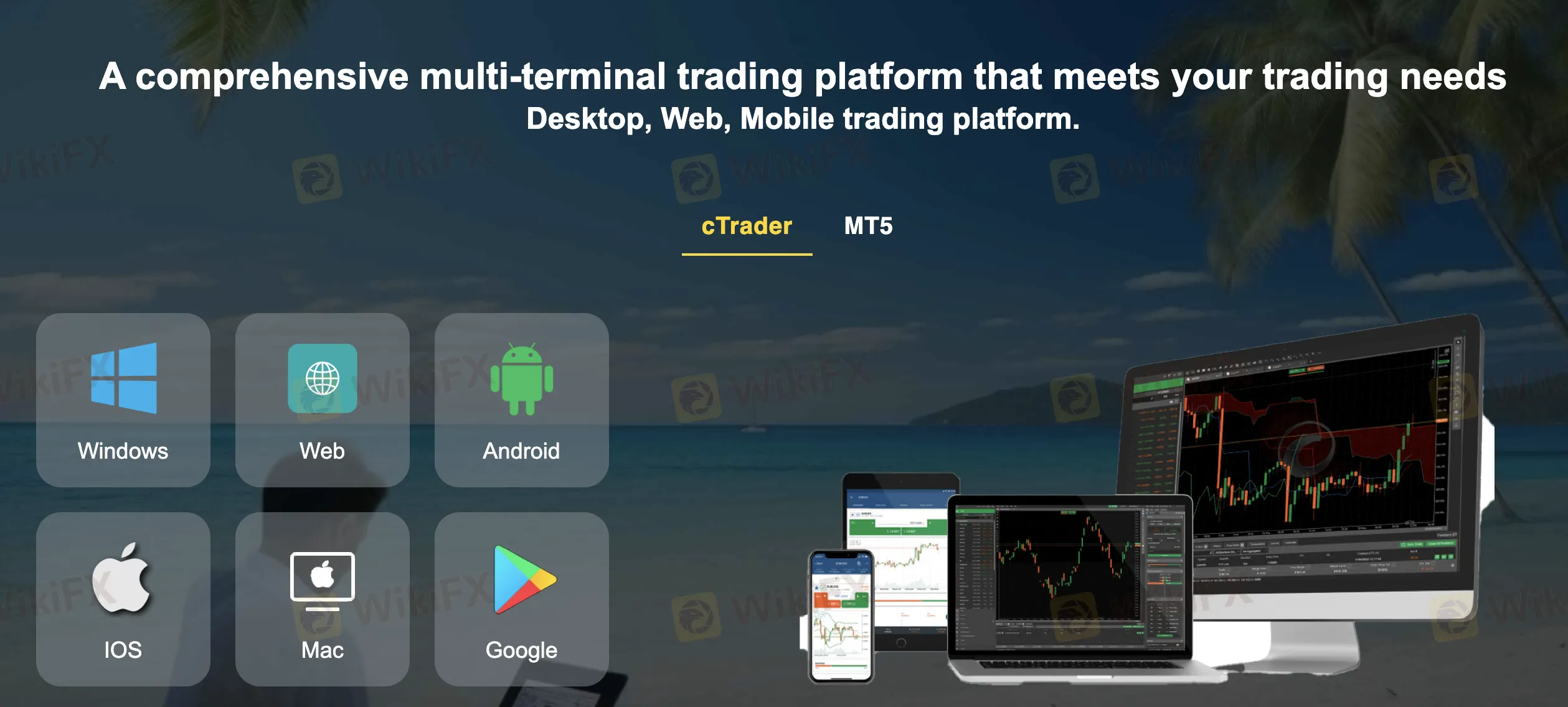

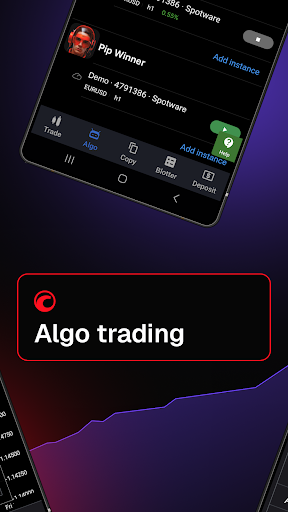

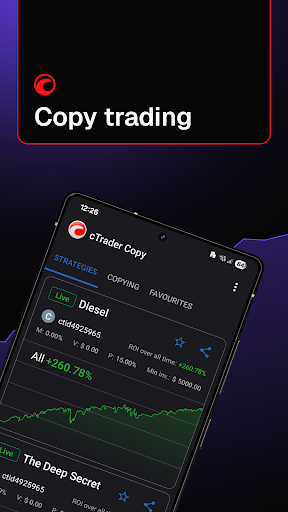

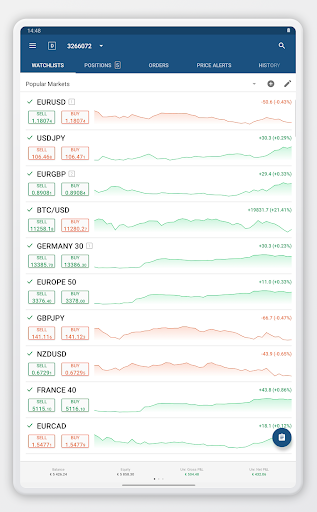

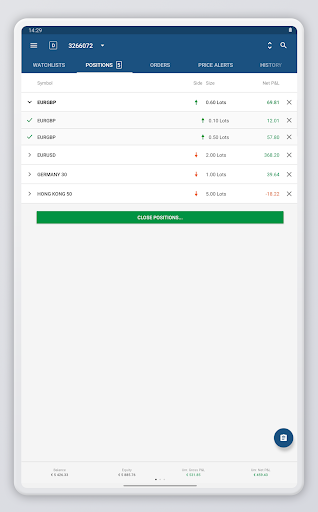

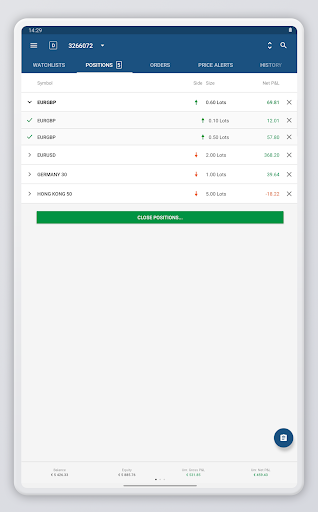

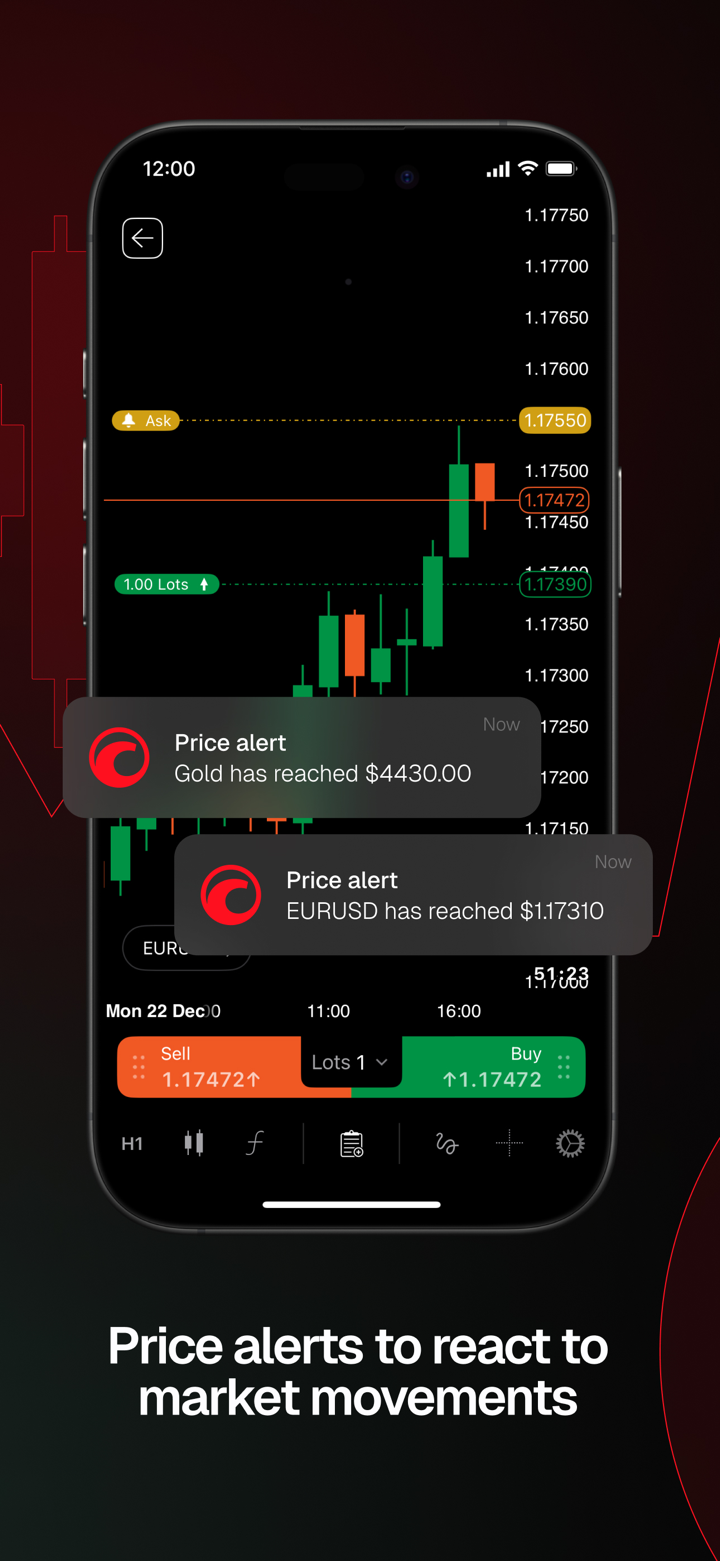

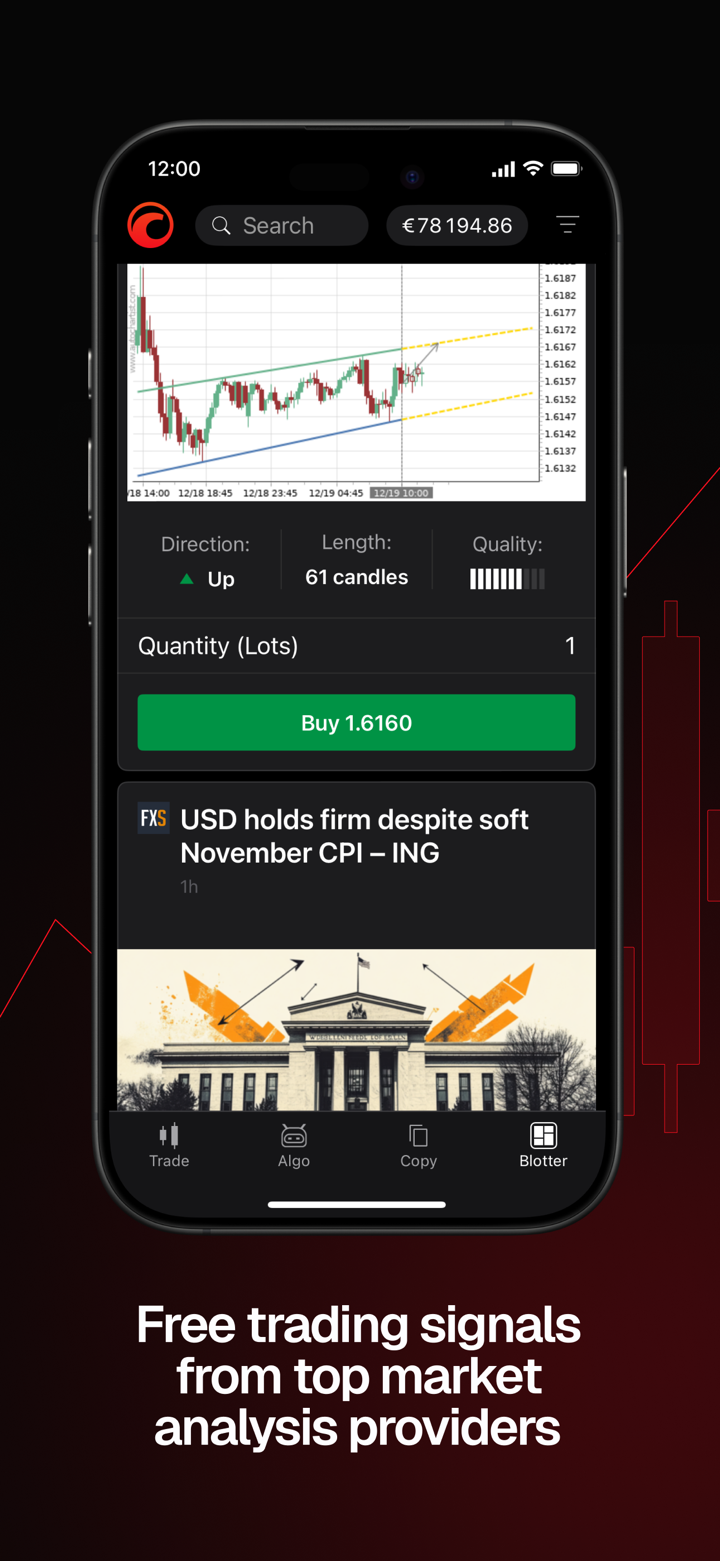

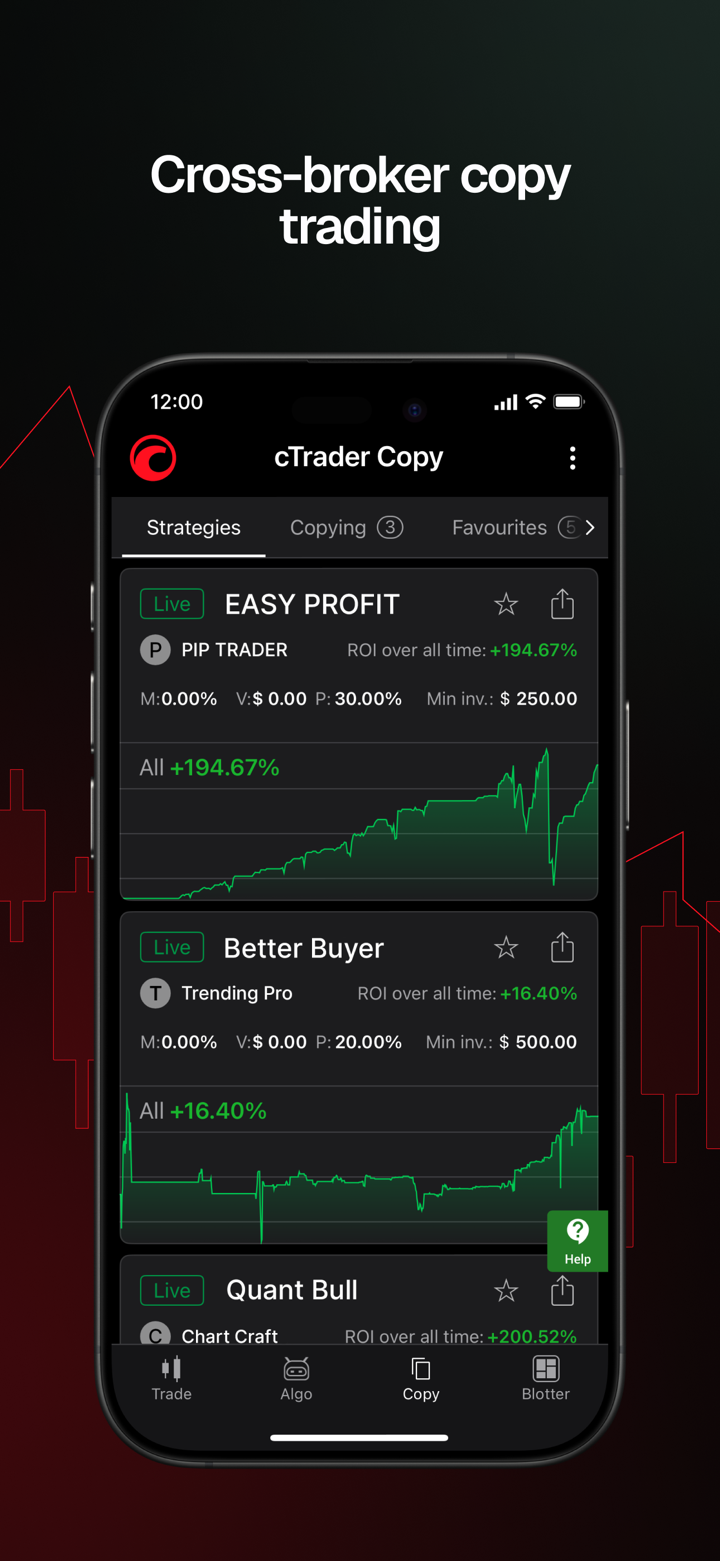

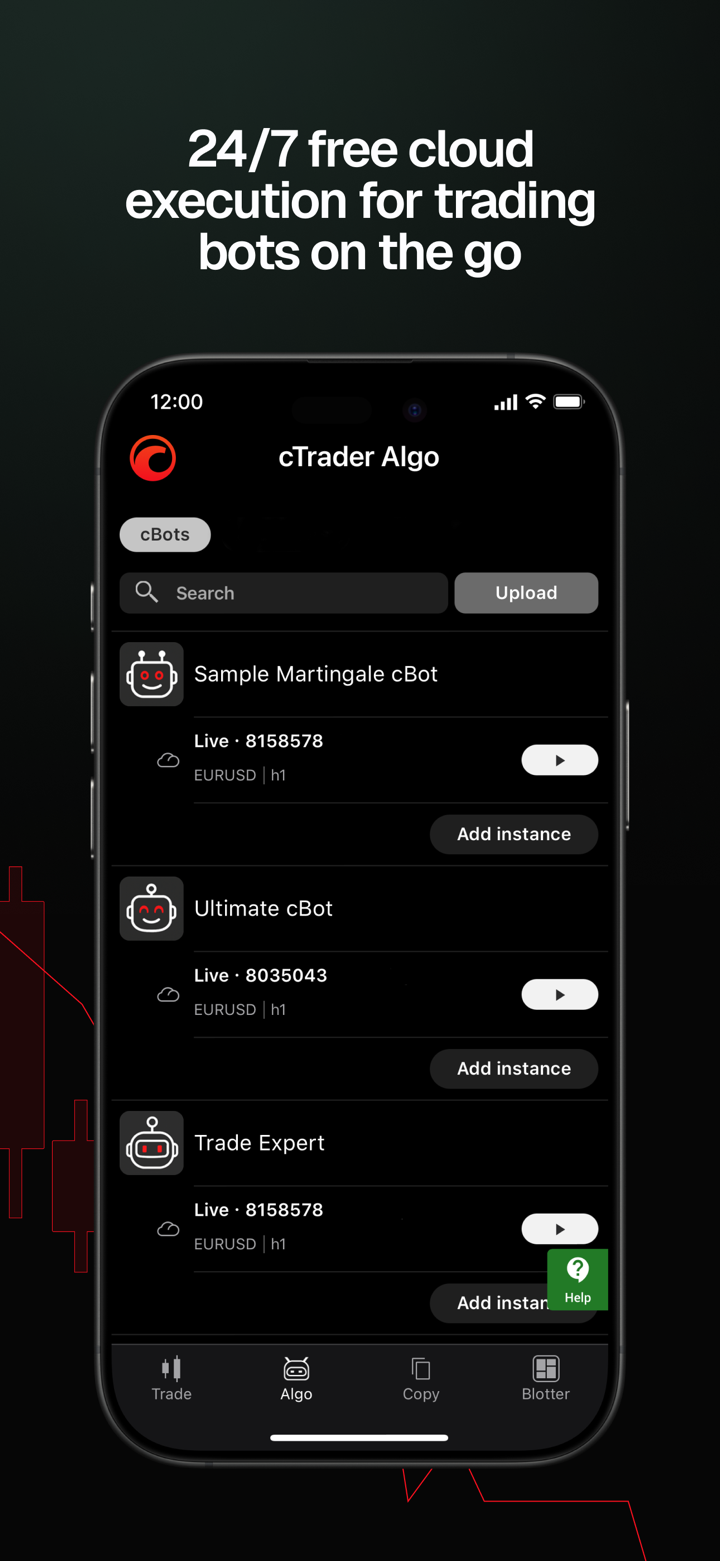

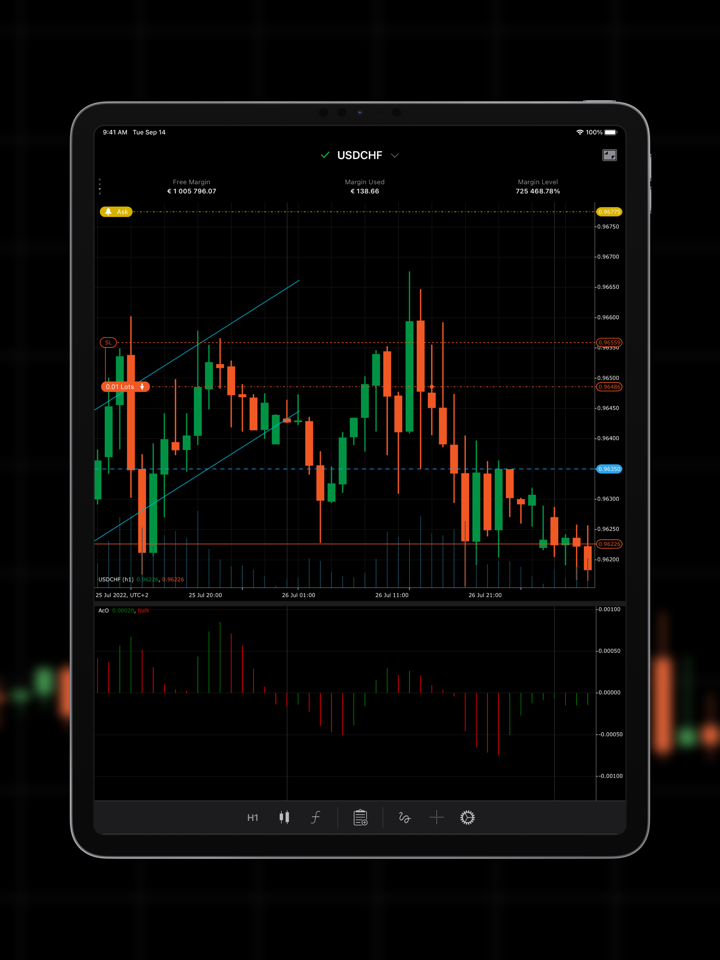

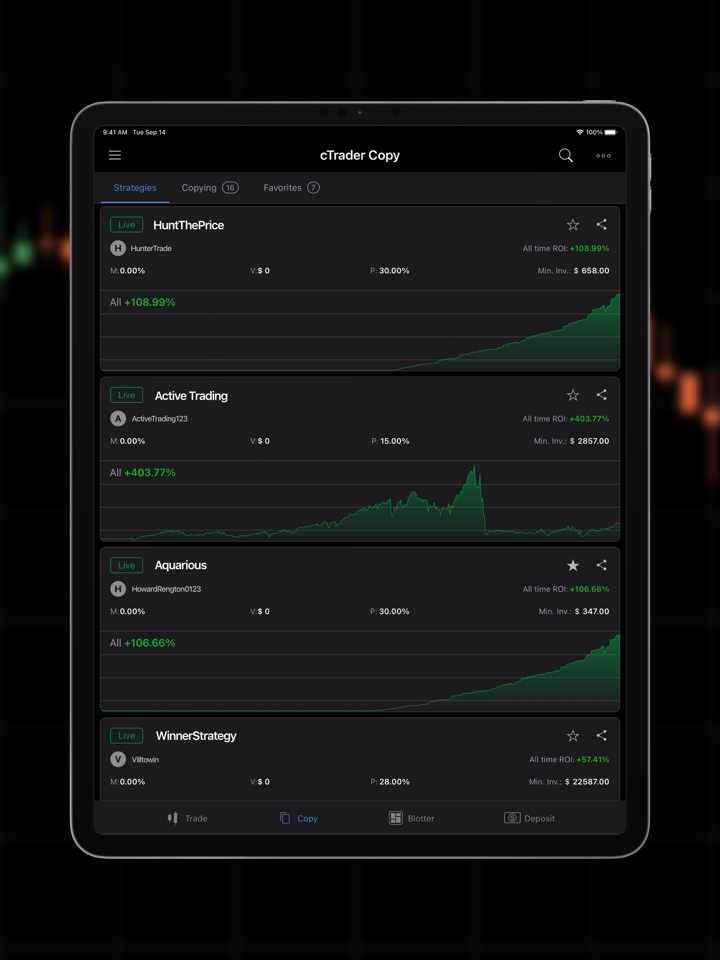

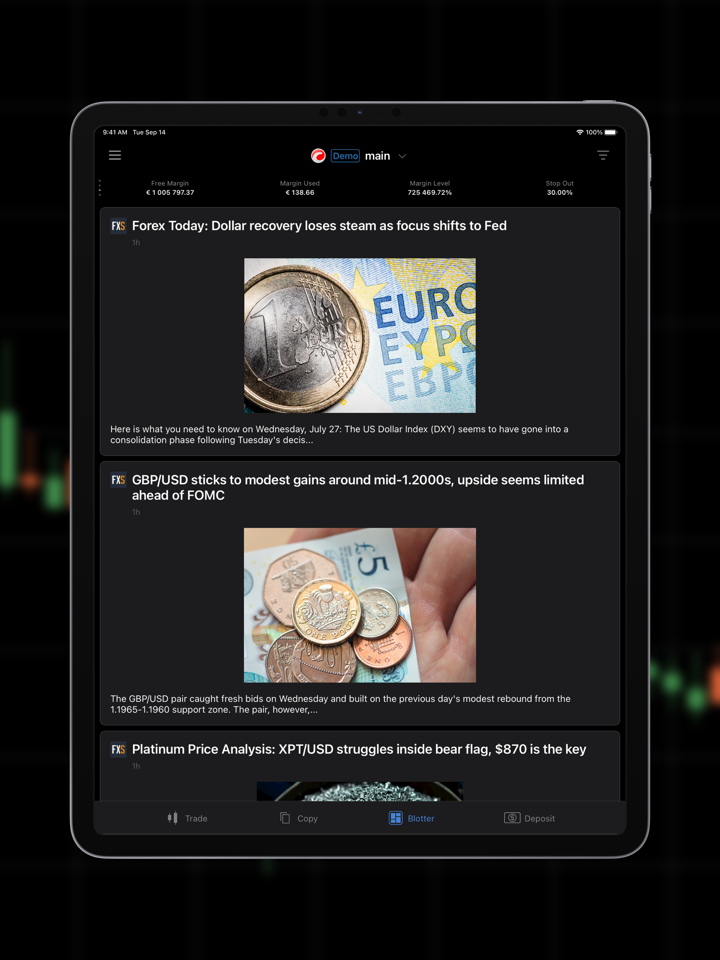

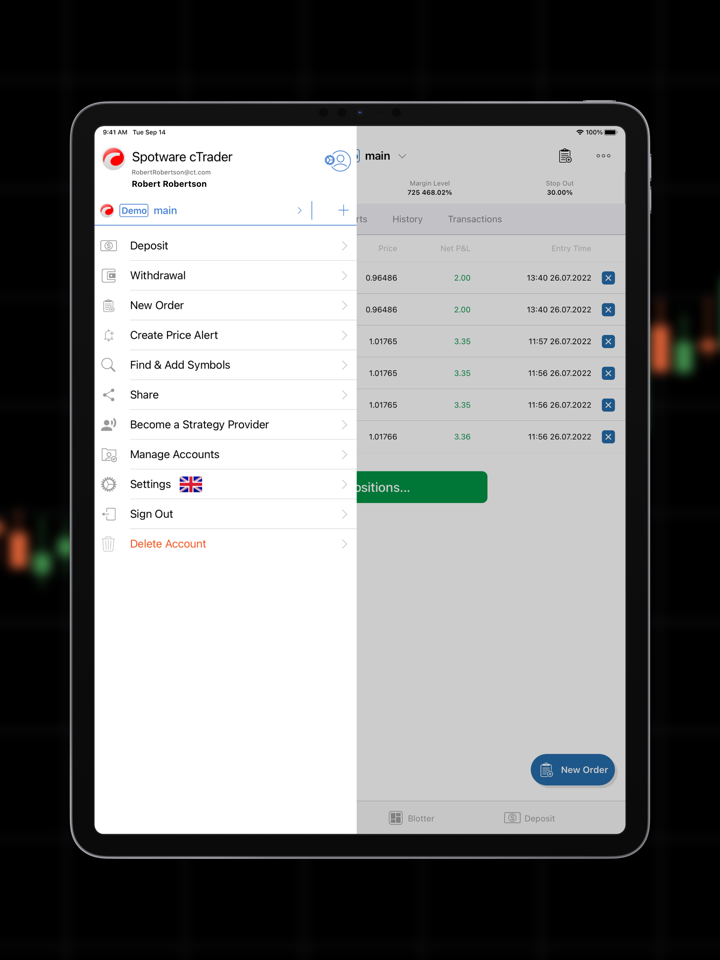

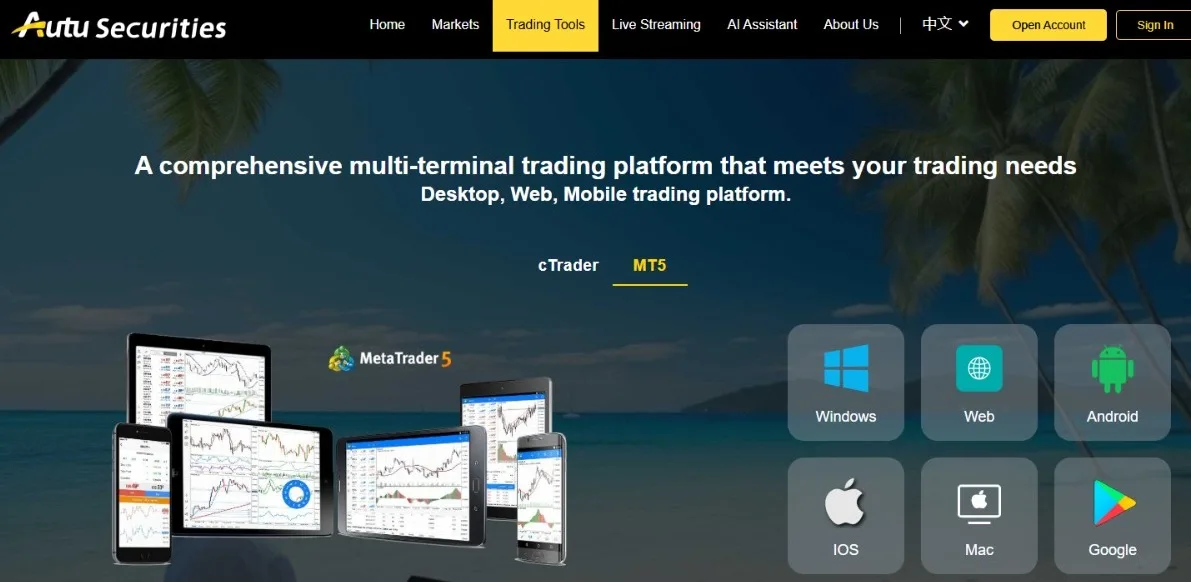

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | Desktop, Web, Mobile | / |

| MetaTrader 5 (MT5) | ✔ | Desktop, Web, Mobile | Experienced traders |

| MetaTrader 4 (MT4) | ❌ | / | Beginners |

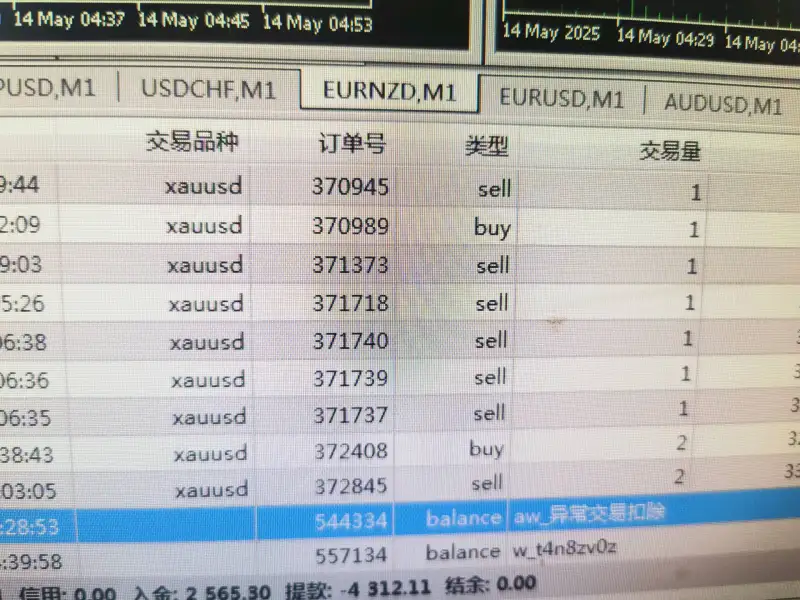

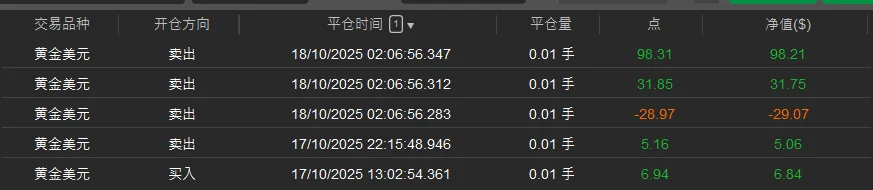

FX3102267582

Hong Kong

I registered several accounts to deposit funds, but some accounts had different slippage at the same time. Larger accounts maintained stability above 20, while smaller ones stayed below 10—clear differential treatment.

Exposure

FX7407354272

Hong Kong

Trash platform

Exposure

LisaAdriela

Indonesia

The Autu site has several advantages and disadvantages. Among its strengths are the availability of live streaming and an AI-based Autu GPT feature that can assist users. Additionally, there is a wide selection of currency pairs available for trading. However, the site also has some drawbacks. The navigation is quite complicated, the information is often not up to date, and the fee transparency is lacking. The content provided is also not in-depth, frequently experiences technical issues, and most importantly, it is not yet regulated by Bappebti.

Neutral

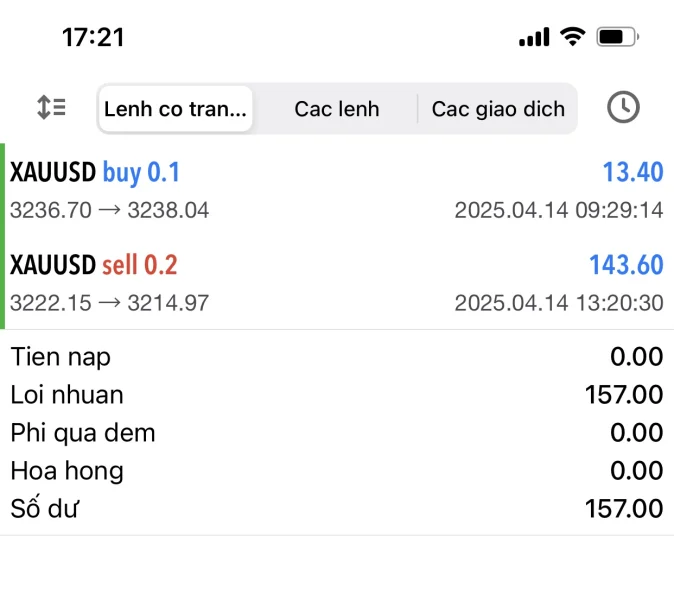

FX2215432601

Vietnam

The platform has fast withdrawal processing, responsive customer support, and a user-friendly trading software interface. Overall, it provides a good experience.

Positive

FX3125152092

Vietnam

Great experience on this platform, fast deposits and withdrawals, and especially no overnight fees.

Positive

88 lyna

Vietnam

Platform is okay, deposits and withdrawals are quite fast, professional and enthusiastic customer service. 10 points, not bad.

Positive

lee4749

Vanuatu

Not bad, fast deposit and withdrawal, great trading system

Positive