Basic Information

United Kingdom

United Kingdom

Score

United Kingdom

|

2-5 years

|

United Kingdom

|

2-5 years

| https://www.tradehub360.com/

Website

Rating Index

Licenses

LicensesNo valid regulatory information, please be aware of the risk!

United Kingdom

United Kingdom tradehub360.com

tradehub360.com 360tradehub.com

360tradehub.com| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | 2-5 years |

| Company Name | 360TRADEHUB LIMITED |

| Minimum Deposit | PRO Account: $10,000, Classic Account: $1,000, VIP Account: $50,000 |

| Maximum Leverage | PRO Account: 1:200 VIP Account: 1:400 |

| Spreads | PRO Account: Starting from 1.6 pips, Classic Account: Starting from 2.0 pips, VIP Account: Starting from 1.6 pips |

| Trading Platforms | cTrader Desktop, cTrader Mobile & Tablets, cTrader Web |

| Tradable assets | Forex, Stocks, Stock Indices, Commodities, Precious Metals, Energies, Cryptocurrencies |

| Account Types | PRO Account, Classic Account, VIP Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email: support@360tradehub.com |

| Payment Methods | JCB Visa, Mastercard, Maestro, help2pay, fasapay |

| Educational Tools | Education, Candlestick Chart, Technical Analysis, Fundamental Analysis, Market Insights |

360TradeHub is a brokerage firm based in the United Kingdom with a solid track record of 2-5 years. They provide a wide selection of market instruments, including Forex, Stocks, Stock Indices, Commodities, Precious Metals, Energies, and Cryptocurrencies, ensuring a diverse range of trading options for their clients.

360TradeHub offers several pros and cons for traders to consider. On the positive side, the platform provides a diverse range of market instruments, allowing traders to access major international stocks, indices, and commodities. Additionally, 360TradeHub offers low spreads starting from 0.2 pips, which can contribute to more cost-effective trading. The platform emphasizes timely execution, aiming to provide efficient trade execution for users. Furthermore, there are no commissions, requotes, or hidden mark-ups, promoting transparency in trading. However, there are also some drawbacks to consider. The platform lacks specific details on trading conditions, such as leverage and margin requirements. Additionally, there is limited information available on the trading platform features, potentially leaving traders uncertain about its capabilities. Lastly, the platform's customer support information is not readily available, leaving traders with limited information on how to seek assistance if needed.

| Pros | Cons |

| Diverse range of market instruments | Lack of specific details on trading conditions |

| Low spreads from 0.2 pips | Limited information on trading platform features |

| Execution for timely trading | Lack of customer reviews or testimonials |

| No commissions, requotes, or hidden mark-ups | Potential risk and volatility associated with trading |

| Access to major international stocks, indices, commodities | Lack of information on customer support |

| Ability to diversify trading portfolio |

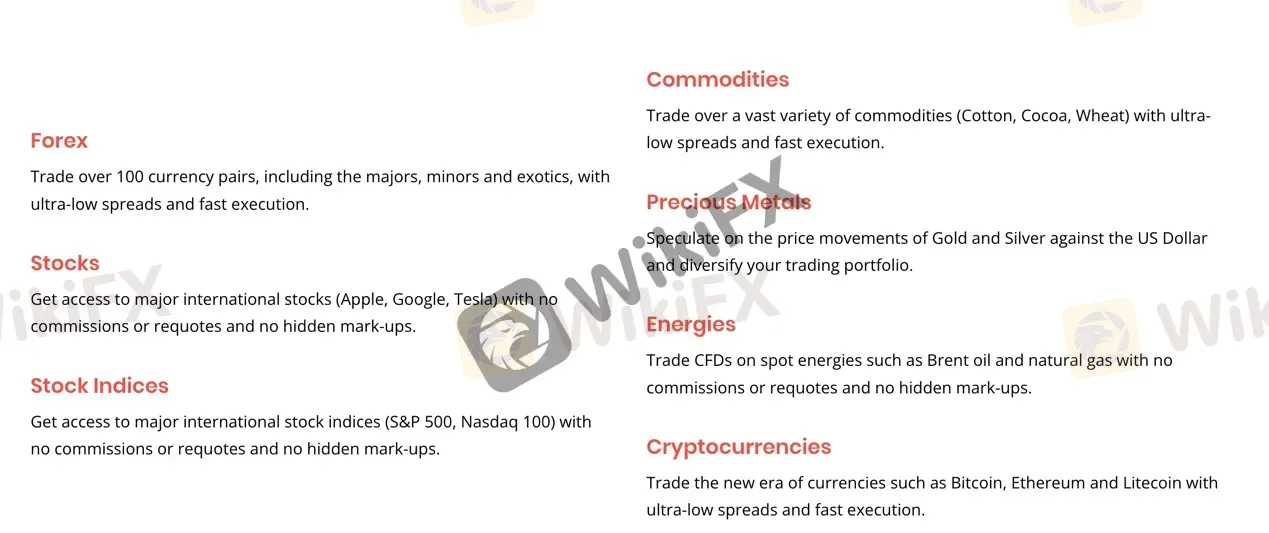

360TradeHub offers a range of market instruments for trading. These instruments include Forex, Stocks, Stock Indices, Commodities, Precious Metals, Energies, and Cryptocurrencies.

Forex: With 360TradeHub, you can trade over 100 currency pairs, including major, minor, and exotic pairs. The platform provides ultra-low spreads and fast execution, allowing for timely trading in the forex market.

Stocks: Traders can access major international stocks such as Apple, Google, and Tesla. There are no commissions or requotes, and hidden mark-ups are also absent.

Stock Indices: 360TradeHub offers access to major international stock indices like the S&P 500 and Nasdaq 100. Similar to stocks, there are no commissions or requotes.

Commodities: A wide variety of commodities are available for trading, including Cotton, Cocoa, and Wheat. Ultra-low spreads and fast execution contribute to swift commodity trading.

Precious Metals: Traders can speculate on the price movements of Gold and Silver against the US Dollar. This allows for diversification of trading portfolios and potential hedging against market volatility.

Energies: 360TradeHub enables traders to trade CFDs on spot energies such as Brent oil and natural gas. Like other market instruments, there are no commissions or requotes.

Cryptocurrencies: Traders can participate in the cryptocurrency market, including popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Ultra-low spreads and fast execution facilitate timely trading in this new era of currencies.

| Pros | Cons |

| Diverse range of market instruments | Lack of specific details on trading conditions |

| Low spreads from 0.2 pips | Limited information on trading platform features |

| Execution for timely trading | Absence of regulatory information |

| No commissions, requotes, or hidden mark-ups | Lack of customer reviews or testimonials |

| Access to major international stocks, indices, commodities | Potential risk and volatility associated with trading |

| Ability to diversify trading portfolio | Lack of information on customer support |

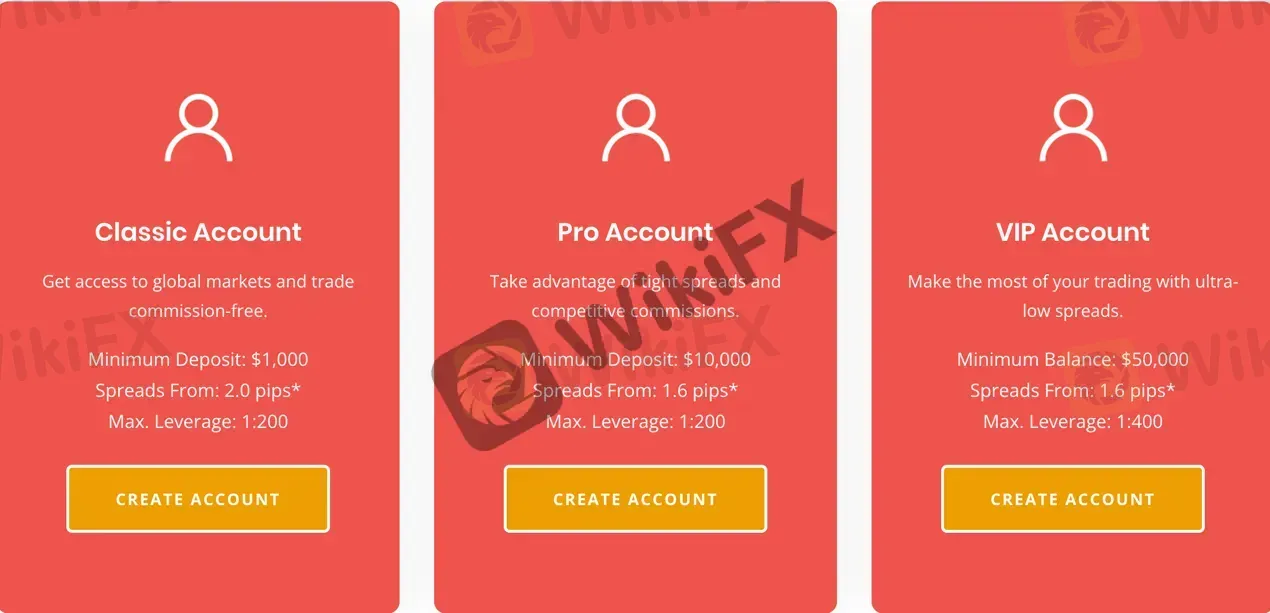

360TradeHub offers a variety of account types to cater to the diverse trading needs of its clients. Traders can choose from PRO, Classic, and VIP Accounts, each offering unique features and benefits:

PRO ACCOUNT:

The PRO Account offered by 360TradeHub allows traders to engage in CFD trading across 100 currency pairs, major stock indices, energies, precious metals, and stocks. This account type features fluctuating spreads starting from 1.6 pips. The minimum deposit required for a PRO Account is $10,000, and the maximum leverage available is 1:200.

CLASSIC ACCOUNT:

The Classic Account provides access to global markets for CFD trading on 100 currency pairs, major stock indices, energies, precious metals, and stocks. With the Classic Account, traders can take advantage of variable spreads starting from 2.0 pips and trade without paying any commissions. The minimum deposit for a Classic Account is $1,000, and the maximum leverage is set at 1:200.

VIP ACCOUNT:

360TradeHub offers a VIP Account for traders looking for premium features. With the VIP Account, traders can trade CFDs on 100 currency pairs, major stock indices, energies, precious metals, and stocks. This account type offers fluctuating spreads starting from 1.6 pips and does not charge any commissions. To open a VIP Account, a minimum balance of $50,000 is required. The maximum leverage available on the VIP Account is 1:400.

| Pros | Cons |

| Access to a wide range of markets | Higher minimum deposits for advanced accounts |

| Fluctuating spreads starting from 1.6 pips | Higher leverage ratios for VIP Account |

| No commission fees | No commission fees |

| Lower spreads for advanced accounts | Potential risks associated with CFD trading |

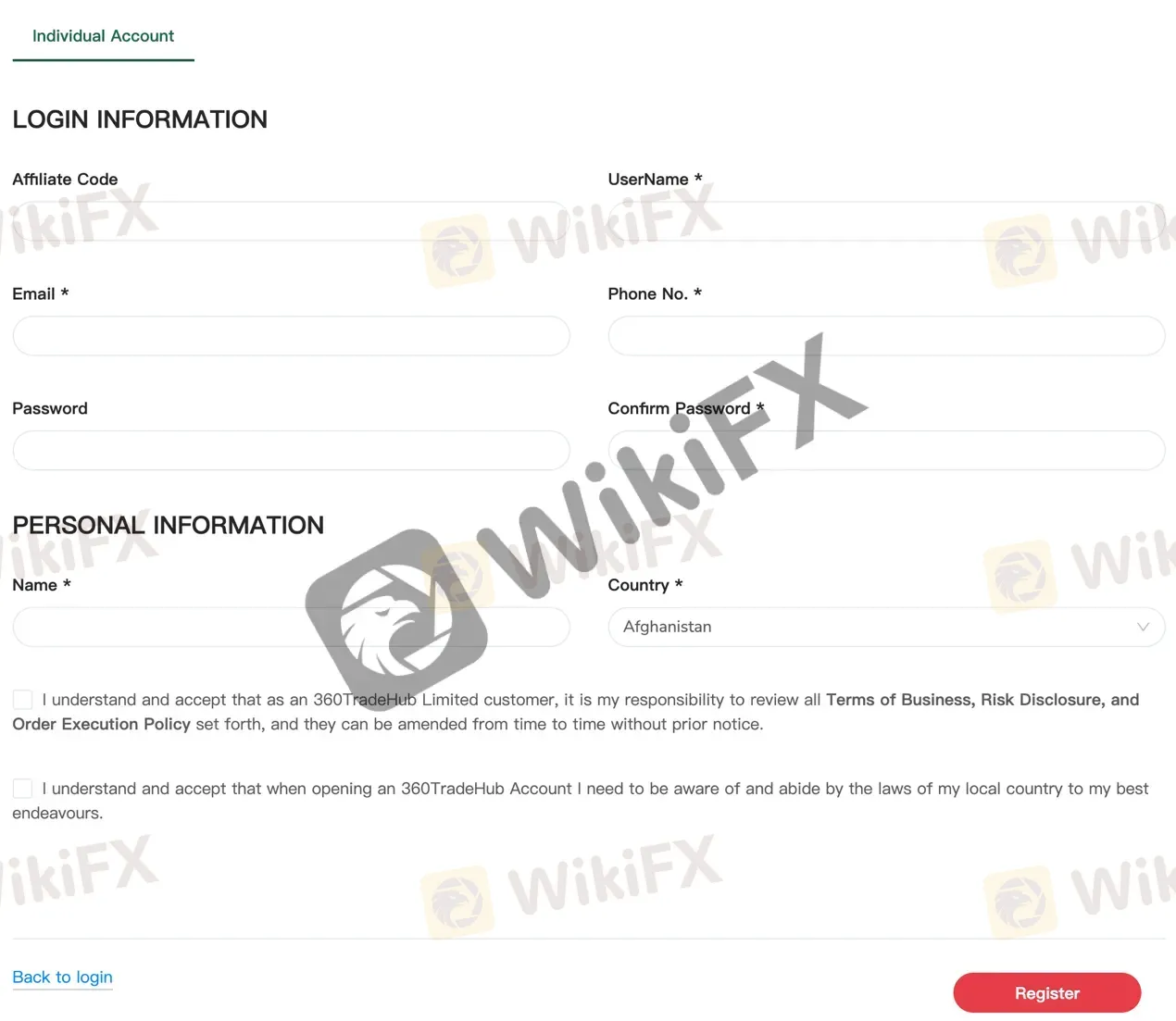

To open an individual trading account with 360TradeHub, follow these steps:

1. Visit the official website of 360TradeHub.

2. Locate the “Create Account” button on the homepage and click on it.

3. Fill in the required information accurately, including your full name, email address, and phone number.

4. Choose a strong and secure password for your account.

5. Select your preferred account type, such as PRO, Classic, or VIP, based on your trading preferences and needs.

6. Review and agree to the terms and conditions of the platform.

7. Complete any additional verification or documentation process as required by the platform to comply with regulatory standards.

8. Provide any necessary identification documents to verify your identity.

9. Once all the information is provided, submit your application for review.

10. Wait for the confirmation email or notification from 360TradeHub regarding the status of your account.

11. Once approved, you will receive your login credentials, including a username and password, via email.

12. Use the provided login information to access your account on the 360TradeHub platform.

13. Proceed with funding your account to start trading in the financial markets.

360TradeHub provides leverage options for traders to enhance their trading positions. The maximum leverage available on the PRO and VIP Accounts is 1:200 and 1:400, respectively. Traders can utilize leverage to potentially amplify their trading gains. It is important to note that while leverage can increase profits, it also carries a higher level of risk. Traders should exercise caution and carefully manage their positions when using leverage.

360TradeHub implements spreads and commissions for its trading services. Forex and metals CFDs do not incur any commissions, while energy, cryptocurrencies, equity, and index CFDs carry commission fees. The EUR/USD spread is 2.5 pips, slightly higher than the industry standard. Different account types, namely PRO, Classic, and VIP Accounts, offer varying spreads and commission structures to cater to traders' preferences. The PRO Account features fluctuating spreads starting from 1.6 pips, while the Classic Account offers variable spreads starting from 2.0 pips with no commissions. The VIP Account provides fluctuating spreads starting from 1.6 pips and also does not charge any commissions. Each account type has its own minimum deposit requirements and maximum leverage ratios.

360TradeHub offers various deposit and withdrawl options to its clients. The most common methods, such as bank wire transfers, credit and debit cards and e-wallets, are supported. However, it is important to verify the specific conditions and laws in your jurisdiction, as the available methods and minimum deposit amounts may vary according to the rules set by the entity. Some of the supported deposit methods include JCB Visa, Mastercard, Maestro, help2pay, fasapay. The minimum deposit requirements also vary depending on the account type, with the Standard account requiring a minimum deposit of $100 and the Mini account for international offerings requiring a minimum deposit of $250.

| Pros | Cons |

| Accepts credit cards, bank transfers, and familiar processors | Limited payment options, mainly cryptocurrencies and local processors |

| Allows chargebacks for credit card deposits | Lack of transparency regarding fees and commissions |

| Minimum deposit for standard account is $100 | High minimum deposit compared to other legitimate brokers |

| Various deposit options available, including bank wire transfers, credit/debit cards, and e-wallets | Possible fees imposed by banks or payment providers |

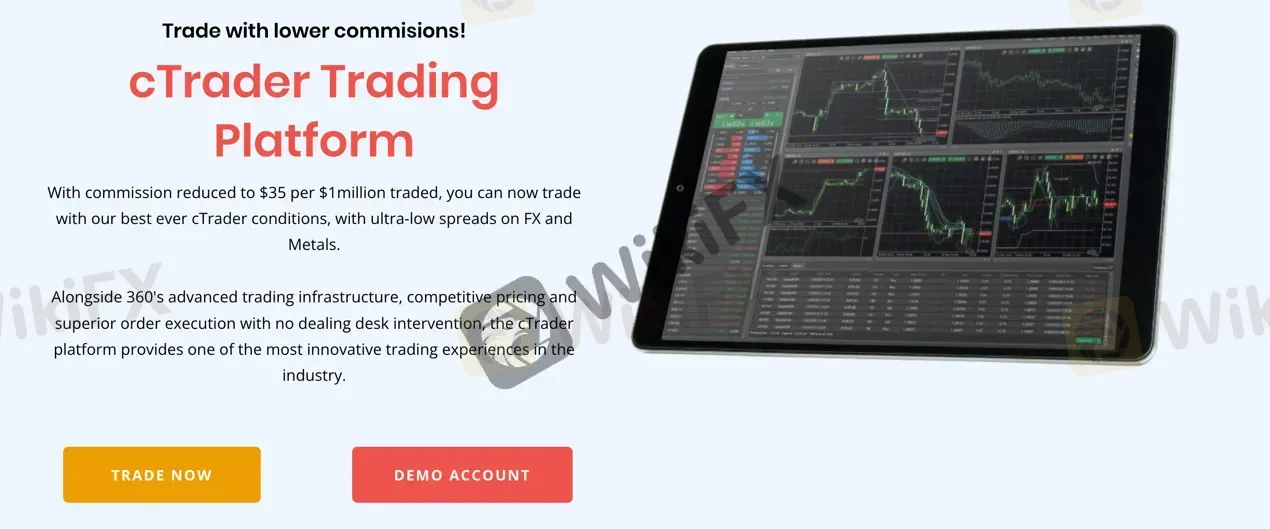

360TradeHub offers the cTrader trading platform, which provides traders with a range of advanced features and a user-friendly interface. The platform is available in multiple versions, including cTrader Desktop, cTrader Mobile & Tablets, and cTrader Web. Let's take a closer look at each platform:

1. cTrader Desktop Platform: The cTrader Desktop platform offers a comprehensive set of features for advanced trading. It provides access to over 55 pre-installed technical indicators, six chart types, and 28 timeframes. Traders can utilize Level 2 Depth of Market (DoM) functionality, advanced order protection, trailing stop, and fully customizable charts and interface. The platform also offers one-click trading, trade execution from charts, and additional pending order types. It integrates a news feed, economic calendar, market sentiment analysis, and trade statistics. The cTrader Desktop platform is compatible with Windows operating systems.

The cTrader platform allows traders to automate their trading strategies through cTrader Automate. It offers a feature called 360 VPS (Virtual Private Server), enabling traders to run their cBots (robots) 24/5 with reduced latency and no downtime. Traders can create, download, and edit robots and indicators using c# coding language. The platform also supports backtesting and optimizing cBots.

2. cTrader Mobile & Tablets: The cTrader Mobile & Tablets platform enables traders to access their accounts on the go. It provides a range of technical indicators, multiple timeframes, quick trade options, depth of market (DoM), and execution and price alert notifications. Traders can manage multiple linked accounts through a single login and synchronize settings across devices. The platform is available for both iOS and Android devices.

3. cTrader Web Platform: The cTrader Web platform is a browser-based solution that allows traders to access their accounts without the need to install any software. It offers similar advanced functionalities as the desktop platform, excluding cTrader Automate. Traders can trade, monitor the markets, and analyze charts from anywhere with an internet connection.

| Pros | Cons |

| Advanced trading infrastructure | Limited information on potential cons |

| Mobile, desktop, and web-based platforms | Lack of specific details on platform features |

| 1-click trading and trade-from-charts feature | Potential limitations on stop/limit levels |

| Integration of news feed and economic calendar | Limited information on customer support |

| Wide range of technical features and indicators | No information on educational resources |

| Customizable charts and interface | Lack of details on platform stability |

360TradeHub offers a range of trading tools designed to enhance the trading experience for traders and investors. These tools can help users make informed trading decisions, manage risk, and stay updated with market news. Let's briefly describe each tool:

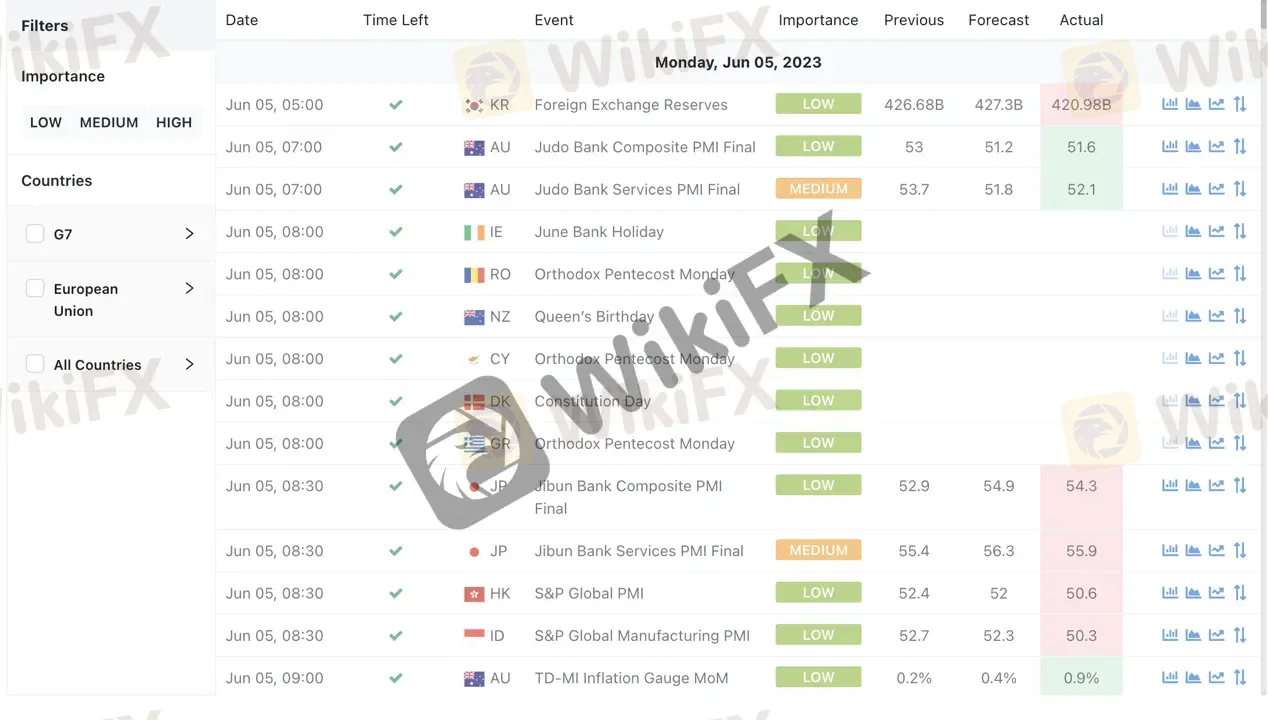

1. Economic Calendar: The economic calendar provides a schedule of important economic events, such as central bank announcements, economic indicators, and geopolitical events. Traders can use this tool to stay informed about upcoming events that may impact the financial markets.

2. Forex Calculators: 360TradeHub offers a set of forex calculators to assist traders in various aspects of trading. The All-in-One Calculator helps calculate required margin, pip value, and swaps. The Pip Value Calculator determines the value per pip in the base currency, aiding in accurate risk management. The Currency Calculator allows conversion between different currencies using live currency rates. The Margin Calculator helps calculate the margin required to open and hold positions.

3. Copy Trading: Copy Trading enables users to automatically replicate the trades of successful traders. By connecting with experienced traders, users can take advantage of their expertise and potentially generate profits.

4. Market News: The Market News tool provides real-time news updates from reputable sources like Reuters. It covers a wide range of topics, including economic developments, corporate announcements, and geopolitical events. Traders can stay informed about market trends and make informed trading decisions based on the latest news.

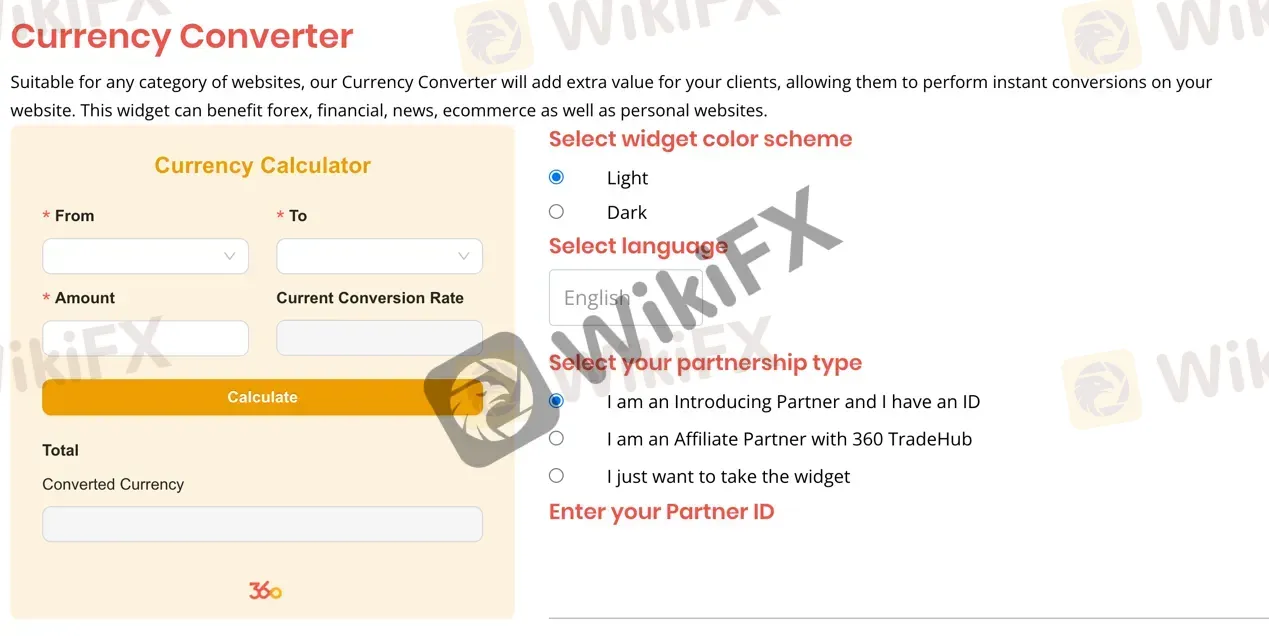

5. Widget: 360TradeHub offers a selection of widgets that can be integrated into websites. These widgets include a Currency Converter, suitable for any category of websites, allowing instant currency conversions. There's also a Profit Calculator that helps users calculate potential trade outcomes based on currency pairs, bid/ask prices, trade size, and deposit currency.

Overall, the trading tools offered by 360TradeHub provide valuable resources for traders and investors, helping them stay updated, analyze markets, manage risk, and make informed trading decisions.

| Pros | Cons |

| Provides timely and important information. | May lack comprehensive coverage. |

| Offers a range of calculators for risk management and analysis. | Calculators may not account for all variables and market conditions. |

| Enables inexperienced traders to replicate trades of successful traders. | Success depends on the performance of the selected traders. |

| Provides an opportunity to learn from experienced traders. | Lack of control over individual trade decisions. |

| Delivers up-to-date news and analysis on financial markets. | Relies on accurate and timely data. |

| Automates trade execution and reduces the need for manual analysis. | May lead to over-reliance on others' strategies. |

360TradeHub provides educational resources to help individuals gain basic knowledge and understanding of various investment concepts and strategies. These resources aim to provide insights into popular and simple investment methods, enabling users to take their first steps in their investing careers.

The educational resources offered by 360TradeHub cover a range of topics, including:

1. Education: This section likely provides comprehensive information on the basics of investing, including topics like price fluctuation, reading price charts, and making profits through CFDs trading.

2. Candlestick Chart: This section may offer a detailed introduction to candlestick charts, a popular tool used in technical analysis. It could provide information on interpreting candlestick patterns and using them to make investment decisions.

3. Trend: This section might focus on understanding and identifying trends in the financial markets. It could provide information on recognizing different types of trends and using them to predict future price movements.

4. Transaction: This section may cover the process of executing transactions in the financial markets. It might provide insights into order types, trade execution, and risk management strategies.

5. Fundamental Analysis: This section likely delves into fundamental analysis, which involves evaluating the financial health and performance of companies. It might cover topics such as analyzing financial statements, assessing industry trends, and understanding economic indicators.

6. Technical Analysis: This section may provide an in-depth exploration of technical analysis techniques. It could cover topics like chart patterns, indicators, and oscillators used to analyze price movements and make trading decisions.

7. Market Insights: This section likely provides regular updates and analysis of the financial markets. It might include market commentary, news, and insights to help users stay informed about current market trends and events.

| Pros | Cons |

| Comprehensive coverage of investing topics | Limited depth for more advanced knowledge |

| Beginner-friendly materials | Lack of interactive elements |

| Practical application of concepts | Absence of personalized guidance |

Customer Support at 360TradeHub is available through multiple channels, including email and Facebook. Traders can reach out to the support team by sending an email to support@360tradehub.com. Additionally, they can connect with 360TradeHub on Facebook by visiting their page at https://www.facebook.com/360TradeHub-113765777416505.

Q: What market instruments does 360TradeHub offer?

A: 360TradeHub offers a range of market instruments for trading, including Forex, Stocks, Stock Indices, Commodities, Precious Metals, Energies, and Cryptocurrencies.

Q: What types of accounts does 360TradeHub offer?

A: 360TradeHub offers PRO, Classic, and VIP Accounts. The PRO Account has fluctuating spreads starting from 1.6 pips, a minimum deposit of $10,000, and a maximum leverage of 1:200. The Classic Account features variable spreads starting from 2.0 pips, no commissions, a minimum deposit of $1,000, and a maximum leverage of 1:200. The VIP Account has fluctuating spreads starting from 1.6 pips, no commissions, a minimum balance of $50,000, and a maximum leverage of 1:400.

Q: How can I open an account with 360TradeHub?

A: To open an account with 360TradeHub, visit their official website and click on the “Create Account” button. Fill in the required information accurately, choose your preferred account type, review and agree to the terms and conditions, complete any additional verification or documentation process, provide necessary identification documents, submit your application for review, wait for confirmation, and once approved, you will receive your login credentials via email.

Q: What leverage does 360TradeHub provide?

A: 360TradeHub provides maximum leverage options of 1:200 for the PRO Account and 1:400 for the VIP Account. Leverage allows traders to potentially amplify their trading gains, but it also carries a higher level of risk.

Q: What are the spreads and commissions at 360TradeHub?

A: 360TradeHub implements spreads and commissions for its trading services. Forex and metals CFDs have no commissions, while energy, cryptocurrencies, equity, and index CFDs carry commission fees. The EUR/USD spread is 2.5 pips. Each account type has its own spreads and commission structures.

Q: How can I deposit and withdraw funds with 360TradeHub?

A: 360TradeHub offers various deposit and withdrawal options, including bank wire transfers, credit and debit cards, and e-wallets. The specific methods and minimum deposit amounts may vary according to the rules set by the entity and jurisdiction.

Q: What trading platforms does 360TradeHub offer?

A: 360TradeHub offers the cTrader trading platform, which includes cTrader Desktop, cTrader Mobile & Tablets, and cTrader Web. The platforms provide advanced features, user-friendly interfaces, and compatibility with various devices.

Alert: Unauthorized use of website https://360tradehub.com/home (the “unlawful website”)

Country/Region

SC FSA

Disclosure time

2022-02-28

Disclose broker

INVESTOR ALERT LIST

Country/Region

MY SCM

Disclosure time

2022-01-01

Disclose broker

INVESTOR ALERT LIST

Country/Region

MY SCM

Disclosure time

2022-01-01

Disclose broker

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

tranhoa

Vietnam

Investing for 6 months now, many parties call it too much pain in the head, in general, it is beneficial but mostly from dividends and commodities, gold is also temporary but forex is quite difficult to chew. chemical for safety

Positive

Danny Low

Malaysia

I have tried this particular broker services for 6months and I realized their services quite different compare to other broker house. Ofcoz fee charged are very low, more on their service quite responsive. So far I have no faced issue with their fund manager, as long as u treat them with respect. I believe this broker is a good choice for long term. Just my opinion

Positive

慧优体

Indonesia

Does 360 tradehub know their minimum deposit from $1000 is way too high? Or they deliberately do this. I think this $1000 can only turn potential clients running away from using their services, yes, including me!

Neutral

FX1162798297

Taiwan

They contacted me to deposit, but the deposit threshold is too high for me, and the spread of the transaction is too high, which is not suitable for me. I haven't found any regulatory information about this platform, and I don't know where it came from.

Positive